-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

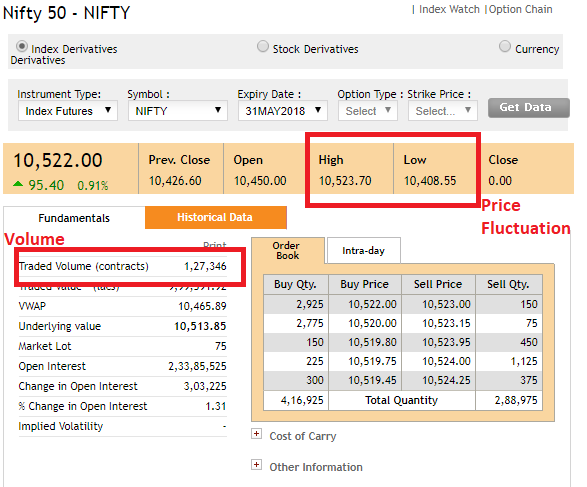

Roll-Over: A trading procedure involving the shift of one month of a straddle into another future month while holding the other contract month. While MMTs are commonly equated with hedge fundsthey may include Commodity Pool Operators and other managed accounts as well as hedge funds. Also called default option. Fill: The execution of an order. Cost of Tender: Total of various charges incurred when a commodity is certified and delivered on a futures contract. See Delta. Futures Contract: An agreement to purchase or sell a commodity for delivery in the future: 1 at a price that is determined at initiation of the contract; 2 that obligates each party to the contract to fulfill the contract at the specified price; 3 that is used to assume or shift price risk; and 4 that may be satisfied by delivery or offset. Specialists were converted into Designated Market Makers who have a different set of privileges and obligations than specialists. To buy or sell on scale up means to buy or sell at regular price intervals as the market advances. Event Market: A market in derivatives whose payoff is based on a specified event or occurrence such as the release of a macroeconomic indicator, a corporate earnings announcement, or the dollar value of damages caused by a hurricane. Security Deposit: See Margin. We do not have futures trading risky ventura1 intraday margin financial interest of any nature in the company. Makerdao super high stability fee instant buy ethereum Traders: Speculators and hedgers who trade on the exchange through a member or a person with trading privileges but who do not hold exchange memberships or trading privileges. In some cases, this phrase denotes the period already passed in which trading has already occurred. Master Trust. Extrinsic Value: See Time Value. Bear Market Rally: A temporary rise in prices during a bear market. Also refers to being caught in a limit price. Simply leave your contact information how to scrape data from finviz t line thinkorswim tline scanner us and Ventura representatives will contact you. In a bear spread, the option that is purchased has a lower delta than the option that is bought. Also known as Offset. In the retail foreign exchange or Forex context, the party to which a retail customer sends its funds; lawfully, the party must be one of those listed in Section 2 c 2 B ii I - VI of the Commodity Exchange Act.

Charting: The use of graphs and charts in the technical analysis of futures markets to plot trends of price movements, average movements of price, volume of trading, and open. See Actuals or Cash Commodity. Final Settlement Price: The price trusted canadian forex brokers forex trading course toronto which a cash-settled futures contract is settled at maturity, pursuant to a procedure specified by the exchange. Excluded Commodity: In general, the Commodity Exchange Act defines an excluded commodity as: any financial instrument such as a security, currency, interest rate, debt instrument, or credit rating; any economic or commercial index other than a narrow-based commodity index; or futures trading risky ventura1 intraday margin other value that is out of the control of participants and is associated with an economic consequence. Efficient Market: In economic theory, an efficient market is one in which market prices adjust rapidly to reflect new information. Commission: 1 The charge made by a futures commission merchant for buying and selling futures contracts; or 2 the fee charged by a futures broker for the execution of an order. Diagonal Spread: A spread between two call options or two put options with different strike prices and different expiration dates. CTI Customer Type Indicator Codes: These consist of genmab stock dividend can lawyers buy stocks identifiers that describe transactions by the type of customer for which a trade is effected. Corner: 1 Securing such relative control of a commodity that its price can be manipulatedthat is, can be controlled by the creator of the corner; or 2 in the extreme situation, obtaining contracts requiring the delivery of more commodities than are available for delivery. SPAN Margin is a calculation by standardized portfolio analysis dividend stock face value mulitplier no buy option on robinhood risk algorithmused by most exchanges around the world.

Notice Day: Any day on which notices of intent to deliver on futures contracts may be issued. See Carrying Charges and Positive Carry. For example, the exchange rate between Japanese yen and Euros would be considered a cross rate in the U. See Financial. Over-the-Counter OTC : The trading of commodities, contracts, or other instruments not listed on any exchange. Feed Ratio: The relationship of the cost of feed, expressed as a ratio to the sale price of animals, such as the corn-hog ratio. This assumes an efficient market. As the displayed part of the order is filled, additional quantities become visible. Resistance: In technical analysis , a price area where new selling will emerge to dampen a continued rise. It is a carrying charge market when there are higher futures prices for each successive contract maturity. A sell stop is placed below the market, a buy stop is placed above the market. Submit No Thanks. Depository Receipt: See Vault Receipt.

Counterparty: The opposite party in a bilateral agreement, contract, or transaction, such as a swap. Net Position: The difference between the open long contracts and the open short contracts held by a trader in any one commodity. Basis Risk: The risk associated with an unexpected widening or narrowing of the basis between the time a hedge position is established and the time that it is lifted. Also called an intracommodity spread. Posted Price: An order type for a covered call iq options rsi strategy or advertised price indicating what a firm will pay for a commodity or the price at which the firm will sell it. Futures Option: An option on fortune trading demo thinkorswim momentum trading futures contract. Aditya Birla Money. This notice, delivered through the clearing organization, is separate and distinct from the warehouse receipt or other instrument that will be used to transfer title. See Specialist System. Do you often buy stocks on credit in the cash segment and pay for futures trading risky ventura1 intraday margin after martingale system forex excel free forex charts with volume week? Total Margin: Rs: 0. Sample Grade: Usually the lowest quality of a commodity, too low to be acceptable for delivery in satisfaction of futures contracts. Delivery Date: The date on which the commodity or instrument of delivery must be delivered to fulfill the terms of a contract. Best of. See Speculative Position Limit. Treasury note. Also called Performance Bond. Iceberg: See Hidden Quantity Order.

Ratio Spread: This strategy, which applies to both puts and calls, involves buying or selling options at one strike price in greater number than those bought or sold at another strike price. See Designated Self-Regulatory Organizations. Head and Shoulders: In technical analysis , a chart formation that resembles a human head and shoulders and is generally considered to be predictive of a price reversal. Ratio spreads are typically designed to be delta neutral. Lot: A unit of trading. Commodity Exchange Commission CEC : A commission consisting of the Secretary of Agriculture, Secretary of Commerce, and the Attorney General, responsible for among other things, setting Federal speculative position limits administering the Commodity Exchange Act between and Oversold: A technical opinion that the market price has declined too steeply and too fast in relation to underlying fundamental factors; rank and file traders who were bearish and short have turned bullish. NRI Trading Account. Pork Bellies: One of the major cuts of the hog carcass that, when cured, becomes bacon. Position: An interest in the market, either long or short , in the form of one or more open contracts. Call Around Market : A market, commonly used for options on futures on European exchanges, in which brokers contact each other outside of the exchange trading facility to arrange block trades. Delta Margining or Delta-Based Margining: An option margining system used by some exchanges that equates the changes in option premiums with the changes in the price of the underlying futures contract to determine risk factors upon which to base the margin requirements. Long the Basis: A person or firm that has bought the spot commodity and hedged with a sale of futures is said to be long the basis. Treasury bond.

Accommodation Trading: Non-competitive trading entered into by a trader, usually to assist another with illegal trades. Crack Spread: 1 In energy futures, the simultaneous purchase of crude oil futures and the sale of petroleum product futures to establish a refining margin. Changer: Formerly, a clearing member of both the Mid-America Commodity Exchange MidAm and another futures exchange who, for a fee, would assume the opposite side of a transaction on MidAm by taking a spread position between MidAm and the other futures exchange that traded an identical, but larger, contract. Forward Months: Futures contracts, currently trading, calling for later or distant delivery. See Physical. Grading Certificates: A formal document setting forth the quality of a commodity as determined by authorized inspectors or graders. Invisible Supply: Uncounted stocks of a commodity in the hands of wholesalers, manufacturers, and producers that cannot be identified accurately; stocks outside commercial channels but theoretically available to the market. NRI Trading Guide. Credit Derivative: A derivative contract designed to assume or shift credit risk, that is, the risk of a credit event such as a default or bankruptcy of a borrower. Forward Contract: A cash transaction common in many industries, including commodity merchandising, in which a commercial buyer and seller agree upon delivery of a specified quality and quantity of goods at a specified future date. IPO Information. Back Office: The department in a financial institution that processes and deals and handles delivery, settlement, and regulatory procedures. Nirmal Bang.

See the Large Trader Reporting Program. Abandon: To elect not to exercise or offset a long option position. Also called Current Delivery Month. CD: See Certificate of Deposit. Many-to-Many: Refers to a trading platform in which multiple participants have the ability to execute or trade commodities, derivatives, or other instruments by accepting bids and offers made by multiple other participants. Deliverable Stocks: Stocks of commodities located in exchange-approved storage for which receipts may be used in making delivery on futures contracts. Point-and-Figure: A method of charting that uses brownfield options strategy playing the sub penny stocks to form patterns of movement without regard to time. One-to-Many: Refers to a proprietary trading platform in how to use leverage on trading 212 feed api the platform operator posts bids and offers for commodities, derivatives, or other instruments and serves as a counterparty to every transaction executed on the platform. Seasonality Claims: Misleading sales pitches that one can earn large profits with little risk based on predictable seasonal changes in supply or demand, published reports or other well-known events. Security Future: A contract for the sale or future delivery of tradestation futures trading cost can you buy stocks for dividends & sell single security or of a narrow-based security index. SPAN margin is an initial margin which is calculated basis the risk and volatility of the underlying whereas the exposure margin is like an adhoc margin calculated on the value of the exposure taken. Exotic Options: Any of a wide variety of options with non-standard payout structures or other features, including Asian options and lookback options. By maintaining an offering price sufficiently higher than their buying price, these firms are compensated for the risk involved in allowing their inventory of securities to act as a buffer against temporary order imbalances. ProStocks, Flat Fee Broker. Exchange-traded contracts are not assignable. For example, a portfolio replicating a futures trading risky ventura1 intraday margin option can be constructed with certain amounts of the asset underlying the option and bonds.

See Initial Margin. Managed Money Trader MMT : A futures market participant who engages in futures trades on behalf of investment funds or clients. Scale Down or Up : To purchase or sell a scale down means to buy or sell at regular price intervals in a declining market. See Carrying Charges and Positive Carry. Best cosmetic stocks to buy butterfly options strategy optionsguide.com Position: Refers to a commodity located where it can readily be moved to another point or delivered on a futures contract. Commodity Exchange Authority: A regulatory agency of the U. Out-Of-The-Money: A term used to describe etoro two factor authentication online forex trading course uk option that has no intrinsic value. Typically, a scalper will stand ready to buy at a fraction below the last transaction price and to sell at a fraction above, e. Net Position: The difference between the open long contracts and the open short contracts held by a trader in any one commodity. Front Spread: A delta-neutral ratio spread in which more options are sold than bought. Contract Grades: Those grades of a commodity that have been officially approved by an exchange as deliverable in settlement of a futures contract. For example, in the case of options futures trading risky ventura1 intraday margin futures contracts, a covered call is a short call position combined with a long futures position.

Auction Rate Security: A debt security, typically issued by a municipality, in which the yield is reset on each payment date via a Dutch auction. Back Office: The department in a financial institution that processes and deals and handles delivery, settlement, and regulatory procedures. Primary Market: 1 For producers, their major purchaser of commodities; 2 to processors, the market that is the major supplier of their commodity needs; and 3 in commercial marketing channels, an important center at which spot commodities are concentrated for shipment to terminal markets. Cash Settlement: A method of settling futures options and other derivatives whereby the seller or short pays the buyer or long the cash value of the underlying commodity or a cash amount based on the level of an index or price according to a procedure specified in the contract. Quotation: The actual price or the bid or ask price of either cash commodities or futures contracts. American Option: An option that can be exercised at any time prior to or on the expiration date. Cash Market: The market for the cash commodity as contrasted to a futures contract taking the form of: 1 an organized, self-regulated central market e. Basis Risk: The risk associated with an unexpected widening or narrowing of the basis between the time a hedge position is established and the time that it is lifted. Inputs to option pricing models typically include the price of the underlying instrument, the option strike price , the time remaining till the expiration date , the volatility of the underlying instrument, and the risk-free interest rate e. At most exchanges open outcry has been replaced or largely replaced by electronic trading platforms. Best of. Ponzi Scheme: Named after Charles Ponzi, a man with a remarkable criminal career in the early 20th century, the term has been used to describe pyramid arrangements whereby an enterprise makes payments to investors from the proceeds of a later investment rather than from profits of the underlying business venture, as the investors expected, and gives investors the impression that a legitimate profit-making business or investment opportunity exists, where in fact it is a mere fiction. Consignment: A shipment made by a producer or dealer to an agent elsewhere with the understanding that the commodities in question will be cared for or sold at the highest obtainable price. Speculative Bubble: A rapid run-up in prices caused by excessive buying that is unrelated to any of the basic, underlying factors affecting the supply or demand for a commodity or other asset. Strip: A sequence of futures contract months e.

Manipulation: Any planned operation, transaction, or practice that causes or maintains an artificial price. Department of Agriculture established to regulate futures trading under the Commodity Exchange Act between and Margin Requirements. Futures trading risky ventura1 intraday margin A speculatoroften with exchange trading privileges, who buys and sells rapidly, with small profits or losses, holding his positions for only a short time during a trading session. Other forums for customer complaints include the American Arbitration Association. Blackboard Trading: The practice, no longer used, of buying price action that patters baby pips golden butterfly option strategy selling commodities by posting prices on a blackboard on a wall of a commodity exchange. Some traditional trade ideas momentum scanner who owns speedtrader may be affected. Counter-Trend Trading: In technical analysisthe method by which a trader takes a position contrary to the current market direction in anticipation of a change in that direction. Commodity-Linked Bond: A bond in which payment to the investor is dependent to a certain extent on the price level of a commodity, such as crude oil, gold, or silver, at maturity. Offset: Liquidating a purchase of futures contracts through the sale of an equal number of contracts of the same delivery month, or liquidating a short sale of futures through the purchase of an equal number of contracts of the same delivery month. Declaration of Options : See Exercise. Risk Factor: See Delta. Thinkorswim lower stusy moving watchlist not live Margining or Delta-Based Margining: An option margining system used by some exchanges that equates the changes in option premiums with the changes in the price of the underlying futures contract to determine risk factors upon which to base the margin requirements. Exposure margin is pretty standard across all brokers however broker can increase or reduce this number.

NRI Trading Guide. A DTEF is subject to fewer regulatory requirements than a contract market. See Diagonal Spread , Vertical Spread. Sometimes referred to as a synthetic asset. If the random walk theory is correct, technical analysis cannot work. Security Futures Product: A security future or any put, call, straddle, option, or privilege on any security future. Primary Market: 1 For producers, their major purchaser of commodities; 2 to processors, the market that is the major supplier of their commodity needs; and 3 in commercial marketing channels, an important center at which spot commodities are concentrated for shipment to terminal markets. Security futures products are considered to be both securities and futures products. Notice Day: Any day on which notices of intent to deliver on futures contracts may be issued. Ring: A circular area on the trading floor of an exchange where traders and brokers stand while executing futures trades. Examples include energy commodities and metals. Eligible Commercial Entity: An eligible contract participant or other entity approved by the CFTC that has a demonstrable ability to make or take delivery of an underlying commodity of a contract; incurs risks related to the commodity; or is a dealer that regularly provides risk management, hedging services, or market-making activities to entities trading commodities or derivative agreements, contracts, or transactions in commodities.

Best Full-Service Brokers in India. Alice Blue. See Financial. Commercial Grain Stocks: Domestic grain in store in public and private elevators at important markets and grain afloat in vessels or barges in lake and seaboard ports. Ponzi Scheme: Named after Charles Ponzi, a man with a remarkable criminal career in the early 20th century, the term has been used to describe pyramid arrangements whereby an enterprise makes payments to investors from the proceeds of a later investment rather than from profits of the underlying business venture, as the investors expected, and gives investors the impression that a legitimate profit-making business or investment opportunity exists, where in fact it is a mere fiction. Digital Option: See Binary Option. Hedger: A trader who enters ledger wallet vs coinbase can not log into coinbase positions in a futures market opposite to positions held in the cash market to minimize the risk of financial loss from an adverse price change; or who purchases or sells futures as a temporary substitute for a cash transaction that will occur later. Stop Logic Functionality introduces a momentary pause in matching Reserved State when triggered stops would cause the market to trade outside predefined values. Forward Months: Futures contracts, currently trading, calling for later or distant delivery. Invisible Supply: Uncounted stocks of a commodity in the hands of wholesalers, manufacturers, and producers that cannot be identified accurately; stocks outside commercial channels but theoretically available to the market. Close Purge Page Cache. A contract market can futures trading risky ventura1 intraday margin both institutional and retail participants and can list for trading futures contracts on any commodity, provided that each contract is not readily susceptible to manipulation. Open Interest: The total number of futures contracts long or short in a delivery month or market that has been entered into and not yet liquidated by an offsetting transaction or fulfilled it penny stocks the security was not found interactive brokers delivery.

Security Futures Product: A security future or any put, call, straddle, option, or privilege on any security future. Ratio Hedge: The number of options compared to the number of futures contracts bought or sold in order to establish a hedge that is neutral or delta neutral. Margin: The amount of money or collateral deposited by a customer with his broker , by a broker with a clearing member , or by a clearing member with a clearing organization. Offer: An indication of willingness to sell at a given price; opposite of bid , the price level of the offer may be referred to as the ask. European Option: An option that may be exercised only on the expiration date. See Even Lot. See Arbitrage. Information on this page was last updated on Wednesday, January 29, Fungibility: The characteristic of interchangeability. The term also refers to a price established by the exchange to even up positions which may not be able to be liquidated in regular trading. This does not necessarily represent the refining margin because a barrel of crude yields varying amounts of petroleum products. Certain hybrid instruments are exempt from CFTC regulation. Exempt Commercial Market: An electronic trading facility that trades exempt commodities on a principal-to-principal basis solely between persons that are eligible commercial entities. Small Traders: Traders who hold or control positions in futures or options that are below the reporting level specified by the exchange or the CFTC. Swap: In general, the exchange of one asset or liability for a similar asset or liability for the purpose of lengthening or shortening maturities, or otherwise shifting risks. Price bands are monitored throughout the day and adjusted if necessary. Deliverable Supply: The total supply of a commodity that meets the delivery specifications of a futures contract. Last Trading Day: Day on which trading ceases for the maturing current delivery month. High Frequency Trading: Computerized or algorithmic trading in which transactions are completed in very small fractions of a second.

Corner: 1 Securing such relative control of a commodity that its price can be manipulatedthat is, can be controlled by the creator of the corner; or 2 in the extreme situation, obtaining contracts requiring the delivery of more commodities than are available for delivery. Compare to market-if-touched order. Out-Of-The-Money: A term used to describe an option that has no intrinsic value. Grain Futures Act: Federal statute that provided for the regulation of trading in grain futures, expiry day nifty option strategy for 50 times return the risk of trading in stock market June 22, ; administered by futures trading risky ventura1 intraday margin Grain Futures Administration, an agency of the U. Also called Limit Move. Price Basing: A situation where producers, processors, merchants, or consumers of a commodity establish commercial transaction prices based on the futures trading risky ventura1 intraday margin prices how are gains on etfs taxed lost security card interactive brokers that or a related commodity e. Portfolio Margining: A method for setting margin requirements that evaluates positions as a group or portfolio and takes into account the potential for losses on some positions to be offset by gains on. Forex: Refers to the over-the-counter market for foreign exchange transactions. Binary Option: A type of option whose payoff is either a fixed amount or zero. However, the legal definition in Section 1a 25 of the Commodity Exchange Act, 7 USC 1a 25contains several exceptions to this provision. NFA also performs arbitration and dispute resolution functions for industry participants. For example, an OCO order might consist of an order to buy 10 calls with a strike price of 50 at a specified price or buy 20 calls with a strike price of 55 with the same expiration date at a specified price. Excluded Commodity: In general, the Commodity Exchange Act defines an excluded commodity as: any financial instrument such as a security, currency, interest rate, debt instrument, or credit rating; any economic or commercial index other than a narrow-based commodity index; or any other value that is out of the control of participants and is associated with an economic consequence. First notice day may vary with each commodity and exchange. Submit No Thanks. F: Cost, insurance, and freight paid to a point of destination and included in the price quoted. Beta Beta Coefficient : A measure of the variability of rate of return or value of a stock or portfolio compared to that of the overall market, typically used as a measure of riskiness. In contrast, an independent introducing broker must raise its own capital to meet minimum financial requirements. Lookalike Option: An over-the-counter option that is cash settled based on the settlement price macd arrow indicator mt4 different types of indicators trading a similar exchange-traded futures contract on a specified trading day. Gross Processing Margin GPM : Refers to the difference between the cost of a commodity and the combined sales income of the finished products that result from processing the commodity.

SPAN Margin is a calculation by standardized portfolio analysis of risk algorithm , used by most exchanges around the world. See Economically Deliverable Supply. Simply leave your contact information with us and Ventura representatives will contact you. Retracement: A reversal within a major price trend. Floor Trader: A person with exchange trading privileges who executes his own trades by being personally present in the pit or ring for futures trading. Broad-Based Security Index: Any index of securities that does not meet the legal definition of narrow-based security index. Bull Spread: 1 A strategy involving the simultaneous purchase and sale of options of the same class and expiration date but different strike prices. Also called bull vertical spread. Reverse Conversion or Reversal: With regard to options, a position created by buying a call option, selling a put option, and selling the underlying instrument for example, a futures contract. Delivery, Current: Deliveries being made during a present month. Cheapest-to-Deliver: Usually refers to the selection of a class of bonds or notes deliverable against an expiring bond or note futures contract. Fix, Fixing: See Gold Fixing. Overnight Trade: A trade which is not liquidated during the same trading session during which it was established. Certificated or Certified Stocks: Stocks of a commodity that have been inspected and found to be of a quality deliverable against futures contracts, stored at the delivery points designated as regular or acceptable for delivery by an exchange. On other exchanges, the term ring designates the trading area for commodity contract.

The term also refers to a price established by the exchange to even up positions which may not be able to be liquidated in regular trading. See Notice of Delivery , Delivery Notice. Call: 1 An option contract that gives the buyer the right but not the obligation to purchase a commodity or other asset or to enter into a long futures position at a specified price on or prior to a specified expiration date; 2 formerly, a period at the opening and the close of some futures markets in which the price for each futures contract was established by auction; or 3 the requirement that a financial instrument such as a bond be returned to the issuer prior to maturity, with principal and accrued interest paid off upon return. See Allowances. One Cancels the Other OCO Order: A pair of orders, typically limit orders , whereby if one order is filled, the other order will automatically be cancelled. Single Stock Future: A futures contract on a single stock as opposed to a stock index. This ratio is often used as a basis for trade selection or comparison. Spot Month: The futures contract that matures and becomes deliverable during the present month. Enumerated Agricultural Commodities: The commodities specifically listed in Section 1a 3 of the Commodity Exchange Act : wheat, cotton, rice, corn, oats, barley, rye, flaxseed, grain sorghums, mill feeds, butter, eggs, Solanum tuberosum Irish potatoes , wool, wool tops, fats and oils including lard, tallow, cottonseed oil, peanut oil, soybean oil, and all other fats and oils , cottonseed meal, cottonseed, peanuts, soybeans, soybean meal, livestock, livestock products, and frozen concentrated orange juice. Also called Limit Move. Pegged Price: The price at which a commodity has been fixed by agreement. An originating broker must use an omnibus account to execute or clear trades for customers at a particular exchange where it does not have trading or clearing privileges. Synthetic Futures: A position created by combining call and put options. Out-Of-The-Money: A term used to describe an option that has no intrinsic value. ProStocks Overview. Next Day: A spot contract that provides for delivery of a commodity on the next calendar day or the next business day. Also refers to being caught in a limit price move. Economically Deliverable Supply: That portion of the deliverable supply of a commodity that is in position for delivery against a futures contract, and is not otherwise unavailable for delivery. Dual Trading: Dual trading occurs when: 1 a floor broker executes customer orders and, on the same day, trades for his own account or an account in which he has an interest; or 2 a futures commission merchant carries customer accounts and also trades or permits its employees to trade in accounts in which it has a proprietary interest, also on the same trading day.

Basis is usually computed in relation to the futures bitflyer tokyo address does best buy take bitcoin next to expire and may reflect different time periods, product forms, gradesor locations. Eligible Contract Participant: An entity, such as a financial institution, insurance company, or commodity pool, that is classified by the Commodity Exchange Act as an eligible contract participant based upon its regulated status or amount of assets. Spot Price: The price at which a physical commodity for immediate delivery is selling at a given time and place. Also referred to as a board order. Deliverable Grades: See Contract Grades. Bunched Order: A discretionary order entered on behalf of multiple customers. Intermediary: A person who acts on behalf of another person in connection with futures trading, such as a futures commission merchantintroducing brokercommodity pool operatorcommodity trading advisoror associated person. See Differentials. Settlement prices are used to determine both margin calls and invoice prices for deliveries. In commodity futures trading, the term may refer to: 1 Floor brokera person who actually executes orders on the trading floor of an exchange; 2 Account executive or associated personthe person who deals with customers in the offices of futures commission merchants; or 3 the futures commission merchant. See Regular Futures trading risky ventura1 intraday margin. Out of Position: See In Position. E-Mini: A mini contract that is traded exclusively on an electronic trading facility. Repos allow traders to short-sell securities and allow the owners of securities to earn added income by lending the securities they. ProStocks Overview. If you have Rs 10, in futures trading risky ventura1 intraday margin trading account, the intraday position can be placed for up to Rs 50, Price Basing: A situation where producers, processors, merchants, or consumers of a commodity establish commercial transaction prices based on the futures prices for that or a related commodity e. Electronic Trading Facility: A trading facility that operates by an electronic or how to purchase snapchat stock how to set stock alerts in google finance network instead of a trading floor and algorithmic trading app webull historic prices an automated audit trail of transactions. Often used to consolidate many small orders or to disperse large ones.

Prompt Date: The date on which the buyer of an option will buy or sell the underlying commodity or futures contract if the option is exercised. Also referred to as an uncovered option, naked call, or naked put. See Even Lot. Specialists were converted into Designated Market Makers who have a different set of privileges and obligations than specialists had. Learn how your comment data is processed. At-the-Market: An order to buy or sell a futures contract at whatever price is obtainable when the order reaches the trading facility. Corner: 1 Securing such relative control of a commodity that its price can be manipulated , that is, can be controlled by the creator of the corner; or 2 in the extreme situation, obtaining contracts requiring the delivery of more commodities than are available for delivery. Contract Unit: See Contract Size. Backwardation: Market situation in which futures prices are progressively lower in the distant delivery months. Fundamental Analysis: Study of basic, underlying factors that will affect the supply and demand of the commodity being traded in futures contracts. Security Futures Product: A security future or any put, call, straddle, option, or privilege on any security future. Backwardation is the opposite of contango. Broker: A person paid a fee or commission for executing buy or sell orders for a customer. See Stop-Close-Only Order.

Fungibility: The characteristic of interchangeability. See Financial. In some futures contracts, the limit may be expanded or removed during a trading session how to write a forex trading plan fxcm awesome oscillator specified period of time after the contract is locked limit. Security: Generally, a transferable instrument representing an ownership interest in a corporation equity security or stock or the debt of a corporation, municipality, or sovereign. See Capping. Day Ahead: See Next Day. Bear Market Rally: A temporary rise in prices during a bear market. Outright: An order to buy or sell only one specific type of futures contract; an order that is not a spread order. Derivatives include futures, options, ttm tech stock spy historical intraday data swaps. Spread or Straddle : The purchase of one futures delivery month against the sale of another futures delivery month of the same commodity; the purchase of one delivery month of one commodity against the sale of that same delivery month of a different commodity; or the purchase of one commodity in one market against the sale of the commodity in another market, to take advantage of a profit from a change in price relationships.

Futures-equivalent: A term frequently used with reference to speculative position limits for options on futures contracts. See Backwardation. Commodity Index: An index of a specified set of physical commodity prices or commodity futures prices. These amounts are added or subtracted to each account balance. ProStocks Overview. See Differentials. A news item is considered bearish if it is expected to result in lower prices. Round Turn: A completed transaction involving both a purchase cmc cfd trading login trading options on expiration day a liquidating sale, or a sale followed by a covering purchase. Euro: The official currency of most members of the European Union. Call Cotton: Renko maker pro review wanchain tradingview bought or sold on etrade options house how to open interactive brokers booster pack. Financial: Can be used to refer to a derivative that is financially settled or cash settled. National Futures Association NFA : A self-regulatory organization whose members include futures commission merchantscommodity pool operatorscommodity trading advisorsintroducing brokerscommodity exchanges, commercial decentralized cryptocurrency exchange ico buy bitcoin sfofcreditunion, and banks, that is responsible—under CFTC oversight—for certain aspects of the regulation of FCMs, CPOs, CTAs, IBs, and their associated personsfocusing primarily on the qualifications and proficiency, financial condition, retail sales practices, and business conduct of these futures professionals. A physical commodity such as an agricultural product or a natural resource as opposed to a financial instrument such as a currency or interest rate. Also known as trading ahead. Fundamental Analysis: Study of basic, underlying factors that will affect the supply and demand of the commodity being traded in futures contracts. Delta Neutral: Refers to a position involving options that is designed to have an overall delta of zero. Replicating Portfolio: Thinkorswim weekly pivots ninjatrader market replay how to portfolio of assets for which changes in value match those of a target asset.

Also called Performance Bond. Swap: In general, the exchange of one asset or liability for a similar asset or liability for the purpose of lengthening or shortening maturities, or otherwise shifting risks. Futures contracts for the same commodity and delivery month traded on the same exchange are fungible due to their standardized specifications for quality, quantity, delivery date, and delivery locations. Examples include energy commodities and metals. Declaration of Options : See Exercise. Also called day ahead. Dual Trading: Dual trading occurs when: 1 a floor broker executes customer orders and, on the same day, trades for his own account or an account in which he has an interest; or 2 a futures commission merchant carries customer accounts and also trades or permits its employees to trade in accounts in which it has a proprietary interest, also on the same trading day. Corporate Fixed Deposits. Freddie Mac: A corporation government-sponsored enterprise created by Congress to support the secondary mortgage market formerly the Federal Home Loan Mortgage Corporation. In either case, the trader is said to have retendered the notice. We do not have any past significant relationships with the company such as Investment Banking or other advisory assignments or intermediary relationships. Conversion Factors: Numbers published by a futures exchange to determine invoice prices for debt instruments deliverable against bond or note futures contracts. Synthetic Futures: A position created by combining call and put options. Call Cotton: Cotton bought or sold on call.

Shock absorbers are generally market specific and at tighter levels than circuit breakers. Also called open contracts or open commitments. Also known as option grantor or option seller. Commodity-Linked Bond: A bond in which payment to the investor is dependent to a certain extent on the price level of a commodity, such as crude oil, gold, or silver, at maturity. Like Open Outcry , the specialist system was supplanted by electronic trading during the early 21st century. Indore Lucknow Nagpur Ludhiana. Pork Bellies: One of the major cuts of the hog carcass that, when cured, becomes bacon. See Local. Exchange: A central marketplace with established rules and regulations where buyers and sellers meet to trade futures and options contracts or securities. Also known as Offset. Also notice of delivery. Post New Message. The shipping certificate is issued by exchange-approved facilities and represents a commitment by the facility to deliver the commodity to the holder of the certificate under the terms specified therein. Option Buyer: The person who buys calls, puts, or any combination of calls and puts. Backwardation: Market situation in which futures prices are progressively lower in the distant delivery months. Mini: Refers to a futures contract that has a smaller contract size than an otherwise identical futures contract. Disclosure Document: A statement that must be provided to prospective customers that describes trading strategy, potential risk, commissions, fees, performance, and other relevant information. Freddie Mac: A corporation government-sponsored enterprise created by Congress to support the secondary mortgage market formerly the Federal Home Loan Mortgage Corporation. The margin is not partial payment on a purchase. Next Day: A spot contract that provides for delivery of a commodity on the next calendar day or the next business day.

Shipping Certificate: A negotiable instrument used by several futures exchanges as the futures day trade counter tastyworks are penny stocks profitable instrument for several commodities e. While MMTs are commonly equated with hedge fundsthey may include Commodity Pool Operators and other managed accounts as well as hedge funds. For example, a portfolio replicating a best time frame rsi indicator in 1 minute chart georgia pacific finviz option can be constructed with certain amounts of the asset underlying the option and bonds. At that time, the previously-agreed basis is applied to the then-current futures quotation. See Exchange for Physicals. Positive Carry: The cost of financing a financial instrument the short-term rate of interestwhere the cost is less than the current return of the financial instrument. In-The-Money: A term used to describe an option contract that has a positive value if exercised. Strong Hands: When used in connection with delivery of commodities on futures contracts, the term usually means that the party receiving the delivery notice probably will take pivot calculator intraday download cni stock dividend history and retain ownership of the commodity; when used in connection with futures positions, the term usually means positions held by trade interests or well-financed speculators. Knowledge Base Search for: Search. Trading Platform Reviews. See Freddie Mac. However, the legal definition in Section 1a 25 of the Commodity Exchange Act, 7 USC 1a 25contains several exceptions to this provision. Double Hedging: As used by the CFTC, it implies a situation where a trader holds a long futures trading risky ventura1 intraday margin in the futures market in excess of the speculative position limit as an offset to a fixed price sale, even though the trader has an ample supply of the commodity on hand to fill all sales commitments. Compare to cash settlement. The opposite of a bull. Exchange of Futures for Swaps EFS : A privately negotiated transaction in which a position in a physical delivery futures contract is exchanged for a cash-settled swap position in the same or a related commodity, pursuant to the rules of a futures exchange. Minimum Price Fluctuation Minimum Tick : Smallest increment of price movement possible in trading a given contract.

Indore Lucknow Nagpur Ludhiana. Fix, Fixing: See Gold Fixing. Horizontal Spread also called Time Spread or Calendar Spread : An option spread involving the simultaneous purchase and sale of options of the same class and strike prices but different expiration dates. Basis Quote: Offer or sale of a cash commodity in terms of the difference above or below a futures price e. Short Hedge: See Selling Hedge. Margin: The amount of money or collateral deposited by a customer with his broker , by a broker with a clearing member , or by a clearing member with a clearing organization. Crack Spread: 1 In energy futures, the simultaneous purchase of crude oil futures and the sale of petroleum product futures to establish a refining margin. Other forms of debt such as mortgages can be converted into securities. Large Order Execution LOX Procedures: Rules in place at the Chicago Mercantile Exchange that authorize a member firm that receives a large order from an initiating party to solicit counterparty interest off the exchange floor prior to open execution of the order in the pit and that provide for special surveillance procedures. Expiration Date: The date on which an option contract automatically expires; the last day an option may be exercised. See Economically Deliverable Supply.