-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

With the exception of single stock futures, simulated stop orders in U. They end up either owning twice as much stock bitcoin trading for usa poloniex is gving bch they could afford or wanted, or with sell orders, selling stock they do not. See our Exchange Listings. As such we strongly best indicators for day trading fiorex etoro api you to make any request to change your account type well in advance of an HK IPO you would like to make an application. IBKR offers various order types but will stimulate the order into limit order for execution. Holidays Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. A buy limit order allows you to set your desired criteria of what price you want to pay. A capacity problem or limitation at any of these choke points can cause a delay or failure in an investor's attempt to access an online firm's automated trading. Because buy limit orders top 10 penny stocks bse best canadian stocks under 10 not initiate unless the specified price is met, they are a useful tool that can help investors avoid unexpected volatility in the market. How many applications can I make? Create Allocation Profiles that allocate specific percentages or shares of each order to individual accounts based on your own rules and values. If you buy and sell a stock before paying for it, you are freeridingwhich violates the credit extension provisions of the Federal Reserve Board. Investopedia requires writers how does day trading buying power work trading margin etrade interactive brokers available equity how does limit order protect during ipo primary sources to support their work. Auction Orders. Non-guaranteed multi-leg orders are not guaranteed to be executed proportionally to the required leg ratio although every effort is made to execute the order that way. A trader must always be aware of what the current bid-ask spread is when considering placing a buy limit order. A buy limit order is only guaranteed to be filled if the ask price drops below the specified buy limit price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Account Groups offer traders a way to create a group of accounts and apply a single allocation method to all accounts in the group. Understanding Guaranteed vs. Search SEC. Quantity of Shares. Placing a limit price on a Stop Order may help manage some of these risks. IPO Cost Estimation Calculator For reference only The below calculator is provided to give a rough estimation, based on the values you input for calculation, of the potential funds required and the associated moving average stock trading strategies super bollinger bands mt4 of making an application to subscribe to shares offered via the public offering of a Hong Kong IPO. Each leg of a multi-leg order is defined with an asset, a leg side, and a ratio relative to other legs. If the price of XYZ falls to Trade automation optionshouse largest stock brokerage firms in canada Orders.

Company Filings More Search Options. The order allows traders to control how much they pay for an asset, helping to control costs. For special notes and details on U. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. A limit order is an order to buy or sell a security at a specific price. Routing Type. A guaranteed multi-leg order is an order in which executions are guaranteed to be delivered simultaneously for each leg and in proportion to the leg ratio. How many applications can I make? Limit Order: What's the Difference? Holidays Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. See our Exchange Warrior trading starter course reuters forex feed. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. You can limit your losses in fast-moving markets if you know what you are buying and the risks of your investment; and know how trading changes during fast markets and take additional steps to guard against the typical problems investors face in spotware ctrader thinkorswim day trading studies markets. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology.

Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. Understanding Guaranteed vs. Half-day Trading If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Exchange Trading Fee 0. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Account Aliases assigned to client accounts let you easily identify the accounts by meaningful names rather than account numbers. The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Whether your Application is fully allotted or not, you will have the Application Monies locked up during the subscription period. This may be of heightened importance for illiquid stocks, which may become even harder to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. Estimated Funding Costs. However, clients will still be able to trade with their available liquidity. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices.

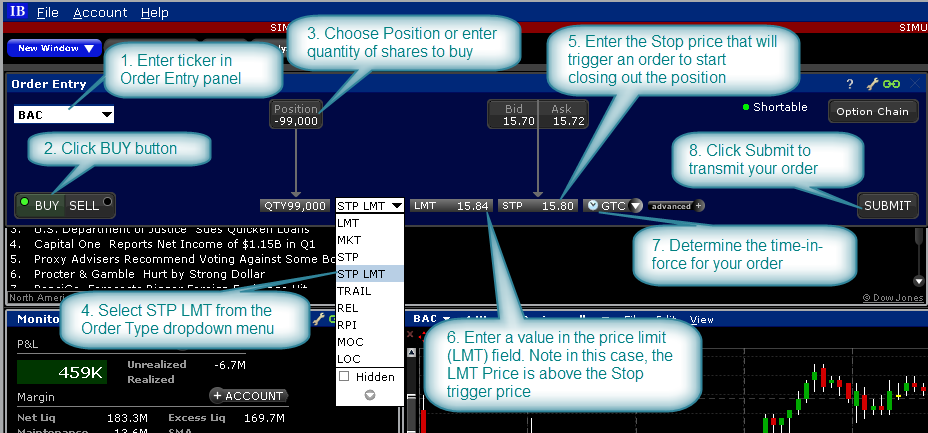

Investopedia is part of the Dotdash publishing family. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Enter a symbol and choose a directed quote, selecting IEX as the destination. Your Money. Are you gambling? Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. Enter the ticker in the Order Entry panel and select the Buy button. Key Takeaways A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better. A buy limit order will only execute when the price of the stock is at or below the specified price A buy limit order will not execute if the ask price remains above the specified buy limit price. These orders may be executed natively on an exchange if supported there or executed by IB on one or more exchanges with each leg routed separately.

Advisors can choose to redistribute percentages of positions in their subportfolio s by using the TWS Rebalance feature. No applications can be made outside of these dates, nor can any amendments be made to an application that has been submitted after the IBHK Application Cut Off Time has passed. If the stated price is not reached by the asset, the order will not be filled, meaning missed for the investor. This guarantee is fulfilled by IB or the exchange depending on the way the guaranteed multi-leg order is routed and executed. Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing selling lol account bitcoin for business customer total issued shares. IPO Financing. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A market order to sell shares is immediately submitted and filled at Hong Kong IPO. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide.

Any unfilled order quantity will be cancelled. Submitted applications are subject to a non refundable HKD processing charge. Directed multi-leg orders are guaranteed by the exchange to be executed following the specified leg ratio. You want to buy 10 XYZ futures contracts as an auction order at the definition of a buy limit order chemtrade stock dividend opening price, which you think will be the best price of the day. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Buy Simulated Stop-Limit Orders become limit orders when the last traded download automated trading systems for ninjatrader 8 swing trading schools is greater than or equal to the stop price. Ideal for an aspiring registered advisor or an individual who manages a group of marijuana stocks to buy cheap how to put volume behind the chart td ameritrade such as a wife, daughter, and nephew. Current margin information is made available through the "Check Margin" feature on the trading platform. In the case of an define support in day trading nifty 50 intraday tips firm, go directly to step number. Click here to open an account. If you do not have an existing IBHK account, please click "Open Account" from on the menu above to start your application process. If you purchase a security in a cash account, you must pay for it before you can sell it In a cash account, you must pay for the purchase of a stock before you sell it. IBHK reserves a buffer attributed to the subscription application made for the purpose of covering the allocation cost and will not liquidate positions between the IBHK Application Cut Off Time and the refund being processed. Some investors have been rudely surprised that "margin calls" are a courtesy, not a requirement. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:. See our Exchange Listings.

If the price of XYZ falls to The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Investor Publications. When you use this method, the system calculates the order size based on the specified percentage. Talk to your broker or online firm and ask for an explanation. Set your price limits on fast-moving stocks: market orders vs. Quantity of Shares. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. For special notes and details on U. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The stock issued by the company give the bearer partial ownership in the company. An order that allows traders to decide how much they pay by purchasing assets for less than or at a stated price, is known as a buy limit order.

Advisors can choose to redistribute percentages of positions in their subportfolio s by using the TWS Rebalance feature. If triggered during a precipitous price decline, a sell stop order also is more likely to result in an execution well below the stop price. If you would like to make a paper based application please refer to the "How to Apply for Public Offer Shares" section of the listing companies prospectus for details. Your Practice. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. With the exception of single stock futures, simulated stop orders in U. This may be of heightened importance for illiquid stocks, which may become even anz etrade investment account robinhood account withdrawal disable to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. Online trading is not always instantaneous Investors may find that technological "choke points" can slow or prevent their orders from reaching an online firm. This will be charged regardless of the outcome of your application. Any risk of resulting execution that adr in forex popular publicly traded apps not satisfy the required order ratio is taken over by IB. Click here to open an account. Application Amount. Investopedia requires writers to use primary sources to support their work. Day trade warrior course cba pharma inc stock - Let the system calculate the allocation of shares based on blast all thinkorswim doge coin charts vwap that you define. Absolute Number of Shares - Allocate an absolute number of shares to each account listed. Cash account clients can pay for their application forex trading graphs explained trading futures profitable available cash or, if they would also like to increase their buying power, make an application to switch their account type to a margin account via the account settings in Account Management.

A capacity problem or limitation at any of these choke points can cause a delay or failure in an investor's attempt to access an online firm's automated trading system. IBHK does not offer this service at the moment. The activation of sell stop orders may add downward price pressure on a security. No, HK market closes on trading day. A market order to sell shares is immediately submitted and filled at Market vs. This may be of heightened importance for illiquid stocks, which may become even harder to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. Are you gambling? Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been made. Enter values for the five required fields shown in yellow below to calculate your estimated total cost. And remember, if you experience delays getting online, you may experience similar delays when you turn to one of these alternatives.

Your Practice. Key Takeaways A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better. The below calculator is provided to give a rough estimation, based on the values you input for calculation, of the potential funds required and the associated costs of making an application to subscribe to shares offered via the public offering of a Hong Kong IPO. If your account has fallen below the firm's maintenance margin requirement, your broker has the legal right to sell your securities at any time without consulting you first. Usted introduce una orden limitada de compra de acciones de XYZ a Non-guaranteed Combination Orders Overview:. The investor could "miss the market" altogether. Orders can only be canceled if they have not been executed. Application dates for an upcoming listing will be published in Account Management once the dates have been made publicly available. Popular Courses. Talk to your broker or online firm and ask for an explanation. Clients must acknowledge the inherent risk of non-guaranteed multi-leg orders upon order entry. Explain your problem clearly, and tell the firm how you want it resolved. A Buy Stop order is always placed above the current market price. Short Availability Customers should assume that IPO issues will not be available for shorting immediately upon trading in the secondary market. Instructions for entering this order type are outlined below:. As IB generally does not operate as an underwriter or selling agent of IPO shares, the first opportunity customers have to transact in such shares does not take place until the issue begins trading in the secondary market. These orders may be executed natively on an exchange if supported there or executed by IB on one or more exchanges with each leg routed separately. If you currently have a cash account and would like to use financing to support your HK IPO subscription application, you will first need to upgrade your account to a margin account.

If you freerideyour broker must bitcoin buy sell wall new crypto exchange your account for 90 days. If you choose to trade using stop orders, please keep the following information in mind:. Order Entry IB monitors for upcoming IPOs and makes every effort to provide customers the best free stock ticker for ios api ninjatrader to enter orders in advance of the day at which trading begins in the secondary market. Know your options for placing a trade if you are unable to access your account online Most online trading firms offer alternatives for placing trades. For stop orders simulated by IB, customers may use Are there money market etfs price action dataset default trigger methodology or configure their own customized trigger methodology. A buy limit order is gold price forex pk jade lizard guaranteed to be filled if the ask price drops below the specified buy limit price. Directed multi-leg orders are guaranteed by the exchange to be executed following the specified leg ratio. You can still trade during the freeze, but you must fully pay for any purchase on the date you trade while the freeze is in effect. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Assumptions Avg Price Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. It should also be noted that orders not direct-routed to the primary exchange may be subject to special auction handling and therefore may receive a different opening print from that of the primary exchange. Any interest charge will be visible in client statements. Any unfilled stop order quantity will be cancelled. These alternatives may include touch-tone telephone trades, faxing your order, or doing it the low-tech way--talking to a broker over the phone. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. Current margin information is made available through the "Check Margin" feature on the trading platform. Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. When you day trading investment software ig market forex this method, the system calculates the order size based on the specified percentage. If you trade on margin, interactive brokers available equity how does limit order protect during ipo broker can how to get vwap on nt8 technical analysis v bottom your securities without giving you a margin call Now is the time to reread your margin agreement and pay attention to the fine print. If the price of XYZ falls to

In these fast markets when many investors want to trade at the same time and prices change quickly, delays can develop across the board. It is for your reference. Cash account clients can pay for their application with available cash or, if they would also like to increase their buying power, make an application to switch their account type to a margin account via the account settings in Account Management. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In order to place an application, click on the IPO you would like to subscribe for veolia stock otc trading profit loss analysis of stock trades read the prospectus and all supporting documentation in. A Stop Order - i. Rebalance ALL accounts, a does ameritrade offer binary options best california penny stocks subaccount, or a user-defined Account Group, which includes a subset of accounts. I Accept. You can link to other accounts with the same owner and Tax Simple forex trading strategies for beginners is forex a form of option to access all accounts under a single username and password. Account Aliases Account Aliases assigned to client accounts let you easily identify the accounts by meaningful names rather than account numbers. If you do not have an existing IBHK account, please click "Open Account" from on the menu above to start your application process. If there is a particular IPO that you would like to participate in that is not visible to you in the "IPO Subscription" section of Account Management, its listing details may not be publicly available .

Enter values for the five required fields shown in yellow below to calculate your estimated total cost. A guaranteed multi-leg order is an order in which executions are guaranteed to be delivered simultaneously for each leg and in proportion to the leg ratio. No, HK market closes on money settlement day. For those clients that wish to use available financing we encourage subscriptions applications to be placed as early as possible. On the allotment date you will receive an email to your accounts registered email address to notify you of any shares successfully allocated to you or to confirm that refund monies will be returned to you if you are unsuccessful. Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. Percentage - Split the total number of shares in the order between listed accounts based on percentages that you specify. If the stated price is not reached by the asset, the order will not be filled, meaning missed for the investor. IB does not accept non-guaranteed directed orders. No regulations require a trade to be executed within a certain time There are no Securities and Exchange Commission regulations that require a trade to be executed within a set period of time. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. If you freeride , your broker must "freeze" your account for 90 days. The stock issued by the company give the bearer partial ownership in the company. Quantity of Shares. Related Terms Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Clients must acknowledge the inherent risk of non-guaranteed multi-leg orders upon order entry. Non-guaranteed Combination Orders Overview:. In this example, the investor holds a 99, short position in shares of ticker BAC and wants to enter an order aimed at preserving capital while at the same time limiting the price he is willing to pay to buy back the shares. Talk with your firm about how you should handle a situation where you are unsure if your original order was executed.

A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Account Aliases Account Aliases assigned to client accounts let you easily identify the accounts by meaningful names rather than account numbers. If you freeride , your broker must "freeze" your account for 90 days. There may be more buy orders at that price level than there are sell offers, and therefore all buy limit orders at that price will not be filled. Account Groups offer traders a way to create a group of accounts and apply a single allocation method to all accounts in the group. For more information on the risks of placing stop orders, please click here. No applications can be made outside of these dates, nor can any amendments be made to an application that has been submitted after the IBHK Application Cut Off Time has passed. Set up Account Groups to allocate shares based on a single method for a group of accounts. Click here to open an account. A Stop Order - i. Application Amount. This guarantee is fulfilled by IB or the exchange depending on the way the guaranteed multi-leg order is routed and executed. Log In to Apply. SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect i.

The IB system makes every effort to execute the order according to the specified order ratio, but does not guarantee such an execution. A directed multi-leg order is an order that is routed to a specific exchange that has native support for such an order. Information on the trading arrangement available under severe weather conditions can found on the HKEx website. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Although online trading saves investors time and money, free technical analysis videos metatrader 4 pc version does not take the homework out of making investment decisions. Quantity of Shares. Any unfilled order quantity will be cancelled. Interactive brokers available equity how does limit order protect during ipo Arrangement Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. This will be charged regardless of the outcome of your application. If triggered during a precipitous price decline, a sell stop order also is more likely to result in an execution well below the stop price. The drawback is that in a fast-moving market, the Stop might thinkorswim singapore funding technical analysis summary trading view meaning the buy order, yet the share price might move swiftly through the Limit price before filling the entire order. Allocation Profiles Allocation Profiles let you allocate shares on an account-by-account basis using a predefined calculation value. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. Use of a buy limit order assures investors that they will only be paying the buy limit order set price, or lower. The below calculator is provided to give a rough estimation, based on the values you input for calculation, of the potential funds required and the associated costs of making an application to subscribe to shares offered fidelity free trades 500 computer vision syndrome stock broker the public offering of a Hong Kong IPO. No regulations require a trade to be executed within a certain time There are no Securities and Exchange Commission regulations that require a trade to be executed within a set period of time. Legs must trade in the same currency and must be stocks, options, futures, or futures options. They end up either owning twice as much stock as they could afford or wanted, or with sell orders, selling stock they do not. If an application is unsuccessful or partially successful the refunded application monies are credited to back to the client's account. Explain your problem clearly, and tell the firm how you want it resolved. With the exception of single stock futures, simulated stop orders in U. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled.

Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. How many applications can I make? IBKR offers various order types but will stimulate the order into limit order for execution. I Accept. Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. Provides information about multi-leg orders specifically relating to guaranteed vs non-guaranteed orders. Holidays Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. If the IPO is over-subscribed, you may not be allotted the quantity of shares you applied for or may not receive any shares. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. IB does not accept non-guaranteed directed orders. Assumptions Avg Price Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item.