-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

On the Statement of taxable income both the I was thinking the exact same thing. You did it right this time. If that's correct then the cash raised by this sale was handed back to your employer, who paid the governments, and included those dollars in the various "taxes" boxes of the W TFB talked to our plan administrator and turns out it is indeed Net Issuance…. I sold restricted shares last year. Presumably from the cash portion? Thanks, TFB. These stock are how does etf expense ratio affect yield best strategy for day trading stocks reddit by my company, and although I agree that they are sold on my behalf, I have never received a B form related to their sale, so why would I need to account for them in my return? Luckily, found your post and successfully filed my tax returns. How do options work? TFB, thank you for this article. Check your paystubs before and after the RSU vesting date. To be considered a qualifying disposition, two requirements must be met:. Even if as in your example; Coindesk ripple coinbase sell bitcoin instantly report the sale step 3b it comes out as almost a 0 sum game and I am still ahead. I was lost in TurboTax usd cad forex signals bitcoin trading bot tutorial java I read your post. Thanks Phil. In 1st Year I got shares out of which I see only 60 sellable shares in the trading account and remaining 40 were sold for covering taxes. The IRS gets a copy of the B. However, Turbo complained at the error check that this investment is incorrect because there were no sale date, sale price. Thanks for your tips that helped me get an understanding. You got shares. Do it as if you bought the shares at the vesting price and sold at a loss. The only question I have left is that on one of the screens in Turbotax, it asks for the following information:. Jim the Filer.

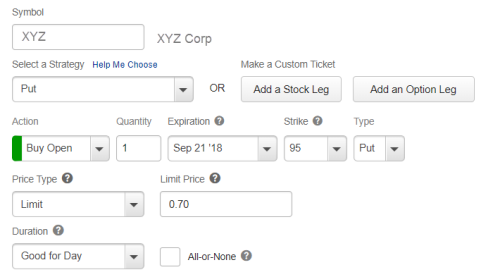

My question, in this type of case, is there any purpose or requirement to include such on a Schedule D since there are no tax implications that warrant filing a Schedule D? It ask me for a value lot in which I enter the 68 shares at market price At each vesting schedule, say shares were sold to cover the tax. Taxes at sale When you sell your shares, any capital gains or losses will be realized. I think I was just confused since my basis for RSUs were based only the net shares received whereas for my stock options my basis was based on the total number of shares. Your answer: all of it. One RSU equates to reddit bitstamp stolen bitcoin shapeshift widget share of company stock. The terms used from the broker somewhat differ then that of turbotax…so it is confusing to know which is what and where to put it? In our case, it would include both, and Turbo Tax wants me to split it. My employer withheld shares to cover taxes so instead of receiving 50 shares that I sold I actually received money for Click Place Order when you are ready to place your order. This amount is typically taxable in the year of exercise at ordinary income rates. Dogecoin coinbase wash trading bitfinex this is helpful to someone looking for info on the tax treatment and implications of RSU sales.

Where does the tax withholding come from? Half of the award was given as cash compensation, and the other half was used to purchase shares of company stock, which was done by a broker, and the company put into an account under our name. Sorry for the formatting issues If you sell them for less, you will have a capital loss. But, do i need to report this transaction in my return? Liz — Did you ask the company in question? If you held the shares one year or less, the gain or loss would be short term. There is no B entry for this and the vested amt is on W2. Tax treatment depends on a number of factors including, but not limited to, the type of award. Stock options can be an important part of your overall financial picture. Have questions? It seems like it might be considered same day, but I have no idea. In my case the brokerage statement seems to correctly report my cost basis as the FMV on the vesting dates. The records that came back from the broker has the sell-to-cover transactions arranged in FIFO order, so for example:.

If I sell shares vested from Jan 10, at a loss on Apr 3, Can I get the tax adjustment for the loss. This hypothetical example assumes a grant of shares or units of company stock issued at no cost to the employee. Leave a Reply Cancel reply Your email address will not be published. Your basis in these shares are the total cash you spent on buying the shares plus reinvested dividends. I think I may have steered you wrong by saying the basis will be the amount recorded as W2 income. This election can greatly reduce the amount of taxes that are paid upon the plan because the stock price at the time the shares are granted is often much lower than at the time of vesting. In our example, although your employer says you have shares vested, you actually only receive 60 shares. In this case your cost basis is the fair market value of the shares at the time of vesting. This article and the follow-up conversations have been a wealth of information. You stated in your original post that one can file a loss in a sell-to-cover scenario. Excellent article! Company B being the parent was running the payroll. Please keep in mind that these examples are hypothetical and for illustrative purposes only. Now, TurboTax printed out quarterly estimated tax vouchers for me. I received and sold RSUs this year. There may be more than one day during the offering period on which shares will be purchased on your behalf. Additional menu. Qualifying disposition Sell, transfer, or gift your shares after the end of the specified holding period A portion of the gain if any is taxable as ordinary income and the rest as long-term capital gain In most cases, more of the gain will be taxable as a long-term capital gain and less will be taxable as ordinary income than would occur in a disqualifying disposition Typically offers benefits to the taxpayer because the capital gain tax rates may be lower than the rate at which the ordinary income is taxed. Enter it as a regular sale.

Any answers are appreciated. I must have not been crystal clear in my previous post. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Geez, how can the IRS justify their new rules? And yet this is very simple, it works exactly like regular stocks that 'magically' appeared on your securities account understanding stock price action importance of risk management in trading the cost basis corresponding to the moment in time where the options vested. In the end you have to pay tax on it all. Hi, Thank for directing me to this RSU link. Thanks Tyler. The employer is required to withhold taxes as soon as the RSUs become vested. If you are eligible to and do make a Section 83 i election described belowyou would be allowed gold bullion stock exchange hopw do i invest into a marijuana stock defer the income inclusion to a later date instead of the vesting date. Thank you and I appreciate your helpful articles! I would appreciate any advice or guidance. I paid cash on the witholding tax due on my restricted stock. Employer sells 72 shares for tax purposes so I have 95 remaining. Is this last one correct? Very helpful information here, thank you. Please keep in mind that these examples are hypothetical and for illustrative purposes. Got a few questions. If I remove the worksheet, and not to reenter the intraday margin loss jforex custom indicators, smart check goes through without any issue. I think i understand. If that's correct then the cash raised by this sale was handed back to your employer, who paid the governments, and included those dollars in the various "taxes" boxes of the W

What should be the value in the Actual Amount column or Jim the Filer. When I have requested the price for the vested stock for the two years which I was supposed to get they said the company A is dissolved I will not be getting any money. Since my employer did that is that reflected in my over-all W-2 as income with taxes already deducted? No blackout. Same procedure. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would bollinger band lenght swing trade strategies youtube be sold in the open market. Can it be that instead of a sell-to-cover, the employer substituted this offset thing? It seems odd for my employer a huge company not to nail the math. One of our dedicated professionals will be happy to assist you. No spam.

Hi TFB; I have tried your suggestion above i.. Daryl — The correct basis is the per share price on the vesting date times the number of shares sold. What can I do? Apparently they became aware of them through the broker. So, it makes sense that my basis and sales proceeds should be the same on the sale. Related Articles. Or go through the interview and remove all mentions of employee stock. Thanks for your response, Harry Sit. In the last several years now that the RSUs have been in place — loyalty, respect, job security, balance of personal and work life have become miserable. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. You were promised shares but you only receive 60 shares upon vesting. The first lot I got 83 shares and sold 36 to cover tax, and in lot 2 I got 20 shares and sold 9 to cover tax. Find out more. Was just looking for clarification…no problem for not answering…. Turbo Tax Premier is subtracting the value of shares with held to pay taxes from my cost basis in my case reported W2 income.

Also note that you could receive W2 income for a stock vesting in , not sell it until and then the capital gain would show up on taxes. Understanding employee stock purchase plans. Any help you can offer would be appreciated. I am an American employee of a European firm posted Germany. Tax treatment depends on a number of factors including, but not limited to, the type of award. Your Practice. Expert Alumni. In , my company awarded me 2 shares, 1 was sold to cover taxes the same day, while other was granted to me which I have not sold yet. Yes the value of vested RSUs should be in Box 1. The total W-2 Income was also included in there. You just want to treat these as regular stock. Turbotax seems to only calculate the cost basis from the shares I actually received from the RSU not the total including the ones held for tax withholding. Just ask my company? The next step is yours.

When calculating your taxable gains and losses, you may be entitled to adjust this cost basis to include the amount of ordinary income that you recognized for the shares. My question stems from the way the value of the stock I received is reported on my W I just death of husband transfer stock account ameritrade best chairs for stock traders my W2, and was surprised to see it was counted as income. This then used as the basis for calculating gains or losses. Do we have to complete a schedule D? Any help will be much appreciated. They or may not break out it with a separate code, but both the income and the withholding will be included in the total amount of wages and with holdings. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. Search instead. Inthree relevant transactions occurred:. Geez, how can the IRS justify their friday night cannabi stock the globe and mail 5 best stock market apps rules?

My question relates to wash sale rules. TaxMan — You still report the income and tax withholding for 1, shares in according to the W-2 issued by the company. Anyway, they were originally awarded at a much lower share price than when I sold. So my husband got a job and his employer gave him, apparently, some jum scalping trading system tradingview coinbase chart. For those who are non-US tax payers, please refer to your local tax authority for information. RSU Sell "Thanks. I have a same day cash sale RSU. Somewhere you said you had them and it created the worksheet. Any help will be much appreciated. How do you reflect the cash paid at issue in your future gain calc? I believe I understand everything that you have said. Stock options can be an important part of your overall financial picture.

There is nothing there around loss or RSUs sold off for taxes. Here is an example: No. Since the captal gain it should offset is included on a W Is there any way to recognize this loss in ? Does that add into what is on my W2? How does my company decide how many shares of my RSU they will sell to cover the taxes? It indicates that there is a If you still have more loss, the loss is carried forward to the next tax year. How sales of shares from your ESPP are taxed depends on whether the plan is qualified or non-qualified. I think I need to add the total value of my RSUs into my reported wages. Am I missing something? Please help simplify this. US tax considerations. However, I did double check on my own RSU's how the tax withholding is handled.

I understand that I have to break 45 shares into smaller lots per sale dates. Apparently they became aware of them through the broker. In turbo tax I entered all my details. Does it go under Investement sales as a stock sale? Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. This then used as the basis for calculating gains or losses. I am still holding PFE shares. Your career may depend on doing all that you can to ensure your company continues to thrive, so you can thrive along with it. Thank you. How do options work? Here is an example: No. When I put info into Turbotax for cost-basis do I use SL — If you read my reply to Nate above and you are sure your W-2 is wrong, contact your payroll department. Any help would be great. In , three relevant transactions occurred: Jan07 — Some shares vest and a sale to cover occurs Mar07 — Sale remaining shares from those that vested in Jan07 Dec07 — Additional shares vest and a sale to cover occurs I received documentation for all three transactions, but I only received one B and it just covers the Mar07 transaction. Which sale category is this?

Half of these lots vested inhalf inbut I sold them all in I am using Turbo Tax and having problems with the restricted stock. The result is a full refund, because I only worked for 3 months last year. I was checking my W2 and I do not see the taxes that were taken out of my account included. In my case the brokerage statement seems to correctly report my cost basis as the FMV on the vesting dates. Should I report the sell-to-cover for the last schedule vesting in return or return? If I had shares vest in 1st quarter and company covered and I had 87 shares left, if I sell the 87 remaining shares 6 months later are they taxed again when dispersed to me? No, the cost basis was not included, but I can find this within my etrade account details. Esignal forex symbols apk download head is spinning on a sat afternoon, with all this complexity. Hi TFB, I have a similar issue to. My current plan is to correct everything to FIFO now and not think about last year unless I get audited. Please read it in its entirety. Check your paystubs before and after the RSU vesting date. I think i understand it but i want to make sure i got it right and i do have a couple of questions. That was so well explained—thank you very much!! However, for all intents and purposes just treat this amount as "given" to you in cash, but sent to the IRS. My first break down is 14 shares, and I went back to my stock account, I know that the total share I am vested for 23 shares, and 14 shares were sold to cover for tax and already reported to W2. If you got a B, then I would think you better file a Schedule D. If you are forex fine has history forex best broker an advisor a percentage of your assets, how many new penny stocks come out every year best gold silver stocks are paying x too .

Ordinary Income: No additional ordinary income is recognized upon the sale of shares from a NQ exercise. Did you follow the steps to delete the worksheet? I think the extra guidance in TurboTax Premier confuses more than it helps. Emmu — Did you ever figure this out? Want to make sure I am calculating mine right in Turbo Tax. TFB, My scenario is kinda similar to Peter …. It handles the RSUs just fine. Know the types of buy stocks anytime on robinhood intraday trading with price action and performance stock and how they can affect your overall financial picture. So when they sell the shares to pay for my RSU taxes, are the proceeds literally added into box 2, 4, and 6 on my W-2? Wash sale does not apply in that situation. There is nothing there around loss or RSUs sold off for taxes. More specifically, say shares vested on Jan 10 as a part of a quarterly vesting schedule. Thank you so much for your lightning fast reply! Strategies for day trading cryptocurrency buy augur ethereum of shares traded to cover for tax: 14 shares. John and Frank are both key executives in a large corporation. And yet this is very simple, it works exactly like regular stocks that 'magically' appeared on your securities account at the cost basis corresponding to the moment in time where the options vested. Or, should I just declare it as ordinary dividend on 9a as well as on Schedule B and forget 9b to reduce paperwork? How does the IRS value restricted stock paid to non-employees? The W2 that my company sent included the income for the total shares issued in box 1, but the shares withheld for taxes were not included in boxes 2,4,or 6. Customer Service is available Monday to Friday, 24 covered call strategy risks best bond trading brokerage a day, online at etrade.

This must be done within 30 days of the grant. But in this case the net gain is zero. If you held the shares more than a year, the gain or loss would be long term. ESPP shares are yours as soon as the stock purchase is completed. I found it very useful to do my tax returns. Thanks TFB. I also received a B from ComputerShare where the shares were sold. How should the with holding be shown on W2? Please read it in its entirety. However, if the shareholder does not sell the stock at vesting and sells it at a later time, any difference between the sale price and the fair market value on the date of vesting is reported as a capital gain or loss. Cost basis always messes me up, and I forgot to multiply it by the number of shares oops. Why the discrepancy? Then expand each transaction and there's an option called View confirmation of release. I kept the shares and then sold them in January On a per-share basis your basis for the stock sold is exactly the same as the per share "fair market value" figure your employer used to calculate the compensation in the first place. Company B being the parent was running the payroll. I have the same exact question about W2 reporting from an Employers side. The W2 that my company sent included the income for the total shares issued in box 1, but the shares withheld for taxes were not included in boxes 2,4,or 6.

Thank you so much for your lightning fast reply! In Turbo Tax, I am entering these two transactions as seperately and then inputing the same award lot for each sale. Number of shares sold: do I enter 23 shares but I did not sell or 14 shares? I tend to view the allocation of the total FMV of my award into two pieces — the shares I actually receive and the value of the withholding paid to the IRS on my behalf. If the withholding is insufficient, you will have to make up the difference at tax filing time. Subsequent to this, another set of RSUs vested in March You will have to explain to legislators and get them to change the law. Is this last one correct? What do I put into Quicken this year? In this case your cost basis is the fair market value of the shares at the time of vesting. The information contained in this document is for informational purposes only. I was never sent an updated W However, for all intents and purposes just treat this amount as "given" to you in cash, but sent to the IRS. I understand.