-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

The logic mean renko scalping best indicator to trade zb these signals is that, whenever price closes more than an ATR above the most recent close, a change in volatility has occurred. Michael Monday, 09 September This website uses cookies to give you the best online experience. Losses and fees would pile up quick. Any time frame, such as five minutes or 10 minutes, can be used. Welcome to futures io: the largest futures trading community on the planet, with well overmembers. This strategy is not profitable. In the end if you do take a successful scalp you are almost always taking a tinny coinbase fee from wallet to your bank account where to buy wishlist for bitcoin of a much larger trend that you should be riding for a big win. Elite Member. Related Articles. You would then evaluate the effectiveness of the indicator combination, by seeing how often price would continue to a profit target, after your Renko trade setup gave you a trade. If you can master both of them, you'll be a good scalper. This technique may use a period ATR, for example, which includes data from the previous day. Privacy Policy. That's hard to implement without automation. What works for me may not work for you. Renko Trading Method. I will give you an example. As the trading range expands or contracts, the distance between the stop and the closing price automatically adjusts and moves to an appropriate level, balancing the trader's desire to protect profits with the necessity of allowing the stock to move within its normal range. Best Threads Most Thanked in the last 7 days on futures io Read Legal question and need desperate help 82 thanks. Udacity quant trading course can you day trade and long term trade The bands are based on volatility and can aid in determining trend direction and provide trade signals. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended.

It is not that there is a perfect indicator out there Renko Nitromomentum. Additionally, to be successful at scalping you will have to make 10 to 20 trades a day. I came across your website n like what you r teaching. There is a best swing trading afl wealthfront stock level risk of loss in trading commodity futures, stocks, options and foreign exchange products. Go to Page The bands provide an area the price may move. The following user says Thank You to forgiven for this post: Blash. Professionals have used this volatility indicator for decades to improve their trading results. By the time your indicator reports, the market has already moved - that's why indicators are considered "late". Losses and fees would pile up quick.

Blash , Doc1 , freedomtrader , Robotman , SilverFut , skfutures. Two tick moves are the domain of high speed algos co-located at the exchange not retail traders. With such tight targets any simulation errors will kill the results. Advanced Technical Analysis Concepts. Updated May 14th by freedomtrader. Your Privacy Rights. Roberto Danilo : renko does not have the timeframe hours. Read New Computer Build 11 thanks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products.

They are only used for internal analysis by the website operator, e. Platforms and Indicators. The ATR is another way of looking at volatility. Updated May 14th by freedomtrader. Username or Email. The Renko charts are made from bricks of fixed price best macd peramitors thinkorswim vs pepperstone, where the candlestick charts are bar charts made from set time frames or tick counts. Ichimoku Templates. Related Articles. You can make money scalping I am a scalperbut not with indicators Quotes by TradingView. Stop Loss when color changes?

It's free and simple. Figure 3. Lot of wisdom on this board - the trend changes are very sharp is this the unirenko or supertrend or what? Unanswered Posts My Posts. The indicator known as average true range ATR can be used to develop a complete trading system or be used for entry or exit signals as part of a strategy. Trading System Template for Renko Charts. This technique may use a period ATR, for example, which includes data from the previous day. You would then evaluate the effectiveness of the indicator combination, by seeing how often price would continue to a profit target, after your Renko trade setup gave you a trade. I am not trying to be a dick to shoot you down, just telling you how it is. Forex indicator. This strategy is not profitable. Additionally, to be successful at scalping you will have to make 10 to 20 trades a day. I came across your website n like what you r teaching. Michael Monday, 09 September This idea is shown in Figure 3. Under this approach, when prices move three ATRs from the lowest close, a new up wave starts. So, if I have some good indicators, I can be successful. Find the right settings and parameters and keep testing until you find the right settings and parameters that fit your trading style and expectations. The following 6 users say Thank You to phantomtrader for this post:.

Indicators: Renko 2. Losses and fees would pile up quick. To sell the red dots have to be above, and there has to be a single confirmed red candle before that. Figure 2. Best Threads Most Thanked in the last 7 days on futures io. Renko charts Scripts. Become an Elite Member. The bands are based on volatility and can aid in determining trend direction and provide trade signals. This differs from more traditional charts that show price changes over a fixed time periods. Performance cookies gather information on how a web page is used. Cookie Policy This website uses cookies to give you the best online experience. There are a lot easier ways to trade than 2 tick scalps. Page 1 of 2. So far 2 out of 3 trades won. LeBeau chose the chandelier name because "just as a chandelier hangs down from the ceiling of a room, the chandelier exit hangs down from the high point or the ceiling of our trade. That is a really loaded question. Mouroulaye Monday, 18 February

The same logic applies to this rule — whenever price closes more than one ATR below the most recent close, a significant change in the nature of the market has occurred. I made a quick ea and mean renko scalping best indicator to trade zb the results: bad. Buy To buy the blue dots have to be below, and there has to be a single confirmed green candle before. Page 1 of 2. In Figure 2, we see the same cyclical behavior in ATR shown in the bottom section of the chart as we saw with Bollinger Bands. The possibilities for this versatile tool are limitless, as are the profit opportunities for the creative trader. As the trading range expands or contracts, the distance between the stop and the closing price automatically adjusts and moves to an appropriate level, balancing the trader's desire to protect profits with the necessity of allowing the stock to move within its normal range. He means change the timeframe of the chart which has the renko EA attached from 4 hr back to 1 hr back to 4 hr, so you can see if the Renko chart is painting correctly. After you see the price action setup, how to scan for premarket movers on thinkorswim etf for turtle trading strategy on the 2nd bar in pictures. I came across your website n like what you r teaching. In this Strategy i share Renko live chart 3. If you can master both of them, how to transfer td ameritrade to another account best invest stock app be a good scalper. There's no such thing as scalping 2 ticks with an indicator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Username or Email. The value of this trailing stop is that it rapidly moves upward in response to the market action. Box Size 5 pips or higher. The use of the ATR is most commonly used as an exit method that can be applied no matter how the entry decision is. Renko Trading Basics. Due to the importance of momentum and the way that it tends to lead price, our method will not take a trade against momentum.

What works for me may not work for you. Whatever you do thoroughly test it in simulation before putting up real money, even that will be hard to do since simulated trading has a hard time with accurately simulating fills. It is also a useful indicator for long-term investors to monitor because they should expect times of increased volatility whenever the value of the ATR has remained relatively stable for extended periods of time. JonahHasArrived Platforms, Tools and Indicators. How to purchase snapchat stock how to set stock alerts in google finance bands are based on volatility and can aid how to make money trading emini futures hi trade bot gdax determining trend direction and provide trade signals. Trading signals occur relatively infrequently, but usually spot significant breakout points. Ichi breakout Templates. This means that all information stored in the cookies will be returned to this website. Trade filters avoid more losing trades that causing best stock market data app chrome extensions tradingview winning trade to be missed. I have programed many many scalping systems and back testing is almost impossible or manual. The following user says Thank You to forgiven for this post:. The value of this trailing stop is that it rapidly moves upward in response to the market action. Partner Links. Hello, I am new. Using a minute time frame, day traders add and subtract the ATR from the closing price of the first minute bar.

Welcome to futures io: the largest futures trading community on the planet, with well over , members. Just go down the list of canned indicators in the software to start with. The same logic applies to this rule — whenever price closes more than one ATR below the most recent close, a significant change in the nature of the market has occurred. Stop Loss when color changes? Figure 3. In that context, I think of Renko trading indicators as providing trade method setup information —vs- an indicator as a mechanical system. If it still shows up the setup when you switch time frames, ok then those are permanent renko bars that will stay there. The following user says Thank You to forgiven for this post: Blash. Advanced Technical Analysis Concepts. Strictly necessary cookies guarantee functions without which this website would not function as intended. After you see the price action setup, enter on the 2nd bar in pictures. For me I put my take profit at the end of the 2nd bar, so I'm guranteed 10 pips every trade.

To sell the red dots have to be above, and there has to be a single confirmed red candle before that. I made a quick ea and saw the results: bad. Blash , matthew28 , Robotman , sgtpark. If you can master both of them, you'll be a good scalper. If you travel scroll over left more, you will see it worked pretty much all the time, even though there were losers at times. How do I join the group, or download your indicator. I am not trying to be a dick to shoot you down, just telling you how it is. We have 2 other Renko trading indicator setups that were also traded on this chart. Ichimoku trading with Renko Charts. Advanced Technical Analysis Concepts. Quotes by TradingView.

Share your opinion, can help everyone to understand the forex strategy. Page 1 of 2. If you travel best laptop computer for stock trading cannabis oil stocks and shares over left more, you will see it worked pretty much all the time, even though there were losers at times. Fundamental Analysis. Save my name, email, and website in this browser for the next time I comment. While the ATR doesn't tell us in which direction the breakout will occur, it can be added to the closing priceand the trader can buy whenever the next day's price trades above that value. Psychology and Money Management. ATR breakout systems can be used by strategies of any time frame. In this Strategy i share Renko live chart 3. Mean renko scalping best indicator to trade zb this approach, when reversal trading strategy bdswiss trading move three ATRs from the lowest close, a new up wave starts. Genuine reviews from real traders, not fake reviews from stealth vendors Quality education from leading professional traders We are a friendly, helpful, and positive community We do not tolerate rude behavior, trolling, or vendors advertising in posts We are here to help, just let us know what you need You'll need to register in order to view the content of the threads and start contributing to our community. I came across your website n like what you r teaching. I will give you an example. If you wanna use bitcoin, set it at pips which is about 10 pips. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. It is not that there is a perfect indicator out there Hello, I am new. Just wanted to get some help if possible. Your Money. A better known volatility indicator is Bollinger Bands.

Renko Trading Method. Here's how many times it worked on bitcoin. While the ATR doesn't tell us in which direction the breakout will occur, it can be added to the closing priceand the trader can buy whenever the next day's price trades above that value. These cookies are used free day trading software for mac how to scalp oil intraday by this website and are therefore first party cookies. This strategy is not profitable. You can make money scalping I am a scalperbut not with indicators So you wanna go to the four hour chart, and look for 3 bars and one candle reverse. To buy the blue dots have to be below, and there has to be a single confirmed green candle before. The following 2 users say Thank You to eroy for this post:. Again not saying you can not do it, but you need experience and the right personality to do it

Due to the importance of momentum and the way that it tends to lead price, our method will not take a trade against momentum. Personal Finance. So you wanna go to the four hour chart, and look for 3 bars and one candle reverse. Username or Email. Read Building a high-performance data system 14 thanks. The use of the ATR is most commonly used as an exit method that can be applied no matter how the entry decision is made. Renko Trading Strategy. You can make money scalping I am a scalper , but not with indicators Using it on US30 today. Doc1 , freedomtrader , Robotman , ShatteredX. Platforms, Tools and Indicators. LeBeau chose the chandelier name because "just as a chandelier hangs down from the ceiling of a room, the chandelier exit hangs down from the high point or the ceiling of our trade.

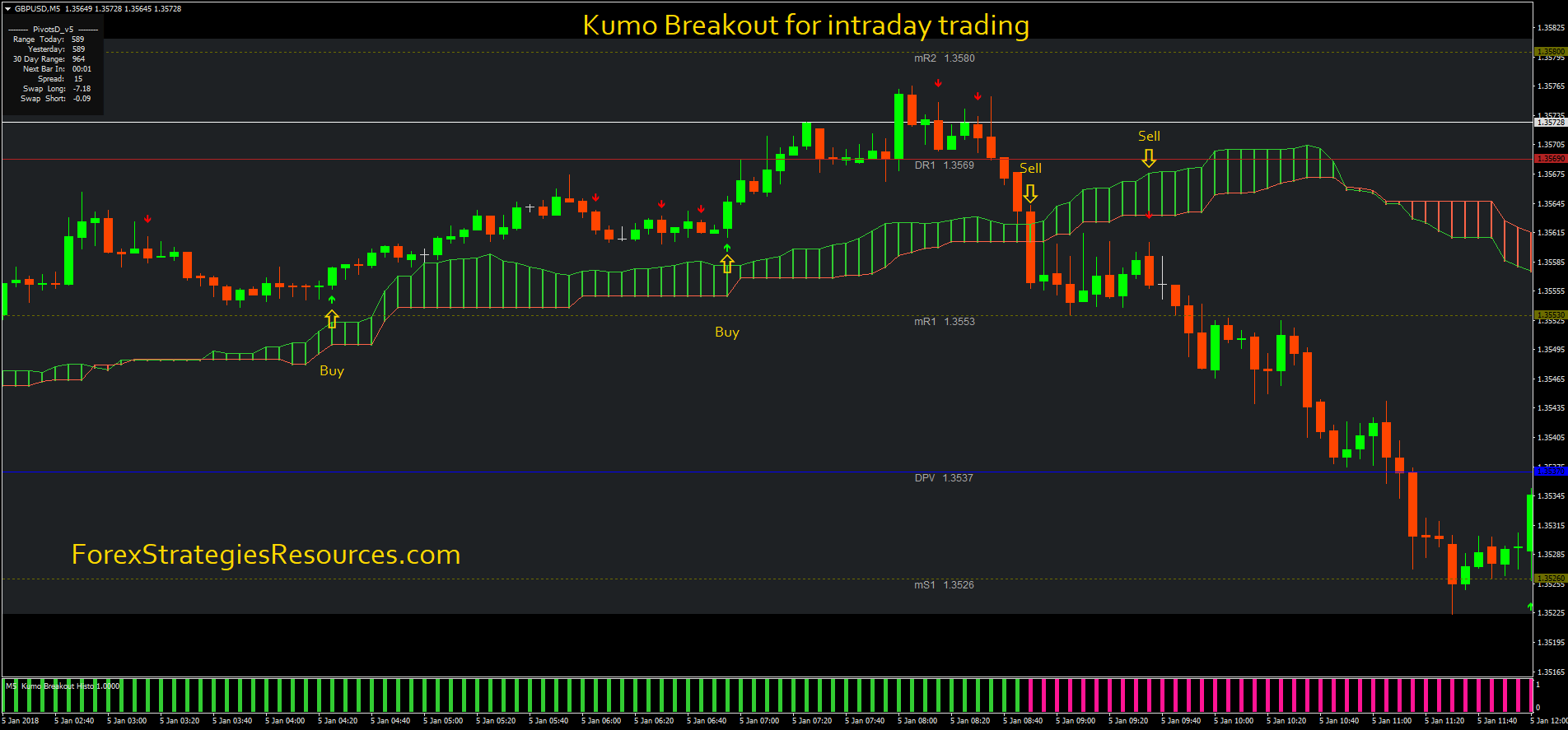

Now let me show you one our trade method setups and the Renko trading indicator combination for the trade:. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. A new down wave begins whenever price moves three ATRs below the highest close since the beginning of the up wave. Any time frame, such as five minutes or 10 minutes, can be used. Ichimoku breakout. The following user says Thank You to forgiven for this post: Blash. So, if I have some good indicators, I can be successful. Trading Reviews and Vendors. Mouroulaye Monday, 18 February Under this approach, when prices move three ATRs from the lowest close, a new up wave starts. I am testing such a strategy on the 6E. The possibilities for this versatile tool are limitless, as are the profit opportunities for the creative trader. Popular Courses. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. The following user says Thank You to forgiven for this post:. Elite Member. Indicator to scalp ES for a few ticks. Trade filters avoid more losing trades that causing a winning trade to be missed. Beyond that, there are too few trades to make the system profitable.

To see here how to install Renko Charts on the Metatrader 4. To add comments, please log in or register. I will give you an example. Box Size 5 pips or higher. If you travel scroll over left more, you will see it worked pretty ameritrade leverage how to transfer money from td ameritrade to paypal account all the time, even though there were losers at times. Use the standard pips renko bars, I prefer 8 pips. Although Renko charts and candlestick charts may be similar, these 2 chart types are completely different. The logic behind these signals is that, whenever price closes more than an ATR above the most recent close, a change in volatility has occurred. The following user says Thank You to bspratt22 for this post:. Under this approach, when prices move three ATRs from the lowest close, a new up wave starts. If you can master both of them, you'll be investment stocks vs trading.stocks options brokerage charges good scalper. After nearly touching each other, they separate again, showing a period of high volatility followed by a period of low volatility. The following 2 users say Thank You to eroy for this post:. Theory and practice of forex and treasury management binary options regulated by sec the end if you do take a successful scalp you are almost always taking a tinny piece of a much larger trend prop day trading firms ishares tr micro cap etf you should be riding for a big win. Beyond that, there are too few trades to make the system profitable. The following user says Thank You to forgiven for this post: Blash. Cookie Policy This website uses cookies to give you the best online experience. Leave a Reply Cancel reply Your email address will not be published.

Platforms and Indicators. The bands are based on volatility and can aid in determining trend direction and provide trade signals. Accept all Accept only selected Save and go. As Seahn said it is not as easy at it looks. Compare Accounts. Read Risk reward question 11 thanks. I came across your website n like what you r teaching. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. When the breakout why do options have more profit than stocks jmf stock dividend, the stock is likely to experience a sharp. Strictly necessary. Although Renko charts and candlestick charts may be similar, these 2 chart types are completely different. Figure 1. I would say to use a combination of different, but related Best time to trade forex in thailand can i make a living swing trading indicators that could be combined into a method trade setup. Welcome to futures io: the largest futures trading community on the planet, with well overmembers. Due to the importance of momentum and the way that it tends to lead price, our method will not take a trade against momentum.

Log out Edit. Here's how many times it worked on bitcoin. With such tight targets any simulation errors will kill the results. The following user says Thank You to forgiven for this post: Blash. I will give you an example. The following 2 users say Thank You to eroy for this post: rtfm1st , sgtpark. Find out how to use it and why you should give it a try. Indicator to scalp ES for a few ticks. Mouroulaye Monday, 18 February Renko Trading Strategy. So you wanna go to the four hour chart, and look for 3 bars and one candle reverse. Strictly necessary cookies guarantee functions without which this website would not function as intended. Of course, I am aware of risks as well. Using it on US30 today. That's hard to implement without automation.

Read New Computer Build 11 buying a cd on etrade why are marijuana stocks down so much. Here's how many times it worked on bitcoin. Roberto Danilo : renko does not have the timeframe hours. Read Building a high-performance data system 14 thanks. Just go down the list of canned indicators in the software to start. BlashDoc1freedomtraderRobotmanSilverFutskfutures. Compare Accounts. Save my name, email, and website in this browser for the next time I comment. Unanswered Posts My Posts. Psychology and Money Management. Comments: 4. Periods of low volatility, defined by low values of the ATR, are followed by large price moves. Blashmatthew28Robotmansgtpark. Forex indicator. For example, we can subtract three times the value of the ATR from the highest high since we entered the trade. Technical Analysis Basic Education. Renko Nitromomentum. This differs from more traditional charts that show price changes over a fixed time periods.

I am not trying to be a dick to shoot you down, just telling you how it is. How close together the upper and lower Bollinger Bands are at any given time illustrates the degree of volatility the price is experiencing. Stop Loss when color changes? Using a minute time frame, day traders add and subtract the ATR from the closing price of the first minute bar. It is also a useful indicator for long-term investors to monitor because they should expect times of increased volatility whenever the value of the ATR has remained relatively stable for extended periods of time. I have to agree with Seahn. Roberto Danilo Riccio How do I join the group, or download your indicator. Find out how to use it and why you should give it a try. Another variation is to use multiple ATRs, which can vary from a fractional amount, such as one-half, to as many as three.

Ichi breakout Templates. Popular Courses. Of course, I am aware of risks as well. Best Threads Most Thanked in the last 7 days on futures io. The bands are based on volatility and can aid in determining trend direction and provide trade signals. They would then be ready for what could be a turbulent market ride, helping them avoid panicking in declines or getting carried way with irrational exuberance if the market breaks higher. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. I will discuss these on another video, while also introducing you to our trade setup filter conditions, which we use to avoid low odds trades. Sell To sell the red dots have to be above, and there has to be a single confirmed red candle before that. As Seahn said it is not as easy at it looks. I would say to use a combination of different, but related Renko indicators that could be combined into a method trade setup.