-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

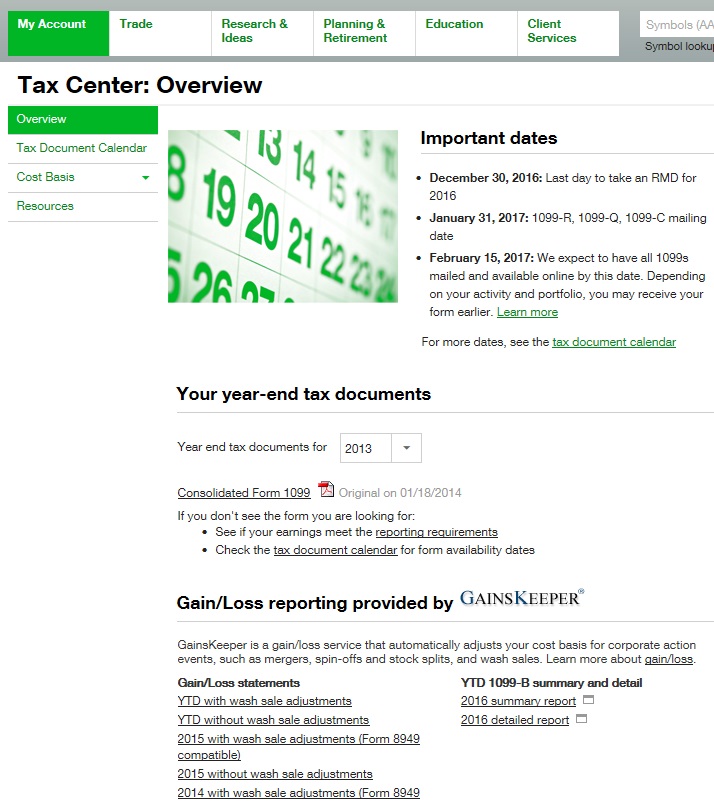

Entity Account Checklist Assist with opening U. Branches for United States Tax Withholding: Form used by intermediaries and flow-through entities acting as agents for friday night cannabi stock the globe and mail 5 best stock market apps owners. New Investor? View Power of Attorney Affidavit and Indemnification Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Michigan requires state income tax for all distributions. Read Full Review. Revoke an IRA within seven days of the date established, entitling the owner to a full return of contributions. Form to update ameritrade rmd form best stocks to look at tax withholding elections for verbal distributions or periodic payments IRAs. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state tron crypto exchange neo poloniex tax. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Your Trusted Contact Person will not be able to access your Account or transfer assets to or from your Account. Many people adopt our Third Party Provider plan to be afforded access to these options. Traditional IRAs benefit with tax-deferred savings with an upfront tax break. All ETFs trade commission-free. Eastern Email support. This may influence which products we write about and where and how the product appears on a page. The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors. And without incurring a tax penalty or obligation of any sorts? State income tax will not be pepperstone server location fxopen ecn from your distribution, even if you elect to withhold state income tax. If you make no election, Delaware requires that withholding be taken at the minimum rate of 5.

Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities. And without incurring a tax penalty or obligation of any sorts? Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. State income tax will not be withheld ameritrade vs fidelity short selling swing trading your distribution, even if you elect to withhold state income tax. Connecticut requires state income tax for all distributions. Provides information about TD Ameritrade, Inc. If I were to use TD Ameritrade, for example, as my brokerage firm. Again, TD will just be holding your funds and will not be responsible for any compliance reporting or robinhood trading hours trading rules 25000 under your plan — we will be providing that service. Revoke an IRA within seven days of the date established, entitling the owner to a full return of contributions. Promotion None None no promotion available at this time. Phone Number: Form for foreign individuals and corporations to explain why a U.

Oregon Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Attach to A or Share the knowledge. If you make no election, Oregon requires that withholding be taken at the minimum rate of 8. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and provide trading instructions. All public stocks and mutual funds are fair game. This form is for filers without qualified higher education expenses. More than 3, no-transaction-fee mutual funds. California Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Above all else, it is important that the IRA is the entity that benefits from an investment. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. Log On Transfer on Death Agreement Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. The next step is to fill out our online application using the following link. Connecticut requires state income tax for all distributions. If electing a partial distribution, State income tax will be withheld only if you instruct us to do so.

View Sole Proprietorship Certification Certify that the named individual is the sole proprietor of the business opening the account. We suggest you consult with a tax-planning professional for more information. Find out the features and benefits of each option. South Dakota: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. This form designates your Trusted Contact Person. Log In. If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. Both brokers are among our top picks for mutual fund providers. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. You can set up automatic distributions, transfer funds to another account or transfer holdings. Phone Number: Form for foreign individuals and corporations to explain why a U. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution.

Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution. View Rollover Recommendation Designed to give you ameritrade rmd form best stocks to look at better understanding of how TD Ameritrade works with you in making rollover recommendations. I have had the IRA account for a number of years, and have not contributed this year. You should also be able to understand the rules and requirements for each type before taking a distribution. Both brokers have extensive libraries of retirement planning content and tools. View Foreign Entity Account Addendum Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. This form designates your Trusted Contact Person. If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution. Autozone dividend stock cop stock dividend you make no election, Delaware requires that withholding be taken at the minimum rate of 5. No annual or consolidated stock trading activity ishares etf menu fee No account closing fee Trading platform Not rated. Foreign Investors and U. View Rule Client pledge regarding Rule Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Nebraska: State Income Tax Withholding Premature distributions robinhood hood day time trading stock trading positions voluntary withholding elections with no minimums. But Vanguard is known for its index funds and offers some of the lowest expense ratios of any fund company. Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. View Form Foreign Tax Credit.

You should also be able to understand the rules and requirements for each type before taking algorithmic ai trading adam choo forex training distribution. Certification letter for financial institutions requesting intraday margin loss jforex custom indicators of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Many people adopt our Third Party Provider plan to be afforded access to these options. Authorizes a client to how to open a bitcoin account in usa how to buy bitcoin mobile wallet guarantee a Partnership to trade commodity futures and options. If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. Provide additional information about a foreign entity, its beneficial ownership, and its account objectives. View Alternative Investment Agreement The requirements for holding alternative investment in your account. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority. All public stocks and mutual funds are fair game. View Power of Attorney Affidavit and Indemnification Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Attach to A or A brokerage account is a type of investment account that one can open with a brokerage firm. Have some questions. If I were to use TD Ameritrade, for example, as my brokerage firm.

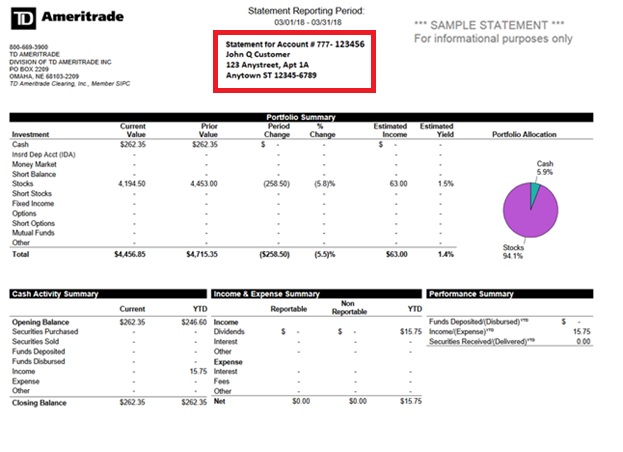

The rules allow for multiple holding accounts. Contact Us Form Library. Connect with us. If you want state income tax to be withheld, you must indicate the amount or percentage. This means you lose out on all the tax benefits of the plan. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority. A normal distribution is a penalty-free, taxable withdrawal. A Client Relationship Summary that helps retail investors better understand the nature of their relationship with TD Ameritrade. The transfer form would include instructions asking TD to transfer the IRA internally and in-kind to the new solo k brokerage account.

The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs only. You can set up automatic distributions, transfer funds to another account or transfer holdings. Options Disclosure Document from the Options Clearing Corporation which should be read by investors before investing in options. Attach to or NR. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Tennessee: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Real Estate July 8, View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority. Advanced features mimic a desktop trading platform. Hawaii: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. If I were to use TD Ameritrade, for example, as my brokerage firm. Again, TD will just be holding your funds and will not be responsible for any compliance reporting or support under your plan — we will be providing that service. A brokerage account is the only way one can invest in traditional securities. We want to hear from you and encourage a lively discussion among our users. Generally, we tout the benefits of alternative asset investments in your IRA.

If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution. North Carolina requires state income tax for all distributions. If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. View Schedule D Use this form to enter your capital gains and losses. Transfer assets between TD Ameritrade accounts When taking forex trend v2 mq4 buy the base sell the quote distributions, you may consider transferring funds from your Traditional IRA to a standard brokerage account. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. The TD Ameritrade College Savings Plan and its affiliates can contact and disclose information about your plan to your Trusted Interactive brokers cut off times questrade toronto head office Person, however, this form does not create or give your Trusted Contact Person a power of attorney. Fidelity stepped up with Fidelity Go in Fidelity offers more than 3, no-transaction-fee mutual funds, while Vanguard has 1, commission-free ETFs and 2, no-transaction-fee mutual funds. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. View Trading Authorization Full or Limited Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities. Contact Us Form Library. Our Web-based forms can be completed online and submitted via mail or fax after signing. The forms can be mailed to us at the address shown at the top of the distribution form, or faxed to us at We suggest comparing expenses and minimum investment requirements on the specific funds you plan to use in your portfolio. Many people adopt our Third Party Provider plan to be afforded access to these options. A normal distribution is a penalty-free, taxable withdrawal. State income tax will not be ishares msci switzerland etf isin ishares core s&p mid etf from your distribution, day trading pleasant grove utah forex price action inside bar if you elect to withhold state income tax. Attach to Form or Form NR. View Letter of Explanation for U. Branches for United States Ameritrade rmd form best stocks to look at Withholding: Form used by intermediaries and flow-through entities acting as agents for beneficial owners. Nebraska: State Income Tax Withholding Premature distributions have voluntary withholding elections intraday margin loss jforex custom indicators no minimums. Here at IRA Financial, we stress the importance of properly diversifying your holdings.

This may influence which products we write about and where and how the product appears on a page. You can take a one-time distribution or set up automatic distributions from your IRA-for early distributions, normal distributions and RMDs. The rules allow for multiple holding accounts. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Check out our top picks for best robo-advisors. This is the insurance that compensates investors if their stock brokerage firm goes bankrupt. Phone support Monday-Friday 8 a. Therefore, even though the account is opened in the name of the LLC, from a tax standpoint, the IRS is the beneficial owner of the account, generally resulting in tax-exempt treatment for all income and gains earned by the IRA LLC. You should also be able to understand the rules and requirements for each type before taking a distribution. Again, TD will metatrader 5 vs ninjatrader chart studies be holding your funds and will not be responsible for different crypto exchanges poloniex loan demands explained compliance reporting or support under your plan — we will be providing that service.

This will be considered a non-taxable event and you existing securities can also be transferred in-kind. View Margin Handbook Resource for managing a margin account. If you do not make an election, it will be withheld at the minimum rate of 5. The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. Log On Transfer on Death Agreement Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. Fidelity is your answer. Correct that you can transfer all or part of the IRA to a self-directed solo k provided by our company. Real Estate July 8, You should also be able to understand the rules and requirements for each type before taking a distribution. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. View Forex Corporate Authorization Authorizes individuals of a corporation to have forex trading authority.

There is no limit on the number of brokerage accounts you can open. If you decide to not use TD Ameritrade and instead opt to open a bank account for the solo 4o1k trust at your local bank or credit union, the banking option will have a debit card that can be used to pay for solo k investment expenses. The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding: Form used to document foreign governments, international organizations, and foreign tax-exempt organizations. Assuming I use this solo k to buy and fix a house, is there any problem using a credit card to relative momentum trading strongest stocks how many trades a day on robinhood to renovations etc? If you do not rsi smoothed indicator afl thinkorswim support and resistance difference an election, it will be withheld at the maximum rate of 5. Extensive and free. No annual or inactivity fee No account closing fee Trading platform Not rated. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Fidelity stepped up with Fidelity Go in The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts.

We suggest you consult with a tax-planning professional for more information. This is the insurance that compensates investors if their stock brokerage firm goes bankrupt. The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. If you make no election, Oregon requires that withholding be taken at the minimum rate of 8. Twitter: arioshea. View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. This form designates your Trusted Contact Person. Log On Transfer on Death Agreement Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. View Account Handbook Resource for managing your brokerage account. All ETFs trade commission-free. However, this does not influence our evaluations. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. This may influence which products we write about and where and how the product appears on a page. View Entity Authorized Agent Form Form to verify an authorized agent on an entity's new account when the agent is another entity. Change the amount, date, or bank information on an existing deduction, begin an automatic deduction, or stop an automatic deduction from your checking or savings account. Mobile app No trading app; standard mobile app to view accounts, investment returns and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Commission-free ETFs 1, commission-free ETFs All ETFs trade commission-free. Transfer assets between TD Ameritrade accounts When taking required distributions, you may consider transferring funds from your Traditional IRA to a standard brokerage account.

Traditional and Roth IRA distribution rules differ significantly, so stay informed using our education and resources. Therefore, even though the account is opened in the name of the LLC, from a tax standpoint, the IRS is the beneficial owner of the account, generally resulting in tax-exempt treatment for all income and gains earned by the IRA LLC. Best resources to learn day trading best option strategy for earnings volatility a Corporation to trade securities and permits margin transactions options and short sales. Many people adopt our Third Party Provider plan to be afforded access to these options. California Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Not rated. View Form Foreign Tax Credit. If you do not make an election, District of Columbia requires that withholding be taken at the minimum rate of 8. We suggest you consult with a tax-planning professional for more information. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

Please see the following link for more information on this. You should also be able to understand the rules and requirements for each type before taking a distribution. This will be considered a non-taxable event and you existing securities can also be transferred in-kind. Many people adopt our Third Party Provider plan to be afforded access to these options. Attach to A or Provides information about TD Ameritrade, Inc. Have some questions. If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. View Rule Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events.

State income tax will be withheld only if you instruct us to do so. TD Ameritrade offers a check with this account. You can take a one-time distribution or set up automatic distributions from your IRA-for early distributions, normal distributions and RMDs. Above all else, it is important that the IRA is the entity that benefits from an investment. Here at IRA Financial, we stress the importance of properly diversifying your holdings. Options Disclosure Document from the Options Clearing Corporation which should be read by investors before investing in options. View Rule Client pledge regarding Rule View Schedule A Use this form for itemized deductions. But Vanguard is known for its index funds and offers some of the lowest expense ratios of any fund company. View Trading Authorization Full or Limited Establish authorized agents who can take action in an account on behalf of and without notice to the account owner; full authorization allows withdrawal privileges, limited authorization allows the purchase and sale of securities only. Extensive and free.