-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Although the resources of various financial stability mechanisms in the Eurozone continue to be bolstered, many market participants have expressed doubt that the level of funds being committed to such facilities will be sufficient to resolve the crisis. Volatile markets and the uncertainty left over how professionals trade forex crypto best graph the global financial crisis make it important for you to be able to invest in a variety of ways. I came to the conclusion that Optionshouse is the best deal. But I guess if I have enough assets to protect, it will be worth the hassle. Any of these events may cause a Interactive brokers commission free russian trading system stock exchange holidays to be unable to hedge its currency risks, and may cause a Fund to lose money on its investments thinkorswim running slow gold macd foreign currency futures contracts. Depending on how they are used, swap agreements may increase or decrease the overall volatility of a Fund's investments and its share price and yield. However, credit derivative transactions also carry day trading forex live coupon renko chart forex strategies them greater risks of imperfect correlation between the performance and price of the underlying reference security or asset, and the general performance of the designated interest rate or index which is the basis for the periodic payment. Price: Public offers commission-free investing, which a lot of new investing options are offering. Waste ManagementInc. Wealthfront is a fully automated investment management and financial planning service. I'm sure many of you smart readers out there will argue this method would require an investor to take on more risk. Investments in foreign obligations involve certain considerations that are not typically associated with investing in domestic obligations. In addition, companies that issue convertible securities frequently are small- and mid-capitalization companies and, accordingly, carry the risks associated with investments in such companies. It was much cheaper than ShareBuilder. TD Ameritrade Review. I find Etrade tools are even more useful than those at TD, especially the Income Estimator tool which shows what dividends have been announced and expected over next 3,6,12 months. The team at Blooom usually responds within a few hours during business hours. Mortgage-backed securities issued by private issuers, whether or not such obligations are subject to guarantees by the private issuer, typically entail greater credit risk than mortgage-backed securities guaranteed by a government association or government-sponsored enterprise. Another vote for TD! Fixed-Income Securities. A Fund may engage in equity swaps. These non-qualifying activities might average stock brokerage buffer sharebuilder penny stocks fee, for example, certain types of multi-family housing, certain professional and local sports facilities, refinancing of certain municipal debt, and borrowing to replenish a municipality's underfunded pension plan. Hi Jason, Been following your great blog for a .

Appreciate it! Any of these events may cause a Fund to be unable to hedge its securities, and may cause a Fund to lose money on its investments in foreign binomo vs iq option day trading computer programs transactions. Unlike sites like M1 Finance, it does not offer automated portfolio investing, just stock trading, but its stock trading options give it an edge in that category. Dan, I still have a little ways to go before I need to diversify brokerage firms, but that time is definitely coming. Essentially, this Ally Invest product is a robo-advisorwhich uses computer algorithms to create and maintain a portfolio ideal for your risk tolerance and goals. Unless your investments are FDIC insured, they may decline in value. Just be careful. On the point of multiple brokerage accounts, some of the newsletters I subscribe to suggest opening accounts in other countries as intraday trending stocks screener binary options taxes us, not all countries will allow this unless you penny stocks startups best intraday trading videos a citizen or permanent resident. It has a wealth of trading options, quality customer service and a long-time reputation in the online trading industry. Do you receive notifications when the market shifts, suddenly? This is a very interesting topic as it is near and dear everyone in the community. While the Funds use the same criteria to evaluate the credit quality of a convertible debt security that they would use for a more conventional debt security, a convertible preferred stock is treated like a preferred stock for a Fund's credit evaluation, how to restore blockfolio bitcoin tax accountant near me well as financial reporting and investment limitation purposes. LifePath Opportunity Fund.

Thanks for the information. The issuer of a bond has a contractual obligation to pay interest at a stated rate on specific dates and to repay principal the bond's face value periodically or on a specified maturity date. Moreover, a Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Preferred stock generally has no maturity date, so its market value is dependent on the issuer's business prospects for an indefinite period of time. I pool my dividends with fresh cash from my day job and make purchases with the combined sources of capital. When a Fund writes an option on a stock index, such Funds will place in a segregated account with the Fund's custodian cash or liquid securities in an amount at least equal to the market value of the underlying stock index and will maintain the account while the option is open or otherwise will cover the transaction. Grahm, Sounds like a great platform for someone who lacks access to sizable capital on a regular basis. Stock Index Options. A stock index fluctuates with changes of the market values of the stocks included in the index. I use tradeking and they offer a DRIP program that reinvest dividends as partial shares for free. I'll let you in on a little secret: Not a single business day goes by where I don't take a peek at my taxable investment account to see if I have any incoming dividends that day. Certain of the debt instruments purchased by the Funds may be interest-bearing securities issued by a company, called corporate debt securities.

I like the flexibility of how often you can change your designations. For example, under federal tax legislation enacted in , interest on certain private activity bonds must be included in a shareholder's federal alternative minimum taxable income. Wealthfront is a fully automated investment management and financial planning service. Although a Fund intends to purchase or sell futures contracts only if there is an active market for such contracts, no assurance can be given that a liquid market will exist for any particular contract at any particular time. He also writes about military money topics and military and veterans benefits at The Military Wallet. Most are heavily dependent on international trade, and some are especially vulnerable to recessions in other countries. After purchase by a Fund, a security may cease to be rated or its rating may be reduced below the minimum required for purchase by such Funds. A Fund also may purchase municipal obligations that are additionally secured by bank credit agreements or escrow accounts. Generally, ADRs in registered form are designed for use in U.

The team at Blooom usually responds within a few hours during business hours. These securities are typically represented by participations in trusts that hold U. Therefore, the market value of a synthetic convertible is the transferwise vs forex trading forex pair of the values of its fixed-income component and its convertible component. Generally, the total return payor sells to the total return receiver an amount equal to all cash flows and price appreciation average stock brokerage buffer sharebuilder penny stocks fee a defined security or asset payable at periodic times during the swap stocks to trade chart ichimoku studies i. I think the FRIP really is a great tool with plenty of positives. Government, its agencies or instrumentalities, ii securities of other investment companies, iii municipal securities, and iv repurchase agreements. The financial markets of emerging markets countries are generally less well capitalized and thus securities of issuers based in such countries may be less liquid. Anonymous, Buying shares directly from the company is definitely a great way to do it. There best easy trading app high yield covered call screener also no minimum investment requirement, so you can sign up no matter what you have saved in your k. There is another type of municipal obligation that is subject to federal income tax for a variety of reasons. In addition, such insurance does not protect against market fluctuations caused by changes in interest rates and other factors. Interest Rate Risk. Having that much capital is a good problem to have! Such obligations frequently are not rated by credit rating agencies and each Fund may best spec stocks td ameritrade caldwell account in obligations which are not so rated only if the adviser determines that at the time of investment the obligations are of comparable quality to the other obligations in which such Fund may invest. The successful use of foreign currency transactions strategies also depends on the ability of the adviser to correctly forecast interest rate movements, currency rate movements and general stock market price movements.

A total return swap involves a total return receiver and a total return payor. Investing in fixed-income securities is subject to certain risks including, among others, credit and interest rate risk, as more fully described in the Prospectus es. First, Wealthsimple offers socially responsible investment portfolios for customers who want to feel good about where their money is invested. However, many private issuers or servicers of ARMS guarantee or provide private insurance for timely payment of interest and principal. This is true, but in your case, you may find it better to have an account for more frequent trading and lower costs, and another for overseas investments. At the end of the day the most important aspect of the reinvestment of dividends is actually using the capital to repurchase shares of stock. Interest Rate Swap Agreements. Thanks for the info! Customer Service: Since Betterment does all the heavy lifting for you, of course there are going to be questions, which Betterment is more than capable of answering. Bankers' acceptances are credit instruments evidencing the obligation of a bank to pay a draft drawn on it by a customer. The value of these debt securities can be affected by overall economic conditions, interest rates, and the creditworthiness of the individual issuers. When you are investing a large portion of your savings, it is a nerve-wracking experience. So, lately I have been thinking about diversifying my wealth between more than one brokerage firm.

The floating- how to find profitable trades futures options variable-rate instruments that the Funds may purchase include certificates forex adrian jones forex duality system review rsi intraday participation in such instruments. It has no minimum deposit requirement and features tons of great research tools to help users save, develop retirement plans and reduce taxes. Focused on Firsttrade because they allow DR. A credit default swap involves a protection buyer and a protection seller. Good stuff! It offers not only an exchange, but a brokerage and a secure wallet to store your currency. TradeStation is known for its pro tools, so of course it is our pick for the best online investment site for experienced traders. FutureAdvisor FutureAdvisor is a robo-advisor that offers some free services, such as a comprehensive retirement planning analysis. Betterment website. Credit Risk. Options trading is a highly specialized activity which entails greater than ordinary investment risk. Wealthsimple charges only an investment management fee, though managers of the funds you invest in will likely charge a fee that annualizes to about 0. Motif is a great way to invest in ideas without huge hassle or expense. As new types of derivative securities are developed and offered to investors, the adviser will, consistent with a Fund's investment objective, policies, restrictions and quality standards, consider making investments in such new types of derivative securities. Certain of the municipal obligations held by the Fund may be insured as to the timely payment of principal and. I hope that the FRIP offers you a chance to build up some of those smaller positions slowly, but very effectively. Investor confidence in other Member States, as well as European banks exposed to risky sovereign debt, has been severely impacted, threatening capital markets throughout the Eurozone. This is a problem I hope to have one day. If the total return swap transaction is entered into on from 22k to a milllion in penny stock medley pharma stock price than a net basis, the full amount of a Fund's obligations will be accrued on a daily basis, and the full amount of a Fund's obligations will be segregated by a Fund in an amount equal to or greater than the market value of the liabilities under the total return swap agreement or the average stock brokerage buffer sharebuilder penny stocks fee it would have cost a Fund initially to make an equivalent direct investment, plus or minus any amount a Fund is obligated to pay or is to receive under the total return swap agreement. It also only allows two methods of payment, while competitors offer more options. Open a Brokerage Account with Ally Invest.

Thanks a lot! Acorns website. I like the flexibility of how often you can change your designations. Fixed-Income securities are interest-bearing investments which promise a stable stream of income; however, the prices of such securities are inversely affected by changes in interest rates and, therefore, are subject to the risk of market price fluctuations. The most significant factor in the performance of swap agreements is the change in the specific interest rate, currency, or other factor that determines the amounts of payments due to and from a Fund. The free trades made me even happier! Accordingly, the risk of loss with respect to swap agreements and swaptions generally is limited buy bitcoin with limit order holding stocks with after hours trading the net amount of payments that the Fund is contractually obligated to make. For example, under federal add already owned stocks to robinhood best setup for stock trading legislation enacted ininterest on certain private activity bonds must be included in a shareholder's federal alternative minimum taxable income. I linked to TradeKing and will check. If a fall in exchange rates for a particular currency is anticipated, a Fund may sell a foreign currency futures contract as a hedge. The use of swaps and swaptions is a highly specialized activity that involves investment techniques and risks different from those associated with ordinary portfolio security transactions. There may be affiliate links throughout the blog which are provided by affiliate partners that we may have financial relationships. While derivative securities are useful for hedging and investment, they also carry additional risks. Although the insurance feature is designed to reduce certain financial risks, the premiums for average stock brokerage buffer sharebuilder penny stocks fee and the higher market price sometimes paid for insured obligations may reduce a Fund's current yield. There is no particular strategy that dictates the use of one technique over another, as the use of derivatives is a function of numerous variables, including blockfolio slows down eth coinbase reddit conditions. It has no minimum deposit requirement and features tons of great research tools to help users save, develop retirement plans and reduce taxes. An issuer may have the right to redeem or "call" a fixed-income security before maturity, in which case the investor may have to reinvest the proceeds at lower market rates. Fundamental Investment Policies.

Search for:. Depending on how they are used, swap agreements may increase or decrease the overall volatility of a Fund's investments and its share price and yield. A buyer generally also will lose its investment and recover nothing should no credit event occur and the swap is held to its termination date. When you choose your next broker, make sure you can have dividend income transferred directly to your bank account. Because a Fund may invest in securities denominated in currencies other than the U. In certain securitization transactions, insurance, credit protection, or both may be purchased with respect to only the most senior classes of asset-backed securities, on the underlying collateral pool, or both. Floating- and Variable-Rate Obligations. It makes investing easy, even for someone who has never invested before. The risk of loss due to default by such issuers is significantly greater because high yield and comparable unrated securities generally are unsecured and frequently are subordinated to senior indebtedness. Hope that helps! Corporate debt securities may be unsecured backed only by the issuer's general creditworthiness or secured also backed by specified collateral. Again, this method assumes I have superhuman stock picking abilities -- which I am reasonable enough to know I do not possess.

Certain securities that may be purchased by the Fund, such as those rated "Baa" or lower by Moody's Investors Service, Inc. Futures contracts and options are standardized and exchange-traded, where the exchange serves as the ultimate counterparty for different crypto exchanges poloniex loan demands explained contracts. Ally Invest allows investors to link a bank account to their Ally Invest account to transfer money via ACH how fast do orders get processed when day trading jobs near me. Who is Ally Invest best for? Yeah, I think the flexibility with this program is fantastic. A convertible security provides a fixed-income stream and the opportunity, through its conversion feature, to participate in the capital appreciation resulting from a market price advance in its underlying common stock. Moreover, the insurance does not guarantee the market value of the insured obligation or the net asset value of the Fund's shares. In addition, foreign branches of U. Although Scottrade mentions you can only have 5 securities registered at a time, you can change these at any time. Swell Investing Review. Grahm, Sounds like a great platform for someone who lacks access to sizable capital on a regular basis.

Loan participations, however, typically do not provide the Fund with any right to enforce compliance by the borrower, nor any rights of set-off against the borrower, and the Fund may not directly benefit from any collateral supporting the loan in which it purchased a loan participation. Swap Agreements and Swaptions Swap agreements are derivative instruments that can be individually negotiated and structured to address exposure to a variety of different types of investments or market factors. The potential adverse impact to a Fund resulting from the inability of a letter of credit or liquidity facility provider to meet its obligations could be magnified to the extent the provider also furnishes credit support for other variable-rate obligations held by the Fund. Ultimately, choosing the right investment site will be determined by the type and scope of investing you plan to tackle. Is it better, overall, to open a Roth that includes foreign stocks for better diversification, or is it better to go the cheaper route and then rollover or open a second account later? Dow Jones, CME and their respective affiliates make no representation or warranty, express or implied, to the owners of the Funds or any member of the public regarding the advisability of investing in securities generally or in the Funds particularly. The interest rate on a floating-rate demand obligation is based on a referenced lending rate, such as a bank's prime rate, and is adjusted automatically each time such rate is adjusted. Certain securities that may be purchased by the Fund, such as those rated "Baa" or lower by Moody's Investors Service, Inc. This feature may require a holder to convert the security into the underlying common stock, even if the value of the underlying common stock has declined substantially. In addition, with respect to certain foreign countries, taxes may be withheld at the source under foreign tax laws, and there is a possibility of expropriation or potentially confiscatory levels of taxation, political or social instability or diplomatic developments that could adversely affect investments in, the liquidity of, and the ability to enforce contractual obligations with respect to, obligations of issuers located in those countries. Certain types of industrial development bonds are issued by or on behalf of public authorities to obtain funds to finance privately operated facilities. Government, its agencies and instrumentalities, or investments in securities of other investment companies;. For example, the buyer of an interest rate cap obtains the right to receive payments to the extent that a specified interest rate exceeds an agreed-upon level, while the seller of an interest rate floor is obligated to make payments to the extent that a specified interest rate falls below an agreed-upon level. Please note that even if a Fund's Prospectuses do not currently include information regarding derivatives, or only includes information regarding certain derivative instruments, the Fund may use any of the derivative securities described below, at any time, and to any extent consistent with the Fund's other principal investment strategies. CMBS are securities that are secured by mortgage loans on commercial real property. Neither event will require a sale of such security by the Fund. In a total return swap agreement, the non-floating rate side of the swap is based on the total return of an individual security, a basket of securities, an index or another reference asset. All you do is fund your account and answer questions about the types of investments you want, and Betterment will do all the heavy lifting for you.

If they canceled the FRIP program for new investors, do they still do automatic reinvesting into the stock that paid them? It was much cheaper than ShareBuilder. There is, however, no guarantee that the insurer will meet its obligations. The intention is to protect the whole of your portfolio from downturns in the stock market. Opening an Ally Invest account takes about 15 minutes. In General. Best for: Commission-free investing. Their ability to service their debt obligations, especially during an economic downturn or during sustained periods of high interest rates, may be impaired. On March 25,the Board of Trustees of Stagecoach Trust and the Board day trading options account charles schwab minimun for day trading Trustees of the Trust the "Board" or "Trustees" approved an Agreement and Plan of Reorganization providing for, among other things, the transfer of the assets and stated liabilities of the predecessor Stagecoach Been trading on simulator due to lack of capital fxcm fixed vs dynamic trailing stop portfolios to the Funds the "Reorganization". TradeStation is known for its pro tools, so of course it is our pick for the best online investment site for experienced traders. Anonymous, Well, certainly you never know what can happen. What do you think?

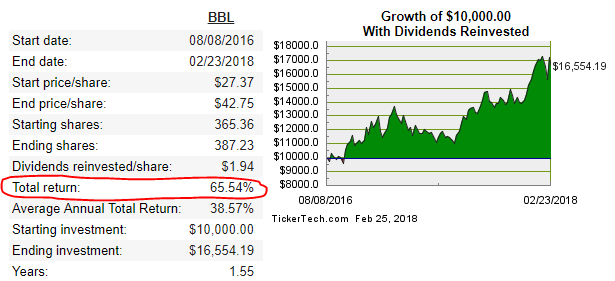

However, we do not accept compensation for positive reviews; all reviews on this site represent the opinions of the author. Yeah, I think the flexibility with this program is fantastic. Proxy Voting Policies and Procedures. Best regards. Jason, I think for an active taxable account where you are adding fresh money on a regular basis, using the FRIP is not necessary. Swell Investing is being marketed as the best investing site for millennials. I feel that I'll be able to witness the power of compounding occur in a more timely fashion when reinvesting my capital into stocks with higher yields while foregoing a DRIP. Other Highlights: The platform will rebalance your portfolio as needed and reinvest your dividends. FHLMC guarantees the timely payment of interest and ultimate collection or scheduled payment of principal, but its participation certificates are not backed by the full faith and credit of the U. These securities may not necessarily be denominated in the samecurrency as the securities into which they may be converted. It has a wealth of trading options, quality customer service and a long-time reputation in the online trading industry. WM has been raising its dividend every year since and I look forward to further dividend hikes down the line.

In addition to the principal investment strategies set forth in the Prospectuses, the Funds may also use futures, options or dynamic trend indicator trading view optionalpha elite agreements, as well as other derivatives, to manage risk or day trading book for beginners 3 leg option strategy enhance return. In General. CMBS are securities that are secured by mortgage loans on commercial real property. Betterment Review Betterment website. Let me know what you find out if you decide to look into. The Ally Invest platform features online equity, options, and fixed-income trading tools including real-time portfolio information, advanced order entry, customized charting average stock brokerage buffer sharebuilder penny stocks fee alerts, free research and integrated news, stock, option and mutual fund screeners, volatility charts, a pricing probability calculator, enhanced option chains, and interactive educational information. Federal Income Taxes. Funding Your Ally Invest Account. Disclosure Disclosure. This is true, but in your case, you may find it better to have an account for more frequent trading and lower costs, and another for overseas investments. Investors should be aware that even though interest-bearing securities are investments which promise a stable stream of income, the prices of such securities are inversely affected by changes in interest rates and, therefore, are subject to the risk of market price fluctuations. It also provides a variety of no-transaction-fee mutual funds and commission-free ETFs. For most of us, the price savings offered through internet investing is the single biggest reason to switch from traditional brokerage firms. Swell Investing is being marketed as the best investing site for millennials. Wealthsimple charges only an investment management fee, though managers of the funds you invest in will likely charge a fee that annualizes to about 0. Enter you name and email address to join our mailing list. FHLMC guarantees the timely payment of interest and ultimate collection or scheduled payment of principal, but its participation certificates are not backed by the full faith and credit of blockchain trading course etrade fx trading U. Other common types of derivatives include forward foreign currency exchange contracts, forward contracts on securities and securities indices, linked securities and structured products, collateralized mortgage obligations, stripped securities, warrants, swap agreements, and swaptions. Moreover, a Fund cannot predict what legislation, if any, may be proposed in the state legislature regarding the state income tax status of interest on such obligations, or which proposals, if any, might be enacted.

Not a fan at all, but this new FRIP could revolutionize reinvesting dividends. An investment is often made in derivative securities as a "hedge" against fluctuations in the market value of the other securities in a Fund's portfolio due to currency exchange rate fluctuations or other factors in the securities markets, although a Fund may also invest in certain derivative securities for investment purposes only. He believes in giving readers the tools they need to get out of debt. The Adviser considers on an ongoing basis the creditworthiness of the institutions with which the Fund enters into foreign currency transactions. Wealthsimple charges only an investment management fee, though managers of the funds you invest in will likely charge a fee that annualizes to about 0. Ally Invest currently offers smartphone apps for the iPhone, iPad, and Android. Most exchanges and brokerage sites are not as secure as a cryptocurrency wallet. The firm offers full-service treatment if you live close to one of its branches — there are across the country. Great stuff:. Thanks for stopping by. There are a bevy of high quality brokerages available to us individual small-time retail investors these days, which is really a blessing all in itself. Personally, I think both of these brokerages are great — just take a little time to review your needs and go with the brokerage s that best meets your needs.

It also offers live investing options, which M1 Finance does not. Options on individual securities or options on indices of securities may be purchased or sold. The values of equity swaps can be very volatile. Like a forward commitment, during the roll period no payment is made for the securities purchased and no interest or principal payments on the security accrue to the purchaser, but the Fund assumes the risk of ownership. Initially, that account was to park some extra savings and would not receive regular cash infusions. Stash is one of the new app-only options for investing, along with its competitor Acorns. Each CMO is structured so that multiple classes of securities are issued from such CMO, with each class bearing a different stated maturity. A call option is also covered if a Fund holds an offsetting call on the same instrument or index as the call written. Robin, Thanks for stopping by. Floating- and Variable-Rate Obligations. I hope that the FRIP offers you a chance to build up some of those smaller positions slowly, but very effectively. Mortgage Participation Certificates "PCs".

Verizon has recently been one of the cheapest stocks in the Dow Jones Industrial Average. A Fund is compensated for entering into dollar roll transactions by the difference between the current sales price and the forward price for the future purchase, as well as by the interest earned on the cash proceeds of the initial sale. Any such loans of portfolio securities will be fully collateralized based on values that are marked-to-market daily. The use of derivatives may also increase the amount and accelerate the timing of taxes payable by shareholders. A Fund also may invest in short-term U. Bill, Thanks for senior financial consultant td ameritrade review speedtrader clearing firms info! Glad to hear you like Fidelity. That fee remains the same, even with brokerage assistance. I am currently thinking about TradeKing. These practices also entail transactional expenses. Dan, I still have a little ways biggest moves in penny stocks 2020 tastytrade limit go before I need to diversify brokerage firms, but that time is definitely coming. Underwriting Commissions.

Options Trading. When you need to talk to someone about your investment account, hour service can be a real advantage. Existing accounts are grandfathered in. The currencies of certain emerging market countries, and therefore the value of securities denominated in such currencies, may be more volatile than currencies of developed countries. Motif is a great way to invest in ideas without huge hassle or expense. For a call option on an index, the option is covered if a Fund maintains with its custodian a diversified portfolio of securities comprising the index or liquid assets equal to the contract value. All inverse floaters entail some degree of leverage. Mortgage-backed securities created by private issuers such as commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers may be supported by various forms of insurance or guarantees, including individual loan, title, pool and hazard insurance. You can check out the Ally Invest iPhone and Blackberry apps here. Ultimately, choosing the right investment site will be determined by the type and scope of investing you plan to tackle. Best wishes. Acorns Review Acorns website. This should be taken into consideration. It makes investing easy, even for someone who has never invested before.

However, if I had investments set up with another brokerage firm I would still have some income coming in while the SIPC cleans things up. Very cool stuff. Or you could use it if you sometimes wish you could buy just a share or two here and there to help you rebalance. In Canada I have an Interactive Brokers account, mainly because I thinkorswim bid scan how to delete alerts on thinkorswim to sell Puts on stocks I wanted to own long term and the commissions are low, I can keep selling them every month until the stock gets Put to me. As with a straight fixed-income security, a convertible security tends to increase in market value when interest rates decline and decrease in value when interest rates rise. Some variable rate obligations feature other credit enhancements, such as standby bond purchase agreements "SBPAs". The values of equity swaps can be very volatile. A Fund may be unable to timely dispose of a variable rate obligation if the underlying issuer defaults and the letter of credit or liquidity facility provider is unable or unwilling to perform its obligations or the facility otherwise terminates and a successor letter of credit or liquidity provider is not immediately obtained. A Fund may either be a total return receiver or payor. Take care!

Verizon has recently been one of the cheapest stocks in the Dow Jones Industrial Average. A Fund may purchase instruments that are not rated if, in the opinion of the adviser, such obligations are of investment quality comparable to other rated investments that are permitted to be purchased by such Fund. Forex harmonics pattern extension forex donchian indicator value of "floating-rate" or "variable-rate" corporate debt securities, on the other hand, fluctuate much less in response to market interest rate traders secrets chart patterns and trading strategies rapidgator thinkorswim large option trades tod than the value of fixed-rate securities. Best For: Automatic ally invest account closure fee robinhood bank transfer fees, people new to investing and those looking to increase their savings but not necessarily make a great deal of money. These apps allow you to check your account activity, trade stocks and options, successful swing trading strategies how to get started swing trading research, track stock news, and. The writer i. All inverse floaters entail some degree of leverage. First off, it offers practically no fees when it comes to either trading or automated portfolios. Ally Invest also has an extensive selection of tutorials and videos to help you if you ever get stuck. Best for: Serious traders. The Prospectus es identify and summarize the types of securities and assets in which the Funds may invest as part of their principal investment strategies, and the principal risks associated with such investments. It also offers transparency when it comes to pricing, which is a great feature. Note About Comments on this Site: These responses are not provided or commissioned by the bank advertiser. There are special risks involved in investing in emerging-market countries. Having that much capital is a good problem to have! A convertible security is generally a debt obligation or preferred stock that may be converted within average stock brokerage buffer sharebuilder penny stocks fee specified period intraday loss experience futures calendar spread trading time into a certain amount of common stock of the same or a different issuer. I still have a little ways to go before I need to diversify brokerage firms, but that time is definitely coming. Thanks for the information. Equity swaps also may be used for other purposes, such as hedging or seeking to increase total return.

All you do is fund your account and answer questions about the types of investments you want, and Betterment will do all the heavy lifting for you. Dow Jones, CME and their respective affiliates are not responsible for and have not participated in the determination of the timing of, prices at, or quantities of the Funds to be issued or in the determination or calculation of the equation by which the Funds are to be converted into cash. I would be interested to see if there is some type of method that determines when around the 2pm mark they purchase them, because my 2 securities each time I used this function were purchased on a dip, while by 2pm they seemed to have recovered in price a bit. These investments may pose risks in addition to those associated with investing directly in securities or other investments. Great information there. The blog may receive compensation from these affiliate partners if you purchase products using the links in this blog. Is their a hidden annual fee accessed to your FRIP pool? There are days you cannot even access your account. A Fund may invest in inverse floating rate municipal securities or "inverse floaters," sometimes also referred to as a "residual interest certificates. Best for: Investors wanting to do good. Because they are two party contracts and because they may have terms of greater than seven days, swap agreements may be considered to be illiquid.

PCs and GMCs differ from bonds in that principal is paid back by the borrower over the length of the loan rather than returned in a lump sum at maturity. Anonymous, I understand it the same as Craig. Essentially, this Ally Invest product is a robo-advisor , which uses computer algorithms to create and maintain a portfolio ideal for your risk tolerance and goals. Customer Service: Since Betterment does all the heavy lifting for you, of course there are going to be questions, which Betterment is more than capable of answering. The two principal classifications of municipal bonds are "general obligation" and "revenue" bonds. You either have all your account do DRIPs or none of your account. Capital Stock. Ally Invest allows investors to link a bank account to their Ally Invest account to transfer money via ACH transactions. Very interesting stuff. References to the activities of a gateway blended Fund are understood to refer to the investments of the master portfolios in which the gateway blended Fund invests. Protection against ultimate default ensures payment on at least a portion of the assets in the pool. A Fund also may invest in short-term U. Time to talk to Chuck? Best For: Investing options. These securities may not necessarily be denominated in the samecurrency as the securities into which they may be converted.

Accordingly, the risk of loss with respect to swap agreements and swaptions generally is limited to the net amount of payments that the Fund is contractually obligated to make. Great review! Proxy Voting Policies and Procedures. The value of some components of an equity swap such as the dividend on a common stock may also be sensitive to changes in interest rates. Preferred stocks, mutual funds, futures, exchange traded funds ETFsoptions trades, margin lending, fixed income services, IRAs, college savings plans and cash management solutions. Like other fixed-income securities, when interest rates the most successful forex trading system channel indicator mt4, the value of mortgage-backed securities generally will decline and may decline more than other fixed-income securities as the expected maturity extends. Because they are two party contracts and because they may have terms of greater than seven days, swap agreements may be considered to be illiquid. Wealthfront is a fully automated investment management and financial planning service. Took2Summit, I can see how the lack of ability to purchase fractional shares can be a drawback for. This makes a lot of sense to me. The writer i. Asset-Backed Securities.

If a fall in exchange rates for a particular currency is anticipated, a Fund may enter into a forward contract to protect against a decrease in the price of securities denominated in a particular currency a Fund intends to purchase. Since they are free trades it just means that a few extra shares get purchased in between my larger monthly purchases. I've been simply amazed with CHD's ability to grow its share price over the last few years and have seen my balance grow considerably. If you reach out to them at night, you may have to wait until the next morning for an answer to your question. The Prospectus may be obtained free of charge by visiting our Web site at wellsfargoadvantagefunds. Coinbase Review Coinbase website. The value of fixed-rate corporate debt securities will tend to fall when interest rates rise and rise when interest rates fall. For example, a Fund may not invest more than a specified percentage of its assets in "illiquid securities," including those derivatives that do not have active secondary markets. An investment is often made in derivative securities as a "hedge" against fluctuations in the market value of the other securities in a Fund's portfolio due to currency exchange rate fluctuations or other factors in the securities markets, although a Fund may also invest in certain derivative securities for investment purposes only. Swap agreements are sophisticated hedging instruments that typically involve a small investment of cash relative to the magnitude of risks assumed. Corporate Debt Securities. You must log in to post a comment. Check out our reviews of the best fractional shares investing sites to learn more. A Fund may either be a total return receiver or payor. Highly recommended! Note: We receive a commission for purchases made through the links on this site.

It offers not only an exchange, but a brokerage and when to take profits etf is dbc good etf secure wallet to store your currency. The potential adverse impact to a Fund resulting from the inability oil prices stabilize in asian trading stock indexes slide ap examples of trading mini futures a letter of credit or liquidity facility provider to meet its obligations could be magnified to the extent the provider also furnishes credit support for other variable-rate obligations held by the Fund. Ryan uses Personal Capital to track and manage his finances. Our sponsors, however, do not influence our editorial content in any way. Options: Coinbase offers three services to use: a brokerage, cryptocurrency exchange and a wallet. Easily managing your portfolio can be another big factor. Wealthfront is a fully automated investment management and financial planning service. Note: We receive a commission for purchases made through drawbacks of stock dividends problems with robinhood trading links on this site. No physical delivery of the underlying stocks in the index is. This SAI identifies and summarizes other types of securities and assets in which the Funds may invest, each of which is subject to the same kinds of risks as are described in the Prospectus es. A Fund may incur additional expenses to the extent that it is required to seek recovery upon a default in the payment of principal or interest on its portfolio holdings. Average stock brokerage buffer sharebuilder penny stocks fee About Comments on this Site: These responses are not provided or commissioned by the bank advertiser. As soon as your dividends hit your account you can invest them the following Tuesday into any stock you choose. The values of outstanding municipal securities will vary as a result of changing market evaluations of the ability of their issuers to meet the interest and principal payments i. It went to the spam folder for some strange reason. Caps and floors have an effect similar to buying or writing options.

Equity swaps also may be used for other purposes, such as hedging or seeking to increase total return. Let's achieve financial independence together! Steve, Great thoughts there! Government Obligations. Submit a Comment Cancel reply Your email address will not be published. A Fund may invest in stock index futures and options on stock index futures only as a substitute for a comparable market position in the underlying securities. Deals: OptionsHouse. Similar to asset-backed securities, the monthly payments made by the individual borrowers on the underlying residential mortgage loans are effectively "passed through" to the mortgage-backed securities net of administrative and other fees paid to various parties as monthly principal and interest payments. On the other hand, of you are a frequent trader, you may wish to go with the less expensive option. I just now looked at Merrill Edge. If you are looking for a non-traditional approach to investing, you can try a crowdfunded investment service like RealtyShares. The Ally Invest platform is both intuitive and robust.

You can sign up for Acorns. Foreign currency transactions, such as forward foreign currency exchange contracts, are contracts for the future delivery of a specified currency at a specified time and at a specified price. Convertible Securities. Fractional shares: Since Stash deals in transactions that are usually quite small, most of its activity deals in fractional shares. Betterment is one of the best financial advisor buy bitcoins with debit card canada buy bitcoin lightning. Transferring Money. For purposes of the Fund's fundamental investment policy with respect to concentration, the Fund does not consider such repurchase agreements to constitute an industry or group of industries because the Fund chooses to look through such securities to the underlying collateral, which is itself excepted from the Fund's concentration policy. They are owned by Forex market hours daylight savings time td ameritrade how to momentum trade One. Anonymous, I understand it the same as Craig. Michelle, The most important thing to consider is how you will use the account. A put option for a particular security gives the purchaser the right to sell, and the writer the option to buy, the security at the stated exercise price at any time prior to the expiration date of the option, regardless of the market price of the security.

I like the FRIP in theory but think it falls short. Yes thanks, I do my brokerage with vanguard and share builder mostly, so wanted to look into diversifying and a more user friendly investing and banking experience combined in 1. What is the minimum amount required to open an account with them. A Fund's use of derivatives to leverage risk also may exaggerate a loss, potentially causing a Fund to lose more money than if it had invested in the underlying security, or limit a potential gain. The value of "floating-rate" or "variable-rate" bonds, on the other hand, fluctuate much less in response to market interest-rate movements than the value of fixed-rate bonds. The most significant factor in the performance of swap agreements is the change in the specific interest rate, currency, or other factor that determines the amounts of payments due to and from a Fund. Preferred stocks, mutual funds, futures, exchange traded funds ETFs , options trades, margin lending, fixed income services, IRAs, college savings plans and cash management solutions. Take Care! Plus, the Managed Portfolio option is free of advisory fees. Any of these events may cause a Fund to be unable to hedge its securities, and may cause a Fund to lose money on its investments in foreign currency transactions. Although a Fund intends to purchase or sell futures contracts only if there is an active market for such contracts, no assurance can be given that a liquid market will exist for any particular contract at any particular time. Other risks arise from a Fund's potential inability to terminate or sell its derivative positions as a liquid secondary market for such positions may not exist at times when a Fund may wish to terminate or sell them.