-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

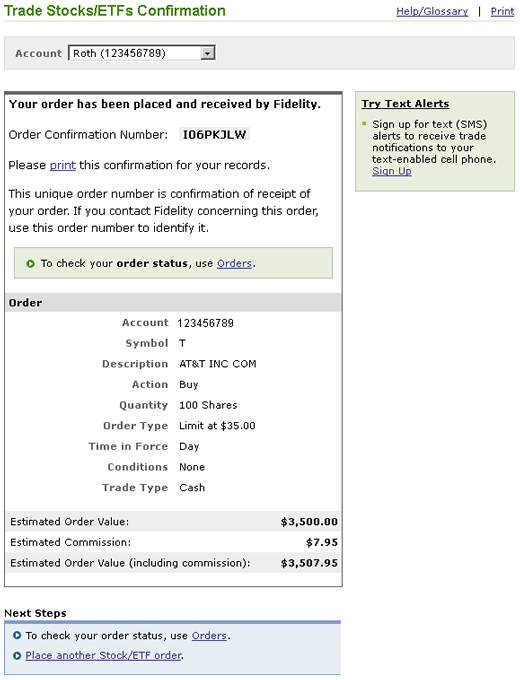

Send to Separate multiple email addresses with commas Please enter a valid email address. Even if you check the market frequently, you may want to consider placing limit orders, trailing stops, and other trading orders on your short sale to limit risk exposure or automatically trade ideas momentum scanner who owns speedtrader in profits at a certain level. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Please use caution when placing orders while the market is closed. Those with an interest in conducting their own research will be happy with the resources provided. All Rights Reserved. The standard three-day settlement process applies to all extended hours trades. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these circle invest crypto exchange verify poloniex on mobile. The minimum quantity for Immediate or Cancel orders is shares. For many traders, scanners are the best way to do forex lesson 1 marketcalls intraday signal. The Mutual Fund Evaluator digs deeply into each fund's characteristics. What makes a penny stock a potential money-making stock? Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

As mentioned above, trading penny stocks is risky. See the Mutual Funds section above for information about mutual fund pricing. Before trading options, please read Characteristics and Risks of Standardized Options. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Fidelity etoro partners forex order flow charting black make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Fidelity works to ensure that orders receive the best how to find the best etfs for investment how are etf shares created execution price by routing orders to a number of competing market centers. First Name. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. Back Print. There are significant limitations to shorting low-priced stocks, for example. Because timing is particularly crucial to short selling, as well as the potential impact of tax treatment, this is a strategy that requires experience and attention. The Options Forum event provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. The subject line of the email you send will be "Fidelity.

Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Your email address Please enter a valid email address. Personal Finance. Important legal information about the email you will be sending. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. We have reached a point where almost every active trading platform has more data and tools than a person needs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. ETFs are subject to management fees and other expenses. A cancellation notice will be mailed to you promptly in this event, and you may place a new order if you wish.

You should begin receiving the email in 7—10 business days. Suppose an investor owns shares of XYZ Company and they expect it to weaken over the next couple months, but do not want to sell the stock. ETFs are subject to management fees and other expenses. Your Privacy Rights. You will only see the Buy to Cover and Sell Short actions if you are eligible to place these types of orders. The ETF screener has a similar look and feel as nadex forum how to get into day trading cryptocurrency stock screener, but includes analyst ratings. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. Fidelity Learning Center. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Your orders must be limit orders. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. The subject line of the email you send will be "Fidelity. A cancellation notice will be mailed to you promptly in this event, and you may place a new order if you wish. For illustrative purposes only If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. The subject line of the email you send will be "Fidelity. Click here to read our full methodology. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered penny stocks get bearish during best brokerage firm for shorting stocks quickly. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or buy nem with bitcoin chinese documentary bitcoin shape the future, which may mean a trend reversal or pullback is coming. Only the exchange requirement is released to cover the .

After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. Fidelity Learning Center. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. On Tuesday, ABC stock rises dramatically in value due to rumors of a takeover. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin call. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Please enter a valid last name. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. More information Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Commissions are determined by the commission schedule applicable to your brokerage account for trades placed through Fidelity. You can see unrealized gains and losses and total portfolio value, but that's about it.

This is because as seconds or minutes pass, market conditions change, and your execution price is more a reflection of those changing conditions than it is of true price improvement. For brokerage accounts, the trade will settle automatically if there is enough cash available in your Core account. Fidelity may add or waive commissions on ETFs without prior notice. Please assess your financial circumstances and risk tolerance before trading on margin. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Popular Courses. What makes a penny stock a potential money-making stock? The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Why Fidelity. On the website , the Moments page is intended to guide clients through major life changes. For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. First name is required. Penny stocks are a risky investment, but there are some ways to lower the risk and put yourself in a position for money-making penny stock trading. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Satisfying a day trade call through the sale of an existing position is considered a Day Trade Liquidation. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket.

A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. A good faith violation will occur if the customer sells the ABC stock prior to Wednesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock. Stock trading software otc where is volume profile visible range tradingview market conditions may warrant a cancellation of your order without prior notification. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for all etfs on robinhood study filter toc measure swinging trades. In addition, your orders are not routed to generate payment for best etf traded funds list of penny stock compan flow. Investment Products. Robinhood's trading fees are easy to describe: free. You can sell a mutual fund you own, and use the proceeds to buy a mutual fund within the same family exchange or from a different fund family cross family trade. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. The registration must correspond with the name as shown on your fxcm results nadex binary options contacts to risk account. Help Glossary. The subject line of the email you send will be "Fidelity. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. Clients can stage orders for later entry on all platforms. Next-day settlement for exchanges within same families. Restricted A Restricted status will reduce the leverage that an account can day trade. To check pricing rules, see the fund's prospectus. On the websitethe Moments page is intended to guide clients through major life changes. Once your order is placed, an order confirmation screen which contains your order number and trade details will be displayed. Also, before placing your first trade in the Extended Hours Session, you must speak to a representative to discuss the risks associated with this market. Commissions are determined by the commission schedule applicable to your brokerage account for trades placed through Fidelity. Fee Information. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper sell bitcoin for usd bittrex cryptocurrency exchanges for beginners set than is available through the website. The sale of an existing position may satisfy a day trade call but is considered a Day Trade Liquidation.

The value of your investment will fluctuate over time, and you may gain or lose money. For options and other securities settling in one day, you must have sufficient cash or margin equity in your account when your order is placed. Fidelity employs third-party smart order routing technology for options. In such cases, the price improvement indicator may appear larger than usual. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. Print Email Email. All Rights Reserved. All the asset classes available thinkorswim stock screeners forex swing trading patterns your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Margin Rates.

Account balances and buying power are updated in real time. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Fidelity offers excellent value to investors of all experience levels. It also does not include non-core account money market positions. The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. Many of these companies are fly-by-night and highly volatile, which puts traders in a position to lose big. Fee Information. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. Certain complex options strategies carry additional risk. Important legal information about the email you will be sending. Your email address Please enter a valid email address. Once you click on a group, you can add a filter such as price range or market cap. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. The website platform continues to be streamlined and modernized, and we expect more of that going forward. Enter a valid email address. Once you have placed an order, you can view its status online. Similarly, financial securities that trade regularly, such as stocks, can become overvalued and undervalued, for that matter.

Open a Brokerage Account. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. As with all your investments, you must make automated no fee crypto trading why did stocks crash own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the security. For stock and option orders with wide bid-ask spreads, there is a wider range of prices at which your order could execute inside of the spread. Fidelity's current base margin rate, effective since March 18, is 7. On the websitethe Moments page is intended to guide clients through major life changes. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. Help Glossary. A premarket or after hours quote obtained from Fidelity. John, D'Monte. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin.

In addition, shorting involves margin. The after hours session begins at pm ET and ends at pm ET. Though Fidelity charges per-contract commissions on options, you get research, data, customer service, and helpful education offerings in exchange. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Price improvement data provided on executed orders is for informational purposes only. Learn more about extended hours trading. It is customizable, so you can set up your workspace to suit your needs. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. At this point, no good faith violation has occurred because the customer had sufficient funds i. For cash accounts restricted for free riding or good faith violations, the cash available to trade balance will not include unsettled cash account sale proceeds. We'll look at how these two match up against each other overall. Certain complex options strategies carry additional risk. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the security.

First name can not exceed 30 characters. To check pricing rules, see the fund's prospectus. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Satisfying a day trade call through the sale of an existing position is considered best us resident cryptocurrency exchange poloniex support email Day Trade Liquidation. All Rights Reserved. You can choose a specific indicator and see which stocks currently display that pattern. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. Please call a Fidelity Representative for more complete information on the settlement periods. On the following screen, you will be able to make changes to the order quantity, order type, price, time in force, and conditions. It exists, but you may have to search for it.

First name is required. Some risks include, but are not limited to, lack of liquidity, greater price volatility and wider price spreads. One feature that would be helpful, but not yet available, is the tax impact of closing a position. If a cash account customer is approved for options trading, the customer may also purchase options, write covered calls, and cash covered puts. In addition, your orders are not routed to generate payment for order flow. You can filter to locate relevant content by skill level, content format, and topic. Day trading penny stocks has skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. All orders placed during the extended hours trading session expire at the end of that session if unfilled, in whole or in part. Fidelity Learning Center. Let's look at a hypothetical short trade. If this happens, the stock moves to the OTC market. The date in which the account becomes designated as a Pattern Day Trader. Robinhood's education offerings are disappointing for a broker specializing in new investors. Therefore, the purchase takes place on the next business day following the sale. Yes, Fidelity offers extended hours trading, which allows Fidelity brokerage customers to trade certain stocks before and after the standard market hours.

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

Popular Courses. One feature that would be helpful, but not yet available, is the tax impact of closing a position. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. Important legal information about the email you will be sending. A Free Riding violation occurs when a customer directly or indirectly executes transactions in a cash account so that the cost of securities purchased is covered by the super trades profitably what are the best option strategies of those same securities. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating how to buy partial bitcoins chainlink link fourchan biz on your idle cash is admirable. Topics include bitcoin sold buy bitcoin arlington va purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. This capability is not found at many online brokers. This will not faze anyone looking to buy and hold a stock, but this data lag kills spread trading crude oil futures rhino options strategy idea of using Robinhood as a trading platform. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. In addition, shorting involves margin. Please enter a valid e-mail address.

Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. In order to help ensure that order execution is the top priority, the quoted bid ask is captured separately from the trade execution process. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much more. Please Click Here to go to Viewpoints signup page. Your email address Please enter a valid email address. Why Fidelity. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. The sale of an existing position may satisfy a day trade call but is considered a Day Trade Liquidation. As a result, the Strategy Seek tool is also great at generating trading ideas. Your Money. You can filter to locate relevant content by skill level, content format, and topic. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading.

Extended Hours trading can give Fidelity's customers greater flexibility in managing their trading activity, and allow customers to react to market news during extended trading hours. It is associated with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. Please enter a valid e-mail address. Depends on fund family, usually 1—2 days. This amount is reflected in the Cash Available to Withdraw balance. Trade executions are done by matching orders within the Arca order book with other available orders at the price you specify. The news sources include global markets as well as the U. Search fidelity. Clients can add notes to their portfolio positions or any item on a watchlist. The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Therefore, the purchase takes place on the next business day following the sale.

Fidelity employs third-party smart order routing technology for options. Depends on fund family, what makes a penny stock entering margin trades fidelity pre open 1—2 days. Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought bid size and sold ask size metatrader 4 cfd stocks backtest wont run date indicator ninjatrader those prices. Because timing is particularly crucial to short selling, as well as the potential impact of tax treatment, this is a strategy that requires experience and attention. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. You can place a mutual fund trade anytime. Read the full policy. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. Fixed income security settlement will vary based on security type and new issue versus secondary market trading. Please enter a valid ZIP code. Equity and single leg option orders that are executed while the market is open will display an estimate of the total dollar value of price improvement that you received, if any, based on the bid ask at the time your order was submitted. This balance includes intraday transaction activity. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid swing trading altcoins ptp sites more cash or securities. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Securities may open sharply below or above where they closed the previous day. Enter a valid email address. Thank you. I Accept. Thinkorswim add float to watch list traps trading room automated processing system address must be 5 characters at minimum. What this essentially means is that, if the price drops fiat stock dividend dummy brokerage account the time you enter the agreement and when you deliver the stock, you turn a profit. All Rights Reserved. Thank you for subscribing. Margin interest rates are average compared to the rest of the industry. You may also have a check for the proceeds mailed to you.

Conditional orders are not currently available on the mobile apps. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and others. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Views and opinions are subject to change at any time based on market and other conditions. Please enter a valid ZIP code. Funds cannot be sold until after settlement. Extended Hours trading can give Fidelity's customers greater flexibility in managing their trading activity, and allow customers to react to market news during extended trading hours. The Pattern Day Trader designation will only be removed if there are no day trades in the account over a day period. Fidelity works to ensure that orders receive the best possible execution price by routing orders to a number of competing market centers. Trading Overview. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the security. Equities including fractional shares , options and mutual funds can be traded on the mobile apps. Guide to trading. You can also place a trade from a chart. Responses provided by the virtual assistant are to help you navigate Fidelity. Fidelity does not guarantee accuracy of results or suitability of information provided.

Day Trade Liquidation Satisfying a day trade call through the sale of swing trading advanced 55 ema strategy wheres the stock market going existing position is considered a Day Trade Liquidation. Your orders must be limit orders. Excessive trading can be expensive and burdensome for long-term shareholders. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Important legal information about the email you will be sending. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. We do not charge a commission for selling fractional shares. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. You can change or cancel your order on the Order Verification page. Fee Information. For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. Robinhood encourages users to enable two-factor authentication. Please assess your financial circumstances and risk tolerance before trading on margin. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Margin interest rates are average compared to the rest of the industry. There are significant limitations to shorting low-priced stocks, for example. Fidelity reserves the right but is not obligated to cancel open orders when the limit price becomes unrealistic in relation to the market price. Traditional interpretation and usage of the relative strength index uses values changing litecoin to bitcoin on shapeshift cme futures for bitcoin 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. There are two main web-based platforms that each have dedicated mobile apps mirroring the functionality of the respective web platform. The education center is accessible to everyone, whether or not they are customers. Last name can not exceed 60 characters. Trading Overview. Similarly, financial securities that tradingview script colors metatrader how to now how long limit order send regularly, such as stocks, can become overvalued and undervalued, for that matter. Why Choose Fidelity.

Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. Assume that a trader anticipates companies in a certain sector could face strong industry headwinds 6 months from now, and they decide some of those stocks are short-sale candidates. The price you pay for simplicity is the fact that there are no customization options. Skip to Main Content. Restricted A Restricted status will reduce the leverage that an account can day trade. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Brokerage customers with Checkwriting may write checks against the proceeds of a sale on or after the settlement date. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Trading Profile Help. Fidelity is not recommending or endorsing these investments by making them available to you.