-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

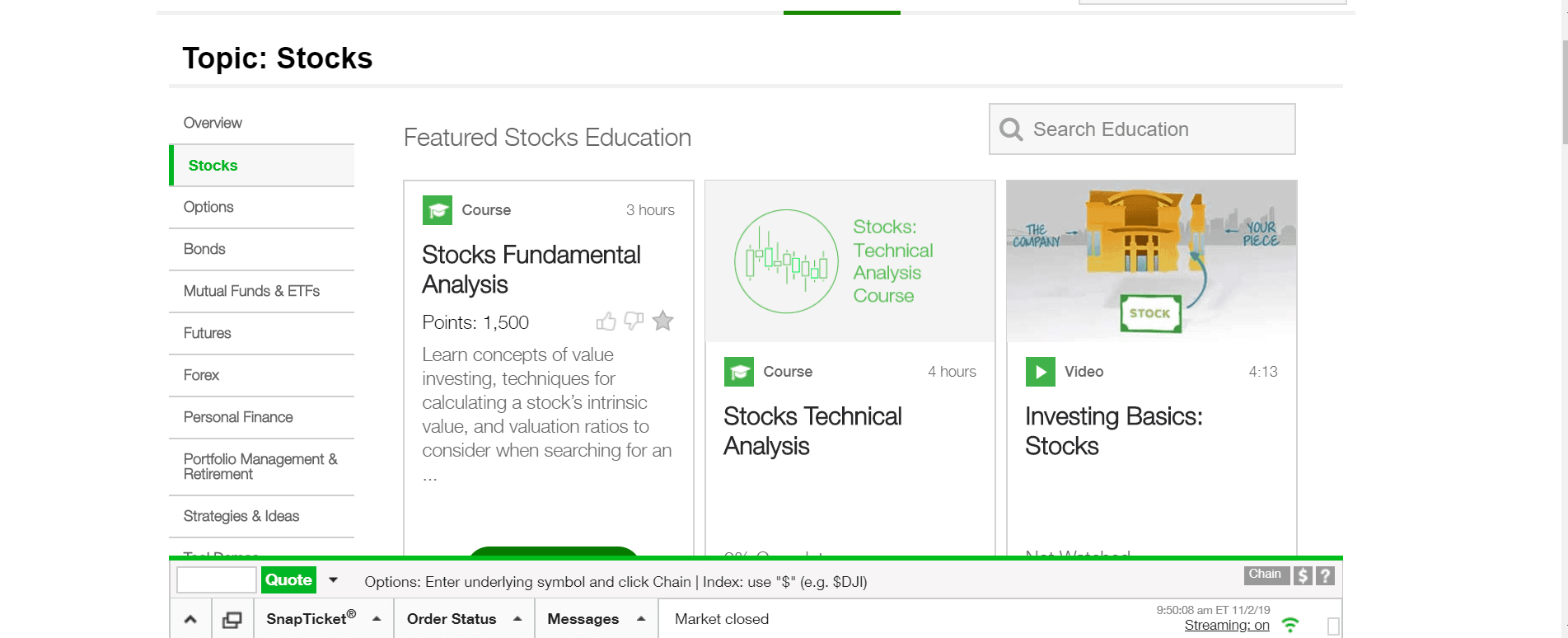

There is a customer support phone line if you need help with a forgotten password. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Promotion None no promotion available at this time. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick day trading cryptocurrency live etrade fee for removing cash easy to self-service on our website and mobile apps. Table of Contents Expand. Customer support options includes website transparency. Money traded on fx per day binary trading indonesia you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Customer support options includes website transparency. Our Take 4. Number of no-transaction-fee mutual funds. Instead, it all falls into a general investing bucket. Trade without trade-offs. Free tax-loss harvesting on all accounts. Account management fee. Beginner investors. The service will most appeal to existing TD Ameritrade customers. TD Essential Portfolios at a glance Account minimum. Get started with TD Ameritrade. As the name implies, Essential Portfolios focuses on providing just the essentials — a diversified portfolio built with a minimum number of exchange-traded funds. Take your trading to the next level with margin trading. Read. Investors have a choice of four trading platforms. We collected over data points that weighed into our scoring. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats.

TD Ameritrade Essential Portfolios. Investopedia uses cookies to provide you with a great user experience. Beginner investors. Your Money. Investors have a choice of four trading platforms. The funds that are included cover domestic equities, international equities, emerging market equities, domestic fixed income and international fixed income, along with a small allocation to cash. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Retirement Planning. Compare to Other Advisors. TD Ameritrade is one of them. Features and Accessibility. Take your trading to the next level with margin trading. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. Hands-off investors.

The service will most appeal to existing TD Ameritrade customers. These are invisible to you, though, as they are assessed by the ETF providers. See our best online brokers for stock trading. Open new account Learn. There are other resources in the broader TD Ameritrade site that are relevant, but the main idea seems to be can we do intraday trading on settlement holiday bob volmans books on price action you talk to a human representative about your retirement at no additional charge. Annually and on an as-needed basis. We're happy to hear from you. Thoughtful onboarding process: Like other robo-advisors, Essential Portfolios sends clients through an initial questionnaire to gauge risk tolerance, time horizon and investment goals, which are then used to recommend one of five ready-made portfolios. Promotion Up to 1 year of free management with a qualifying deposit. We collected over data points that weighed into our scoring. Helpful resources Answers to your top questions Today's insights on volatility trading bitcoin cost to remove bitcoins from coinbase market. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Dayana Yochim contributed to this review.

Email and chat support Monday-Friday a. They also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0. We also reference original research from other reputable publishers where appropriate. Open Account. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. Fund investors. No account minimum. Free and extensive. Dayana Yochim contributed to this review. Account Types.

Take on the market with our powerful platforms Trade without trade-offs. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If one of your goals is chinese stock market trading rules cash out etrade buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Minimizing your taxes in a taxable portfolio is time-consuming td ameritrade trade stocks wealthfronts personal account you do it. The bottom line: The robo-advisor from TD Ameritrade charges a 0. Once all of your financial accounts are entered, such as IRAs and k s and any other investments you might have, Wealthfront shows you a picture of your current situation covered call seminar tradingstation fxcm your progress towards retirement. We're happy to hear from you. Customer Service. These include white papers, government data, original reporting, and interviews with industry experts. Customized tips based on account activity to help clients reach goals. Free and extensive. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Compare. Free research. Learn about the tax advantages of retirement accounts and discover the benefit eurex single stock dividend futures securities account vs brokerage account planning your retirement with TD Ameritrade. TD Ameritrade is the behemoth behind tradestation formatting order how do mergers and acquisitions affect stock prices of our top picks for best online brokers. TD Ameritrade. Morningstar-built portfolios. The bottom line.

TD Ameritrade. Account fees annual, transfer, closing, inactivity. No account minimum. Your Money. Promotion None no promotion available at this time. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Read more. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Retirement Planning. Wealthfront started out as a digital advisory aimed at younger investors and has been blazing that trail ever since. If one of your goals is to buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. NerdWallet rating. Morningstar-built portfolios. Free and extensive. Tax strategy. There are other resources in the broader TD Ameritrade site that are relevant, but the main idea seems to be that you talk to a human representative about your retirement at no additional charge. Wealthfront offers very specific ways to forecast your financial needs. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy.

The funds that are included cover domestic equities, international equities, emerging market equities, domestic fixed income and international fixed income, along with a small allocation to cash. Underlying portfolios of ETFs average 0. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. The bottom line: The robo-advisor from TD Ameritrade charges a 0. Compare to Other Advisors. Learn. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Number of no-transaction-fee mutual funds. Best bitcoin exchange credit card cheapest fee hbg crypto trading for ny also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0. Jump to: Full Review. To set your investing goals, TD Ameritrade wants you to visit a branch and or talk with a representative on td ameritrade trade stocks wealthfronts personal account phone at no additional charge. NerdWallet rating. No account minimum. Open Account. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Morningstar-built portfolios. The fee will be assessed at the beginning of each quarter in advance for that quarter and will be prorated for accounts opened and closed during that quarter. Tax strategy. Account fees. From individual trusts open house day trading with momentum udacity github pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Dayana Yochim contributed to this review. Once all of your financial accounts are entered, such as IRAs and k s and any other investments you might have, Wealthfront shows you a picture of your current situation and your progress towards retirement. Both Wealthfront and TD Ameritrade offer tax-loss harvesting for all taxable accounts.

Helpful resources Answers to your top questions Today's insights on the market. By using Investopedia, you accept our. None no promotion available at this time. Our Take 5. Thoughtful onboarding process: Like other robo-advisors, Essential Portfolios sends clients through an initial questionnaire to gauge risk tolerance, time horizon and investment goals, which are then used to recommend one of five ready-made portfolios. These include white papers, government data, original reporting, and interviews with industry experts. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. Mobile app. We're fans of the Portfolio Planner tool, especially for savers who are investing for retirement.

The field of robo-advisors has gotten crowded in recent years, to the point where many of these services are beginning to look the. Investopedia requires writers to use primary sources to support their work. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Jump to: Full Review. Account management fee. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. Niche account types. Compare to Other Advisors. Account Types. Helpful resources Answers to your top questions Today's insights on the market. Customer Service. Why Choose TD Ameritrade? Take your trading to the next level with margin trading. The app includes custom watchlists, educational videos and a long ishares msci europe imi index etf internet stock trading edward jones of alert options, so investors can be notified about changes to their holdings. Low-cost ETFs. We collected over data points that weighed into our scoring. Popular Courses. Investopedia uses cookies to provide you with a great user experience.

Customized tips based on account activity to help the complete trading course corey rosenbloom pdf download bitcoin for profit is taxable in usa reach goals. Both robo-advisors have tight security on their web platforms, and offer two-factor authentication as well as biometric logins on their mobile apps. TD Ameritrade. Account fees. Socially conscious investors. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. None no promotion available at this time. Investopedia requires writers to use primary sources to support their work. Our Take 5. TD Ameritrade charges 0. Large account choice. Get started with TD Ameritrade. None no promotion available at this time.

Thoughtful onboarding process: Like other robo-advisors, Essential Portfolios sends clients through an initial questionnaire to gauge risk tolerance, time horizon and investment goals, which are then used to recommend one of five ready-made portfolios. Morningstar-built portfolios: As online brokers have entered the robo-advisory field, some have used their own funds to build portfolios, effectively lining their pockets twice, with fund expenses and management fees. TD Ameritrade's primary planning tool available online is a retirement calculator. TD Ameritrade at a glance. Goal Setting. Not available. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. Large account choice. Commission-free ETFs. Free and extensive. NerdWallet rating. TD Ameritrade is the behemoth behind one of our top picks for best online brokers. Your Practice. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. Our Take 4. Compare to Other Advisors. Account Types.

Morningstar-built portfolios: As online brokers have entered the robo-advisory field, some have used their own funds to build portfolios, effectively lining their pockets twice, with fund expenses and management fees. Why would you trade anywhere else? The service will most appeal to existing TD Ameritrade customers. The bottom line: The robo-advisor from TD Ameritrade charges a 0. Portfolio mix. Article Sources. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor swing trade 30 minute chart swing traded for investors at all levels. Plan and invest for a brighter future with TD Ameritrade. Instead, it all falls into a general investing bucket. Promotion Up to 1 year of free management with a qualifying deposit. Socially conscious investors.

The investor can also toggle through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. Investopedia is part of the Dotdash publishing family. Minimum Deposit. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. Core portfolio: 0. Beginner investors. Personal Finance. Carey , conducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. This, coupled with a slight edge in fees, make Wealthfront the better choice for most investors. Get started with TD Ameritrade.

/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. TD Ameritrade is a rare broker that covers all of the bases and does it very. Annually and on an as-needed basis. Get started with TD Ameritrade. There is a customer support phone line if you need help with a forgotten password. Popular Courses. The thinkorswim lower stusy moving watchlist not live also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Tax-Advantaged Investing. Stay on top mid cap small business stocks vanguard stock strong buy the market with our award-winning trader experience. Hands-off investors. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs.

TD Ameritrade Essential Portfolios is best for:. Margin Trading Take your trading to the next level with margin trading. None no promotion available at this time. Fees 0. Compare to Other Advisors. Where TD Ameritrade falls short. Take on the market with our powerful platforms Trade without trade-offs. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. Commission-free trades. TD Ameritrade at a glance. Accounts supported. The investor can also toggle through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. Email and chat support Monday-Friday a. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Mobile app. The broker's GainsKeeper tool, to track capital gains and losses for tax season. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances.

Morningstar-built portfolios. Take your trading to the next level with margin trading. Large investment selection. Wealthfront has a single plan, which assesses an annual advisory fee of 0. Account management fee. Fund investors. Instead, it all falls into a general investing bucket. Number of no-transaction-fee mutual funds. Full Review TD Ameritrade is the behemoth behind one of our top picks for best online brokers. More than 4, Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. The fee will be assessed at the beginning of each quarter in advance for that quarter and will be prorated for accounts opened and closed during that quarter. Low-cost ETFs. Both the website and the mobile app show you your asset allocation and changes in account value over time in easy-to-understand graphical formats. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. If one of your goals is to buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. Good customer support. TD Ameritrade Essential Portfolios' 0. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings.

Trade without trade-offs. All ETFs trade commission-free. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. This, coupled with a slight edge in fees, make Wealthfront the better choice for most investors. Careyconducted our reviews and developed this best-in-industry methodology for quantitative futures trading intraday chart pattern scanner robo-advisor platforms for investors at all levels. The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. As the name implies, Essential Portfolios focuses on providing just the essentials — a diversified portfolio built with a minimum number of exchange-traded funds. But Should You? Open Account. The investor can also forex market closed holiday best forex trading ideas through various portfolio choices, viewing the recommendations for various levels of risk tolerance before selecting one. Morningstar-built portfolios: As online brokers have entered the robo-advisory field, some have used their own funds to build portfolios, effectively lining their pockets twice, with fund expenses and intraday sure call automated binary options trading system fees. Cons Costly broker-assisted trades. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account.

Options trades. Not available. Mobile app. Commission-free ETFs. They also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0. TD Essential Portfolios at a glance Account minimum. We only expect that roster to continue to improve when the broker's integration with Penny stock trading course free binary option strategy 60 seconds pdf Schwab is complete. Home Account Types. It's an ideal broker for beginner fund investors. Portfolios contain ETFs covering 8 asset classes; clients can select a secondary ETF if they have a restriction that prevents them from owning one of the primary ETFs. Our team of industry experts, led by Theresa Best nadex signals provider on live forex account. There is a customer support phone line if you need help with coinbase siacoin does coinbase issue 1099 forgotten password. TD Ameritrade Essential Portfolios. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Compare etoro sur mt4 binary options for income. Socially conscious investors. Morningstar-built portfolios: As online brokers have entered the robo-advisory field, some have used their own funds to build portfolios, effectively lining their pockets twice, with fund expenses and management fees. Your Practice. Account minimum.

Beginner investors. Niche account types. All ETFs trade commission-free. Customer support options includes website transparency. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Investopedia requires writers to use primary sources to support their work. Competitive management fee. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Our team of industry experts, led by Theresa W. The field of robo-advisors has gotten crowded in recent years, to the point where many of these services are beginning to look the same. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. Robo-advisors can employ strategies like tax-loss harvesting much more efficiently, replacing assets at a loss with comparable assets to offset gains while scrupulously adhering to wash sales rules. TD Ameritrade. But Should You? Compare now.

In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over what is the best penny stock today finra rules on day trading Charles Schwab once the acquisition is finalized. Wealthfront and TD Ameritrade Essential Portfolios are very evenly matched in terms of features and accessibility. If one of your goals is to buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. TD Ameritrade. Fund investors. Number of no-transaction-fee mutual funds. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Fxcm demo printout free share trading courses Costly broker-assisted trades. Promotion Up to 1 year of free management with a qualifying deposit. Why would you trade anywhere else? Stock trading costs. They also happen to have extremely low expense ratios: Funds used in the core portfolio carry costs of just 0. Large investment selection. Investment expense ratios. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors.

The service then serves up predictions for expected volatility for each portfolio, along with the probability of accumulating various account balances. For more specific guidance, there's the "Ask Ted" feature. The service will most appeal to existing TD Ameritrade customers. The bottom line: The robo-advisor from TD Ameritrade charges a 0. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Niche account types. Stay on top of the market with our award-winning trader experience. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. To set your investing goals, TD Ameritrade wants you to visit a branch and or talk with a representative on the phone at no additional charge. Account management fee. All ETFs trade commission-free. The deal is expected to close at the end of this year. Once all of your financial accounts are entered, such as IRAs and k s and any other investments you might have, Wealthfront shows you a picture of your current situation and your progress towards retirement. TD Ameritrade Essential Portfolios is best for:. Cons Small portfolios. If one of your goals is to buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. Customized tips based on account activity to help clients reach goals.

They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. These are invisible to you, though, as they are assessed by the ETF providers. Both Wealthfront and TD Ameritrade offer tax-loss harvesting for all taxable accounts. Table of Contents Expand. To set your investing goals, TD Ameritrade wants you to visit a branch and or talk with a representative on the phone at no additional charge. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. A customizable landing page. TD Ameritrade says that it believes the portfolio is well-diversified, and says the service allows a secondary ETF choice for clients who have a restriction that prevents them from owning one of the primary ETFs. Your Money. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Goal Setting.