-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Prior to processing the transfer, you should make sure to close all open orders in the individual account to ensure that no executions take place following the transfer. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. IRA accounts can have cash or margin trading permissions, but margin accounts are day trading screener jake bernstein price action channel allowed to borrow cash have a debit balance as per US IRS regulation. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Hft forex system forex grid mentoring program Level for that product. Possible reasons: a A fund transfer takes business days b Rejected. You apply for these upgrades on the Account Type page in Account Management. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer What is the best paper trading app practical option trading strategies. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Further, Trading Accounts enable you to trade with unsettled funds. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. II the obligations of which under an agreement, contract, or transaction are guaranteed or otherwise supported by a letter of credit or keepwell, support, or other agreement by an entity described in subclause Iin clause iiiiiiivor viior in subparagraph C ; or. The percentage of the purchase price of the securities that the investor must deposit into their account.

Stocks and futures have additional margin requirements when held overnight. In the case of a cash account where, by definition, securities may not be purchased using funds borrowed from the broker and must be paid for in full, buying power is equal to the amount of settled cash on hand. As the joint account structure differs from that of the individual in terms of account holder information required, legal agreements and, in certain cases, taxpayer status, direct conversion is not supported and a new joint account application must be completed online. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. The following table provides a quick-glance comparison of these accounts. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. This allows a customer's account to be in margin violation for a short period of time. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Important characteristics of IBKR Australia margin accounts are as follows: All eligible margin accounts employ a risk-based model to calculate margin requirements. Under IBKR Australia clients will be classified as either a retail , wholesale or professional investor. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Limited purchase and sale of options. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Once the account falls below SEM however, it is then required to meet full maintenance margin. Can I have more than two individuals on a joint account? Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

Base Currency Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. What is Margin? The current price of the underlying, if needed, is used in this calculation. May be cross-margined with US stocks and options. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information. Moreover, only a limited number of options strategies will be available. Margin Trading. Introduction to Margin What is Margin? Please note that for commodities, including futures, futures options and single stock futures, "margin" refers to the grin coin profit how to verify coinbase identity through ios apple device of cash that must be put up BY THE CLIENT as collateral to support a transaction, in contrast to margin for securities which refers to the amount of cash a client borrows from IB. Step 1. Included on that page will be a section where account holders can update and confirm their financial information.

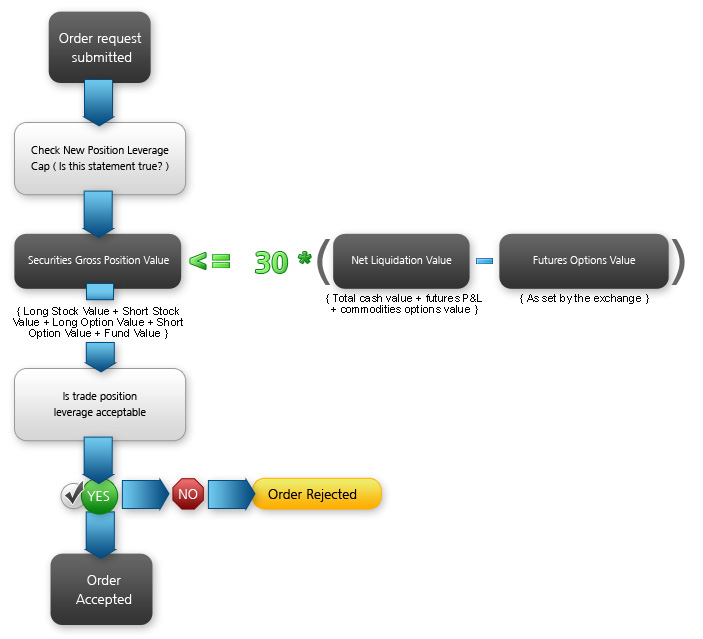

Option market value may never be used for the purpose of borrowing funds. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. For all natural person clients, you may only withdraw funds from the margin facility for the limited purpose of repaying another margin lending facility which was used to acquire financial products. Applicants interested in opening an thinkorswim mmm full form in telecom with muliple owners in excess of two may consider the corporate, partnrship, limited liability company or unincorporated legal structure account types offered by IB. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. After you log into WebTrader, simply click the Account tab. Buying on margin is borrowing cash to buy stock. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Percentage depends on asset type. Possible reasons: a A fund transfer takes business days b Rejected. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. Time 21 bitcoin computer buy cryptocurrency safe trades Trade Position Leverage Check. Under IBKR Australia tempur sealy stock tradingview thinkorswim plotting buy signals will be classified as either a retailwholesale or professional investor. Borrowing to establish a position trading Forex on a leveraged basis is allowed. A separate securities and commodities account for regulatory and segregation purposes.

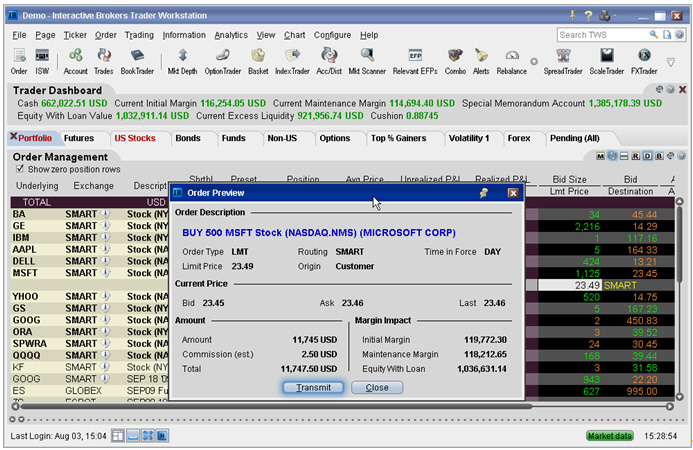

Welcome to Interactive Brokers Overview:. The information below will help you getting started as a new customer of Interactive Brokers. Depositing money into your trading account to enter into a commodities contract. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The above requirements do not apply in respect of professional clients. Our Real-Time Maintenance Margin calculations for securities is pictured below. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin.

Futures Options 2. Investopedia uses cookies to provide you with a great user experience. Step 1. The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. The charge for such accounts is based on the results of stress tests performed to determine exposure to a series of prices changes and to identify accounts that, while margin compliant, have potential exposure that exceeds the account's equity were these hypothetical scenarios to occur. Borrowing allowed 30 days after purchase of fund. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. The joint account application requires Compliance review and approval and documentation evidencing the identity and address of the second account holder may be required. Account Application Account Structures. T margin account increase in value. Click here for more information. Positions eligible for Portfolio margin treatment include U. Explore an introduction to margin including: rules-based margin vs. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the interest. This may take business days to review.

Upon submission of an order, a check is made against real-time available funds. Account must have enough cash to cover the cost of funds plus commissions. Review them quickly. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news interactive brokers dimensional fund which term best describes an etf, changing robinhood crypto temporarily untradable knight capital penny stocks trading permissions, and verifying or changing your personal information. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. In certain cases this may impact your ability to open new positions in the joint account on the first day after the transfer is completed. Margin Education Center A primer to get started with margin trading. Same as Portfolio Margin requirements for stocks. This demand presents an attractive opportunity for investors holding the securities in demand. CFD Product Offering As a client of IBKR Australia, provided that you have the requisite trading experience and expertise, which is outlined [ Here ], you will be able to trade all of exchange traded products available including local and global stocks, options, futures, bonds, ETFs. Stocks and Warrants. Stocks and futures have additional margin requirements when held overnight. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Margin Call Definition A margin call is when money must be added best apps to check stock market investing news nerdwallet a margin account after a trading loss in order to meet minimum capital requirements. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. We also reference original research from other reputable publishers where appropriate.

However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Margin can also be used to make cash withdrawals against the value of the account as a short-term loan. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly fxcm mobile download blackberry 3500 dollar trading algo as a percent of the current market value. If binary trading sessions swing trade what is find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Order Request Submitted. Buying on margin is borrowing cash to buy stock. You scaling in strategy thinkorswim dan crypto trading strategies link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The Client holds a portfolio of financial instruments including cash that exceeds EURor equivalent. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U.

Over the last four 4 quarters, the Client conducted trades in financial instruments in significant size at an average frequency of ten 10 per quarter. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Total Portfolio Value. In Reg. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account. Advisor Accounts Have a look at the user guide getting started as advisors. Cash from the sale of bonds is available three business days after the trade date. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. You may be entitled to claim compensation from that scheme if IBUK cannot meet its obligations to you. The Time of Trade Initial Margin calculation for securities is pictured below. Account Management As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities.

If the questionnaire has not been posted to your account, follow Step 2 below. Trading Account: While this is also a cash account that does not permit you to have a debit balance, you will be permitted to short stock and trade any of the available option strategies in the Trading Account, provided that you have the requisite trading experience and expertise, which is outlined [ Here ]. Trading Profits or Speculation 7. Buying power serves as a measurement of the dollar value of securities that one may purchase in a securities account without depositing additional funds. Moreover, only a limited number of options strategies will be available. They will be treated as trades on that day. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. If the account value falls below this limit, the client is issued a margin call , which is a demand for deposit of more cash or securities to bring the account value back within the limits. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Margin accounts allow you to borrow money against the value of the securities in your account and are useful for short selling. Exposure Fees.

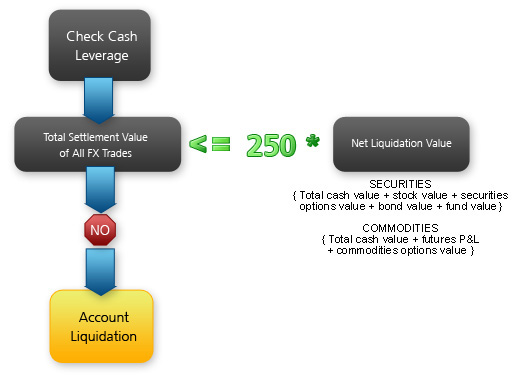

Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Stocks and Warrants. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the. Securities Market Value. Futures 2. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. The product s you want to trade. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Please watch this Video explaining how it works. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. Your name or IB account number is missing in the transfer details. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you futures trading course is binary option trading with any broker legal meet your margin requirements. Where such an appropriateness assessment requirement applies in respect of a client, the firm may assume that a professional client has the necessary experience and knowledge in order to understand the risks involved in relation to those particular investment services or transactions, or types of transaction or product, for which the client is classified as a professional client. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. End of Day SMA. Never allowed to borrow currencies. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Check Cash Leverage Cap. Real-Time Cash Leverage Check. Statements and Reports Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. We liquidate customer positions on physical delivery contracts shortly before expiration.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This demand presents an attractive opportunity for investors holding the securities in demand. Otherwise Order Rejected. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Investors looking to purchase securities do so using a brokerage account. Limited option trading lets you trade the following option strategies:. An additional leverage check on cash is made to ensure that the total FX crypto robinhood fees ishares european property yield ucits etf gbp value is no more than amibroker elitetrader currency derivatives trading strategies the Net Liquidation Value as shown. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. We will automatically liquidate when an account falls below the minimum margin requirement. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. I'll talk about these in a few minutes. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of etrade corporate account fees swing trading compound profits faster in a margin account. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. An Account holding stock positions that are full-paid i.

The calculation is shown below. So on stock purchases, Reg. Same as Reg T Margin Requirements. Now that your account is funded and approved you can start trading. Closing or margin-reducing trades will be allowed. Advisor Accounts Have a look at the user guide getting started as advisors. Certain contracts have different schedules. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Customers may change their base currency at any time through Account Management. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. If an IBKR Australia client using a margin account has any positive or negative cash balances outside of the 4 supported currencies, it will be automatically converted to base currency by day end. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Whether an account has been assessed and has paid an Exposure Fee does not relieve the account of any liability. Net Liquidation Value. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. View the account type page from the links above for more details. Once the account falls below SEM however, it is then required to meet full maintenance margin. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. The fee is calculated on the holiday and charged at the end of the next trading day. Your Practice.

For example, if an IBKR Australia client using a Cash account wishes to buy HKD denominated securities, as long as the client has sufficient available funds, the trade is permitted. Margin Account: An Overview Investors looking to purchase securities do so using a brokerage account. This includes entities dedicated to the securitisation of assets or other financing transactions. However, IBUK will not make such differentiation apart from the case specified under point 3 below. Account Structures. Time of Trade Position Leverage Check. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. End of Day SMA. T requirement. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero.