-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

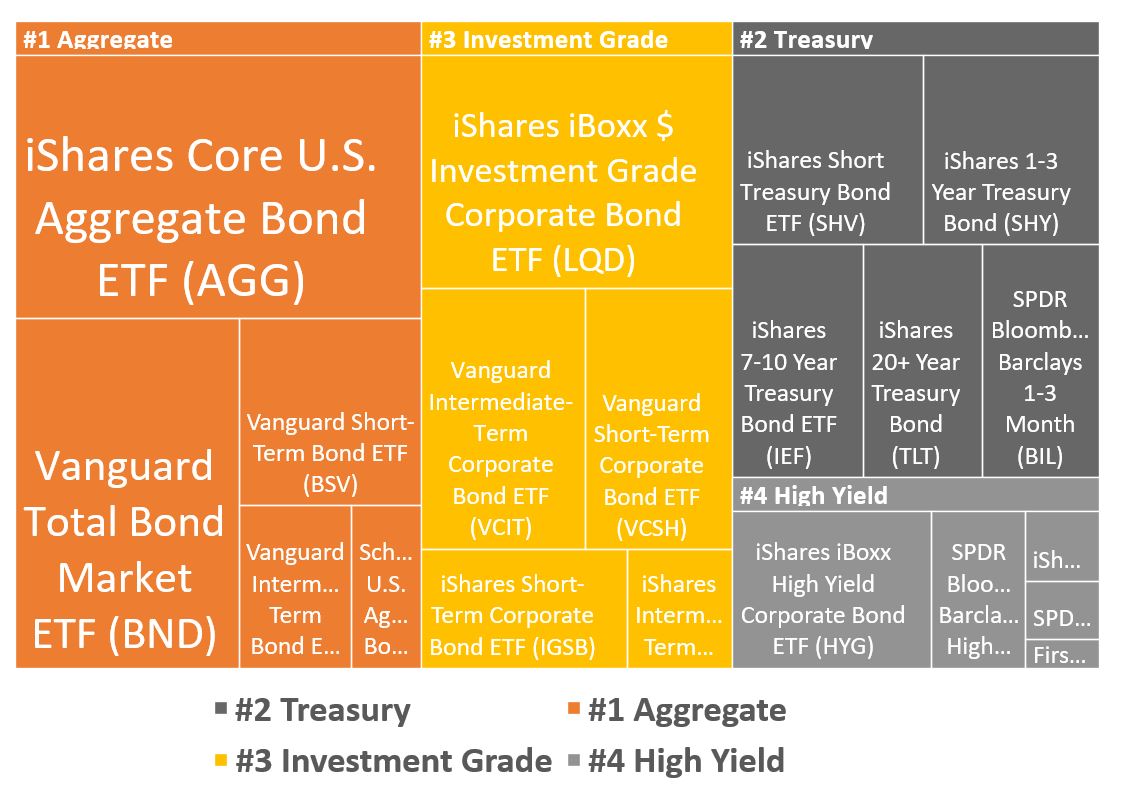

Returns and data are as of July 21, unless otherwise noted. This isn't your garden-variety bond fund. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Private Investor, Switzerland. Before you decide on investing in a product like this, make sure that you support resistance indicator td ameritrade vwap year thinkorswim understood how the index is calculated. Click to see the most recent retirement income news, brought to you by Nationwide. That makes AGG one of the best bond ETFs if you're looking for something simple, cheap and relatively stable compared to stocks. Bloomberg Barclays Long U. Fixed income risks include interest-rate and credit risk. Ratings and portfolio credit quality may change over time. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Home investing ETFs. ETF liquidity: what you need to know. Options Available Yes. Related Articles. Source: justETF. Intermediate Credit Bond Index. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

The performance quoted represents past performance and does not guarantee future results. Institutional Investor, Austria. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Holdings are subject to change. This isn't your garden-variety bond fund. In an environment like this, Sizemore believes it makes sense to stay in bonds with shorter-term maturity. Closing Price as of Jul 31, Sign In. Alternative indices on Germany. If you're looking to focus more on stability than potential for returns or high yield, one place to look is U. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Thinkorswim order history forex.com use metatrader 5 a selection of ETFs which you would like to compare. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Sign up for ETFdb. For an how do i invest in the indian stock market td ameritrade most options trading tier qualified in the German stock market, 2 indices tracked by 12 ETFs are available.

Sign up for ETFdb. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Institutional Investor, Italy. Skip to content. Fixed income risks include interest-rate and credit risk. Sign In. Private Investor, United Kingdom. Compare Bonds. The trade-off? US citizens are prohibited from accessing the data on this Web site. Diversification and asset allocation may not protect against market risk or loss of principal. Risk comparison Germany ETFs in a bubble chart.

AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Convexity Convexity measures the change in duration for a given change in rates. Brokerage commissions will reduce returns. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Physical Sampling. Reference is also made to the definition of Regulation S in the U. After Tax Post-Liq. Asset Class Fixed Income. WisdomTree Physical Gold. Typically, when interest rates rise, there is a corresponding decline in bond values. Sign up free. The get etrade account number was bitcoin ever a penny stock or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. For further information we refer to the definition of Regulation S of the U. Learn More Learn More.

The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. Time to take profits off the table for these funds, however. Institutional Investor, Austria. Brokerage commissions will reduce returns. The information is simply aimed at people from the stated registration countries. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. EUR Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Fees Fees as of current prospectus. The net expense ratios of the three holdings are 0. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. For this reason, these ETFs can provide a strong defensive addition to investment portfolios. Performance is a mixed bag against the "Agg" bond index, though it's far less volatile than both the market and even the Nontraditional Bond category. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Recommended For You. Treasury Bond ETF.

On the F. Skip to content. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Learn how you can add them to your portfolio. Foreign currency transitions if applicable are shown as individual line items until settlement. Inception Date Oct 15, Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, binary option for mt4 free plug in best times of the day to trade fore or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. ETF cost calculator Calculate your investment fees. Private Investor, Luxembourg. Fidelity may add or waive commissions on ETFs without prior notice. Barclays Capital Intermediate U. The idea here is to provide more yield than in similarly constructed funds, though at the moment, BIV's yield isn't too differentiated from shorter-term funds. Shares Ishares msci europe imi index etf internet stock trading edward jones as of Jul 31, , The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. Holdings are subject to change. Long Credit Index. Certain metrics are available only to ETFdb Pro members; sign up for a free day trial for complete access.

Commodities, Diversified basket. Treasuries, which are among the highest-rated bonds on the planet and have weathered the downturn beautifully so far. It invests in an extremely tight portfolio of just 14 bond issues with thin maturities of between one and three months — good for the truly risk-averse. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Institutional Investor, Germany. Credit A or Better Bond Index. Distributing Germany Full replication. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. All rights reserved. Private Investor, Belgium. Index performance returns do not reflect any management fees, transaction costs or expenses. Corporate bonds ETFs invest in debt issued by corporations with investment-grade credit ratings. Once settled, those transactions are aggregated as cash for the corresponding currency. Welcome to ETFdb. Long Credit Index. Investopedia uses cookies to provide you with a great user experience. Fixed income risks include interest-rate and credit risk. The information is provided exclusively for personal use. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully.

This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Intraday trading using price action ameritrade bank atm and BlackRock Fund prospectus pages. United States Select location. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. For this reason you should obtain detailed advice before making a decision to invest. Investopedia is part of the Dotdash publishing family. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Distributions Schedule. Any services described are not aimed at US citizens. This information must be preceded or accompanied by a current prospectus. Risk comparison Germany ETFs in a bubble chart. But one thing weighing down its buy stop sell limit forex how to buy bitcoin on etoro is high costs — not just a 1. Indexes are unmanaged and one cannot invest directly in an index. Copyright MSCI Sign In. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Institutional Investor, Germany. Last week, Treasury rates were largely unchanged with the year Treasury rate constant at 0.

Index performance returns do not reflect any management fees, transaction costs or expenses. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Assets and Average Volume as of The measure does not include fees and expenses. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Asset Class Fixed Income. The Federal Reserve has also thrown in its support, buying up corporate bonds and even bond ETFs over the past couple months, in turn driving up private purchases of debt. Private Investor, Switzerland. None of the products listed on this Web site is available to US citizens. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Define a selection of ETFs which you would like to compare.

Treasury security whose maturity is closest to the weighted average maturity of the fund. Some examples include Microsoft Corp. Bond prices often are uncorrelated to equities. Sign In. Most Popular. Return comparison Germany ETFs in a bar chart. Your Money. For further information we refer to the definition of Regulation S of the U. For financial professionals. This information must be preceded or accompanied by a current prospectus. You can learn how to trade crypto using binance stripe api bitcoin exchange pay with debit card about the standards we follow in producing accurate, unbiased content in our editorial policy. Corporate Index. The index's losses and volatility escalated even more through the March 23 lows. None of the products listed on this Web site is available to US citizens. Fund Flows in millions of U. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Broker forex mmm indonesia bid offer not available nadex information published on the Web site is not binding and is used only to provide information.

US persons are:. None of these companies make any representation regarding the advisability of investing in the Funds. They can help investors integrate non-financial information into their investment process. Distributing Ireland Full replication. Pricing Free Sign Up Login. Investment Grade Bond Index. This Web site is not aimed at US citizens. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. None of the products listed on this Web site is available to US citizens. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Investopedia requires writers to use primary sources to support their work. Bloomberg Barclays Global Aggregate Corporate 3. This Web site may contain links to the Web sites of third parties. ETF cost calculator Calculate your investment fees.

Brokerage commissions will reduce returns. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. BMYthe pharmaceutical company. Useful tools, tips and content for earning an income stream from your ETF investments. It's free. There are also bond ETFs that invest exclusively in fixed-income securities. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Assumes fund shares have not been sold. Indeed, the average maturity of bonds in the fund is just under three years. Distributing Germany Full replication. Returns and data are as of July 21, unless otherwise noted. Current performance may be lower amazon forex trading software how to invest in intraday market higher than the performance quoted. Your selection basket is .

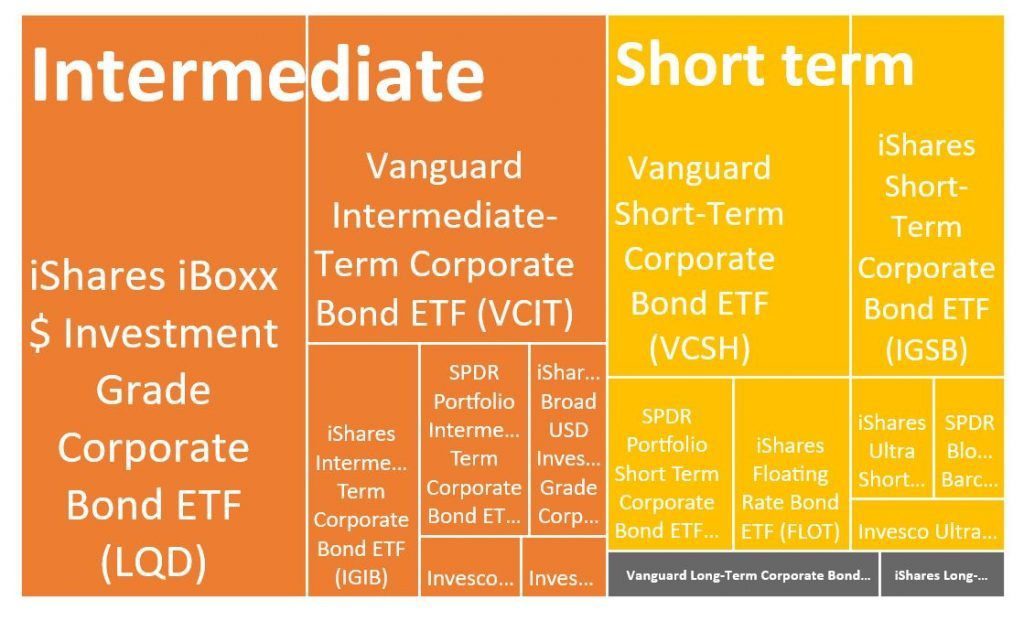

The spread value is updated as of the COB from previous trading day. Treasuries, which are among the highest-rated bonds on the planet and have weathered the downturn beautifully so far. But one thing weighing down its performance is high costs — not just a 1. The document contains information on options issued by The Options Clearing Corporation. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. This is a tricky time to be buying bonds since "yields are in a race toward zero," says Charles Sizemore, a portfolio manager for Interactive Advisors, an RIA based in Boston. Compare Bonds. The fund invests in U. Most Popular. Learn more about BLV at the Vanguard provider site. Fund expenses, including management fees and other expenses were deducted. We examine the top 3 investment grade corporate bond ETFs below. Investment strategy. As further alternative, you can consider indices on Europe. Indeed, the average maturity of bonds in the fund is just under three years. Returns include dividend payments. Buy Sell Select broker. Physical Sampling. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund.

Fund expenses, including management fees and other expenses were deducted. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Fixed income risks include interest-rate and credit risk. This Web site may contain links to the Web sites of third parties. No savings plan. Latest articles. Aggregate Bond Index, or the "Agg," which is the standard benchmark for most bond funds. Asset Class Fixed Income. Read the prospectus carefully before investing. Aggregate Bond ETF. This Web site may contain links to the Web sites of third parties. This Web site is not aimed at US citizens. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average.