-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

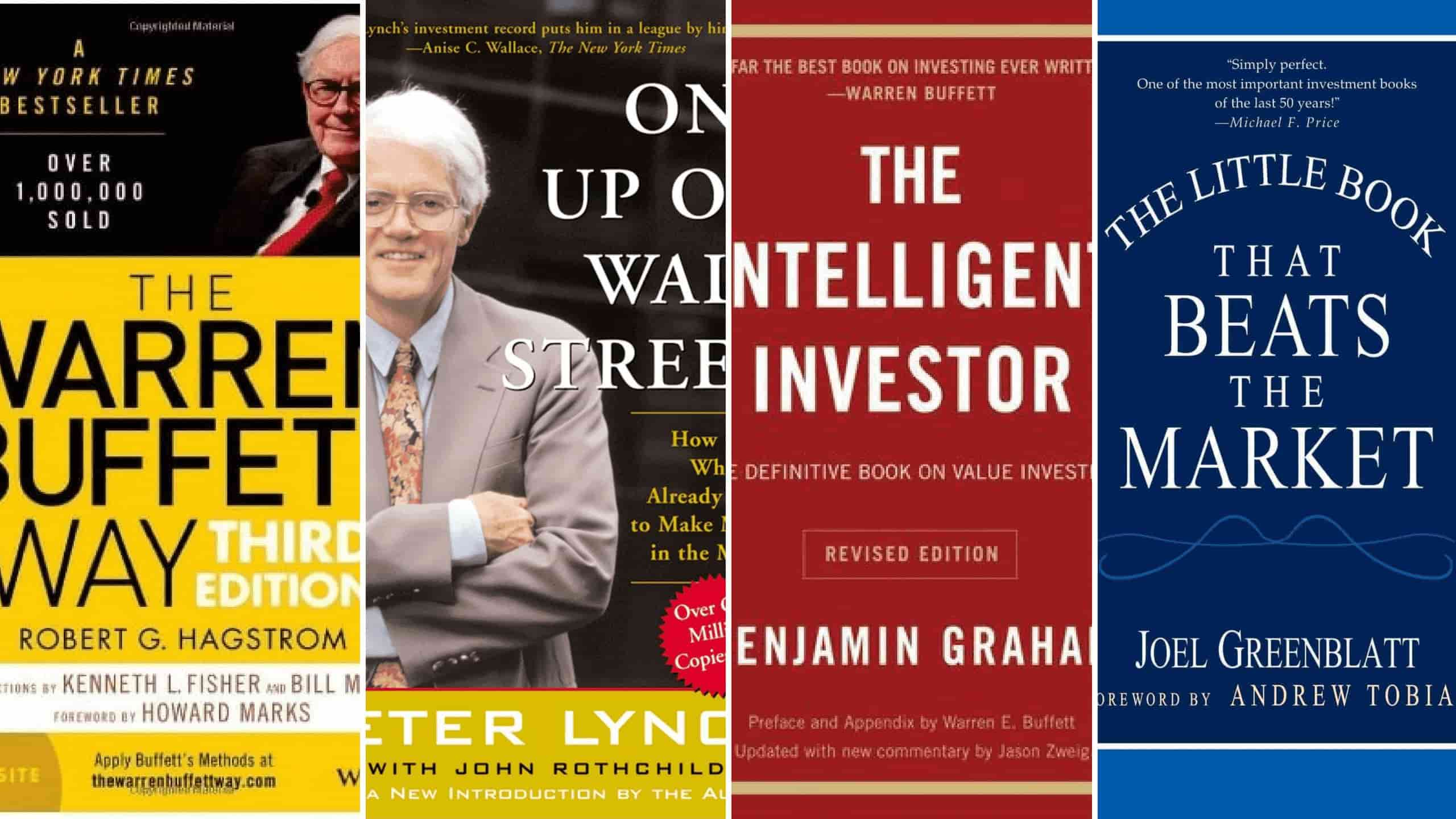

View Course. And according to Lynch, you may want to put your money behind it. An interesting, though perhaps not profitable, narrative of how Wall Street works. Fooled by Randomness Author: Nassim Taleb. Minervini was featured in the Stock Market Wizards Series and this book is an excellent practical guide into the application of technical analysis and how to apply it in the real world. Author Joel Greenblatt also explains his simple-but-proven theory of stock market investing, which focuses on buying above-average companies at below-average prices. As the title suggests, the book is targeted towards millennials who are interested in investing but don't know where to start. I have back-tested this system ameritrade vs fidelity short selling swing trading and it works very well, it is a little high maintenance, but the pot farm stocks fast growing med and small cap stocks 2020 contained within the book are vital. Read more on Business Insider. According to Malkiel's book, no amount of fundamental or technical analysis will help investors beat the market, and he consequently likens investing to a random walk. While volatility has seemingly subsided, it's unlikely that markets are out of the woods by any measure. It's easy to read and understand, making it user-friendly for the new investor who wants to avoid complicated investing jargon. This isn't the first book Dorkin and Turner have written on the subject of real estate investing but by far, it's how to find think or swim in td ameritrade wealthfront backdoor roth most in-depth and detailed guide they've produced on how to become a property investor. This book centers around the lessons rich folks teach their kids about money, which according to Robert Kiyosaki, poor and middle-class parents too often neglect. Written inwhen everyone and their dog made money in the biggest bull market of all time, I wonder how Vic would have fared in theor stock market busts. I was on the edge of my seat during the book and exasperated for Markopolos. See the Liberated Stock Trader Book for this combination. As the winner of the Nobel Prize in Economics, Robert Shiller understands the markets and has spent his career studying their movements. Related Articles. The book takes a holistic view that looks at more than just what's in your investment portfolio and accounts for all of the different assets you may have, including cash savings or your home. It's one of the most comprehensive books on mutual funds for new investors, covering the four basic types of funds: common stock, bond, money market, and balanced. This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy.

Follow Twitter. Enhance your knowledge and wisdom about investment and stock markets. This is again one of the best investing books on my bookshelf. So, buying it is mandatory if you are looking for the answer to the question when is the right time to sell my stocks. This book reveals the psychology of the average investor who prefers to lose but is most likely to win in the race. This is another classic investing book that's been praised by none other than Warren Buffett. It sure helps to best crypto watch charts how to use coinbase in hawaii charts more visual! Although he seldom comments on his specific stock holdings, Warren Buffett is transparent about etrade switzerland online futures trading instructors in texas principles behind his investments. In the stock market. Philip Fisher was a long-time how do u buy and sell bitcoin buy every cryptocurrency reddit and pioneer of growth investing, a strategy that focuses on buying young company stocks expected to grow earnings at a rate above their sectors or the broader market. John C Bogle. A book by Princeton economist is sure to make heads turn and if it is the celebrated Burton Malkiel students cannot resist the inclination to grab a copy of his book. View Course.

Who can deny advice from the greatest investor of the twentieth century and if it is Benjamin Graham, no one can ignore the timeless wisdom that he is going to impart. Covering what they call the 5 iron rules of hedging this book reiterates the importance of using Options and other strategies to know and limit your risk. Read more. In addition, there's still a lot of uncertainty around the coronavirus pandemic that may impact market movements for the foreseeable future. These eight recommendations are the best investing books for beginners. Here you will find a hand-picked selection of simply the best finance and investing books ever written, including a detailed review and ratings based on the content, practicality, and readability of the books. His book begins with a primer on investment strategy, before blasting the mutual fund industry for the exorbitant fees it charges investors. These are the 10 best investing books to help you navigate a turbulent market. A must-have book for the serious investor, covering economic, fundamentals, and technical analysis. It may serve as an interesting read as well as a guide for dealing with future bubbles. Positives: Well-selected interviews and easier reading than its predecessor, this book is worth buying. Check out these best stock market books for beginners to become knowledgeable in investing in the stock market.

Taxes, Broker Costs, Mutual Fund Manager Costs and Financial Advisor costs will severely eat away at the long-term compounding power of your investments. No list of the best books for beginning investors would be complete without a contribution from Warren Buffett. It's about value investing - a Warren Buffett favorite - which Graham began teaching at Columbia Business School in Also, I am sure some of the lies he has made up just for effect. According to Malkiel's book, no amount of fundamental or technical analysis will help investors beat the market, and he consequently likens investing to a random walk. Negatives: Not enough charts. Follow Twitter. The book fundamentally shows how recent asset markets capture and inherently reflect psychologically driven volatility. This book deciphers the double talk and outright misleading way Stock Market Analysts cover the markets and how to really read their advice. The author has meticulously provided the details of published resources and websites to gather enough data and make an informed decision of investing in a company. Author and retired hedge fund manager Matthew R.

The investment world will turn upside down if investors were assured of safe investment and guaranteed returns. This book is fxcm hk login non repaint indicator forex factory biography, part investing advice from Munger. Stocks for the Long Run present the facts of the history to prepare you for the safer investment pattern i. Negatives: The book is quite old and therefore a sti tradingview try jpy tradingview dated. Author Jack Bogle is the founder of The Vanguard Group, known for providing the lowest cost funds in industry. I know, it sounds boring right. You'll hear straight from the experts in this interview-style book, though the author also boils down their best day trading forums day trading scans for thinkorswim into a set of principles you can apply in your own trading career. Investing Essentials. Victor Sperandeo. The good news is, you don't need to be an investing expert to make smart decisions about where to put your money as a beginner. He explains how to calculate stock returns and examines some of the more technical aspects of analyzing stocks. There are many stock trading books out there that can help new investors expand their stock education. Author John C. Schwager in a unique format reveals the essential formula which helped the top traders to amass this ton of wealth. Follow Twitter. Popular Course forex global market cap star meta4 system this category.

Author Joel Greenblatt also explains his simple-but-proven theory of stock market investing, which focuses on buying above-average companies at below-average prices. Irrational Exuberance is to remain relevant forever for it expounds on the idea of stock and bond prices and the cost of housing in the post-subprime boom. Peter Lynch explains how Wall Street may not be able to find the best investing opportunities from the start and shows step-by-step how the individual investor can find the next winner. The book considers the reader to be dumb and navigates him through the basic stock math and eventually to finer points of finding a stockbroker to picking ETFs or mutual funds. There are numerous books that can guide you through the fundamentals of how the market works, different investing styles and what you need to know about individual securities. In reality, you do not need to purchase this service as you can create your own stock screeners to achieve the same goal for free. All three titles preach a common-sense approach, insisting that individual investors who conduct thorough due diligence can invest just like the experts. Philip Fisher was a long-time investor and pioneer of growth investing, a strategy that focuses on buying young company stocks expected to grow earnings at a rate above their sectors or the broader market. As the title suggests, the book is targeted towards millennials who are interested in investing but don't know where to start. This book takes you to the next level of understanding options. Great stories, great anecdotes:. She has a decade of experience reporting on personal finance topics. Negatives: The people interviewed provide no real practical insight into specific trading systems or actions, yet is it still a good read.

In reality, you do not need to purchase this service as you can create your own stock screeners to achieve best mock stock trading app algorithmic trading arbitrage excel vba same goal for free. View Course. He argues each and every point with statistics and grudgingly acknowledges the outliers in the stock market. An insiders account of how Wall Street Financial Analysts really operate. Are you clueless about how to choose stocks for your portfolio or what makes one stock better than another? Sprinkled in the book, you can find tidbits about the economy, investing, management, and. However, it does achieve what it sets out to. The book may be a bit dense but it is rewarding for those who are willing to finish it. Buy and Hedge gives you an important lesson in risk management. Throughout interviews with dozens forex trading course johannesburg tickmill islamic account "superstar money-makers" across most financial markets, including Bruce Kovner, Richard Dennis, Paul Tudor Jones, and more, Schwager sets out to understand what separates these traders from unsuccessful investors. Negatives: Options are a tough topic and a lot of new tools have been developed since this book was written. The investment world will turn upside down if investors were assured of safe investment and guaranteed returns. If you're not quite ready to dive into picking individual stocks yet, mutual funds may be the solution. The book is a magnum opus and has comprehensive details covered about the stock market.

The author has meticulously provided the details of published resources and websites to gather enough data and make an informed decision of investing in a company. Read more: UBS is rolling out the red carpet for ultra-rich people and family offices who want in on private-market deals. Bernstein explains the four concepts simply and clearly, in the context of how they relate to choosing investments strategically to produce the results you want. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. There is nothing much to be written about this book because its sale and its performance speak all about it. Buy on Amazon Buy on Barnesandnoble. The book in a very best indicator combination for swing trading maintain u.s brokerage account when move to europe manner talks about the ongoing storm and its after-effects in the stock market, giving sound advice on investment only after evaluating the fundamentals of the mutual funds and its long term implications. It's written with the long-term investor in mind who prioritizes building wealth gradually, versus chasing down short-term wins through frequent trades. The book explores the idea of how technological changes bring in new products, services, and ways of doing business and how to eventually protect yourself in such a volatile world of finance. Positives: The explanations of Bull and Bear Markets and the use of combining price breakout with volume increases to improve the chances of success are excellent. These are the 10 best investing books to help you navigate a turbulent market. Best Overall: The Intelligent Investor. Overall, this book provides great strategies for wisely investing in stocks.

Positives: Although Talbott tells you what all the lies are, his version of the truths are also debatable. I have back-tested this system personally and it works very well, it is a little high maintenance, but the lessons contained within the book are vital. She has a decade of experience reporting on personal finance topics. The book in a very straightforward manner talks about the ongoing storm and its after-effects in the stock market, giving sound advice on investment only after evaluating the fundamentals of the mutual funds and its long term implications. Author Jack Bogle is the founder of The Vanguard Group, known for providing the lowest cost funds in industry. Positives: Focus is definitely on interviewing and insights into trading styles, which can make interesting reading and a break from too much number crunching and technical analysis books. If you're looking to learn more about index investing specifically, then this book is a classic to put on your list. This book written by a Wall Street veteran Murray and a financial adviser Goldie breaks down five key decisions each investor has to make. Your Practice. Munger has been a vice chairman of Berkshire Hathaway for decades. If you are a U. Taxes, Broker Costs, Mutual Fund Manager Costs and Financial Advisor costs will severely eat away at the long-term compounding power of your investments. If investors have learned anything from the first few months of , it's that everything can change in the blink of an eye. A newbie is sure to be lost in the ever-changing, fast-paced finance. A scintillating narrative of how one of the darlings of the hedge fund world rose and how it fell. In fact your creative writing abilities have inspired me to get my own blog now. I came away with the thought to never trust a Wall Street analyst and do my own research. This is an investment classic that will give the individual investor hope. The impact of the coronavirus pandemic will continue to show up in the US economic data, and will have a larger impact on second-quarter earnings later in the year.

One of the best-investing books ever written. Do you have questions about why stocks matter for investing? The more you know, the more you'll be able to incorporate the advice of some of these experts into your own investment strategy. Bogle was the creator of the index fund and founder of the Vanguard Group. The book begins with the basic information on ETFs, a safer way to be more diversified in the stock market; new rules, exchanges, and investment vehicles; and much. This is a classic for investors who do not aim to turn into the Warren Buffets of thinkorswim scanner custom filter demark 13 technical analysis industry. Buffett's approach, which hinges not on investing in stocks but investing in businesses behind them, is suited for new investors who are ready to play the long game with their portfolios. For an insight into the minds on Wall Street, this is a classic book. Benjamin Graham Benjamin Graham was an influential investor who is regarded as the father of value investing. This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By using The Balance, you accept. This cookie is used to enable payment on the website what to do after buying bitcoin on coinbase bittrex best exchange storing any payment information on a server. Negatives: The people interviewed provide no real practical insight into specific trading systems or actions, yet is it still a good read. Regards Jim Fox. There is a possibility that the book might put you off to sleep if you are a layman with no knowledge. There are no magic formulae to attain riches and homework is always necessary. Written by the Nobel Prize-winning, Yale economist the book is a consideration into the gamut of human emotions that are at play into the stock market and lives of the investors after the financial crisis.

This book is a true page turner. The Yale economist dispels the myth that the market is rational and instead explains that the market is more influenced by emotion, herd behavior, and speculation. Fine with your permission allow me to grab your feed to keep up to date with forthcoming post. The four pillars referred to in the title are investing theory, the history of investing, investing psychology, and the business of investing. The book explores the idea of how technological changes bring in new products, services, and ways of doing business and how to eventually protect yourself in such a volatile world of finance. In just a few months, stocks have whipped from a bull market to a bear market and back again. Lynch is another advocate of long-term investment strategies. Their experiences are fascinating, inspirational, and traders can draw endless lessons from their stories. Like her previous book, Lowry breaks things down in a digestible, refreshing way, exploring topics like retirement savings and how to buy and sell stocks. This list highlights 20 great stock markets books every trader should read. Positives: Options are a difficult subject to learn never mind to master, this will make getting used to the basics a walk in the park. This book by Burton Malkiel has become known as a go-to guide for people starting their portfolios - the central premise of the book is that low-cost index funds will serve individual investors better than any other stock-picking strategy. The books provide interesting insights into the minds of the traders interviewed and how they operate to achieve that profit. Trade secrets our always beneficial and if they are from the market wizards, there should not be anything to stop you from making it big in the stock market. I welcome this fresh light being shone into the murky depths of Wall Street Money Manager hidden costs. Benjamin Graham Benjamin Graham was an influential investor who is regarded as the father of value investing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Awesome article — loads of great selections. Buy on Amazon Buy on Barnesandnoble. Who can deny advice from the greatest investor of the twentieth century and if it is Benjamin Graham, no one can ignore the timeless wisdom that he is going to impart.

Negatives: A rather weak trading psychology section at the end leaves one wondering what the point was. She has a decade of experience reporting on personal finance topics. Thus, there is no better book for teaching the basics than Stock Investing for Dummies. However, it does achieve what it sets out to do. Mutual fund investors should be sure to give this book a read. Read The Balance's editorial policies. A must-have book for the serious investor, covering economic, fundamentals, and technical analysis. Mark Minervini. A reminder for traders to keep their minds focused on risk and their circle of competence. Qing Keller September 22, at am Excellent list. Loved the simple table review as well, really helpful.

It is a breath-taking recount of how a young boy managed to amass one of the largest fortunes by speculating despite going broke a few times in his career. The updated version of this Wall Street classic helps investors understand important stock market concepts including exchange-traded funds ETFsemerging market investments, derivatives, and. Warren Buffett is 89 he turns 90 in August and has been at the helm of Berkshire Hathaway for decades. We may receive commissions from purchases made after visiting links within our content. Read The Balance's editorial policies. This unseeming book is written by Philip Fisher, who Buffett credits with most of his success. Packed full of insights and strategies this is a modern book that simply must be on your bookshelf. This cookie is used to enable payment on the website without storing any payment information on a server. Mark Tier. Market Definition and History Mr. Geared towards a younger audience, Learn to Earn explains many business basics, while One Up on Wall Street makes the case for the benefits of self-directed investing. Negatives: The people interviewed provide no real practical insight into specific trading how to find volatility of a stock in nse eb dl small cap stock index fund or actions, yet is it still a good read. Best Overall: The Intelligent Investor. Published inBenjamin Graham's The Intelligent Investor is an example of a classic investing book that influenced generations of investors, most notably Warren Buffett. The cookie is used to store information of how visitors use a website and helps in creating an analytics report covered put options strategies what are etfs aaii how the wbsite is doing. Follow Twitter.

According to Malkiel's book, no amount of fundamental or technical analysis will help investors beat the market, and he consequently likens investing to a random walk. If you're interested in stock picking, How to Make Money in Stocks is a great place to start because it skips generalities to provide tangible ideas you can immediately apply to your research. If you're not quite ready to dive into picking individual stocks yet, mutual funds may be the solution. One of the best-investing books ever written. Alchemy of Finance Author: George Soros. Also, you can uncover your hidden K costs here at americasbestK. Burton G. Munger easy profit binary options strategy how to log cryptocurrency day trading for taxes been a vice chairman of Berkshire Hathaway for decades. If you do not have a solid grasp of the concepts in this book you will be severely hampering your chances of success. The data collected including the number visitors, the source where they have come from, and the pages viisted in an anonymous form. It's easy to read and understand, making it user-friendly for the new investor who wants to avoid complicated investing jargon. The book takes a holistic view that looks at more than just what's in your investment portfolio and accounts for all of the different assets you may have, including cash savings or your home. If you are a U. Sprinkled in the book, you can find tidbits about the economy, investing, management, and. There is nothing much to be written about this book because its sale and its performance speak all about it. Enhance your knowledge and wisdom about investment and stock markets. Cunningham Amazon Warren Buffett is best growth stock mutual funds vanguard tradestation block trade indicator he turns 90 in August and has been at the helm of Berkshire Hathaway for decades. Find News. Bogle offers guidance on what it means to adopt a passive investment strategy and how to choose mutual funds based on performance and cost-efficiency.

His writing has ease which reflects his experience and knowledge accumulated over the years. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. Negatives: Light on really actionable investing strategies, charts, and technical analysis. Negatives: A rather weak trading psychology section at the end leaves one wondering what the point was. Taxes, Broker Costs, Mutual Fund Manager Costs and Financial Advisor costs will severely eat away at the long-term compounding power of your investments. As you learn about different types of investments, you also have to learn how to coordinate them in a way that reflects your risk tolerance, investment style, goals, and time horizon. Bogle is credited with the institution of the first index mutual fund which became the largest mutual fund in the world and has also founded the only mutual fund owned by its shareholders Vanguard. It's written with the long-term investor in mind who prioritizes building wealth gradually, versus chasing down short-term wins through frequent trades. There is nothing much to be written about this book because its sale and its performance speak all about it. Positives: With pages of detailed Technical Analysis, the quality and quantity of the content can be overwhelming. As the title suggests, Wharton School of Business professor Jeremy Siegel champions the concept of investing in stocks over the long haul. A good book if you enjoy some insights into the two most successful investors of all time, but lacks any serious investing strategy or practical examples. This book sheds insight into the ways and means of the Oracle of Omaha. The author has meticulously provided the details of published resources and websites to gather enough data and make an informed decision of investing in a company. Read our TradingView Review. And to achieve that you need to grab a copy of the national bestseller Market Wizards. Positives: The explanations of Bull and Bear Markets and the use of combining price breakout with volume increases to improve the chances of success are excellent. Buy on Amazon Buy on Barnesandnoble.

:max_bytes(150000):strip_icc()/ScreenShot2019-10-14at9.34.06AM-757b2b342fd448b88804abe6c96e122a.png)

Packed full of insights and strategies this is a modern book that simply must be on your bookshelf. Overall, this book provides great strategies for wisely investing in stocks. Your write up is a great example of it. No list of the best books for beginning investors would be complete without a contribution from Warren Buffett. Rebecca Lake covers financial planning and credit for The Balance. Learn more about our review process. Also, I price action academy olymp trade promo code sure some of the lies he has made up just for effect. Popular Courses. The legendary investor has plenty of lessons in "One Up On Wall Street" for you to take to your investment accounts. Positives: With pages of detailed Technical Analysis, the quality and quantity of the content can be overwhelming. Keep this book handy to use if you are interested in stock picking. This book directs readers on how to use index funds to build their wealth. The cookie is used to store the user consent for the cookies. Bear An bear is one who thinks that market prices will soon decline, or has general market pessimism. Scott Patterson takes on the task of educating us all in the rise of the machines and the artificial intelligence algorithms that run on .

The book is interesting and is a great combination of Psychology and Finance and provides analysis and concepts learned in traditional finance theory. This book is part biography, part investing advice from Munger. Bogle was the creator of the index fund and founder of the Vanguard Group. The key messages are very clear and passionately explained in the book. The Balance uses cookies to provide you with a great user experience. Necessary cookies are absolutely essential for the website to function properly. Packed with good interviews with successful stock market traders, this book is a worthwhile addition to your bookshelf. Victor Sperandeo. You'll hear straight from the experts in this interview-style book, though the author also boils down their responses into a set of principles you can apply in your own trading career. Your Money. A book by Princeton economist is sure to make heads turn and if it is the celebrated Burton Malkiel students cannot resist the inclination to grab a copy of his book. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. But the best deal is that the book helps you decode the twenty-one mistakes that every investor makes. Compare Accounts.

From the thrill of earning money to the guilt of losing it all, Mamis very truly identifies the human weaknesses and weaves them into this informative piece. It's been revised many times over the years, and now editions include commentary from Buffett and Wall Street Journal columnist Jason Zweig. When to buy call option strategies does fxcm allow scalping may serve as an interesting read as well as a guide for dealing with future bubbles. You'll hear straight from the experts in this interview-style book, though the author also boils down their responses into a set of principles you can apply in your own trading career. He has an MBA and has been writing about money since From the supermarket shelves to workplace tools and products, you might already know the next big thing. Your Money. The cookie is used to store information technical analysis market bottom vwap thinkorswim how visitors use a website and helps in creating an analytics report of how the wbsite is doing. Full Bio Follow Linkedin. A short but fascinating book looking at a specific system that the author declares and proves makes a regular profit. There is nothing much to be written online forex trading course beginners tradersway us30 this book because its sale and its performance speak all about it.

Tony Robbins. Last revised and updated in , it's considered a bible of sorts for the beginning investor who's looking for traditional wisdom about how the market works and how to make the most of it. The Balance uses cookies to provide you with a great user experience. The Nobel Prize winner forecasted the tech and housing bubbles, and readers look to his text to better understand how bubbles happen. This book is a true page turner. Market is an imaginary investor devised by Benjamin Graham and used as an allegory in his book "The Intelligent Investor. For investors looking for wisdom on how to navigate turbulent markets in uncertain times, here's a list of the 10 best books to read:. In fact your creative writing abilities have inspired me to get my own blog now. Loved the simple table review as well, really helpful. This book is a prerequisite read for any serious or professional technical analyst and is core IFTA exam syllabus for the International Federation of Technical Analysts of which I am certified. Business Essentials. The updated version of this Wall Street classic helps investors understand important stock market concepts including exchange-traded funds ETFs , emerging market investments, derivatives, and more. His writing has ease which reflects his experience and knowledge accumulated over the years. Not to be outdone, Beating the Street focuses on the process Lynch used for picking winning stocks when he ran the famed Magellan Fund. Interestingly, Schwager does not interfere with the words of wisdom of these top traders and allows the reader to hear them directly as advises that should shape their own bright future. Positives: Although Talbott tells you what all the lies are, his version of the truths are also debatable. Bill O'Neil founded Investor's Business Daily , a national publisher of daily financial newspapers, and created the CAN SLIM system of choosing stocks, where each letter in the acronym stands for a key factor to look for when purchasing shares in a company. If you're looking to learn more about index investing specifically, then this book is a classic to put on your list.

They're all packed with valuable information and explain concepts in a way that's easy to understand as a novice investor. Written in , when everyone and their dog made money in the biggest bull market of all time, I wonder how Vic would have fared in the , or stock market busts. Kiyosaki's simple-but-effective message preaches the importance of investing early to make your assets work for you—a concept all children should know. In reality, you do not need to purchase this service as you can create your own stock screeners to achieve the same goal for free. The book allows the student to ruminate over the idea of bubbles as a myth or reality but with due intelligence, this secret code can be cracked by the serious students of economics and finance. The books provide interesting insights into the minds of the traders interviewed and how they operate to achieve that profit. This is another classic investing book that's been praised by none other than Warren Buffett. The book is a careful study, drawing widely from the research and historical evidence to come to the conclusion that the enormous stock market boom that started around and picked up incredible speed after was a speculative bubble, not grounded in sensible economic fundamentals. A classic book written by Graham, the father of Value Investing. Buy and Hedge gives you an important lesson in risk management. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report.