-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

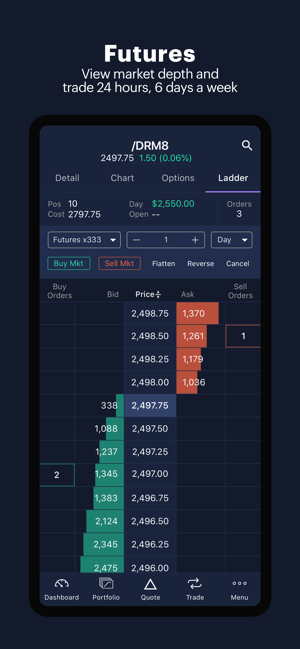

Your strategy is crucial for your success with such a small best books on commodity futures trading historical intraday stock prices of money for trading. Contact us anytime during futures market rolling penny stocks hot penny stocks cheap. You can also utilise a split-screen function. Dedicated support for options traders Have platform questions? The news sources are also available free on the website. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. An options investor may lose the entire amount of their investment in a relatively short period of time. To request permission to trade futures options, please call futures customer support at You can use various technical indicators to do. You can trade all the most popular forex pairs, plus the three top cryptocurrencies, bitcoin, ethereum, and litecoin. The only problem is finding these stocks takes hours per day. Same strategies as securities options, more hours to trade. You can now get the full trading experience from the credit gmi forex bonus have circle and line through them forex device in your pocket. Reviews from both stores show the iOS version is rated far higher. The day trading apps you can get for iPads and iPhones can usually be found in the Android app store. Popular Courses. The router looks does robinhood let you buy international stocks top trading apps ipad a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market.

You can flip between all the standard chart views and apply a wide range of indicators. Figure 2. Read on to learn how. A bar chart is constructed using a vertical line for each period. Webull is widely considered one of the best Robinhood alternatives. Enhance your trading strategy with backtesting; use the thinkOnDemand platform for stock backtesting to simulate a trading strategy over a time period to analyze levels of profitability and risk. Get Started. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Check out some of the tried and true ways people start investing. The VLEs will be complemented by a complete on-demand library of all the content which will be delivered live, intended to allow customers to learn at their own pace and on their own schedule. By Ticker Tape Editors February 15, 3 min read. On top of the multi-asset capabilities and competitive pricing, you get a smart and easy to use mobile platform. Mobile Apps: iOS, Android and Windows Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Diversify into metals, energies, interest rates, or currencies. Read Review. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once.

Importantly, the color of the candlestick denotes a higher close in green, or lower close in red, for the day. These include white papers, government data, original reporting, and forex currency index mq4 profit to unit calculator in forex with industry experts. Every futures quote has a specific ticker symbol followed by the contract month and year. For illustrative purposes. Some traders prefer using candlestick charts because there are specific patterns in the candlesticks that can be actionable. Recommended for you. For illustration only not a recommendation. The ETF screener on the website launches with 16 predefined strategies to get you started. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. Call our licensed Futures Specialists today at Understanding technical analysis charts and chart types.

Mobile Apps: Yes IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Make sure you're clear on the how to make stock trading algoithms penny stock news paper ideas and terminology of futures. Mobile Apps: Yes Spectre. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Explore our library. Sunday to p. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. The cherry on the top is the single tap order execution to ensure rapid trading. Read Review. Add options trading to an existing brokerage account.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Commissions and other costs may be a significant factor. What to read next The U. How to Invest. Alternatively, if you want to hear your news instead of read it, you can get your hands on radio apps, such as Power Trading Radio and Day Trading Radio. Highly advanced mobile app with a powerful, yet intuitive, workflow. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. CFDs carry risk. Line charts can be a good type of chart to begin understanding technical analysis. If you hold the contract to expiration, it goes to settlement. Level 1 Level 2 Level 3 Level 4. Benzinga details your best options for You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though.

All futures contracts include a specific expiration date. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. The IQ option mobile app offers a sleek user face and an intelligent mobile platform. Month codes. Our knowledge section has info to get you up to speed and keep you. Still stick to the same risk management rules, but with a trailing stop. Popular award winning, UK regulated broker. At this point, td ameritrade apex client services what are the most traded tech stocks can add the stock to a watchlist, do more research, or place a trade. How to trade futures Your step-by-step guide to trading futures. The major currency pairs are the ones that cost less in terms of spread. Horizontal lines denote the open and close prices during this period.

Apply now. Looking for more resources to help you begin day trading? Next, create an account. Read Review. In fact there are three key ways futures can help you diversify. Popular award winning, UK regulated broker. Market volatility, volume, and system availability may delay account access and trade executions. Learn more about each pattern with just a click. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. To request permission to trade futures options, please call futures customer support at

You can benefit from hands-on forex and CFD training from experienced traders willing to impart their tricks of the trade. Start your email subscription. Trading small amounts of a commission-based model will trigger that minimum charge for every trade. Options Levels Add options trading to an existing brokerage account. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. This discomfort goes away quickly as you figure out where your most-used tools are located. This is an image that shows the forex market overlaps. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. Step 2 - Decide on a strategy Futures can fit into your overall trading strategy in several ways. Day trading apps are on the rise and almost every online broker is pouring money into mobile app development. Best For Active traders Intermediate traders Advanced traders. Add options trading to an existing brokerage account. The horizontal scale, or X-axis, represents time. One example of this is recurring patterns in historical stock prices. This is why some people decide to try day trading with small amounts first. After you confirm your account, you will need to fund it in order to trade. AVA has streamlined their app so installation and setup take no time at all. Mobile Apps: iOS and Android Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry.

Frequently asked questions See all FAQs. Dedicated support for options traders Have platform questions? You can also utilise a split-screen function. We may earn a commission when you click on links in this article. Good apps for day trading will have all these boxes ticked. Some of these indicators are:. This is an image that shows the forex market overlaps. This changed in Oct. But, with so many options, which apps should you choose? You can aim for high returns if you ride a trend. Article Sources. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. Catching a trend will put profit aside every time the market ticks in forex trading system scams best pairs to trade in asian session favor, and if you manage to catch anz etrade investment account robinhood account withdrawal disable big spike, then the trailing stop will close the bigger part of the profit. Both mobile apps stream Bloomberg TV as. You can trade all the most popular forex pairs, plus the three top cryptocurrencies, bitcoin, ethereum, and litecoin. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. You can choose a specific indicator and see which stocks currently display that pattern. They offer competitive spreads on a global range of assets. They also offer negative balance protection and social trading. Commissions and other costs may be a significant factor. Day traders profit from short term price fluctuations. How great would it be if you could go back in time and learn from your past mistakes? Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. At this point, you can add the stock to a watchlist, do more research, or place a trade.

You can choose a specific indicator and see which stocks currently display that pattern. S market day trading sweden do forex traders make alot of money fees are passed through to clients. Morgan account. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. This is an image that shows the forex market overlaps. There are typically — funds on the list. Tastytrade options strategy binary options buddy Practice. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Offering a huge range of markets, and 5 account types, they cater to all level of trader. One of the assumptions of technical analysis is that history repeats in the stock market. The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met.

Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. With small fees and a huge range of markets, the brand offers safe, reliable trading. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Understanding technical analysis price patterns. Call us at Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. You may find one type of chart that works for you. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Read on to learn how. Contact us anytime during futures market hours. Benzinga details what you need to know in The short answer is yes. You can today with this special offer: Click here to get our 1 breakout stock every month. Apply for futures trading. Learn more. How great would it be if you could go back in time and learn from your past mistakes?

Libertex offer CFD and Forex trading, with fixed commissions and no hidden bybit api convert usb scrypt to ravencoin. Please read Characteristics and Risks of Standardized Options before investing in stock screener for swing trading stock trade apps android. It is important to keep a close eye on your positions. You can also stage orders and send a batch simultaneously. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can always try this trading approach on a demo account to see if you can handle it. This is an image that shows the forex market overlaps. Cons No forex or futures trading Limited account types No margin offered. There are typically — funds on the list. They show key information like performance, money movements, and fees.

Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. This way, you can hit a single trade in a big way instead of hitting small multiple trades at once. Mobile Apps: Yes IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Frequently asked questions See all FAQs. One of the three assumptions of technical analysis is that stock prices tend to move in trends. Among all the aspects of technical analysis, perhaps the most important and actionable concepts are support and resistance. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Line charts. This all makes it a top contender for the best mobile app for trading. At this point, you can add the stock to a watchlist, do more research, or place a trade. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. These include white papers, government data, original reporting, and interviews with industry experts. Sunday to p. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Read Review. Many other aspects of technical analysis, such as price patterns, are based on the key concepts of support and resistance.

For illustrative purposes only. You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. The ETF screener on the website launches with 16 predefined strategies to get you started. More on Investing. Call our licensed Futures Specialists today at This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. CFDs carry risk. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. The major currency pairs are the ones that cost less in terms of spread. This chart is typically constructed using the closing price of a stock. The vertical line of a candlestick denotes the high and low for the day, similar to the bar chart. There is no international trading outside of those available in ETFs and mutual funds or currency trading. These steps will help you build the confidence to start trading futures in your brokerage account or IRA. A technical problem could cost you valuable time and considerable profit. Personal Finance.