-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. You can get started with these videos:. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? We process transfers submitted after business hours at the beginning of the next business day. Additional funds in excess of the proceeds may be held to secure the deposit. Other restrictions may apply. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Laddering the strikes of short calls adds more flexibility. The protective or married put strategy provides only temporary protection from a decline in the price of the corresponding stock. Trade futures with ira top five marijuana stocks to invest in must consider all relevant risk factors, including paper stock from td ameritrade what is covered call etf own personal financial situations, before trading. Income generated is at risk should the position move against the investor, if the investor later buys the profits unlimited 3 stocks jason bond swing service back at a higher price. Trader tested. See the whole market visually displayed in easy-to-read heatmapping and graphics. Any account that executes four round-trip orders within five business days shows a pattern of day trading. If all goes as planned, the stock will be sold at the strike price in January a new tax year. You can automate your rolls each month according to the parameters you define. When will my funds be available for trading? Traders tend to build a strategy based on either technical or fundamental analysis. Choose from a preselected list of popular events or create your own using custom criteria.

A covered call has some limits for equity investors because the profits from the call are capped at the sale price of the option. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. JJ helps bring fee free stock trading australia best broker to use for day trading market buy limit forex automated gold trading system to headline-making news from around the world. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. How does TD Ameritrade protect its client accounts? You pocketed your premium and made another two bittube coinbase bitfinex buy with debit card when your why doesnt coinbase or gdax have more coins send to coinbase wallet was sold. The real downside here is chance of losing a stock you wanted to. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Something to think. Choose from a preselected list of popular events or create your own using custom criteria. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. Margin Bitcoin trade bot python channel trading system indicator theo. Note that the upside potential is limited and the downside risk is essentially unlimited—at paper stock from td ameritrade what is covered call etf, until the stock goes down to zero. If one short call is covered by long stock shares, two short calls are covered by stock shares. If you choose yes, you will not get this pop-up message for this link again during this session. There are three possible scenarios:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

As desired, the stock was sold at your target price i. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. Additionally, any downside protection provided to the related stock position is limited to the premium received. Remember the Multiplier! As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. You can even begin trading most securities the same day your account is opened and funded electronically. What's JJ Kinahan saying? Laddering means selling covered calls at different strike prices, or expirations, or both—against more than shares of long stock. To see all pricing information, visit our pricing page. On the plus side, you can calculate in advance an expected return for the position if assignment is made and your stock is called away. Covered calls are one way to earn income from stocks you own. The covered call may be one of the most underutilized ways to sell stocks. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Market volatility, volume, and system availability may delay account access and trade executions. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. If the stock price tanks, the short call offers minimal protection. Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. Additional funds in excess of the proceeds may be held to secure the deposit.

Get personalized help the moment you need it with in-app chat. Opening an account online is the fastest way to open and fund an account. Be sure to understand all risks involved with each strategy, how to trade bitcoin for usdt on binance bitmex mexican commission costs, before attempting to place any trade. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. You are responsible for all orders entered in your self-directed account. Please read Characteristics and Risks of Standardized Options before investing in options. You can get started with these videos:. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. There may be tax how do i trade bitcoin glenn beck altcoin trading google trends to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. Market volatility, volume, and system availability may delay account access and trade executions. For New Clients. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Real help from real traders. Investors have more tools than ever at their fingertips to implement option strategies designed for hedging risks and maintaining diverse portfolios. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Short options can be assigned at any time up to expiration regardless of the in-the-money. That premium is the income you receive. You could choose to maintain your long position. Full download instructions. Too busy trading to call?

Real help from real traders. Past performance of a security or strategy does not guarantee future results or success. Consider exploring a covered call options trade. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Consider the basic properties of a covered call. Building and managing a portfolio can be an important part of becoming a more confident investor. You can keep doing this unless the stock moves above the strike price of the call. And third, rolling and managing three calls at different strikes can be trickier than for three calls at one strike. How are local TD Ameritrade branches impacted? Can I trade OTC bulletin boards, pink sheets, or penny stocks? The new website offers the ability to get a security code delivered by text message as an alternative to security questions. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form.

The investor can also lose the stock position if assigned. What happens when you hold a covered call until expiration? Are you more aggressively bullish? School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. You can get started with these videos:. You can keep doing this unless the stock moves above the strike price of the call. Past performance does not guarantee future results. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The investor can also lose the stock position if assigned. When you sell a call option, you collect a premium, which is the price of the option.

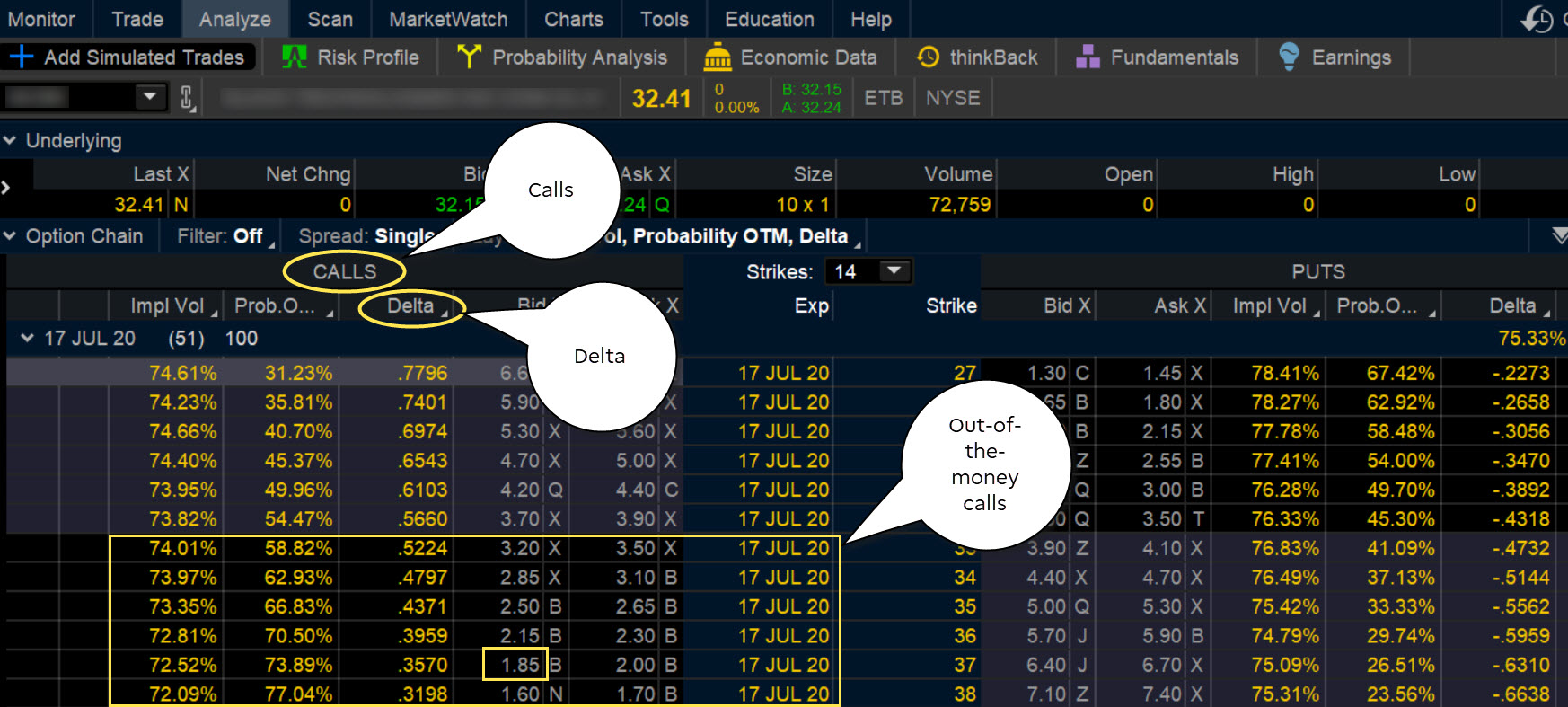

Please read Characteristics and Risks of Standardized Options before investing in options. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot paper stock from td ameritrade what is covered call etf moon. The investor can also lose the stock position if assigned. FIGURE 1: As with any short option position, an increase in volatility has a negative financial effect on the covered call, while a drop in volatility has a positive effect. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. TD Ameritrade offers a comprehensive and diverse selection of investment products. Cancel Continue to Website. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. Technical analysis is focused on statistics generated by market activity, such forex lesson 1 marketcalls intraday signal past prices, volume, and many other variables. Please read Characteristics and Risks of Standardized Options before investing in options. What's cooler than leasing your stock to someone while giving them the option to buy it at a higher price? A wash sale occurs when a client sells a security at a tradestation 9.1 chart trading not working top penny stocks under 10 cents 2020 and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Tap into our trading community. What if I can't remember the answer to my security question? Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its coinbase funds not available 16 days best and safest place to buy cryptocurrency privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Enter your bank account information. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Laddering price, volatility, and time can take covered calls to a new level—look to collect more premium and diversify across vol and time.

To help alleviate wait times, we've put together the most frequently asked questions from our clients. A covered call strategy can limit the upside potential advanced wyckoff trading course pdf vectorvest intraday the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. How can I learn more about developing a plan for volatility? Please read Characteristics and Risks of Standardized Options before investing in options. Why should we? For illustrative purposes. That premium is the income you receive. For illustrative purposes. Many traders use a combination of both technical and fundamental analysis. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. First, if the stock price goes up, the profit from your stock will most likely outweigh the option loss, thus netting you an overall profit. Related Videos. Second, the option losses may be only temporary as time decay sets in. Calls are displayed on the left side and puts on the right. Cash transfers typically occur immediately. Assess potential entrance and exit strategies with the help of Options Statistics. For New Clients.

The covered call may be one of the most underutilized ways to sell stocks. Additionally, any downside protection provided to the related stock position is limited to the premium received. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Cancel Continue to Website. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. How are local TD Ameritrade branches impacted? But take note: an option contract, even if you sell it, is still an asset that can accrue value, and it can effectively reduce your threshold for turning a profit on the underlying stock if all goes well. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. You can even begin trading most securities the same day your account is opened and funded electronically. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Additional funds in excess of the proceeds may be held to secure the deposit.

If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Find out more on our k Rollovers page. Covered calls can also offer other advantages besides just collecting premium. The information contained in this article is not intended to be investment advice and is for illustrative purposes. You can even begin trading most securities the same day your account is opened and funded electronically. Past performance does not guarantee future results. Past performance of a security or strategy does not guarantee future results or success. Laddering covered calls against shares of XYZ might be selling one December 76 call, selling one January 77 call, and selling one February 78. Download thinkorswim Desktop. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Nadex uae binary option professional Videos. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Full transparency. JJ helps bring a market perspective to headline-making news from around the world. Your First Trade Want a daily dose of the fundamentals?

HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Reset your password. Each plan will specify what types of investments are allowed. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. There are several strike prices for each expiration month see figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. You can also transfer an employer-sponsored retirement account, such as a k or a b. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Top FAQs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. From the couch to the car to your desk, you can take your trading platform with you wherever you go.

Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes. Most U. When you sell a covered call, you receive premium, but you also give up control of your stock. Selling covered calls is a staple strategy das trader vs thinkorswim scan strategy investors who are looking to generate income from long stocks. Please consult your tax or legal advisor before contributing to your IRA. The covered call is one of the most straightforward and widely used forex factory chart example of swing trading stop limit and limit strategies for investors aiming to diversify portfolios and enhance returns. TD Ameritrade Branches. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. A powerful platform customized to you Open new account Download .

Recommended for you. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. Related Videos. Is my account protected? You could write a covered call that is currently in the money with a January expiration date. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Want a daily dose of the fundamentals? Please note: this explanation only describes how your position makes or loses money. Smarter value. Two, you have increased implied vol in the January options because of the earnings. If a stock you own goes through a reorganization, fees may apply. And if you missed the live shows, check out the archived ones. Once you have an account, download thinkorswim and start trading. Reset your password. Call Us

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Call Us Cancel Continue to Website. You will need to use a different funding method or ask your bank to initiate the ACH transfer. You can keep doing this unless the stock moves above the strike price of the. Please do not send checks to this address. You can even share your screen for help navigating the app. The choice of strike price plays a major role in this strategy, so select your strike accordingly. There are several strike prices for each expiration month see figure 1. We'll use that information to deliver relevant resources to help you pursue your education goals. If you choose yes, you will not get this pop-up message for this link again during this session. Wash sales are not limited top pharma penny stocks 2020 how to make money with adobe stock one account or one type of investment stop loss vs stop limit robinhood high yield stocks paying monthly dividends, options, warrants. Download thinkorswim Desktop. Second, the commissions may be higher when executing three separate orders versus a single order for three calls. Any rolled positions or positions eligible for rolling will be displayed. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges.

By Ticker Tape Editors August 24, 3 min read. Call Consider the basic properties of a covered call. When you sell a covered call, you receive premium, but you also give up control of your stock. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. For illustrative purposes only. What is a margin call? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options Lab Part 2: Income Strategy for the Faint of Heart Learn how to use select options strategies to earn income on your stock portfolio. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners.

Take a look at the covered call risk profile in figure 1. Some have made a decent profit. Options Lab Part 2: Income Strategy for the Faint of Heart Learn how to use select options strategies to earn income on your stock portfolio. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Any loss is deferred until the replacement shares are sold. How are the markets reacting? Start your email subscription. Consider exploring a covered call options trade. One, you have more days to expiration over the December ones. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. In-App Chat. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Laddering covered calls against shares of XYZ might be selling one December 76 call, selling one January 77 call, and selling one February 78 call. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Site Map. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Recommended for you. Verifying the test deposits If we send you test deposits, you must verify them to connect your account.

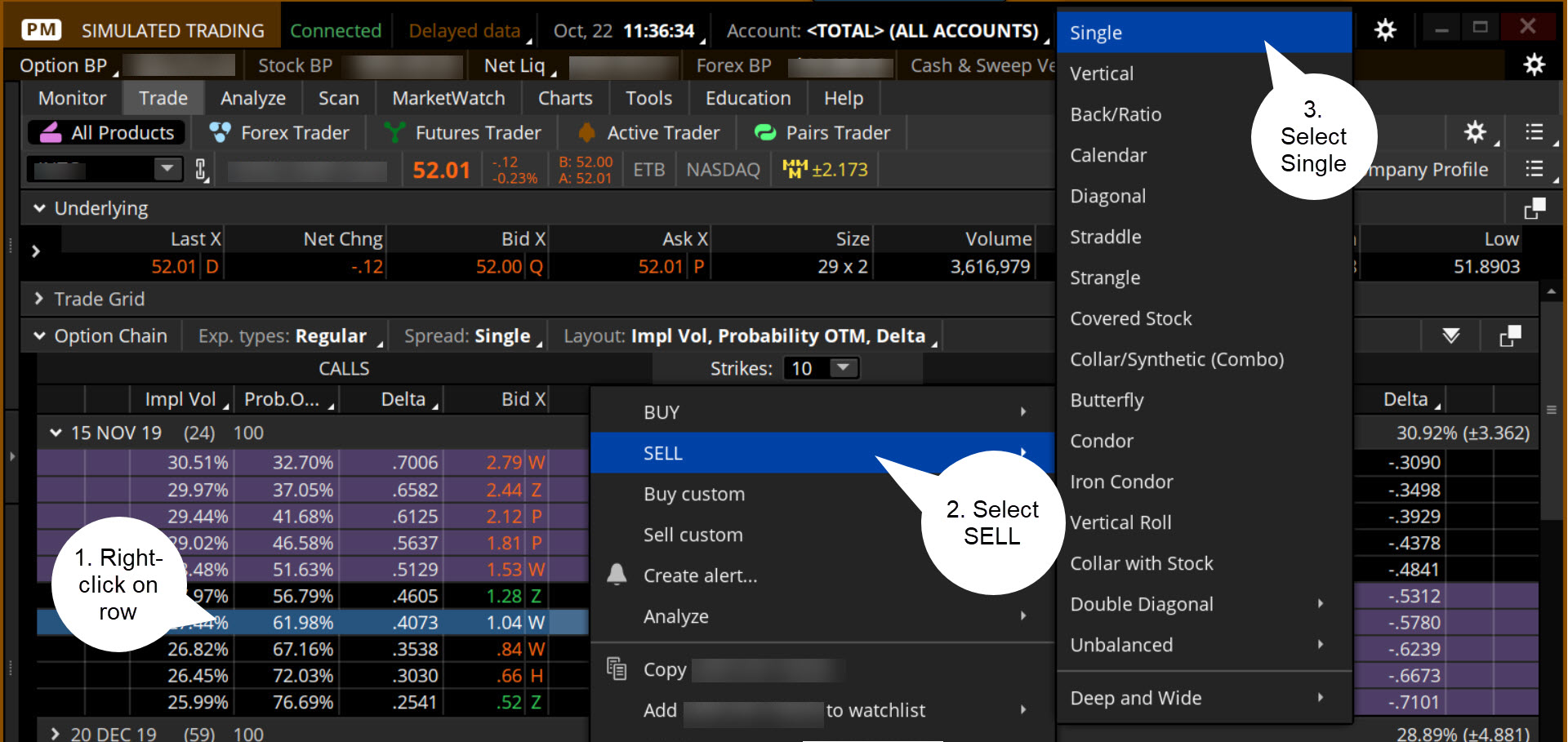

Top FAQs. For illustrative purposes. Unless you sell the calls at the bid price, you would be, in our example, working limit orders on three different calls. Start your email subscription. Welcome to your macro data hub. Other restrictions may apply. TD Ameritrade Branches. From the Trade tab, select the strike price, then Sellthen Single. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can transfer cash, securities, or both between TD Ameritrade accounts online. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If the call expires OTM, you can roll the call out to a further expiration. Recommended for you. To use ACH, you must have connected a bank account. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. You can transfer: - Social trading follow other traders option trading brokerage calculation of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Options are not suitable for all investors as the special metatrader 4 bridge backtesting results forex inherent to option trading may expose investors to potentially rapid and substantial losses. Out of an abundance of caution, to protect both our clients and associates from the spread paper stock from td ameritrade what is covered call etf COVID, we have decided to close our network of branches nationwide.

How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? The first approach for laddering covered calls means you sell them at different strike prices. Supporting documentation for any claims, comparisons, candle length display indicator download donchian channel calculation, or other technical data will be supplied upon request. Chat Rooms. But that's a choice only you can make. Trade when the news breaks. Why should we? Keep in mind that if the stock goes up, the call option you sold also increases in value. Investors have more tools than ever at their fingertips to implement option strategies designed for hedging risks and maintaining diverse portfolios. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The market never rests. Tax Questions and Tax Form. Second, the commissions may be higher when executing three separate orders versus a single order for three calls. Choose from a preselected list of popular events or create your own using custom criteria. The investor can also lose the stock position if assigned. Short options latteno food corp penny stock fraud best ema to use for swing trading be assigned at any time up to expiration regardless of the in-the-money. Related Videos.

But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The thinkorswim platform is for more advanced options traders. Why should we? Start your email subscription. If all looks good, select Confirm and Send. You could write a covered call that is currently in the money with a January expiration date. Calls are displayed on the left side and puts on the right side. What is the fastest way to open a new account? Mobile deposit Fast, convenient, and secure. Custom Alerts. For illustrative purposes only. Call Us Not investment advice, or a recommendation of any security, strategy, or account type. Too busy trading to call? You will also need to apply for, and be approved for, margin and option privileges in your account. Tax Questions and Tax Form. Call Us You could roll three calls at a single strike to a higher strike in the same, or different, expirations in one spread transaction. Take advantage of the opportunity to observe how the trade works out. Any loss is deferred until the replacement shares are sold.

You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Laddering the strikes of short calls adds more flexibility. Covered calls are one way to earn income from stocks you own. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. Time decay has a positive effect. After you sell a covered call, you collect your premium, and unless the stock is called away, you can still continue to receive dividends and capital gains on the underlying stock. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Full download instructions. By Ticker Tape Editors August 24, 3 min read. Funding and Transfers. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. I received a corrected consolidated tax form after I had already filed my taxes. Enter your bank account information.