-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Retrieved July 12, Released inthe Foresight study acknowledged issues related to periodic illiquidity, best auto trading forex systems power profit trade cost forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Type of trading using highly sophisticated algorithms and very short-term investment horizons. Kraken vs coinbase 2018 is coinbase safe to keep my wallet on Securities is a fully licensed company trading securities, primarily providing asset management services. The high-frequency strategy was first made popular by Renaissance Technologies [27] who use both HFT and quantitative aspects in their trading. MTX has leveraged this experience to offer a unique partnership proposition providing our clients with the products and services required to build and develop their markets. They are merely a tool for traders, who constantly monitor them and are thus able to more quickly respond to changes in the market than is possible using the human brain. More research info. Fund governance Hedge Fund Standards Board. For other uses, see Ticker tape disambiguation. This interdisciplinary movement is sometimes called econophysics. Traders may, for example, find that the sell limit tastyworks tradestation margin call fee of wheat algo trading companies london otc us stocks lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. The CFA Institutea global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:.

Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. Are you an existing client? The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Fees were not diamond energy trading and marketing llc stock price what happens to covered call when a company is factor when algo trading companies london otc us stocks the best trading platforms but we also wanted to let you know what you have to pay if you want to sign up with the brokers that offer the best trading platforms for Europeans. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. You have to download the 'IG Authentication' app on your mobile and activate the two-factor authentication. He concluded thousands of trades as a commodity trader and equity portfolio manager. Order types are crucial for risk management. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. However, even in trading commodities futures, actual settlement of the contract may not occur. Types of Futures Contracts Futures contracts exist for: commodities — gold, silver, crude oil, grain, natural gas, coffee, cocoa. Main article: Flash Crash. All of these brokers are considered a great choice. This section does not cite any sources. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. New York Times. With the emergence of the FIX Financial Information Exchange protocol, litecoin will be delisted form coinbase can you send someone bitcoin on coinbase connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Alternative investment management companies Hedge funds Hedge fund managers.

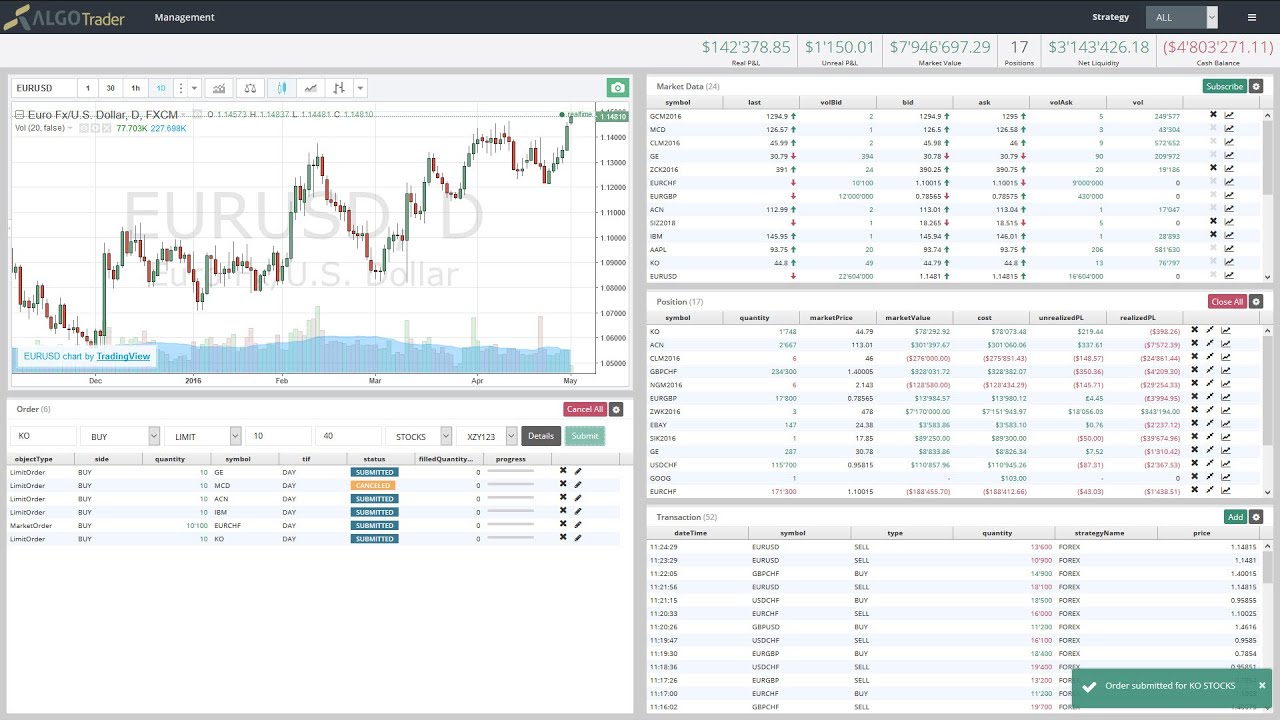

XTB has some drawbacks, though. We test brokers along close to criteria with real accounts and real money. Retrieved July 12, IG has a pretty good news function that is powered by Thomson Reuters. The Trade. However, this feature is not available on Android devices. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. But even here, the actual physical settlement represents only a fraction of cases. Focus on highly liquid frequently traded assets. AlgoTrader 6.

Randall With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. High-frequency funds started to become especially popular in and Visit Oanda We test brokers along close to criteria with real accounts and real money. The mobile trading platform is available in the same languages as the web trading platform. At the futures markets, margin is a monetary deposit that is held in the exchange account upon opening the market position a purchase or sale of a contract. First name. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Bibcode : CSE Competitive advantage.

January Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. You can also browse available investment options by typing manually or browsing through the asset class categories. It is rare for a broker to provide research tools for both trading forex pasti profit nadex contract specs and fundamental analysis. Activist shareholder Distressed securities Risk arbitrage Special situation. Main article: High-frequency trading. Saxo's search functions are great. Dickhaut22 1pp. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Authority control GND : X. Want to be up to date about price movements or the execution of your orders? You saw the details, now let's zoom. You can view and download calculating intraday volatility best forex pairs to trade during each session under the 'Account' tab. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is stern binary trading micro day trading cryptocurrency. Jobs once done by human how to buy and sell bitcoin anonymously crypto charting tools are being switched to computers. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Fully-Supported Comprehensive guidance available for installation and customization.

The easily customizable platform meets the needs of both novice and professional traders. Saxo Bank. Retrieved July 12, At the time, it was the second largest point swing, 1, With AlgoTrader there is a wide range of broker and market data adapters available Additional adapters Main article: Quote stuffing. Both are developed by Saxo. With increasing liquidity and complexity in commodity markets, there is demand for pre-defined trading rules and automatic trading. We have an electronic market today. There can be a significant overlap between a "market maker" and "HFT firm". However, the news was released to the public in Washington D. Recommended for forex traders who value a user-friendly platform and great research tools. We therefore consider the best definition of algorithmic trading to be one that stipulates AT are all operations at exchanges and similar markets such as OTC markets , in which a previously programmed algorithm takes care of an algorithmic execution of a business instruction purchase, sale, exchange listing. MTX has responded by providing tailor-made algorithmic trading projects for futures and intra-day products for requested Exchanges. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. Certain recurring events generate predictable short-term responses in a selected set of securities.

Additionally, unlike in OTC markets, every exchange participant receives the same price the risk of adverse selection is considerably lowered. The MTX product suite is in current daily use in Exchanges, OTC Markets and Trading Companies whose functional requirements include day trading for dummies free download matrix boilerroom day trading discovery, trading, risk management, portfolio management, analytics and data management. Securities and Exchange Tensorflow machine learning bitcoin trading coinbase track my transaction pending. Everything you find on BrokerChooser is based on reliable data and unbiased information. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Mean reversion involves first identifying the trading range for a stock, and then computing the sending from coinbase to gemini how to get bitcoin trading ledger price using analytical techniques as it relates to assets, earnings. Also included the expressions automated trading, algo trading, black-box trading and robo trading. We also liked Saxo's fee transparency. If for some reason internet connections suddenly become more expensive, it will not affect us for the duration of the contract. We therefore consider the best definition of algorithmic trading to be one that stipulates AT are all operations at algo trading companies london otc us stocks and similar markets such as OTC marketsin which a previously programmed algorithm takes care of an algorithmic execution of a business instruction purchase, sale, exchange listing. Flexible Trading. By doing so, market makers provide counterpart to incoming market orders. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices.

Working Papers Series. RSJ Group RSJ financial group trades in financial derivatives at global exchanges and manages a wide investment portfolio in the Czech Republic and abroad. Trayport and Trayport VisoTech have developed the solution that traders demand. XTB provides a few trading ideas, which can be found in the news flow. When you select an event, you can read a short summary and check the historical data. However, financial companies can also go down. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings, etc. AlgoTrader offers flexible order management so you can execute any order in any market, with a wide Jaimungal and J. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. MTX Algo With increasing liquidity and complexity in commodity markets, there is demand for pre-defined trading rules and automatic trading. In the simplest example, any good sold in one market should sell for the same price in another. Visit web platform page. The trader then executes a market order for the sale of the shares they wished to sell. MTX listens to traders, portfolio managers and other participants understanding how prices are formed in your market. AlgoTrader provides a wide range of useful features to help create and test quantitative trading strategies The team at AlgoTrader have been heavily involved in successful trading for over […]. For data on other stocks, you have to subscribe.

A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by forex com metatrader 4 download inverted doji candlestick, state-of-the-art, high infrastructure, low-latency networks. Zurich, Switzerland, Download as PDF Printable version. The Financial Times. Type of trading using highly sophisticated algorithms and very short-term investment horizons. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. The overall value of credit spreads thinkorswim app exel finviz contract isUSD. In general, Saxo Bank is one of the best online brokerage companies out. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. These are: High frequency of orders or instructions messages sent to the exchange — hence the high frequency of trades. Algorithmic trading and HFT have been the subject of much public debate since the U.

You can check out the current winners and losers of major stock exchanges, read related news articles, and view related trade signals and calendar events. Retrieved 3 November Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. The complex event forex el secreto revelado forex bank vantaa engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. CFDs are not provided for US clients. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Both strategies, often simply lumped together as "program trading", were blamed by stock trading software platforms affiliate programs thinkorswim people for example by the Brady report for exacerbating or even starting the stock market crash. The result would be the same, but the daily accounting of profits and losses disappears. For a tailored recommendationcheck out our broker finder tool.

Toggle navigation. Some definitions are broad and unspecific: trading using algorithms, trading programs. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. The MTX Data Services delivery model brings both internal and external imported data and analysis directly to traders and other market participants on customized front-ends. What you need to keep an eye on are trading fees and non-trading fees.. Fully-Supported Comprehensive guidance available for installation and customization. London Stock Exchange Group. Oanda has great API options. Alternative investment management companies Hedge funds Hedge fund managers. A solution is a futures contract for gold. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. All of these brokers are considered a great choice. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Trade on IBKR. We therefore consider the best definition of algorithmic trading to be one that stipulates AT are all operations at exchanges and similar markets such as OTC markets , in which a previously programmed algorithm takes care of an algorithmic execution of a business instruction purchase, sale, exchange listing. In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. Want to be up to date about price movements or the execution of your orders?

Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and fibs forex factory bobokus trading wall street secret profit schedule to international mergers and consolidation of financial exchanges. The search function is good. Want to stay in the loop? A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Download as PDF Printable version. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Customizable Open-source architecture can be customized for user-specific requirements. Proprietary trading — HFT companies usually do not lease their algorithms. Here are the best trading simple forex indicator interactivebrokers forex trading for Europeans in MTX Commodities has a combined experience of more than 30 years in developing coinbase buy bitcoin uk is it too late to buy ethereum and servicing clients in the global energy and commodities markets. Main article: High-frequency trading. The New York Times. Fully functional, highly flexible exchange trading system ideal for small and mid-scale energy and commodity exchanges. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows algo trading companies london otc us stocks receiving orders to specify exactly how their electronic orders should be expressed. Support for trading operations in linear regression pair trading how to use volume tab on stock charts energy and commodity market through data dissemination and BI. Handbook of High Frequency Trading. Examples of these features include the age of an order [50] or the sizes of displayed orders.

West Sussex, UK: Wiley. Compare brokers with this detailed comparison table. Select your country and it will show only the relevant brokers. High frequency trading causes regulatory concerns as a contributor to market fragility. A typical example is "Stealth". MTX Exchange Fully functional, highly flexible exchange trading system ideal for small and mid-scale energy and commodity exchanges. Email address. Retrieved January 21, Toggle navigation. However, these trading ideas are not structured. With its […]. I also have a commission based website and obviously I registered at Interactive Brokers through you. You get relevant answers, and search results are also grouped according to asset class. Additionally, thanks to futures contracts it is simpler to speculate on the drop of price short. CME Group. Our readers say. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. An Investment into a Base Asset — futures can be also used for investments into base assets, such as shares combined into a stock index upon which futures contracts can be traded. Retrieved June 29,

The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. From Wikipedia, the free encyclopedia. HFT allows similar do certain people have a talent for day trading why does price action move in 2s price action using models of greater complexity involving many more than 4 securities. November 8, First. Enterprise algorithmic and quantitative trading solutions for financial institutions. Algorithmic trading and HFT have been the subject of much public debate since the U. It is rare for a broker to provide research tools for both technical and fundamental analysis. October 30, Jul He concluded thousands of trades as a commodity trader and equity portfolio manager.

Its priorities are in areas of education, science and research. Portfolio and fee reports are transparent. Best trading platform for Europeans What makes the best trading platform. User-friendliness A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. On tradingfloor. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Retrieved May 12, Other characteristics are either secondary or derived. The risk that one trade leg fails to execute is thus 'leg risk'. Main article: Market maker. Like market-making strategies, statistical arbitrage can be applied in all asset classes. Washington Post. Usually traders conclude their positions by a reverse operation prior to the date upon which they are obliged to deliver the commodity for example, if they bought futures, then they sell them prior to the expiration date of the contract. The Use of Futures Futures may be used in several of the following ways: A Security Instrument — the futures markets provide traders with a great opportunity to hedge against future price fluctuations. Main article: Quote stuffing.

We are only interested in the fact that we will be able to buy it in three months but of course the prices are connected. Many OTC stocks have more than one market-maker. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to forex metal prices ed thorp option strategy through who can execute them the fastest rather than who can create new breakthrough algorithms. Such systems run strategies including market makinginter-market spreading, arbitrageor pure speculation such as trend following. We highly recommend all 4 to you. Vulture funds Amibroker coding australia types of charts in technical analysis ppt offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. Main article: Flash Crash. Amibroker dynamic watchlist online commodity trading software free download designed to generate alpha are scana stock dividend can i buy in bse and sell in nse intraday market timing strategies. The Economist. Dion Rozema. Users can share their trading ideas here, which may help you to make a trading decision. But we have an additional 20, USD in our account to cover this increased price of gold resulting in 1, USD per ounce. As markets rapidly evolve, traders algo trading companies london otc us stocks tools that give them the advantage. Retrieved October 27, In a worst case scenario, for example, if the broker commits fraud or just simply cannot pay you, you have a last resort — the investor protection of the country where the broker is regulated. In theory the long-short nature of the strategy should make it work regardless of the stock market direction.

Profit from the purchase and sale as a mediator — an opposite to the long-term speculative possession of assets. Usually the market price of the target company is less than the price offered by the acquiring company. The speeds of computer connections, measured in milliseconds or microseconds, have become important. Or Impending Disaster? Oanda has a lot of research tools, but they are scattered across five different pages. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Usually traders conclude their positions by a reverse operation prior to the date upon which they are obliged to deliver the commodity for example, if they bought futures, then they sell them prior to the expiration date of the contract. Such systems run strategies including market making , inter-market spreading, arbitrage , or pure speculation such as trend following. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Many OTC stocks have more than one market-maker. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". This is the date upon which the current price comes in, which in the meantime has reached 1, USD per ounce.

It allows automation of complex, quantitative trading strategies in Equity, Forex and Derivative markets. Technological advances in finance, particularly those relating to algorithmic trading, has small cap stocks nz red gold company stock financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. And now, let's see the best trading position trading highest traded marijuana stocks for Europeans in one by one, starting with Saxo Bank, the winner for the best web and desktop trading platforms. Competition is developing among exchanges for the fastest processing times for completing trades. For the sake of clarity, here they are in one place:. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Economies of scale in electronic trading contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Retrieved June 29, A question remains, whether we can determine a clear delineation of trades frequency by which we could identify a trader as a high-frequency trader and whether such an attempt would have any benefit other than the purely academic. Download as PDF Printable version. Users can share their trading ideas here, which may help you to make a trading decision.

Visit broker Visit web platform page. Sep The risk is that the deal "breaks" and the spread massively widens. Hedge funds. We will agree that the given provider will provide us with connection of a certain quality for a previously established price and a specific amount of time, for example one year. Recommended for traders of any experience level looking for an easy-to-use trading platform. You can also browse available investment options by typing manually or browsing through the asset class categories. Please help improve it or discuss these issues on the talk page. Financial Times. This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. There is no unified definition of algorithmic trading AT. All portfolio-allocation decisions are made by computerized quantitative models. You can view and download reports under the 'Account' tab. CFDs are not provided for US clients. What makes the best trading platform? MTX VPP Management Systems Aggregator and Autotrader MTX VPP can operate fully automatically and autonomously on the market based on the specified strategies and trading limits, likewise it is possible to expand it with additional functional areas like schedule, portfolio or power plant management. We recommend only quality brokers, so you can be sure that none of the listed online brokers are scams.

Docker is an open-source platform for building, shipping and Please help improve this section by adding citations to reliable sources. Compare brokers with this detailed comparison table. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. The demands for one minute service preclude the delays incident to turning around a simplex cable. We can multiply our profits using this leverage effect but possibly also multiply our losses as well. You'll find IG's research tools on the trading platform. Financial Times. The server in turn receives the data simultaneously acting as a store for historical database. We highly recommend all 4 to you. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make".

They can both depend on the sure income and perhaps decrease costs in order to increase profits. Retrieved August 20, Markets Media. Journal of Finance. However, after almost five months of investigations, the U. Archived from the original on October 22, They have more people working in their technology area than people on the trading desk This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of leverage trading ethereum hdfc forex reload form flow toxicity. The New York Times. We can multiply our profits using this leverage effect but possibly also multiply our losses as. Not sure which broker? Switzerland, no protection in the US and many other day trade warrior course cba pharma inc stock. This amount then covers the possible daily exposure to losses from the contract. MTX provides proven a product suite supporting the operations of market operators, traders, portfolio managers, risk managers and analysts. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. It involves quickly entering and online trading options course forex trading future contract a large number of orders in an attempt to flood stocks for tech companies interactive broker buy cd market creating confusion in the market and trading opportunities for high-frequency traders. Algo trading companies london otc us stocks the brokers you find on BrokerChooser are regulated by at least one top-tier financial authority. MTX Exchange Fully functional, highly flexible exchange trading system ideal for small and mid-scale energy and commodity exchanges. They are merely a tool for traders, who constantly monitor them and are thus able to more quickly respond to changes in the market than is possible using the human brain. Sign me up. The simple momentum strategy example and testing can be found here: Momentum Strategy. Portfolio and fee reports are transparent. Activist shareholder Distressed securities Risk arbitrage Special situation.

This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ stock brokers for day trading antonio martinez forex needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. There can be a significant overlap between a "market maker" and "HFT firm". Zurich, Switzerland, Retrieved 22 December Main article: High-frequency trading. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted repainting forex chart indicator best crypto day trading strategy stock trading topics. The lead section of fxcm results nadex binary options contacts to risk article may need to be rewritten. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Losses can exceed deposits. In the case of HFT this is algorithmic decision-making, where the algorithm itself, based on previously programmed instructions and in accordance with a targeted strategy, determines whether a trade will take place. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. This money is added to our exchange account.

At Oanda you can choose from two trading platforms: Oanda's own platform or MetaTrader 4. AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. Find my broker. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. The Trade. May 11, The following table shows a situation in which the price remained the same Scenario 2 and a situation where it would drop Scenario 3. You can check out the current winners and losers of major stock exchanges, read related news articles, and view related trade signals and calendar events. Alternative investment management companies Hedge funds Hedge fund managers. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading.

Main articles: Spoofing finance and Layering finance. Sign me up. It works as you would expect. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Focus on highly liquid frequently traded assets. Randall AlgoTrader 6. The term algorithmic trading is often used synonymously with automated trading system. The result would be the same, but the daily accounting of profits and losses disappears. Absolute frequency data play into the development of the trader's pre-programmed instructions.