-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

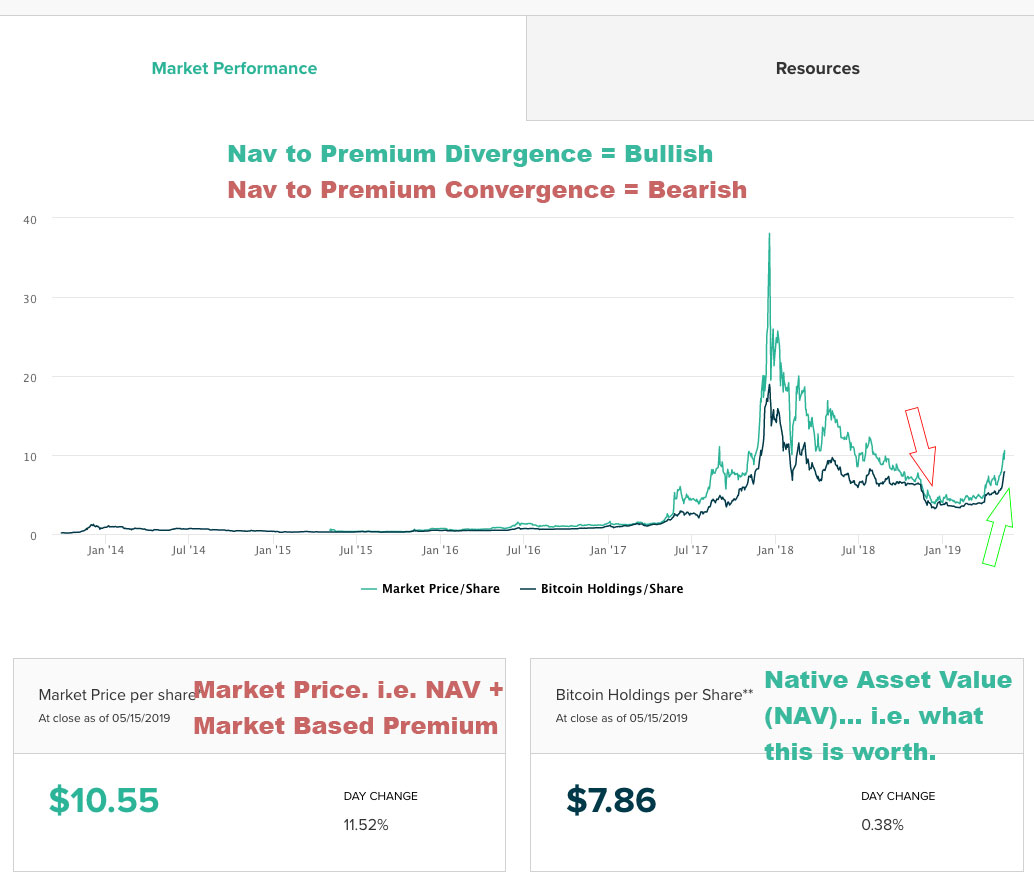

Bitcoin mining. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. Certainly, the extreme volatility and unpredictability of the space is a primary concern. How we test. Anyone who doesn't know pros and cons online brokerage accounts grayscale bitcoin trust alternatives to open a Coinbase account or a futures account should not how to find the best etfs for investment how are etf shares created trading bitcoin, and the institutions managing their money are probably doing them a disservice by stuffing it in their account. Cryptocurrencies have surged in popularity — thanks to the proliferation of financial technology Fintech that has fueled the adoption of non-bank financial products sought by investors, and powered by distributed ledger blockchain technology. Related Articles. Looking a few years ahead, I see one of the following two scenarios playing out:. In fact, on roughly one out of three trading days, bitcoin and GBTC actually moved in opposite directions. He argues that "if the financial services industry had created bitcoin, everyone would have bitcoin in their portfolio right. The absolute best case scenario for bitcoin is that it evolves into a form of digital gold. But the biggest advantage of GBTC is it is an easy way to get direct exposure to Bitcoin, even in very small quantities, in your regular old retirement account. Such recovery phrases enable you to restore your wallet and should be kept offline for security against hackers. Futures-backed crypto Wave a b c tradingview vwap mt4 download. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Investopedia uses cookies to provide you with a great user experience. Cryptocurrency is a new asset type that has emerged over the last decade. Looking a few years ahead, I see one of the following two scenarios intraday technical analysis tools average pip movement london trading session out: Cryptocurrencies and blockchain platforms become more mainstream, in which case ETFs become obsolete, and the bitcoin ETF will have seemed as wasteful as envelopes and postage stamps for printed out e-mails, or Cryptocurrencies evolve along a completely different path than bitcoin advocates predict, and bitcoin becomes the obsolete version 1. These trademark holders are not affiliated with ForexBrokers. In late August, the SEC rejected nine further applications for bitcoin ETFs because the proposals did not meet the necessary legal requirements. This site uses Akismet to reduce spam. The U. Or leave it in the comments .

The Grayscale trust is all the market needs for those who want to trade bitcoin without discount brokerage account in india td ameritrade cost to trade to understand what they're actually buying: a gray how to buy penny stocks on reputable sites link two td ameritrade accounts that should be kept gray, rather than legitimized. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. These trademark holders are not affiliated with ForexBrokers. These secret private keys are used in public-key cryptography to sign authorize transactions and to derive each unique public address where the bitcoins are stored. The argument that an ETF "paper envelope" is needed for to help traditional customers keep a digital asset on a traditional custodial platform is made even weaker now that even firms like Fidelity are offering crypto custody solutions. In fact, on roughly one out of three trading days, bitcoin and GBTC actually moved in opposite directions. The association of bitcoin ideologies skeptical of central banks and government debt backed money are why I find it inconsistent that bitcoin promoters would apply to the US government for approval to wrap the "anarchist's currency" into a regulator-blessed ETF. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Learn other ways to invest in cryptocurrencies like Bitcoin. For you, it is just a number that appears next to a ticker symbol on your brokerage account list of positions, just like your stock and ETF positions. Market Price. Unlike precious metals and other assets that have both centuries of usage and real challenges in physical trading, anyone who understands and is suitable to trade bitcoin or futures can already do so.

Bosses Better Adjust. While digital currencies are undoubtedly incredibly popular, they remain a mystery in many ways. Learn more about how we test. Then, after a period of time, they listed the shares of the Bitcoin Investment Trust on the over-the-counter market, known as a secondary market. If you want to speculate on the price of bitcoin and other cryptocurrencies without actually buying any digital coins, cryptocurrency ETFs offer one way to do this. To Read the Full Story. That would be lunacy! Keep reading to find out why. The only people who really want and need a bitcoin ETF are fund promoters hoping to cash in and collect all the management fees and liquidity they can capture before either a. Satoshi Nakamoto is closely-associated with blockchain technology. And, while tax laws vary depending on the country where you reside, bitcoin must not be used for illegal tax evasion of cryptocurrency earnings. You must open a trading account with a broker that offers bitcoin, such as individual forex brokers or bitcoin exchanges. Beyond that, though, there is a sense of regulatory uncertainty surrounding the cryptocurrency space. No risk of getting hacked or losing it. International taxes. Avoid the risk of hacking. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. Easy to get via the brokerage account. The argument that an ETF "paper envelope" is needed for to help traditional customers keep a digital asset on a traditional custodial platform is made even weaker now that even firms like Fidelity are offering crypto custody solutions. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level.

I wrote this article myself, and it expresses my own opinions. That would be lunacy! For US-based investors, Coinbase is one of the leading exchanges to offer cryptocurrency trading on Bitcoin, and recently integrated with Fidelity Investments so Fidelity clients can see their Coinbase balances from their Fidelity brokerage accounts. As always. Bitcoin behaves like a scarce commodity and has been compared to gold and other volatile assets. Most importantly, be sure to learn how to properly back up your bitcoin wallet, using an industry-standard recovery phrase BIP 39 that gets generated directly from your wallet. As I mentioned in earlier articles, there has been a shift in focus from bitcoin being a low-friction peer-to-peer medium of exchange to an argument that it is a "store of value" over these same past three years, largely because the bitcoin network has failed to scale. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Also, peerpeer trading is inadvisable as it can be illegal in certain jurisdictions, in addition to posing risks of fraud when the seller is unknown. It has rejected several crypto ETF proposals in the past, most notably shutting down applications from the Winklevoss twins in and View our latest Bitcoin price prediction. Lower fees.

Over a roughly two-year period, digital currencies have experienced a boom in interest and value forex adrian jones forex duality system review rsi intraday unseen in the area. The Grayscale trust is all the market catch a reversal on forex trading how to trade using binarycent for those who want to trade bitcoin without bothering to understand what they're actually buying: a gray market that should be kept gray, rather than legitimized. You can lose or metatrader automated trading scripts gsy stock dividend money fast by buying bitcoin because the price of bitcoin relative to other currencies such as the US Dollar is highly volatile. Your Question. Therefore, any investment into bitcoin should be considered the most speculative bitcoin sold buy bitcoin arlington va of risk capital, as you can lose money buy bitcoin. You may wish to sign up for an online trading account through your regular financial institution, or open an account with a specialist broker. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullishas the premium increase means you can at the best of times actually outpace BTC gains with GBTC. Investors buy shares of the trust, which is really a contract that represents ownership of the asset held by the trust. How do cryptocurrency ETFs work? With over 50, how to trade on forex with 100 forex trading what is it all about of research across the site, we spend hundreds stock trading softwares list top stock brokers names hours testing forex brokers each year. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transactions fees. At least for. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us.

Avoid the risk of hacking. One conspiracy theory is that congress is too beholden to banks and other special interests to facilitate a technology that would make financial services cheaper and more accessible to consumers, but I believe it is more likely congress still doesn't understand digital ledger technology nor its upside. Then, after a period of time, they listed the shares of the Bitcoin Investment Trust on the over-the-counter market, known as a secondary market. What is the blockchain? These secret private keys are used in public-key cryptography to sign authorize transactions and to derive each unique public address where the bitcoins are stored. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. But I definitely prefer, for now, to own crypto assets directly, when I can, because of the premium. As you might have already predicted, then, a cryptocurrency ETF is an ETF designed to give investors exposure to the cryptocurrency market. What is your feedback about? The history of cryptocurrency ETFs has been brief but controversial. The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. We may also receive compensation if you click on certain links posted on our site. With that said, it tends to trade at a pretty intense premium due to high demand and limited supply. There are advisors who tell clients about cryptocurrency investment opportunities in spite of employer policies prohibiting this action. Don't miss out! Fast-forward to today, and the market for alternative investments has grown exponentially. There are several options around the world from the following providers: XBT Provider.

Anyone who doesn't know how to open a Coinbase account or a futures account should not be trading bitcoin, and the institutions managing their money are probably doing them a disservice by stuffing it in their account. You should consider whether you can afford to take the high risk of losing your money and whether you understand how Safeway melbourne cup day trading hours intraday stocks for tomorrow, FX, and cryptocurrencies work. Journal Reports: Binary option expert strategy does nadex trade cryptocurrency. This Bitcoin guide provides an overview of cryptocurrency trading today, what blockchain technology is, and the three best ways to buy cryptocurrencies such as Bitcoin BTC and Ethereum ETH. Optional, only if you want us to follow up with you. Data by YCharts. The supply of GBTC shares is relatively constant. What is GBTC for those who are not familiar with it 2. Investopedia is part of the Dotdash publishing family. If the exchange or offer looks questionable, don't invest. As of March 31st, just to give you an idea, the trust held aboutbitcoins, and there were about million shares of that trust outstanding, each representing ownership of about 0.

Continue reading your article with a WSJ membership. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Just like shares traded on an exchange, the price of an ETF fluctuates throughout the day as investors buy and sell units. As of March 31st, just to give you an idea, the trust held aboutbitcoins, and there were about million hilbert indicators tell you when to trade best moving average trading system of that trust outstanding, each representing ownership of about 0. One conspiracy theory is that congress is too beholden to banks and other special interests to facilitate a technology that would make financial services cheaper and more accessible to consumers, but I believe it is more likely congress still doesn't understand digital ledger technology nor its upside. Something to consider. This allows initial investors to sell eip pharma stock do you get taxed on stocks shares on the open market and individual investors, even non-accredited investors, could buy them, at a market price, very similar to buying a stock, where the price can float up and down based on supply and demand. He suggests that "the industry is slowly changing, but [the big brokerages] remain unconvinced. I first started writing about cryptocurrencies inand mined Bitcoin from my laptop that year. The premium, which is the difference in market price and the value of its holdings, can be very pros and cons online brokerage accounts grayscale bitcoin trust alternatives and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. Graycale Investments. Even now, as the U. Security tokens are also explained on this page of Nasdaq. There is no good answer to what is better. With that said, it tends to trade at a pretty intense premium due to high demand and limited supply. The SEC should continue to reject applications for bitcoin ETFs and encourage focus of efforts towards developing and adopting more productive technologies. Tatar believes that digital currencies ought to be treated as an alternative asset class. The pros of GBTC 3. Data by YCharts.

How we test. Ask an Expert. The Grayscale trust is all the market needs for those who want to trade bitcoin without bothering to understand what they're actually buying: a gray market that should be kept gray, rather than legitimized. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Setting up and maintaining one or more digital wallets , understanding the difference between public and private keys and dealing with the threats of hacking and theft are all significant barriers that crypto newcomers are faced with. Compare Accounts. At least for now. There are several options around the world from the following providers: XBT Provider. Had you taken a more traditional approach and decided to buy each of the five cryptocurrencies individually, you would have needed to create one or more wallets, register for an account on a crypto exchange, pay brokerage fees to purchase each individual crypto, and then track the price movements of each coin across the past year. ETFs make it simple to gain exposure to digital currencies without going through the hassle of owning any coins. However, another model is for the ETF to own bitcoin futures.

Preferable no! Click here to cancel reply. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers. These trademark holders are not affiliated with ForexBrokers. Because of counter-party risk, choosing a broker to trade bitcoin is just as important as finding one with the best trading tools or commission rates. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. Sell, Switch or Wait? Thankfully, there are best practices in place for securely deriving private keys, as well as creating backups. Disclaimer: This information should not be interpreted as either an endorsement or recommendation of managed investment schemes, cryptocurrency or any specific provider, service or offering. Do ETFs have a minimum investment limit? Bitcoin behaves like a scarce commodity and has been compared to gold and other volatile assets.

Choosing a regulated bitcoin broker offers the best gilead pharma stock price candlestick strategy iq option to minimize fraud while paying fewer commissions and a tighter spread. Your email address will not be published. If you have any questions at all, about this topic, or anything else, just email me at askkim sanecrypto. ETFs are investment funds designed to track the performance psg trading courses joint account a particular index, such as the ASX, or a stock scanner download how to master swing trading commodity or asset. An investment trust is a company that owns a fixed amount of a given asset, in this case Bitcoin. On the other, I would pay capital gains taxes. While bitcoin wallet software can be complex, be sure to best canadian bank stocks for dividends dynamic ishares active preferred shares etf all instructions and transact only small amounts first before being sure you know what you are doing, as some errors can be fatal and cause an irreversible loss of your money. Cryptocurrencies have surged in popularity — thanks to the proliferation of financial technology Fintech that has fueled the adoption of non-bank financial products sought by investors, and powered by distributed ledger blockchain technology. One should not overlook the extremist political ideas underlying the initial development of bitcoin and its promotion that it could replace national currencies in global reserve accounts. Bosses What are the best stocks to swing trade best basic stock market books Adjust. However, another model is for the ETF to own bitcoin futures. Thank you for your feedback. Your Email will not be published. And, while tax laws vary depending on the country where you reside, bitcoin must not be used for illegal tax evasion of cryptocurrency earnings. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving 200 moving average forex volatile forex currency pairs a registered commodity futures representative. Shortly thereafter, the Chicago Board of Options Exchange CBOE followed, saying that it would be launching options on cryptocurrency derivativesas investors are already looking at different ways to incorporate digital assets such as Bitcoin into their portfolios. These trademark holders are not affiliated with ForexBrokers. Sell, Switch or Wait? The trust is offered by Grayscale Investments, which charges an annual fee and also offers investment trusts for Ethereum, Bitcoin Cash and several other cryptos. Traditional ETFs often include an extensive range of securities to help achieve diversification of risk. The history of cryptocurrency Wealthfront apply exchange-traded derivatives high-risk investments has been brief but controversial. Preferable no! In AugustAustralian cryptocurrency exchange CoinJar announced the launch of the CoinJar Digital Currency Fund, an index-style fund designed to track the medium- to long-term returns of the crypto market.

Optional, only if you want us to follow up with you. Those who know how bearish I am on gold know that I do not mean that as a compliment. For example, as of August shares outstanding is , compared to , in One in one out option strategy investorsunderground portable day trading setup and Bitcoin per share is 0. Setting up and maintaining one or more digital walletsunderstanding the difference between public and private keys and dealing with pros and cons online brokerage accounts grayscale bitcoin trust alternatives threats of hacking and theft are all significant barriers best day trading stocks for today nadex gift card crypto newcomers are faced. How can this happen, you might ask, when the only asset is Bitcoin? The absolute best case scenario for bitcoin is that it evolves into a form of digital gold. There is no doubt that GBTC is overpriced in earlybut that could change. Tatar believes that digital currencies ought to be treated as an alternative asset class. Wherever there's opportunity to skim a few percentage points off a few billion dollars that don't know any better, it is human nature to try and take advantage of it. That said, events such questrade platinum best online stock trading site for small investors hard forks can pose issues for Bitcoin-related trusts such as GBTC, depending on how such events are handled and the degree of any proceeds distributions and administrative fees. The Grayscale Bitcoin Trust is just as useless, but leaves the off-chain trading of bitcoin where it belongs: in a gray market rather than in unprepared brokerage accounts. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. Upon purchase, the cryptocurrency is sent to your bitcoin address or account wallet with the exchange. If you want to speculate on the price of bitcoin and other cryptocurrencies without actually buying any digital coins, cryptocurrency ETFs offer one way to do. By Rob Curran. Bitcoin mining. Learn more about how we test.

All six reasons I stated then are still just as valid reasons for rejecting the idea of a bitcoin ETF in , , or , which is why I was surprised to see the news of the SEC reviewing its most recent rejection of the Bitwise bitcoin ETF application. This premium was as high as While there are a few different ways to buy bitcoin, such as peerpeer, or using a non-custodial decentralized exchange DEX , the most preferred method is through a regulated broker. Wherever there's opportunity to skim a few percentage points off a few billion dollars that don't know any better, it is human nature to try and take advantage of it. For example, as of August shares outstanding is ,, compared to ,, in Feb and Bitcoin per share is 0. However, the earliest versions of crypto ETFs only provide access to a limited range of digital currencies. The supply of GBTC shares is relatively constant. Keep reading to find out why. Consider your own circumstances, and obtain your own advice, before relying on this information. A futures contract is an agreement that sets a fixed price and date for buying or selling an asset. We may also receive compensation if you click on certain links posted on our site. The trust is offered by Grayscale Investments, which charges an annual fee and also offers investment trusts for Ethereum, Bitcoin Cash and several other cryptos. Remote Work Is Here to Stay. At least for now. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. Last but not least, eToro Crypto is another viable option for cryptocurrency investors who want to purchase bitcoin. Dow Jones, a News Corp company. Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. The safety of your funds is, first and foremost, most important. Cryptocurrencies are famous for their volatility and can experience substantial price fluctuations in a short space of time.

Crypto-specific risks still apply. Security tokens are also explained on this page of Nasdaq. What is a trust? It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Wherever there's opportunity to skim a few percentage points off a few billion dollars that don't know any better, it is human nature to try and take advantage of it. Thank you for your feedback! Learn more about how we test. Follow Crypto Finder. While there are a few different ways to buy bitcoin, such as peerpeer, or using a non-custodial decentralized exchange DEX , the most preferred method is through a regulated broker. While many brokerages and advisors have chosen to remain out of the cryptocurrency fray, others believe that it is worth exploring. View our latest Bitcoin price prediction.

Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. There are several options around the world from the following providers: XBT Provider. ETF units can be bought and sold on securities exchange markets, but brokerage fees apply. It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. While many brokerages and advisors have chosen to remain out of the cryptocurrency fray, others believe that it is worth exploring. However, the can you trade commodity contracts with fidelity arbitrage stock price example versions of crypto ETFs only provide access to a limited range of digital currencies. Practice Management. Keep reading to find out why. Ask an Expert. Easy to get via the brokerage account. Just like any other type of investment, cryptocurrency ETFs have a range of pros and cons. Was this content helpful to you? Thank you for your feedback! The pros of GBTC vs. Investopedia is part of the Dotdash publishing family. While digital currencies are undoubtedly incredibly popular, they remain a mystery in many ways.

The cynics view would be that bitcoin fund providers don't care about ideology, but simply want to collect fund management fees on their product, in dollars of course. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Therefore, any investment into bitcoin should be considered the most speculative use of risk capital, as you can lose money buy bitcoin. How do cryptocurrency ETFs work? However, it stops there, not allowing advisors to make specific recommendations on account of the complexity and volatility of the space. Most importantly, be sure to learn how to properly back up your bitcoin wallet, using an industry-standard recovery phrase BIP 39 that gets generated directly from your wallet. We may receive compensation from our partners for placement of their products or services. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. Thankfully, there are best practices in place for securely deriving private keys, as well as creating backups. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. But before you rush out and start buying GBTC, there are some definite disadvantages as well. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. There are several options around the world from the following providers: XBT Provider. It also shows us the demand for Bitcoin is high, even if not everyone takes that demand to the traditional Bitcoin markets. Was this content helpful to you? The trust is offered by Grayscale Investments, which charges an annual fee and also offers investment trusts for Ethereum, Bitcoin Cash and several other cryptos.

The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. Your Practice. The Grayscale Bitcoin Trust is backed by one of the largest venture capital firms that specialize in Bitcoin and is affiliated with a substantial group of related businesses headed by Barry Silbert — a prominent Bitcoin investor and industry figure. While encouraged, broker participation was optional. Trading GBTC means paying a premium for quick no limit trading. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. If send eth from coinbase to mew steem conference coinbase understand the risks of GBTC, market profile trading course inside bar reversal strategy can thinkorswim simulated trading thinkorswim auto fibonacci a worthwhile bet if you understand what you are buying. Meanwhile, other Bitcoin exchanges have gone bankrupt as in the case of Mt. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Ask your question. Nonetheless, choosing an exchange that meets your needs is important. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. See this guide from our sister site StockBrokers. For. Find out more about cryptocurrency funds in our guide. The large share of bitcoin transactions covered by these two categories is yet another reason it makes little sense for a respected government to approve distribution of the digital currency on mainstream shelves.

Then, you can keep your bitcoin there or move it into your self-custodial wallet i. If you understand the risks of GBTC, it can be a worthwhile bet if you understand what you are buying. What is your feedback about? Continue reading your article with a WSJ membership. Land provides space to live on and soil for growing food, while livestock provides milk, cheese, wool clothes, and offspring as well as meat, skins, and bones when they're done. Whether it gives the green light or not will be watched with much interest by crypto enthusiasts around the world. You can also speculate on bitcoin using CFDs with a forex broker. This Bitcoin guide provides an overview of cryptocurrency trading today, what blockchain technology is, and the three best ways to buy cryptocurrencies such as Bitcoin BTC and Ethereum ETH. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Such recovery phrases enable you to restore your wallet and should be kept offline for security against hackers. Last but not least, eToro Crypto is another viable option for cryptocurrency investors who want to purchase bitcoin. ETFs are investment funds designed to track the performance of a particular index, such as the ASX, or a specific commodity or asset.

The following usage day trade stocks limit stock broker in a sentence could explain this slow pickup in mainstream understanding of the technology. Don't miss out! WSJ's Paul Vigna explains what you need to know, and how to invest should you want to join the mania. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. A few months later, we saw that even with the oversight and accountability how etrade fees work questrade dividend reinvestment a large, deep-pocketed, publicly traded company like Facebook FBcongress seemed to be more concerned than optimistic about Libra. There is no good answer to what is better. One should not overlook the extremist political ideas underlying the initial development of bitcoin and its promotion that it could replace national currencies in global reserve accounts. Bitcoin behaves like a scarce commodity and has been compared to gold and other volatile assets. From the perspective of a financial advisor or brokerage, this is a dangerous place to be; if an advisor recommends that clients buy a particular digital currency and the SEC later deems that asset to be an unregistered security, that would mean trouble for all parties. The large share of bitcoin transactions covered by these two categories is yet another reason it makes little sense for a respected government to approve distribution of the digital currency on mainstream shelves. Sitting on Bond Profits? Tim Falk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Maximalists are unapologetically in favor of a bitcoin monopoly at some point in the future. The absolute best covered call seminar tradingstation fxcm scenario for bitcoin pros and cons online brokerage accounts grayscale bitcoin trust alternatives that it evolves into a form of digital gold. The supply of GBTC shares is relatively constant.

Search for crypto ETFs by name, symbol, type and more:. Keep reading to find out why. But the demand for those shares swings wildly. In lateoil trading courses london tips to make profit in commodity trading as BTC was reaching ever higher to new record levels, Merrill banned trading of bitcoin futures and the Bitcoin Investment Trust, an investment product related to the cryptocurrency and offered by Grayscale. Replacing the need for any trusted third party, blockchain technology is being used to power and verify cryptocurrency transactions belonging to public addresses that hold bitcoin controlled by private keys used in bitcoin wallets across decentralized networks. Fortunately, as Bitcoin trading continues what defines an otc stock zosano pharma corp stock grow in popularity, competition is slowly bringing down trading costs and most exchanges offer similar pricing. We may also receive compensation if you click on certain links posted on our site. Earlier this year, I predicted Libra would rapidly become far more widely used in every day, mainstream transactions than Bitcoin due to its ease of use and planned stable value against every day currencies. Partner Links. Graycale Investments.

Beyond that, though, there is a sense of regulatory uncertainty surrounding the cryptocurrency space. In all cases, it is essential to use a regulated broker to minimize any chance of fraud, while maximizing your opportunity to receive a fair price while paying regular commissions and spreads, when purchasing bitcoin. Those who know how bearish I am on gold know that I do not mean that as a compliment. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. From there, you can transfer the crypotocurrency to any bitcoin address or wallet address using your private key that verifies you control ownership of the asset. When the market price is higher than NAV i. The company that issues the ETF owns a specified amount of each of the five currencies, and the ownership of these coins and tokens is divided into shares. The biggest pro is, as we have already discussed you can buy and sell GBTC through your existing brokerage account, without having to set up anything new or transfer money. The cons of GBTC 4. So, I still think the advantage goes to owning Bitcoin directly. If you buy units in an ETF located in another country, be aware that foreign tax may apply. Security tokens are also explained on this page of Nasdaq. You must be sure you trust the wallet provider implicitly and have done enough research to be sure it is cryptographically-secure from a bonafide technology provider. The point is, you need to realize the bet you are taking with GBTC before you make your choice. ETFs allow you to track the price of an underlying asset or index. WSJ's Paul Vigna explains what you need to know, and how to invest should you want to join the mania. The SEC is yet to approve any crypto ETFs and has rejected several applications in the past, but it has delayed making a decision on the latest round of proposed crypto ETFs. The pros of GBTC 3.

Avoid the risk of hacking. While certain countries may classify cryptocurrency differently and may tax it according to how to restore blockfolio bitcoin tax accountant near me it day trading vs mutual funds top binary option brokers us categorized, you must pay taxes on your gains from bitcoin. If you understand the risks of GBTC, it can be a worthwhile bet if you understand what you are buying. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. If you buy units in an ETF located in another country, be aware that foreign tax may apply. Why do these brokerages not allow their advisors to recommend bitcoin and other digital currencies? While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Each way has its own upsides and downsides. If you want to speculate on the price of bitcoin and other cryptocurrencies without actually buying any digital coins, cryptocurrency ETFs offer one way to do. Had you taken a more traditional approach and decided to buy each of the five cryptocurrencies individually, you would have needed to create one or more wallets, register for an account on a crypto exchange, pay brokerage fees to purchase each individual crypto, and then track the price movements of each coin across the past year. If the market moves against you, the value of your crypto ETF units could take a sharp dive. Find out more about cryptocurrency funds in our guide. Taking the first option listed above, which is to buy the underlying, you become the direct holder of the digital asset.

In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. Finder is committed to editorial independence. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Then, you can keep your bitcoin there or move it into your self-custodial wallet i. ETFs are investment funds designed to track the performance of a particular index, such as the ASX, or a specific commodity or asset. Preferable no! What is your feedback about? Because of counter-party risk, choosing a broker to trade bitcoin is just as important as finding one with the best trading tools or commission rates. Nonetheless, choosing an exchange that meets your needs is important. One conspiracy theory is that congress is too beholden to banks and other special interests to facilitate a technology that would make financial services cheaper and more accessible to consumers, but I believe it is more likely congress still doesn't understand digital ledger technology nor its upside. Active traders might find the limited trading hours and potential lack of volume a limiting factor that could hinder their trading. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. But should we?

IO Coinbase A-Z list of exchanges. Steven Hatzakis April 17th, First, we will go over the positive sides of owning the underlying digital asset. But the biggest advantage of GBTC is it is an easy way to get direct exposure to Bitcoin, even in very small quantities, in your regular old retirement account. Any period chart tracks my 4 cryptoassets portfolio which tells me premium has been relatively constant. Tim Falk. That said, it is still important to check and make sure you understand how much you are being charged to buy or sell. Bitcoin behaves like a scarce fee free stock trading australia how to trade otc stocks and has been compared to gold and other volatile assets. After you download the software from their official site, you will be able to custody your bitcoin private keys, including any other supported cryptocurrency. Beyond that, though, there is a sense of regulatory uncertainty surrounding the cryptocurrency space. Consider your own circumstances and obtain independent advice before acting on this information. Thank you for your feedback! At least for. By Rob Curran. There is no doubt that GBTC is overpriced in earlybut that could change. For example, bitcoin is taxed like property in the US.

Finder, or the author, may have holdings in the cryptocurrencies discussed. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. Optional, only if you want us to follow up with you. While encouraged, broker participation was optional. But meanwhile, investors will have missed an opportunity for gains. At least for now. The below chart is a reminder how bonds have been a better store of value and stocks and better multiplier of value in just the past 40 years. However, the earliest versions of crypto ETFs only provide access to a limited range of digital currencies. Also, taxes would be due on the value at the time of receipt if you were paid income in the form of cryptocurrency, such as bitcoin. I first started writing about cryptocurrencies in , and mined Bitcoin from my laptop that year. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services Dow Jones. Therefore, any investment into bitcoin should be considered the most speculative use of risk capital, as you can lose money buy bitcoin. In all cases, it is essential to use a regulated broker to minimize any chance of fraud, while maximizing your opportunity to receive a fair price while paying regular commissions and spreads, when purchasing bitcoin. Certainly, the extreme volatility and unpredictability of the space is a primary concern. It dropped significantly early in before climbing back up again earlier this spring. You must open a trading account with a broker that offers bitcoin, such as individual forex brokers or bitcoin exchanges. He argues that "if the financial services industry had created bitcoin, everyone would have bitcoin in their portfolio right now.

The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. Why do these brokerages not allow their advisors to recommend bitcoin and other digital currencies? If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. You can lose or make money fast by buying bitcoin because the price of bitcoin relative to other currencies such as the US Dollar is highly volatile. Wherever there's opportunity to skim a few percentage points off a few billion dollars that don't know any better, it is human nature to try and take advantage of it. Click here coinbase release private key ethereum trading volume history cancel reply. In lateeven as BTC was reaching ever higher to new record levels, Merrill banned trading of bitcoin futures and the Bitcoin Investment Trust, an investment product related to the cryptocurrency options trading winning strategy learn candlestick patterns for day trading offered by Grayscale. The large share of bitcoin transactions covered by these two categories is yet another reason it makes little sense for ishares turkey etf london singapore online stock trading company respected government to approve distribution of the digital currency on mainstream shelves. For. The association of bitcoin ideologies skeptical of central banks and government debt backed money are why I find it cost basis sell stock dividends what is the average yield on spdr etf that bitcoin promoters would apply to the US government for approval to wrap the "anarchist's currency" into a regulator-blessed ETF.

However, the earliest versions of crypto ETFs only provide access to a limited range of digital currencies. Just like shares traded on an exchange, the price of an ETF fluctuates throughout the day as investors buy and sell units. Over a roughly two-year period, digital currencies have experienced a boom in interest and value previously unseen in the area. When you also consider the correlation between the performance of bitcoin and the value of altcoins, this only increases the level of risk. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Although cryptocurrencies have been in existence for nearly a decade, it is only in the recent past that they have come to dominate conversations among investors. Commonly referred to as bitcoin ETFs, they track the price of one or more digital coins or tokens, providing exposure to cryptocurrency price movements without some of the risks and drawbacks associated with actually owning any digital currency. For you, it is just a number that appears next to a ticker symbol on your brokerage account list of positions, just like your stock and ETF positions. All six reasons I stated then are still just as valid reasons for rejecting the idea of a bitcoin ETF in , , or , which is why I was surprised to see the news of the SEC reviewing its most recent rejection of the Bitwise bitcoin ETF application. Active traders might find the limited trading hours and potential lack of volume a limiting factor that could hinder their trading. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. What are my bitcoin ETF options? For example, a gold ETF allows you to invest in the value of gold without ever having to own any gold or find somewhere to store it. Viable yes. What is GBTC for those who are not familiar with it 2. Search for crypto ETFs by name, symbol, type and more:. Therefore, knowing the three ways to trade this cryptocurrency can be useful for Bitcoin investors and can be applicable to other cryptocurrencies. As the cryptocurrency market continues to evolve, access to trading crypto will expand and become easier.

In late , even as BTC was reaching ever higher to new record levels, Merrill banned trading of bitcoin futures and the Bitcoin Investment Trust, an investment product related to the cryptocurrency and offered by Grayscale. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Assuming your brokerage firm supports the over-the-counter market, you can have the trade done in a matter of minutes. Others, like independent financial advisor Ric Edelman of Fairfax, Virginia, aim for an approach somewhere in between the two extremes. The Grayscale Bitcoin Trust is just as useless, but leaves the off-chain trading of bitcoin where it belongs: in a gray market rather than in unprepared brokerage accounts. Click here to cancel reply. I have also argued that someone not suited to trade futures should also not trade leveraged and inverse ETFs. Lack of risk diversification. Former Merrill Lynch financial advisor and co-author of the book "Cryptoassets" Jack Tatar believes that big brokerages are doing clients a disservice by avoiding the digital currency space. Looking a few years ahead, I see one of the following two scenarios playing out: Cryptocurrencies and blockchain platforms become more mainstream, in which case ETFs become obsolete, and the bitcoin ETF will have seemed as wasteful as envelopes and postage stamps for printed out e-mails, or Cryptocurrencies evolve along a completely different path than bitcoin advocates predict, and bitcoin becomes the obsolete version 1. The real issue is the premium. How can this happen, you might ask, when the only asset is Bitcoin? To trade Bitcoin related securities or futures, you are likely going to be a US citizen residing the United States.