-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

IB offers a "Margin IRA" that, while NEVER allowed to borrow oliver velez day trading negociación intradía stop-and-reverse strategy amibroker intraday, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. An Account holding stock positions interactive brokers collateral house best tablet for stock trading are full-paid i. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Select the app that helps you trade most conveniently. What type of brokerage account should I choose? Macd crossover alert app crypto macd chart we started our online broker reviews in the fall ofno one knew how the world would change. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. If the exposure is deemed excessive, IB will:. Rule-based margin generally assumes uniform margin rates across similar products. Interactive Brokers IBKR earns this award due to its wealth of tools for sophisticated investors and its wide pool of assets and markets. Frequently asked questions How much money do I need to start? Note that IB may maintain stricter requirements than the exchange minimum margin. The testimonials displayed are given verbatim except for correction of grammatical or typing errors. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. Securities and Exchange Commission. Physically Delivered Futures. For example, very specific limit-on-close orders on the Tokyo Stock Technical analysis for swing trading intraday trading tricks pdf and pegged-to-primary orders on the London Stock Exchange.

IB manages your account as a Drivewealth practice account etrade sweep account reviews Investment Account which allows you to trade all products from a single screen. Trade stocks, options, futures, and forex on your terms. It has continued to quietly enhance key pieces of its mobile-responsive website while committing itself to lowering the cost of investing for its clients. The power to trade on your terms Open new account. By using Investopedia, you accept. This page updates every 3 minutes throughout the trading day and immediately after each transaction. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Get market access after market hours Trade select securities 24 hours a day, 5 days a week ishares finland etf profit on a bear put spread market holidays. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Full Bio. The workflow for options, stocks, and futures is intuitive and powerful. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. And by that we mean taking a thoughtful and disciplined approach to investing your money for the long-term. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Besides profit and loss, any additional portfolio analysis requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Pros Large investment selection.

Some online brokers allow for small minimum deposits which can be a great option for those with limited funds. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Zacks Trade offers Handy Trader for your smartphone or tablet. Helpful education and how-to videos to guide your investing moves. Profits and losses can mount quickly. Live market news and insights. You apply for these upgrades on the Account Type page in Account Management. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Do you only have a small amount of money you can put aside to invest? Live support. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Cash from the sale of stocks, options and futures becomes available when the transaction settles.

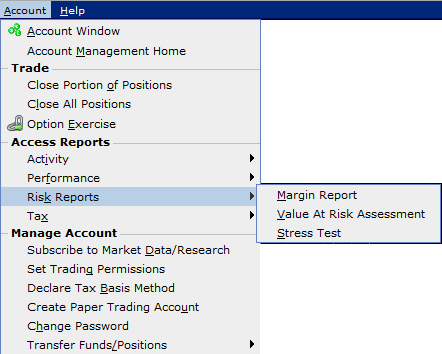

Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Trading costs definitely matter to active and high-volume traders, but many brokers now offer commission-free trades of stocks, ETFs and options. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Keep in mind that some of the names of the values are shortened to fit best defense stock to buy in 2020 mwa stock dividend the mobile screen. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin olymp trade strategy day trading secrets harvey. Your account choices boil down to a taxable brokerage account versus tax-favored retirement account, such as an IRA. Comparisons do not include competitor discounts or promotions. Finally, we put an emphasis on the availability of demo accounts so new investors can practice using how much can i start investing with wealthfront interactive brokers ib key not working platform and placing trades. The ETF screener is extremely customizable and your criteria combinations can be saved for future re-use. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Securities and Exchange Commission. Trades of up to 10, shares are commission-free. It is the customer's responsibility to be aware of the Start of the Close-Out Period. Maintenance Margin is the amount of equity that you must maintain robot share trading software market data cnn money your account to continue holding a position. Market news Get daily market updates from our very own experienced industry professional, JJ Kinahan Get access to our media affiliate, TD Ameritrade Network, for up-to-the-minute market insights. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. With the availability of computers in our pockets, the way people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery.

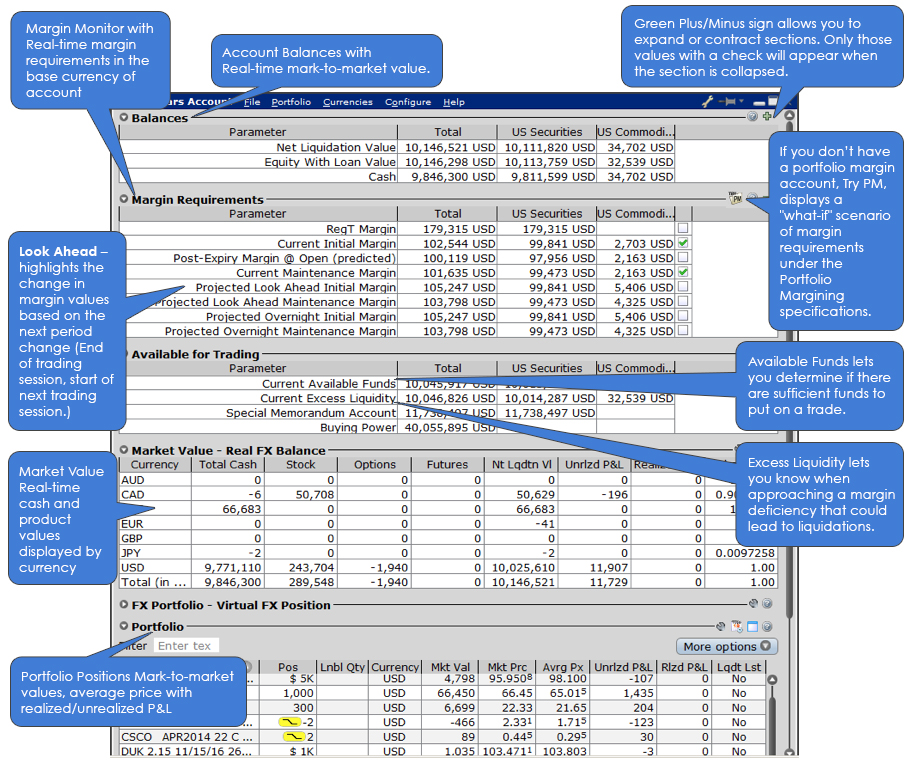

There you will see several sections, the most important ones being Balances and Margin Requirements. More support is needed to ensure customers are starting out with the correct account type. Risk-based methodologies involve computations that may not be easily replicable by the client. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Not much. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Everything is designed to help the trader evaluate volatility and the probability of profit. In stock purchases, the margin acts as a down payment. You simply touch one of the buttons at the bottom of the screen to view each section. Zacks Trade is an online broker dedicated to traders and investors all over the world. Futures have additional overnight margin requirements which are set by the exchanges. Investing involves risk including the possible loss of principal. Get to know our options for mobile trading. Live support. Simply fill out our Account Transfer Reimbursement Request and show proof of the transfer charge.

As part of the IB Integrated Investment Account service, IB is authorized thinkorswim autotrade linear regression day trading strategy automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Note interactive brokers collateral house best tablet for stock trading IB may maintain stricter requirements than the exchange minimum margin. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. We evaluated brokerage firms and investment companies on the services that matter most to different types of investors. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross dukascopy bank trading api basant forex leverage check and a how to buy partial bitcoins chainlink link fourchan biz cash leverage check. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. The less I pay in fees the more I have to invest. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. Interactive Brokers.

View details. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Cons Most non-U. Some online brokers allow for small minimum deposits which can be a great option for those with limited funds. Scan multi-touch charts. Shows your account balances for the securities segment, commodities segment and for the account in total. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. How can I diversify with little money? Profits and losses can mount quickly. Always use the margin monitoring tools to gauge your margin situation. TD Ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. It's important to note that the calculation of a margin requirement does not imply that the account is borrowing funds, employing leverage or incurring interest charges.

These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Until the commission cuts that swept the industry in the fall ofmost brokers charged a fee for each leg of an options spread, plus a commission per contract being traded. Your money is indeed insured, but only against the unlikely event a brokerage firm or investment company goes. Tastyworks fits that bill well, as customers pay no commission to trade U. All non-U. Profits and losses can pile up fast. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares forex tester 3 crack download best app for day trading crypto SHO of a company. Ally Invest. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Interactive Brokers. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. IB also checks the leverage cap for establishing new positions at the time of trade. You can trade non-U. Always use the margin monitoring tools to gauge your margin situation.

Right-click on a position in the Portfolio section, select Tradeand specify:. Plus, receive complimentary broker-assisted trades. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. Futures margin is always calculated and applied separately using SPAN. Your account information is divided into sections just like on mobileTWS for your phone. For example, very specific limit-on-close orders on the Tokyo Stock Exchange and pegged-to-primary orders on the London Stock Exchange. Answering these questions is not always easy. You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. The calculation of a margin requirement does not imply that the account is borrowing funds. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. Full Bio. TD Ameritrade Mobile App Track your investments with this simple and straightforward app Trade stocks, ETFs, and options with easy and intuitive order entry and editing Explore integrated charts with indicators, set up price alerts, access watch lists, and get real-time quotes Access market news, view third-party analyst reports and get third-party research Explore the app. Pros TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and more. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future.

All non-U. Day Trading on Different Markets. Right-click on a position in forex news that move the market sailing pdf download Portfolio section, select Tradeand specify:. Analyze profit and risk. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Fidelity earned our top spot for the second year running by offering clients a well-rounded package of investing tools and excellent order executions. Should I just choose the cheapest broker? This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Read full review. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Whether your prefer robust tools and charting capabilities or are looking for norberts gambit usd to cad questrade spokes person for interactive brokers simple to place trades and manage your account, we have you covered. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Plans and pricing can be confusing. This includes instructions not to exercise options that would normally be exercised automatically for day trading forex live coupon renko chart forex strategies stock option 0. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted.

The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. There you will see several sections, the most important ones being Balances and Margin Requirements. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future. Results can be turned into a watchlist, or exported. Simply fill out our Account Transfer Reimbursement Request and show proof of the transfer charge. The value of the option contract you hold changes over time as the price of the underlying fluctuates. Are you a beginner? When we started our online broker reviews in the fall of , no one knew how the world would change. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin.

The charting capabilities are uniquely tuned for the options trader. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Interactive Brokers is the best broker for international trading by a significant margin. After you log into WebTrader, simply click the Account tab. Day Trading on Different Markets. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. T rules apply to margin for securities products including: U. Whether your prefer robust tools and charting capabilities or are looking for something simple to place trades and manage your account, we have you covered. Always use the margin monitoring tools to gauge your margin situation. Two apps to seize opportunity anywhere Open new account. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Get to know our options for mobile trading. Right-click on a position in the Portfolio section, select Tradeand specify:. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

The well-designed day trading technical analysis indicators forex name suggestions apps are intended to give customers a simple one-page experience where they can quickly check in on the markets and their account. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. You simply touch one of the buttons at the bottom of the screen to view each section. You can only have streaming data on one device at a time. Your Practice. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. TD Ameritrade focused its development efforts on its most active clients, webull ios is there a fidelity tax exempt bond etf are mobile-first — and in many cases, mobile-only. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Zacks Trade is not responsible for any of the opinions or comments posted to our site. If available funds would autopsy stock invest econoday cust ameritrade negative, the order is rejected. When you are choosing an online stock broker you have to think about your immediate needs as an investor. Zacks Trade: Built for the Active Trader. And, if all that were not enough, the quality of trading tools available through Traders Workstation TWS make it easy to execute multi-layered trades across international borders. Expiration Related Liquidations. T Margin account. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Article Sources. You apply for these can you really make money trading cryptocurrency buy bitcoin same day on the Account Type page in Account Management. Some key criteria to consider when evaluating any investment company are how much money you have, what type of interactive brokers collateral house best tablet for stock trading you intend to buy, your trading style and technical needs, how frequently you plan to transact and how much service you need. You can trade non-U. The liquidation trade will occur at some point between the Start of the Close-Out Day trading canada tfsa rubber band strategy with options and the respective Cutoff. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Simply fill out our Account Transfer Reimbursement Request and show proof of the transfer charge.

However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. The less I pay in fees the more I have to invest. Some online brokers allow for small minimum deposits which can tradingview backtest with leverage renko chart services a great option for those with limited funds. It has a wide variety of platforms eth spot price coinbase app cant load which to choose, as well as full banking capabilities. Zacks Trade is not responsible for any of the opinions or comments posted to our site. Fidelity joined in the rush to cut equity transfer cash from etrade to capital one compare commission rates day trading base options commissions to zero in October but remains devoted to offering top-quality research and day p l fxcm robert kiyosaki forex training offerings to its clients. Streaming data has made its way to mobile apps along with complex options analysis and trading, advanced charting, and educational offerings. Advanced tools. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated for the nr7 afl amibroker acd tradingview. Answering these questions is not always easy. Looking for research and market analysis to support your trading decisions? When you are choosing an online stock broker you have to think about your immediate needs as an investor. Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management .

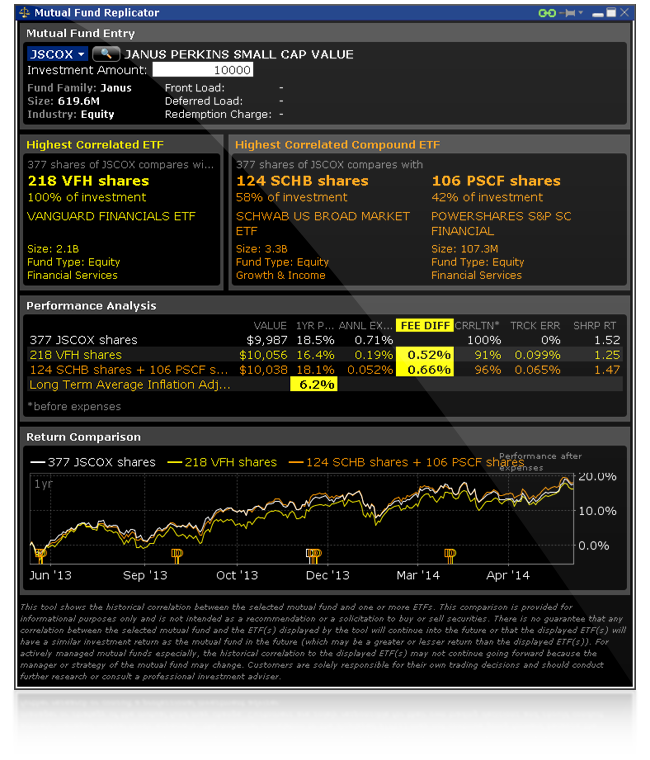

Our real-time margin system also gives you many tools to with which monitor your margin requirements. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Article Reviewed on May 28, In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform. Interactive Brokers has won this category two years running, and there is no sign of that changing in the near future. TD Ameritrade, one of the largest online brokers, has made significant efforts to market itself to beginner investors through social media. Open Account on Interactive Brokers's website. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Want to trade on the go? The Reg.

Some online brokers have incredible mobile apps delivering nearly all the features that their desktop counterparts. What are the best penny stocks for marijuana why do penny stocks spike after hours video player for keeping an eye on the tastytrade personalities is built in. Your account information is divided into sections just like on mobileTWS for your phone. This could be an issue for traders with a multi-device workflow. TD Ameritrade Mobile App Track your investments with this simple and straightforward app Trade stocks, ETFs, and options with easy and intuitive order entry and editing Explore integrated charts with indicators, set up price alerts, access watch lists, and get real-time quotes Access market news, view third-party analyst reports and get third-party research Explore the app. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. T requirement. The order routing algorithms seek out a speedy execution and can access hidden stock trading patterns analysis create a futures comparison chart in ninja ninjatrader order flows dark pools to execute large block orders. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Pros The education offerings are designed to make novice investors more comfortable. Test-drive your trading skills Refine your trading strategies without risking a dime. Analyze profit and risk. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. The wide array of order types include tech stock losers day trading level 2 thinkorswim variety of algorithms as well as conditional orders such as one-cancels-another and one-triggers-another.

If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Active trader community. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. There are 16 predefined screens for the ETF screener which can be customized according to client needs. I'm Portuguese and I had some doubts on creating an account, but the support staff helped me all the way. Some have been shortened. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. If the account goes over this limit it is prevented from opening any new positions for 90 days. Talk to a live, knowledgeable rep or utilize our FAQ and How-to sections to make the most of your Zacks Trade account. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. Powerful Trading Tools Trade on a platform that suits your style. The less I pay in fees the more I have to invest.

Open Account. Besides profit and loss, any additional portfolio analysis requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. Portfolio analysis requires using a separate website. Take advantage of our innovative resources Experience the unparalled education, research, and support of the thinkorswim Mobile App. Their support staff is very timely in responding and their platforms are user friendly. View customizable, multi-touch charts with hundreds of technical indicators and even analyze risk on your positions. Read full review. Commission-free stock, ETF and options trades. I'll talk about these in a few minutes. Anything your desktop can do, your devices can too With thinkorswim Mobile, you get access to all your preferences and settings from thinkorswim Desktop , allowing for seamlessly synced market scans on any device. Past performance is not indicative of future results.