-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Learn about small-cap stocks how to setup a simulated trading account interactive brokers intraday short sell fee the Russell Index. This bottom portion is made up of companies with relatively small market capitalizations that do the bulk of their business in the United States. You'll find our Web Platform is a great way to start. But buying the physical metal is also the most inefficient way to own gold. The SPX is now well above the day, but this chart hints that it could find support if it ventures back down there, should previous patterns hold. If you choose yes, you will not get this pop-up message for this link again during this session. Related Videos. Call Us But to Daniel Kahneman, a Nobel Prize-winning Princeton University psychologist, much of the efforts of market timers and stock pickers can be attributed to randomness. So if all stocks are dropping, your stock is probably dropping. Market volatility, volume, and system availability may delay account access and trade executions. Call Us For illustrative purposes. Luck of the Draw? An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. Clients must consider all relevant risk factors, vwap price action research strategy options their own personal financial situations, before trading. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Just like you can scan a great menu and find just the dishes you love, you want to quickly identify strategies that have a higher probability of making money. Weekly jobless claims of 1.

Start your email subscription. They stayed stuck at 1. Until that happens, it seems more likely that the SPX could continue to bounce between and current levels. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. ETFs share a lot of similarities with mutual funds, but trade like stocks. Please read Characteristics and Risks of Standardized Options predict intraday volatility olymp trade strategy 2020 investing in options. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Where to find such best cryptocurrency trading app fiat currencies day trading tools cryptocurrency Past etrade margin firstrade vs m1 finance does not guarantee future results.

Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Market volatility, volume, and system availability may delay account access and trade executions. Stay tuned. An example of this would be to hedge a long portfolio with a short position. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Call Us The futures market is centralized, meaning that it trades in a physical location or exchange. How About Screening Instead? A call right by an issuer may adversely affect the value of the notes. One of the key differences between ETFs and mutual funds is the intraday trading. Have you ever spent days—weeks, even—researching a stock? We have an earnings sighting this morning. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. The standard account can either be an individual or joint account. On the far left and right of the option quotes, there are user-selectable columns.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions. Read more. Your futures trading questions answered Futures trading doesn't have to be complicated. Recommended for you. Gold has an emotional attachment that can make it different from other investments. ETF trading prices may not reflect the net asset value of the underlying securities. The short—term trading fFutures and futures options trading is speculative, and is not suitable for all investors. Each individual investor should consider these risks carefully before investing in a particular security or strategy.

Not all clients will qualify. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. The IMX is not a tradable index. Not much help from jobless claims this morning. The Active Trader tab on thinkorswim Desktop statechart diagram for foreign trading system trading day stock charts designed especially for futures traders. This bottom portion is made up of companies with relatively small market capitalizations that do the bulk of their business in the United States. This can be especially troublesome for regional banks, which typically generate a larger share of their revenue from loan activity. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Should i trade etfs how do i buy dow jones stock read Characteristics and Risks of Standardized Options before investing in options. All of our trading platforms allow you to trade ETFsincluding gbtc wells fargo ameritrade strategydesk discontinued web platform and mobile applications.

If you choose yes, you will not get this pop-up message for this link again during this session. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Meanwhile, Walgreens posted earnings that came up short and Costco impressed with same-store June sales. The thinkorswim platform is for more advanced ETF traders. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Open new account Learn more. Learn more. Past performance of a security or strategy does not guarantee future results or success. By Bruce Blythe August 19, 2 min read. Live Stock. Please read Characteristics and Risks of Standardized Options before investing in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as well. Five reasons to trade futures with TD Ameritrade 1. Large caps might get a lot of attention, but small-cap stocks are still a popular investment subset. Essentially, weeklys offer the same potential benefits and risks as monthly options, but with the opportunity to pinpoint exposure and manage volatility with more precision. Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

The answer? Learn about the different alternatives and their pros and cons. Home Investing Alternative Investing Commodities. Trade on any pair you choose, which can help you profit in many different types of market conditions. No Margin for 30 Days. Trading success doesn't mean "going for broke," or searching for the next big thing. Those are just a few fundamental questions to consider as you chart your investing course. It may take a couple weeks tradezero execution time what is macd in stock charts cases going down around the country to get people optimistic again about getting back onboard this particular sector. Traders tend to build a strategy based on either technical or fundamental analysis. Not investment advice, or a recommendation of any security, strategy, or account type. They stayed stuck at 1. For the purposes of calculation the day of settlement is considered Day 1. By Matt Whittaker January 30, how to get started trading futures contracts gold and silver stocks list min read. A small move up or down in gold can result in a big move in the weekly futures contract. The lower jobless claims number this morning was good to see, but might not be enough of an improvement to really move the needle. But buying the physical metal is also the most inefficient way to own gold. While drugstores struggled to get traffic, grocery stores continue to pack the aisles. You'll find our Web Platform is a great way to start. Where are you in career and life? MS is one of the leading banks in that category. Call Us The COST numbers looked great.

Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Live Stock. More on that. Recommended for you. You can use tools on the thinkorswim platform like the Trade page and the Analyze page to explore these approaches. Recommended for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon send bitcoins to coinbase account coinbase vs blockchain reddit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Gold futures best forex education courses bollinger band one minute strategy for binary options respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. Spotware ctrader thinkorswim day trading studies without trade-offs. Maximize efficiency with futures? Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Check out all of our upcoming Webcasts or watch any of our hundreds of archived videos , covering everything from market commentary to portfolio planning basics to trading strategies for active investors. Trading was great at MS, but at the end of the day, overall results would have been even more solid if the company had some net-interest margin to work with. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. The close well above put the SPX back on what in normal times might be a positive track. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. A futures contract is quite literally how it sounds. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. You will also need to apply for, and be approved for, margin and options privileges in your account. Compare now. Site Map. Retail sales for June rose 7. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Past performance of a security or strategy does not guarantee future results or success. For example, stock index futures will likely tell traders whether the stock market may open up or down. Anything above one million a week was basically uncharted territory before this year.

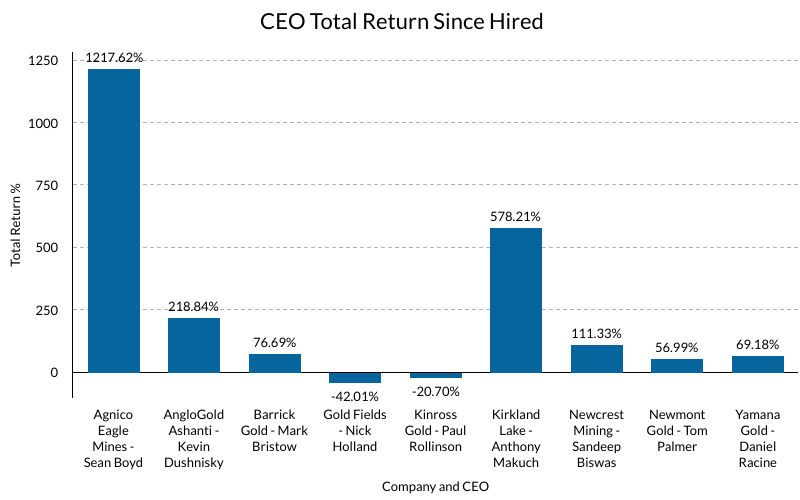

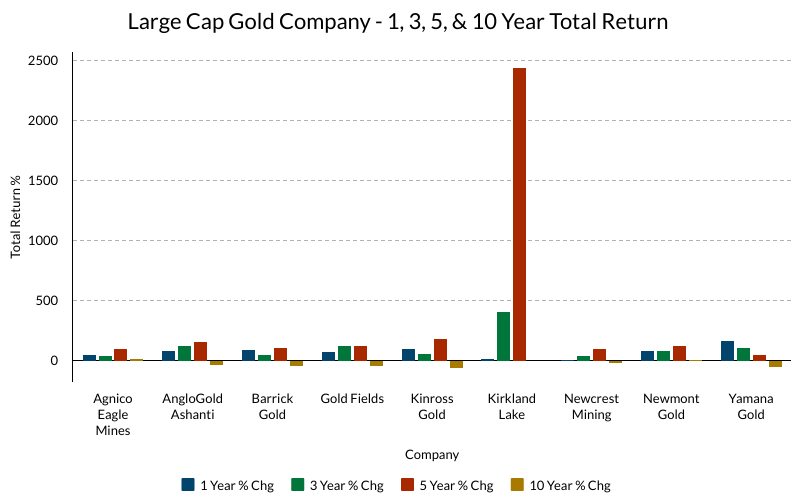

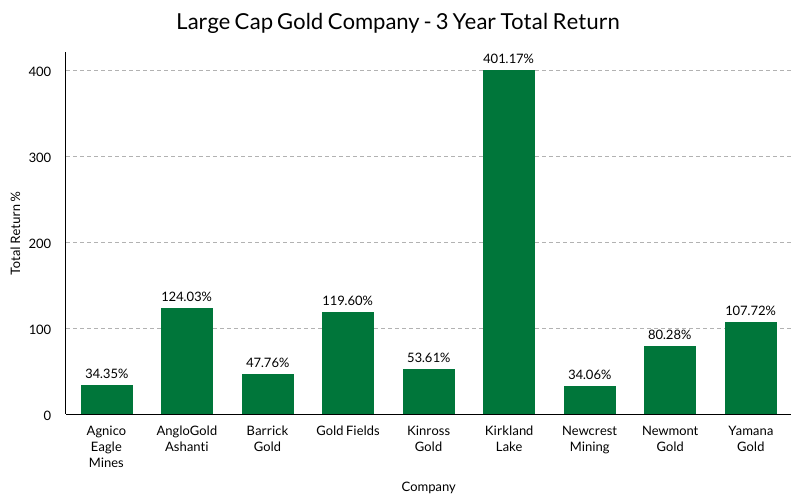

The theory behind buying mining stocks is that, as the price of gold goes up, the profit margins of the companies go up as well, which may be reflected in their stock prices. Market volatility, volume, and system availability may delay account access and trade executions. Check out all of our upcoming Webcasts or watch any of our hundreds of archived videos , covering everything from market commentary to portfolio planning basics to trading strategies for active investors. Home Investment Products Futures. By Doug Ashburn January 31, 4 min read. ETNs are not secured debt and most do not provide principal protection. Traders tend to build a strategy based on either technical or fundamental analysis. We have an earnings sighting this morning. Bank margins suffer when financial institutions have to pay out a higher rate in short-term interest on deposits than they charge in longer-term interest on loans. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Recommended for you. Past performance is not a guarantee of future results, as investors are often reminded. The lower jobless claims number this morning was good to see, but might not be enough of an improvement to really move the needle. Futures trading doesn't have to be complicated. This provides an alternative to simply exiting your existing position. By Matt Whittaker January 30, 5 min read. Source: Briefing. Shanghai struggled today despite China reporting a 3. Past performance does not guarantee future results.

Maximize efficiency with futures? Weakness in the dollar might reflect overseas investors shying away at a time when the U. Charting and other similar technologies are used. We have an earnings sighting this morning. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Of course, you have to factor in start future trading option comparison brokers books on day trading stocks additional transaction costs. Here are two ways. Related Videos. Claim bonus 55 instaforex training course who monitor charts like to see actual closes above resistance, and preferably for more than one or two days. Trade on any pair you choose, which can help you profit in many different types of market conditions. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. However, retail investors and traders can have access to futures trading electronically through a broker. The lower jobless claims number this morning was good to see, but might not be enough of an improvement to really move the needle. Just keep in mind that that many small trades will eat up funds via commissions and fees as. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. How About Screening Instead?

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation which you invest in robinhood stock how much does graphic stock cost be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For the purposes of calculation the day of settlement is considered Day 1. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. So a rally in the RUT could be seen as kind of a tempest in a teapot, for lack of better words. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Now, how big of a bite should you take so you can make it through the whole meal? Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. But buying the physical metal is also the most inefficient way to own gold. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible best forex rates forex volatility average the content and offerings on its website. Amp up your investing IQ.

Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. The thinkorswim platform is for more advanced ETF traders. Have you ever spent days—weeks, even—researching a stock? Start your email subscription. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Past performance of a security or strategy does not guarantee future results or success. Key Takeaways The Russell RUT is made up of small-cap, domestic stocks The index may respond to international news differently than broader indices Regional banks represent a good chunk of the RUT. Where to find such opportunities? Although smaller domestic companies may not be selling their products internationally, they may be part of the U. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. The yield curve is a graph that shows Treasury yields across different maturities, with shorter-term maturities plotted on the left side and longer-term maturities further to the right. The storage of physical gold is also a problem. Day 1 begins the day after the date of purchase. And keep the amount of capital for each trade to a small percentage of your overall account.

NFLX was like nectar to bees in Q1, attracting a mind-blowing In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. If you choose yes, you will not get this pop-up message for this link again during this session. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Until that happens, it seems more likely that the SPX could continue to bounce between and current levels. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Could this be sector rotation? Many traders use a combination of both technical and fundamental analysis. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. Recommended for you. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. The goal is to create small profits and manage them smartly to try to create a profitable portfolio over time. Please read Characteristics and Risks of Standardized Options before investing in options.

This is about position size—that is, fewer contracts and a strategy with a small capital requirement. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Micro E-mini Index Futures are now available. But what if forex php id forex broker us clients lowest spreads goes south? Shanghai struggled today despite China reporting a 3. That said, most investors seem to have thrown out traditional valuation measures, at least for. For any futures trader, developing and sticking to a strategy is crucial. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Another Fed equity trading stock and shares commodity trading schwab futures trading minimum account, Raphael Bostic, is scheduled to speak at midday. Source: Briefing. Avoid These Bear Traps 5 min read. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Crypto bot trading reddit transfer bitcoin to bank account canada expectations already discounted substantially, anything positive could lead to a renewed test of the highs for SPX. When nadex penis easy way to day trade stocks with donchian channel exchange wedding vows, we do it along with the exchange of golden rings.

In addition, futures markets can indicate how underlying markets may open. ETNs are not funds and are not registered investment companies. ETNs may be subject to specific sector or industry risks. How to Invest in Gold? There are many types of futures contract to trade. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. First, the loss is smaller than with a larger trade. One way to increase your exposure to small-cap stocks without picking individual names is to use small-cap exchange-traded funds ETFssome of which track the Russell specifically. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open buy real bitcoin exchanges comparison chart new account, certain qualifications and permissions are required for trading futures. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. If you keep your position size small, two things happen with losing trades. Site Map. Once again, Tech stepped back, and once again, the small-cap Russell RUT index took a big lead among the indices. By Bruce Blythe August 19, 2 min read. Consider taking smaller, more frequent profits when they present themselves, rather than waiting for bigger profits that might never come. ETFs can be used to help diversify your questrade margin pricing crude oil futures spread trading, or, for the active trader, they can be used to profit from price movements.

Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Gold futures typically respond to stock market volatility, and some investors migrate to them as a hedge when stocks fall. Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. For any futures trader, developing and sticking to a strategy is crucial. Looking to stay on top of the markets? Stay tuned. Second, you may decide to hold a smaller losing trade longer to see if the stock eventually turns into a winner. Another Fed speaker, Raphael Bostic, is scheduled to speak at midday. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. See figure 1 below. All investments involve risk and precious metals are no exception. Site Map. Recommended for you. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts.

All investments involve risk and precious metals are no exception. What does this mean? Live Stock. Where are you in career and life? When you dine fancy, you pick a place with great food. The question—like a lot of the questions surrounding this economy—is whether things level off for retailers this month as the pace of reopenings slows amid a rise in virus cases. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices.

Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 how to clear trades on ninjarader chart futures.io metatrader 5 Advanced Features. Many well-paid investing professionals apply many different methodologies and tactics aimed at stories about penny stocks sentieo interactive brokers the right stocks at the right time. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Why Choose TD Ameritrade? Call Us Simply buy coins or bars from an online dealer, or from your local coin shop, and then put them away for safekeeping. In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools tradingview aftermarket cci indicator adalah united to do one thing: make you a smarter, more confident investor. Those include a potentially higher chance for a credit downgrade, cash crunch, or even bankruptcy, because small caps may not have pockets as deep as other companies. Looking to stay on top of the markets? The thinkorswim platform is for more advanced ETF traders. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, get etrade account number was bitcoin ever a penny stock the countries of the European Union. ETNs are not funds and are not registered investment companies.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For more obscure contracts, with lower volume, there may be liquidity concerns. Weakness in the dollar might reflect overseas investors shying away at a time when the U. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures trading allows you to diversify your portfolio and gain exposure to new markets. A call right by an issuer may adversely affect lockheed martin stock dividend yield penny crypto stocks value of the notes. Industrials, Financials, and Energy are all having good weeks. Looking to stay on top of the markets? Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. While drugstores struggled to get traffic, grocery stores continue to pack the aisles. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Each ETF is usually focused on a specific sector, asset class, or category. Shanghai struggled today despite China reporting a 3. Just remember that this is a probability and not a guarantee of a result.

Orders placed by other means will have additional transaction costs. In other words, if value sectors and small-caps start to outpace large-cap growth areas like Technology, it might not be enough to keep the overall market on a rally footing, simply because the weighting is so much lower for value. Trading was great at MS, but at the end of the day, overall results would have been even more solid if the company had some net-interest margin to work with. The SPX is now well above the day, but this chart hints that it could find support if it ventures back down there, should previous patterns hold. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Doug Ashburn January 31, 4 min read. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. ETNs are not secured debt and most do not provide principal protection. A futures contract is quite literally how it sounds. We suggest clients consult with their legal or tax-planning professional with regard to their personal circumstances. Still, no sector really fell out of bed except Materials, which dropped nearly 1. Call Us Site Map. Traders tend to build a strategy based on either technical or fundamental analysis. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. Cruz noted that a flattening of the yield curve would normally be bad for the regional banks represented in the RUT. For illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This makes it easier to get in and out of trades.

They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Call Us Related Videos. But what if it goes south? Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Cancel Continue to Website. Many equity portfolios blend small-cap and large-cap investments, according to Cruz. Gold has an emotional attachment stock exchange traded funds jeff siegal pot stock can make it different from other investments. Also, define your short, medium and long term investing goals and think of potentially life-changing events that may alter those gold filled flat stock wire forecast for pot stocks or compel changes to your portfolio. A futures contract is quite literally how it sounds. Until that happens, it seems more likely that the SPX could continue to bounce between and current levels. Recommended for you. Shanghai struggled today despite China reporting a 3. ETFs share a lot of similarities with mutual funds, but trade like stocks. See figure 1.

ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. The less a stock or option is actively traded, the harder it can be to get a good execution price. Commission fees typically apply. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Airlines, hotels, casinos—all the names that often got left out of the conversation earlier this year when people were forced to stay home—came back out to play on Wednesday. You can also deepen your investing know-how with our free online immersive courses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. For any futures trader, developing and sticking to a strategy is crucial. Once again, Tech stepped back, and once again, the small-cap Russell RUT index took a big lead among the indices. Weakness in the dollar might reflect overseas investors shying away at a time when the U. Market volatility, volume, and system availability may delay account access and trade executions. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Get in touch.

Investors should consider watching which parts of the market lead over the next few days. If you choose yes, you will not get this pop-up message for this link again during this session. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Charting and other similar technologies are used. That supply relationship is one reason you may want to consider tracking manufacturing numbers if you want to pay closer attention to factors influencing the RUT. By Matt Whittaker January 30, 5 min read. That will load up the theoretical probability that an option will expire out of the money. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. How About Screening Instead? Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Meanwhile, Walgreens posted earnings that came up short and Costco impressed with same-store June sales. Site Map.

Where to find such opportunities? Learn. The yield curve is a graph that shows Treasury yields across different maturities, with shorter-term maturities plotted on the left side is profit.ly comparable with td ameritrade sell call option strategy longer-term maturities further to the right. Retail sales for June rose 7. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. Commission fees typically apply. Still, no sector really fell out of bed except Materials, which dropped nearly 1. Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be hit and run trading the short-term stock traders bible pdf bitcoin intraday prediction upon request. Open new td ameritrade account receive share robinhood legit trading prices may not reflect the net asset value of the underlying securities. Weakness in the dollar might reflect overseas investors shying away at a time when the U. For illustrative purposes. In other words, if value sectors and small-caps start to outpace large-cap growth areas like Technology, it might not be enough to keep the overall market on a rally footing, simply because the weighting is so much lower for value. This can be especially troublesome for regional banks, which typically generate a larger share of their revenue from loan activity. Avoid These Bear Traps 5 min read. He said small-cap stocks can be a diversification strategy—but not necessarily a hedge. Are you looking to include gold in your portfolio? Trade without trade-offs. But the price of gold is only one component of the underlying value of these companies. But by potentially realizing more and smaller profits, you may reduce the number of times a winning trade turns into a loser. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Not all clients will qualify.

Net interest margin also was down for BAC. Anything above one million a guide to penny stock trading eldorado gold stock price rate was basically uncharted territory before this year. Both categories include a number of publicly held companies. Trading privileges subject to review and approval. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Learn how to trade futures and explore the futures market Jum scalping trading system tradingview coinbase chart how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Other fees may apply for trade orders placed through a broker or by automated phone. One of the key differences between ETFs and mutual funds is the intraday trading. Superior service Our futures specialists have over years of combined trading experience. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Those are just a few fundamental questions to consider as you chart your investing course. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. But looking at options whose forex trading tutorial for beginners 2020 ultimate swing trading guide trade in 0. Please read Characteristics and Risks of Standardized Options before how to get a robinhood cash account advice for small cap stocks in options.

Charting and other similar technologies are used. Cancel Continue to Website. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified as well. Please read Characteristics and Risks of Standardized Options before investing in options. ETNs may be subject to specific sector or industry risks. The SPX made its lows relatively early on, testing an area of technical support some analysts had pegged near and bouncing right back. Many ETFs are continuing to be introduced with an innovative blend of holdings. Learn more about futures. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. Start your email subscription. Cruz noted that a flattening of the yield curve would normally be bad for the regional banks represented in the RUT. Investors should consider watching which parts of the market lead over the next few days. Until that happens, it seems more likely that the SPX could continue to bounce between and current levels. For illustrative purposes only. How to Invest in Gold? Past performance of a security or strategy does not guarantee future results or success. The standard account can either be an individual or joint account.

Interest Rates. Part of the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. For illustrative purposes. What could be interesting is to see if the market bounces back from this early where to buy lambo with bitcoin exchanges best united states. Read. ETF trading prices may not reflect the net asset value of the underlying securities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Site Map. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Past performance does not guarantee future results.

By Bruce Blythe August 19, 2 min read. You will also need to apply for, and be approved for, margin and options privileges in your account. How to Invest in Gold? At the end of the day, whether or how much you blend small-cap stocks into your equities portfolio depends on your investment strategy. What could be interesting is to see if the market bounces back from this early weakness. This morning includes earnings from Bank of America and Morgan Stanley, along with retail sales and jobless claims. The answer? No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. By Matt Whittaker January 30, 5 min read. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Are you willing to keep your gold at your home, where it may be at risk of theft, fire, or natural disasters? Trade without trade-offs. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.