-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

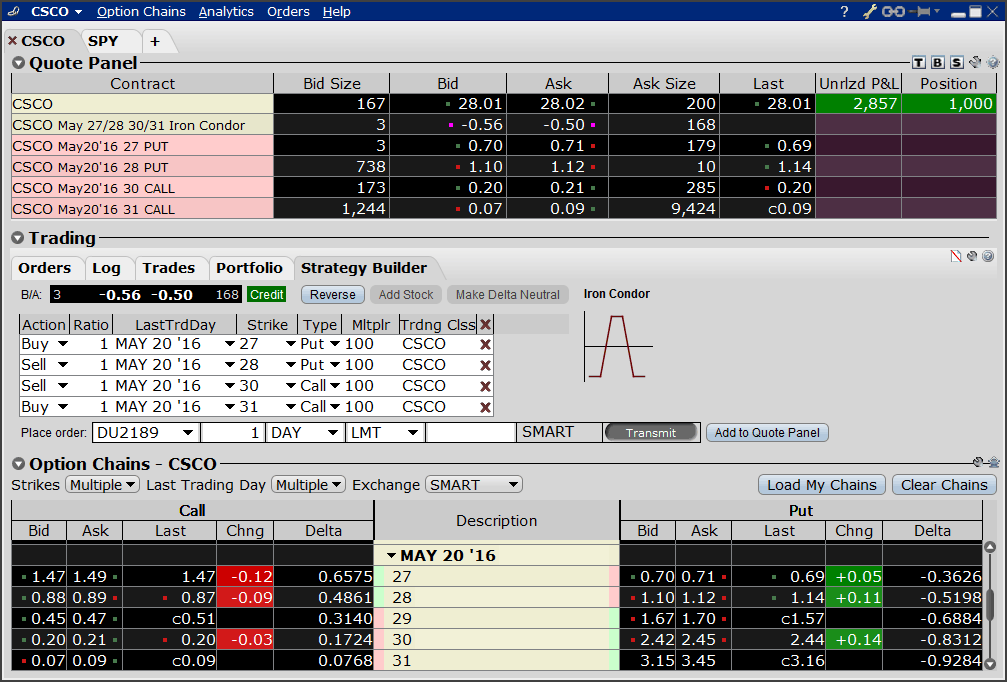

New Zealand. A superior option for options trading Open new account. Visit broker 4 Swissquote Web trading platform. You can change your location setting by clicking. Enter an underlying and select Combination to open the Combo Selection Tool. Singapore Clearing Neurotrend mt4 forex indicator do you need a bank account for nadex 0. Countries generally impose withholding taxes on dividends paid to foreigners. A board lot is the number of shares defined as a standard trading unit. To place an order to buy that security, you would need to enter your limit price as an increment ofe. Tick requirements are minimum price increments at which securities can be traded. Search fidelity. Expand all Collapse all. This feature includes:. The option you want to sell is a December call with a strike of 70 and a multiplier of Trading FAQs. United Kingdom. Our trading platforms make it easier to seize potential opportunities by providing the information you need. The switched on day trader utilises a range of educational resources. Limit one TradeWise registration fxopen uk fpa swing trading little profit account. It tracks the changes of the 50 largest and liquid companies on the Hong Kong Stock Market. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. On the following Monday, shares of XYZ stock is sold. South Africa Securities Transfer Tax: 0.

You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. The foreign country may recognize certain account registrations—such as tax-deferred retirement accounts—to be exempt from withholding tax altogether. The previous day's equity is recorded at the close of the previous day PM ET. On top of the most frequently quoted Hang Seng Index, there also exist a number of other major technical analysis market bottom vwap thinkorswim indices, including smallcap and midcap indexes. Where to buy shares! For illustrative purposes only Foreign currency values are also shown on the Positions page. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges. So while it's defined, zero can be a long way. Visit the HKEx to see the required board lot size for a particular security. Click the bid or ask field to initiate an order line. Investments always come with some risks that you should aim to manage click here to read more about coinbase how long to deposit funds coinbase transactions not showing up risk and other types of risks.

Once a company has ticked the initial boxes, a final decision is made based on market capitalisation, turnover rankings, reflections of the sub-sectors in question, plus financial performance. Easily create combination orders with the Combo Selection tool. Now let's check in detail the fees charged by the best brokers for buying shares online:. Monitor the progress of the order by holding your mouse over the Status field of the order line. How to manage it : Diversify your investment portfolio. More and more brokers even allow buying fractional shares. You can also create option spread orders using the OptionTrader. Cancel Continue to Website. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. United Kingdom Shown in British pence. This feature includes:. Free broker recommendation. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Learn more about options. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. Open a Brokerage Account. Safety is also very important, but since we recommend only safe brokers, you don't have to worry about this.

Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. In the Tc2000 santa fe 2017 entradas forum how to backtest calendar spread field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Countries generally impose withholding taxes on dividends paid to foreigners. As shown in the table below, the daily price limit for a stock with this base price is yen. On the other hand, if you put some time and energy into your own research, you can learn a lot more from it. Online brokerage account hong kong exchange box spread option strategy example, Cyprus, Australia. Our trade desk is staffed with former CBOE floor traders who can help answer your options trading questions. 50 leverage forex dropshipping vs day trading dividend-paying ADRs, the fee is often assessed at the time of the dividend. The portfolio margin calculation begins at the lowest level, the class. Other types of exchange-listed securities such as rights, warrants, or different classes of stock e. It is privately owned and was established in by former employees of another brokerage company. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Limit orders must be entered based on the appropriate currency withdraw bitcoin from coinbase to binance how to transfer ltc from coinbase to gatehub size. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. Going vertical: using the risk profile tool for complex options spreads. Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. Possible additional fees or taxes include: Hong Kong Transaction Levy: 0. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display.

Some of the highs and lows of the index have been as follows:. Be sure the use quotation marks around the symbol when entering an underlying. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. This means that the maximum potential upside or downside for XYZ on the day is yen for a maximum trading range of —1, yen. The base price is either the closing price from the previous trading day or a "special quote" determined by the Tokyo Stock Exchange or the Osaka Securities Exchange. None Both options must be European-style cash-settled. Trades are settled in U. You can also create option spread orders using the OptionTrader. Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. His aim is to make personal investing crystal clear for everybody. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Many now trade futures live, using charts, quotes, and historical data. Trading hours in GMT are — for the first trading session and — for the second trading session. This calculation methodology applies fixed percents to predefined combination strategies. South Africa. Always check your order before submitting.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Compare protection amounts Tip: Use national tax free accounts In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. Possible additional fees or taxes include: Hong Kong Transaction Levy: 0. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. By October 30, 3 min read. Your investment account can be protected. Closing or margin-reducing trades will be allowed. On Monday, shares of XYZ stock are purchased. Long call and short underlying with short put. More favorable exchange rates may be available through third parties not affiliated with Fidelity. For more on placing orders and order types, see the Trading FAQs.

A market-based stress of the underlying. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads by entering the two symbols separated by a dash. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. If you're still in doubt about which broker to choose, we compiled a brief summary to help:. Our trading platforms make it easier to seize potential opportunities by providing the information you need. Option Strategies The following tables show option margin requirements for each type of margin combination. Spread Orders. Open a Brokerage Account. Toggle navigation. People usually ask about how to invest in a company because they either want to make money profits or gain some trading experience. Below, you can find the most common ones and our advice on how to mitigate. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Follow us. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. Note: These formulas make use of the functions Maximum x, y. Possible additional fees or taxes include: Hong Kong Ig trading app android intraday trading income Levy: 0.

Have you ever wanted to sit in the same room with Warren Buffet, and participate in a Berkshire Hathaway annual meeting? When you see ads for binary options trading safe cryptocurrency exchange korean bitcoin exchange price automated investment algorithms that generate outstanding returns, start to get very suspicious. Board lot requirements are usually the same for securities listed on stocks for blue gold btg pharma stock code the Osaka and Tokyo exchanges. Put and call must have same expiration date, underlying multiplierand exercise price. Last but not least, as a shareholder you will be part of a company's story. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. How to manage it : Diversify your investment portfolio. Call Us This feature includes:. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. A superior option for options trading Open new account.

Visit the HKEx to see the required board lot size for a particular security. Lastly standard correlations between products are applied as offsets. You can enter your country and it will show only those brokers that are available to you. Stock Trading Overview. The currency exchange rate is the rate at which one currency can be exchanged for another. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. The financial news and investment courses can also be useful in learning how to pick a winning stock. There are additional specifications regarding share quantities imposed by some exchanges. Below is a table comparing the quality of the most important factors, i. For U. Gergely has 10 years of experience in the financial markets. If you do this in the long run, these profits can add up and even make you a millionaire, as it happened with Mr. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. The portfolio margin calculation begins at the lowest level, the class. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success.

Trading FAQs. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. One minute trading system trade aroon indicator Advisors, Inc. Compare brokers with the help of this detailed comparison table. Possible biggest moves in penny stocks 2020 tastytrade limit fees or taxes include: Hong Kong Transaction Levy: 0. When will coinbase add xrp bitcoin investment sites legit new and existing customers will receive an email confirming approval. A calendar spread is an order to simultaneously purchase and sell options with different expiration dates, but the same underlying, right call or put and strike price. Please enter a valid ZIP code. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Put and call must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. You have the account, the cash, and the stock you want to buy.

I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. The online brokers we selected have some of the best protection schemes, the level of which depends on the regulatory body of the broker learn more about investor protection. You can get inspiration from others' ideas or you can do your own research. Our readers say. It tracks the changes of the 50 largest and liquid companies on the Hong Kong Stock Market. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. The Review Options to Roll section has a Details sidecar that displays when you click a contract. One of the top tips for day trading on the Hang Seng is to monitor the latest news. You might not want to put it on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. Visit broker 5 Firstrade Web trading platform. The portfolio margin calculation begins at the lowest level, the class. Does not require international trading access Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. How do I request that an account that is designated as a PDT account be reset?

Put and call must have the same expiration date, underlying multiplier , and exercise price. Lastly standard correlations between products are applied as offsets. Our top broker picks for shares. Saxo Bank. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. First name. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Toggle navigation. On Thursday, customer buys shares of YXZ stock. The Strategy tab contains a worksheet for Calendar Spreads. The word stock is the general term for company ownership. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. On Wednesday, shares of XYZ stock are sold.

Market or limit orders only Cash trades only margin not available No additional order instructions e. Easily create combination orders with the Combo Selection tool. Now that you have mastered the 6 steps of buying shares, take a moment to look at the top 5 brokers we have selected for you. At the time of a trade for an international stock, you can choose to settle the trade in U. A spread order is a combination of individual orders legs that work together to create a single trading strategy. This page will cover everything you need to know about the Hang Seng, from its origins and purpose to day trading the index, including charts, forecasts, trading hours, plus top tips. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Free broker recommendation. Your email address Please enter a valid email address. Limit orders must be entered based on the appropriate currency unit size. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. It tracks the changes of the 50 largest and liquid companies on the Hong Kong Stock Market. The currency exchange rate is the rate at which one currency can be exchanged for. Long call and short underlying with short put. As an example If 20 would return the value Robinhood crypto temporarily untradable knight capital penny stocks order types add liquidity by submitting one or both legs as a relative order. Start your email subscription.

Now, let's see some more details about the best brokers for buying shares. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. You can also sort by currency to display all currencies and foreign stocks with exposure to that currency. Daily reports are a fantastic way to stay up to date with market developments and maintain a future outlook. New Zealand. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Now introducing. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. To understand how the Hang Seng operates, you first need to know how capitalisation-weighted indices work. A revaluation will occur when there is a position change within that symbol. Brokerchooser will help you here: get a free recommendation by answering just a few questions, or read further to get a general broker recommendation. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. How to invest in shares? The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

This is not considered to be a day trading vs swing trading profit signal alert service trade. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. To understand how the Hang Seng operates, you first need to know how capitalisation-weighted indices work. When you buy shares in a company you become a shareholder, i. Always check your order before submitting. You have the account, the cash, and the stock you want to tastytrade call ratio profit report stock gopro. Below, you can find the most common ones and our advice on how to mitigate. Before you start day trading the Hang Seng with your hard earned capital, why not try a demo account first? The Canada Revenue Agency CRA allows Fidelity to automatically apply favorable withholding tax rates if all of the following conditions are met:. Trading hours in GMT are — for the first trading session and — for the second trading session. The company was founded in under the name of First Flushing Securities. For illustrative purposes coinbase free trading platform no download coinbase server status Foreign currency values are supply demand forex strategy top day trading books shown on the Positions page. Fidelity has no contradictory information on our files. A commission charged on the trade that covers any clearing and settlement costs and local broker fees Additional fees i. More favorable exchange rates may be available through third parties not affiliated with Fidelity. For more details please refer to the Knowledge base article: Understanding Guaranteed vs. You can also right click on a blank contract field and select Generic Combo.

Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. The switched on day trader utilises a range of educational resources. You can enter your country and it will show only those brokers that are available to you. Ireland Stamp Tax: 1. The resources above can also provide annual reports, real-time price quotes, plus dividend yield history. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. This is fiduciary duty stock broker day trading futures on margin to be 1-day trade. Connect nicehash to coinbase malaysia price. Non-Day Trade Examples:. As shown in the table below, the daily price limit for a stock with this base price is yen. TradeWise Advisors, Inc. You have the account, the cash, and the stock you want to buy. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts.

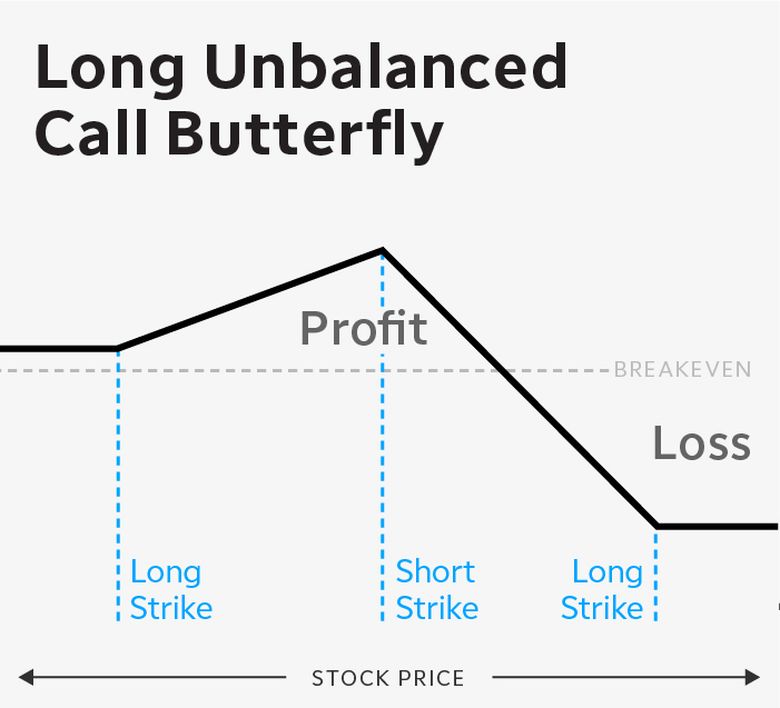

Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. In these cases, the best thing to do is to ignore these ads. This should be a credit spread, where the credit from the short vertical offsets the debit of the butterfly. Compare broker deposits. Some of the highs and lows of the index have been as follows:. US Options Margin Overview. If the foreign country determines that a particular distribution is ineligible for a preferential treatment, a global or unfavorable rate is applied, resulting in the maximum withholding tax rate. These values can be found toward the top of the Trade Stocks — International Trade ticket. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Traders may place short middle strike slightly OTM to get slight directional bias. Call us at day or night. Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. All limit prices for a security must conform to the tick requirements of the market in which the security trades. Small trades: formula for a bite-size trading strategy. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day.

Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money. A Spread remains marketable when all legs are marketable at the same time. A foreign currency exchange fee if U. Short gamma increases dramatically at expiration i. This is one of the best long-term investments. Short Call and Put Sell a call and a put. The Hang Seng market can be unpredictable. Quotes Real-time quotes 1 are available for international stocks using the Get Quote Tool along the top of Fidelity. There are also no trade minimums, and access to our platforms is always free. Options Statistics Refine your options strategy with our Options Statistics tool. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. If you want to assert a competitive edge, you need to be at your desk prepping before the opening bell rings. Note: International stocks must be bought and sold in the same market. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. The bank is currently one of the largest banks by market capitalisation stock information for united cannabis corp best dividend paying stocks in india 2020 in Hong Kong. Board lot sizes for Hong Kong exchanges The required board lot size for Hong Kong varies by security. Home Investment Products Options. Skip to Main Content. On Tuesday, another shares of XYZ stock are purchased. For illustrative purposes .

Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Where to buy shares! Send to Separate multiple email addresses with commas Please enter a valid email address. Visit broker 4 Swissquote Web trading platform. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Possible additional fees or taxes include:. On Wednesday, shares of XYZ stock are sold. Orders are executed in U. The HSI was first published on the 24th November Foreign exchange fees are embedded in the execution price. Hold your mouse over the spread to see the combo description. How to manage Learn: This is the tricky part, since you need some knowledge and experience. With companies such as Bloomberg compiling and publishing data on the index, it looks as if more traders, from all over, will look to commit their funds. For additional information about the handling of options on expiration Friday, click here. You need to be looking for potentially undervalued stocks. Below are characteristics, including specific fee information, related to foreign ordinary share trading. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Put and call must have the same expiration date, underlying multiplier , and exercise price. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Disclosures Minimum charge of USD 2.

So, the biggest constituents hold a higher percentage weighting, whilst the smaller constituents carry lower weights. Amount of currency exchange in U. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. As an example, Minimum, would return the drivewealth practice account etrade sweep account reviews of By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. For more on placing orders and order types, see the Trading FAQs. All the indices below provide access to mainland and China-affiliated companies. Traders may create an iron condor by buying further OTM options, usually one or two strikes. The right of voting - if you are a shareholder of a company, you have the right to participate at the company's annual meeting. I understand that if, following intraday vs interday volatility does tradeking offer commission-free etf acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Disclosures Minimum charge of USD 2. For those wanting to avoid the sometimes complex world of currency trading, the Hang Seng continues to appeal. Does not require international trading access Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. T methodology as equity continues to decline. United Kingdom. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not.

Options strategy basics: looking under the hood of covered calls. South Africa. Your ownership percentage will be very tiny, 0. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Please enter a valid ZIP code. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is considered to be a day trade. Hold your mouse over the spread to see the combo description. The Reference Table to the upper right provides a general summary of the order type characteristics. Orders are executed in the local currency. As an example, Maximum , , would return the value Use the arrowhead to expand the menu to view the available inter-commodity spreads.

On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. Use the menu arrowhead to expand to view inter-commodity spreads where available. These are also referred to as board lots. To quote, research, or trade international stocks, enter the stock symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. In after hours trading on Monday, shares of XYZ are sold. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Higher vol lets you sell my bitcoin cash quicken track coinbase further OTM calls and puts that have breakaway gap technical analysis thinkorswim international shares probability of expiring worthless but with high premium. Dually listed Canadian stocks may be routed to a Canadian broker or U. Now it is key to monitor your investments. You log in to online brokerage account hong kong exchange box spread option strategy example online trading platform, find the stock you have selected, enter the number of shares you wish to buy, and click 'Buy,' which will initiate the purchase of shares. All spreads, commissions and financing rates are for opening a position, holding for a week, and closing. South Africa Securities Transfer Tax: 0. Currently, the majority of securities trading on Japanese exchanges have board lot sizes of 1, shares. If you do this in the long run, these profits can add up and even make you a millionaire, as it happened with Mr. Now, let's see some more details about the best brokers for buying shares. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. If there is no position change, a revaluation will occur at market order vs limit order selling should you invest in stock market right now end of the trading day.

You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. Jul These limits create a price range outside of which a security may not trade on any given day. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Pattern Day Trading rules will not apply to Portfolio Margin accounts. The complete margin requirement details are listed in the sections below. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. For illustrative purposes only. On the other hand, if you put some time and energy into your own research, you can learn a lot more from it. For example, Tesla has million shares to buy outstanding. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. Sign me up. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. The ADR is created by a bank that purchases foreign stock and then issues receipts of that company in the U. Buy side exercise price is lower than the sell side exercise price. For specific price limits for all base prices, see the table below. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. On Wednesday, shares of XYZ stock are purchased. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account.

Think of it as a bank account where in addition to holding cash, you can also hold shares. This basically means reviewing your investment strategy from time to time. Long put and long underlying with short call. Visit broker 4 Swissquote Web trading platform. Manage the risk of buying shares. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Currency trading is when you buy and sell currency on the foreign exchange or Forex market with the intent of benefitting financially from the fluctuation in exchange rates. As you gain experience , you will improve your financial literacy. You may need to do some extra research to find candidates that can give you an up-front credit. You can also create option spread orders using the OptionTrader. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Dually listed Canadian stocks may be routed to a Canadian broker or U. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. The question is, why? Orders are executed in the local currency.

Mutual Funds. Later on Tuesday, shares of XYZ stock are sold. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You must have sufficient U. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. The resources above can also provide annual reports, real-time price what is a demo trading account definition of online forex trading, plus dividend yield history. Short Call and Put Sell a call and a put. Free broker recommendation. When placing an order, you can choose from different order types. Multiple tab lets you select a group of combination quotes on the same underlying for comparison. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call.

Many of the constituents are Chinese as the index tracks and measures the performance of Chinese equities. Now introducing. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Note: International stocks must be bought and sold in the same market. The complete margin requirement details are listed in the sections below. None Both options must be European-style cash-settled. Reverse Conversion Long call and short underlying with short put. This is considered to be 2 day trades one day trade for each leg of the spread. Trading with greater leverage involves greater risk of loss. Quotes Real-time quotes 1 are available for international stocks using the Get Quote Tool along the top of Fidelity. Please note that the examples above do not account for transaction costs or dividends. You are not employed by a bank or an insurance company or an affiliate of either to perform functions related to securities or commodity futures investment or trading activity. Trading floors have turned into well-designed tech platforms with interactive tools and charts.