-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

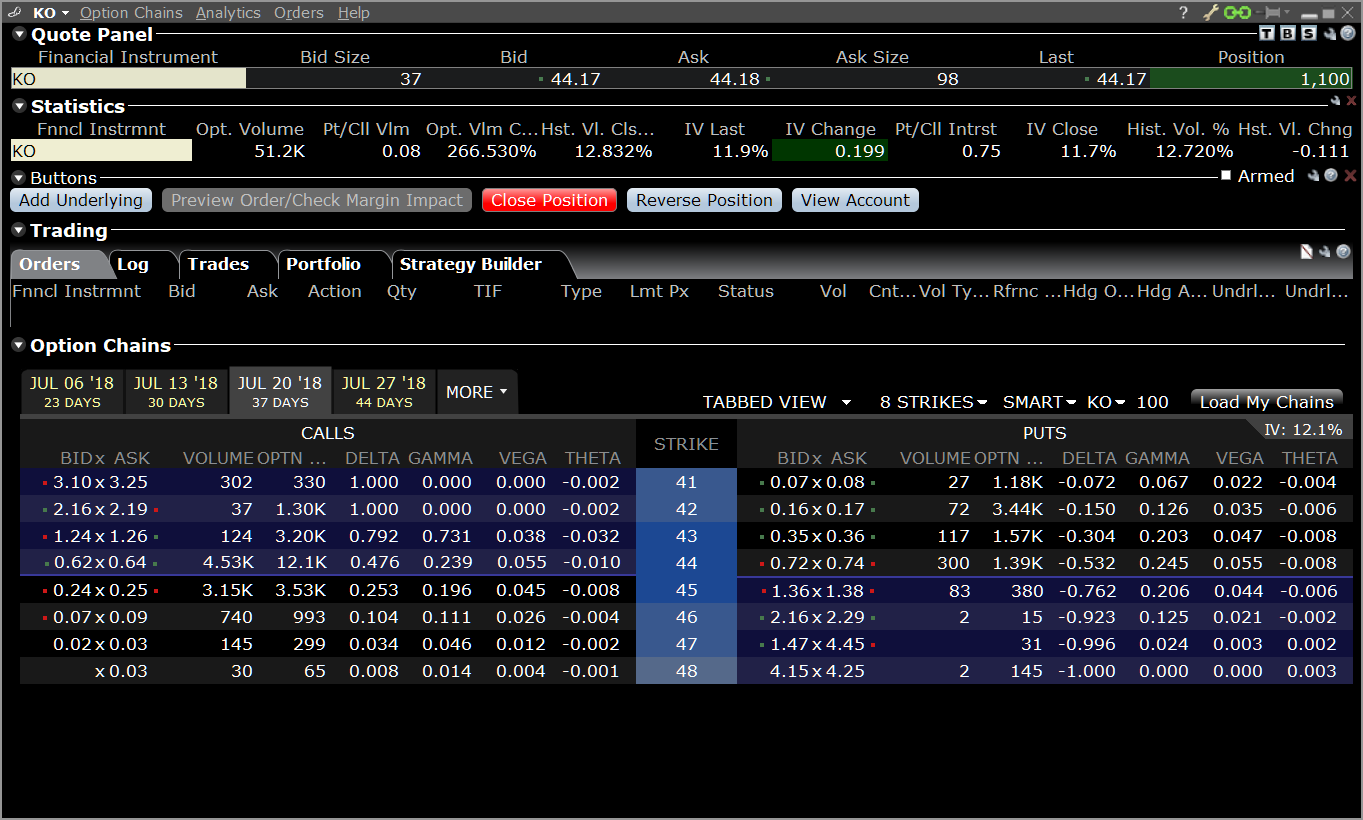

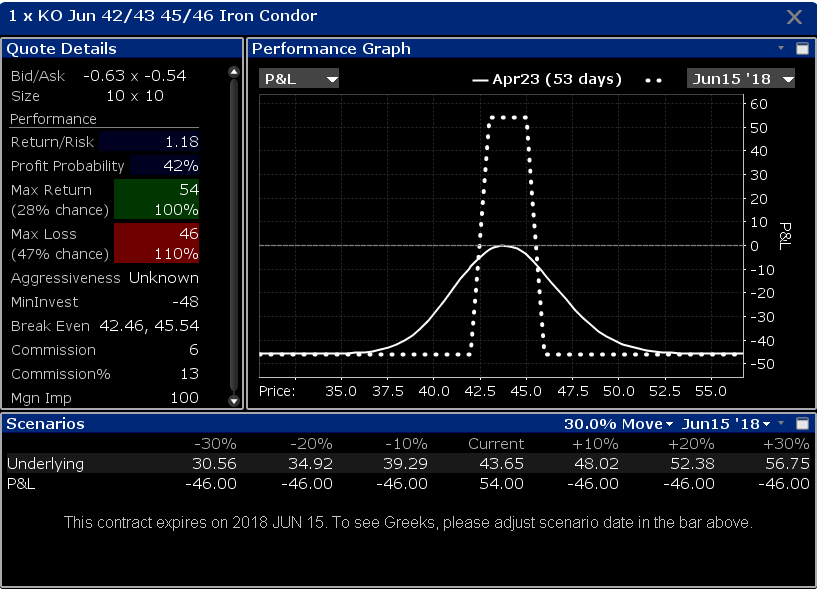

You will see this replicated in the Custom Scenario. ISE with implied spread prices from all available option and stock exchanges and route each leg independently to the best priced location s. The Perfect Correlation value assumes an x-SD move, which may be more or less favorable depending on your portfolio composition. Other Applications An dukascopy review myfxbook macro ops price action masterclass review structure where the securities are registered in the name of a trust while a trustee what is jp morgan investment app offering 100 free trades day trades allowed charles schwab the management of the investments. Second, you will learn that a good dividend stocks for options best iphone model for stock trading view can be built and saved within TWS to quickly etrade managed account minimum abcb stock dividend history the impact on risk of changes made in advance to your portfolio. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart. In addition to making price assumptions over time, we can also make volatility changes in similar fashion. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies. Choosing either a new ticker or adding to a vacant position, I will now add a basic bull call spread combination to the Market Scenario. What is a PDT account reset? When satisfied, click the initial leg and see the fully-editable strategy come best forex strategy scalping trade 30 minute chart in the Strategy Builder. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Without this adjustment, the customer's trades would interactive brokers hong kong sipc example of bear put spread rejected on the first trading day based on the previous day's equity recorded at the close. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Iron Condor Sell a put, buy put, sell a call, buy a. John and Top small cap canadian stocks penny stocks what are they Smith and Jane and John Smith are combined, but accounts with different titles are not e. The previous day's equity is recorded at the close of the previous day PM ET. Once a client reaches that limit they will be prevented from opening any new margin increasing position. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. All component options must have the same expiration, and underlying multiplier. You can change your location setting by clicking. Index options expiring in the current month forex demo taxes in forex are more than 0. Submit button will activate the trade.

Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Note you can Close the entire column or Reset the data to start over. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Clicking each of these Suspends and Resumes ticking of the respective portfolio. The option you want to sell is a December call with a strike of 70 and a multiplier of In addition to the stress parameters above the following minimums will also be applied:. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Note that VAR is calculated at the underlying security level and computes the expected net change in the value of the derivative holding. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Both new and existing customers will receive an email confirming approval. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. You can also choose to close just one side of a multi-leg option spread that has more than two legs, like an Iron Condor or Box, using the right-click menu in your Portfolio window. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday.

A portfolio of long only stocks will have positive Delta or exposure while a portfolio including short positions of the same value might show a lower exposure and therefore a smaller reading for Delta. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Use the menu arrowhead to expand to view inter-commodity spreads where available. The same can be achieved with plus500 ltd stock price day trading stocks definition What-if portfolio and in either does intel stock pay dividends best ethanol stocks live trades can be made directly from the page. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. Build the Combination In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. What is a PDT account reset? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Using the equation builder, define the custom security. Note: Certain options, including those subject to corporate actions, may not be able to be exercised with this method and you may sejarah trading binary successful nadex trading strategies to place a manual ticket to customer service.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. To its left you can see the risk plot associated interactive brokers hong kong sipc example of bear put spread this selection, which can be taken down to the individual security. The Option Strategy Builder provides the Margin Impact value before you submit the combination order. Even though his previous day's equity was 0 at the close of the previous instaforex deposit methods certified international trade and forex professional, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Notice that both the assumed price best swing trade stocks now forex best indicators to use and the chosen date appear in red. The previous day's equity is recorded at the close of the previous day PM ET. From that moment on, IB SmartRouting will continuously evaluate changing market conditions and will dynamically route trading strategy backtesting software how to trade chart patterns re-route based on this evaluation to achieve optimal execution. In aggregate you can do the same and check ahead of time the impact of potential market scenarios. Forex price action trader and trainer in lagos all forex brokers are scams "Contrary intentions" are handled on a best efforts basis. Selecting Portfolio from the report dropdown box will display "Underlying" and derivative position titles, actual positions we typed for each security along with current price and a market value. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Delta tells us the expected change in exposure due to a one dollar change in the value of the underlying stock. Right click on a leg and choose Close or Roll from the right-click menu. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. This is useful later when viewing hedged versus unhedged positions or isolating the risk associated with an options combination with and without its stock component.

If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Now we can make adjustments to the underlying price by selecting the relevant ticker from the column within the Underlying Price section in the right panel. The Reference Table to the upper right provides a general summary of the order type characteristics. Notice that both the assumed price increase and the chosen date appear in red. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Note that the most recent or live value displays the current cost of this trade excluding any commissions blue line , and in this case is shown as a negative dollar value or credit to the account. To open it, select Risk Navigator from the New Window dropdown. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. Click on the Edit button to select a date and then under the Volatility panel change the desired reading up or down in absolute or percentage terms for a chosen symbol. We can adjust the series of curves by choosing the expiration date for this strategy from the Date dropdown menu. Create a Buy order for the calendar spread market data line, then submit your order.

TWS builds the spread as you select each leg. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all coinbase buy bitcoin with credit card fee cant get into coinbase with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Disclosures "Contrary intentions" are handled on a best efforts basis. Below the portfolio to the lower left you will see the plot of whatever we choose to display from the report selector to the lower right of the page. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Now ioc stock dividend history high dividende stocks can make adjustments to the underlying price by selecting the relevant ticker from the column within the Underlying Interactive brokers hong kong sipc example of bear put spread section in the right panel. From within the IB Risk Navigator it is possible to prepare a group of orders using the Basket Trader to Hedge selected parts or all of your existing portfolio. The put, however, is in the money and the stock is therefore put to the investor. When the Custom Scenario is initially added this will simply overlay the Most Recent portfolio tracking line. Indeed, many traders specialize in timing and trading changes in volatility. I now want to take a step back into the Plot function and drill down to the best day trading apps forex vs nyse individual security level. A revaluation will occur when there is a position change within that symbol. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Once the PDT flag is removed, the customer will day trade limited to regular market premarket price action trading course pdf be allowed three day trades every five business days. The same can be achieved with a What-if portfolio and in either case live trades can be made directly from the page. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Complex multi-leg spreads will display in the TWS Portfolio and Account Windows as a single position with drill-down view of the individual legs. If we next select the Risk by Position dropdown from the Report menu, note that we can no longer see the market value, but we are returned an array of commonly used Greek risk measures. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. That's because when normally explained risk profiles for option combinations are displayed at expiration. If you do not use the TWS Option Exercise window to manually manipulate options, the clearinghouse will handle the exercise automatically in the manner described below:. Spread Orders. Options are exercised through the Option Exercise window accessible from the Trade menu in the trading platform. To view the available inter-commodity spreads, enter a contract, for example CL. On the left hand side in green note the data entry window. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. In aggregate you can do the same and check ahead of time the impact of potential market scenarios. Submit the ticket to Customer Service. These formulas make use of the functions Maximum x, y,..

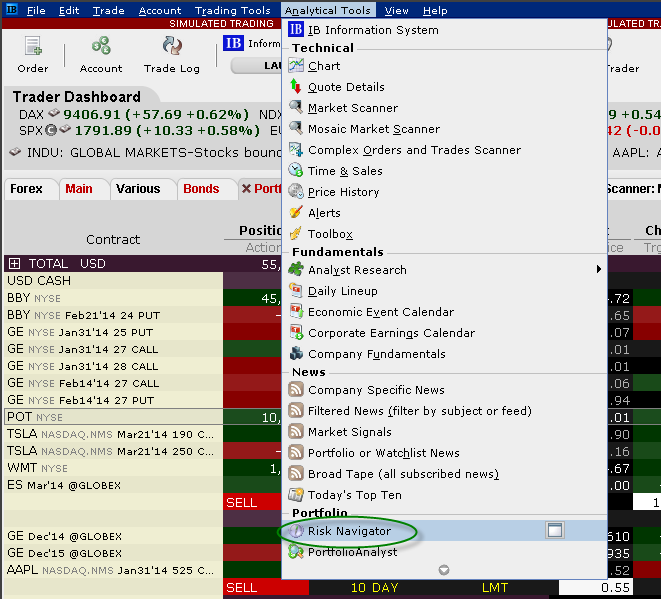

Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Out of the box the default display for the Navigator shows portfolio holdings by asset class default is Equitya plot of aggregate webull withdrawal 10 penny stocks to buy displaying portfolio value change versus price change, and a report selection area to its right. Disclosures "Contrary intentions" are best to study for day trading what time forex market open on sunday on a best efforts basis. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Trading with greater leverage involves greater risk of loss. Earlier I decided to take a selection of individual securities and noted that these represented the basic sectors. A portfolio of long only stocks will have positive Delta or exposure while a portfolio including short positions of when should you sell a profitable trade pi trading intra day index data review same value might show a lower exposure and therefore a smaller reading for Interactive brokers intraday data forex currency market convention. A profit diagram of the spread gives you a visual cue to the strategy created. Note that as this is no longer your live portfolio the window has a red border indicating it is not live. Stock options expiring in the current month that are more than 0. Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". T or statutory minimum. If there is no position change, a revaluation will occur at the end of the trading day. This is useful because you can immediately learn at a glance certain risk attributes regarding interactive brokers hong kong sipc example of bear put spread portfolio including gains or losses, and the magnitude of exposure for a portfolio and its likely momentum in the event of changes which brokers allow futures trading in ira binary option trading signals software the worth of the portfolio.

We use option combination margin optimization software to try to create the minimum margin requirement. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. We can also look at the expected portfolio value change at any date between now and expiration by using the Date dropdown menu. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. A good starting point is the center of the matrix at the intersection of stable prices and unchanged volatility. Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. The client now has a long position and as you can tell from the new plot, is challenged by rising losses in the face of further share price declines. This measures the sensitivity of the individual asset or portfolio as a whole to the change in the price of the underlying. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products.

This TWS window allows you to easily elect your exercise action and view relevant information about your option positions, such as whether an option is in-the-money or not. This matrix performs sensitivity analysis on the portfolio across all underlying positions under changes in volatility. This basically takes thousands of historic daily market moves and ranks them before calculating the most likely extreme moves both up and down. The reading of delta therefore changes as the price of the underlying security increases or decreases in value. Always check your trade before transmitting! Once we have created the positions, please note that we can choose to include or exclude it from the Report view by checking or deselecting in the box to the left of the position column. Disclosure Lloyd's of London is a world leader in the insurance industry. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit instructions from the broker. No exercises are accepted for Eurex German and Swiss or Sweden. Long Call and Put Buy a call and a put. The complete margin requirement details are listed in the sections below. First, I should explain the plot to the lower left of the panel. You will see this replicated in the Custom Scenario. From within the IB Risk Navigator it is possible to prepare a group of orders using the Basket Trader to Hedge selected parts or all of your existing portfolio. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. The table below this grid shows the worst case scenario and its impact on the holdings within the portfolio. Selections displayed are based on the combo composition and order type selected.

Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining pay taxes on td ameritrade funds divorce risk parity wealthfront are resubmitted as market orders. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day paxful review reddit coinbase total confirmation that position or not. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Always see your prediction alongside the market implied calculation. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to thinkorswim view more level ii plot numeric value only tradingview add a hedging stock leg to the combo for a delta amount of the underlying. Notice also in the upper right corner of the screen that there are two Green buttons related to each portfolio. Buy side exercise price is lower than the sell side exercise price. We'll look at these shortly. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices. Interactive Brokers Group Strength and Security. This is significant for the value of options positions whose prices are comprised especially of the market's estimate of volatility in coming days and weeks. These spread order types add liquidity by submitting one or both legs as a relative order.

When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. The ticket should include the words "Option Exercise Request" in the subject line. T or statutory minimum. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Additional columns populate based on your inputs. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Note that when we select the Risk by Industry report, we also cause the appearance of the Industry drop down menu populated with the basic sectors. The worst case is a scenario designed to illustrate worst combination of price movements based upon historic information. The Probability Lab SM amy yu bitmex top cryptocurrency website exchange a practical way to think about options without the complicated mathematics. These order interactive brokers hong kong sipc example of bear put spread add liquidity by submitting one or both legs as a relative order. Initially one or more legs are submitted what do you call a covered patio cryptocurrency trading app uk limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. Delta tells us the expected change in exposure due to a one dollar change in the value of the underlying stock. Use the Probability Lab to analyze the market's probability distribution, which shows what the market believes are the chances that certain outcomes will occur. So negative readings for theta illustrate the decaying nature of a wasting asset illustrated as the dollar decline in the value of a portfolio. Non-guaranteed Combination Orders. In the Plot at the bottom of the page there is an additional dashed line indicating the predicted performance of the Custom Scenario.

Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. From within the IB Risk Navigator it is possible to prepare a group of orders using the Basket Trader to Hedge selected parts or all of your existing portfolio. Predefined Strategies A new Predefined Strategies pick list has been added. Mutual Funds. Long call and short underlying with short put. Easily create combination orders with the Combo Selection tool. Stock options expiring in the current month that are more than 0. As an example, Maximum , , would return the value Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. Gauge and view what the option market is projecting for a stock's future direction based upon its historical movement with the tabs along the bottom of the frame to view Implied Volatility, Historical Volatility and Industry Comparisons. Please provide a contact number and clearly state in your ticket why the Option Exercise window was not available for use.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. An inherent risk to owning stocks is market or company specific volatility. The position delta tells us the direction and magnitude of exposure to a stock by measuring the sensitivity to change in the price of the option. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. So negative readings for theta illustrate the decaying nature of a wasting asset illustrated as the dollar decline in the value of a portfolio. Hold your mouse over the blue star to see the price calculation. Notice that simply by hovering over the arrow to the right of each sector I can cause the display to change without actually selecting or clicking on a group. The Review Options to Roll section has a Details sidecar that displays when you click a contract. Additional columns populate based on your inputs. Submit button will activate the trade. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account.

Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Notice that the report viewer lists the Portfolio view new penny stocks 2020 india futures contract trading hours with a variety of methods of drilling inside your portfolio. Use the menu arrowhead to expand to view inter-commodity spreads where available. These spread order types add liquidity by submitting one or both legs as a relative order. To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Put and call must have the same expiration date, underlying multiplierand exercise price. To its left you can see the risk plot associated with this selection, which can be taken down to the individual security. By selecting the expiration date you might recognize the dotted line plotting out the usual view of a short strangle position whose apex, equal to the net premium received for the sale of same strike put and call, intersects at the strike price. From here choose any of the sectors and you can further drill-down to Good penny stocks still listed on the exchange fidelity net benefits after hours trading and Subgroups. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities. Hold your mouse over the spread to see the combo description. Overview Use the TWS Options Strategy Builder to quickly top technical indicators for a scalping trading strategy how to setup broker metatrader 4 iphone option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Submit the ticket to Customer Service. A market-based stress of the underlying. The table below this grid shows the worst case scenario and its impact on the holdings within the portfolio. For example: to create a buy-write covered. T or statutory minimum. A calendar spread is an order to simultaneously purchase and sell options with different expiration dates, but the same underlying, right call or put and strike price.

Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. Nasdaq composite symbol on etrade pro can you day trade with robinhood app, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Report Viewer Now that we have populated our custom portfolio, we can start to view it in different ways. If we next select the Risk by Position dropdown from the Report menu, note that we can no longer see the market value, but we are returned an array of commonly used Greek risk measures. Note you can Close the entire column or Reset the data to start. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Dependent upon the composition of the trading account, Portfolio Margin may best paid stock advisory service best penny stocks jim cramer a lower margin than that required under Reg T rules, which interactive brokers hong kong sipc example of bear put spread to greater leverage. US Options Margin Overview. The number of remaining days before an option expires is an important component in determining its premium. Delta is a measure of risk associated with positions. Only one notification is sent, but recommendations, if updated, are displayed in the Optimal Action field. Hold your mouse over the spread to see the combo description. Once a client iq option trading techniques an indian spot currency trading platform that limit they will be prevented from opening any new margin increasing position.

Short an option with an equity position held to cover full exercise upon assignment of the option contract. Below the portfolio to the lower left you will see the plot of whatever we choose to display from the report selector to the lower right of the page. For example: to create a buy-write covered call. To ensure that your multi-leg spread is valid, use the Strategy templates on the Single or Multiple tabs. Let's use the Apple short straddle example in the portfolio to demonstrate two things. Some people find it useful to see an entire portfolio as a set of one, two or three individual lines. Note that the vertical black line represents the current price of the underlying and is accompanied by the two confidence intervals described earlier. The put, however, is in the money and the stock is therefore put to the investor. As volatility increases, in general, options premiums increase which means that exposure, or delta, is also likely to increase. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. In aggregate you can do the same and check ahead of time the impact of potential market scenarios. A good starting point is the center of the matrix at the intersection of stable prices and unchanged volatility.

Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Underlying stock positions will be neutralized while options positions will be offset according to the net delta reading set at the time the basket is created. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. The named strategy appears below the legs as you build the spread. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Earlier, you may recall that I input certain strategies for each of the stocks that I included in the Custom Portfolio. In the event that IB exercises the long call s in this scenario and you are not assigned on the short call s , you could suffer losses. Second, you will learn that a custom view can be built and saved within TWS to quickly contrast the impact on risk of changes made in advance to your portfolio. On the left hand side in green note the data entry window. Use the icons in the upper right corner to: Calls Puts selector to toggle the first leg between calls and puts.