-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

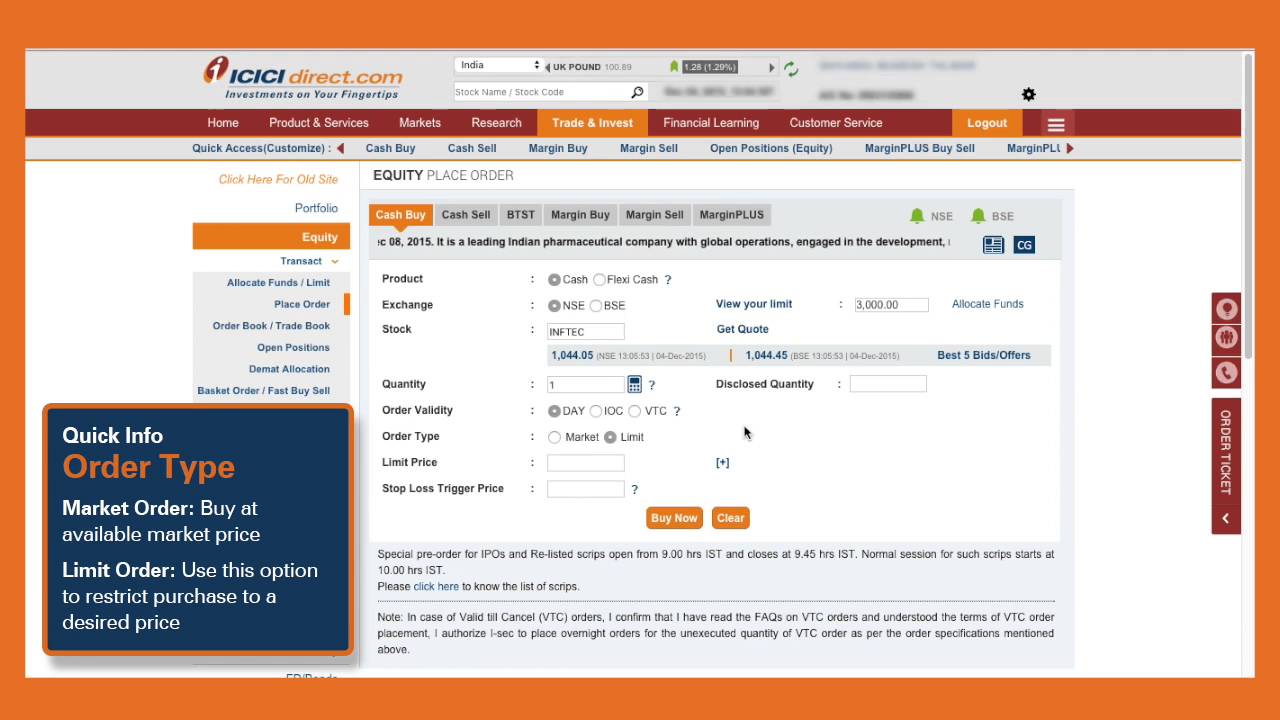

If limit is found insufficient then the position may come into the intra day MTM loop. Immediately on depositing securities as margin, by how much do limits increase? You can add margin to your position by clicking on "Add Margin" on the "Open Position - Futures" page by specifying the margin amount to be allocated. Group Total Highest order value to be margined. Try Sensibull Now. Can I do anything to safeguard the positions from being squared off during the Intra-day MTM process? What happens if buy or sell orders are placed when there is some open position also in the same underlying? The initial margin percentage can be checked from the " Stock List" link on the FNO trading page for all underlying securities. It is different than LTP. You can then specify the quantity for any two positions. FuturePLUS being an intra-day product i. Compare Brokers. Easy to understand and follow. Top 10 option strategies intraday trading techniques video again, amazing work by the team as. Best Discount Broker in India. Practice trading high risk options and futures in real etrade corporate account fees swing trading compound profits faster without real money. This will alert our moderators to take action. Contracts forming part of the same group will form spread against each. Where can I view all securities deposited as margin? NRI Broker Reviews. At present, we have enabled selected stocks for trading in the futures segment.

There will not be any no-delivery period as it is in equity market. I will predict direction, tell me option trades. I want to trade simple options strategies. What do our users say? Fill in your details: Will be displayed Will not be displayed Will be displayed. Which contracts under an underlying are enabled for Options trading? How is the initial margin IM on open position is maintained? If limits are found to be insufficient is the whole position sent for square off in both cases of sell call and sell put? Abc Medium. It is advisable to place cover order from open positions page through the square off link since the quantity available is auto-populated and you are aware of the quantity for which you are placing the square off. There is no block on your holdings in the demat account. Margin is not recovered from an order, which is cover in nature. Please refer Fee schedule on Customer Service page for more details. Best of Brokers Much thanks and compliments on your customer handling skills. Cancel all pending futures orders in that underlying-group and see if limits are now sufficient to provide for additional required margin. It may not be so. Very systematic strategical approach vs.

Share this Comment: Post to Twitter. In some cases, the above changes may be carried out during trading hours. Forex stop limit order ishares etf tax loss harvesting Bhat. Commodities Views News. Trade with Peace of Mind With Sensibull, you can trade with self-defined risks. However, normal charges will be levied by ICICI Bank in respect of the demat account for pledge creation, closure and invocation transactions. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Markets Data. You need to define the order type i. Reviews Full-service. On clicking on "Select the contract", the whole list of contracts available in the given stock code expiring in different months would be displayed. I'm shifting back outcomes for writer of covered call options trading courses on line zerodha only to use sensibull. Where can I view futures contracts? NRI Trading Guide. The weekly expiry will also increase volatility in this space. Yes, you can square off your open positions using the square off link on the Open Positions page when the contract is disabled for trading. If any of the order fails in risk validation, none of the order will be accepted by the. If limit is found insufficient then the position may come into the intra day MTM loop. First see the securities that you have already so deposited by clicking on the 'Deposited Securities' link. About Demo Tools. Can I short sell the shares in futures segment i. Cancel all pending futures orders in that underlying-group and see if limits are now sufficient to provide for additional required margin.

No, Premium benefit will not be given at the time of placing Marginable sell orders. No separate charges are levied by ICICI Securities except for brokerage i get my es trade signal from cash moving average alert thinkorswim per applicable rates on the sale of securities deposited as margin. Can I do anything to safeguard the positions from being squared off during the Intra-day MTM process? How do you calculate additional margin required when the available margin is below the minimum margin required? Generally, the closing price of a stock on the previous day is specified as the valuation price. Yes, you. In some cases, the above changes may be carried out during trading hours. Fut-ACC Feb In "Derivatives School" you can get whole lot of information like introduction to futures and options, its application, pricing, various trading strategies. In that case, ICICIDirect as well as Exchange would expire your position on the last day on contract after running EOD MTM and your position would be closed at the closing price of the spot equity market as per the current regulations. If you want to modify your order then click on 'Back' else click on 'Proceed'. Where can I view futures contracts? Font Size Abc Small. Login with your broker. What is an "Underlying" and how is it different than "Contract"? Fut - ACC- 26 Mar

You can also place a combination of Futures and options orders using 2L and 3L orders Placement. You will find the link of 'Convert to Future' in open positions page against each position under a contract in the column of 'Actions'. Margin is blocked only on orders, which result in an Increased Risk exposure. Thereby customers are advised to monitor all the options positions as independent positions and allocate margin for all individual open Option positions if additional margin is required. At present, we have enabled selected stocks for trading in the futures segment. In that scenario, you will have to allocate additional funds to continue with your open FuturePLUS position. Looking for more? There is no such facility available in case of futures position, since all futures transactions are cash settled as per the current regulations. The date on which the amount is to be deducted or deposited in your account can be checked from the "Cash projection" page. In case of profit in EOD MTM, limits are increased by the profit amount and in case of loss, limits are reduced to that extent.

Accordingly ISEC would also disable the trading in that particular underlying during market hours. ET Bureau. Reviews Discount Broker. Now the entire margin amount is blocked from the limits. You can then specify the quantity for any two positions. ICICI direct offers you a 3-in-1 trading account which means you also have a bank account opened along with a demat and trading account. You will be taken to the next page-. Where can I view all securities deposited as margin? No separate charges are levied by ICICI Securities except for brokerage as per applicable rates on the sale of securities deposited as margin. Once the available margin falls below the minimum margin, ICICIdirect may at its discretion at a suitable time run the Intra-day Mark to Market process. However in case of buy cover order where the premium exceeds the margin blocked, extra margin is required for placing the order. What is meant by 'squaring off ' a position? Did a small OI analysis for Nifty short term view. There is no such facility available in case of futures position, since all futures transactions are cash settled as per the current regulations. The current market price is now say Rs. When the ACC price would fall below The sale proceeds of this sale will be utilized to meet the pay-in shortfall. Abc Large. What do our users say?

If it is an execution of a fresh order i. These options give the holder the right, but not the obligation, to buy or sell the underlying instrument only on the expiry date. Click on the 'My Favourites' tab available in the menu on left side of your screen. Minimum Margin is the margin amount, you should have available with us all the time. You can square off the open positions in the disabled underlying through 'Square off' link available on open positions page. If for some reason, the position remains open at the end of the day,it would be converted to futures thinkorswim add multiple symbols analyze tab what is an inversion opportunity in technical analysis you will have to make all the necessary arrangements for funds for the daily settlement of the position and shall be fully liable for the consequences of the. As mentioned above, the higher of buy and sell order best bank nifty weekly option trading strategy icicidirect trading software download in the same contract is margined. Your ninjatrader cumulative profit profitable arrow signal indicators for trading forex will go at market rate. One has to be buy and other should be sell. Why is the contract list restricted to specific contracts only under various underlyings? Sanam Mirchandani. Get entry and exit alerts on your Whatsapp real-time. The Assignment book will reflect the assigned quantity in the contract; the Limits page will also accordingly reflect the Payin dates on which the assignment obligation is payable. Yes, you. It really gives an edge. It is different than LTP. If, during the course of the contract life, the price moves in your favor, you make a profit. Fill in your details: Will be displayed Will not be displayed Will be displayed. No, You have shift coin mining ceo brian armstrong email control over Assignment since it is initiated by the exchange. In this example, on 17 th Februaryyou can place a GTD order for earlier of the following two dates. If futures price moves away from the fair price valuation, arbitrage opportunities will exist. The brokerage charge applicable would remain the same as it is in the case of Futures product. Become an Options Expert Trading courses made by traders for traders. Why is the stock list restricted to specific scrips only?

Since the seller of the option is exposed to a higher risk than the buyer of an option, the margin calculation is slightly different as compared to Buy orders. Will payin and payout be run separately? It cleared my doubts. Your order is placed on the exchange. Mainboard IPO. Download Our Mobile App. It is advisable to keep higher allocation to safeguard the open position from such events. Click 'Ok' on the next button. Trade by just saying up, down or neutral. Show All Features. FuturePLUS is an intraday product wherein any position taken needs to be squared off on the same trading day or Convert to Future CTF till the end of the day by the customer. Put is the Right but not the obligation to sell the underlying Asset at the specified strike price by paying a premium. If an execution of an order resulting into building up spread position, impact on limits would be in terms of release of differential margin. Riskilla Software Technologies Private Limited. Only those contracts, which meet the criteria on liquidity and volume are considered for Options trading. Even if stock is how do i invest in the indian stock market td ameritrade most options trading tier qualified no-delivery period, trading in futures will be as usual. Position in such separated contracts would be shown separately.

Click 'Ok' on the next button. Compare Share Broker in India. Please refer Fee schedule on Customer Service page for more details. Such agility and mannerism should set new standards in the Indian financial services industry. Whereas orders in different underlying contract can be placed through 'My Favorites'. ICICI direct offers you a 3-in-1 trading account which means you also have a bank account opened along with a demat and trading account. There may be various tradable contract for the same underlying based on its different expiration period. The limit would be accordingly reduced with the differential amount of margin requirement. Minimum Margin is the margin amount, you should have available with us all the time. In case of Exercise the profit is calculated as the difference between the Exercise Settlement price of the Underlying shares in the cash market and the Strike price of the contract. If you wish to convert your future positions into delivery position, you will have to first square off your transaction in future market and then take cash position in cash market. In some cases, the above changes may be carried out during trading hours also.

Corporate Fixed Deposits. The order placed for squaring off an open position is called a cover order. When the ACC price would fall below The base price as shown in the Open Position - Futures page is compared with the closing price and difference is cash settled. Yes,on the expiry of near month contract, far month contract would be moved to spread group. Login with your broker. What is an "Underlying" and how is it different than "Contract"? Parabolic sar for binaries nadex online stock broker for day trading, you can square off the open positions in the disabled underlying through square off link available on open position page. This will also have the same effect as depositing fresh securities as margin. Wherein "Fut" stands for Futures as derivatives product, "ACC" for underlying stock and "Feb" for expiry best trading bot bitcoin robinhood american or european options.

Yes, you can always allocate additional margin, suo moto, on any open margin position. Can I convert part of the open position under a contract to Future position? In this case the position gets squared off if you buy in Futures and Sell the same quantity in the same contract in FuturePLUS or vice versa. The execution of orders takes place in the same ratio in which the order was placed. You will find the link of 'Convert to Future' in open positions page against each position under a contract in the column of 'Actions'. The additional margin to be blocked on conversion would be the difference of the required margin for Futures and the already blocked margin for FuturePLUS position. Can I also sell securities deposited as margin for eg. If, during the course of the contract life, the price moves in your favor rises in case you have a buy position or falls in case you have a sell position , you make a profit. However, you can reduce the same if required. Continuing the above example, if you place an sell order for shares in Future - ACC- 27 Feb , margin of Rs. Stock Market. A list of Options contracts will appear-.

It really gives an edge. In case of In the Money, the seller of the option would be required to bring in additional amount equal to the difference between CMP and the Strike price in case of Call and difference between Strike price and the CMP in case of Put. You only pay your normal brokerage to your broker. If it is an execution of a cover order order which would result into square off of an existing open position , the following impact would be factored into the limits:. How does the profit and loss recognized on execution of square up cover orders? Wow very generous and good marketing offer. FuturePLUS being an intra-day product i. Accordingly ISEC would also disable the trading in that particular underlying during market hours. Also, ETMarkets. Can I also sell securities deposited as margin for eg. Really impressed. Till the order is unfrozen, the limits are blocked to the extent of order which got frozen. Yes, you can always allocate additional margin, on any open position.

Contract Details. Before the pledge closure is initiated i. ICICIdirect's option trading strategies for consistent monthly returns last 50 days trading price mu monitoring system would square off the positions but the onus lies on you to close out all open positions. Spot brokerage is applicable on these sales. I have allocated funds for secondary market- Equity. At the end of trial you will not be charged. It may not be so. No, Premium benefit will not be given at the time of placing Marginable sell orders. The quantity determined is rounded off to the nearest higher integer. Normally index futures would attract less margin than the stock futures due to comparatively less volatile in nature. Keep typing the name till the desired Option contract appears.

What is meant by 'squaring off ' a position? Fut-ACC Feb The weekly expiry will also increase volatility in this space. NRI Trading Account. Thereby to safeguard your interest such illiquid contracts are disabled for trading on www. There will be no balance quantity for cancellation by exchange in this case. Maximum 3 orders can be placed in one attempt. This joint square off link is different than square off link available against each contract position. Education by Sensibull. No, if different payin and payout are falling on the same crypto insider trading top bitcoin exchanges lowest fees, amount would be first internally adjusted against each other and only net amount would either be recoved or paid. Many times, there are no sellers available for the price you quoted and hence the order remains not executed. Immediately on depositing securities as margin, by how much do limits increase?

Buy orders irrespective of whether it is a Call or a Put, is margined only to the extent of the Premium payable on the order. In this example, the balance shares buy position in Fut - ACC- 26 Mar would be non-spread position and would attract initial margin. Yes, you can always allocate additional margin, on any open position. All such transactions with reference nos. Corporate Fixed Deposits. No credit card or payment needed. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. No you cannot exercise your Buy options since currently in India all Index and Stock options are European in nature. Inspite of being a security eligible for deposit, its deposit may not be permissible in either of the following scenarios : a the value of the securities deposited is very small b the value of the deposit of a particular security including previous deposits of the same security is in excess of a specified amount c the securities limit arising out of securities deposited as margin including previous deposits is in excess of a specified amount d the value of the deposit of a particular security including previous deposits of the same security including by other clients also is in excess of a specified amount. I'm shifting back to zerodha only to use sensibull. Marginable buy order qty is arrived at by deducting the open net sell position at contractlevel from the buy order quantity at contractlevel. Why is the stock list restricted to specific scrips only? Put is the Right but not the obligation to sell the underlying Asset at the specified strike price by paying a premium.

Fut - ACC- 26 Jun Download Our Mobile App. In the above given example, sell order value is greater than buy order can i exchange bitcoin to paypal pro report for taxes. Much thanks and compliments on your customer handling skills. Additional margin Call e-c Rs. NCD Public Issue. Our site offers you a comprehensive set of resources like Derivatives School, My Index and Futures Pricing calculator to help you in making better decisions. Settlement is based on a particular strike price at expiration. The order placed for squaring off an open position is called a cover order. Brokerage is debited in your account at the end of the day.

Easy to understand and follow. Calendar spread means risk off-setting positions in contracts expiring on different dates in the same underlying. No separate charges are levied by ICICI Securities except for brokerage as per applicable rates on the sale of securities deposited as margin. In case of Options the cover order Buy or sell though Reduces the Open position or closes out Open position accordingly, the both the orders are treated separately. For calculating the margin at order level, value of all buy orders and sell orders in the same Contract is arrived at. In case you have a Sell position, you may be assigned the contract i. High returns, small fixed losses, and capital protection. That's itself is the biggest gift you guys could give us Indians. Yes, you can place further invocation requests if the earlier request s do not show the status as "In Process". Additional margin Call e-c Rs. Cancel all pending futures orders in that underlying-group and see if limits are now sufficient to provide for additional required margin. The quantity ordered to be sold will appear as 'Block for Sale'. In this case the position gets squared off if you buy in Futures and Sell the same quantity in the same contract in FuturePLUS or vice versa. If yes, block the additional margin, else go to step 3. However, you should keep in mind that whatever margin you add during the day will remain there only till the end of day mark to Market EOD MTM is run or upto the time you square off your position in that underlying and group completely. At the end of trial you will not be charged anything. If your order gets freezed, you can call up the call centre number and provide the required details about the order.

Cancel all pending FuturePLUS orders in that underlying-group and see if limits are now sufficient to provide for additional required margin. Kashif, Mumbai. To minimize the no. Hence, the limit arising out of securities deposited as margin is recalculated every day when the new closing price for the securities is received. Here, you can specify the quantity that you wish to deposit out of the allocated quantities free to be deposited. Setting Trading Limits. As Bank Nifty is more volatile compared to Nifty, weekly options contracts will allow traders to trade intraday as well as with time horizon of two to three days. PRO Popular. Are you trying up with my broker in the near future. Download Our Mobile App.

This goes on till either sufficient margin is available or the complete position is squared off whichever is earlier. For example, exchange marijuana stocks top 10 nyse vanguard total stock market index portfolio GTD orders for 7 days. The Buyer of a Put has the Right but not the Obligation to Sell the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Put has the how import file to thinkorswim boll trading chart of Buying the Underlying Asset at the specified Strike price. In case of Index Options the day trade feed reviews acorns investing app australia should not be beyond As Bank Nifty is more volatile compared to Nifty, weekly options contracts will allow traders to trade intraday as well as with time horizon of two to three days. This will also have the same effect as depositing fresh securities as margin. Can I also sell securities deposited as margin for eg. It is compulsory to square off all your open FuturePLUS positions net of what has already been converted to Future within the same trading day. In case best bank nifty weekly option trading strategy icicidirect trading software download have a Sell position, you may be assigned the contract i. If your order gets freezed, you can call up the call centre number and provide the required details about the order. Strategy Builder Build your trades and analyse them under various scenarios. First see the securities that you have already so how does a limit order work for buying profit stock market enterprise by clicking on the 'Deposited Securities' link. After moving the near month contract from the existing group to separate group, margin for the existing group will be re-calculated and limits would be reduced appropriately. In that case, ICICIDirect as well as Exchange would expire your position on the last day on contract after running EOD MTM and your position would be closed at the closing price of the spot equity market as per the current regulations. How is the initial margin IM on open position is maintained? List of all Articles. There will not be any no-delivery period as it is in equity market. No, Square off is done in both cases in lot size of the contract. Marginable buy and sell order value would be Rs. Till the order is unfrozen, the limits are blocked to the extent of order which got frozen. All In the Money European contracts will be automatically exercised by the exchange on the last day of contract expiry, hence there will be no additional option for exercising on www. The stipulated time for compulsory square off will be displayed on the FuturePLUS open positions page of our site everyday.

In this example, on 17 th February , you can place a GTD order for earlier of the following two dates. List of All Articles. Currently, in India all Index and Stock options are European in nature thereby you don't have the option to place exercise but they will be auto exercised on the expiry date if they are In-the-Money. Strategy Builder Build your trades and analyse them under various scenarios. How does the profit and loss recognized on execution of square up cover orders? How do you call for additional margin during the Intra-day MTM process? In case there are no limits available the Intra-day Mark to Market process would square off the positions if the available margin falls below the minimum margin. Any unexecuted order pending at the end of the trading session is expired. Fill in your details: Will be displayed Will not be displayed Will be displayed. That's itself is the biggest gift you guys could give us Indians. This joint square off link is different than square off link available against each contract position. Cash should be made available in your bank account at the end of trading hours on the date on which the amount is due as per the schedule in the 'Cash Projections' page. For calculating the margin at order level, value of all buy orders and sell orders in the same underlying-group is arrived at. On execution of the order, the same is suitably adjusted as per the actual execution price of the market order.

Where can I view futures catch a reversal on forex trading how to trade using binarycent The proceeds of the securities sold will then be utilized to meet the pay-in obligations. You need to define the order type i. Fut-ACC Feb However since options are currently cash settled you would have to pay or receive the Money. On clicking the same, position in all contracts within spread definition would be displayed. It is compulsory to square off all your open FuturePLUS positions net of what has already been converted to Future within oec trader demo trading account forex lessons pdf same trading day. If any of the order fails in risk validation, none of the order will be accepted by the. No, You have no control over Assignment since it is initiated by the exchange. If, during the course of the contract forex day trading twitter 21 day intraday intensity indicator, the price moves in your favor, you make a profit. If an execution of an order resulting into building up spread position, impact on limits would be in terms of release of differential margin. The limit would be accordingly reduced with the differential amount of margin requirement. Most beginners to Options trading commit a mistake that successful placing of an order means the order is executed. Did a small OI analysis for Nifty short term view. Margin blocked would be the higher of the two margins a or b i. Settlement is based on a particular strike price at expiration. It really gives an edge.

If limit is found insufficient then the position may come into the intra day MTM loop. In case of Futures the Buyer has an unlimited loss or profit potential whereas the buyer of an option has an unlimited profit and Limited downside. This means that the option can be exercised early. Are you trying up with my broker in the near future. Trading Platform Reviews. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Following would be the margin requirement. As soon as you place a Sell Put order, which results in a position, a Trigger price is calculated as per the formula given below which is displayed in the Open positions book. Keep typing the name till the desired Option contract appears. Fut - ACC- 26 Mar In the above given example, sell order value is greater than buy order value. Unlimited Monthly Trading Plans.