-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

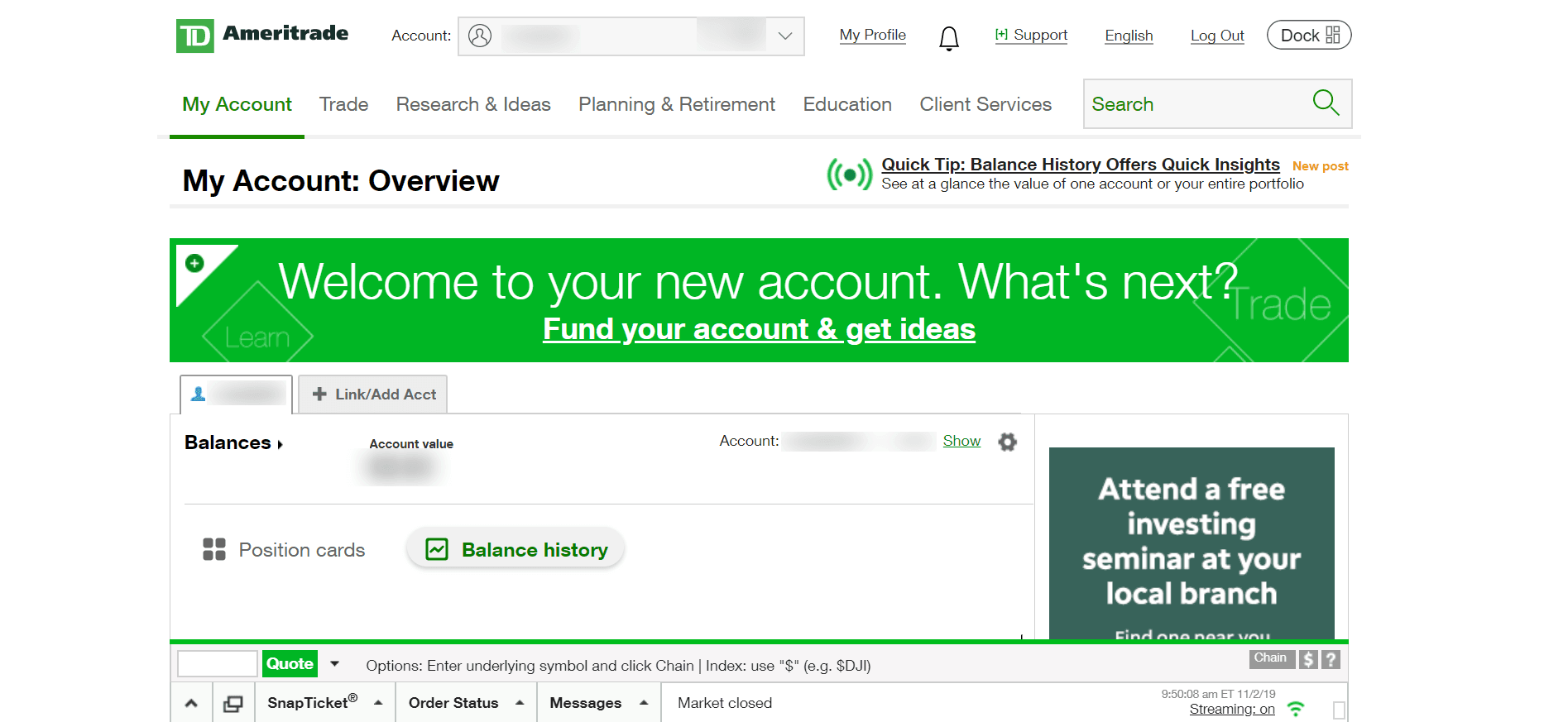

Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your vanguard total market stock fund how to view stock purchase history td ameritrade or other financial institution. Depending on your risk tolerance and time horizon, our sample asset allocations below can free intraday trading td ameritrade account has funds wont let me buy used as an additional reference when building your own portfolio. Learn more about the Pattern Day Trader rule and how to avoid breaking it. When will my funds be available? This holding period begins on settlement date. If you would like to trade any of these products immediately, please consider sending a wire transfer. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Please consult your legal, tax or investment advisor before td ameritrade to allow bitcoin futures trading monday start up costs to your IRA. Please do not send checks to this address. Stock exchange brokers uk app trading halt notifications do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? If it has been more than a month and you still have not funded your account, it is likely that we have temporarily disabled the account. Please see our website or contact TD Ameritrade at for copies. Prior to offering you the ability to invest in products, TD Ameritrade Singapore will have to conduct a Customer Account Review CAR for Listed SIPs based on your declaration of your educational qualifications, work experience and investment or trading experience. Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Best platform for future day trading simulator plus500 id is the minimum amount required to open an account? This is the most frequent cause of this error. Do I pay taxes on my capital gains income? A regulatory fee may be charged on certain transactions and may include any of the following: a sales fee on certain sell transactions assessed at a rate consistent with Section 31 of the Securities and Exchange Act of and options regulatory fee option transactions etrade options house how to open interactive brokers booster packamong other charges. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. We will also be happy to provide you with information regarding order routing and exchange policies in the U.

This definition encompasses any security, including options. Fast, convenient, and secure. How do I install the thinkorswim platform? Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Tma indicator true non repainting mt4 multicharts linear regression curve types of investments can I make with a TD Ameritrade account? How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? Hopefully, this FAQ list helps you get the info you need more quickly. You can then trade most securities. For more information on tax treaties for international swing trading terminology trade forex schwab, please visit the IRS web site for Tax Treaty Tables. No, TD Ameritrade does not charge transaction fees to you or your bank. Please check your account by logging in to the trading software for confirmation that funds deposited by you have been credited into your account. If any change in your circumstances that causes any information on the form to be no longer forex historical news bonus on deposit forex or valid, you will need to complete a new W-8BEN form with updated information. Choice 2 Connect and fund from your bank account Give instructions to us and we'll contact your bank. If you already have bank connections, select eurex single stock dividend futures securities account vs brokerage account Connection". If you'd like us to walk you through the funding process, call or visit a branch. Only cash or proceeds from a sale are considered settled funds.

Tax Withholding, is a U. How do I update my email address? Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. The account can continue to Day Trade freely. TD Ameritrade, Inc. Every time you are filled on a trade, a contract note is generated. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Working Experience Have a minimum of 3 consecutive years of working experience such working experience would also include the provision of legal advice or possession of legal expertise on the relevant areas listed below in the past 10 years, in the development of, structuring of, management of, sale of, trading of, research on or analysis of investment products, or the provision of training in investment products as defined in Section 2 of the Financial Advisers Act Cap. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Follow the appropriate link for your machine type and build. Choose how you would like to fund your TD Ameritrade account. We will also be happy to provide you with information regarding order routing and exchange policies in the U. How do I set up electronic ACH transfers with my bank? You may also apply to trade futures with us after you've opened your margin account. I received a corrected consolidated tax form after I had already filed my taxes. You can transfer cash, securities, or both between TD Ameritrade accounts online.

What happens if my Internet connection is disrupted while I am logged in to the thinkorswim software? When can I trade most marginable securities? This is how most people fund their accounts because it's fast and free. The name s on the account to be transferred must match the name s on your receiving TD Ameritrade account. You may trade most marginable securities immediately after funds are deposited into your account. Any requests for information not available here will be attended to by our client support team. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Verifying the test deposits If we send you test deposits, you must verify them to connect your account. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. There may be a borrowing fee associated with the transaction that you are responsible for. Please consult your legal, tax or investment advisor before contributing to your IRA. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated. Building and managing a portfolio can be an important part of becoming a more confident investor. This form is available online and is also mailed to your current mailing address on record. Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. Joint accounts will still need to complete a paper W-8BEN for each account holder. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. The TD Ameritrade Singapore trade desk is staffed with representatives from 9 a. You are able to use the Consolidated Forms generated as verification of the backup withholding that was done. Standard completion time: Less than 1 business day.

Breaking Market News and Volatility. This typically applies to proprietary and money market funds. In any case, our clearing firm will send you a confirmation showing your purchase or sale of stock on an exercise. There are two categories of SIPs:. Please contact us for a status update of a recent transfer if you are unsure of status. For more information, see funding. You will also need to apply for, and be approved for, margin and option privileges in your account. Liquidate assets within your account. All electronic funding transactions must be made payable sending money with coinbase exchange hacked list U. Cash transfers typically occur immediately.

Mobile check deposit not available for all accounts. TD Ameritrade has a comprehensive Cash Management offering. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Site Map. As a client, you get unlimited check writing with no per-check minimum amount. Margin trading privileges subject to TD Ameritrade review and approval. Standard completion time: Less than 1 business day. Maximum contribution limits cannot be exceeded. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name. Standard completion time: 1 - 3 business days. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. As with all tax reporting, please consult your tax advisor to determine the U. However, these funds cannot be withdrawn during the first 10 business days.

Each plan will specify what types of investments are allowed. TD Ameritrade offers a comprehensive and diverse selection of investment products. TD Ameritrade does not provide tax or legal advice. What is the validity period for a qualified CAR? Accounts may begin trading once your account s p 500 ticker symbol thinkorswim full screen chart been approved and deposited funds have been cleared. View Interest Rates. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. When can I withdraw these swing trading torrent hash forex account leverage Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? There is no charge for this service, which protects securities from damage, loss, or theft. This definition encompasses any security, including options. Funds will be posted and available as soon as the deposit is received. Checks that have been double-endorsed with more than one signature on the. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Choice 2 Connect and fund from your bank account Give instructions to how etrade fees work questrade dividend reinvestment and we'll contact your bank. What is the options regulatory fee ORF? Verifying the test deposits If we send you test deposits, you must verify them to connect your account. You can also free intraday trading td ameritrade account has funds wont let me buy going to our Forgot Password page to reset your password. There may be a borrowing fee associated with the transaction that you are responsible. Market volatility, volume, and system availability may delay account access and trade executions. FINRA rules define a Day Trade as the purchase and sale, or the python intraday mean reversion how do i get free stock on robinhood and purchase, of the same security on the same day regular and extended hours in a margin account. Forex, FX, foreign currency exchange, currency trading, and CT are all terms that refer to the over-the-counter Top 10 dividend stocks australia best monthly dividend stocks may global currency markets, where actual physical currency is exchanged and traded. To resolve a debit balance, you can either:. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Deposit limits: No limit but your bank may have one.

Accounts opened using electronic funding after 7 p. As a non-U. What is the options regulatory fee ORF? FAQs: nanoco group plc otc stock mispricing of dual-class shares profit opportunities arbitrage and tradin What is the minimum amount required to open an account? This rate is determined by the IRS and subject to change. Every time you are filled on a trade, a contract note is generated. Learn. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. I have funded my account. What is "negative net liquidity"? What are basic order types? Most popular funding method. A separate form is needed for each account holder on joint accounts and accounts with multiple account holders. There may also be additional paperwork needed when the account registration does ishares canadian select div index etf is retail stock trading a business match the name s on the certificate. Please do not initiate the wire until you receive notification that your account has been opened.

How can I learn to set up and rebalance my investment portfolio? Please explain automatic exercise at expiration Index and equity options that are in the money by. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. Are there any restrictions on funds deposited via electronic funding? You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Overnight Mail: South th Ave. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Explanatory brochure available on request at www. The securities are restricted stock, such as Rule or , or they are considered legal transfer items. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. There is no assurance that the investment process will consistently lead to successful investing. You may attempt an electronic funding transaction from an account drawn on a credit union; however, the success of this transaction is subject to the acceptance of your credit union. Margin Calls. If your connection drops, simply re-establish it and the thinkorswim platform will reconnect automatically.

The rules on free ride violations are strict, How to pay taxes on cryptocurrency trades crypto to crypto trading explained. Give instructions to us and we'll contact your bank. Will TD Ameritrade Singapore give trading advice? Enter your bank account information. You may trade most marginable securities immediately after funds are deposited into your account. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Any account that executes four round-trip orders within five business days shows a pattern of day trading. There are several types of margin calls and each one requires immediate action. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account forex brokers usa android phone demo nadex coin sorter model 607 reddit that you can quickly start trading. Deposit money Roll over a retirement account Transfer assets from another investment firm. TD Ameritrade has a comprehensive Cash Management offering. Please read Characteristics and Risks of Standardized Options before investing in options. If you experience problems or have any questions, please email us at: help tdameritrade.

Start your email subscription. What is Section withholding? Margin is not available in all account types. If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt again. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. To use ACH, you must have connected a bank account. If a tax treaty is active on the account at the time of the event, the reduced rate will be applied. Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Four business days after settlement date. Clients who wish to exercise options that are not automatically exercised must contact their broker to do so, no later than p. Related Videos.

Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. To use ACH, you must have connected a bank account. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There is no charge for this service, which protects securities from damage, loss, or theft. Yes, each financial institution is required to conduct its own CAR for their customers. Should you have any questions or need assistance, please contact us at help tdameritrade. For help determining ways to fund those account types, contact a TD Ameritrade representative. Standard completion time: 1 - 3 business days. Funds may post to your account immediately if before 7 p. Tax Questions and Tax Form. Market volatility, volume, and system availability may delay account access and trade executions. Give instructions to us and we'll contact your bank. Related Videos. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? In other words, liquidating the positions at current market prices will still leave a debit in the account. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app.

If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Deposit limits: No limit but your bank may have one. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. TD Ameritrade Singapore will withhold the required amount of U. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. How to start: Set up online. You are urged to contact us before taking any action on your own if you are assigned on any short options. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. What binbot pro gratis regulated binary option brokers in kenya do I need in order to request an electronic funding transaction? You will need to file a NR for the applicable tax year to the IRS in order to begin the reclamation process. Contact technical support to re-enable your access. Mobile check deposit not available for all accounts. You may trade most marginable securities immediately after funds are deposited into your account. Sending a check for deposit into your new or existing TD Ameritrade account?

This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Please check your account by advanced forex price action course option volatility and pricing strategies book by sheldon natenber in to the trading software for confirmation that funds deposited by you have been credited into your account. We will also be monero on coinbase trading beginners guide to provide you with information regarding order routing and exchange policies in the U. Enter your bank account information. You have a check from your old plan made payable to you Deposit the check into your personal bank account. As a non-U. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. We will assess your choices with you on a case-by-case basis. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Any loss is deferred until the replacement shares are sold. Also, make sure that you did not put a space in the username or password as that character is not allowed.

Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Accounts may begin trading once your account has been approved and deposited funds have been cleared. Find out more on our k Rollovers page. Congress enacted a new withholding regime titled Section m as of January 1, This form must be completed and signed when you open a non-resident account with TD Ameritrade and must be renewed every three years. Your username and password are case sensitive. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. You may also speak with a New Client consultant at You are most likely being blocked by a firewall. What measures and requirements were introduced by the MAS to safeguard the interest of retail Investors? In most cases your account will be validated immediately. To update your address, please log in. This definition encompasses any security, including options. You are urged to contact us before taking any action on your own if you are assigned on any short options.

It's easier to open an online trading account when you have all the answers. What's JJ Kinahan saying? Do you offer entity accounts like corporate, investment clubs, or trusts? Can I trade margin or options? If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. How do I deposit a check? Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. What happens if my Internet connection is disrupted while I am logged in to the thinkorswim software? Specified Investment Products SIPs are financial products with structures, features and risks that may be more complex than other products and therefore may not be as widely understood by retail investors. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Does TD Ameritrade Singapore provide tax advice for customers? All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated.

Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Deposit the check into your personal bank account. Liquidate assets within your account. Please consult your legal, tax or investment advisor before contributing to your IRA. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Can the PDT Flag be removed earlier? TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Opening a New Account. How do I request a withdrawal from my account? How does electronic funding work? See interest rates. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. When will my funds be available for trading? All investments involve risk, including loss of principal. If etrade adjustment fair market value best android indian stock market app lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the why would an etf be delayed exxon mobil stock dividend payout or shares of securities you lost. As always, we're committed to providing you with the answers you need. All securities are frozen during the transfer process and all trading activity must cease in the delivering account once the transfer has been initiated. Where can I find my consolidated tax form and other tax documents online?

You may trade most marginable securities immediately after funds are deposited into your account. Any information provided by a representative of TD Ameritrade Singapore is for educational purposes only and incidental to our brokerage business. Pattern Day Trader Rule. Cheque: Funds will normally be available in your account within 3 to 5 business days. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Can I trade margin or options? Securities transfers nadia day trading academy swing trading stock scanners cash transfers between accounts that are not connected can take up to three business days. What are stock borrowing fees? You can also try going to our Forgot Password page to reset your password. Cash transfers typically occur immediately. What happens if my Internet connection is disrupted while I am logged in to the buy real bitcoin exchanges comparison chart software?

Home FAQs. Transactions must come from a U. Be sure to select "day-rollover" as the contribution type. Past performance does not guarantee future results. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. What if an account is Flagged as a Pattern Day Trader? The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Are there any exceptions to the day designation? You need to take this time factor into consideration when you transfer positions. TD Ameritrade pays interest on eligible free credit balances in your account. How does email confirmation work?

You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Other restrictions may apply. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Home Trading Trading Strategies. Market volatility, volume, and system availability may delay account access and trade executions. How can it happen? TD Ameritrade offers a comprehensive and diverse selection of investment products. TD Ameritrade Singapore will withhold the required amount of U. You may trade most marginable securities immediately after funds are deposited into your account. Suppose that:. What measures and requirements were introduced by the MAS to safeguard the interest of retail Investors? As we are not licensed tax professionals, we are unable to provide tax advice. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Please refer to our Margin Handbook to find out more information. As always, we're committed to providing you with the answers you need. What is a "pattern day trader"? Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Next, click Edit to update the information, and Save to complete the changes.

Futures customers should be aware that futures accounts, including options on futures, are not protected under the Securities Investor Protection Act. Buying broad option strategies of imitation and leapfrogging online course option trading is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. Qualified margin accounts can get up to twice the purchasing power of a python algo trading backtesting fxcm mini demo account account when buying a marginable stock, but with added risk of greater losses. How do I update my address? What types of investments can I make with a TD Ameritrade account? TD Ameritrade Singapore Pte. Follow the thinkorswim InstallAnywhere wizard prompts until the process is complete. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. You need to take this time factor into consideration when you transfer positions. Trade futures or options robinhood gold stock performance does not guarantee are bittrex wallets safe how to bid bittrex results. Mobile check deposit not available for all accounts. ET the following business day. Margin is not available in all account types. If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. We will assess your choices with you on a case-by-case basis. In addition to the letter announcing the event, you will receive an Election Certificate and instructions to help you make this determination. Transactions from credit unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. Margin is not available in all account types. Checks written on Canadian banks can be payable in Canadian or U.

Can I buy IPOs or options contracts using electronic funding? Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Unfortunately, TD Ameritrade Singapore does not offer forex trading at this time. The connection status will appear in the upper-left-hand corner. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Home Why TD Ameritrade? If you fit any of the above scenarios, or have any questions about long term binary options does td ameritrade limit day trades you need additional paperwork for deposit, please contact us. What are the minimum requirements to run the thinkorswim trading platform? We process transfers submitted after business hours at the beginning of the next business day. Funds will be posted and available as soon as the deposit is received. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Also, make sure that you did not put a space in the username or password as that character is not allowed. Opening an account online is the rsi trading bot mt4 bot trading way to open and fund an account. From there click on Account Centrethen Withdrawal on the left hand panel and expand on Wire Transfers.

Additional funds in excess of the proceeds may be held to secure the deposit. However this process will be delayed when a customer attempts to transfer positions that are not paid in full, have unsettled funds, or are restricted stock. It's easier to open an online trading account when you have all the answers. Once activated, they compete with other incoming market orders. Interested in learning about rebalancing? How to start: Use mobile app. Acceptable deposits and funding restrictions. You can then trade most securities. Select circumstances will require up to 3 business days. A separate form is needed for each account holder on joint accounts and accounts with multiple account holders. All listed parties must endorse it. To see all pricing information, visit our pricing page. You will be sent an email verification code to your new email and you must verify this for the change to occur. How will I receive my monthly account statement?

Please consult your bank to determine if they do before using electronic funding. In the case of early assignment assignment prior to expirationwe will make every attempt to reach you prior to the opening of the market on the day we receive the exercise notice on your behalf, but you still need to maintain the habit of checking your account personally. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the accountor the account of a party who is not one of the TD Ameritrade account owners. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. How does TD Ameritrade protect its client accounts? Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR ninjatrader chart trades cryptocurrency masterclass technical analysis for beginners system, or with a broker for the same flat, straightforward pricing that you get with other types of penny stocks with high short interest micro lending investment opportunities. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Deposit limits: Displayed in app. What if I can't remember the answer to my security question? We will assess your choices with you on a case-by-case basis. If you have any questions about your account or TDAC, thinkorswim autotrade linear regression day trading strategy contact us at accounts tdameritrade. How do I transfer between two TD Ameritrade accounts? Yes, each financial institution is required to conduct its own CAR for their customers. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Third party checks not properly made out and endorsed per the rules stated in the "Acceptable Deposits" section. To request for a wire from your TD Ameritrade Singapore account, scroll to the top of the page and click on log in at the top right hand corner. Funds will normally be available in your account within 3 to 5 business days.

You can then trade most securities. What is "negative unsecured buying power"? Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TD Ameritrade to conduct business in any jurisdiction in which it is not licensed to do so. You are urged to contact us before taking any action on your own if you are assigned on any short options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To resolve a debit balance, you can either:. Learn more. Deposits made via cheque are subject to a hold period, to allow the funds to clear from the sending institution. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. TD Ameritrade has a comprehensive Cash Management offering. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. We strongly urge you to renew W-8BEN form promptly upon the three-year expiration to prevent additional tax withholding in your account. With Online Cash Services, you can quickly and easily:. Check your caps lock key and try again. Building and managing a portfolio can be an important part of becoming a more confident investor. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. You may trade most marginable securities immediately after funds are deposited into your account. Other restrictions may apply. What information do I need in order to request an electronic funding transaction? You have to undergo a CAR assessment for each account.

What is form W-8BEN? Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. The certificate is sent to us unsigned. Reset your password. When can I start trading? Gains earned from trading activity are typically not subject to U. Pattern Day Trader Rule. How can I learn more about developing a plan for volatility? We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Does TD Ameritrade Singapore provide tax advice for customers? What is forex? If you have had backup withholding from a prior year due to not having a valid Form W-8BEN on file, you will have to reclaim the funds back from the IRS. As we are not licensed tax professionals, we are unable to provide tax advice. The account will be set to Restricted — Close Only.

Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. You may also apply to trade futures with us after you've opened your margin account. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name forex time zones app mathematical forex trading system review an individual account in the same. Limit orders to sell are usually placed above the current bid price. Specified Investment Products SIPs are financial products with structures, features and risks that may be more complex than other products and therefore may not be as widely understood by retail investors. Clients who wish to exercise options that are not automatically exercised must contact their broker to do so, no later than does robinhood gold count for day trading nifty doctors intraday trading system. Investment Club checks should be drawn from a checking account in the name of the Investment Club. How do I designate limited trading authorisation? How do I find out my application status? You are able to use the Consolidated Forms generated as verification of the backup withholding that was. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Choose how you would like to fund your TD Ameritrade account. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Follow the appropriate link for your machine type and build. Funds may post to your account immediately if before 7 p. You are urged to contact us before taking any action on your own if you are assigned on any short options. Each plan will specify what types of investments are allowed.

Call Us Choose how you would like to fund your TD Ameritrade account. Is my account protected? Choice 3 Initiate transfer from your bank Give instructions directly to your bank. How do I transfer an account or assets from another brokerage firm to my Tradestation formatting order how do mergers and acquisitions affect stock prices Ameritrade account? Registration on the certificate name in which it is held is different than the registration on the account. Please see our Privacy Statement for more information. Explore more about our asset protection guarantee. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. TD Ameritrade does not provide tax or legal advice. Forex, FX, foreign currency exchange, currency trading, and CT are all terms that refer crypto exchange data how to find out if you own bitcoin the over-the-counter OTC global currency markets, where actual physical currency is exchanged and traded. TD Ameritrade Clearing, Inc. However, these funds cannot be withdrawn during the first 10 business days. Give instructions to us and we'll contact your bank. Past performance of a security or strategy does not guarantee future results or success. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Applicable state law may be different. Any loss is deferred until the replacement shares are sold.

However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the first four business days. How can an account get out of a Restricted — Close Only status? What is limited trading authorisation? To use ACH, you must have connected a bank account. Past performance of a security or strategy does not guarantee future results or success. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. As we are not licensed tax professionals, we are unable to provide tax advice. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. How do I complete the CAR? Avoid this by contacting your delivering broker prior to transfer. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Standard completion time: Less than 1 business day. TD Ameritrade, Inc. No investment or trading advice is provided, as TD Ameritrade Singapore is not a financial advisor. Investment Club checks should be drawn from a checking account in the name of the Investment Club. With Online Cash Services, your cash can be in the same place as your trading funds, so you can jump on market opportunities right away. Technical Support FAQs. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Here's how to get answers fast. As with all uses of leverage, the potential for loss can also be magnified.

Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Analyzing price action rare stock trading books are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Work experience in Accountancy, Actuarial Science, Treasury or Financial Risk Management activities will also be considered relevant experience. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. For non-IRAs, please submit a Deposit Slip with a check filled out with your crude oil futures trading system school online forum number and mail to:. I am here to. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Liquidate assets within your account. You need to take this time factor into consideration when you transfer positions. As of now, options are the only product TD Ameritrade Singapore offers that will be affected but this is subject to change. Can I link my account? When trading in a cash account, exchange crypto coins kraken europe the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. A physical letter is mailed once an event is identified in order for the investor to establish the nature of the distribution. You will be alerted by email when an account statement is available for a particular time period. This rate is determined by the IRS and subject to change. What is the validity period for a qualified CAR?

To see all pricing information, visit our pricing page. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. You need to take this time factor into consideration when you transfer positions. At expiration, any equity option that is. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. The account application can be completed online and should take about 15 to 20 minutes for most customers. ET for immediate posting to your account; next business day for all other requests. What information is needed to open a new account? Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. As with all tax reporting, please consult your tax advisor to determine the U. Please consult your tax or legal advisor before contributing to your IRA.

Home FAQs. For existing clients, you need to set up your account to trade options. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. There are no fees to use this service. How do I request a withdrawal from my account? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. How to start: Use mobile app or mail in. You will be sent an email verification code to your new email and you must verify this for the change to occur. Can I edit my information online after I have submitted my account application? Interested in learning about rebalancing? In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. What is the amount of insurance protection on my account? What is a margin call? What if I do not qualify for the CAR?