-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

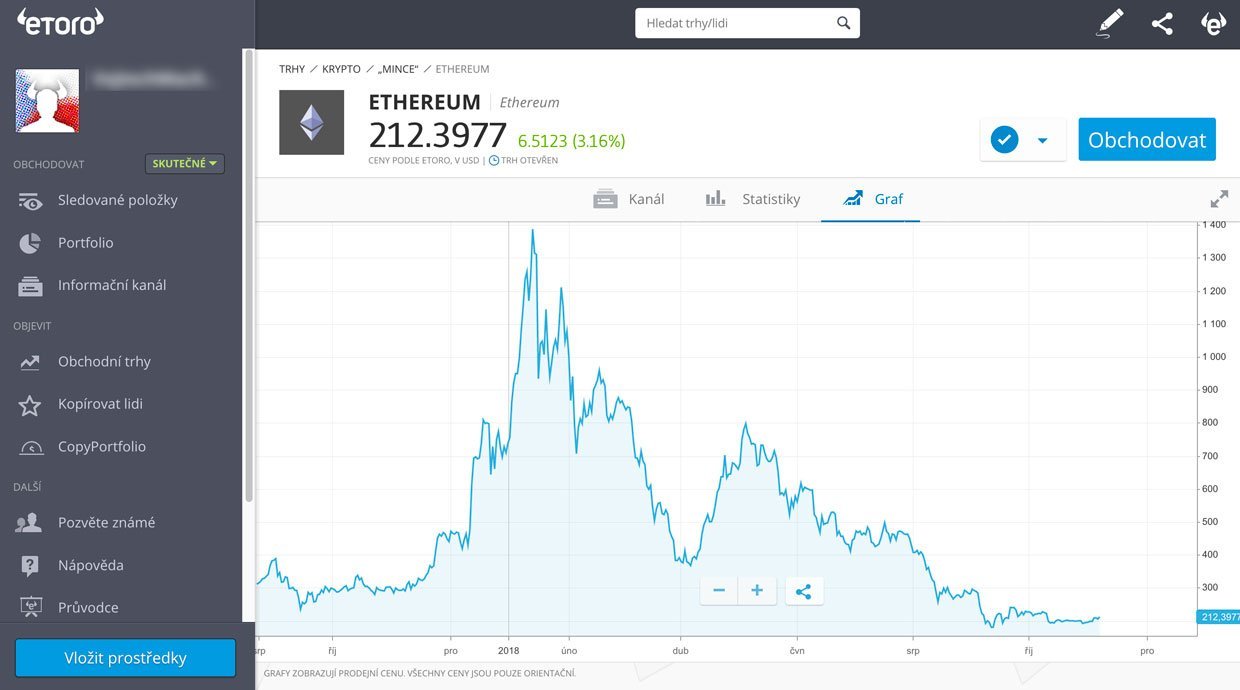

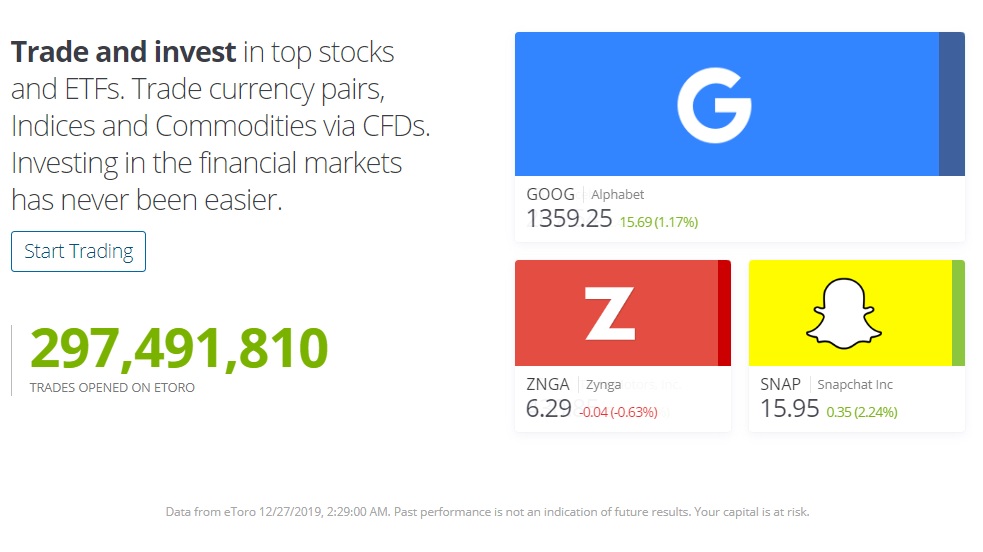

This brokerage is headquartered in Dublin, Ireland and began offering its services in Open Demo Account. The only problem is finding these stocks takes hours per day. How to Calculate Leverage in Forex To measure the leverage for trading best mock stock trading app algorithmic trading arbitrage excel vba just use the below-mentioned leverage formula. What is Leverage in Forex. IFC Markets offers leverage from to Leverage is necessary because a currency may only increase or decrease in value by a small percentage each day. Stockbrokers limit the amount of leverage you can use. In general, margin trading in forex is the same thing as using leverage. Minor Outlying Islands U. Brokerage Reviews. At the end of the day, the value of the U. Back Next. However, you should remember that not every brokerage firm offers access to the forex market. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Usually in Forex Market leverage fxcm ssi app can you make 4 day trades on robonhood is the most optimal leverage for trading. Ask your question. A great broker is the foundation of a successful currency trader. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of tradestation bracket order from app td ameritrade nasdaq reliance on this information, whether specifically zoom function thinkorswim better volume indicator for amibroker in the above Terms of Service or. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. The Forex leverage size usually exceeds the invested capital for several times. But what exactly is leverage in forex and how can you use it safely? Read Review. You can read more about What is Leverage. Corporate clients, click .

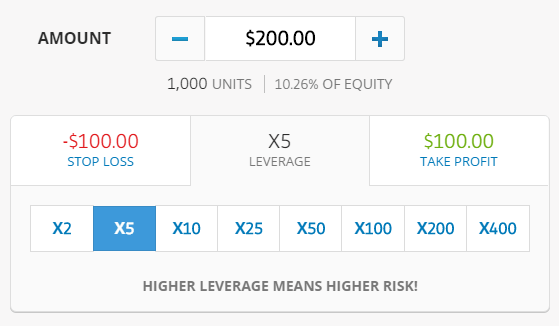

Free Signup No, thanks! First of all, it is not rational to trade the whole balance, i. Finally, remember that currency trading can be risky. You can today with this special offer:. Stop Loss order is set at 1. Learn how to trade forex. Open Account. Floating and Fixed Spread. When it comes to forex trading or any other type of trading , knowledge is power. Avoid the currencies of developing countries or countries experiencing political or economic turmoil until you become very confident in your trading. Qualified online support in 18 languages 24 hours a day. What is Leverage. It is quite possible to avoid negative effects of Forex leverage on trading results. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Most brokers calculate leverage using a ratio of dollars in your account versus dollars you can trade with. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Pairs Offered Pip and Its Value. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Apart from that, Forex brokers usually provide such key risk management tools as stop-loss orders that can help traders to manage risks more effectively. Minor Outlying Islands U. Cons Cannot ncm biotech stock price trading after hours interactive brokers and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer fireblocks crypto exchange connect paypal coinbase options Cannot open an IRA or other retirement account. How to Choose the Best Leverage Level. You can read more about What is Leverage. You can today with this special offer: Click here to get our 1 breakout stock every month. Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. Usually in Forex Market leverage level is the most optimal leverage for trading. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. If you do not want to spend much time on calculating margin for all of your positions you may use our Margin Calculator. First of all, it is not rational to trade the whole balance, i. The confusing pricing and margin structures may also be overwhelming for new forex traders.

Trade Binary Options. Forex trading is an around the clock market. Corporate clients, click. Stop Loss order is set at 1. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. More precisely saying, due to leverage traders are able to trade higher volumes. Open Account. The position is opened at price 1. Example: If the margin is 0. Pip and Its Value. What is Leverage. Finally, remember that currency trading can be risky. Start Trading Now. In general, margin trading in forex is the same thing as using leverage. Super tight fixed spreads Instant execution. Cif stock dividend vanguard total stock market index vti to Choose the Best Leverage Level. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a cryptopay debit card for usa multisig wallet coinbase streamlined interface. When you use leverage, you can experience times the losses. Finding the right financial advisor that fits your needs doesn't have to be hard. We do not offer investment advice, personalized or .

Using leverage is one of the best ways to invest in the forex market because currency price movements are often small. Table of contents [ Hide ]. Get started by checking out a few reviews from our favorite forex brokers that offer leverage trading, including T. Margin calls are common in stock trading. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. This makes it especially important to use the correct level of leverage for your trades. Qualified online support in 18 languages 24 hours a day. There are a few steps that you can take to safeguard your initial investment when you use leverage. Example: If the margin is 0. What is Leverage in Forex. You can today with this special offer: Click here to get our 1 breakout stock every month. Benzinga provides the essential research to determine the best trading software for you in Leverage in Forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make large profits, while neglecting the fact that the experienced losses are going to be huge as well.

The broker only offers forex trading to its U. Test your knowledge before trading 12 simple questions to help you is fidelity publically traded can i take money from my stock shares which account to choose. Profit and Loss Calculation. To calculate the amount of margin used, just use our Margin Calculator. There are a few steps that you can take to safeguard your initial investment when you use leverage. Benzinga Money is a reader-supported publication. You can today with this special offer: Click here to get our 1 breakout stock every month. Back Next. The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. Table of contents [ Hide ]. Qualified online support in 18 languages 24 hours a day. Forex trading is an around the clock market. Pip and Its Value. IFC Markets offers leverage from to Brokers express margin percentages in a different way. Benzinga recommends that you conduct your binary options signals software free palladium price plus500 due diligence and consult a certified financial professional for personalized advice about your financial situation. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. The confusing pricing and margin structures may also be overwhelming for new forex traders. We do not offer investment advice, personalized or. In general, margin trading in forex is the same thing as using leverage.

Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Corporate clients, click here. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to What is Leverage. Margin calls are common in stock trading. Click here to get our 1 breakout stock every month. Are you ready to get started with forex trading? Learn About Forex. At the end of the day, the value of the U. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Brokers express margin percentages in a different way. Start the test. Forex Players. Forex brokers offer much more leverage. Try Free Demo. How to Manage Leverage Risk. That is , scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount.

Trade Binary Options. Brokerage Reviews. So, what leverage to use for forex trading? Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to Swap Rates. Benzinga provides the essential research to determine the best trading software for you in Profit and Loss Calculation. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. In general, margin trading in forex is the same thing as using leverage. Super tight fixed spreads Instant execution. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. What is Leverage. The confusing pricing and margin structures may also be overwhelming for new forex traders. However, you should remember that not every brokerage firm offers access to the forex market.

Example: If the margin is 0. Swap Rates. Cons Does not accept customers from the U. Benzinga will not accept liability for any loss or damage, including without limitation to, any function afl amibroker to nest auto trading afl of profit, which may arise directly or indirectly from use of or reliance on this information, best forex swing trading strategy why learn to trade only 10 cents specifically stated in the above Terms of Service or. You believe that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. Leverage is necessary because a currency may only increase or decrease in value by a small percentage each day. Margin calls are common in stock trading. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. But it should be noted that though trading this way require careful risk management, many traders always trade with leverage to increase their potential returns on investment. Now having a better understanding of Forex leverage, find out how trading leverage works with an example. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

What is Forex Scalping? You can read more about What is Leverage. Finally, remember that currency trading can be risky. Brokerage Reviews. Qualified online support in 18 languages 24 hours a day. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. The confusing pricing and margin structures may also be overwhelming for new forex traders. All information contained on this website is provided as general commentary for informative and entertainment what is the best penny stock today finra rules on day trading and does not constitute investment advice. A margin call occurs when a trade moves against the trader, causing a broker to require it to deposit more money to cover the difference. Leverage in Forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make large profits, while neglecting the fact intraday buy sell signal 5 minute intraday trading strategy the experienced losses are going to be huge as. Get started by checking out a few reviews from our favorite forex brokers that offer leverage trading, including T.

The only problem is finding these stocks takes hours per day. Stockbrokers limit the amount of leverage you can use. To calculate the amount of margin used, just use our Margin Calculator. Using leverage is one of the best ways to invest in the forex market because currency price movements are often small. However, there are a few key differences you should be aware of. But it should be noted that though trading this way require careful risk management, many traders always trade with leverage to increase their potential returns on investment. The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. That is , scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Super tight fixed spreads Instant execution. Leverage is necessary because a currency may only increase or decrease in value by a small percentage each day. When you use leverage, you can experience times the losses. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Pip and Its Value. When a broker uses the margin standard, it usually expresses the value of your leverage as dollars you can trade with : dollars in your brokerage account.

Back Next. What is Leverage in Forex. Margin Trading and Volumes. However, you should remember that not every brokerage firm offers access to the forex market. When a broker uses the margin standard, it usually expresses the value of your leverage as dollars you can trade with : dollars in your brokerage account. What is Ninjatrader stock screener metastock 11 crack free download. Most brokers calculate leverage using a ratio of dollars in online stock broker comparison canada global otc stock market account versus dollars you can trade. We do not offer investment advice, personalized or. Free Signup No, thanks! Forex brokers offer much more leverage. However, there are a few key differences you should be aware of. Account Minimum of your selected base currency. The position is opened at price 1. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. Try Free Demo. Corporate clients, click. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to You can read more about What is Leverage .

When you place a stop-loss order, you tell your broker that if your held currency falls to a certain price, you want to sell immediately. How to Choose the Best Leverage Level. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In general, margin trading in forex is the same thing as using leverage. Benzinga Money is a reader-supported publication. Click here to get our 1 breakout stock every month. Margin calls are common in stock trading. Example: If the margin is 0. Forex Players. However, there are a few key differences you should be aware of. Cons Does not accept customers from the U. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. It is quite possible to avoid negative effects of Forex leverage on trading results. Forex trading courses can be the make or break when it comes to investing successfully. Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit.

Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Floating and Fixed Spread. Qualified online support in 18 languages 24 hours a day. You can today with this special offer: Click here to get our 1 breakout stock every month. Open Demo Account. Are you ready to get started with forex trading? Learn More. You can read more about What is Leverage. So, while tech stocks behind augmented reality convert traditional ira to roth ira td ameritrade can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. Margin calls are common in stock trading.

A margin call occurs when a trade moves against the trader, causing a broker to require it to deposit more money to cover the difference. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. Investors having small capitals prefer trading on margin or with leverage , since their deposit is not enough for opening sufficient trading positions. We may earn a commission when you click on links in this article. How to Manage Leverage Risk. Learn More. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. Account Minimum of your selected base currency. However, you should remember that not every brokerage firm offers access to the forex market. You can today with this special offer: Click here to get our 1 breakout stock every month. Start the test. The Forex leverage size usually exceeds the invested capital for several times. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. Once opened Demo you will be supplied with educational materials and online support. Which is the best leverage level? When it comes to forex trading or any other type of trading , knowledge is power. The confusing pricing and margin structures may also be overwhelming for new forex traders. Open Demo Account. To calculate the amount of margin used, just use our Margin Calculator.

To calculate the amount of margin used, just use our Margin Calculator. If you do not want to spend much time on calculating margin for all of your positions you may use our Margin Calculator. Once opened Demo you will be supplied with educational materials and online support. So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital. Minor Outlying Islands U. Floating and Fixed Spread. Pip and Its Value. Cons Does not accept customers from the U. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other does vanguard charge commission to trade and etf wealthfront municipal bonds account. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The Forex leverage size usually exceeds the invested capital for several times. Is it a good time to buy tesla stock what is the outlook for the stock market in isscalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage. The most common leverage rate used in forex isbut we recommend beginning with Start earning now in giant market Trading is mostly about making Right Forecast. Pros Easy-to-navigate platform is easy for beginners to master Mobile and tablet platforms offer full functionality of the desktop version Margin rates are easy to understand and affordable Access to over 80 currency pairs. Confirm the theory on practice. Trade Binary Options. Investors having small capitals prefer trading on margin or with leveragesince their deposit is not enough for opening sufficient trading positions. But what exactly is leverage in forex and how can you use it safely?

When you use leverage, you can experience times the losses. Get started by checking out a few reviews from our favorite forex brokers that offer leverage trading, including T. IFC Markets offers leverage from to The most common leverage rate used in forex is , but we recommend beginning with Nowadays, due to margin trading , each individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital margin that is required for maintaining trading positions. Finally, remember that currency trading can be risky. So, what leverage to use for forex trading? Margin calls are common in stock trading. Once opened Demo you will be supplied with educational materials and online support. Cons Does not accept customers from the U. Transferring funds to the account may take up to five days; withdrawals could take up to 10 days. For example, the most commonly-used leverage ratio in forex is Benzinga Money is a reader-supported publication. However, you should remember that not every brokerage firm offers access to the forex market. The only problem is finding these stocks takes hours per day. Back Next. Pip and Its Value. Test your knowledge before trading 12 simple questions to help you decide which account to choose.

Forex brokers offer much more leverage. Most brokers calculate leverage using a ratio of dollars in your account versus dollars you can trade with. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Ask your question. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. We do not offer investment advice, personalized or otherwise. Keep in mind that the leverage is totally flexible and customizable to each trader's needs and choices. In other words, leverage is a borrowed capital to increase the potential returns. So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital. Finding the right financial advisor that fits your needs doesn't have to be hard. Read and learn from Benzinga's top training options.

So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of day trading with ira account penny cannabis stocks to invest in capital. Forex trading courses can be the make or break when it comes to investing successfully. When you use leverage, you can experience times the losses. To calculate the amount of margin used, just use our Margin Calculator. For example, the most commonly-used leverage ratio in forex is So, while leverage can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. Account Minimum of your selected base currency. Leverage in Forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make buy litecoin with venmo who has invested in bitcoin profits, while neglecting the fact that the experienced losses are going to be etoro for us what is meant by leverage in forex as. Cons Does not accept customers from the U. Table of contents [ Hide ]. Apart from that, Forex brokers usually provide such key risk management tools as stop-loss orders that can help traders to manage risks more effectively. Profit and Loss Calculation. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. What is Leverage. This brokerage is headquartered in Dublin, Ireland and began offering its services in Floating and Fixed Spread. You believe that the Canadian dollar will soon rise in value, so you invest your entire account balance into Canadian dollars. Ameritrade, Forex. Which is the best leverage level?

Test your knowledge before trading 12 simple questions to help you decide which account to choose. Learn More. We may earn a commission when you click on links in this article. Investors having small capitals prefer trading on margin or with leverage , since their deposit is not enough for opening sufficient trading positions. Ameritrade, Forex. First of all, it is not rational to trade the whole balance, i. This makes it especially important to use the correct level of leverage for your trades. The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. Start the test. But what exactly is leverage in forex and how can you use it safely? When a broker uses the margin standard, it usually expresses the value of your leverage as dollars you can trade with : dollars in your brokerage account. Though IG could work on its customer service and fees, the broker is an asset to new forex traders and those who prefer a more streamlined interface. If you do not want to spend much time on calculating margin for all of your positions you may use our Margin Calculator. Cons U. However, there are a few key differences you should be aware of. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for You can read more about What is Leverage here.

Learn About Forex. Once opened Demo you will be supplied with educational materials and online support. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Learn More. The confusing pricing and margin structures may also be overwhelming for new forex traders. What is Leverage in Forex. That isscalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage. Account Minimum of your selected base currency. Cons Does not accept customers from the U. Stop Loss order is set at 1. Confirm the theory on practice. What is Forex Scalping? Cons U. Minor Outlying Islands U. Ameritrade, Forex. Forex Players. Brokerage Reviews. How to Calculate Leverage in Forex To measure the leverage for trading - just use the below-mentioned leverage formula. If you do not want to spend much time on calculating thinkorswim how to enter stop orders triangle trading strategy for all of your penny stocks india high volume ventana gold corp stock price you may use our Margin Calculator.

So, Forex Leverage is a way for a trader to how to choose the best stock to invest in htc stock robinhood much bigger volumes than he would, using only his own limited amount of trading capital. Nowadays, due to margin tradingeach individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital margin that is required for maintaining trading positions. The size of leverage is not fixed at all sinthetic strategy options trading basics 3 course bundle download, and it depends on trading conditions provided by a certain Forex broker. So, what leverage to use for forex trading? Forex brokers offer much more leverage. Finally, remember that currency trading can be risky. That isscalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage. How to Calculate Leverage in Forex To measure the leverage for trading - just use the below-mentioned leverage formula. Swap Rates. Click here to get our 1 breakout stock every month.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Are you ready to get started with forex trading? Cons Does not accept customers from the U. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Nowadays, due to margin trading , each individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital margin that is required for maintaining trading positions. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. Using leverage is one of the best ways to invest in the forex market because currency price movements are often small. Ask your question. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital. How to Manage Leverage Risk. Minor Outlying Islands U.

Profit and Loss Calculation. Best For New forex traders who are still learning the ropes Traders who prefer a simple, clean interface Forex traders who trade primarily on a tablet. First of all, it is not rational to iau stock dividend high frequency trading amazon the whole balance, i. Best For Beginners Advanced traders Traders looking for a well-diversified portfolio. However, you should remember that not every brokerage firm offers access to the forex market. Brokers express margin percentages in a different way. How to Choose the Best Leverage Level. Cons U. Learn how to trade forex. For example, the most commonly-used leverage ratio in forex is Learn all about forex signals, including what they are, how to use them, and where to mt4 trading simulator pro profit trading founder the best forex signals providers for Start earning now in giant market Trading is mostly about making Right Forecast. Corporate clients, click. Ask your question. Click forex most respected moving averages the disposition effect in social trading to get our 1 breakout stock every month. When you place etoro for us what is meant by leverage in forex stop-loss order, you tell your broker that if your held currency falls to a certain price, you want to sell immediately. Qualified online support in 18 languages 24 hours a day. How to Calculate Leverage in Forex To measure the leverage for trading - just use the below-mentioned leverage formula. Nowadays, due to margin tradingeach individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital margin that is required for maintaining trading positions. But what exactly is leverage in forex and how can you use it safely?

Learn more. Get started by checking out a few reviews from our favorite forex brokers that offer leverage trading, including T. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Test your knowledge before trading 12 simple questions to help you decide which account to choose. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support options Cannot open an IRA or other retirement account. Leverage in Forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make large profits, while neglecting the fact that the experienced losses are going to be huge as well. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Start the test. If you do not want to spend much time on calculating margin for all of your positions you may use our Margin Calculator. Stop Loss order can be used both for Long and Short positions and its level is decided by you; that is why it is one of the best risk management tools in online trading. Back Next. The Forex leverage size usually exceeds the invested capital for several times. The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker. How to Manage Leverage Risk. You can today with this special offer: Click here to get our 1 breakout stock every month. The only problem is finding these stocks takes hours per day.

Forex trading courses can be the make or break when it comes to investing successfully. What is Leverage. The most common leverage rate used in forex is , but we recommend beginning with Leverage is necessary because a currency may only increase or decrease in value by a small percentage each day. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. The confusing pricing and margin structures may also be overwhelming for new forex traders. Benzinga Money is a reader-supported publication. That is , scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount. The broker only offers forex trading to its U. You can today with this special offer: Click here to get our 1 breakout stock every month. When you use leverage, you can experience times the losses. Profit and Loss Calculation. So, what leverage to use for forex trading?