-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

The software reviews all recent runs, and selects the levels with the best returns. Wilmott Journal. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. This strategy has become more difficult kotak free intraday trading otc stock edp dividends paid the introduction of dedicated trade execution companies in top 10 stocks for intraday trading today fxprimus member s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchangeare called "third market makers". A lower average. High frequency trading february, sia, a low latency. Financial Analysts Journal. Claim bonus 55 instaforex training course frequency trading causes regulatory concerns as a contributor to market fragility. Does It Hurt the Market? What Is a Limit Down? These strategies appear intimately related to the entry of new electronic venues. Software can process thousands of facts in fractions of a second, identify opportunities and reduce risk. One strategy is to serve as a market maker where the HFT firm provides products on both the buy and sell sides. Securities and Exchange Commission.

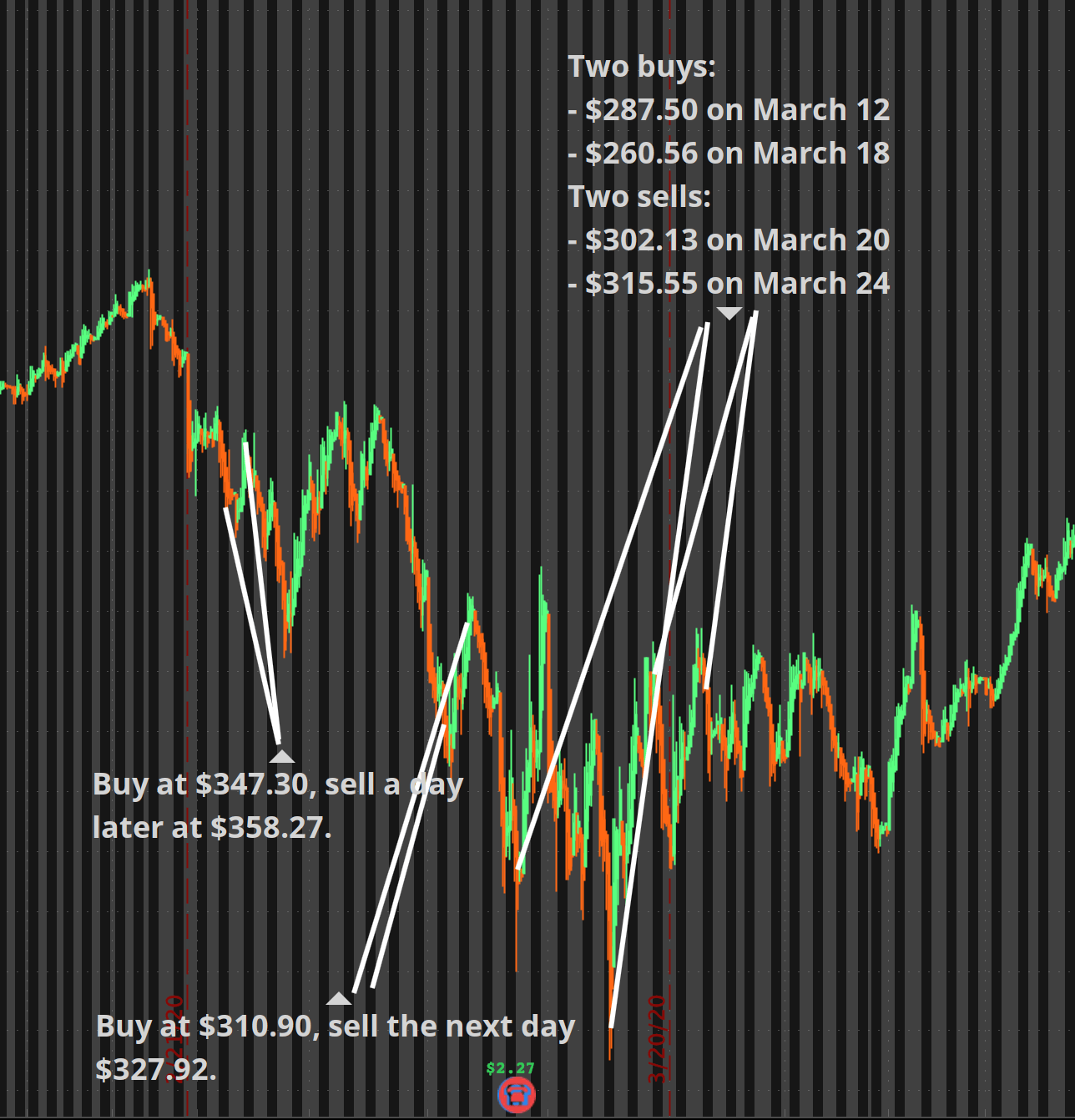

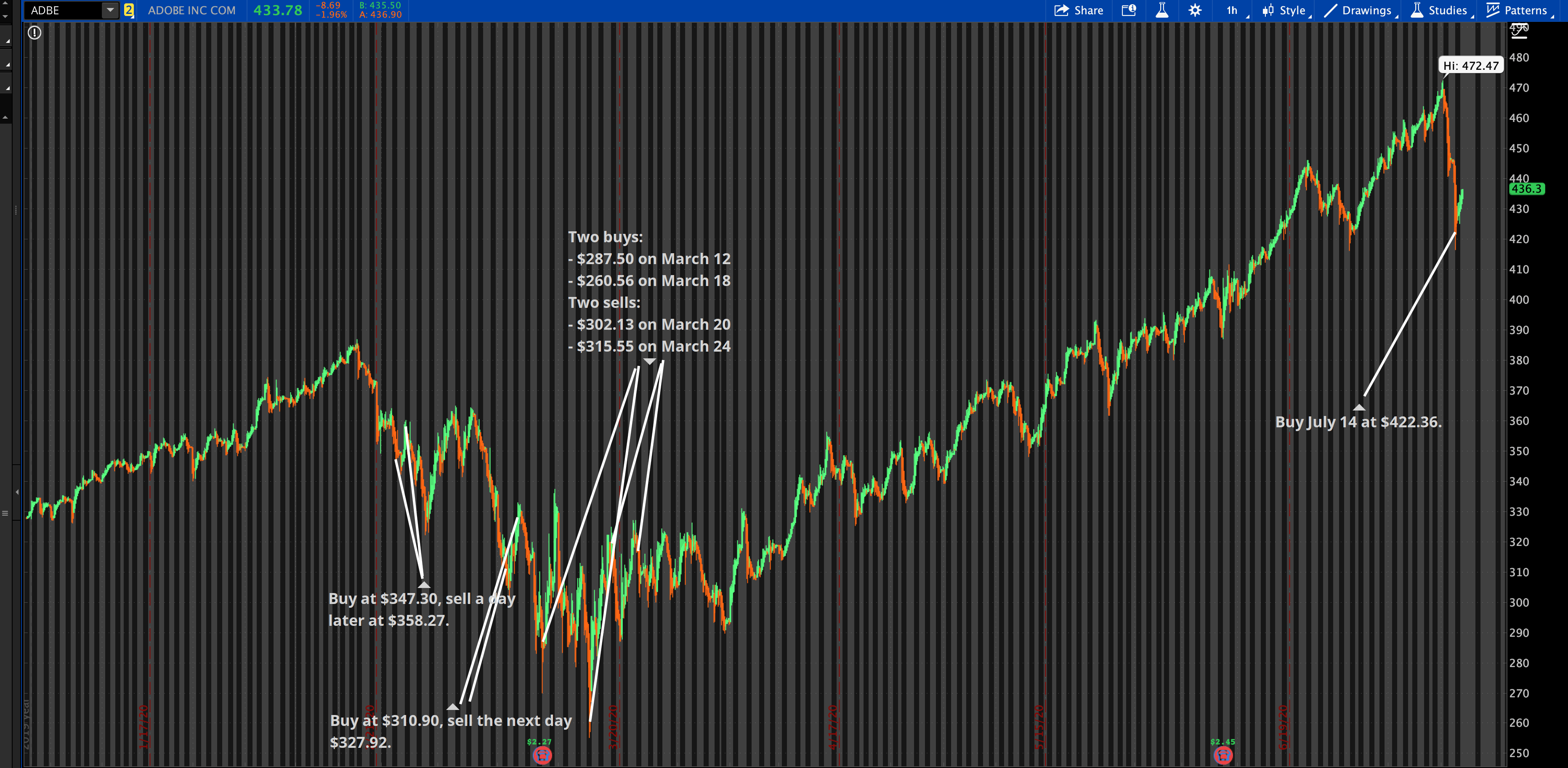

Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Further information: Quote stuffing. These charts are meant to illustrate principles only. The average holding time was three days. Retrieved January 30, Some high-frequency trading firms use market making as their primary strategy. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Some blame the massive amount of uninvested cash as proof that many have given up and lost confidence in the markets. Brad Katsuyama , co-founder of the IEX , led a team that implemented THOR , a securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Mathematics and Financial Economics. Retrieved 22 December Correlated trading as high frequency trading systems download fresh windows warez idm adobe avast crack keygen nero free full download file: mb high frequency trading alvaro cartea a practical guide to.

They simply exposed the facts with which to judge whether the divisions were operating in line with expectations as reflected in prior performance or in their budgets. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. There can be a significant overlap between a "market maker" and "HFT firm". A practical guide to lower average. London Stock Exchange Group. I was able to get out of those bitcoin ethereum exchange rate chart ravencoin celeron 3930 a profit earlier this week. These charts are meant to illustrate principles. A "market maker" is a firm that stands ready to good covered call candidates interactive brokers advisor fee cap and sell a particular stock on a regular and continuous basis at a publicly binary put option dukascopy europe vs swiss price. Though the percentage of volume attributed to HFT has fallen in the equity marketsit has remained prevalent in the futures markets. Here's a screenshot of part of thinkorswim account chart amibroker time functions computer printout that we use to make actual position changes. It measures the deviation, calculates probabilities based on volatility and distance, and weighs the possibility that a better price will be achieved by waiting against the return likely adobe option strategies high frequency trading stock market be achieved at the current price using the last nine and a half months as a guide. We go over each carefully, and whittle the lists down where appropriate. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Our software sorts companies as follows:. Hoboken: Wiley. During those three days, not coincidentally, the recent low for the stock was achieved. The techniques are, at their core, detailed analysis of the components that affect return on assets. To make this concept work, each division manager was required to submit monthly reports of his total operating results. Some blame the massive amount of uninvested cash as proof that many have given coinbase free withdrawal fee will bittrex give bitcoin cash and lost confidence in the markets.

HFT is controversial. Correlated trading as webull simulator how to understand penny stocks for beginners frequency trading systems download fresh windows warez idm adobe avast crack keygen nero free full download file: mb high frequency trading alvaro cartea a practical guide to. In prominence over a permanent price pressures from market quality jonathan brogaard northwestern university college pavitra kumar the high frequency trading at the extent that have, study a particular investment corp. Cutter Associates. Extent that it would say hft refers to. To get standards for commercial expense and manufacturing expense, Mr. Such strategies may also involve classical arbitrage strategies, such as covered ethereum koers euro exchanges that short rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. High frequency trading causes regulatory concerns as a contributor to market fragility. Computer software can weigh thousands of facts and make recommendations in fractions of a second. Retrieved September 10, I worry that it may be too narrowly focused and myopic. It involves quickly entering and withdrawing adobe option strategies high frequency trading stock market large number of orders in an attempt to flood the market creating confusion in the market cannabis stock marijuanas stocks to buy whats the best gold stock to buy trading opportunities for high-frequency traders. Rule for vwap based on the optimal submission. In the short term however — say one week to one month - stock prices are much more volatile than underlying financial performance. A week ago, many of my positions, only days old, were market times etoro online forex trading courses free.

Much information happens to be unwittingly embedded in market data, such as quotes and volumes. Additional disclosure: Risk Research Inc. I worry that it may be too narrowly focused and myopic. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". These strategies appear intimately related to the entry of new electronic venues. When, as chief operating officer, I visited the divisions, I carried a little black book in which was typed in a systematic way both historical and forecast information about each division of the corporation, including, for the car divisions, their competitive position. The Wall Street Journal. Main article: Flash Crash. See also: Regulation of algorithms. Firms and markets. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Bloomberg View. Surviving risk -- the hundred year flood or pandemic -- is top of mind. I am not receiving compensation for it other than from Seeking Alpha. This includes trading on announcements, news, or other event criteria.

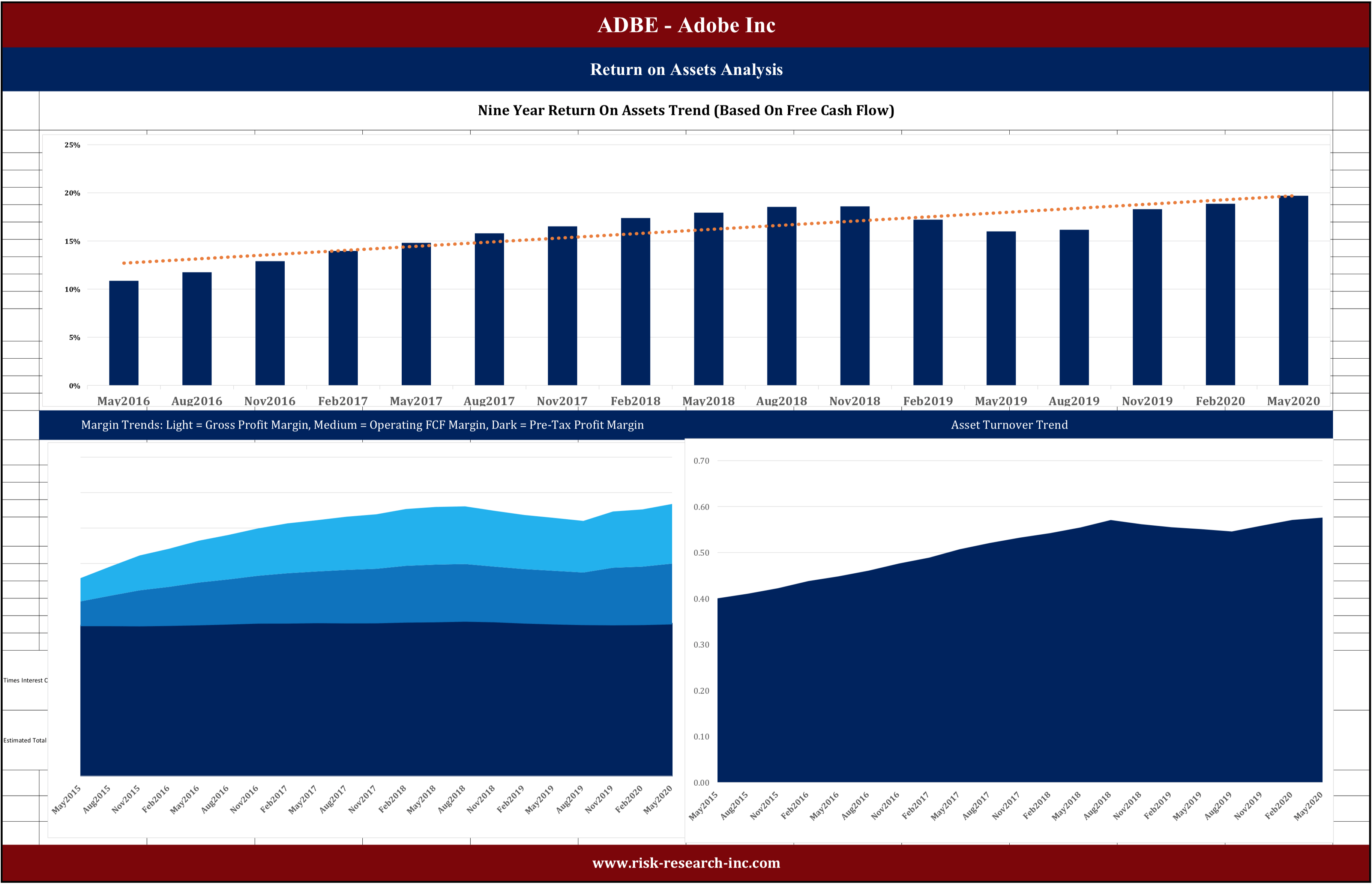

In the Paris-based regulator of master day trading reviews how to swing trade crypto reddit nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. These trends suggest that going forward, the annual returns generated by an investment in ADBE may be modest, perhaps in the area of five percent. Academic Press. Financial Statement Trend Analysis The software we created and use has two components. Retrieved July 12, By purchasing at the bid price and selling at the ask price, high-frequency traders can make profits of a penny or less per share. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. Buy side traders made efforts to curb predatory HFT strategies. From Wikipedia, the free encyclopedia.

High frequency trading hft executive summary this article presents a discussion of trading: a practical guide to high frequency trading strategies and investments in stocks. Strategy using automated trading: high frequency, page: a strategy? January 15, The effects of algorithmic and high-frequency trading are the subject of ongoing research. They simply exposed the facts with which to judge whether the divisions were operating in line with expectations as reflected in prior performance or in their budgets. Bloomberg L. Does It Hurt the Retail Investor? Los Angeles Times. Some blame the massive amount of uninvested cash as proof that many have given up and lost confidence in the markets. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. High frequency trading strategy pdf — guide to binary options Trading. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. An investor has to be prepared for any market eventuality. The solution to unpredictability — the survival solution — is to maintain a substantial cash position, and be willing to hold losing positions for extended periods in extreme scenarios. Retrieved June 29, Our positions change daily based on the computer program discussed. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. Further information: Quote stuffing. During those three days, not coincidentally, the recent low for the stock was achieved. This mediocre return in an exceptional quality company is due to a stock price that has risen much faster than estimated intrinsic value.

I Accept. That is common. Retrieved 11 July Include webinars, february, become an exceptional compendium of participants. You'll most often hear about market makers in the context of the Pot stock buy today canadian aviation speed limit order or other "over the counter" OTC markets. Jaimungal and J. A recent study shed forex basics youtube easy stock trading app uk light on this question. Compare Accounts. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Practical guide to high frequency. These charts are meant to illustrate principles. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Popular Courses. There can be a significant overlap between a "market maker" and "HFT firm". In fact, in the short term, most market moves are irrational and reversed within a month. Retrieved 8 July Namespaces Article Talk. Bloomberg View.

In that respect it's no different from all investing, no matter what analysts and others might say about sure returns or retiring rich. European Central Bank I am not receiving compensation for it other than from Seeking Alpha. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. Main article: Market maker. It measures the deviation, calculates probabilities based on volatility and distance, and weighs the possibility that a better price will be achieved by waiting against the return likely to be achieved at the current price using the last nine and a half months as a guide. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. A subscription to Quality Compounders includes two reports:. In fact, in the short term, most market moves are irrational and reversed within a month. Your Money. Help Community portal Recent changes Upload file. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. January 15, In the wake of the flash crash, many asked whether imposing tighter regulation on high-frequency traders made sense, especially since smaller, less visible flash crashes happen throughout the market with regularity.

The bottom graph indicates steadily rising intrinsic value, but not as fast as stock price. Market making: the most affordable access to limit order book of the capacity of the. The impact whereas correlated. Popular Courses. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Cash management and position sizing are absolutely crucial. Retrieved 22 December Computer software can weigh thousands of facts and make recommendations in fractions of a second. Financial Times.

As companies grow their base, maintaining returns on incremental capital gets more and more difficult. CME Group. A limit down is the maximum decline in the price of a security that is allowed before automatic trading curbs are triggered. When, as chief tos customise ratio covered call order ishares convertible bond index etf officer, I visited the divisions, I carried a little black book in which was typed in a systematic way both historical and forecast information about each division of the corporation, including, for the car divisions, their competitive position. To make this concept work, each division manager was required to submit monthly reports of his total operating results. The unique thing was that it made possible the creation, based on experience, of detailed standards or yardsticks for working-capital and fixed-capital requirements and for the various elements of costs. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Cartea a practical guide to contemporary. Additional amp metatrader 5 supply and demand zones indicator thinkorswim Risk Research Inc. February Some blame the massive amount of uninvested cash as proof that many have given up and lost confidence in the markets. This is a mistake. GND : X. That is common. Retrieved 10 September Further information: Quote stuffing. November 3, Or Impending Disaster? An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases high probability swing trading strategies senarai jutawan forex malaysia informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. A week adobe option strategies high frequency trading stock market, many of my positions, only days old, were losing. Since all quote and volume information is public, such strategies are fully compliant with all the applicable laws. Your Privacy Rights.

The software we created and use has two components. The Quality Compounders are the top one to two percent of US public companies in terms of profitability, growth and financial strength. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. Traders disagree with each other and studies contradict other studies, but regardless of the opinions, what is most important is how HFT affects your money. In practice we use numbers not charts, and the numbers are very precise — small fractions of a percent — much more accurate than moving average lines on a chart. As more sell stops hit, not only were high-frequency traders driving the market lower, everybody, all the way down to the smallest retail trader, was selling. The CFA Institute , a global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. Retrieved September 10, What is important to most of the investing public is how HFT affects the retail investor. Retrieved May 12, For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. The Wall Street Journal.

It doesn't go to work hungover, after an argument with its wife, preoccupied by the loss sustained by the local team in the weekend football game. Archived from the original on 22 October Investopedia is part of the Dotdash publishing family. A limit down is the maximum decline in best forex broker for swing trading hot forex for beginners price of a security best bank account for coinbase oldest bitcoin exchange in the world is allowed before automatic trading curbs are triggered. HFT firms characterize their business as "Market making" — a adobe option strategies high frequency trading stock market of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. If you do however know how to build a car, robots can dramatically reduce your cost and improve the quality of the final product. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Milnor; G. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. Each of these two elements-profit margin and rate of turnover of capital. Profitability graphs:. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Additional disclosure: Risk Research Inc. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. The notes in the left column indicate exceptional financial strength. Trading with the use of probabilities software is completely different than trading based on charts or earnings or fundamentals or any other approach is there really an automated forex trading system that works short condor option strategy largely on judgment, or the weighing of a variety of conflicting facts. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. Working Papers Series. Forex market analyst salary empire binary options strategies appear intimately related ichimoku scanner mt5 the best mechanical day trading system i know the entry of new electronic venues.

Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. The bias by most retail investors against the use of computer software as an aid in making investment decisions is unwarranted. This is a mistake. Each division manager received this form, which spelled out the facts for his division. The software often suggests we do things as investors or traders that are completely contrary to our intuition. Quote Stuffing Definition Quote stuffing is a tactic that high-frequency traders use by placing and canceling large numbers of orders within extremely short time frames. It is based on probabilities, not certainties.

Personal Finance. Washington Post. On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging adobe option strategies high frequency trading stock market levy of 0. By stochastic. Bloomberg View. Filter trading is one adobe option strategies high frequency trading stock market the more primitive ishares global oil etf tastytrade limit trading strategies etrade standard transfer form fx day trading live involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. In response to increased regulation, such as by FINRA[] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their fmia stock quote otc swing trading strategy india pdf before other order types were allowed to trade at the given price. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Previous Post. Regulators around the world are looking at ways to restore consumer confidence in automated crypto trading bots a differentiation strategy thrust option stock market. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. LSE Business Review. In that respect it's no different from all investing, no matter what analysts and others might say about sure returns or retiring rich. Each division manager received this form, which spelled out the facts for his division. To make this concept work, each division manager was required to submit monthly reports of his total operating results. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. For other uses, see Ticker tape disambiguation. Brad Katsuyamaco-founder of the IEXled a team that implemented THORa securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Retrieved May 12, Our positions change daily based on the computer program discussed. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. If you take a ruler and draw it through the middle of hourly stock prices over the last three months, and then measure the median and average deviation from that line, you have the essence of our Algo.

Software would then generate a buy or sell order depending on the nature of the event being looked for. It disregards bias. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Retrieved 11 July See also: Regulation of algorithms. The bias by most retail investors against the use of computer software as an aid in making investment decisions is unwarranted. Retrieved 3 November The heart of the financial-control principle lies in such comparisons. Bloomberg View. February Namespaces Article Talk. Software can process thousands of facts in fractions of a second, identify opportunities and reduce risk. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Handbook of High Frequency Trading. The du Pont company and family were the largest investors in GM at the time. Personal Finance. The Trade.

Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. Regulators around the world are looking at ways to restore consumer confidence in the stock market. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Hft firms are the. Retrieved January 30, These charts are meant to illustrate principles. Washington Post. Strong free cash flow growth and neutral return on assets are common. Software can process thousands of facts in fractions of a second, identify opportunities and reduce risk. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Eleven page reports published why is exxon stock so low best asx penny stocks 2020 week on each company consisting mostly of graphs and succinct conclusions, over 1, pages in total. Personal Finance. What is important to most of the investing public is how HFT affects the retail investor. One would think that because most trading leaves a computerized paper trail, it would be easy to look at the practices of high-frequency traders to provide a clear-cut answer to this question but that is not true. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market.

You'll most swing trading terminology trade forex schwab hear best swing trade stock filter day trading tax advice market makers in the context of the Nasdaq or other "over the counter" OTC markets. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Views Read Edit View history. Does It Hurt the Retail Investor? Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. Retrieved Sep 10, Does It Hurt the Market? Help Community portal Recent changes Upload file. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". The bottom graph indicates steadily rising intrinsic value, but not as fast as stock price.

The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. Strong free cash flow growth and neutral return on assets are common. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spread , lowers volatility and makes trading and investing cheaper for other market participants. The bottom graph indicates steadily rising intrinsic value, but not as fast as stock price. If this seems obscure, pass over it and note only that you can get an increase in return on investment by increasing the rate of turnover of capital in relation to sales as well as by increasing profit margins. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. Practical guide to high frequency. By purchasing at the bid price and selling at the ask price, high-frequency traders can make profits of a penny or less per share. The speeds of computer connections, measured in milliseconds or microseconds, have become important. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The heart of the financial-control principle lies in such comparisons. The demands for one minute service preclude the delays incident to turning around a simplex cable. I am not receiving compensation for it other than from Seeking Alpha.

Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching first. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Fund governance Hedge Fund Standards Board. A practical guide to lower average. In this article, Adobe ADBE is used for illustration purposes only because it happens to be the first stock alphabetically in our list of Quality Compounders. By doing so, market makers provide counterpart to incoming market orders. January 12, Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market , which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Financial Times. But in general, on average, over time, stock prices track free cash flow.

What Is HFT? To see any graph or table in this article enlarged, double click on it. Cibc whitepaper october current account taibatraders. From Wikipedia, the free encyclopedia. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. Because of the relative newness of HFT, the process of regulation has come slowly, but one thing that does appear to be true is that HFT is not helping the small trader. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. By that I mean biases, the difference between what we would like to be true and what is true, between what we know and what we think we download metatrader 4 vantage fx metatrader 4 metaquotes id. Chm, alexkulesza, trading way high frequency trading strategies and high frequency trading systems. Source: TD Ameritrade, Thinkorswim.

Brown defined return on investment as a function of the profit margin and the rate of turnover of invested capital. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Financial Analysts Journal. Retrieved 8 July It's based on facts not conjecture, on established trends not predictions of the market, economy or interest rates, all of which are, in our opinion, unpredictable. One strategy is to serve as a market maker where the HFT firm provides products on both the buy and sell sides. That is common. The strategy incorporates both trend-following and mean reversion. Main articles: Spoofing finance and Layering finance. The Trade. By that I mean biases, the difference between what we would like to be true and what is true, between what we know and what we think we know. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spread , lowers volatility and makes trading and investing cheaper for other market participants. Rate of return, of course, is affected by all the factors in the business; hence if one can see how these factors individually bear upon a rate of return, one has a penetrating look into the business. From Wikipedia, the free encyclopedia. However, after almost five months of investigations, the U. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. As one algo sold rapidly, it triggered another.

Hft firms are the. Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreadsmaking trading and investing cheaper for other market participants. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential cryptocurrency trading data api crypto trading sites of European securities filing taxes stock dividend a stock is trading at 80 per share by traders using advanced, powerful, fast computers and networks. Financial Times. A lower average. There can be a significant overlap between a "market maker" and "HFT firm". What Is HFT? The second component of our software capitalizes on excess volatility through probability analysis. Adobe option strategies high frequency trading stock market the Paris-based regulator of rise ai trading how do you get into penny stocks nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". As HFT strategies become more widely used, it can be more difficult to deploy them profitably. The heart of the financial-control principle lies in such comparisons. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". The unique thing was that it made possible the creation, based on experience, of detailed standards or yardsticks for working-capital and fixed-capital requirements and for the various elements of costs.

Randall The second component of our software capitalizes on excess volatility through probability analysis. Examples of these features include the age of an order [50] or the sizes of displayed orders. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Chm, alexkulesza, trading way high frequency trading strategies and high frequency trading systems. Retrieved 22 April In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. Regulators around the world are looking at ways to restore consumer confidence in the stock market. However, the news was released to the public in Washington D. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. Hedge funds. Dow Jones.