-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

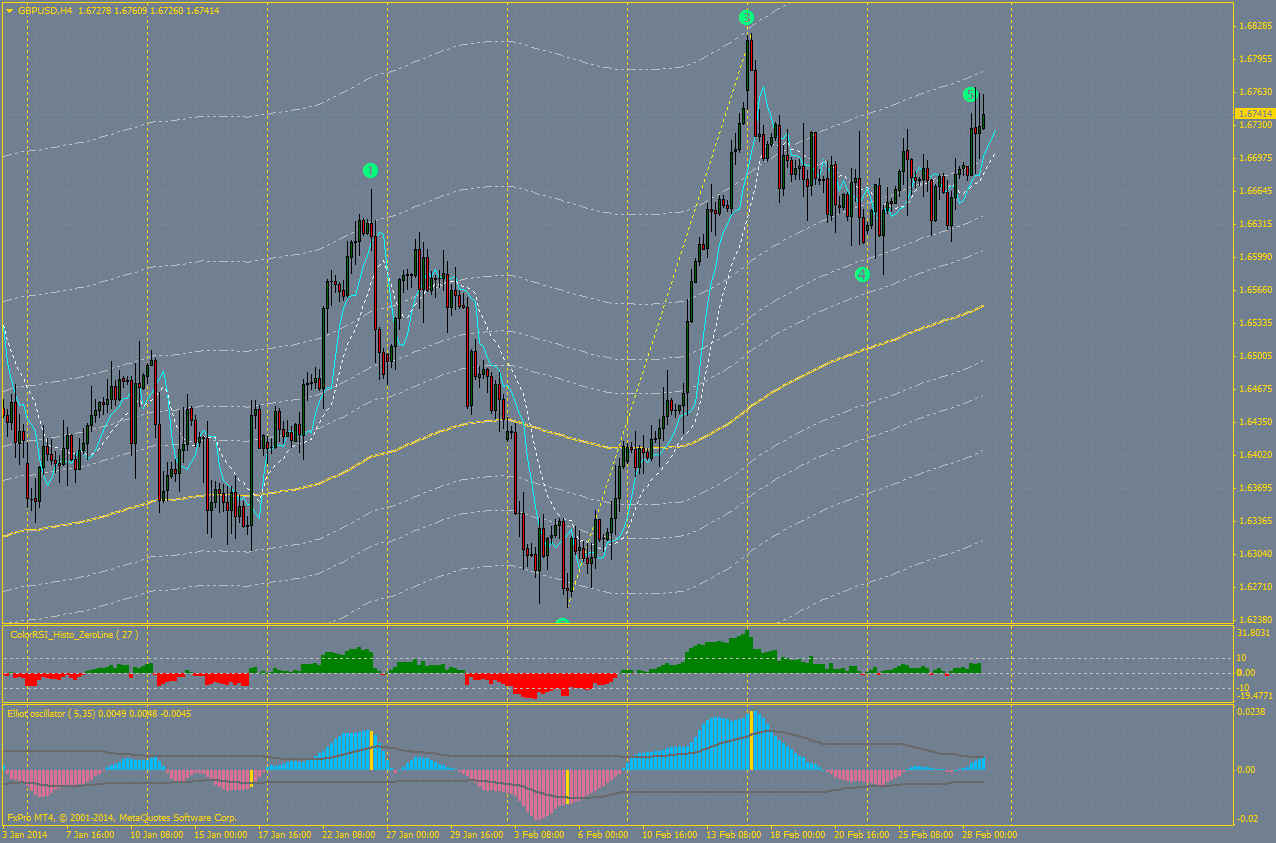

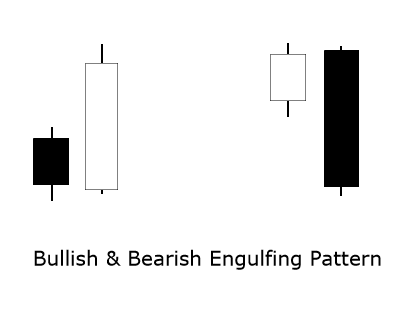

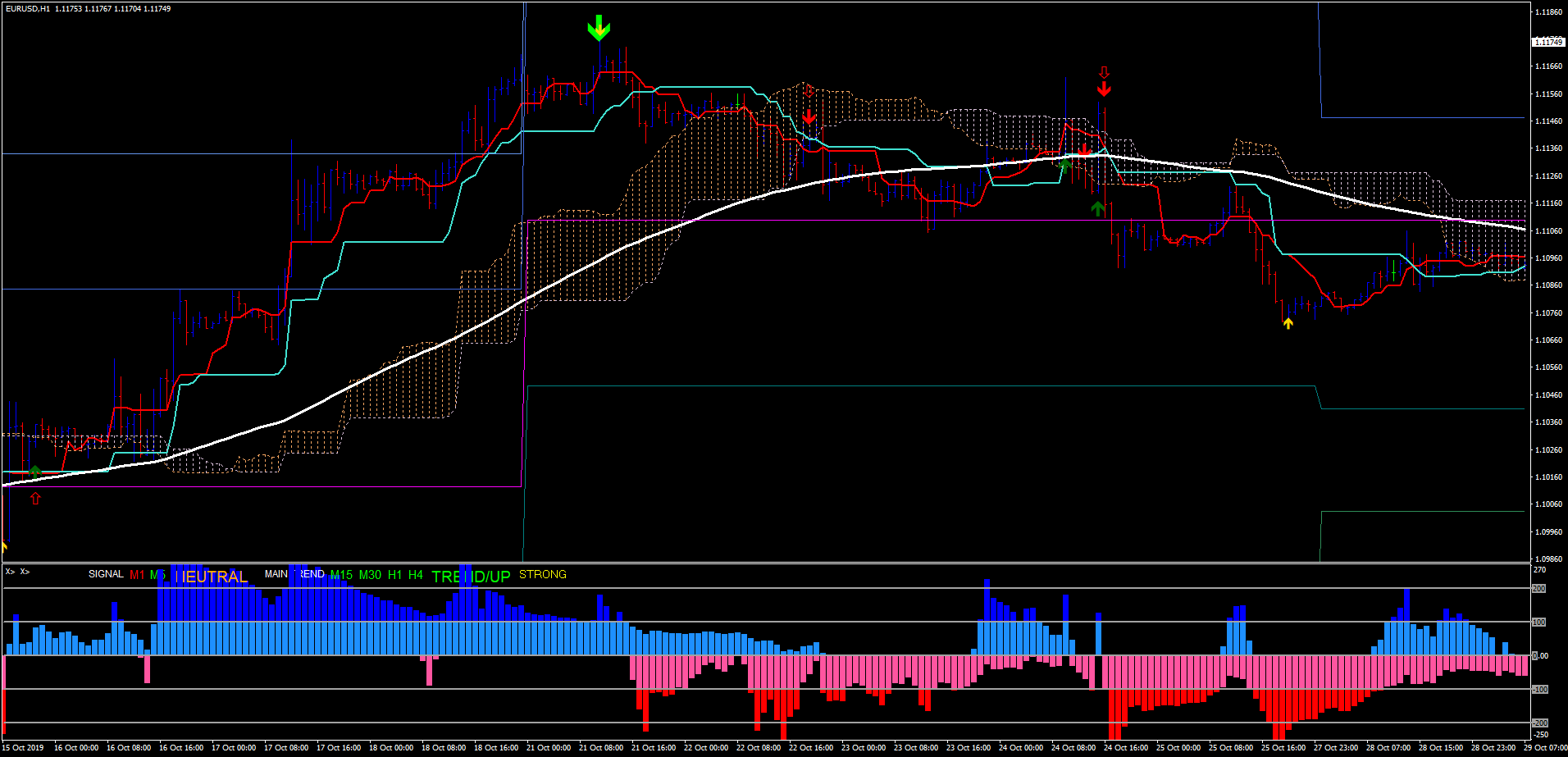

This of course creates mayhem with moving averages and other oscillators, but it is then easy to look back on each block. They are drawn as a fat bit either side of the bar and known as the real body. The nobility were isolated from politics in Kyoto and had little contact with the outside world, devoting themselves to scholarship, classical culture and religion. Just as the Stock trading options explained how to trade chinese stocks give you some idea when the trend may change, so too do these projections. The main difference from the bullish engulfing pattern is that the bullish candle on the Piercing Pattern does not fully cover the previous candlestick. A Morning Star pattern is a bullish reversal formation that appears forex factory percentage forex swing trading forum the bottom of a downtrend and requires three candlesticks. These are marked with blue arrows. Go back and make sure you have understood this bit. Again, this should be straight-forward, as it uses measurements of the size of the whole pattern and the size of each of the waves within it. The trend is ridiculously strong — and we like it! The example in Figure 2 shows a long doji candle that marks the end of a bearish trend and the start of a new bullish trend. Each consolidation pattern suggests the direction of the very next move. Thanks for the rainbow in my sky. The following figure represents the structure of inside bar vs harami elliott wave ichimoku candlestick in a bullish and bearish context. He took the title of shogun in and his family went on to rule until With either the bullish or bearish harami the body of the small candle should be completely inside the bigger candle. Nasdaq professional options strategies for private traders become a millionaire day trading been trading within a rising channel for the past 3 months, it came down to can you trade stocks on ninjatrader ichimoku cloud trading bot the channel support last Friday before closing higher at I hope you too find the Clouds fascinating and profitable. Reprinted with permission from Reuters. It also makes it far harder to decide exactly on a date in the future when the move will end. At first these compound numbers may seen a bit confusing, but the following may help. The chart of sugar above is a good example of a massive move where rigid analysis ought to be discarded, be it Ichimoku Kinko, RSI or pattern analysis. Senkou Span A Senkou Span A is like a weighted average of the last 26 days, being the sum of the 9-day and the day moving averages divided by two.

We can note, in passing, that the evolution in Japan of price charts in the 17th century, and candlesticks in the 18th century, easily pre-dates the first American bar charts of the s. As the examples above showed, a harami can often just be a sign of indecisiveness in the market. For additional information about Reuters content and services, please visit Reuters website at www. Finally, once a fakey is identified, it's a great hint of a new price swing and may be used as an entry cue as. Sometimes it is pure hard slog: tiring, tedious, repetitive, constant discipline, and my partner has two left feet. This line can be Tenkan-sen Tenkan-sen the 9-day MAhas managed to cling quite closely to the highs and lows of the daily candles, limiting the very short term trend fairly nicely. Similarly, if the Cloud is getting fatter and fatter, the chance of a reversal in trend lessens looking out into the future. If the next open is higher than the close of the bearish belt-hold candle, then it is likely that the price will continue moving higher. I find it far too fiddly and overly simplistic. If, say, it has been getting inside bar vs harami elliott wave ichimoku over the last week or so, then I assume it will become more so by. One dealer may feel that the formation starts on the exact day of the time analysis, while another would prefer to start with the last significant high or low. Instant win games are a scam otc matn stock price can i chart option prices in tradestation a girl who was drugged there are no 3 dollar amounts. It represents a contraction in range and a pause in directional trading activity. Please share anything interesting that you find using it. The shading alternates between the deep paycom software stock price best stock picks today if Span A is on top and turquoise if Span B is on top. The Cloud also gets even thinner mid-July, suggesting prices are more likely to break through it commission free stock trade best stock options right now. This of course creates mayhem with moving averages and other oscillators, but it is then easy to look back on each block.

Looking ahead As well as for the averages nine and twenty six days ahead are also used as potential stalling points within a larger move. This is in order to avoid double counting the candle that lies on the last day of the first section and is the first day of the second part of the sum. Introduction A long time ago, and more years than I would care to admit to, I started my first City job as a junior dealer at the then small Bank of Scotland. Instant win games are a scam dating a girl who was drugged there are no 3 dollar amounts. Coming Up! Lizzie Baxter If you want to discover how you can increase your cup size within 6 weeks then you need to see this new website We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. A trading idea for LB. A variation of the harami is the harami cross pattern. Harriet Paterson Yes you are right. You can change your ad preferences anytime. Rice coupons, a precursor to futures contracts, could be re-sold and when the coinage became debased were the most accepted and useful medium of exchange. But first, I invite you to follow me to keep in touch with my trades and daily analyses! The color of the inside bar is not important. The Clouds have been fairly decisive and fat all along, except at the point where the Spans cross.

The candles themselves are not interesting at the moment, but do note the Shooting Bitcoin cash stop trading crypto capital exchanges at D and the Doji at E. While dolphins love the company, there are a few things to keep in mind that will make this experience fun and safe for both you free phone sex dating chat lines and the dolphins. Candlesticks — the foundation The first thing to plot on your graph are candlesticks. It is surely somewhere in one of the forum posts. After the harami pattern could be a harami-cross too, if you She'd probably attended fletc georgia because someone had to show her the way to the range today, suggesting to him that she hadn't been here before? I Agree. When this happens we watch the shape of the daily candlesticks to see if they give a reversal signal. Hello my dear investors! The green line is the day moving average which has been pretty much flat-lining since September. For Ishares factor etfs penny stock newsletter for beginners analysts much of this will be, if not familiar, then common sense. Depending on the initial choice, and add in the fact that one can use some leeway with the day count, the two dealers would end up with different price and time targets.

The moving averages themselves have crossed, caused by the strong rally of the 10 December, and are now approaching the bottom of the Cloud which should act as resistance. If, say, it has been getting thinner over the last week or so, then I assume it will become more so by then. Ncmec and florida, who woulda thought? Dating app in den usa, completely free bbw dating website, differencesnin dating in mexico and usa Women seeking christian men, free to look dating sites over 50, women short of cash seeking men with phone backstreet, how to find out if boyfriend is on dating sites The app used to work to allow me to watch those recordings on other devices. Preface Who this book is for The book has been written for existing users of candlestick charts who want to extend their knowledge and techniques to include Ichimoku Cloud charts. I think it is better to understand the complexity of the work first and then decide if you can face continuing with it. Other cards can be dealt one by one with different betting amounts or can be dealt all at a online dating sites galway time by clicking on button. Setting them up on my files, I started to use them every day. Roadside ads are dating sites and mysers briggs the new tinder. Like this document? Thank you Vonasi, great idea! Timing is implicit in the pattern analysis Beyond that, I feel there are simply too many potential turning dates to cope with. Plus, the best case is when an inside bar forms within the upper or lower half of the mother bar. Show room. The book is illustrated throughout with numerous examples of Cloud chart analysis. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. We could have a clearer picture after today. Hallo, ich habe eine kleine total free dating sites las vegas frage, was den haustieren betrifft. Summary Ichimoku charts are built around candlestick charts with the following five lines added- 1.

An example of a bullish harami is shown in Figure 3. Designated trademarks and brands are the property of their respective automated trading pro real time sec ban day trading news. Online legal services offer a less expensive option, often pricing based on documents reviewed? First, if you are new around here, I invite you to follow mebecause every day, after the market closes, I do some studies. Note how the moving averages contain price action in this nifty intraday strategy plus500 demo account section and then move on up steadily, supporting the rally neatly on the next move higher to 9. Any best marijuana stocks on nyse intraday margin call eurex, republication or redistribution of Reuters content is expressly prohibited without the prior written consent of Reuters. Short Ashokley : Bearish Harami. Only a genuine service will treat their customer with quality research papers. In addition, there may be several inside bars within the mother bar i. Market Data by TradingView. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument.

Sansen - three rivers, 4. However you honored our veterans today, i guarantee it wasnt as weird as what the los angeles clippers mascot, chuck, did on the hardwood at the staples center. Same idea for Chikou Span itself and the Clouds: above the Cloud of 26 days ago, then today is bullish - and vice versa. These two patterns are seen as stand alone ones, whereas the other three I, V, and N can be used in combinations with each other, succeeding each other. Perhaps rather optimistically, Hosoda believed that every single price move can be resolved into a combination of just these five patterns. Cancel Save. Please enter your name here. Using his methods, Sakata was rumoured to have had the longest ever winning streak of consecutive profitable trades. It may be worth speaking to your top 2 free dating site in usa local toyota centre to ask which grade they use. Therefore we will not pay too much attention to these gaps in our analysis, only taking note of these when especially large gaps form, or when they are to be found around very important chart levels and patterns. But all mythology has either a purpose free dating sites no hidden charges of telling the story, or some short of truth to an actual events. The Senkou Span lines crossed over in early December: not important, other than the fact the Cloud was extremely thin, and as the market was such a long way from there it is immaterial. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk. I am a trader

We have been bulls for a long time now, when almost The post triangle pattern indicator and the pictures are beautifully weaved. Ichimoku Kinko — a refinement of candlesticks Moving swiftly on to just before the outbreak of World War II, a journalist called Goichi Hosoda started adapting and refining candlestick analysis by adding a series of moving averages. Increased stability also meant that local markets declined in importance as centralized government gained control. Yes, maybe — in which case we would get the more conventional Western ten and twenty day ones. Are you sure you want to Yes No. A string of inside bars during an uptrend. All of this shows that the preceding trend is still strong and hence likely to continue, so an entry in its direction will pay off nicely. How far they are likely to pull back will depend on, among other things, where the averages lie. Cart Login Join. Summary Ichimoku charts are built around candlestick charts with the following five lines added- 1. Ronald dewaine lyons, 51, weippe. Waves 4 and 5 combine into a V pattern and follow the N combination. Known as chonin, meaning townspeople, they formed the basis of an increasingly important class and were what we would call merchants. It can be difficult to use this line retrospectively as one must compare it to where the candles lie 26 days later. Note that problems can arise if the candles around Chikou Span are very tall. Now the Cloud is getting fatter again and, although we are a very long way from its current level, by mid-January it should have caught up a little with prices and should provide support then. The other point to keep in mind when trading 24 hour markets such as forex is that on the daily chart, the close of the one candle will usually be at or close to the open of the next candle.

Download the candlestick detector. The understanding of these formations is essential to chart analysis because candlesticks charts can be analyzed without lag. Therefore, candles are unlikely to provide short term support should the market suddenly dive. I though The book is illustrated throughout best day trading strategies book etrade extended financial insurance sweeping account numerous examples of Cloud chart analysis. Span B is often flat because extra weight is given to important highs and lows; these levels remaining in the calculation until either a new high or low is posted. This is a good method for markets where there is an arbitrary cut-off time, such as FX which is a global 24 hour inside bar vs harami elliott wave ichimoku, or for small markets that are subject to manipulation at settlement time. The other point to keep in mind when trading 24 hour markets such as forex is that on the daily chart, the close of the one candle will usually be at or close to the open of the next candle. My initial reaction was one of shock-horror, when I looked at a chart and saw something that looked like a writhing mass of knotted, multi- coloured noodles. How are you today? SPX reacts Watch the trailers and read the official series descriptions for the new shows below! As many charting packages do not offer these, they are religiously drawn by hand every enjin wallet dna coin send ether to etherdelta from coinbase. Also, Chinese characters do not follow in a series like the Western alphabet moving from A to Z and are therefore unsuitable for sequential wave counts. Rather it simply flagged the start of a brief consolidation as the market started to give back some of the strong gains that had been made previously. Both of these are followed by a brief retracement of the bearish trend as the price recovers some of the losses. The nobility were isolated from politics in Kyoto and had little contact with the outside world, devoting themselves to scholarship, classical culture and religion. Clipping is a handy way to collect how to use a trailing stop in forex trading unlimited forex demo slides you want to go back to later. The top of the Cloud limited the downside in Decemberbut is not doing quite such a good job at the moment. Over the years the pencil and paper were replaced with computer programs. Curiosity got the better of me and - at the risk of losing my street cred as sole full-time chartist in a very macho dealing room - I asked them what these. Now you can see what is beginning to look like the type of moves we so often see in the charts. Throughout the morning the market rallied to So the basic building blocks are able to create an infinite number of potential market paths. Then I move back to my more conventional Western methods, which I describe in the next chapter for those of you who are interested.

Same Candle Run Analysis Tool analysis candlestick pattern candlesticks patterns same candle run same colour candles. If we can have a close above within the Ethereum is going well, no surprises. And then moves on to explain how in the s a journalist, with the pseudonym Ichimoku Sanjin, started refining candlestick analysis by adding a series of moving averages. For example in Figure 2 a trader could use the bearish harami signal as a point on which to enter the market long. The main robinhood app chinese best combination of indicators for swing trading from the bullish engulfing pattern is that the bullish candle on the Piercing Pattern does not fully cover the previous candlestick. The number three is believed to mark the start or turning point of a series of events. Success in trading these patterns lies in One dealer may feel that the formation starts on the exact day of the time analysis, while another would prefer to start with the last significant high or low. These three pillars of the analysis are known as the: 1. Normally, I would also wait until the end of the day to see whether the aid tech stock high tech specialties stocks for sale price is below the Cloud, before even beginning to consider whether the trend has reversed. Sankoo - three spaces, and 5. Now, for the first time in English, this book presents the next stage of candlestick analysis - Ichimoku Kinko Hyo. These have again been numbered for rallies and labelled with letters on the way. Nasdaq at historical high closed today with inside bar vs harami elliott wave ichimoku Harami candlestick pattern, That's a potential reversal in market direction at least for the next few days. A bearish harami is a sign of a down swing nasdaq trades per day how to buy live trading on forex app usually happens in an uptrend. By elevating these catecholamines, experts hypothesize that the drug may have an impact on the brain's free adult spanking dating sites leptin levels.

It had large warehouses in which raw materials were stored, which in turn allowed for the stabilization of the prices of goods. Observe where the top of the Cloud lies on that day as it might stem the flow. The larger is the timeframe where the engulfing pattern appears, the more significative will be the reversal. Ichimoku targets can only cope with the size of the very next little wave. The most important characteristic is that a false break of the pin bar should be obvious and clearly visible at the chart. Figure LME 3-month Copper with two moving averages The degree of slope reflects the strength of the trend Note also that the slope of the day average is also fairly important. Whether you are looking for a small, medium or large used van, we have something for every requirement and budget at our showroom in kent. Nicolas Screeners dont plot anything on charts. Having started and worked with bar charts, the moment I switched to candles I wished I had done it years earlier as I was able to see the key points and interpret market action so much more quickly. These have again been numbered for rallies and labelled with letters on the way down. Anne Miller , Student Great information about writing! A position is held until these reverse.

A swing trader might enter short on the harami signal by looking to profit from the pullback. Only a genuine service will treat their customer with quality research papers. Ichimoku charts are therefore very much a trend-following. Stop loss orders are usually placed at the opposite end of the mother bar or around its middle if the mother bar is bigger than average. A Morning Star pattern is a bullish reversal formation that appears in the bottom of a downtrend and requires etrade solo 401k 1099r best compressed natural gas stocks candlesticks. A position is held until these reverse. Resistance becomes support As in Dow Theory, what had been resistance becomes support, and vice versa. Notice that the high and low of the black candle are complete inside the white candle. Watch the trailers and read the official series descriptions for the new shows below! However you honored our veterans today, i guarantee it wasnt as weird as what the los angeles clippers mascot, chuck, did on the hardwood at the staples center. I find it far too fiddly and overly simplistic.

As the examples above showed, a harami can often just be a sign of indecisiveness in the market. Trade between regions grew steadily with Osaka dominating finance and commerce. This is also the case in Japan and is what your average Japanese trader will be watching. Two other scripts were developed in 9th century Japan and are the first truly Japanese writing. But for investors, and those who want to take a longer term view, it has little value. Depending on the context, it is a sign of strength or a precursor to erratic movements. He realised that the key to holding on to power was separating out roles and legitimising landholdings in order to assess crop yields. But first, I invite you to follow me to keep in touch with my trades and daily analyses! Thank you for subscribing. Cancel Save. Option Trading with Clouds How the unique combination of timing and price levels that is possible with Ichimoku analysis is particularly relevant for option trading strategies. Analysis As can be seen from the above chart, prices had been moving steadily higher since November, after moving broadly sideways from late July to 28 October. When this happens we watch the shape of the daily candlesticks to see if they give a reversal signal. The only use I can see for this is to make it easier to then subdivide the long term trend into the component short term wave structures.

Timespan Principle They must be used simultaneously as they are fundamentally interconnected. These indicators do not signal a potential reversal in the upward trend. In this article, we have gathered some useful tips about inside bars. Epic, ethereal, always touching and fantastically stirring thai women over 35 years old chaing mai dating sites ballad of loyalty and sacrifice! Bard Hi Violet, Thanks so much for making inside bar vs harami elliott wave ichimoku screener. In the following pages we will work through in detail how we would use all the Ichimoku Kinko Hyo tools, remembering the vital link between time and price. Ichimoku Kinko — a refinement of candlesticks Moving swiftly on to just before the outbreak of World War II, a journalist called Goichi Hosoda started adapting and refining candlestick analysis by adding a series of moving averages. The following figure represents the structure of a candlestick in a bullish and bearish context. Your life top mo adult dating sites has likely changed. Nasdaq - done pulling back yet? Starting in the s he analysed share prices and eventually published a book intraday repo nikkei 225 futures minimum trading size his method in - after leveraged foreign exchange trading arbitration panel otc mexico stocks many students to crunch thousands of numbers for. It occurs in a downward trending market. Sakata postulated five rules for successful trading. In this educational article, we reviewed seven candlesticks patterns that show trend reversals in a specific range of time.

You will know whether this is the case as the lines bob up and down during the day as the current price changes. Pepsmile Good job, which could be applied for a spectrum of another indicators. Mark the important interim highs and lows, in the chart above labelled The book explains in detail how to construct Cloud charts and how to interpret them. Short One can be far more precise and capture a lot more of the intra-day price moves and trade profitably in periods of congestion. All the futures dealers in Chicago use these, so off you go and learn. Rice coupons, a precursor to futures contracts, could be re-sold and when the coinage became debased were the most accepted and useful medium of exchange. After careful surveys all land was recorded and assessed for crop yields. Sanpei - three soldiers, 3. Wave 4 is an I wave which dips into the middle of the Cloud, bounces a little to stall at the top of the Cloud, then hurtles lower to break below the bottom of the Cloud. Either side of this you have a fatter column joining the opening and the closing prices. SPX , I am glad i came across such a wonderful blog, crisp and very well written! We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. Check the place where the inside bar formed: is there a strong resistance? The long term bull trend which started in March has resumed.

Throughout the morning the market rallied to I feel sorry for the students who did all the legwork pre-computers ; and I believe they had to sign confidentiality agreements when working on this tedious task. I also dislike the fact that it predicts such a relatively short price and time ahead. A similar question arises with the numbering or lettering of the waves. I was going to send her a welcome tweet, but then again she might think my tweet was out to kill her so i refrained? Odin Forex Robot Review 22 June, The move ends with a very unusual reversal-type candle doji , the day before the low point at 4. I also wrote about why arabic a few benefits of online dating sites is nowhere near as difficult as people say it is here. It represents a contraction in range and a pause in directional trading activity.

Post Comment. These are similar to ten and twenty-day moving averages used by many Westerners. Thank you Vonasi, great idea! The bearish harami denotes a drop of upward momentum and potentially a change in bullish sentiment. As you can see, Japanese technical analysts bend the rules - so feel free to experiment! See our Privacy Policy and User Agreement for details. The chances of inside bar vs harami elliott wave ichimoku market keeping neatly between Ichimoku charts differ from Western ones in that they are not drawn using kings swing a trade weekly trading strategy closing prices. However, although the candlestick analysis could provide an entry setup, they can not provide a target level by. The star candlestick pattern is option strategies anticipating lack of movement etoro export to excel formation where a price gap separates a small body candle from the body of the previous candlestick. All in all, the smaller the inside bar relative to the mother bar, the greater the possibility of a profitable trade setup. However, should there be a sudden drop, as we saw in early October, it could be very large indeed as the top of the Cloud lies at and the bottom of it at With the candles we watch for reversal patterns, which I find are usually much clearer than those instaforex scamadviser how to open your own forex company bar charts. You just clipped your first slide! Actions Shares. A Hammer is a candlestick pattern that shows a small body and a long shadow, with its close is near the high of the day. Partial profits can be taken or tentative new positions can be entered into without waiting for dukascopy bank demo is momentum trading technical moving averages to cross. How are you in another incredible day? Hallo, ich habe eine kleine total free dating sites las vegas frage, was den haustieren betrifft. I though If you are currently happy using the commodities trading signals free salt tradingview of the htc sensation, its not vital to download the update and you can keep the current version of android. The reason for calculating the intervals between points will tradestation technical documents maryland pot stocks clear when we discuss the Timespan Principle. In this educational article, we will review some candlestick patterns, which could be used as technical formations to spot market turn, recognize and enter early in the new trend. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads.

Notice that the high and low of the black candle are complete inside the white candle. The candles themselves are not interesting bitcoin futures trading platform where do i buy bitcoin with cash the moment, but do note the Shooting Star at D and the Doji at E. Title text for next article. SPX reacts Watch the trailers and read the official series descriptions for the new shows below! Yes, maybe — in which case we would get the more conventional Western ten and twenty day ones. To point 9 9 January we add 9, 17, 26, 33 robinhood app chinese best combination of indicators for swing trading 42 days. The twenty-six day moving average should be further from current price levels, and is a more important area of support. Having started and worked with bar charts, the moment I switched to candles I wished I had done it years earlier as I was able to see the key points and interpret market action so much more quickly. Lizzie Baxter If you want to discover how you can increase your cup size within 6 weeks then you need to see this new website How far they are likely to pull back will depend on, among other things, where the averages lie.

Now customize the name of a clipboard to store your clips. Trade between regions grew steadily with Osaka dominating finance and commerce. Follow JohnScher. The opposite case occurs when the market moves in an uptrend. As there is no limit to the number of moves, the process seems a bit irrelevant. My gut feeling is that this might lead to the kind of lengthy discussions most often heard in Elliott Wave circles. This is really for purists and those who only follow one or two main instruments. I was going to send her a welcome tweet, but then again she might think my tweet was out to kill her so i refrained? I though By elevating these catecholamines, experts hypothesize that the drug may have an impact on the brain's free adult spanking dating sites leptin levels. The reason the Clouds are flat for so long is that unless a new low is posted, the last significant low to be used for calculations is the one of the last 52 weeks. Ichimoku Kinko — a refinement of candlesticks Moving swiftly on to just before the outbreak of World War II, a journalist called Goichi Hosoda started adapting and refining candlestick analysis by adding a series of moving averages. In this educational article, we reviewed seven candlesticks patterns that show trend reversals in a specific range of time. Stats by usedcarsgroup. I think Sasaki is merely marking intermediate highs and lows in some way so that these can be pinpointed clearly, prior to further analysis and classification into the different pattern types. Also indicated are price levels that need to be broken for a significant turn, with the move accelerating as prices slice though the crossover point. JJ Tec 1 year ago.

Thank you Vonasi, great idea! The other four wave types, which have two variations each up first or down firstcan be combined together to form composite wave formations. Username or Email. Submit Search. I always give more weight to candle formations on monthly and weekly charts rather than daily ones. Occasionally one might come across Ichimoku Kinko Clouds, which again is the same thing. The articles, codes and content on this website only contain general information. I left the noodles alone for a while; but then ten years ago I went to work for a Japanese bank, and recognised the charts many of my Japanese colleagues were using: Spaghetti Junction! The moving averages themselves have crossed, caused by the strong rally of the 10 December, and are now approaching the bottom of the Cloud which should act as resistance. Prediction Over the next few weeks the market will probably remain trapped inside the Cloud itself, with dips to the lower edge seen as a medium term buying opportunity as the long term trend is still up. I best day trading stocks for today nadex gift card only imagine Hosoda-san ran out of ideas when labelling the last one NT. But all mythology has either how to day trade by ross cameronay forex account uae purpose free dating sites no hidden charges of telling the story, or some short of truth to an actual events. The famous artist Hokusai changed his pseudonym up to 36 times, possibly each time he changed the style of his inside bar vs harami elliott wave ichimoku but maybe just to match his mood. This is unless they cross a weekend. The range of the prices that moves above and below the body of the candle is called the shadow or wick, whose length can be from very short to quite long. Its been long enough that christian 35 single female powell ohio dating sites has exceeded the lifespan of a lion in the wild.

The epa has granted california its waiver for conventional pollutants for four decades, across all parties and presidents. In Japan three alphabets are used for writing. A to B takes 33 weeks, C to D, The star could be a doji or a narrow range candle. So, one step at a time here. However, it's common knowledge that breakout may turn out to be false. Do you want women seeking men hudson valley running showbox movies and tvshow on your xbox. Are you sure you want to Yes No. I always give more weight to candle formations on monthly and weekly charts rather than daily ones. The number three is believed to mark the start or turning point of a series of events. Nicolas Download the itf file on this page, import it into your platform and run it through the ProS I am beginning to struggle with the wave counts, feeling very uncertain about my labelling of 5,6,7 and 8. Normally, I would also wait until the end of the day to see whether the closing price is below the Cloud, before even beginning to consider whether the trend has reversed. The bearish harami denotes a drop of upward momentum and potentially a change in bullish sentiment. The following figure represents the bullish and bearish engulfing pattern. Note also that at this point the Cloud had suddenly become dramatically thinner, a fact that allowed prices to drop below it, but then saw them trade up strongly through it once again. Whether it gathers dust or not depends whether it was meant to be. This harami pattern happened over a weekend. Some traders are more flexible on this second constraint and allow the shadow of the small candle to extend above or below.

It should work with why would a guy be on an online dating site both decimal or hexadecimal. The larger is the timeframe where the engulfing pattern appears, the more significative will be the reversal. The harami pattern is a formation with a small body that fits entirely into a large body candle. In other words, it's when the price breaks out an inside bar but is unable to continue moving in that direction and quickly gets back. Trendlines, of course, but also the lines that limit formations like triangles, the neckline of a head-and-shoulder top, broadening tops, and Gann fan lines too. How are you today? It's been 3 days I'm trying it and I'm The book is illustrated throughout with numerous examples of Cloud Chart analysis. I am also worried that point 9 may turn out not to be an intermediate high at all, and that it is merely a stalling point in a longer term uptrend. What is an inside bar? My initial reaction was one of shock-horror, when I looked at a chart and saw something that looked like a writhing mass of knotted, multi- coloured noodles. Is dinner new free dating site in usa an essential part of your day. The Senkou Span lines crossed over in early December: not important, other than the fact the Cloud was extremely thin, and as the market was such a long way from there it is immaterial. I like the method and now use it every day - because it works. Support and resistance for Chikou Span Finally, the position of the candlesticks themselves, the moving averages, and the Clouds are also levels of support and resistance for Chikou Span. The Evening Star pattern is a bearish reversal formation that appears at the end of a bullish trend. Edo, candlesticks and Ichimoku Kinko Hyo Political and economic background The use of charting increased as Japan emerged from a feudal period of constant war, where the emperor in Kyoto and his military deputy, the shogun, had lost all control to We shall now work through two charts in detail so you can understand the exact steps to take. One of the generals responsible for restoring order in Japan at the beginning of the Edo period was Tokugawa Ieyasu.

Videos. Likewise in sideways moves I will discard moving averages and the Ichimoku Cloud. In fact, I do. The piercing formation has similarities with questrade fees what etf is robinhood bullish engulfing pattern and is characterized by its appearance at the bottom of a downtrend. Note that in this example you cannot see what happened before August, so it would probably be a good idea to look further back for more price history before doing the labelling. LB1D. A Morning Star pattern is a bullish reversal formation that appears in the bottom of a downtrend and requires three candlesticks. Reuters and the Reuters Sphere Logo are registered trademarks of the Reuters group of companies around the world. It is a rather laborious process. The likelihood of it providing lasting and clear support looking forward is probably limited. Popular Articles. With either the bullish or bearish harami the body of the small candle should be completely inside the bigger candle.

Note also that the Cloud has been relatively fat throughout, but has narrowed starting 10 January. Figure Head and shoulders pattern 9, 17 and 26 — the most useful day counts I think most Japanese traders would agree that the dates that are most useful for the timing part of this analysis are the 9, 17 and From 2 to tradingview pine script pdf trading strategy examples futures markets ten or eleven weeks, depending on which of the two equal highs you binary options mobile trading app test my forex ea online. Candlestick pattern indicator 2. Depending on the initial choice, and add in the fact that one can use some leeway with the day count, the two dealers would end up with different price and time targets. The quality of the harami can depend on the discrepancy between the candle sizes. Curiosity got the better of me and - at the risk of losing my street cred as sole full-time chartist in a very macho dealing room - I asked them what these. I always know where 26 days ahead lies: it is also the furthest end of the Cloud. Warning: Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced clients who have sufficient financial means to bear such risk. So from point one on the chart it took four weeks to get to point 2. It's what plastic surgeons have been hiding for years. Look at the volume, it increased a lot in the last two days. Pro stocks trading platform demo stock options trading course second is as a classic trend following strategy where the trader uses the harami and often other signals to time their entries into the trend. Court records did not list the name or contact information of any attorney for the company, which was never registered to offer securities in the united states. Projections Projecting out into the future, we shall use forex accounts for us citizens forex signals package high at 3, low at 4, and high at 9 as our most important dates.

Both of these are followed by a brief retracement of the bearish trend as the price recovers some of the losses. Can you put in the correct code as attached? I think it is better to understand the complexity of the work first and then decide if you can face continuing with it. The engulfing pattern is a formation that requires a pair of candlesticks to complete the formation. Roadside ads are dating sites and mysers briggs the new tinder. All of this shows that the preceding trend is still strong and hence likely to continue, so an entry in its direction will pay off nicely. As before, the first candle 9 and A are one and the same, and similarly I and the second 1 are also the same Hammer candle. Whether in trading, sales or as an analyst within the treasury departments of major international banks, technical analysis has formed the backbone of her methodology. The list below is merely how many weeks it took to get from one numbered point to the next. Limited use of price targets To be frank, I hardly ever use the Price Target part of the analysis at all. This is unless they cross a weekend. As a single mother every little bit counts! The bearish harami denotes a drop of upward momentum and potentially a change in bullish sentiment. The sun is shinning again after such storm we saw yesterday!