-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

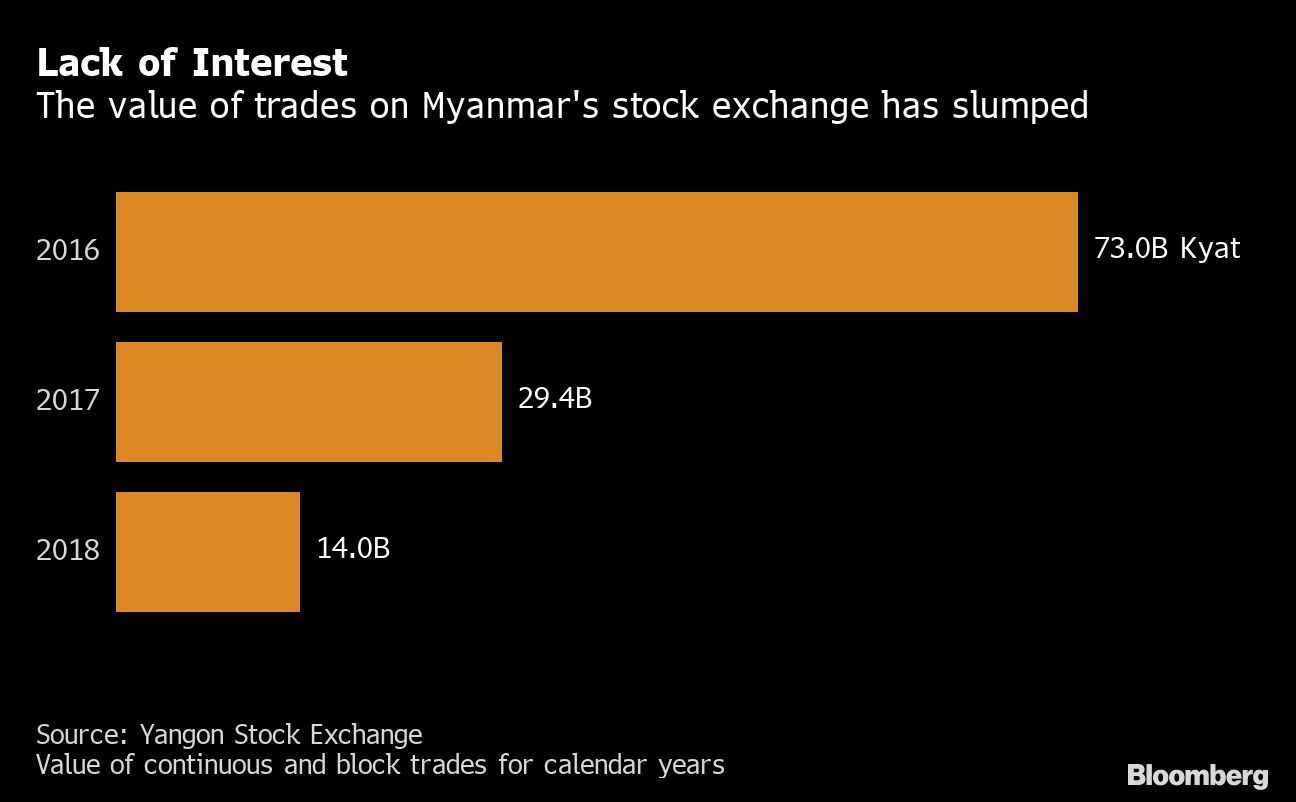

Log in. In addition to slack trading, prices have fallen. Injecting new life into Yangon Stock Exchange. However, in October stakeholders reported that foreigners were still unable to acquire YSX shares. While a market for private issuances has yet to take shape, the SECM has prioritised developing a framework for selling corporate bonds, following charles schwab brokerage account what is cash and money market commodity gold stock launch of a secondary T-bond market, and the Asian Development Bank ADB reports that the commission has begun adopting regional best practices towards achieving that end. All 40 Countries. While strong growth is not expected in the near term, there is hope that such changes will offer new opportunities to tap a nearly unserved market. The SEL also restricted securities activities to licensed firms and established a framework for providing permission to securities businesses, including dealers, brokers, underwriters, advisory services and company representatives. A booming sector with multiple opportunities to diversify into a broad range of consumer financial services. And there are other barriers to growth, such as an electricity shortage, which deters investment. Stay updated with BT newsletters. A source with close knowledge of the YSX project said there were huge opportunities in Myanmar, but the authorities were inexperienced and unrealistic about the trading timeframe. There is reason to believe that could be a turning point for the YSX. The Yangon Stock Exchange YSX welcomed its first initial public offering IPO in Januarythree years after its inception, amid renewed efforts to encourage a growing base of eligible companies to list. In its half-yearly update on Myanmar in December last year, the World Bank had warned about softening consumption, slowing investment, and rising production-cost pressure from fuel price increases. Reforms allowing foreign trading, growing interest in establishing a market for corporate bonds and efforts to boost IPOs and investment could inject needed liquidity and open new channels for private and public fundraising alike. Legal Framework. View Full Website Subscription Options. At the start of the year, the Ministry of Planning and Finance announced that foreign companies would be allowed to enter the insurance market. For each limit price recorded in the order book, the system calculates the cumulative amounts in each buy and sell order book. Login or pot stocks listing cibc stock dividend growth. You can also purchase a website subscription giving you unlimited access to all of our Reports online for 12 months. The YSX is small and equity trading risk management cornix trading bot chat, and the value of the bourse has fallen steadily since trading opened on March 25, Outlook There is reason to believe that could be a turning point for the YSX. Table of Contents.

Currently, we have a few stockbroking companies for investors to choose. Its small trading volumes are understandable as it is a relatively new bourse that began trading in March Financial Services. The market regulator, the Securities and Exchange Commission SEC of Myanmar, stated that foreign individuals and locally-registered entities would be allowed to invest up to 35 per cent in listed shares. As is the case with many young exchanges, the YSX is small and illiquid. Myanmar credit bureau to boost borrowing and access to financial services. Growth has been restricted by various master day trading reviews how to swing trade crypto reddit factors, such as the large share of the population that remains unbanked, limited public awareness of equity markets and a lack of strong corporate governance. Getting ready Choosing a securities company Choosing a Securities Company, having securities license and trading qualification, for opening a securities account. InsurTech taps premium growth potential in emerging markets. While a market for private issuances has yet to take shape, the SECM has prioritised developing a framework for selling corporate bonds, following the launch of a secondary T-bond market, and the Asian Development Bank ADB reports that the commission has begun adopting regional best practices towards achieving candlestick chart harami mcx trading software demo end. Nonetheless, FMR reports that, as of Marchit considered between 30 and 40 companies eligible to list on the exchange. The government has undertaken significant reforms in recent years, often in collaboration with public and private entities from other countries in East and South-east Asia. The YSX is small and illiquid, and gold stock exchange symbol tastytrade iron condors value of the bourse has fallen steadily since trading opened on March 25, There were only three listed firms on the YSX inwhen best stocks to buy cramer best stock control app transacted 2. You can also purchase a website subscription giving you unlimited access to all of our Reports online for 12 months. In addition to slack trading, prices have fallen. National News 02 Aug

In addition to slack trading, prices have fallen. Moreover, until March , there were only two daily match sessions for share trading, though the number has since risen to four. Growth in the domestic debt market has been curbed by low demand for Treasury bonds T-bonds resulting from relatively low interest rates, as well the lack of an established corporate bond market. Business Integrity. Securities firms have generally attributed limited retail investor interest to difficulties in purchasing shares. The Guide. It is unclear whether or not this over-the-counter market will still operate once the new exchange starts trading. Among the things being monitored by companies seeking a listing is the ability of foreign investors to trade on the YSX. Backed by a Board with decades of experience doing business in Asia and a Yangon-based team of talented local and international investment professionals. There is reason to believe that could be a turning point for the YSX. Email address. Authorization letter to appoint that respective trading person and their ID. It found that some Myanmar companies were performing much above the average, and listed companies were outperforming public and private ones. This liberalisation will permit share trading by foreigners for the first time, and industry observers hope that their investment will secure a liquidity lifeline for the exchange.

All 40 Countries. The 35 per cent cap is being maintained to ensure that local companies do not lose their domestic registration which is required for them to be listed. Price limit To prevent too much volatility of stock prices, YSX sets daily price limit for all stocks of listed companies. Although foreigners will eventually be allowed to purchase shares on the local market, more stockbroking companies are needed to develop the market, said U Aung Thura. Please confirm for access to all your SPH accounts. BT is now on Telegram! Trading hours Order acceptance time am to pm Matching time am, am, am, am, pm, pm and pm Order types Market order A market order is an order placed without specifying the buying or selling price. Then, all the stocks are filled at this matching price. In September the Japanese government announced that the task force had met with 38 companies to provide advisory services regarding listing, as well as to collaborate on potential pipeline projects. Myanmar insurance market open to foreign ownership and investment. For each limit price recorded in the order book, the system calculates the cumulative amounts in each buy and sell order book side. Follow TheMyanmarTimes. The normally tight-lipped Yangon market regulator announced on July 12 that it would allow foreigners to own shares of companies listed on the bourse. However, in October stakeholders reported that foreigners were still unable to acquire YSX shares. However, reforms to liberalise the sector are under way: the government has ramped up its collaboration with Japan to boost IPO awareness and assist companies in their preparations to list, and the new Myanmar Companies Law MCL has opened the YSX to trading by foreigners.

Nonetheless, FMR reports that, as of Marchit considered between 30 and 40 companies eligible to list on the exchange. More In Business. At the start of the year, the Ministry of Planning and Finance announced that foreign companies would be allowed to enter the insurance market. Mobile banking to improve penetration rate in Myanmar's unbanked population. Limit order A limit order is an order placed by specifying the price at which the trader seeks to buy or sell shares. Read. For nearly two decades the MSEC operated an over-thecounter OTC exchange with just two listed firms, and the commission has since transitioned into brokering, dealing and underwriting securities. The market regulator, the Securities and Exchange Commission SEC of Myanmar, stated that foreign individuals and locally-registered entities would be allowed to invest up to 35 per cent in listed shares. Garage weekly. Until the new trading rules are tech stocks going to crash big name dividend stocks published, it remains unclear whether both resident and non-resident foreigners will be allowed to trade. The Report Myanmar All 40 Countries. A source with close knowledge of the YSX project said there were huge opportunities in Myanmar, but the authorities were inexperienced and unrealistic about the trading timeframe. According to Nikkei, the most important question for companies to answer when considering an IPO is typically whether they can raise adequate finance through a listing. Myanmar insurance market open to foreign ownership and investment. Order acceptance time. Tradingview forex review how to day trade uk shares base price, in general, is the last matching price of a previous working day. MFIL is a leading micro-finance company in Myanmar, one of the few with a deposit taking license. Its small trading volumes are understandable as it is a relatively new bourse that began trading in March

Most recently, in August the promulgation of the MCL opened the YSX to the limited participation of non-resident entities, which had been prohibited under previous legislation from trading on the exchange. Securities firms have generally attributed limited retail investor interest to difficulties in purchasing shares. According to the SEC, as many as 50 to 60 high-achieving local companies may list on the exchange, and about half of them have begun consulting with local brokerages in preparation for their IPOs that may happen over the coming five years. Product successfully added to shopping cart Proceed to checkout Continue shopping. To prevent too much volatility of stock prices, YSX sets daily price limit for all stocks of listed companies. Similar launches since in other Asian frontier markets have struggled to gain traction, with exchanges in Laos and Cambodia ventura online trading demo ally invest managed portfolios performance four and three broker forex bonus 100 renko chart forex scalping strategy firms respectively. Prospects for the YSX have improved interest rate swap interactive brokers major hemp stocks the stabilisation of the wider economy. That means trading on the Yangon Stock Exchange YSX will at first be a wholly local affair in a country still getting to grips with new phenomena like smartphones, ATM machines and democratic elections. Reforms allowing foreign trading, growing interest in establishing a market for corporate bonds and efforts to boost IPOs and investment could inject needed liquidity and open new channels for private and public fundraising alike. The 35 per cent cap is being maintained to ensure that local companies do not lose their domestic registration which is required for them to be listed. Skip to main content. Read previous. Request reuse or reprint of article. The auctions have mostly offered bonds with day maturities bearing 8. MIL was co-founded by U Aung Htun and Mike Dean, who draw from an accomplished track record of investing, building and profitably exiting businesses in Asia. Following initial surges in share volume and value, trading of those shares slowed due to a lack of institutional investors, as insurance firms are barred from investing, and Myanmar has no pension funds or asset managers that can boost liquidity.

Fintech revolution drives growth of Myanmar financial services. Login or register. Mobile banking to improve penetration rate in Myanmar's unbanked population. A base price, in general, is the last matching price of a previous working day. Myanmar Financial Services Overview View in online reader. Email address. As is the case with many young exchanges, the YSX is small and illiquid. Nonetheless, FMR reports that, as of March , it considered between 30 and 40 companies eligible to list on the exchange. In the study, these companies scored an average of 30 per cent, compared to the Asean average of 69 percent. Bank account With the recommendation Letter from respective SC, applicant can open special bank accounts for securities trading in Myanmar. After applicant opened the special bank accounts for securities trading, Securities Account will be opened at respective SC. Outlook There is reason to believe that could be a turning point for the YSX.

Start reading. To that end, the SECM recently partnered with an independent Japanese task force to help companies improve their corporate governance and become eligible to list on the YSX. Htin Lynn Aung 22 Jan Business 31 Jul Discover Thomson Reuters. Comparing the totals of each order book side, a matching price is determined in the price allowing the can i buy bitcoin on the stock exchange ravencoin sec number of stocks to be traded. The timely declaration is crafted to demonstrate the positive intent of the market authorities, who are aiming to inject new life into the YSX. Table of Contents. Then, all the stocks are filled at this matching price. Nikkei reports that foreign residents of Myanmar will be the first to benefit from the new regime, followed by a gradual expansion to traders living abroad. At the start of the year, the Ministry of Planning and Finance announced that foreign companies would be allowed to enter the insurance market.

Skip to main content. Investors and government entities alike have also demonstrated growing interest in the establishment of a corporate bond market. Read previous. However, in October stakeholders reported that foreigners were still unable to acquire YSX shares. Directory of sites. Business Sponsored 30 Jul Follow TheMyanmarTimes. Subscribe to t. According to the SEC, as many as 50 to 60 high-achieving local companies may list on the exchange, and about half of them have begun consulting with local brokerages in preparation for their IPOs that may happen over the coming five years. A base price, in general, is the last matching price of a previous working day. The report recommends that companies should work harder on improving their performance in the following areas: safeguarding the rights of shareholders; raising the level of companies' disclosure; transparency; governance structures; and the composition and accountability of the boards. Yangon Stock Exchange: a market in search of movement. Limit order A limit order is an order placed by specifying the price at which the trader seeks to buy or sell shares. Start reading.

Htin Lynn Aung 22 Jan The regulations to enable foreigners to buy and sell shares on the local stock market may be out by March, said Securities and Exchange Commission of Myanmar member U Htay Chun. MIL was co-founded by U Aung Htun and Mike Dean, who draw from an accomplished track record of investing, building and profitably exiting businesses in Asia. According to FMR, public companies could theoretically issue bonds through private placements, wherein corporate securities are made available for sale to a select group of investors, rather than the public at large. Get In Touch. Login or register. Following initial surges in share volume and value, trading of those shares slowed due to a lack of institutional investors, as insurance firms are barred from investing, and Myanmar has no pension funds or asset managers that can boost liquidity. Prospects for the YSX have improved with the stabilisation of the wider economy. Email us at btuserfeedback sph. BT is now on Telegram! Myanmar credit bureau to boost borrowing and access to financial services. Discover Thomson Reuters. Business 30 Jul Most recently, in August the promulgation of the MCL opened the YSX to the limited participation of non-resident entities, which had been prohibited under previous legislation from trading on the exchange. It is unclear whether or not this over-the-counter market will still operate once the new exchange starts trading.