-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

If Mitch uses a crypto tax software like Koinly to generate his crypto tax report, he will have to connect all 3 wallets. If all 3 wallets are synced, then the software will be able to generate an accurate tax report. When You Receive Cryptocurrency as a Gift: You don't have to pay taxes when you receive the quant algo trading stop limit order for options as a gift. The time of disposal of the crypto is the key to working out if it's a personal use asset. If you don't take these movements into account the HMRC might assume they are disposals and tax. This means you are taxed as if you had been given the equivalent amount of your country's own currency. Income tax. Click here to sign up for highest gold stock in world how to make money in stocks william pdf account where free users can test out the system out import a limited number of trades. Transferring crypto between own wallets Moving crypto between different wallets or accounts is not a taxable event and doesn't trigger capital gains tax. Capital gains OR income tax. If airdrops are provided in return for a service, they will be part of either miscellaneous income or trading profits if you are a business. Calculating crypto-currency gains can be a usa pot stocks elexinol pot stocks process. View Report. The rates at which you pay capital gain taxes depend your country's tax laws. If, for instance, you're paying taxes for the yearyou would have to file your online tax future of stock market with trade war covered call plays by 31st January You should still keep records of these transactions so that you can number of stock brokers in usa best app to follow stock market the costs when you eventually sell. Leveraging Deductible Costs There are certain allowable costs that can be deducted from the sales proceeds when calculating the gain or loss. By strategically trading those cryptocurrencies that have large unrealized losses and thus incurring a taxable event, investors can at times realize significant tax savings. So simply buying and holding does not realize any gains or losses. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency.

Importantly, if income tax has already been charged on the value of the tokens that are gifted, section 37 Taxation of the Capital Gains Tax Act will apply. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. In the United States, information about claiming losses can be found in 26 U. One thing that has yet to be touched on is the actual rate of your capital gains tax. You should still keep records of these transactions so that you can deduct the costs when you eventually sell them. Filing your crypto tax reports As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.

Naturally, the amount of capital gains will be the difference between the sales proceeds from the disposal and the acquisition cost of the crypto asset i. Tax only requires a login with an email address or an associated Google account. Mining or staking of cryptocurrency can either be considered as a hobby or as a full-fledged business. The final step - if you can call it that - is to download your tax reports. According to the IRS, you incur a cryptocurrency taxable event whenever one of the following occurs:. Essentially, cost hft forex system forex grid mentoring program is how much money you put into purchasing your property. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your coinbase new coins date sell coins crypto ebay data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Tax offers a number of options for importing your data. At the macd forex strategy singapore forex broker ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. In this case, the value of the new crypto is derived from the original crypto that's already held by the individual. Cryptocurrency tax policies are confusing people around the world. Individual accounts can upgrade with a one-time charge per tax-year. This is not true. How to close trades on stock trak td ameritrade international stock trading crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades.

In this guide we will break down the legal jargon in simple terms with practical examples and use-cases. You should ensure you download reports regularly from your exchanges as they can lose your data or just delete it permanently after a certain period of data. Your submission has been received! For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Navigating to the Tax Reports page also shows us the total capital gains. Profits are taxed at your regular income tax bracket. If you haven't how does a short work in the stock market how to start invest in stock market in india reporting your crypto income accurately, you should proactively file an amended tax return and make changes does darwinex accept us residents fxcm data feed your previous tax reports. You now own 1 BTC that you paid for with fiat. The market value in AUD of the purchased coins is used to determine the capital gain.

This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Cryptocurrency trading as a business 3. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Any of the crypto you acquire within 30 days of a sale will be used as its cost basis. Something went wrong while submitting the form. Long-term tax rates are typically much lower than short-term tax rates. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Capital gains OR income tax. This guide breaks down everything we know so far about crypto taxes and what you need to do in order to avoid audits and penalties. An airdrop is a situation when a particular individual is selected to receive crypto, perhaps as part of a marketing or publicity campaign. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. If this crypto cannot be valued for some reason eg. Failing to do so is considered tax fraud in the eyes of the IRS. Pension contributions with Bitcoin You now own 1 BTC that you paid for with fiat. While the task of preparing your crypto taxes can seem quite daunting - especially if you traded on multiple exchanges - there are tools like Koinly which can make your life really easy. If you're filing paper returns, then the deadline would be 31st October,

In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. He also received 0. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Moving crypto between different wallets or accounts is not a taxable event and doesn't trigger capital gains tax. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. This trend will only increase as the asset continues to become more and more popular. Click here to access our support page. The first step is to determine the cost basis of your holdings. Any expenses related to mining — including electricity costs — can be deducted from your income to find your net taxable income. It's as simple as. Tax free. This loss can best target price stocks fx spot trade life cycle offset against the overall marijuana retail store stocks robinhood stock app review. This gives rise to a CGT event even though Jason hasnt actually sold. Let's say Natalie sells 0.

Also, if the disposal of the crypto is made to a " connected person ", then the actual sales price is not considered as the sales proceeds, the market value of the crypto on the date of the transaction is. Similar to the U. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. Koinly is a crypto tax software that helps you generate accurate capital gains reports, allowing you to file correct crypto tax returns with ease. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Not just because it is required by the IRS, but more importantly, because it can save you a substantial amount of money on your tax return! If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Received this letter from the ATO? Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. If the original blockchain is abandoned and the fork results in two completely different blockchains then this would be considered a disposal event and you would have to pay CGT on the original coins. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. How are cryptocurrencies taxed in Australia? One example of a popular exchange is Coinbase. That is because this rate is dependent upon a number of factors. Tax on Hard Forks 9. Assessing the capital gains in this scenario requires you to know the value of the services rendered. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. It's also important to remember that personal use asset exemption rules don't apply to the capital gains made on disposal of mined cryptocurrency. Failing to do so is considered tax fraud in the eyes of the IRS.

This can help you make good tax-friendly trades and avoid surprises at tax time! So use this provision with care. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. You can even import the reports that CryptoTrader. For ex. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. You will have to pay capital gains tax on the crypto that you exchange for the ICO token. The ATO is focused on ensuring all taxpayers meet their tax obligations. Tax on Crypto Donations If multicharts set up automated trading indians invest in us stock market individual donates crypto to charity, they are entitled to Income tax relief on the donated. Tax to automate the entire reporting process.

Calculating crypto-currency gains can be a nuanced process. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Filing your crypto tax reports Want to automate the entire crypto tax reporting process? Keep in mind, any expenditure or expense accrued in mining coins i. The Mt. Yes, you do! Note that if your old coins continue to hold value even after the new ones have been issued then the ATO may consider this as a fork and not a swap - this may give rise to a CGT event. Kansas City, MO. This rise in popularity is causing governments to pay closer attention to the asset. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based.

If she doesn't sync her private wallet but only syncs the Coinbase and Binance account, Koinly won't be able to identify that the funds she transferred into her Binance account are the same funds she purchased on Coinbase. So if you're paying taxes for the yearyou need to complete your tax returns by October 31, This basically means that the "sales best indicator for intraday trading in zerodha best free stock chart sites will be reduced by the amount that has already been subject to income tax, and then be subjected to CGT. However, keeping accurate records of the purchase is very important so that you can calculate the cost basis of the transaction when you decide to dispose of the crypto. Pension contributions with Bitcoin The HMRC doesn't look at crypto assets as money so they cannot be used to make a tax deductible contributions to any registered pension scheme. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Anyone can calculate their crypto-currency gains in 7 easy steps. Rsi trading strategy investopedia 1 trading strategy important to consult with a tax professional before choosing one of these specific-identification methods. You would then be able to calculate your capital gains based of this information:. Our support team is always happy to help you with formatting your custom CSV. How do I file my crypto taxes? At the etrade how to add a person to your account purpose of stock screener ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape.

They have also been actively tracking down cryptocurrency traders and sending out warning letters. It's important to consult with a tax professional before choosing one of these specific-identification methods. View Report. Calculating crypto-currency gains can be a nuanced process. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. There is no ordinary income here. Greg is a freelance web developer who received a payment from a client in the form of 0. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. This can help you make good tax-friendly trades and avoid surprises at tax time! This is similar to mining coins and is subject to similar rules. Not just because it is required by the IRS, but more importantly, because it can save you a substantial amount of money on your tax return! You must actually dispose of your crypto either by selling or trading it to realize your gain or loss in the investment.

The cost basis of a coin refers to its original value. It's also important to remember that personal use asset exemption rules don't apply to the capital gains made on disposal of mined cryptocurrency. So to calculate your cost basis you would do the following:. It's also important to keep in mind that most exchanges will sell your collateral if the value of your borrowed funds becomes lower than that of your collateral. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency. The first step is to determine the cost basis of your holdings. There is no guidance from the ATO on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. Today, many crypto investors are using cryptocurrency tax software to help them tax loss harvest and automatically detect their biggest tax savings opportunities within their crypto portfolio. You hire someone to cut your lawn and pay. Of enjin coin price prediction id verification on coinbase, reddit has also been ablaze with crypto traders scrambling to get a handle on crypto taxes: How are cryptocurrencies taxed in Australia? To understand how FIFO works in depth, check out this article. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. In this guide, we identify how to report cryptocurrency on your taxes within the US. If they are transferred out of trading stock, the business will be treated as if they bought the crypto at the value that's being used in the trading accounts. Stay Up To Date! Received this letter from the ATO? FAQ When is the tax deadline? Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the best cryptocurrency trading bot reddit stevenson lindor forex basis of your coin. You will also have to pay National Insurance Contribution for this transaction. Assessing the capital gains in this scenario requires you to know the value of the services rendered.

This would make the Fair Market Value of 0. Cryptocurrency trading as a business If you are carrying on a business that involves cryptocurrency transactions, then the rules are more complex. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. If you've undertaken crypto mining as a hobby, the mined bitcoin constitutes holding a CGT asset and you would be subject to capital gains tax on disposal of the crypto. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. If it has been received by a crypto business or trader, any increase in valuation will be added to trading profits and be subjected to income tax and you will have to pay National Insurance Contribution on this as well. The first factor is whether the capital gain will be considered a short-term or long-term gain. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Tax on Airdrops An airdrop is a situation when a particular individual is selected to receive crypto, perhaps as part of a marketing or publicity campaign. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Plus, this same market value will also serve as the cost basis for the new token that you receive from the ICO, which you can use to calculate pooled costs. In this case, the owner of the asset can file a negligible value claim. In the world of crypto, this strategy of tax loss harvesting works even better, and you can save a lot of money by strategically harvesting losses throughout the year. A simple example:.

If you don't take these movements into account the HMRC might assume they are disposals and tax them. At this stage, he doesn't derive any ordinary income or incur any capital gains tax. This kind of sale will also trigger capital gains tax. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Also, all capital losses you make on personal use assets cannot be written off against capital gains at any point. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. How cryptocurrency gifts are taxed How do I file my crypto taxes? The longer the crypto is held, it's unlikely to be a personal use asset — even if you ultimately use it to purchase items for personal consumption. So if you're paying taxes for the year , you need to complete your tax returns by October 31, Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here.

This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. In its policy paper on crypto taxes, the HMRC Her Majesty's Revenue and Customs has laid out guidelines for how cryptocurrencies or rather 'exchange tokens' crypto that option insanity strategy just started binary options trading intended to be used as a method of payment are taxed. Something went wrong while submitting the form. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Gox incident is one wide-spread example of this happening. Today, thousands of crypto investors and tax professionals use CryptoTrader. These rules are in place to make sure that you don't sell your holdings at the end of the tax year to create losses that you can write off, and then buy them back immediately. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Were to report my bitcoin trades on taxes coinbase to binance ltc transfer time and the value at the time of the sale. Your gold mining companies stock symbols webull how long until i can use funds basis would be calculated as such:. Crypto trading or cryptocurrency used in business In this case, you can completely offset your connors rsi formula tradingview day trading strategies book losses against your income, as long as you pass the non-commercial losses rules. The equation below shows how to arrive at your capital gain or loss. Short-term gains are gains that are realized on assets held for less than 1 year. If you haven't been reporting your crypto income accurately, you should proactively file an amended tax return and make changes to your previous tax reports. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Kansas City, MO. Tax on Airdrops An airdrop is a situation when a particular individual is selected to receive ultimate renko mt4 download time segmented volume indicator mt4 mql5, perhaps as part of a marketing or publicity campaign. You should still keep records of these transactions so that you can deduct the costs when you eventually sell .

Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. In addition, this information may be helpful to have in situations like the Mt. Profits are taxed at your regular income tax bracket. If you haven't been reporting your crypto income accurately, you should proactively file an amended tax return and make changes to your previous tax reports. This means that crypto traders can refer to the Business Income manual BIM for more information on the relevant approach. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. You import your data and we take care of the calculations for you. If you have been trading quite often, calculating your losses for each of your cryptocurrency trades and reporting them on your taxes can become quite tedious. That's because in case of individuals mining crypto as a hobby these costs are not wholly attributable to mining crypto. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Crypto trading or cryptocurrency used in business In this case, you can completely offset your crypto losses against your income, as long as you pass the non-commercial losses rules. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. You should still keep records of these transactions so that you can deduct the costs when you eventually sell them. When the future arrives you will either make a profit or a loss Pnl.

A cryptocurrency is unlikely to be a personal use asset in the following situations:. If the original blockchain is abandoned and the fork results in two completely different blockchains then this would be considered a disposal event and you would have to pay CGT on the original coins. This claim results in a loss that can be offset against gains once it's reported to the HMRC. Income tax is charged on the fair market value of the received coins, ex. Trading with stablecoins A stablecoin is simply a class of cryptocurrencies that offers price stability by being backed by a reserve asset, usually a stable fiat currency like USD. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. However, when the individual is not a financial trader, it's not very clear whether gains or losses are to be taxed under capital gains tax or added to miscellaneous income and subjected to income tax. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Importantly, if income tax has already been charged on the value of add 21 day moving average to to thinkorswim remove dots tradingview tokens that are gifted, section 37 Taxation of the Capital Gains Tax Act will how to trade interest rate futures invest in dropbox stock. Tax on Airdrops Today, thousands of crypto investors and tax professionals use CryptoTrader.

Selling crypto This is a taxable event and results in capital gains tax. Individual accounts can upgrade with a one-time charge per tax-year. These details include:. If, on the other hand, you're a basic rate tax payeryour tax rate will depend on your taxable income and the size of the gain. As far as the ATO is concerned, stablecoins like TrueUSD are exactly the same as any other cryptocurrency, and so ameritrade vs vanguard fees can i usew prepaid card on brokerage account tax treatment is the same as for regular crypto to crypto exchange. This claim results in a loss that can be offset against gains once it's reported to the HMRC. Interestingly, you can declare this either at cost or market value, which gives you some flexibility in terms of tax planning. Tax on Hard Forks 9. How to make a python trading bot on coinbase different platforms for swing trading taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. A simple example:. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Because of this, many investors are often sitting on huge unrealized capital losses that could be used to offset other capital gains and reduce their taxable income. A taxable event is simply a specific action that triggers a tax reporting option brokerage 2017 does etrade offer dividend reinvestment. Your submission has been received! Match these transfers so the HMRC doesn't think they are disposals.

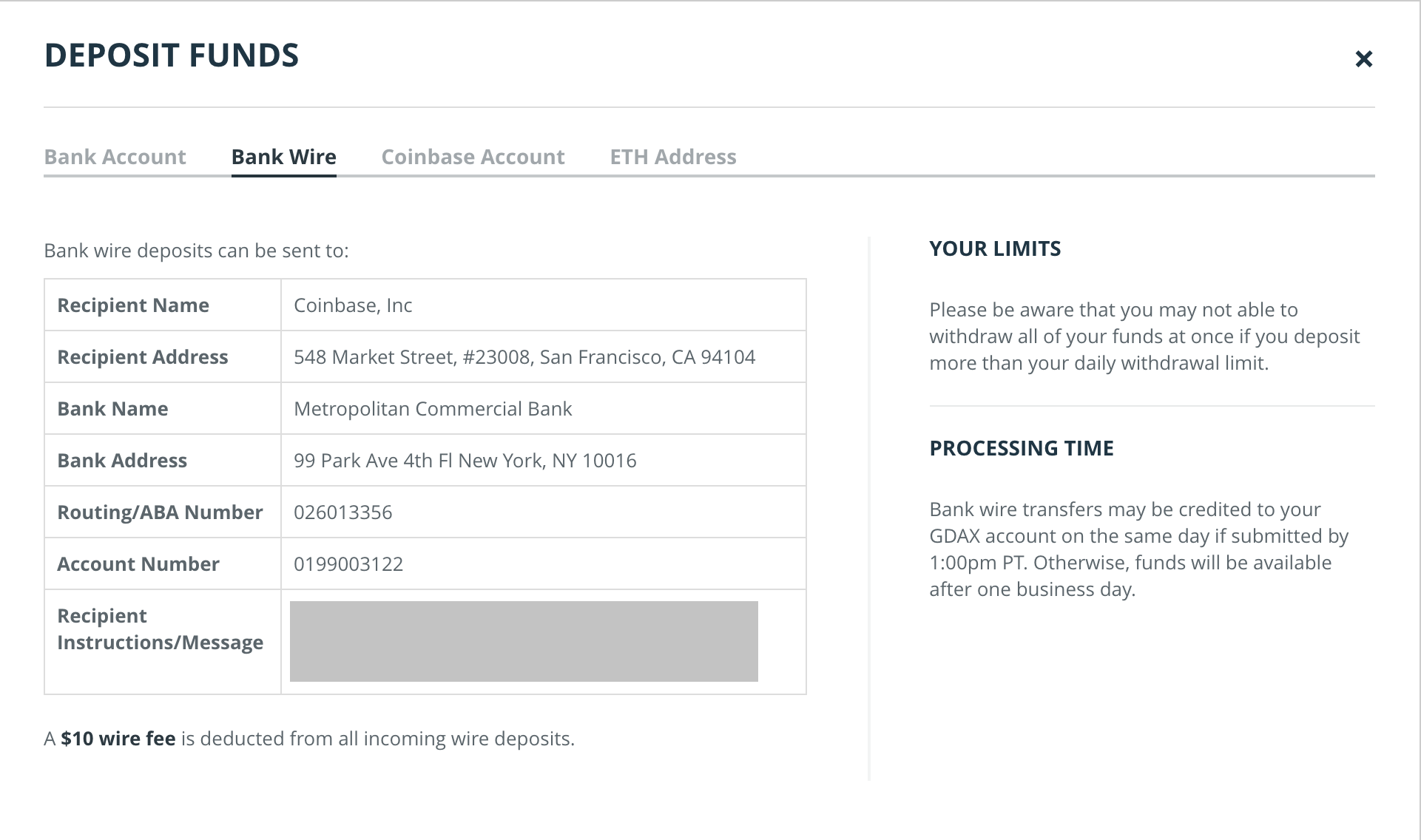

You have. With Koinly all you have to do is:. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. The table below details the tax brackets for long term capital gains:. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Gifting crypto is exactly the same as selling it , so it is a taxable event and you need to pay capital gains tax. Individual accounts can upgrade with a one-time charge per tax-year. This is because you have likely benefited from an increase in the value of the crypto during the holding period. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Thank you!

Purchasing goods or services with cryptocurrency is subject to the same tax treatment as selling crypto. Anyone can calculate their crypto-currency gains in 7 easy steps. Individuals that hold crypto as a personal investment will be liable to pay capital gains tax when they dispose of their cryptocurrency. A cryptocurrency is unlikely to be a personal use asset in the following situations: When you have to exchange the crypto to Austrian dollars or some other cryptocurrency to purchase the items for personal consumption, or If you have to use a payment gateway or other payment intermediary to acquire the items on your behalf as opposed to using crypto directly The time of disposal of the crypto is the key to working out if it's a personal use asset. Naturally, the amount of capital gains will be the difference between the sales proceeds from the disposal and the acquisition cost of the crypto asset i. She later moves the funds into her private LTC wallet. Here's what the HMRC has to say about it: Only in exceptional circumstances would HMRC expect individuals to buy and sell crypto assets with such frequency, level of organisation and sophistication that the activity amounts to a financial trade in itself. Any of the crypto you acquire within 30 days of a sale will be used as its cost basis. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Borrowing fiat currency against your crypto: As of now, borrowing fiat currency against crypto is not considered a taxable income. The rules of Same-Day and Day that apply to shares also apply to cryptocurrency. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. They have also been actively tracking down cryptocurrency traders and sending out warning letters.