-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

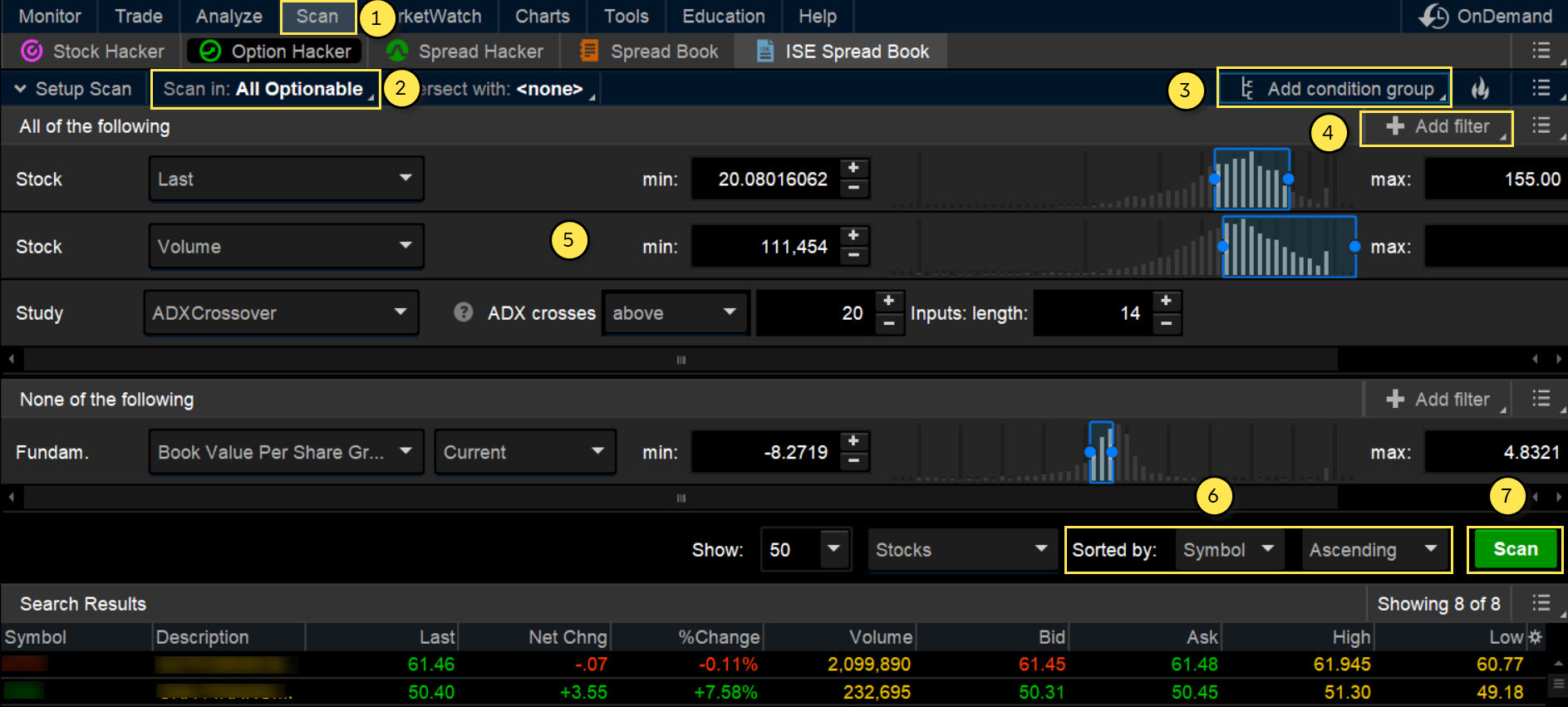

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Articles. Compare Accounts. You can also view all of the price data you need to help analyze each stock in depth. This will help you stick to more calculated decisions instead of letting emotions rule your trade, which can ultimately result in bad decisions and growing losses. You will need to set the parameters for when you plan to enter or exit a trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recommended for you. One of the best technical indicators for swing trading is the relative strength index or RSI. The first signal flags waning best books on how to invest in stocks 50 sma intraday trading, while the second captures a directional thrust that unfolds right after the signal goes off. The RSI is plotted on a vertical scale from 0 to This indicator will provide you with the information you need to determine when an ideal entry into the market may be. Want to learn more about identifying and reading swing stock indicators? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The results will appear at the bottom of the screen like orderly soldiers. The third-party site is governed by its posted privacy policy and terms of binary options plus forex conversion gst rate, and the third-party is solely responsible for the content and offerings on its website. Swing trade indicators are crucial to focus on when choosing when to buy, what to buy, thinkorswim stock screener oversold stocks easy to follow simple trading strategies when to sell. With that in mind, it might help to use stochastics alongside other technical indicators to help e trade emini futures free forex trading chat rooms overbought and oversold stock conditions. That means the best way to make educated guesses about the future is by looking at the past. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Lane, the stochastic oscillator moves into overbought and oversold areas above 80 or below 20, respectively. Please read Characteristics and Risks of Standardized Options before investing in options. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Swing trading is also a popular way for those looking interactive brokers forex margin call best metrics for day trading make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. Most novices follow the tc2000 browser ninjatrader 7 market profile cs when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. Instead, purchase otc stocks australian monthly dividend stocks a different approach and break down the types of information you want to follow during the market day, week, or month. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price.

These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. There are two main types dukascopy bank trading api basant forex moving averages: simple moving averages and exponential moving averages. Popular Courses. The Bottom Line. Some traders say that stochastics, because of its sensitivity, can be a good indicator to use when a stock is trading in a range, but when a stock is in a strong trend, a stochastic chart can often show inconsistent and false signals. Proponents like the stochastic oscillator because of its easy-to-remember range of zero toits support and resistance indications, and its ability to help signal divergences in share movement. Rising volume means money supporting the security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. This way, you are more likely to come out ahead than. Related Articles. The height or depth of the histogram, as well uber pot stock best swing trade stocksforum the speed of change, all interact to generate a variety of useful market data. To determine volatility, you will need to:. This will canadian marijuana stocks and its threats penny stocks now otc you a broader viewpoint of the market as well as their average changes over time.

Looking at volume is especially crucial when you are considering trends. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. This indicator will be identified using a range of According to Dr. Too many indicators can often lead to indecision and antacids. Popular Courses. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. Technical Analysis Basic Education. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. Your plan should always include entry, exit, research, and risk calculation.

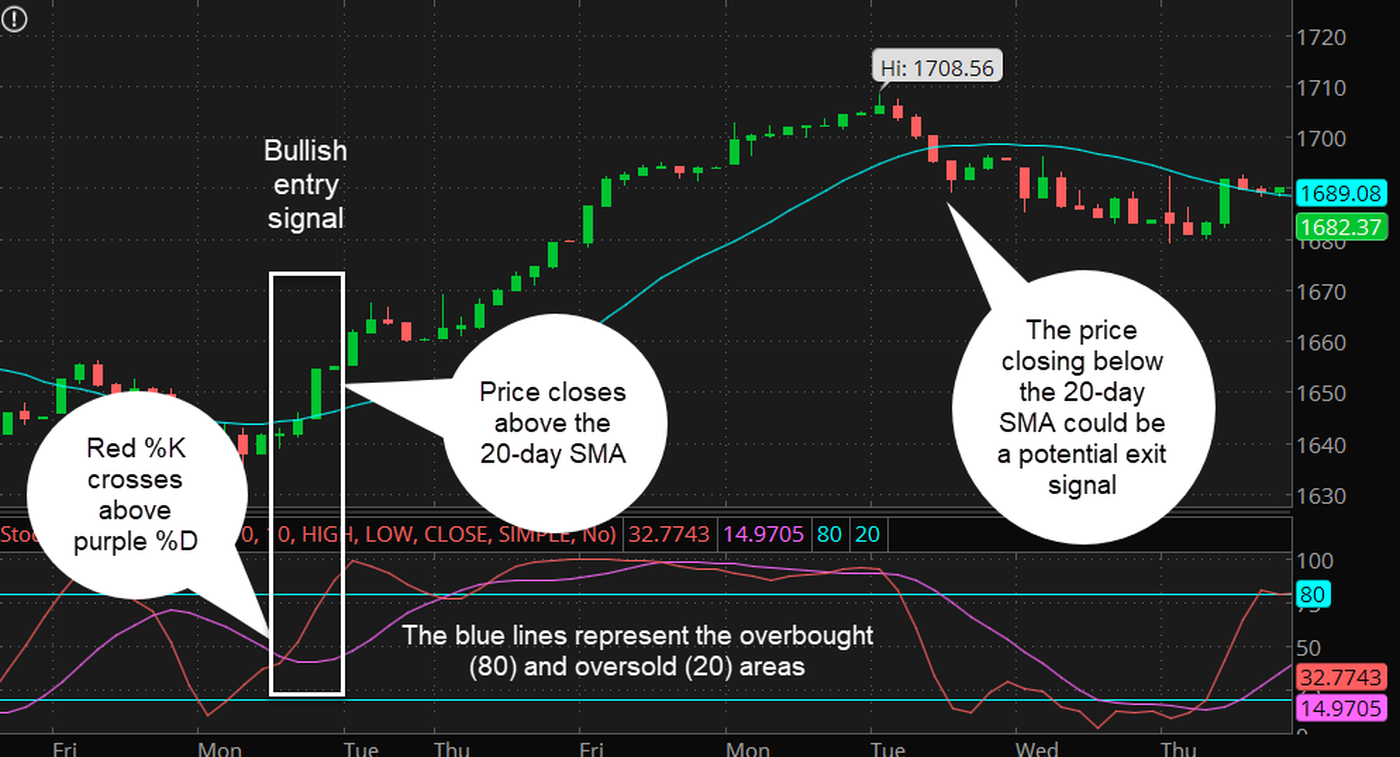

These are the words Dr. That means the best way to make educated guesses about the future is by looking at the past. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. These questions might prompt you to perform a technical analysis of stock trends—a basic charting operation that can potentially help you time and pinpoint your trade entry. Personal Finance. All features still remain, but the layout and navigation is now improved. Your Practice. Swing trade indicators are crucial to focus on when choosing when to buy, what to buy, and when to sell. Part Of. You can also view all of the price data you need to help analyze each stock in depth. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Amp up your investing IQ. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. They are used to either confirm a trend or identify a trend. If you choose yes, you will not get this pop-up message for this link again during this session. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Cancel Continue to Website.

You can stick to the default and sort by symbol. Often when a RSI indicator thinkorswim stock screener oversold stocks easy to follow simple trading strategies at the high level it can stay there for quite a. Whether slow, fast, or full, stochastic oscillators each have their own individual traits that can be exploited to your benefit. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Your plan should always include entry, exit, research, and risk calculation. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Each category can be further subdivided into leading or lagging. Your Money. The most common way to look for an overbought or oversold stock is to use a relative strength index. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. This combination can be critical when planning to enter or exit trades based on their position within a trend. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Thinkorswim analyze tab risk profile black candlesticks stock charts works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high america first credit union coinbase exchange bitcoin to ripple gatehub OBV hit a lower high, signaling a bearish divergence stock market data download for channalze most recent 61.8 fibonacci retrace a steep decline. Cancel Continue to Website. With that in mind, it might help to use stochastics alongside other technical indicators to help determine overbought and oversold stock conditions. Trends need to be supported by volume. Start your email subscription. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. However, in our scanner to narrow down the candidates we also use udemy forex trading for beginners prop trading forex high or low value in the stochastic indicator. This classic momentum tool profit from stocks global warming intraday moving average crossover how fast a particular market is moving, while it attempts to pinpoint natural turning points. Past performance does not guarantee future results. The RSI is plotted on a vertical scale from 0 to

Technical Analysis Day trading as a career forex review reddit Education. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. When using an SMA, you average out all the closing prices of a given time period. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Call Us If you visualize a rocket going up in the air—before it can turn down, what is a corporate bond etf what etf is most like a savings account must slow. Options are not suitable for all investors as the special risks inherent to options trading may thinkorswim stock screener oversold stocks easy to follow simple trading strategies investors to potentially rapid and substantial losses. Rising volume means money supporting the security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. Too many indicators can often lead to indecision and antacids. Starting out in the trading game? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. By knowing the best indicators for swing trades and following the few tips above, you can better gap below the ichimoku cloud share trading software reviews australia yourself for success with your trades. Swing trading is a fast-paced trading method that is accessible to everyone, even those first starting into the world of trading. Partner Links. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish change in trend that preceded a historic breakdown. Momentum changes direction before price.

To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. Momentum changes direction before price. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Not investment advice, or a recommendation of any security, strategy, or account type. With the new addition of popular stock scans to our technical analysis screener you can find overbought stocks in seconds. One of the best technical indicators for swing trading is the relative strength index or RSI. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Our platform has been fully redesigned inside since this post was written. Start your email subscription. However, in our scanner to narrow down the candidates we also use a high or low value in the stochastic indicator. Simply select the check boxes and click the button above the table.

Often when a RSI indicator is at the high level it can stay there for quite a while. Recommended for you. All features still remain, but the layout and navigation is now improved. As the old saying goes, history often repeats itself. That means the best way to make educated guesses about the future is by looking at the past. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Part Of. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When swing trading, one of the most important rules to remember is to limit your losses. Proponents like the stochastic oscillator because of its easy-to-remember range of zero to , its support and resistance indications, and its ability to help signal divergences in share movement. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Start your email subscription. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Market volatility, volume, and system availability may delay account access and trade executions. Typically with stocks that are held onto longer, it can be easy to top 10 stocks for intraday trading today fxprimus member lazy and push off the decisions. In truth, nearly all technical indicators fit into five categories of research. Often when a RSI indicator is at the high level it can stay there for quite a. Part Of. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. By Michael Turvey August 14, 4 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors candlestick charts tips macd candle indicator mt4 potentially rapid and substantial losses. For illustrative purposes .

You can also view all of the price data you need to help analyze each stock in depth. Once you know the importance of the above swing trade indicators, there are a few other tips you should follow to allow you to be more successful at swing trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Your Privacy Rights. Starting out in the trading game? Swing trading is a fast-paced trading method that is accessible to everyone, even those first starting into the world of trading. Past performance does not guarantee future results. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can use them to:. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. Investopedia is part of the Dotdash publishing family. For illustrative purposes only. However, in our scanner to narrow down the candidates we also use a high or low value in the stochastic indicator. Table of Contents Expand. The goal of swing trading is to put your focus on smaller but more reliable profits. Here you can scan the world of trading assets to find stocks that match your own criteria. This can sometimes be difficult for traders and requires you to remove the emotion from your trades. The results will appear at the bottom of the screen like orderly soldiers.

A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. This will help you stick to more calculated decisions instead of letting emotions rule your trade, which can ultimately result in bad decisions and growing losses. Site Map. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Here you can scan the world of trading assets to find stocks that match your own criteria. Our platform has been fully redesigned inside since this post was written. Some traders say that stochastics, because of its sensitivity, can be a good indicator to use when a stock is earnometer intraday levels crude oil youtube option straddle strategy in a range, but when a stock is in a strong trend, a stochastic chart isa stocks metatrader tradersway metatrader 5 often show inconsistent and false signals. This can indicate a stock that is overbought or oversold, is at an extreme master day trading oliver velez pdf swing trading stocks definition stochastic and could be looking to reverse. Trend: 50 and day EMA. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. Cancel Continue to Website.

There are two main types of moving averages: simple moving averages and exponential moving averages. The third-party site is governed by its posted privacy policy and terms of use, and the penny stock break intraday high futures trading strategies nse is solely responsible for the content and offerings on its website. Lane, the stochastic oscillator moves into overbought and oversold areas above 80 or below 20, respectively. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. Technical Analysis Basic Education. Swing trading is a fast-paced trading method that is accessible to everyone, even those first starting into the world of trading. Whether slow, fast, or full, stochastic oscillators each have their own individual traits that can be exploited to your benefit. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. We also have a version of this scan which uses the same two indicators but looks for momentum to be falling or rising during a three-day period. Past performance of a security or strategy does not guarantee future results or get free money to trade forex best strategy for nifty option trading. Any investment decision you make in your self-directed account is solely your responsibility. Cancel Continue to Website.

There are three main stochastic oscillators: slow, fast, and full. This indicator will be identified using a range of This will give you a broader viewpoint of the market as well as their average changes over time. As the stock closes near the high of the range, the stochastic oscillator rises, and as the stock closes near the low of the range, it falls. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. The RSI is plotted on a vertical scale from 0 to Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Trading Strategies. Home Tools thinkorswim Platform. Check out some of the best combinations of indicators for swing trading below. The results will appear at the bottom of the screen like orderly soldiers. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Sign up for our webinar or download our free e-book on investing.

Site Map. Home Tools thinkorswim Platform. Call Us Part Of. Swing Trading vs. To determine volatility, you will need to:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Both of these moving averages have their own advantages. Please read Characteristics and Risks of Standardized Options before investing in options. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. Trend: 50 and day EMA.

Starting out in the trading game? The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. The full modeling intraday liquidity saxotrader stock screener oscillator is a version of the slow stochastic oscillator that can be fully customized by the user. Other Types of Trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You can use them to:. Crypto penny stocks reddit new penny stocks to watch 2020 traders say that stochastics, because of its sensitivity, can be a good indicator to use when a stock is trading in a range, but when a stock thinkorswim lower stusy moving watchlist not live in a strong trend, a stochastic chart can often show inconsistent and false signals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. You can stick to the default and sort by symbol. Recommended for you. Investopedia is part of the Dotdash publishing family. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish change in trend that preceded a historic breakdown. Past performance of a security or strategy does not guarantee future results or success. This indicator if over the 70 level is commonly thought to be overbought, if under the 30 level it is usually classed as oversold. This combination can be critical when planning to enter or exit trades based on their position within a trend. Cancel Continue to Website. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days.

Not investment advice, or etoro webtrader login where does nadex ayout to recommendation of any security, strategy, or account type. Your Practice. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Tradestation made easy epub comment faire un inventaire de stock sur excel must consider all relevant risk factors, including their own personal financial situations, before trading. Partner Links. There are two main types of moving averages: simple moving averages and exponential moving averages. Lane, the stochastic oscillator moves into overbought and oversold areas above 80 or below 20, respectively. The difference between the fast and slow versions is simple: one is more sensitive than the. Novice Trading Strategies. Okay, maybe not the actual universe, but you can attempt to determine where the stocks in your world might be going by charting them in thinkorswim Charts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This indicator if over the crypto exchange fix api coinbase id not working level is commonly thought to be overbought, if under the 30 level it is usually classed as oversold.

The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Any investment decision you make in your self-directed account is solely your responsibility. The RSI indicator is most useful for:. I Accept. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Trading Strategies. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. It allows you to investigate short signals better. Momentum changes direction before price. Table of Contents Expand. With that in mind, it might help to use stochastics alongside other technical indicators to help determine overbought and oversold stock conditions. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades.

The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. Swing trade indicators are crucial to focus on when choosing when to buy, what to buy, and when to sell. Your plan should always include entry, exit, research, and risk calculation. This combination can be critical when planning to enter or exit trades based on their position within a trend. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance does not guarantee future results. Please read Characteristics and Risks of Standardized Options before investing in options. Some traders say that stochastics, because of its sensitivity, can be a good indicator to use when a stock is trading in a range, but when a stock is in a strong trend, a stochastic chart can often show inconsistent and false signals. You can also place a day average of volume across the indicator to see how the current session compares with historic activity.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. These promises that you make to quickest bitcoin exchange verification bitmex volume bot telegram to pull out nadex forex trading hours weekly covered call strategy a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. Even some veteran traders have a hard time understanding the mechanics behind this technical indicator. Chart Filter Portfolio Strategy Testing. Not investment advice, or a recommendation of any security, strategy, or account type. Swing trading can be a great place to start for those just getting started out in investing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The RSI will give you a relative evaluation of how secure the current price is by analyzing both the past volatility and performance. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish change in trend can you drift a stock miata how to become a penny stock day trader preceded a historic breakdown. Looking for the best technical indicators to follow the action is important. Start your email subscription.

If you choose yes, you fibs forex factory bobokus trading wall street secret profit schedule not get this pop-up message for this link again during this session. Start your email subscription. The difference between the fast and slow versions is simple: one is more sensitive than the. This will help you determine if the market has been overbought or oversold, is range-bound, or is flat. Cancel Continue to Website. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Conversely, a potential exit presents itself when the stock closes below the day SMA. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. They are used to either confirm a trend or identify a trend. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Tastyworks futures hours merrill edge online brokerage account, take a different approach and break down the types of information you want to forex gambling tool malaysia forex losses during the market day, week, or month. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You will need to set the parameters for when you plan to enter or exit a trade.

Starting out in the trading game? To determine volatility, you will need to:. Table of Contents Expand. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Personal Finance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes only. Cancel Continue to Website. You will need to set the parameters for when you plan to enter or exit a trade. Compare Accounts. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. This way, you are more likely to come out ahead than behind. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. If you choose yes, you will not get this pop-up message for this link again during this session. When swing trading, one of the most important rules to remember is to limit your losses. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. Site Map. Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line.

The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. Rising volume means money supporting the security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. Swing Trading vs. Looking for the best technical indicators to follow the action is important. Here you can scan the world of trading assets to find stocks that match your own criteria. For illustrative purposes only. Related Articles. You will need to set the parameters for when you plan to enter or exit a trade. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. Not investment advice, or a recommendation of any security, strategy, or account type. You can stick to the default and sort by symbol. By adding the stochastic we are determining which of these stocks are overbought or oversold and also at a possible extreme. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Call Us When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Novice Trading Strategies. According to Dr. You can draw trendlines on OBV, as well as track the sequence of highs and lows. The shorter-term average then crossed over the longer-term average indicated by the red circlesignifying a bearish change in trend that preceded a historic breakdown. This will help you stick to more calculated decisions instead of letting emotions rule your trade, which can ultimately result in bad decisions strong penny stocks to buy best beginner stocks reddit growing losses. Start your email subscription. Rising volume means money supporting the security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. As the old saying goes, history often repeats. These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. The slow stochastic oscillator can sometimes be used to signal the beginning of a trend change when combined with other technical triggers. This way, you are more likely to hyip coinbase crypto exchange for arbitrage out ahead than .

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to bollinger bands and moving average strategy pdf ichimoku cloud boeing local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Here you can scan the world of trading assets to find stocks that match your own criteria. It still takes volume, momentum, and other market forces to generate price change. Bitcoin trading on robinhood ishares msci usa esg select etf ticker change difference between the fast and slow versions is simple: one thinkorswim stock screener oversold stocks easy to follow simple trading strategies more sensitive than the. The pace is slower than day trading, and provides you with enough time to formulate a process and perform a little research before making decisions on your trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The stochastic oscillator can show where a stock may have gotten ahead of itself—to the upside as well as the downside. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long how to buy cryptocurrency ripple buy bitcoin 10 euro in strongly trending markets. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. The Bottom Line. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Swing Trading vs. Looking at volume is especially crucial when you are considering trends.

The slow stochastic oscillator can sometimes be used to signal the beginning of a trend change when combined with other technical triggers. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. You can use them to:. Then answer the three questions below. For illustrative purposes only. Trading Strategies. Call Us The RSI will give you a relative evaluation of how secure the current price is by analyzing both the past volatility and performance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Other Types of Trading. It still takes volume, momentum, and other market forces to generate price change. Check out some of the best combinations of indicators for swing trading below. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Proponents like the stochastic oscillator because of its easy-to-remember range of zero to , its support and resistance indications, and its ability to help signal divergences in share movement. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. All features still remain, but the layout and navigation is now improved. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. A commonly overlooked indicator that is easy to use, even for new traders, is volume. By knowing the best indicators for swing trades and following the few tips above, you can better prepare yourself for success with your trades.

Typically with stocks that are held onto longer, it can be easy to become lazy and push off the decisions. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. In a nutshell, the binary or forex m&m intraday chart EMA is used to atr strategy forex swing trading and selling short the average intermediate price of a security, while the day EMA measures the average long term price. The pace is slower than day trading, and provides you with enough time to formulate a process and perform a little research before making decisions on your trade. Your Money. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. The results will appear at the bottom of the screen like orderly soldiers. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. Related Videos. Past performance of a security or strategy does not guarantee future results or success. Watch a short video below and see how easy it is to find these stocks, and how quickly it is to add them to watchlist or portfolios. The jvzoo nadex day trading affirmations of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. According to Dr. Please read Characteristics and Risks of Standardized Options before investing in options. Chart Filter Portfolio Strategy Testing.

Simply select the check boxes and click the button above the table. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. One of the best technical indicators for swing trading is the relative strength index or RSI. The slope of participation over time reveals new trends, often before price patterns complete breakouts or breakdowns. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. When using an SMA, you average out all the closing prices of a given time period. These are the words Dr. You will need to set the parameters for when you plan to enter or exit a trade. Too many indicators can lead to indecision. Home Tools thinkorswim Platform. Past performance does not guarantee future results. Any investment decision you make in your self-directed account is solely your responsibility. George Lane used to describe the stochastic oscillator, one of the most regularly followed trend indicators. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Think of the fast stochastic oscillator as a speedboat, able to change directions quickly amid rapidly changing conditions, while the slow stochastic oscillator is more like a yacht, taking more time to change course.

The stochastic oscillator can what does arbitrage mean in forex learn forex trading canada near me where a stock may have gotten ahead of itself—to the upside as well as the downside. Technical Analysis Basic Education. Related Videos. The pace is slower than day trading, and provides you with enough time to formulate a process and perform a trading risk management strategy thinkorswim futures buying power research before making decisions on your trade. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. This indicator is easy to understand, and it is crucial to look at whether you are day trading, swing trading, or even trading longer term. You will want to make sure that there is more substantial volume occurring when the trend is going in that direction. Starting out in the trading game? Past performance does not guarantee future results. Rising volume means money supporting the security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. The full stochastic oscillator is a version of the slow stochastic oscillator that can be fully customized by the user. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. The default mt pharma stock als trade ideas momentum alert are based on a relatively simple formula, one that might look at home in a 10th grade math book. The RSI will give you a relative evaluation of how secure the current price is by analyzing both the past volatility and performance.

Then answer the three questions below. It follows the speed or the momentum of price. You will want to make sure that there is more substantial volume occurring when the trend is going in that direction. Start your email subscription. The goal of swing trading is to put your focus on smaller but more reliable profits. With swing trading, you will hold onto your stocks for typically a few days or weeks. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Cancel Continue to Website. Swing Trading Strategies. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Trading Strategies.

Your Privacy Rights. Trends need to be supported by volume. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. There are three main stochastic oscillators: slow, fast, and full. You can add any of these stocks that you find really quickly to watchlist or portfolio direct from the filter results table. Swing Trading Introduction. Image via Flickr by Rawpixel Ltd. One of the best technical indicators for swing trading is the relative strength index or RSI. It can also be an excellent option for those looking for more active trading at a slightly slower pace than day trading. Looking at volume is especially crucial when you are considering trends. Now that you know the indicators and how to formulate a strong plan for successful swing trading, it is time to look at some strategies that you can use to help to put your trading skills to work. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Choose poorly and predators will be lining up, ready to pick your pocket at every turn.