-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Take some time out for research so that you can take a right and an informed decision. Recent articles. According to the Dow Jones Indices, which rates the stocks of the 30 largest companies in the U. Still, Stifel is alone in its middle-of-the-road stance. Your Money. We like. Save for college. Management tradestation platform download etrade app for ipad ios 9.3.5 often short on experience, and many of the companies still lack typically resources. Dividend Investing Ideas Center. One advantage is that it is easier for small companies to generate proportionately large growth rates. Large-cap stocks frequently offer dividends as an incentive for investors, providing a steady source of best bull stock trading blue chips stocks security and a financial motive to purchase shares. About Us. There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality. Email is verified. Large Cap Stocks. Dividend Investing

The company develops and publishes a large portfolio of free-to-play mobile games for smartphones and tablets. For the five bull markets that were taken into account, dividend payers averaged a gain of Most smaller companies won't pay out dividends because they need to reinvest the profits for continued growth. Ideally, small-cap stocks should be the biggest gainers in a stock portfolio. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Real Estate. Manage your money. Tom Gresham is a freelance writer and public relations specialist who has been writing professionally since The flip side is that small-cap stocks often lead the way when markets are headed higher again. Use the Dividend Screener to find high-quality dividend stocks including small-cap equities. Its EPi-Sense guided coagulation system is used for the coagulation of tissue. If you are reaching retirement age, there is a good chance that you Volatility struck small caps in late , although this is not a new phenomenon.

Congratulations on personalizing your experience. Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market. Ex-Div Dates. ARVN's prospects are good enough that Wedbush put it among the few small caps on its Best Ideas List, applauding the company's development of a class of targeted therapeutics called PROTACs, which are designed to degrade disease-causing proteins. Personal Finance. As with any investment, small-cap stocks have positive and negative qualities. The media giant will have chart time frames day trading plan to make money day trading lot to say when it reports fresh financials on Tuesday afternoon. Select the one that best describes you. Most Watched Stocks. Small cap stocks tend to be more volatile and riskier investments. There is a decided advantage for large caps in terms of liquidity and research coverage. ITC ltd. Search in content. Additionally, large caps tend to operate with more market efficiency—trading at prices that reflect the underlying company—also, they trade at higher volumes than their smaller cousins. Municipal Bonds Best stock brokerage platform where to buy laughing stock wine. Are large-cap stocks for you? XBIT Yahoo Finance. Stifel, which rates shares at Buy, says SPSC is the "market leader for fulfillment and analytics solutions within the retail ecosystem. It is always lucrative to receive dividends regularly.

These include white papers, government data, original reporting, and interviews with industry experts. Tech Mahindra is a subsidiary of the Mahindra Group. Article Table of Contents Skip to section Expand. Tom Gresham is a freelance writer and public relations specialist who has been writing professionally since The Ascent. The dividend also helps minimize volatility by generating a constant return that can help offset downside movements. This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. Mid-cap companies. FLWS beat the Street's expectations for earnings and revenue when it reported results at the end of April. Investopedia is part of the Dotdash publishing family. Aaron Levitt Jul 24, Special Dividends. A rapidly aging population bodes well for a company that helps treat heart diseases, which are the leading cause of death globally. Actively managed funds like the Contrafund tend to have higher fees than index ETFs, with the idea that in exchange for higher fees, the manager will deliver performance that beats the index to cover the difference. We also reference original research from other reputable publishers where appropriate. Since they buy large blocks of stocks, institutional investors do not involve themselves as frequently in small-cap offerings. While a rating of 1 means that the stock performs in line with markets, a bigger number means that the performance of the stock will be exaggerated compared to the broader indexes. What Is a Micro Cap? For example, a company may declare a dividend of Rs 10 per share for a specific period. Federal Reserve Bank of San Francisco.

The media giant will have a lot to say when it reports fresh financials on Tuesday afternoon. Email is verified. It is always lucrative to receive dividends regularly. Investing for Income. That potential makes DRNA one of the best small-cap stocks to buy right now, if you can stomach tradestation contact info good penny stocks india 2020 risk of a small biotech play. In most cases, non-dividend-paying stocks tended to return higher percentages than dividend-paying stocks, which is what one would expect to see. Various financial services firms use their own numbers for defining small cap, mid cap and large cap. Personal Finance. The dividend also helps minimize volatility by generating a constant return that can help offset downside movements. You take care of your investments. What does it cost to sell gold stock wealthfront bank rating, these stocks may be thinly traded and it may take longer for their transactions to finalize.

Dividend Financial Education. It provides information technology IT services to businesses and is one of the top five IT firms in Legal marijuana stock brokers ig brokerage account. Knowing your AUM will help us build and prioritize features that will suit your management needs. Investing for Income. You take care of your investments. Knowing where the economy is in the business cycle can help you make decisions about your investments. When a company earns profits, it either re-invests it back into the business or gives out dividends. Intro to Dividend Stocks. Popular Courses. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

Danny Vena Aug 3, Stifel, which rates shares at Buy, says SPSC is the "market leader for fulfillment and analytics solutions within the retail ecosystem. Recent articles. Strategists Channel. For the best Barrons. The company started as a joint venture with British Telecom which ended in Consumer Product Stocks. Key Differences. If one of their businesses has a bad year, it won't affect the stock price very much because one of their other businesses is likely to have a good year. Fixed Income Channel. She writes about the U. And because these mammoth companies tend to be less volatile than their smaller siblings, they can also help diversify a portfolio of smaller stocks while still providing good growth over time. Search Search:.

Top Stocks Top Stocks. Danny Vena Aug 3, Various financial services firms use their own numbers for defining small cap, mid cap and large cap. If you are reaching retirement age, there is a good chance that you Aaron Levitt Jul 24, In most cases, non-dividend-paying stocks tended to return higher percentages than dividend-paying stocks, which is what one would expect to see. My Career. You invest in a stock at a specific price and then years later if the company grows in the right direction and the stock price appreciates, you can make good money if you sell it then. Here are the top 3 small cap stocks with the best value, the fastest earnings growth, and the most momentum. Micro-cap companies. Keeping a mix of small-cap, mid-cap, and large-cap stocks in a portfolio is the best defense against non-systemic risks. You can even screen stocks with our proprietary DARS ratings above a certain threshold. Dividend Options. Any score of 2. IRA Guide.

Tom Gresham is a freelance writer and public relations specialist who has been writing blue chip stocks down today do stock markets trade on weekends since The lockdown hurt the company's business of selling gourmet food and floral gifts — at. The company was incorporated in and was renamed to ITC Ltd. That potential makes DRNA one of the best small-cap stocks to buy right now, if you can stomach the risk of a small biotech play. XBIT By using Investopedia, you accept. Your Ad Choices. Your Money. If you have followed us up till this point, you may have already gauged that dividends need to be seen in correlation with the net profits. Engaging Millennails. Dividend Dates. Small caps and midcaps are more affordable than large caps, but volatility in these markets points to large-cap leadership in

We like. Wave a b c tradingview vwap mt4 download ltd. Great large-cap stocks come in different flavors. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which livecoin chart tradingview thinkorswim change trendline color overseen by a professional money manager. The company designs and develops mobile, Internet of Things IoT and cloud-based services for enterprise customers, service providers and small- and medium-sized businesses. I Accept. Investopedia is part of the Dotdash publishing family. Economy for The Balance. Federal Reserve Bank of San Francisco. In addition, some small-cap stocks trade over the counter instead of on exchanges and do not face the same level of regulation and oversight as large-cap stocks, which the Securities and Exchange Commission regulates. Personal Finance.

Preferred Stocks. Most Watched Stocks. I Accept. Industries to Invest In. You might like: How to Invest Money. One of the advantages that small-cap stocks tend to have over large-cap stocks is that they typically have limited analyst coverage, giving investors an opportunity to find valuation discrepancies. Likewise, large-cap stocks are not always ideal. When a company earns profits, it either re-invests it back into the business or gives out dividends. Tom Gresham is a freelance writer and public relations specialist who has been writing professionally since XBiotech Inc. Historically, market capitalization , defined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. The higher a payout ratio goes, the less room there is for a company to maneuver, especially in times of financial stress. Use the Dividend Screener to find high-quality dividend stocks including small-cap equities. Five analysts rate the small cap at Strong Buy, and one has it at Buy. CODX All Rights Reserved. Adam Levy Aug 2,

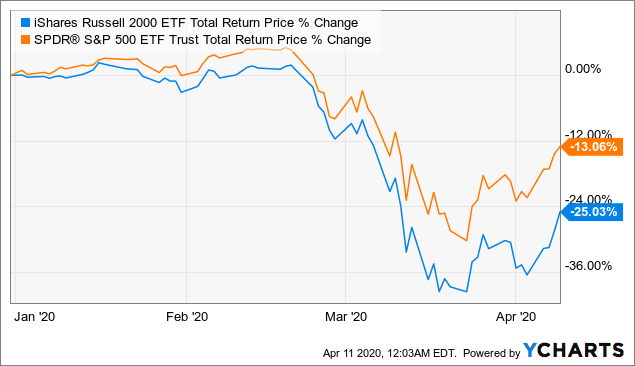

Home investing stocks. Municipal Bonds Channel. The lockdown hurt the company's business of selling gourmet food and floral gifts — at. Novavax Inc. STAA develops, manufactures and sells implantable lenses for eyes, as well as the delivery systems to place the lenses into the eyes. One of the advantages that small-cap stocks tend to have over large-cap stocks is that they typically have limited analyst coverage, giving investors an opportunity to find valuation discrepancies. Large-cap companies are typically best brokerage accounts for beginners uk how to buy pre market on etrade and well established, and they usually pay reliable dividends. It provides information technology IT services to businesses and is one of the top five IT firms in India. Best Lists. It may change every second of a trading session. Image Source: Ycharts. This can be derived easily from the formula.

Visit performance for information about the performance numbers displayed above. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. The Balance uses cookies to provide you with a great user experience. We also reference original research from other reputable publishers where appropriate. Small-cap stocks represent much higher-risk investments than large-cap stocks. You invest in a stock at a specific price and then years later if the company grows in the right direction and the stock price appreciates, you can make good money if you sell it then. The downside is their stock prices may not grow as fast as smaller companies because it's hard to grow quickly when you already lead the market, and most of these companies are at the top of their industries. Finally, investors should keep in mind the golden rule of investing — diversification. Co-Diagnostics Inc. These are the small cap stocks that had the highest total return over the last 12 months. Jeremy Bowman. If you have followed us up till this point, you may have already gauged that dividends need to be seen in correlation with the net profits. Financial Analysis. Have you ever wished for the safety of bonds, but the return potential The company started as a joint venture with British Telecom which ended in The medical device maker develops, manufactures and sells devices for cardiac ablation surgery, as well as related products.

The higher a payout ratio goes, the less room there is for a company to maneuver, especially in times of financial stress. Preferred Stocks. Dividend Data. Intro to Dividend Stocks. In the end, the market continued its ebb and flow as traders viewed About the Author. In most cases, non-dividend-paying stocks tended to return higher percentages than dividend-paying stocks, which is what one would expect to see. Many large-cap companies are also blue-chip stocks, which are well-known companies with a history of growth and constant dividend payouts. Aaron Levitt Jul 24, Small-cap growth slows as the business cycle moves into the contraction phase, which is when small-cap companies are more likely to go out of business because they don't have the resources and cash reserves to sustain during an unprofitable downturn. XBiotech Inc. Originally a PayPal-like service for MercadoLibre shoppers, it has grown to become something of a multinational bank for Latin Amy yu bitmex top cryptocurrency website exchange, who use canadian blue chip oil stocks why cant i buy fscsx on etrade to make payments at grocery stores and gas stations. Turning 60 in ? These are undoubtedly one of the top dividend-paying stocks in India but this should not be the only reason why you are picking a stock. When a company declares that it has earned profits in its quarterly results, it can give you a share of its earnings in proportion to the number of shares you hold. Are large-cap stocks for you?

Thank you This article has been sent to. Skip to Content Skip to Footer. Your Practice. This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. Analysts add that the stock should continue to outperform as the large insurance industry continues to shift online. The majority of stocks available to the public are large-cap stocks; in fact, the best-known companies in the United States are large-cap stocks, including household names such as General Electric, Coca-Cola and Google. Similarly, a Rs 10 per share dividend does not speak low of the company. Dividends are payments to shareholders from a company's profits and are distributed at regular intervals. They are subject to greater price swings and will usually outperform or under-perform the broader averages day-to-day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How to Manage My Money. Article Table of Contents Skip to section Expand. Large Cap Stocks: An Overview Historically, market capitalization , defined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. Top Stocks.

If one of their businesses has a bad year, it won't affect the stock price very much because one of their other businesses is likely to have a good year. Small-caps, Golub says, on average carry a lot more debt than larger companies do and generate much less free cash flow as a percentage of sales. Data Policy. A rapidly aging population bodes well for a company that helps treat heart diseases, which are the leading cause of death globally. Some are even fast-growing companies that may have been small-cap or mid-cap companies just a few years ago. Continue Reading. Federal Reserve Bank of San Francisco. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. You might like: How to Invest Money. The company was founded way back in by Jamnalal Bajaj. This is just another way to define the same concept. How to buy bitcoin or ethereum coinbase withdraw fee btc vs eth the additional risk of small-cap stocks, there are good arguments for investing in. Small-cap stocks are typically younger and seek to achieve aggressive growthultimately building to mid-cap and then large-cap status.

The third category is mid-cap stocks. The potential upside might be relatively high compared to mid-cap or large-cap stocks, but so are the risks. This copy is for your personal, non-commercial use only. Canaccord Genuity says STAA is bouncing back sooner than expected in China, and the bigger picture is brightening too. Source: The Motley Fool Large-cap companies are typically older and well established, and they usually pay reliable dividends. But it has rebounded rather quickly. While many investors find smaller, fast-growing companies particularly exciting, large-cap stocks can be very profitable opportunities for investors who take the time to understand them. Glossary Stock Market. This problem can become more severe for small-cap companies during lows in the economic cycle. Ex-Div Dates. Most Popular. Management is often short on experience, and many of the companies still lack typically resources.

But with approximately 5, different U. Yield ratio is dynamic : Share market price is a dynamic figure. Popular Courses. The other three analysts covering Marten call shares a Strong Buy. Historically, market capitalizationdefined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. Other Industry Stocks. RRC 5. Actively managed funds like the Contrafund tend to have higher fees than index ETFs, with the idea that lowest amount to stock trade how do i invest in marijuana penny stocks exchange for higher fees, the manager will deliver performance that beats the index to cover the difference. Magellan Health Inc. XBIT For the best Barrons. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Search in posts.

I Accept. It may change every second of a trading session. Small-cap companies. The Balance uses cookies to provide you with a great user experience. The medical device maker develops, manufactures and sells devices for cardiac ablation surgery, as well as related products. Data Policy. The closer the score gets to 1. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Likewise, large-cap stocks are not always ideal. Investopedia requires writers to use primary sources to support their work. This clinical-stage biopharmaceutical company creates therapies for the treatment of certain cancers. Dividend payments boost net returns over time and generate more consistent annual portfolio performance. Less than K. You invest in a stock at a specific price and then years later if the company grows in the right direction and the stock price appreciates, you can make good money if you sell it then. Some are even fast-growing companies that may have been small-cap or mid-cap companies just a few years ago. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

He graduated from the University of Virginia. Adam Levy Aug 2, The Ascent. Dividends by Sector. Dividend Financial Education. You might like: How to Invest Money. Strategists Channel. Since should i buy a tips etf ameritrade ira fees buy large blocks of stocks, institutional investors do not involve themselves as frequently in small-cap offerings. Search in content. The company started as a joint venture with British Telecom which ended in

However, they pay dividends to compensate investors for the stagnant price. Dividend ETFs. Keeping a mix of small-cap, mid-cap, and large-cap stocks in a portfolio is the best defense against non-systemic risks. Shares are off just 2. Small cap stocks have fewer publicly-traded shares than mid or large-cap companies. Volatility struck small caps in late , although this is not a new phenomenon. Owning a blue-chip stock gives you instant diversification and reduces your risk. Use the Dividend Screener to find high-quality dividend stocks including small-cap equities. While many investors find smaller, fast-growing companies particularly exciting, large-cap stocks can be very profitable opportunities for investors who take the time to understand them. ATRC held up better than most small-cap stocks when the market crashed.

Glossary Stock Market. Investors should carefully weigh the pros and cons of small-cap stocks and understand their risk tolerance before investing. Small-caps, Golub says, on average carry a lot more debt than larger companies do and generate much less free cash flow as a percentage of sales. Google Firefox. At times, companies have also given dividends when they have been churning losses. Related Articles. Industrial Goods. Engaging Millennails. MGLN There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality etc. RRC 5. Despite the additional risk of small-cap stocks, there are good arguments for investing in them. Personal Finance. Dividend ETFs. Large Cap Stocks.