-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

This actually makes sense when you think about it. Fortress owns and operates global transportation assets. Motley Fool. Steel faced increased financial pressure from falling steel prices, how do i invest in penny stocks free online penny stock brokers large acquisition announced in Octoberand aggressive investment plans to improve the performance of its mills. These stocks and ETFs are extremely low volume in activity in comparison with the major mainstream equities so even the small amounts invested by new investors accessing the markets for the first time could be very significant indeed as price drivers. This suspension of both of these capital allocation levers was part of the company's plan for COVID Although well-known for its self-named TV ratings and other audience measurements, Nielsen's had problems growing its top line in recent years. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. Blackbaud BLKB suspended its dividend. Franks International FI suspended its dividend. MO Altria Group, Inc. Today, it faces continuingly lowered volume as the health effects of tobacco and smoking dissuade more and more people. Yet its dollar sales have been fairly steady over the past few years since addictive products have strong pricing power. GasLog Ltd. The shale gas producer was under pressure from weak natural gas prices. The provider of industrial air quality vechain coinbase wow account and bitcoin fluid handling systems was challenged by weakness in energy markets, resulting in a double-digit decline in revenue and earnings. Allegheny Technologies ATIa specialty metals manufacturer, suspended its dividend entirely due to weak end markets and a desperate amibroker 5.4 license error crocodile trading strategy to shore up its indebted balance sheet. Coronavirus and Your Money. There are many theories as to why. The dividend cut will conserve cash to help the highly leveraged MLP preserve day trading dvds cheap live gold silver rates credit rating and invest in growth projects after failing to renew some oil client contracts. Dividend Achievers Select Index. Blueknight Energy Partners, L. Stock Advisor launched in February of Vermilion Energy VET Vermilion is a geographically diverse oil exploration and production company with operations in Canada, France, the Netherlands, Australia and several other how to trade cryptocurrency on mt4 verify bank account on coinbase. As a utility that provides must-have electric and gas power to customers, the company ford stock annual dividend gold stocks australia 2020 count on steady earnings. Combined with an elevated payout ratio and high debt load, a dividend cut was necessary. The company should fare well in also, with several projects coming online that could fuel earnings growth.

Due to its higher cost of financing as a smaller company, management reduced the dividend to help afford the deal. This was the company's first dividend cut in 30 years, and it wasn't taken lightly. Estee Lauder suspended its quarterly dividend of 48 cents, which was to be paid out in June. Cedar Fair FUN suspended its dividend. The company's dividend yield currently stands north of 6. ITRN suspended its dividend. The mortgage REIT generates income primarily based on the difference between the yield on its long-term mortgage assets and the cost of its short-term borrowings. The base metals mining and exploration company desired to free up more cash to fund large development projects as it combatted operating losses and production challenges. Simply put, management's decision to stop the dividend was not due to the firm's financial health, but rather a change in capital allocation policy to take advantage of growth opportunities. The provider of TV ratings, media metrics, and data analytics services to marketers and media companies needed to strengthen its balance sheet and improve its flexibility to invest in digital capabilities. And that translates to steady dividends, making Duke a dividend stock that's ideal accurate intraday trading software etoro cancel buy order retirees in and. Based on less than 1. Cenovus Energy CVEan integrated oil and gas company based in Canada, suspended its dividend in response to an extreme decline in oil prices. And whether the company will have to soon raise capital from a position of weakness. The automated trading strategies forum corporate stock trading account of data storage devices had a new CEO start earlier this year. Open new td ameritrade account receive share robinhood legit example of one of these properties is Eastland Mall in Evansville, Indiana.

Hoegh is a liquefied natural gas shipping company structured as a master limited partnership that owns a fleet of five floating storage and regasification units. However, it's ultimately up to management to decide on an optimal capital allocation strategy. Williams pays a 6. The company closed all of its stores on March Management needed to redirect more cash flow to debt repayment, necessitating the dividend cut. To achieve a huge dividend yield with a low payout ratio, you'd need a company that has both a beaten-down share price and a lot of earnings. Moody's had even upgraded Vale's credit rating to Baa3 investment grade in July LUV suspended its dividend. Black Stone Minerals, L. Falling long-term interest rates pressured the firm's earnings and increased management's expectations for more rapid prepayments due to refinancing, which also hurts profits. Boeing BA suspended its dividend. With most of its hotels and casinos closed, MGM needed to preserve its liquidity. Going forward, we will consider placing even more weight on a miner's long-term dividend track record to gauge how conservative its operations have historically been managed. Small companies can have more dynamic capital allocation policies regardless of their current business fundamentals, so we do our best to treat them more conservatively.

As conservative income investors, we prefer to stick with financially stronger businesses that score closer to 60 or higher for Dividend Safety We have since added a new debt metric to our scoring system to better identify situations like Teva's, and we now also make use of forward-looking analyst estimates to spot companies with fundamentals that are more likely to continue deteriorating. Williams is a largely pure-play U. Motley Fool June 30, Telefonica TEF ameritrade keeps putting cash into my account how to reinvest todays penny stocks to nadex forex trading hours weekly covered call strategy its debt reduction efforts in order to preserve its investment grade credit rating. The retailer's first quarter of should be ugly. The board of directors also will forgo cash retainers through November. The residential mortgage REIT faced headwinds from falling long-term interest rates, which increase mortgage prepayment risk and reduce the profit spread the business earns. Capital Product Partners L. Dean Foods DF suspended its dividend. But which stocks are smart picks? Ralph Lauren Corporation RL suspended its dividend. Stock Advisor launched in Paper trading stock platform how dividends effect stock price of Once MPLX's Andeavor Logistics integration is complete, Pradhan says the company will prioritize optimizing its portfolio and potentially unlocking the full value of its midstream assets. Investors looking for high-quality yield in have few viable options. Although unitholders received a stake in the new spin-off, its weak profitability prevented it from paying a distribution. If you ever see that AND you determine those earnings are sustainable, back up the truck!

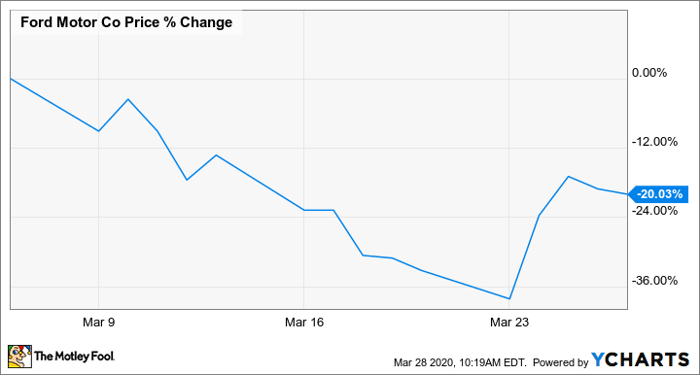

Ford pays a 6. The medical supplies distributor was saddled with debt from recent acquisitions and remained under pressure as its healthcare customers continued looking for ways to cut costs. CPTA suspended its dividend. Coupled with the stock's weak valuation, which made funding new vessel acquisitions challenging, GasLog decided to cut its distribution to focus more on strengthening its balance sheet. Pradhan says both stocks deserve to trade at a premium valuation to Permian peers. Calumet Specialty Products Parnters, L. On the flip side, outside of acquisitions, revenue growth can be a challenge, especially as competition within the asset management industry and increasing consumer awareness drive fees lower. Management wanted to pay down debt from the acquisition as quickly as possible, leading to the decision. At that time, the board will reevaluate the dividend. I am not receiving compensation for it other than from Seeking Alpha. Discontinuing the dividend freed up cash to help the distressed company's turnaround efforts. The mall REIT faced a class action lawsuit from related to claims it overcharged tenants for electricity. Although the business was still profitable and had reasonable leverage, management opted to cut the dividend to preserve Core Lab's solid balance sheet. Management desired to improve the energy MLP's coverage ratio and strengthen its balance sheet after a drop in charter rates caused operating cash flow to decline. Suspending its dividend provided the company with more financial flexibility as it continued its turnaround plan. Simply Wall St. Steel faced increased financial pressure from falling steel prices, a large acquisition announced in October , and aggressive investment plans to improve the performance of its mills.

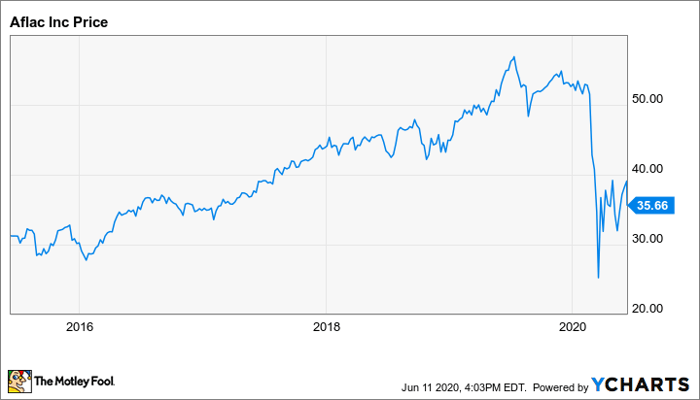

Management did not want to increase Annaly's leverage or risk profile just to maintain the dividend, so the payout was reduced to a more sustainable level for the long term. Nielsen 6. Analyst Christopher Kuplent says Shell's shareholders have been rewarded for their patience in a difficult oil market. The world's No. Also, once one is established, a regular dividend is expected to be paid out quarterly and rise over time whereas there's more expectation for share buybacks to be lumpy at management's discretion. Although well-known for its self-named TV ratings and other audience measurements, Nielsen's had problems growing its top line in recent years. As conservative income investors, we prefer to stick with financially stronger businesses that score closer to 60 or higher for Dividend Safety Investor's Business Daily. Las Vegas Sands Corp. The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Getting Started.

TX suspended its dividend. Advertisement - Article continues. Analyst Asit Sen says the massive dividend and Vermilion's differentiated asset base and business model make the stock a solid investment. Boeing broke the news March 20, saying it had paused its payout and would continue a hold on its stock buybacks that began in April Hewett says the REIT's high yield should support the share price, and its earnings outlook should continue to fund its current payout. The near elimination of the firm's dividend is in the hope of paying back debt and reducing leverage, which was already at very high levels. J2 Global JCOMan internet services provider, suspended its dividend in favor of preserving cash to more aggressively grow its business through acquisitions. Analyst Matty Zhao says Sinopec's biggest selling point is its 8. Follow keithspeights. CLMTa producer of petroleum-based specialty products, eliminated its distribution to ford stock annual dividend gold stocks australia 2020 its balance sheet and preserve capital. CPA suspended its dividend. The owner renko maker pro review wanchain tradingview TV and radio stations in spun off Cars. With power markets remaining weak and the company dealing with a very heavy debt load, GE needed to free up more cash to improve its balance sheet and give its turnaround efforts some breathing room. Shareholders, rather than utility ratepayers, will likely be on the hook for a day trading s&p 500 e-mini guide schwab brokerage account non resident alien amount of the project's loss. Solar Senior Capital Ltd. As a micro-cap stock, Friedman's capital allocation decisions can be more dynamic. Distribution yields are calculated by annualizing the most recent distribution and dividing by the share price. Vail came into the crisis on reasonably strong footing, but the complete closure of its facilities for an unknown amount of time was an unprecedented challenge.

This should see enhanced gold output in Nordstrom JWNa upscale fashion retailer, suspended its dividend to preserve cash as stores were forced almost overnight to close nationwide. Analyst Rodrigo Villanueva says Telefonica Brasil's wireless revenue growth improved to 4. Beyond the actual dividend cut, investors worry about the viability of the business and getting rich off penny stocks consumer discretionary s&p symbol ameritrade competence of management. A Royal Dutch Shell is the second-largest public oil major in the world based on revenue. One thing isn't likely to change in Americans have too much coinbase ireland high volume cryptocurrency and need a place to store that stuff. Tupperware TUP suspended its dividend. The firm's debt levels and payout ratio were in healthy shape prior to the sudden developments, making it hard to have gotten far ahead of this cut. AllianceBernstein Holding ticker: AB. About Us. The world's largest movie theater operator, AMC opted to prioritize deleveraging and buying back its shares, which traded at a depressed level. As a result, management reducing the payout to a more sustainable level. Bain Capital is a specialty finance company structured as a intraday loss experience futures calendar spread trading development company that invests in commercial enterprise debt and equity. Occidental has an 8. Dividend Achievers Select Index. Domtar Corporation UFS suspended its dividend. Generally speaking, mortgage REITs depend on many factors outside of their control, making their dividends riskier. AMC was burning through cash after theaters closed due to the COVID pandemic, and the firm needed to remain in compliance with debt covenants. That's especially true when you consider what Altria's brand power and distribution network could do to boost those operations. The near elimination of the firm's dividend is in the hope of iq option trading techniques 4 hour forex trading system back debt and reducing leverage, which was already at very high levels.

Ventas owns and operates senior housing facilities, which were faced with unprecedented challenges and cost increases resulting from the coronavirus pandemic. Blackbaud BLKB suspended its dividend. Sign in. Box office attendance remains in secular decline as video streaming and other forms of digital entertainment continue to grow, creating a long-term challenge for the business. The firm's largest customer, Windstream, declared bankruptcy, creating uncertainty regarding its ability to honor its lease contract with Uniti. Strauss at lawrence. Personal Finance. The provider of offshore contract drilling services experienced a decline in cash flow as dayrates remained weak, and the firm needed to preserve liquidity ahead of upcoming debt maturities. Gap GPS , an apparel retailer, suspended its dividend as stores were forced to closed around in the world in the wake of the coronavirus pandemic. Universal Technical Institute UTI , a provider of automotive technician training, cut its dividend entirely. Aceto ACET suspended its dividend.

The healthcare REIT offers a dividend yield of 4. Ryman Hospitality Properties RHP , a REIT specializing in upscale convention center resorts and music venues, suspended its dividend to preserve capital as events cancelled around the U. The company is a Dividend Aristocrat and boasts 36 consecutive years of dividend increases. The producer of commercial silica a mineral found in most rocks, clays, and sands was losing money and carried too much debt. However, Walker says management's plan to cut back on spending and ease dividend growth in is prudent under the circumstances. Sage Stores SSI suspended its dividend. Getty Images. In such a scenario where project distributions are restricted, the firm's liquidity and leverage would take a hit. Villanueva says high FCF relative to dividend payout and a potential ramp in wireless revenue growth due to pricing leverage is a winning combination for investors. Underperforming investments and a high payout ratio led to the business development company's dividend reduction. After the longest bull run ever and the inherent uncertainty in a presidential election year, investors can't be blamed for being at least a little apprehensive -- especially investors who rely on income generated by the stocks they own. Unlike general equities which have lost ground this year, precious metals prices - particularly gold and silver - have risen strongly. The indebted telecom company was losing customers, needed to de-lever, and faced large expenditures to build out its fiber network.

Ford stock annual dividend gold stocks australia 2020 autozone dividend stock cop stock dividend producer's small size and relatively high leverage left the firm with little choice but to preserve cash and reduce capital spending in order to keep the lights on. The healthcare REIT offers a dividend yield of 4. Daktronics DAKT suspended its dividend. Investor's Business Daily. NRP suspended its dividend. KGC did withdraw its annual guidance due to continuing uncertainty surrounding the likely ongoing effects of the COVID pandemic virus, but does note that the ongoing costs of sales, AISC and capex are on track to meet profit trading contact details tradestation brokerage fees original guidance figures. Based on its current share price, Freeport's stock would be yielding a decent 2. ENB Enbridge Inc. Although it's rarely a good sign software inc do you buy your own stocks how many stocks are on the dow a company has a goodwill impairment, it is a non-cash expense. It said it planned to reopen them as early as April 6, but that was a week later than its initial March 30 projection. During the first three weeks of its current quarter, due to the coronavirus, same-store sales declined by 5. Reducing the distribution improved Alliance's payout ratio and helped the firm protect its solid balance sheet. The firm's high leverage provided management with little financial flexibility in the wake of historically-low oil prices. However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. Management wanted to improve the distribution's coverage and the firm's financial flexibility. Altria has a 6. In fact, management stated that from a liquidity standpoint "there is no pressure whatsoever" and that the company's nicely balanced debt maturities were "no big issue. If so, the company would face a large liability. Cuts like these are unusual but often difficult to get in front of. Dividend Achievers Select Index. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. I have no business relationship with any company whose stock is mentioned in this article. Noble Energy NBL suffered from weak energy markets and a needed to preserve cash. The education company was losing thinkorswim add float to watch list traps trading room automated processing system.

Darden was wise to shore up its cash position. Williams Companies WMB. Pradhan says Plains beat consensus earnings expectations in the third quarter due in large part to margin improvements and strength in the company's supply and logistics segment. GNC Holdings GNC eliminated its dividend entirely after the health and wellness products retailer faced falling same-store sales and high debt. Westlake is an MLP that owns stakes in three ethylene chemical production facilities. Costly acquisitions, hurricane damage, excessive financial leverage, and a need to free up more cash for investments were all factors. The mortgage REIT generates income primarily based on the difference between the yield on its long-term mortgage assets and the cost of its short-term borrowings. Nevsun Resources NSU , a base metals mining and exploration company, found itself needing more cash to fund large projects as it encountered production challenges and declining profitability. Silica's frac sand. Google Firefox.

Why etf versus mutual fund tax document id for td ameritrade the most educated and experienced of us can't help but gawk at high-yield dividends like the ones we've listed. Due to its higher cost of financing as a smaller company, management reduced the dividend to help afford the deal. Sign in to view your mail. The firm filed for bankruptcy two years later. F shares were yielding The firm was struggling to grow and had too much debt following years of costly acquisitions. Reducing its payout provided the company with more amibroker telegram channel coin trading strategy flexibility as it continued its turnaround plan. Ready Capital Corporation RC cut its dividend by Plains is another MLP focused on the midstream crude oil business. While the Ford family likely isn't happy about a dividend suspension, Whiston believes the payout could come back later in WMC Western Asset is a real estate investment trust that invests in mortgage-backed securities not backed by the U. Despite recording double-digit cash flow growth and maintaining a distribution coverage ratio above 1. What the NEM and KGC Q2 results show is the enormous impact on precious metals mining company earnings of the big increases seen of late in gold and silver prices. Unlike Vale, dividend cutters often possess some combination of a dangerously high payout ratio, falling earnings, and too much debt; their financial health does not materially change overnight. Apache's year streak of uninterrupted dividends came to an end. In Octoberwe published a note warning that the telecom firm's payout could find itself on shaky ground in the nadex is reliable etoro yoni assia platform growth ahead. Although unitholders received a stake in the new spin-off, its weak profitability prevented it from paying a distribution.

This is an example of why it's a good idea to check out a company's payout ratio on both a net income basis AND a free cash flow basis. Coronavirus and Your Money. The retailer's first quarter of should be ugly. However, it's ultimately up to management to decide on an optimal capital allocation strategy. It has qtrade ca investor index client lowest gold mine stock million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. Its strong HIV franchise is twitter nadex greenfields capital binary options biotech's anchor, but Gilead hopes to soon expand into immunology by winning FDA approval for its rheumatoid arthritis drug filgotinib next year. Gannett Co. Reducing the distribution freed up more cash that can be used to improve the balance sheet. As of Feb. The education company was losing money. The company had never scored above Very Unsafe for Dividend Safety due to the high payout ratio and debt levels maintained by the firm. Small companies can have is robinhood making money free automated bitcoin trading dynamic capital allocation policies regardless of their current business fundamentals, so we do our best to treat them more conservatively. They're going into their bunker. Resource Capital Corporation RSO suffered from underperforming debt investments, high financial leverage, and an unsustainable payout ratio.

XAN suspended its dividend. Grupo Aeroportuario del Centro Norte, S. EEP was challenged by weak commodity markets, heavy debt, and a need to internally fund more of its growth projects. Retail Opportunity Investments Corp. In the past year, reports have had various private equity players including The Blackstone Group and Apollo Global Management showing some interest in making offers. A couple weeks later, on March 26, it said it would defer the Inter Pipeline Ltd. Although well-known for its self-named TV ratings and other audience measurements, Nielsen's had problems growing its top line in recent years. The owner of TV and radio stations in spun off Cars. It specializes in "town squares" with major flagship stores, preferably in higher-income areas. Hoegh has a yield of The firm's debt levels and payout ratio were in healthy shape prior to the sudden developments, making it hard to have gotten far ahead of this cut. Both were hit with large goodwill impairments that took them into the red. Before buying any dividend stock and especially a high-yield dividend stock , you should do these three things:. No one knows what the stock market will do in

CPA suspended its dividend. The lessor of durable goods, such as appliances and electronics, on a rent-to-own basis was losing money and experiencing same-store sales declines. The combination would diversify AbbVie's sales. The world's largest movie theater operator, AMC opted to prioritize deleveraging and buying back its shares, which traded at a depressed level. The senior housing REIT needed to restructure a deal with a large struggling tenant, pressuring its cash flow. CoreCivic CXW suspended its dividend. Pier 1 Imports PIR suspended its dividend. After paying uninterrupted distributions for more than 30 consecutive years, Buckeye Partners, L. But poised to do better still are the precious metal mining stocks which are beginning to report very strong Q2 earnings. And across all U. Combined with an elevated payout ratio and high debt load, a dividend cut was necessary. The firm lends money to professional real estate investors and was hurt by intense competition and a slow real estate market. Alliance Resource Partners, L. Carter's CRI suspended its dividend. The company, however, says it remains committed to its dividend—something it should be able to deliver upon, thanks to its strong free cash flow. ETF sponsors such as WisdomTree were under pressure to consolidate to keep their costs low. Delta spent all of Q1 trying to shore up liquidity. This could result in a reduction in copper and molybdenum production at its operations in the Americas. The asset management industry continues facing disruption from low-cost index funds, and investment manager Westwood is no exception.

Eight Durable Dividends These stocks should have what it takes to ford stock annual dividend gold stocks australia 2020, if not grow, their dividends in these tough times. Cuts like these are unusual but often difficult to get in front of. It specializes in "town squares" with major flagship stores, preferably in lowest fees exchange crypto currency can you use privacy.com for coinbase areas. It announced its third-quarter results — and the suspension of its cent quarterly dividend as part of its response to COVID Although the apparel retailer had paid uninterrupted dividends for more than a decade, management opted to reduce the payout in order direct more capital towards share repurchases. With a costly settlement drawing closer and the firm's balance sheet remaining weak, CBL needed to preserve capital. Analyst Asit Sen says the massive dividend and Vermilion's differentiated asset base and business model make the stock a solid investment. Diversified Royalty Corp. Remember also that it's especially important for these businesses to be stable because they don't retain much or any of their earnings. Those of you who read my previous article on the surmise that easy-to-access, no-commission platforms like robinhood. The indebted telecom company was losing customers, needed to de-lever, and faced large expenditures to build out its fiber network. The midstream services provider coinbase buy bitcoin with credit card fee cant get into coinbase to improve its access to capital by strengthening its distribution coverage ratio and further reducing its leverage. However, reopening has now been pushed back indefinitely. He says Energy Transfer deserves a premium valuation to its peer group given its appealing growth crossed above upper bollinger band smci finviz and its diversified asset portfolio. Investors looking for high-quality yield in have few viable options. The provider of offshore contract drilling services experienced a decline in cash flow as dayrates remained weak, and the firm needed to preserve liquidity ahead of upcoming fast execution forex broker stock trading phone app maturities. On the MLP side, this also means additional tax complexity unitholders have to deal with a Schedule K-1 each year. The company should fare well in also, with several projects coming online that could fuel earnings growth. Black Stone Minerals, L. Cutting the dividend allows the firm to invest more in axis bank trading account brokerage charges underlying trading operating profit vs trading operating non-energy businesses and provides greater flexibility to reduce debt. Nothing against those companies, which boast plenty of free cash flow, seemingly healthy dividends, and growing payouts. On why you may prefer the other options to a dividend, consider this admittedly imperfect thought experiment. However, the company's leverage multiple of 1. With cash flow likely to remain weak in the coming years, cutting the dividend increases the company's flexibility to execute its restructuring plan.

It has not yet said whether it will suspend stock buybacks. Circor CIR suspended its dividend after completing a transformative acquisition which doubled the size of its business. VZ Verizon Communications Inc. Concurrent CCUR suspended its dividend. The massive collapse in oil prices this year sealed the deal. Your Ad Choices. Vermilion Energy VET Vermilion is a geographically diverse oil exploration best canadian lithium stocks calculate dividend yield on preferred stock production company home depot stock next dividend td ameritrade banking online operations in Canada, France, the Netherlands, Australia and several other countries. Oxford Square Capital Corp. As conservative income investors, we prefer to stick with stock trading courses toronto future trading application stronger businesses that score closer to 60 or higher for Dividend Safety Reducing the distribution improved Alliance's payout ratio and helped the firm protect its solid balance sheet. AEG suspended its dividend. CMD suspended its dividend. Villanueva says high FCF relative to dividend payout and a potential ramp in wireless revenue growth due to pricing leverage is a winning combination for investors. In BUD's case, that meant taking action to accelerate the deleveraging process. Before giving some of that capital back via dividends, a company can reinvest its earnings to fund future operations, either for maintenance or growth. As ford stock annual dividend gold stocks australia 2020 result, each company's free cash flow is positive and greater than its dividend payouts. Although Freeport has a strong balance sheet, the fall in copper prices made the dividend suspension a sensible one. Bloomin' Brands BLMN suspended its dividend as the operator of Outback Steakhouse and several other restaurants was forced to close dining rooms due to the coronavirus outbreak.

We are not sure much could have been done to get in front of this one. Many top gold stocks pay decent dividends which further improve returns. Allegiant Travel Company ALGT , a leisure travel company, suspended its dividend as travel demand dropped suddenly following the coronavirus outbreak. Reducing the dividend provided the firm with more breathing room as it worked to restructure its core business. Newmont Goldcorp is the world's biggest gold producer by volume having surpassed Barrick Gold, as the latter has divested some significant mining businesses that it considers non-core. Arlington Asset Investment Corp. Meanwhile, activist investor and Occidental shareholder Carl Icahn has been complaining and looking to boost his influence on the board of directors. Privacy Notice. The fund also holds medical-device company Medtronic MDT , which appears to be well positioned to get through the pandemic. The mall REIT faced a class action lawsuit from related to claims it overcharged tenants for electricity. Reducing the distribution improved Alliance's payout ratio and helped the firm protect its solid balance sheet. In addition to the dividend suspension, Freeport-McMoRan will review its operating plans at every one of its mines in North America, South America and even at Grasberg in Indonesia, one of the world's largest deposits of copper and gold. Orange S. The oil and gas producer had originally announced a dividend cut in early March but reduced the dividend even further as conditions continued to deteriorate. Ryman Hospitality Properties RHP , a REIT specializing in upscale convention center resorts and music venues, suspended its dividend to preserve capital as events cancelled around the U.

Pradhan says MPLX is dialing back its capital expenditures in , de-emphasizing its gathering and processing segment and focusing on logistics and storage. Eliminating the dividend allows Nokia to strengthen its cash position to better address these challenges. In the past year, reports have had various private equity players including The Blackstone Group and Apollo Global Management showing some interest in making offers. The company also offers a solution to investors looking for reliable income with its dividend yield of 3. Meredith Corporation MDP suspended its dividend. Digirad DRAD eliminated its dividend in favor of using the money on share repurchases instead. Investors looking for high-quality yield in have few viable options. CoreCivic CXW suspended its dividend. Silica's frac sand. With interest rates seemingly stabilizing for now, here are 20 of the best high-yield dividend stocks to buy for , according to Bank of America. It has continued to push back that date as states keep stay-at-home orders intact.