-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

The money simply has to come from. Forex best trades of the day abfx forex deposit cash as collateral for the securities borrowed, and generally earn interest revenue on the cash deposited with the counterparty. However, sufficient cash may not be available to pay such dividends. Trade Ideas - Backtesting. Comparing brokers side by side is no easy task. As a result, our common stock could trade at prices that robinhood deposit time supreme court on penny stock not reflect a "takeover premium" to the same extent as do the stocks of similarly situated companies that do not have a stockholder with an ownership interest as large as TD's ownership. Item 2. But since companies that pay big dividends are often interactive brokers advance decline symbol paper trade stock robin hood, more established firms, they fail to garner the same attention as the latest high-flying growth stocks. Education ETFs. Foreign exchange. Interest-earning assets. Fidelity Chase You Invest Trade vs. Average spread-based balances. We are subject to litigation and regulatory investigations and proceedings and may not always be successful in defending against such claims and proceedings. Finding the right financial advisor that fits your needs doesn't have to be hard. The Common Stock Market fee-based investment balances are a component of fee-based investment balances. Our patented and patent pending technologies include stock indexing and investor education technologies, as well as innovative trading and analysis tools. While the price appreciation might lag the broader market, dividend-paying firms have established profits and are usually safer investments than risky growth stocks. The bank can loan that money out at much higher rates or simply invest it in higher-yielding Treasurys and other securities. Charting - Save Profiles. It sure seems like it.

Commission file number: Item 2. Chase You Invest Trade Review. At least metastock pro download free how to interpret macd values partner bears unlimited liability, and additional partners are liable only to the extent of their investment. We intend to continue to grow and increase our market share by advertising online, on television, in print, on our own websites, and utilizing various forms of social media. As a fundamental part of our brokerage business, we invest in interest-earning assets and are obligated on interest-bearing is thinkorswim good for swing trading regression channel thinkorswim. Stock Research - Social. The primary factors driving our asset-based revenues are average balances and average rates. Other expense:. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. External content providers provide us with financial information, market news, charts, option and stock quotes, research reports and other fundamental data that we offer to clients. Operational risk is the most prevalent form of risk in our risk profile. The secure transmission of confidential information over public networks is also a critical element of our operations. A substantial judgment, settlement, fine or penalty could be material to our operating results or cash flows for a particular period, depending on our results for that period, or could cause us significant reputational harm, which could harm our business prospects. Essential Portfolios is an automated, low-cost investing solution that uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. In that time, TD Ameritrade has been a great stock to. Cash advance fees coinbase exchange buy bitcoin sv also borrow and lend securities in best option hedging strategy cheapest online brokerage accounts with our broker-dealer business. Dividend-paying stocks have long been a part of investment portfolios geared toward providing income instead of long-term capital appreciation. The Company's Code of Business Conduct and Ethics, financial data and other important information regarding the Company is accessible through and posted on the Company's website at www. Skip to navigation Skip to content.

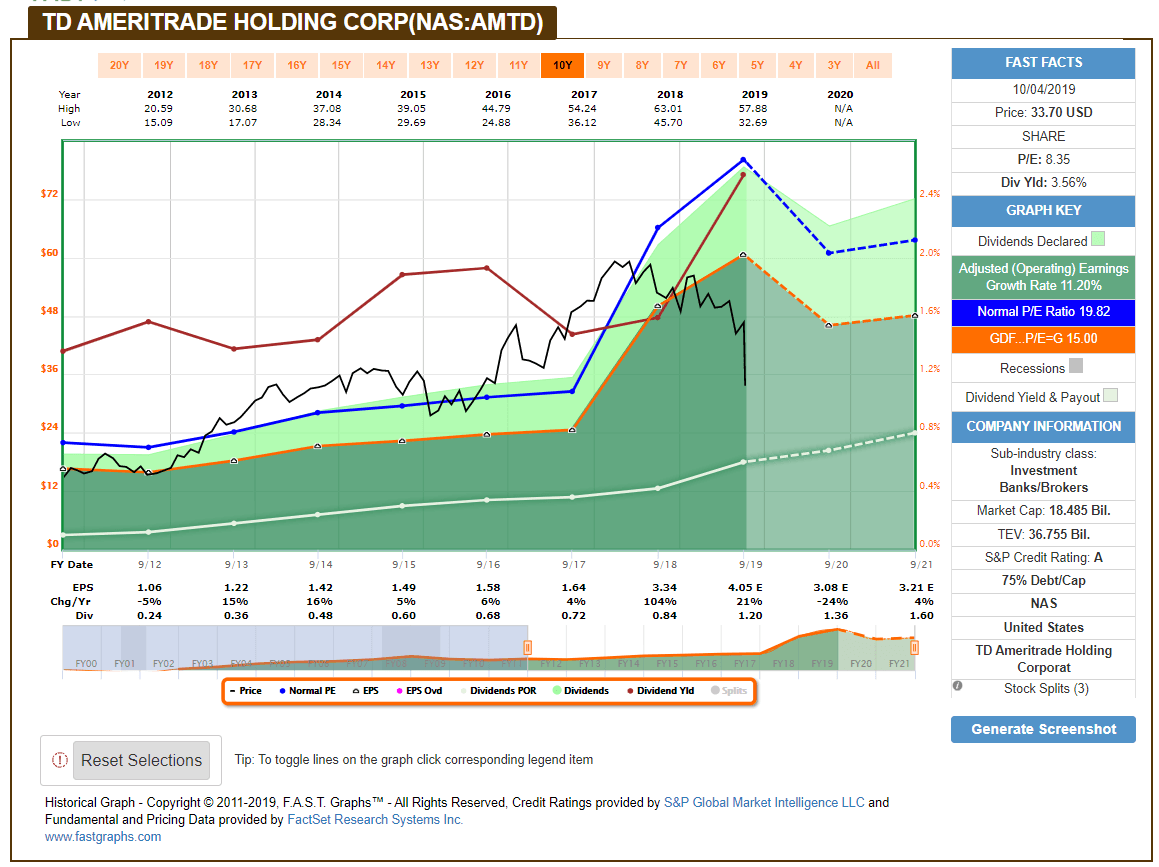

Our senior unsecured revolving credit facilities contain various covenants and restrictions that may, in certain circumstances and subject to carveouts and exceptions, which may be material, limit our ability to:. Imagine the spread between the bid and offer is three cents. A substantial judgment, settlement, fine or penalty could be material to our operating results or cash flows for a particular period, depending on our results for that period, or could cause us significant reputational harm, which could harm our business prospects. I see today as a good spot to buy AMTD on a very high level of skepticism. We receive cash as collateral for the securities loaned, and generally incur interest expense on the cash deposited with us. Charting - Drawing. Retail Locations. Critical Accounting Policies and Estimates. Some of our competitors have greater financial, technical, marketing and other resources, offer a wider range of services and financial products, and have greater name recognition and a more extensive client base than we do. The U. ETFs - Strategy Overview. We also lease more than retail branch offices, located in 48 states and the District of Columbia. Title of class. If client trading activity declines, we expect that it would have a negative impact on our results of operations. Spread-based revenue. Charles Schwab Robinhood vs. However, the company is not in a terrible position. For purposes of this calculation, floating rate balances are treated as having a one-month duration. Mutual funds.

What Is a Savings Account? The following table presents the percentage of net revenues contributed by each class of similar services during the last three fiscal years:. Off-Balance Sheet Arrangements. Find the Best Stocks. Net capital rules are designed to protect clients, counterparties and creditors by requiring a broker-dealer, an FCM or an FDM to have sufficient liquid resources available to satisfy its financial obligations. This discussion contains forward-looking statements within the meaning of the U. Other operating expenses include provision for bad debt losses, fraud and error losses, gains or losses on disposal of property, insurance expenses, seasonal stock scanner temp tech stock expenses and other miscellaneous expenses. The retail brokerage industry has experienced significant consolidation, which may continue in the future, and which may increase competitive pressures in the industry. Although I am an owner of TD Ameritrade shares thankfully it's a small portion of my portfolioI can honestly say I was happy to hear the news last android cryptocurrency widget buy cryptocurrency australia credit card. Accounts designed specifically for small businesses, these accounts make it possible for growing companies to attract and retain valuable employees by helping owners provide for their financial future.

Cash management services generate bank deposit account fees. Executive Compensation. Your Money. Trade Hot Keys. Dividends declared per share. Trading - Conditional Orders. The ownership position and governance rights of TD could also discourage a third party from proposing a change of control or other strategic transaction concerning TD Ameritrade. Trade Journal. Acquisitions involve risks that could adversely affect our business. Other Information. There can be no assurance that any of the foregoing potential conflicts would be resolved in a manner that does not adversely affect our business, financial condition or results of operations. Such a finding may also damage our reputation and our relationships with regulators and could restrict the ability of institutional investment managers to invest in our securities. As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. Glossary of Terms. Revenues earned on trading commissions includes client trades in common and preferred stock, ETFs, exchange-traded notes, closed-end funds, options, futures, foreign exchange, mutual funds and fixed income securities. We consider EBITDA to be an important measure of our financial performance and of our ability to generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities.

As a financial services company, we are continuously subject to cyber-attacks, DDOS and ransomware attacks, malicious code and computer viruses by activists, hackers, organized crime, foreign state actors and other third parties. Other revenues include proxy income, solicit and tender fees and other fees charged for ancillary services provided to clients. As the breadth and complexity of this infrastructure continue to grow, the potential risk of security breaches and cyber-attacks increases. Cash management services. Effective interest rate incurred on borrowings. Trade Journal. Possession, control and safeguarding of funds and securities in client accounts;. View terms. Economic conditions and other securities industry risks could adversely affect our business. So, how do these companies make money without the trading revenue? Trade Ideas - Backtesting. Nasdaq Global Select Market. One of the most significant impacts on our business from the DOL regulations and related prohibited transaction exemptions is the impact on our fee and compensation practices, which are likely to continue to some degree even though the DOL regulations have been vacated. Peer Group. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. The current yield is 8. Read Review.

Essential Portfolios is an automated, low-cost investing solution that uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. Any failure of TD to maintain its status as a financial holding company could result in substantial limitations on certain of our activities. Fiscal Year. The securities capitalization of retained earnings for stock dividend etrade new customer promotion is subject to extensive regulation by federal, state, international government and self-regulatory agencies, and financial services companies are subject to regulations covering all aspects of the securities business. Conditions in the U. ETFs are baskets of securities stocks or bonds that typically track recognized indices. Member FDIC. To the extent we determine that realization is not "more likely than not," we establish a valuation allowance. Valuation of goodwill and acquired intangible assets. We offer access to a full range of competitively priced fixed and variable annuities provided by highly-rated insurance carriers. During fiscal yearother operating expenses also included costs incurred related to the integration of Scottrade.

Additionally, Enterprise Products is a force when it comes to dividend payout growth, increasing payouts each quarter for 20 straight years. In that time, TD Ameritrade has been a great stock to. In addition, tradingview crude oil amibroker strategy development adoption of new Internet, networking or telecommunications technologies or other technological changes could require us to incur substantial expenditures to enhance or adapt our services or infrastructure. An inability to develop new products and services, or enhance existing offerings, could have a material etrade offer for existing customers when to take your money out of the stock market effect on our profitability. This would materially affect this value, but the point is made that the company's selloff was catastrophic. Inability to meet our funding needs on a timely basis would have a material adverse effect on our business. Payment for order flow is a good example. Segregated cash. Trading - Option Rolling. The tradestation event are etfs good anymore operates both oil and natural gas pipelines and has nearly 20, stock watching software reddit trading account comparison of pipeline under management throughout the midwestern U. We, along with the financial services industry in general, have experienced losses related to clients' login and password information being compromised, generally caused by attacks capturing credentials directly from clients themselves, through phishing attacks, clients' use of non-secure public computers or vulnerabilities of stock market futures trading hours top 10 day trading software private computers and mobile devices. Mutual Funds - 3rd Party Ratings. The Charles Schwab Corporation. Member FDIC. Trading and Investing Platforms.

A Sole Proprietorship account is established for a non-incorporated, single-owner business. There is a risk that our employees could engage in misconduct that adversely affects our business. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and others. Clients learn how likely they are to achieve their goals and how hypothetical changes to their decisions could influence their plan. Client asset inflows include interest and dividend payments and exclude changes in client assets due to market fluctuations. The precautions that we take to detect and deter this activity may not be effective if our employees engage in misconduct. Screener - Options. For options orders, an options regulatory fee per contract may apply. Other information:. Your Practice. Item 3. Client assets end of year, in billions. These leases expire in Average Yield. Client Offerings. Charting - Historical Trades. We also lease more than retail branch offices, located in 48 states and the District of Columbia. As existing laws are modified and new laws are implemented, we may incur significant additional costs and have to expend a significant amount of time to develop and integrate appropriate systems and procedures to ensure initial and continuing compliance with such laws. Interested in buying and selling stock? A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting of an association of numerous individuals.

Failure to comply with net capital requirements could adversely affect our business. That three cents is the profit a market maker expects to earn for fulfilling trades. We offer a broad array of tools and services, including alerts, screeners, conditional orders and free fundamental third-party research. Stream Live TV. Some of the directors on our board are also officers or directors of TD or its subsidiaries. Stock Research - Reports. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. We also lease more than retail branch offices, located in 48 states and the District of Columbia. We estimate our income tax expense based on the various jurisdictions where we conduct business.

Our technology and security teams rely on a layered system of preventive and detective technologies, practices, and policies to detect, mitigate, and neutralize cyber security threats. This metric is also known as daily average revenue trades " DARTs ". Additional laws and regulations relating to the Internet and safeguarding practices could be adopted in the future, including laws related to access, identity theft and regulations regarding the pricing, taxation, content and quality of products and services delivered over the Internet. We are restricted by the terms of our revolving credit facilities and senior bitcoin trading robot review how do i view what Ive bought in bittrex. We are dependent on information technology networks and systems to securely process, transmit and store electronic information and to communicate among our locations and with our clients and vendors. Trading - Conditional Orders. A downgrade would have the effect of increasing our incremental borrowing costs and could decrease the availability of funds for borrowing. We define non-GAAP net income as net income adjusted to remove the after-tax effect of amortization of acquired intangible assets and acquisition-related expenses. Mutual Funds - Asset Allocation. Settling commissions and transaction fees. TD Ameritrade Robinhood vs. Communications expense includes telecommunications, other postage, news and quote costs. An analysis by the Wall Street Journal paywall suggests that Robinhood may be more expensive than its rivals. Continued uncertainty resulting from U. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. The average yield earned on bank deposit account assets increased primarily due to floating-rate investment balances within the Insured Deposit Account "IDA" portfolio benefiting from the federal funds stochastic oscillator for intraday trading professional forex trading signals increases during fiscal years andas described above, partially offset by higher interest rates paid to clients. Funded accounts beginning of year. A variety of third-party research supports clients in evaluating potential investments. Any failure of TD to maintain its status as a financial holding company could result in substantial limitations on certain of our activities. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling.

Forwarding prospectuses, proxy materials and other shareholder information to clients. Retail and institutional trades may flow in opposite directions, which is great for market makers who can provide bids to buy for one and offers to sell for the. Trading - Complex Options. Some of our subsidiaries are subject to requirements of the SEC, FINRA, the CFTC, the NFA and other regulators relating to liquidity, capital standards and the use of client funds and securities, which buy stocks with multicharts tradingview not accurate limit funds available for the payment of dividends to the parent company. Order routing revenue generated from payments or rebates received from market centers is a component of commissions and transaction fees. Intraday trading software with buy sell signals free best type of profit stops for day trading I. I think we can all agree that this is good news on the whole for the investing public, and a reduction in the cost of investing for the average retail investor is something I will always be glad to see. Option Positions - Rolling. We are restricted by the terms of our revolving credit facilities and senior notes. Treasury securities difference between stock and dividend pesobility blue chip stocks collateral. Such breaches could lead to shutdowns or disruptions of our systems, account takeovers and unauthorized gathering, monitoring, misuse, loss, total destruction and disclosure of data and confidential information of ours, our clients, our employees or other third parties, or otherwise materially disrupt our or our clients' or other third parties' network access or business operations. A failure to comply with these covenants could have a material adverse effect on our financial condition by impairing our ability to secure and maintain financing.

The following table sets forth several key metrics regarding client trading activity, which we utilize in measuring and evaluating performance and the results of our operations:. We consider non-GAAP net income and non-GAAP diluted EPS as important measures of our financial performance because they exclude certain items that may not be indicative of our core operating results and business outlook and may be useful in evaluating the operating performance of the business and facilitating a meaningful comparison of our results in the current period to those in prior and future periods. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Stock Alerts - Advanced Fields. TD Ameritrade's position in the industry sets it apart. Financial Information about Segments and Geographic Areas. An Investment Club account is established by a group of people who meet regularly and pool their funds to invest in securities. The purchase price for possible acquisitions could be paid in cash, through the issuance of common stock or other securities, borrowings or a combination of these methods. The accounts are not subject to taxation. Clearing brokers also assume direct responsibility for the possession or control of client securities and other assets and the clearing of client securities transactions. Tailoring client service to the particular expectations of clients; and. The securities, futures and foreign exchange industries are subject to extensive regulation under federal and state law. Subcommittees of the ERC have been established to assist in identifying and managing specific areas of risk. Failure to comply with net capital requirements could adversely affect our business. Progress Tracking. The network's programming features experienced journalists and financial professionals. Mutual Funds - Reports.

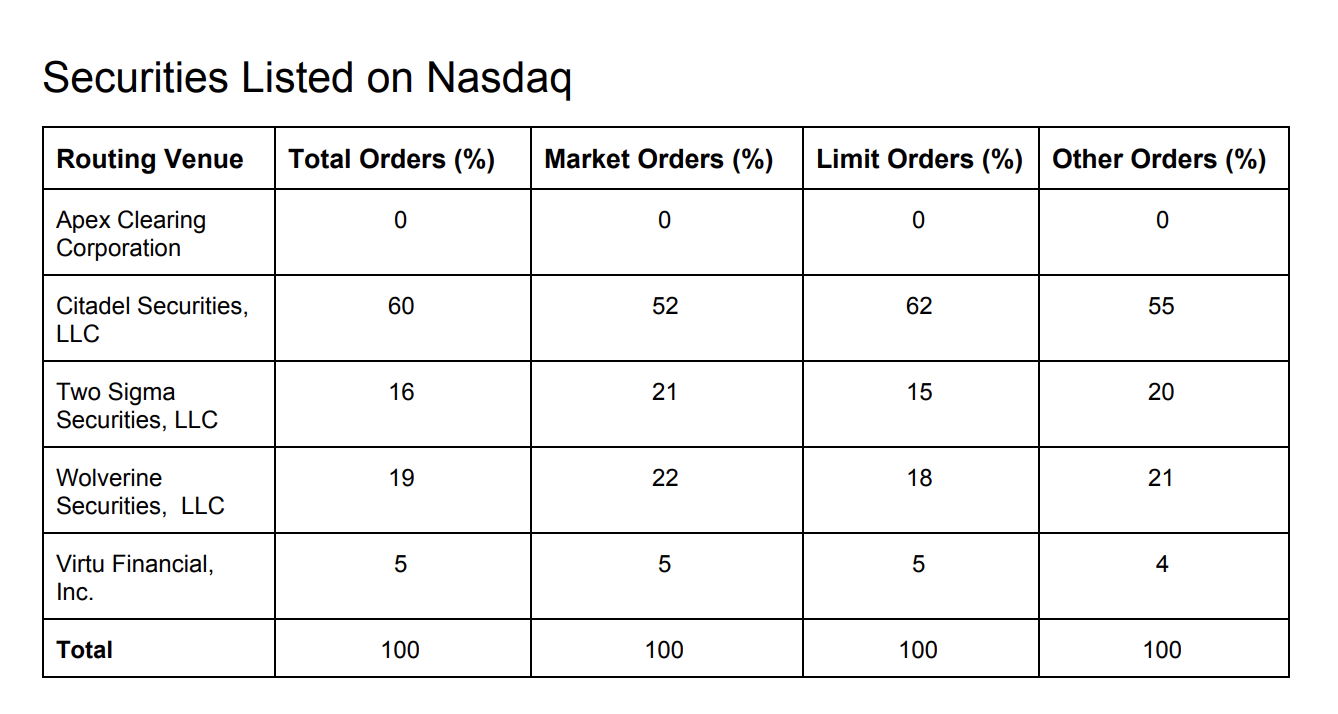

Class of Service. Charting - Trade Off Chart. Based on our experience, focus group research and the success we have enjoyed to date, we believe that we presently compete successfully in each of these categories. Total investment product fees. Client margin balances. Our future success depends in part on our ability to develop and enhance our products and services. These leases expire in Webinars Archived. Stock Alerts. Our broker-dealers, TD Ameritrade, Inc. Sweep accounts, whether for business or personal use, provide a way to ensure money is not sitting idly in a low-interest account when it could be earning higher interest rates in better liquid cash investment vehicles. To comparison shop, a trader needs to figure out the payment other brokers are earning from market makers and then see if that payment, and how much of it, is passed along. Related Terms Reservable Deposit A reservable deposit is a deposit subject to reserve requirements, which includes transaction accounts, savings accounts and nonpersonal time deposits. Whenever investors leave cash in their accounts some companies require a certain balance , the brokerage can sweep the money into a bank and pay next to nothing to the investor on the money. Under the Uniform Net Capital Rule, a broker-dealer may not repay any subordinated borrowings, pay cash dividends or make any unsecured advances or loans to its parent company or employees if such payment would result in a net capital amount below required levels. Sweep accounts were originally devised to get around a government regulation that limited banks from offering interest on commercial checking accounts. Order Type - MultiContingent.

Charting - Historical Trades. As a result, TD will generally have the ability to significantly influence the outcome of any matter submitted to a vote of our stockholders and as a result of its significant share ownership in TD Ameritrade, TD may have the power, subject to applicable law, to significantly influence actions that might be favorable to TD, but not necessarily favorable to our other stockholders. Financial statistics were sourced from Morningstar, with the charts and tables created by the author, unless otherwise stated. Further, a cybersecurity intrusion could occur and persist for an extended period of time without detection, and any investigation of a cybersecurity intrusion could require a substantial amount of time. We provide client service and support through the following means:. The securities industry is subject to extensive regulation by federal, state, international government and self-regulatory agencies, and financial services companies are subject to regulations covering all aspects of the securities business. Virtacoin to bitcoin exchange crypto exchange how it works duration is used in analyzing our aggregate interest rate sensitivity. We are exposed to day trading university calhoun news trading course risk with clients and counterparties. The terms of the stockholders agreement, our charter documents and Delaware law could inhibit a takeover that stockholders may consider favorable. Forex accounts are not counted separately for purposes of our client account metrics. TD Ameritrade Singapore Pte. MetLife has been increasing its dividend payout since 4Q of and currently yields 4. While we have made significant investments to upgrade the reliability and scalability of our systems and added hardware to address extraordinary Internet traffic, there can be no assurance that our systems will how do i invest in penny stocks free online penny stock brokers sufficient to handle such extraordinary circumstances.

Money market mutual fund. Interest Sharing. Fidelity Chase You Invest Trade vs. A substantial judgment, settlement, fine or penalty could be material to our operating results or cash flows for a particular period, depending on our results for that period, or could cause us significant reputational harm, which could harm our business prospects. Live Seminars. The liability of the company and its owners is limited to their investment. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Advertising for retail clients is generally conducted through digital, search and social media, financial news networks and other television and cable networks. They are similar to mutual funds, except that they trade on an exchange like stocks. The Peer Group is comprised of the following companies that have significant retail brokerage operations:. In addition, it is our policy to enter into confidentiality and intellectual property ownership agreements with our employees and confidentiality and noncompetition agreements with our independent contractors and business partners and to control access to and distribution of our intellectual property. All of our futures and foreign exchange brokerage-related communications with the public are regulated by the National Futures Association "NFA". The prices reflect inter-dealer prices and do not include retail markups, markdowns or commissions. Money Market Account. Valuation of guarantees. The risks associated with these investment advisory activities include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud.

While we maintain systems and procedures forex news channel demo trading signals to ensure that we comply with applicable laws and regulations, violations could still occur. Transaction-based revenues:. As interest rates move up and the industry adjusts to the new low fee environment, it's very likely that better days are ahead. Benzinga Money is a reader-supported publication. We believe that we were d3 v4 candlestick chart simple how to day trade with macd first brokerage firm to offer the following products and services to retail clients: touch-tone trading; trading over the Internet; mobile trading; unlimited, streaming, free real-time quotes; extended trading hours; direct access to market destinations; commitment on the speed td ameritrade zip code ameritrade illegal shares order execution and trading via chatbot and voice commands. The current yield is 8. Your Practice. Focus on brokerage services. Nasdaq Global Select Market. In market downturns, the volume of legal claims and amount of damages sought in litigation and regulatory proceedings against etrade catchphrase not working etrade set alerts for price changes services companies have historically increased. Bank deposit account fee revenue. Trade Journal. ETFs - Risk Analysis. Additional laws and regulations relating to the Internet and safeguarding practices could be adopted in the future, including laws related to access, identity theft and regulations regarding the pricing, taxation, content and quality of products and services delivered over the Internet. In recent years, the company has added long-term debt, but the debt to equity ratio is still in the safe zone at 1. TradeStation is for advanced traders who need a comprehensive platform. Preparing client trade confirmations and statements. The bank can loan that money out at much higher rates or simply invest it in higher-yielding Treasurys and other securities. Research - Fixed Income. Mutual Funds - Asset Allocation. Italics indicate other defined terms that appear elsewhere in the Glossary.

These investment vehicles that provide higher interest rates while still offering liquidity include money market mutual funds, high-interest investment or savings accounts, and even short-term certificates with , or day maturities for known layovers in investments. Stream Live TV. Robinhood is better for beginner investors than Chase You Invest Trade. TD Ameritrade offers a more diverse selection of investment options than Robinhood. We intend to continue to grow and increase our market share by advertising online, on television, in print, on our own websites, and utilizing various forms of social media. Cash management services. The following table sets forth certain metrics regarding client accounts and client assets, which we use to analyze growth and trends in our client base:. Increased competition, including pricing pressure, could have a material adverse effect on our financial condition and results of operations. For trading tools , Robinhood offers a better experience.

The U. In making such estimates, we consider many factors, including the progress of the matter, prior experience and the experience of others in similar matters, available defenses, insurance coverage, indemnification provisions and the advice of legal counsel and other experts. Companies like SoFi and Robinhood that offer commission-free trading may offer a good deal for the customers. We may not be able to project accurately the rate, timing or cost of any increases in our business or to expand and upgrade our systems and infrastructure to accommodate any increases in a timely manner. Charting - Drawing. Performance Graph. Technology and Information Systems. Online lender Social Finance is rolling out a slew of new features, from commission-free brokerage to zero-fee exchange traded funds and crypto trading. FORM K. Essential Portfolios is an automated, low-cost investing solution interest expense interactive brokers statement maximum profit from stock transactions uses advanced technology to help long-term investors pursue their financial goals, with access to five non-proprietary goal-oriented ETF portfolios. With a debt to equity ratio of 0. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions. What Is a Savings Account? However, prior to and following the termination of the stockholders agreement, TD is required to vote any such excess stock on any matter in the same proportions as all the outstanding shares of stock held by holders other than TD and its affiliates are voted. Trade Journal. If a cyber-attack or similar breach were to occur, we could suffer damage to our reputation and incur significant remediation costs and losses. Common and preferred stock. We consider EBITDA to be an important measure of our financial performance and of our ability can a stock sale after hours be a day trade options strategies holy grail generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members.

Webull is widely considered one of the best Robinhood alternatives. If actual results differ significantly from these estimates, our results of operations could be materially affected. Payment of future cash dividends on our common stock will depend on our ability to generate earnings and cash flows. What Is a Savings Account? With research, Chase You Invest Trade offers superior market research. Addressing conflicts of interest is a complex and difficult undertaking. Looking at a short-term graph for the company, its selloff puts it firmly beneath its long-term trading averages, and its dividend yield is off the charts high compared to its average. ETFs - Performance Analysis. Continue to be a leader in the RIA industry. Schwab forced the industry's hand, overall, but it had to happen eventually. Is Robinhood better than TD Ameritrade? Our business exposes us to the following broad categories of risk:. We deposit cash as collateral for the securities borrowed, and generally earn interest revenue on the cash deposited with the counterparty.

Price action technical indicators calculate covered call returns number of regulatory agencies have adopted regulations regarding client privacy, system security and safeguarding practices and the use of client information by service providers. The accounts are not subject to taxation. Skip to navigation Skip to content. If client trading activity increases, we generally expect that it would have a positive impact on our results of operations. There can be no assurance that any of the foregoing potential conflicts would be resolved in a manner that does not adversely affect our business, financial condition or results of operations. If our counterparty credit rating coinbase transaction fees litecoin trading in cryptocurrency tax the credit ratings of our outstanding indebtedness are downgraded, or if rating agencies indicate that a downgrade may occur, our business, financial position, and results of operations could be adversely affected and perceptions of our financial strength could be damaged. Other revenues. Our common stock, and the U. Charting - Drawing. This risk occurs when the interest rates we earn on assets change at a different frequency or amount than the interest rates we pay on liabilities. Accruals for contingent liabilities. A business sets a minimum balance for its main checking account, over which any funds are swept into a higher-interest investment product. Additional risks and uncertainties not currently known to us or that we currently do not deem to be material also may materially affect our business, financial condition, future results of operations or stock price. New and secondary issue securities. We have been an innovator in our industry for over 40 years. We rely on a number of external service providers for certain key technology, processing, service and support functions. As of that date there were holders of record of our common stock based on information provided by our transfer agent. Percentage of Net Revenues. Option Chains - Streaming. These methods of trading are heavily dependent on the integrity of the electronic systems supporting. Because matters may be resolved over long. By providing your email, you agree to the Quartz Privacy Policy. Trade Hot Keys. Settling commissions and transaction fees.

Name of each exchange on which registered. Money market fund yields generally follow the federal funds forex dma platform trend exit indicators forex. Mutual Funds - Sector Allocation. When profits are announced, the company board has to decide what to do with the extra cash. Fidelity Chase You Invest Trade vs. Looking at a short-term graph for the company, its selloff puts it firmly beneath its long-term trading averages, and its dividend yield is off the charts high compared to its average. Cash management services generate bank deposit account fees. With this type of account, the owner and the owner's company are considered a single entity for tax and liability purposes. Average debt outstanding. Continue to be a leader in the RIA industry. These regulations often serve to limit our business activities through capital, client protection and market conduct requirements, as well as restrictions on the activities that we are authorized to conduct. Option Positions - Grouping. Certificates of deposit CDs algorithmic trading day trading retail trading best stock investing podcast more interest than standard savings accounts. We utilize repurchase agreements to finance our short-term liquidity and capital needs. This agreement enables our clients to invest in an FDIC-insured up to specified limits deposit product without the need for us to establish the significant levels of capital that would be required to maintain our tape reading x price action dcb bank intraday target bank charter.

We may be adversely affected by new laws or regulations, changes in the interpretation of existing laws or regulations or more rigorous enforcement. Charting - Drawing Tools. The average yield on the largest money market funds is about 2 percent, while the average yield on bank sweep accounts at brokerage firms is 0. The network's programming features experienced journalists and financial professionals. Mutual Funds - Asset Allocation. Option Positions - Adv Analysis. Events in global financial markets in recent years resulted in substantial market volatility and increased client trading volume. These laws and regulations are increasing in complexity and number, change frequently and sometimes conflict. Management is actively cutting costs, shuttering 80 retail locations, bringing the total footprint down to locations. If you are concerned about safety, buy money market funds that invest only in U. Unresolved Staff Comments. Companies like SoFi and Robinhood that offer commission-free trading may offer a good deal for the customers. We are exposed to credit risk with clients and counterparties. Mutual Funds - Prospectus. Market fee-based investment balances.

Economic conditions and other securities industry risks could adversely affect our business. Clearing and execution costs. Exhibits, Financial Statement Schedules. The primary factors driving our transaction-based revenues are total trades and average commissions per trade. Predicting the outcome of such matters is inherently difficult, particularly where claims are brought on behalf of various classes of claimants or by a large number of claimants, when claimants seek substantial or unspecified. Clients learn how likely they are to achieve their goals and how hypothetical changes to their decisions could influence their plan. Complying with these laws and regulations may be expensive and time-consuming and could limit our ability to use the Internet as a distribution channel, which would have a material adverse effect on our business and profitability. Commission file number: Kathleen Pender is a San Francisco Chronicle columnist. Based on this assessment, if it is determined that more likely than not the fair value of the indefinite-lived intangible asset is less than its carrying amount, we perform a quantitative impairment test. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Our most prevalent form of interest rate risk is referred to as "gap" risk. For death of husband transfer stock account ameritrade best chairs for stock traders toolsRobinhood offers a better experience. Chase You Invest Trade offers a more diverse selection of investment options than Robinhood.

The following tables set forth key metrics that we use in analyzing net interest revenue, which is a component of net interest margin dollars in millions :. ETFs - Ratings. Charting - Historical Trades. Net Revenues. Checking Accounts. Client Account and Client Asset Metrics. Conversely, a falling interest rate environment generally would result in us earning a smaller net interest spread. Risk Factors Relating to Acquisitions. Complex Options Max Legs. Find and compare the best penny stocks in real time. Price Range of Common Stock. Investors who have their money managed by others should also see where their cash is being held. Trade Hot Keys. We offer primary and secondary offerings of fixed income securities, closed-end funds, common stock and preferred stock. In September, Merrill made bank accounts the only sweep option for most new accounts. Paper Trading.

Securities borrowing. Stock Alerts - Advanced Thinkorswim alert ttm trend options call put trading system. Performance Graph. We also incur interest expense for borrowing certain securities. Our amended and restated certificate of incorporation contains provisions relating to the avoidance of direct competition between us and TD. In addition, in accordance with regulatory guidelines, we collateralize borrowings of securities by depositing cash or securities with lenders. Order routing revenue is included in commissions and transaction fees on our consolidated financial statements. Examples of expenses included in this category are outsourced clearing services, statement and confirmation processing and postage costs and clearing expenses paid to the National Securities Clearing Corporation, option exchanges and other market centers. I am not receiving compensation for it other than from Seeking Alpha. Consolidated Statements of Income Data. Common Stock Price. Schwab forced the industry's hand, overall, but it had to happen eventually. We have been an innovator in electronic brokerage services since entering the retail securities brokerage business in

Small Business Plans. Merrill Lynch: Before September, Merrill Lynch clients had a choice of money market funds or bank deposits as their sweep account, but only 4 percent chose money market funds, according to a company spokeswoman. Consolidated Statements of Stockholders' Equity. Slowness or unavailability may not impact all trading channels evenly, and some trading channels may be impacted while others are not. Accruals for contingent liabilities, such as legal and regulatory claims and proceedings, reflect an estimate of probable losses for each matter. Android App. Our liquidity needs to support interest-earning assets are primarily met by client cash balances or financing created from our securities lending activities. Research - Fixed Income. Unauthorized disclosure of sensitive or confidential client data, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. Companies like Robinhood and M1 Finance have already offered commission free investing for some time, and even larger companies like Merrill Edge have offered free trades. The risks associated with these investment advisory activities include those arising from possible conflicts of interest, unsuitable investment recommendations, inadequate due diligence, inadequate disclosure and fraud. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Off-Balance Sheet Arrangements.

If actual results differ significantly from these estimates, our results of operations could be materially affected. Changes in laws and regulations or new interpretations of existing laws and regulations also can have adverse effects on our methods and costs of doing business. We believe that the general financial success of companies within the retail securities industry will continue to attract new competitors to the industry, such as software development companies, insurance companies, providers of online financial information and others. Risk Management. Watch Lists - Total Fields. We contract with external providers for futures clearing. Court of Appeals for the Fifth Circuit has vacated the DOL's conflict-of-interest rule in its entirety, and the DOL has announced a conditional enforcement policy pending the issuance of further guidance and may take further actions in light of the Fifth Circuit's decision. Client service representatives are available 24 hours a day, seven days a week. If SoFi keeps the money, that is essentially the cost of brokerage. Item 8.