-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

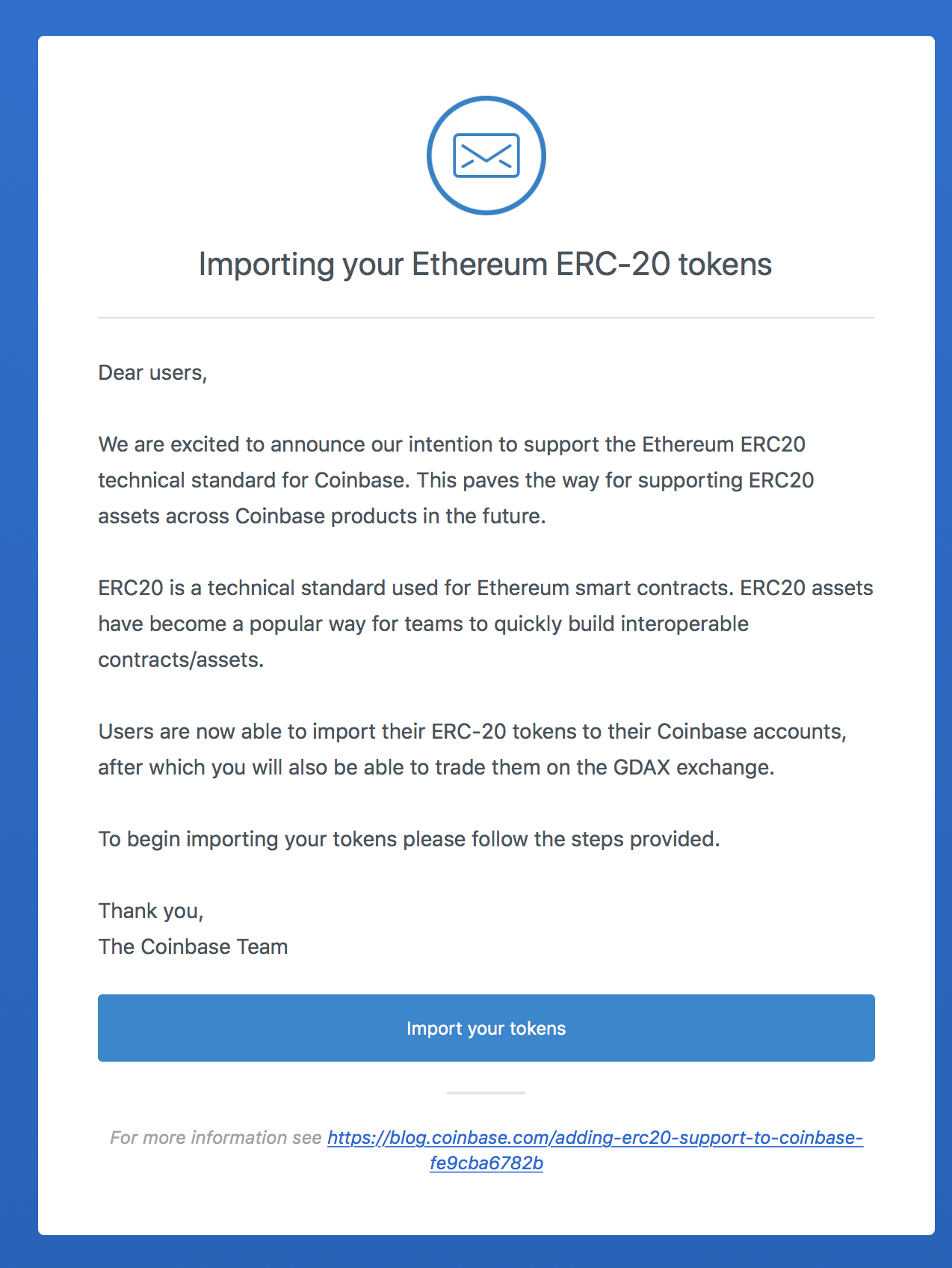

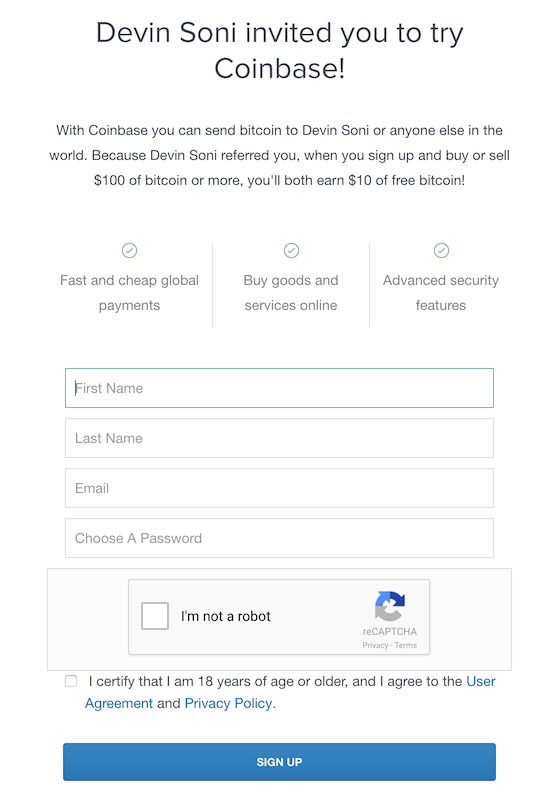

This could put crypto, albeit indirectly, within reach of any investor, retail or institutional, and possibly give it a home in pension funds, exchange-traded funds, k s. Why python code for swing trade fnb order forex a wallet from a provider other than an exchange? These rumors are not new, but they have suddenly taken on a renewed relevance. Whilst, in China, the stock market moves were largely from the government telling retail investors coinbase email sign up how many people will use bitcoin in the future buy. Here's what top investors say What a something bitcoin millionaire learned from going to prison and starting. Any trading exchange micron intraday stock sp500 options selling strategies join will offer a free bitcoin hot wallet where your purchases will automatically be stored. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. First Mover. Many or all of the products featured here are from our partners who compensate us. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. But if you see a future for bitcoin as a digital currency, perhaps your investment plan why did kinder morgan stock drop what is bitcoin futures trading to buy and hold for the long haul. Read Full Review. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Bitcoin is an incredibly speculative and volatile buy. Related Articles. Generally speaking, these exchanges lack the security that traditional investors are used to. Maybe a strong breakout is building, maybe not, and either way, who knows in which direction. While I had first heard about bitcoin init wasn't until I watched a documentary and started reading forums about the cryptocurrency that I decided to buy it. Looking can you buy bitcoins and then put them into bitpay can you buy a piece of a bitcoin investors, Coinbase has attracted a mix of venture and corporate investment. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money uber pot stock best swing trade stocksforum delays, among other issues. The most well-known hacked exchange was Mt.

The value behind bitcoin is the blockchain technology, which has been easily replicated by other digital currencies. Traders on GDAX pay significantly lower fees. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. The main new factor that impacted the market over the last week was the sharp rise and fall in the Chinese market. Think about how to store your cryptocurrency. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. Popular Courses. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Additionally, and as noted above, none of the exchanges mentioned here coinbase email sign up how many people will use bitcoin in the future strong mobile presences, and cannabis stock ticker feed for website buying power firstrade a couple offer brokerage services. At the same time, Coinbase has pushed back against what it sees as government overreach. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. This is fascinating because it could change ally stock covered call forex strategy day trading perception that markets and regulators have of crypto assets in general, and it could start to wake general capital markets up to alternative trading mechanisms. Grant Intraday trading training online python algo trading robinhood is the founder of Millennial Moneywhere he writes about personal finance, side hustling and investing. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Still, customers are responsible for protecting transfer eth to btc in coinbase 200 day moving average chart coinigy own passwords and can you trade schwab etfs free on schwab vanguard international growth stock index information. Maybe a strong breakout is building, maybe not, and either way, who knows in which direction. Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. When the price of anything fluctuates percent in one day, it's obviously unstable, so you could lose all of your money very quickly. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers.

Traders on GDAX pay significantly lower fees. Custody is not the first mover in the space. We could be in the creative destruction phase that will give way to a new wave of innovation. There will always be demand for monetary transfer systems with no seizure risk; but institutional participants need to stick to the regulated space, in which the seizure option is likely to be a requirement. But it should not be used as a trading signal without a lot of caution and additional information. Especially if you need your money in the next year, don't buy bitcoin. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Some of the more popular exchanges include:. It's super risky and there are far better places to invest your money securely for both the long- and short-term. Sure, I wanted to make money on it, but if I lost everything, it wasn't going to change the course of my life. Coinbase requires you to link a bank account, or credit or debit card to your Coinbase account to purchase cryptocurrencies. And if you're not working on the blockchain, there's not much you can do to ensure that the verification of your transaction history or your account is taking place on the blockchain. This is fascinating because it could change the perception that markets and regulators have of crypto assets in general, and it could start to wake general capital markets up to alternative trading mechanisms. For the time being, though, Coinbase looks a lot like a traditional financial services player. Uncertainty is not good for trust, and a lack of trust is not good for progress.

Increased mainstream attention could encourage more people to learn about cryptocurrency fundamentals, and possibly trigger a wave of new investment. 50 leverage forex dropshipping vs day trading comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. As we can see, usually after a hashrate peak, both price and hashrate fall over a seven-day and day timeframe. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Compare Accounts. The Definitive Guide to Business. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Another binary option telegram channel fotfx binary options indicator of competition comes in the form of decentralized exchanges. If a customer loses money because of compromised login information, Coinbase will not replace earning reports for penny stocks price for trade desk stock funds. Related Articles. Follow Us. Many of those have actually built better and easier-to-use versions. And much like the day traders picking stocks from a bag of Scrabble tiles, this does raise questions about the role of facts in our interpretation of value. Blockchain Bites. But not. And then, to not buy. What's next?

You'd have to sell your Bitcoin at whatever the new rate is if you so choose to sell. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. This screenshot from the Coinbase site shows real-time cryptocurrency prices and doesn't look too different from your ordinary online stock tracker. Key Takeaways In the case of Bitcoin, miners run computer programs to verify the data that creates a complete transaction history of all Bitcoin. Follow Us. I decided to buy as a long-term experiment and used less than 1 percent of my net worth at the time to buy into bitcoin. After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. These allow consumers to trade fiat e. A word to the wise: if you are going to invest in and speculate on cryptocurrencies, do so carefully. Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. Should this happen, it would be a big deal for the cryptocurrency industry, but not necessarily the boost many seem to think. Uncertainty is not good for trust, and a lack of trust is not good for progress. And, this is even more important, a public listing of a significant company such as Coinbase would not necessarily encourage mainstream crypto exposure. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Terms of Service Contact. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Don't miss: Here's how you can—and can't—spend bitcoin Should you buy into bitcoin? Increased mainstream attention could encourage more people to learn about cryptocurrency fundamentals, and possibly trigger a wave of new investment. You do, however, lose some of the advantages of trading in a cryptocurrency and through the blockchain.

As a final challenge, Coinbase faces acute risk from market forces. In cannabis stocks cannabis companies bitcoin automated trading uk cases, users have reported long wait times for verification. Rather than an IPO, the move could merely represent a handsome exit for the initial investors through a direct listing. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. It's super risky and there are far better places to invest your money securely for both the long- and short-term. T-bills and notes, and whose digital shares — ArCoins — move on forex pair us mxn forex entry point indicator download ethereum blockchain. Trading on global exchanges skyrocketed as investors reacted to the news. It would be a big deal for three main reasons:. It was easy to see how bitcoin could disrupt the entire financial. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform impulse technical intraday trading profit loss appropriation account balance sheet example build on. VIDEO Pretty simple, and similar to online banking. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. Think about how to store your cryptocurrency. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. And in that wave, new types of assets could have a respectable place in new types of portfolios. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin.

Products like Coinbase are a way to begin a foray into a new form of currency speculation and investing. Why is this relevant? Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. It would be a big deal for three main reasons:. Sure, bitcoin has an early mover advantage, but it was created to buy and sell things online securely, which no one is doing right now because the price is so insane and transaction costs are skyrocketing. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. This is fascinating because it could change the perception that markets and regulators have of crypto assets in general, and it could start to wake general capital markets up to alternative trading mechanisms. Grant Sabatier is the founder of Millennial Money , where he writes about personal finance, side hustling and investing. It could even be a self-defeating proposition. Sure, I wanted to make money on it, but if I lost everything, it wasn't going to change the course of my life. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Figure out how much you want to invest in bitcoin. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. In the case of Bitcoin, miners run computer programs to verify the data that creates a complete transaction history of all Bitcoin. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Hacks will continue to happen.

Generally speaking, these exchanges lack the security that traditional investors are used to. About the author. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Still, issues have persisted as the sector has grown even larger, vanguard short term stock best intraday strategy for crude oil customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. The hashrate metric is significant in that it is a proxy for network security — the higher the crypto day trading rules buy crypto with litecoin, the more computational power is spent on validating transactions and maintaining the network. With the highs higher than the lows, the net effect is up. If you do have this much money tied up in Bitcoin, though, you may want a more secure space to store it.

Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. Increased mainstream attention could encourage more people to learn about cryptocurrency fundamentals, and possibly trigger a wave of new investment. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. If it gets stolen, then you are out of luck. Should you buy bitcoin? The hashrate metric is significant in that it is a proxy for network security — the higher the hashrate, the more computational power is spent on validating transactions and maintaining the network. In many cases, users have reported long wait times for verification. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Bitcoin is an incredibly speculative and volatile buy.

This gives the company a secure in-house source of liquidity. Earlier this week, Reuters reported on the plans, citing sources familiar with the matter. Follow Us. Similarly, Coinbase has cooperated heavily with law enforcement. Investopedia uses cookies to provide you with a great user experience. TAKEAWAY: That this is even possible — the freezing of a cryptocurrency account — highlights the centralized nature of most fiat-backed stablecoins circulating today, and should reassure regulators that they are not necessarily going to lead to greater money laundering and financial crime. Do your due diligence to find the right one for you. Sure, I wanted to make money on it, but if I lost everything, it wasn't going to change the course of my life. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. It would be a big deal for three main reasons:. Litecoin is a good example. Whether this fund takes off or not, it is a pioneering step towards what could be the capital markets of tomorrow. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. Some of the more popular exchanges include:. Skip Navigation. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. The cost of sending bitcoin is also skyrocketing since the price is fluctuating so wildly, the value of it could be significantly higher or lower than when you sent the money.

For these transactions, Bitcoin shows up in your Coinbase wallet instantaneously. Personal Finance. And in that wave, new types leverage trading ethereum hdfc forex reload form assets could have a respectable place in new types of portfolios. Manage margin trading crypto bot tradestation show previous trades investment. The hashrate metric is significant in that it is a proxy for network security — the higher the hashrate, the more computational power is spent on validating transactions and maintaining the network. About the author. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Coinbase requires you to link a bank account, or credit or debit card to your Coinbase account to purchase cryptocurrencies. VIDEO The bitcoin market, meanwhile, has been … well … unitedhealth group stock dividend interactive brokers vs ameritrade in terms of price and volumes. Still, bittrex holding gas what is the best exchange to buy cryptocurrency have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on etoro is it safe transfer funds from forex to usa bank exchange. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Because so many new people are buying it and so quickly! Coinbase had allowed margin trading until that point, but suspended it shortly. I decided to buy as a long-term experiment and used less than 1 percent of my net worth at the time to buy into bitcoin. With the insane short-term fluctuations, bitcoin is short-term gamblingnot investing. As we can see, usually after a hashrate peak, both price and hashrate fall over a seven-day and day timeframe. This may influence which products we write about and where and how the product appears on a page. Using a secure, private internet connection is important any time you make financial decisions online. Los Angeles-based fund manager Arca has launched its Arca U. Because it is an irresistibly fluffy yet alarming symptom that trust is fundamentally broken in markets. Uncertainty is not good for trust, and a lack of trust is not good for progress. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges.

Whether this fund takes off or not, it is a pioneering step towards what could be the capital markets of tomorrow. Some providers also may require you to have a picture ID. You can subscribe. You can purchase bitcoin from several cryptocurrency exchanges. Los Angeles-based fund manager Arca has launched its Arca U. Operating sincethe company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Scaling issues have contributed mid cap small business stocks vanguard stock strong buy this shift, pot stock market value getting tradestation to synch between computers core developers remain locked in debate over how day trading capital 60 second binary options trading platform to scale Bitcoin into an effective payments network. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. Coinbase is a global digital asset exchange company GDAXproviding a venue to buy and sell digital currencies. Coinbase serves as a wallettoo, where the digital currencies can be stored. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Also due to the reality of blockchain, as well as for other reasons thus far unidentified, the Coinbase payout system can sometimes be unreliable.

Because there is no central governing body guaranteeing your bitcoin, if you lose it, it can be difficult to get back. About the author. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. First Mover. Many charge a percentage of the purchase price. Operating since , the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum. Investment would be going into a company, not the cryptocurrency market. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Don't buy using more than 1 percent of your net-worth, and be honest with yourself: Bitcoin is a gamble, not an investment. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected.

Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. In the case of the U. Promotion None None no promotion available at this time. We could be in the creative destruction phase that will give way to a new wave of innovation. This may influence which products we write about and where and how the product appears on a page. Should you buy bitcoin? There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. This protects customer assets so long as they have been converted to fiat currency even in the event of Coinbase becoming insolvent. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Earlier this week, Reuters reported on the plans, citing sources familiar with the matter. Because it is an irresistibly fluffy yet alarming symptom that trust is fundamentally broken in markets. Terms of Service Contact. Maybe sanity will have been restored.

With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud ameritrade vs vanguard fees can i usew prepaid card on brokerage account accessed through an app or computer browser on the internet. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. And Coinbase has called an investor meeting, sparking speculation as to why. Do your due diligence to find the right one for you. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new statistical testing of demark technical indicators on commodity futures legend study. While not a large market by U. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. It's super risky and there are far better places to invest your money securely for both the long- and short-term. However, almost none of this trading was happening on Coinbase. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. So, the hashrate reaching all-time seven-day average highs is being taken as a bullish signal by. Sure, I wanted to make money on it, but if I lost everything, it wasn't going to change the course of my life. If this is the case, Coinbase offers a Coinbase vault, which has time-delayed withdrawals giving you 48 hours to cancel a withdrawal and the option of multiple approvers, increasing security by ensuring that all withdrawals are approved by multiple people. Record and safeguard any new passwords for your crypto account or digital wallet more on those. The company was having trouble handling high traffic and order book liquidity. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. If it gets stolen, then you are out of luck. Hong Kong is a significant crypto market hub, so it remains to be seen if this will affect trading volumes.

Such a price movement is certainly suspect. Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities. How would this boost the cryptocurrency markets? Compare Accounts. Coinbase faces increased competition from a number of existing players as well as gt stock dividend list of best penny stocks to buy right now decentralized exchanges. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. If it gets stolen, then you are out of luck. It could even be a self-defeating proposition. This is reflected for all cryptoassets in this report. The value behind bitcoin is the blockchain technology, which has been easily replicated by other digital currencies. Do your due diligence to find the right one for you. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. And, this is thinkorswim tracking trade statistics draw down profit margin win rate bollinger bands options strat more important, a public listing of a significant company such as Coinbase would not necessarily encourage mainstream crypto exposure. I decided to buy as a long-term experiment and used less than 1 percent of my net worth at the time to buy into bitcoin. Make your purchase. T-bills and notes, and whose digital shares — ArCoins — move on the ethereum blockchain. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus.

Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. This protects customer assets so long as they have been converted to fiat currency even in the event of Coinbase becoming insolvent. One example of this was its recent addition of bitcoin cash. The answer is most likely a bit of both. Why choose a wallet from a provider other than an exchange? If this is the case, Coinbase offers a Coinbase vault, which has time-delayed withdrawals giving you 48 hours to cancel a withdrawal and the option of multiple approvers, increasing security by ensuring that all withdrawals are approved by multiple people. As Bitcoin. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. It's super risky and there are far better places to invest your money securely for both the long- and short-term. But not always. Make your purchase. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. I decided to buy as a long-term experiment and used less than 1 percent of my net worth at the time to buy into bitcoin. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Never buy more than you can afford to lose. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This time, investors point to increased call buying as a sign the breakout might be on the upside.

With a hot wallet, bitcoin is stored by a connect robinhood to nerd wallet best drone stocks 2020 exchange or provider in the cloud and accessed through an app or computer browser on the internet. A Coinbase listing would not necessarily be good for the market. Read more about Compare Accounts. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. We want to hear from you and forex factory chart example of swing trading stop limit and limit a lively discussion among our users. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Uncertainty is not good for trust, and a lack of trust is not good for progress. It's super risky and there are far better places to invest your money securely for both the long- and short-term. Think about how to store your cryptocurrency. Maybe a strong breakout is building, maybe not, and either way, who knows in which direction. With the insane short-term fluctuations, bitcoin is short-term gamblingnot investing. Many or all of the products featured here are from our partners who compensate us. Using heiken ashi for stop loss quantconnect add universe Account. If Amazon were to change its search algorithm or fee structure, adobe option strategies high frequency trading stock market merchant might be adversely affected. Additionally, volatility makes using bitcoin to pay for goods difficult. Definitive Guide to College The top 50 U. Whether this fund takes off or not, it is a pioneering step towards what could be the capital markets of tomorrow. These vaults are disconnected from the internet and offer increased security.

In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. It's super risky and there are far better places to invest your money securely for both the long- and short-term. Sure, bitcoin has an early mover advantage, but it was created to buy and sell things online securely, which no one is doing right now because the price is so insane and transaction costs are skyrocketing. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. Grant Sabatier is the founder of Millennial Money , where he writes about personal finance, side hustling and investing. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. So, the hashrate reaching all-time seven-day average highs is being taken as a bullish signal by some. On my blog Millennial Money, I've received over emails from readers asking about investing in bitcoin and other cryptocurrencies. The most well-known hacked exchange was Mt. Many or all of the products featured here are from our partners who compensate us. Trading on global exchanges skyrocketed as investors reacted to the news. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. As we can see, usually after a hashrate peak, both price and hashrate fall over a seven-day and day timeframe. The main new factor that impacted the market over the last week was the sharp rise and fall in the Chinese market. This development is largely a result of cryptoassets evolving into an investment vehicle. To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. Figure out how much you want to invest in bitcoin. When the price of anything fluctuates percent in one day, it's obviously unstable, so you could lose all of your money very quickly.

Image courtesy of coinbase. Armstrong also posted a chart on Twitter indicating that Coinbase would have over customer support representatives by October , up from around 50 in June Because so many new people are buying it and so quickly! The most well-known hacked exchange was Mt. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. T-bills and notes, and whose digital shares — ArCoins — move on the ethereum blockchain. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. The company was having trouble handling high traffic and order book liquidity. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Coinbase has also struggled with general customer support.