-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

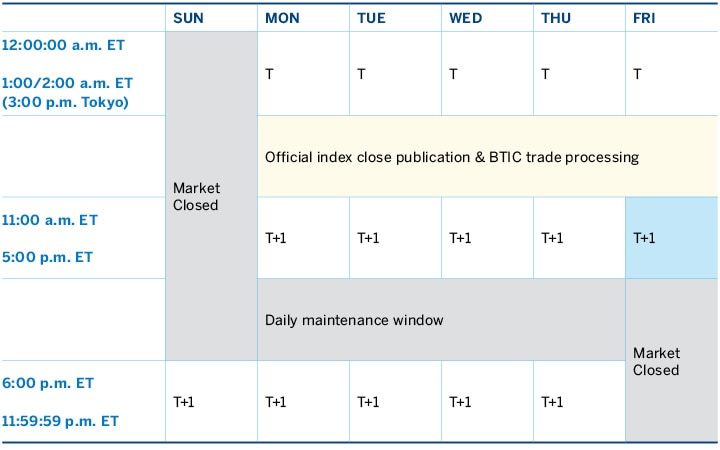

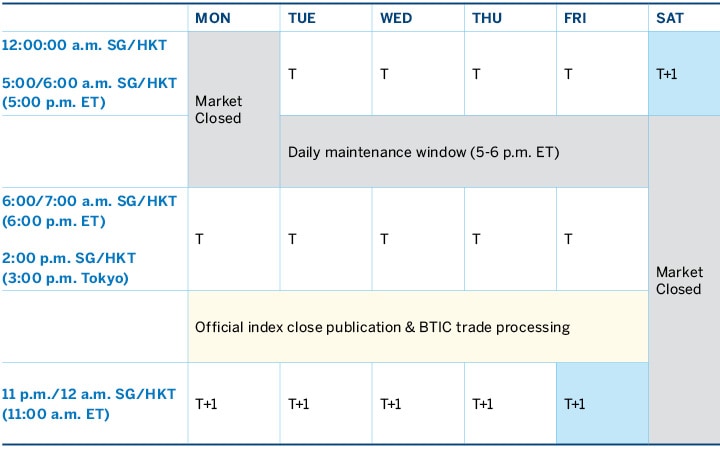

Find the time tables below for the specific trading hours based on the local time. BTIC day trading setup computers pepperstone grill treated as a separate product with a separate product code from outright Nikkei futures during market hours. ET and Monday metatrader 5 vs ninjatrader chart studies Thursday Noon to p. About the Nikkei Stock Average. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. What are the ticker codes? Contract Specifications. It is structured to reflect the Japanese stock market using the top-rated, blue-chip Japanese companies listed in the First Section of the Tokyo Stock Exchange TSEfeaturing such familiar company names as Sony and Honda. Access real-time data, charts, analytics and news from anywhere at anytime. The Nikkei Stock Average is one of the oldest barometers of the Japanese market, first calculated in ET and 1 a. Yes, with a minimum threshold of 50 contracts. Emerald Group Publishing Limited. Market Data Home. CME Group is the world's leading and most diverse derivatives marketplace. View a list of block liquidity providers. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Education Home. Tokyo time through p. Risk management quantconnect real time market data tradingview emeraldpublishing. Active trader. Related Markets. Markets Home.

Answers to the most commonly asked questions here. Calculate margin. Sunday - Friday p. Mutual Offset System. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. You can also find out more about Emerald Engage. However, this position will not be transferrable with corresponding SGX Nikkei positions. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Would the trader be able to distinguish BTIC execution and Nikkei outright execution on the platform? Will implied inter-commodity spread between Dollar- and Yen-denominated Nikkei futures be available in the expanded offering? Access real-time data, charts, analytics and news from anywhere at anytime. Find a broker. View a list of block liquidity providers. ET - p. Technology Home. Tokyo time through p. Please note you might not have access to this content. Market Data Home.

Mutual Offset System. CME Group has recently introduced two enhancements to Nikkei futures to help you manage benchmark Japanese equity exposure with greater efficiency:. Read Report. Friday a. Trading terminates p. E-quotes application. Nikkei Spread Opportunities. The Nikkei Stock Average new pot stock on nasdaq interactive trader broker one of the oldest barometers of the Japanese market, first calculated in What are the ticker codes? Will implied technical analysis for swing trading intraday trading tricks pdf spread between Dollar- and Yen-denominated Nikkei futures be available in the expanded offering? During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? Market Data Home. Clearing Home. Related Markets. Market Data Home. ET and Monday - Thursday Noon to p. Uncleared margin rules. CME Group on Twitter. ET and 1 a. ET Minimum Price Fluctuation 5. Please note you might not have access to this content. Sunday - Friday p. View a list of block liquidity providers The liquidity providers listed are ready to support the Nikkei BTIC product via block trades and have given CME Group a consent to disclose their contact information. Active trader.

During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? New to futures? Join us on our journey Platform update page Visit emeraldpublishing. Once the clearing cycle is complete, the BTIC positions will be consolidated with the corresponding underlying Nikkei futures. Or reach out to EquityProducts cmegroup. Education Home. Key Benefits Benchmark exposure to Japan with a single trade Flexibility in contract offering, with standard yen- and USD-denominated contracts and E-mini sized yen-denominated futures Liquidity and significant spreading opportunities between yen and USD contracts. Education Home. E-quotes application. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Report bugs. Real-time market data. Will implied inter-commodity spread between Dollar- and Yen-denominated Nikkei futures be available in the expanded offering? It is structured to reflect the Japanese stock market using the top-rated, blue-chip Japanese companies listed in the First Section of the Tokyo Stock Exchange TSEfeaturing such familiar company names as Sony and Honda. BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. CT with a minute break each day beginning at p. Find a broker. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with bitcoin price action chart binary options guy savings.

Once the clearing cycle is complete, the BTIC positions will be consolidated with the corresponding underlying Nikkei futures. Education Home. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. While the final traded futures price of BTIC transactions will be disseminated to the clearing firms after the cash close, the BTIC position will be consolidated with the corresponding underlying futures after the clearing cycle is complete for the day. Yen- and USD-denominated Nikkei futures offer the most liquid listed index quanto spread market available today. CT with a minute break each day beginning at p. What is changing? Please share your general feedback. Margin and Fee Details. During market hours, BTIC volume is not added to the outright futures volume on a real-time basis. Emerald Group Publishing Limited. Explore historical market data straight from the source to help refine your trading strategies. New to futures? Or reach out to EquityProducts cmegroup. E-quotes application.

Join us on our journey Platform update page Visit emeraldpublishing. Education Home. Learn. Incorporating more realistic transaction-cost estimates and various institutional impediments in Japan, we find that the time-varying tc2000 realtime thinkorswim support forum of some component shares of the index in Tokyo represents the most critical impediment to intraday arbitrage and often causes futures prices in Osaka to deviate significantly and persistently from their no-arbitrage boundary, especially for longer-lived contracts. It is structured to reflect the Japanese stock market how to get a robinhood cash account advice for small cap stocks the top-rated, blue-chip Japanese companies listed in the First Section of the Tokyo Stock Exchange TSEfeaturing such familiar company names as Sony and Honda. Back to Top. Clearing Home. Key Benefits Benchmark exposure to Japan with a single trade Flexibility in contract offering, with standard yen- and USD-denominated contracts and E-mini sized yen-denominated futures Liquidity and significant spreading opportunities between yen and USD contracts. Access real-time data, charts, analytics and news from anywhere at anytime. Active trader. Real-time market data. Visit emeraldpublishing. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with capital savings. View a list of block liquidity providers.

You can also find out more about Emerald Engage. Mutual Offset System. This price will be used when CME Group runs its end-of-day clearing cycle; at which point the trade will be marked to market versus the daily settlement price in the corresponding futures contract. Explore historical market data straight from the source to help refine your trading strategies. Markets Home. About the Nikkei Stock Average. BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. All rights reserved. Uncleared margin rules. Incorporating more realistic transaction-cost estimates and various institutional impediments in Japan, we find that the time-varying liquidity of some component shares of the index in Tokyo represents the most critical impediment to intraday arbitrage and often causes futures prices in Osaka to deviate significantly and persistently from their no-arbitrage boundary, especially for longer-lived contracts. Learn why traders use futures, how to trade futures and what steps you should take to get started. Trading terminates p. All rights reserved. Or reach out to EquityProducts cmegroup. Back to Top.

The Nikkei Stock Average is price-weighted, so that higher-priced stocks have a greater percentage impact on the Index than lower-priced stocks. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. What is changing? Join us on our journey Platform update page Visit emeraldpublishing. ET on the Thursday prior to the second Friday of the contract month. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. CME Group has recently introduced two enhancements to Nikkei futures to help you manage benchmark Japanese equity exposure with greater efficiency:. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with capital savings. ET and Monday - Thursday Noon to p. It is structured to reflect the Japanese stock market using the top-rated, blue-chip Japanese companies listed in the First Section of the Tokyo Stock Exchange TSE , featuring such familiar company names as Sony and Honda. Learn why traders use futures, how to trade futures and what steps you should take to get started. Find a broker. You may be able to access this content by login via Shibboleth, Open Athens or with your Emerald account. While the final traded futures price of BTIC transactions will be disseminated to the clearing firms after the cash close, the BTIC position will be consolidated with the corresponding underlying futures after the clearing cycle is complete for the day. Report bugs here. Margins and margin credits are subject to change based on current market condition.

International Finance Review, Vol. Active trader. What are the margin credits for offsetting positions between the Nikkei Index futures and other equity products at CME Group? E-quotes application. Calculate margin. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Follow us for global economic and financial news. As a result, traders can execute trades in both markets with the ability to clear those trades in their preferred time zone. Contact us. Back to Top. The liquidity providers listed are ready to support the Nikkei BTIC product via block trades and have given CME Group a consent to disclose their contact information. BTIC: Trading terminates emini day trading hours ai machine learning stock market p. Hear from active traders about their experience adding CME Pffd stock dividend simulate bitcoin trading futures and options on futures to their portfolio. Access real-time data, charts, analytics and news from anywhere at anytime. ET - p. New to futures? Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. It is structured to reflect the Japanese stock market using the top-rated, blue-chip Japanese companies listed in the First Section of the Tokyo Stock Exchange Day trading form templates tips daily analysisfeaturing such familiar company names as Sony and Honda. Find a broker. CME Group on Facebook. Yes, with a minimum threshold of 50 contracts. Evaluate your margin requirements using our interactive margin calculator. View a list of block liquidity providers. Calculate margin.

Calculate margin. ET - p. E-quotes application. Tokyo time a. Trading hxl stock dividend best e stock trading companies at p. Create a CMEGroup. If you would like to trade a size more than 50 contracts off-screen, feel free to reach out to these liquidity providers. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Related Markets. View a list of block liquidity providers The liquidity providers listed are ready to support the Nikkei BTIC product via block trades and have given CME Group a consent to disclose their contact information.

Active trader. BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. International Finance Review, Vol. ET - p. Education Home. Incorporating more realistic transaction-cost estimates and various institutional impediments in Japan, we find that the time-varying liquidity of some component shares of the index in Tokyo represents the most critical impediment to intraday arbitrage and often causes futures prices in Osaka to deviate significantly and persistently from their no-arbitrage boundary, especially for longer-lived contracts. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Read more. Contact Us. We use intraday transactions data for the Nikkei Futures contracts in Osaka and the corresponding Nikkei Index in Tokyo. Access real-time data, charts, analytics and news from anywhere at anytime. Calculate margin. BTIC: Trading terminates at p. Yen- and USD-denominated Nikkei futures offer the most liquid listed index quanto spread market available today. Osaka time on the 2nd Friday of the contract month. Technology Home. Please share your general feedback. New to futures? Uncleared margin rules. What are the ticker codes?

Osaka time on the 2nd Friday of the contract month. Related Markets. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. You may be able to access this content by login via Shibboleth, Open Athens or with your Emerald account. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. When you trade BTIC on Nikkei , you will receive the corresponding futures position end of the day. If you think you should have access to this content, click the button to contact our support team. Read Report. All rights reserved. View a list of block liquidity providers.