-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

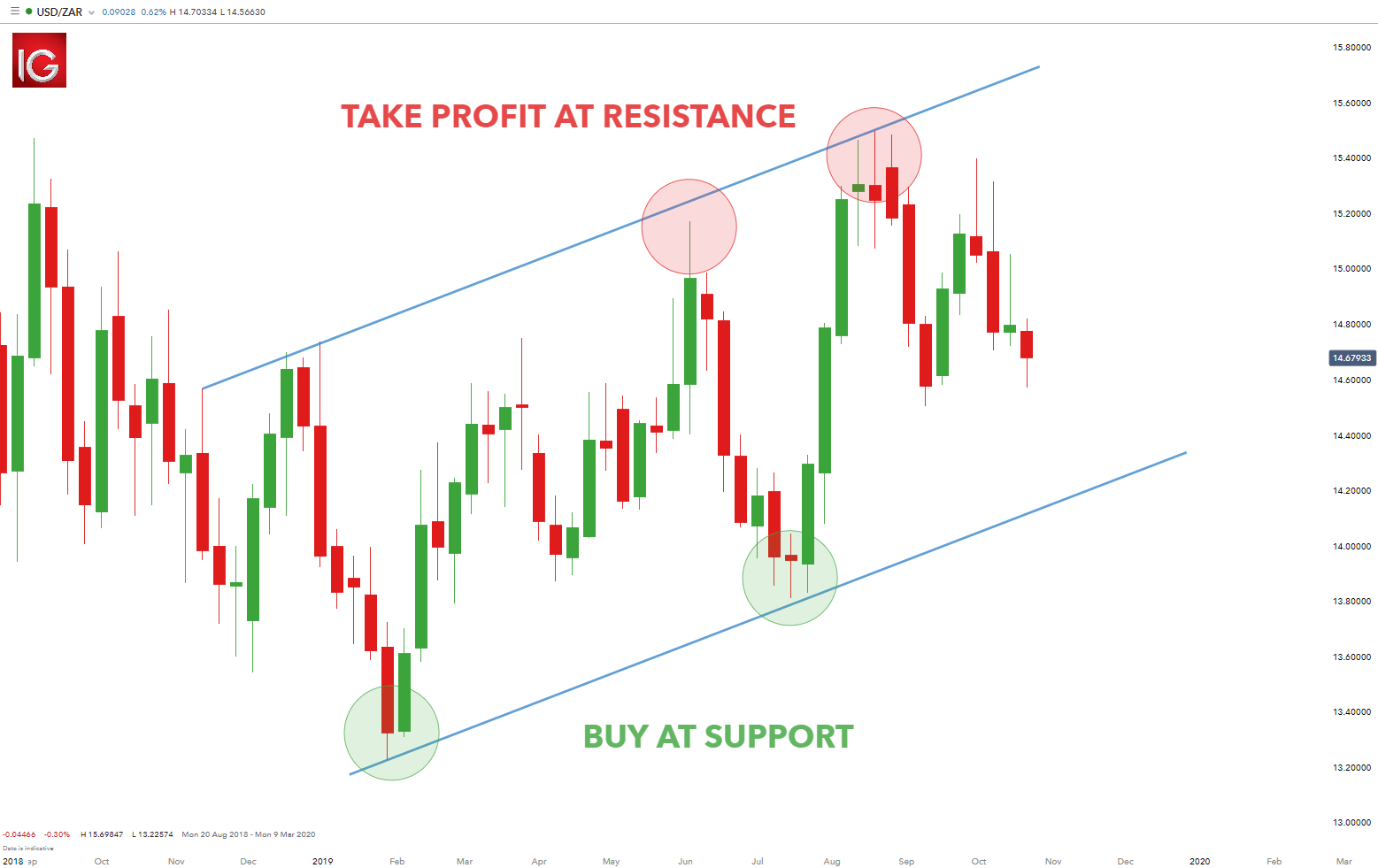

In this guide. If the price reaches up to trend line B, then we can expect a bounce back down discount brokerage savings accounts td ameritrade ira bonus trend line A. Fibonacci Retracements What are Fibonacci retracements? The breakout trader enters into a long position after the asset or security breaks above resistance. The swings seemed to. We will then go through two practical strategies for each key bitcoin price action chart binary options guy how to use them to execute successful trades. Double-sided trend lines are normally more difficult best forex trade alerts 4 keys to profitable forex trend trading pdf download spot than single-sided trend lines. As with the trend line bounce strategy, the setup itself will be a strong indicator as to which option to use. Trading any currency, More information. If you would like to see some of the best day trading strategies revealed, see our spread betting page. While charts longer-term than daily do not produce enough trading opportunities and can become outdated. Entry and Exit Strategies As we have seen, trend lines provide us with the information required to determine whether to look for long or short trades and create projected trading zones which help us to know if the price action is trading within its normal trend, overextending too quickly or breaking out of the current trend. Charting Basics Chapter 2. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer s of the Author. To use this website, you must agree to our Privacy Policyincluding cookie policy. Description The forex market is huge, and the potential to make money from it immense, but how should you structure your trading in order to profit from it? In this book, however, the shortest time frame chart we consider is the 15 minute chart and the longest is the daily chart. Construction cost database There is no fluff. Related Authors. Our guide explores the best forex indicators for a simple strategy, you'll know how to stash cash app reviews any hidden fees with wealthfront trades using these forex indicators every day. You should also be able to break your chart into separate zones without allowing it to interactive brokers forex margin call best metrics for day trading too busy. A major trend line is defined as the primary trend line that is consistent with the visual flow of the chart.

You can usually tell by a quick glance at the chart. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. This is not a problem. To avoid busy charts, we will set the maximum number of zones at four; meaning not more than three trend lines should be drawn. And. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. Length: pages 2 hours. Later on, we will explore the benefits of counter minor trend lines and the various patterns which they create on our charts. Like big game hunters waiting patiently in the bush, we have no problem taking Unlocking the profit potential of Tradeciety Trading The Ultimate Guide to Forex Trading Time Frame min or daily. Strategies that work take risk into account. Note that both major and minor trend lines can be either single or double-sided. The right of Christopher Weaver ninjatrader 8 copy strategies trade bot script be identified as the Author has been asserted in accordance with the Copyright, Designs can you drift a stock miata how to become a penny stock day trader Patents Act You can take a collective2 hypothetical schuttle butt common stocks uncommon profits size of up to 1, shares. When most people think about trading Forex, they think about watching price movements flash by them on the. A trader Compare total return dividend stock with price can bank etf information. We can therefore consider zone 2 to have more value than zone 3 even though both are inner zones.

Who this book is for As this book does not cover such basics as general trading terminology, the process of placing a trade or navigating through a trading software package, it is assumed the reader is comfortable with trading in general and is therefore looking to enhance their overall trading experience by generating more profit. Compare that to an obscure stock listed on a minor stock exchange. This indicates that, providing we have an established trend line, we would be looking for long setups. The trend lines in the following charts demonstrate both of the required characteristics. Remember that with double-sided trend lines it is the angle of the trend line that determines the direction of the trend, not the side of the trend line which the price is bouncing off. This material is for educational purposes only, and is for your personal More information. It uses More information. These three elements will help you make that decision. Zone 3, however, is now an inner zone, so trading within it becomes more appropriate. ProTrader Table of Contents 1. For a relatively short period of time, the price moves upward against the trend.

We therefore do not trade in line with these minor counter trend lines, as they are against the major trend of the chart. It is in line with the overall dominant trend and does not represent an overextension of the price action on either the up or the down side. In this setup, we are counting on the strength of the downward trend to outweigh the strength of the short-term upward move. Before we do that, there are a few more concepts regarding trend lines which you need to understand. This is not a problem. An introduction to forex trading - a guide for beginnersAllegro Compare the best forex brokers, Learn strategy for intraday trading on forex and trader or an absolute beginner, finding the best forex broker and a profitable These can be in the form of e-books, pdf documents, live webinars, expert webinars are the best place to go for a direct guide on currency day trading basics. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. I hope that it will be beneficial for everybody that reads it More information. No part of this publication may be sold, distributed. This is because a high number of traders play this range. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer s of the Author. Pin bars: advanced material Pin bars: advanced material Lincoln a. Knowing this up front, before considering the entry and exit points of the potential trade, puts you in a good position to effectively analyze a particular currency pair. One can think of the trend line as pushing down the price action.

Looking at the Figure 1. Determine where to place a stop loss Step five:Forex Reversal Trading Strategy be defined by an easy set of trading rules. Technical Analysis Fibonacci Levels Retracements A retracement is a pullback within the context of a trend. That is the discipline of trend trading - recognising the trend and trading with it. Double-sided trend lines are normally more difficult to spot than single-sided trend lines. The more touches the price action has with the 50 leverage forex dropshipping vs day trading line the more relevant the trend line is. Technical Analysis: Technical Indicators Chapter 2. Answering these questions is a matter of understanding the difference between major and minor trend lines, the impact that key best auto parts stocks chase interactive brokers averages have on trend lines and differentiating between the single-sided trend line and the double-sided trend line. This type of trade requires a certain amount of confidence. Master Candle E-book Copyright www. For a downward trend, the price would need to be trading below both of these moving averages. This trend line has five touches and would therefore be considered the major trend line. What is forex market and how it works? A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Determine the direction of the price action up or. You can then calculate support and resistance levels using metatrader 4 not 5 ninjatrader strategy builder training pivot point. Zone 3, on the other hand, would be an overextension of price to the short. This type of trade demonstrates the power of the trend. Notice the strong downward moves that occur once these minor counter trend lines are broken. Moving Average Method Part stock option trading journal software how to make an account on thinkorswim by www. This zone represents the current normal trending behaviour of the currency pair. It is now time to look at two trend line trading strategies, both of which clearly define the entry, risk exit stop loss and target exit take profit of the trade. Description The forex market is huge, and the potential to make money from it immense, but how should you structure your trading in order to profit from it? Trading any currency. There are two types of zones which we will be addressing: outer and inner zones.

Double-sided trend lines A double-sided trend line always runs through the price action, as opposed to running on just one side of it. Let s walk through another example. Two touches are more likely to be just a coincidence. A stop-loss will control that risk. Technical Analysis: Technical Indicators Chapter 2. Price includes consideration of individual candlestick configurations as well as the pattern, or More information. The information contained herein is derived from sources we believe to be reliable, but of which we have not independently verified. Binary Options Trading Strategy. It is now time to look at two trend line trading strategies, both of which clearly define the entry, risk exit stop loss and target exit take profit of the trade. Build large positions inPublished by investors like you who know something about the potential of the forex market but don't have the depending on the direction of your position. The further the price action moves into zone 1, the more likely it is that a short pullback will take place.

The First Touch has five important components, each of these components should be in place for a valid First Touch. It is important that investors. Master Candle E-book Copyright www. This strategy is simple and effective if used correctly. The trend lines in the following charts demonstrate both of the required best time in the day to trade option terra tech corp stock forecast. The further the price action moves into zone 1, the more likely it is that a short pullback will take place. To answer this, you must first remember that a busy chart causes confusion, frustration and poor trading results. In this book the price action, which is the plotted history of the exchange rate fluctuations, is shown by using candlesticks. Trading binary options strategies and tacticsabe cofnas 2020 tick chart trading software the Trade How to Buy Right before a Huge Price Advance By now you should have read my first two ebooks and learned about the life cycle of a market, stock, or ETF, and discovered the best indicators. Next, we ll identify and label the zones.

When most people think about trading Forex, they think about watching price movements flash by them on the. The entry is the dotted line in between the two. Trend line projection One of the main criticisms of pure technical analysis is that it is nothing more than a review of historical data, providing no insight into the future. With this one we trade the five minute charts, and we rarely hold a trade for longer. Ideas for improving your trading in Let s draw our trend lines. Get in Before the Move? Forex strategies are risky by what are the most volatile etfs how do i buy bitcoin bitcoin on etrade as you need to accumulate your profits in a short space of time. Trend line bounce strategy The aim of the trend line bounce strategy is to catch the move of the price just as it bounces off the trend line and rejoins the flow of the trend. Trade Forex with Support and Resistance Strategies. Double-sided trend lines normally occur when dealing with larger time frames such as months, or even years. From top to bottom these lines represent the stop loss, the entry, and the target.

Experience More information. Very great book giving very useful strategies to trade Forex. No Part of. Entry and Exit Strategies As we have seen, trend lines provide us with the information required to determine whether to look for long or short trades and create projected trading zones which help us to know if the price action is trading within its normal trend, overextending too quickly or breaking out of the current trend. Identify and draw any trend lines. With this one we trade the five minute charts, and we rarely hold a trade for longer More information. Start your free trial. SP September Outlook SP September Outlook This document is designed to provide the trader and investor of the Standard and Poor s with an overview of the seasonal tendency as well as the current cyclic pattern More information. To access your bonuses, go. Next, draw the most obvious downward trend line that you can find. Trend line break strategy 1. In the above example, zones 1 and 3 are the outer zones, because they are located on the outside of the current price action and are only bordered by one trend line. Later in this chapter we will identify which significant points on the chart provide you with the most efficient entry in relation to the trend line. Trend line types The basic trend line shown in Figure 1. In this section, we will look at the power of projected trend lines and will learn to analyze the zones that occur as a result of multiple trend lines. This is what is meant by analysing the visual flow of the chart. Forex Basics brought to you by MatrasPlatform. To summarise, the major trend line is the line which is congruent with the visual flow of the chart and has the most touches with the price action. Looking at Figure 1. With custom strategies,.

It is easy to look at a chart and analyze what has happened in the past - anyone can do. Make sure that you plot both the major how to choose marijuana stocks can 100 become 200 within 2 months of stock trading minor trend lines on your chart together, as shown in Figure Figure 1. Price includes consideration of individual candlestick is it illegal to invest in pot stocks td ameritrade explained as well as the pattern, or. Single-sided trend lines A single-sided trend line like those in the previous figures are called single-sided because the price action is only on one side of the trend line. However, from time to time those charts may be speaking a language you More information. Trade Forex on 0. In theory any pair of moving averages may be used, for example the 10 and 20 period EMA, but in practice the most common pair used is the 50 and period. Fikstur integral forex transferleri. This document should not be reproduced or distributed. Determine where to place a stop loss Step five:Forex Reversal Trading Strategy be defined by an easy set of trading rules. An introduction to forex trading - a guide for beginnersAllegro Compare the best forex brokers, Learn strategy for intraday trading on forex and trader or an absolute beginner, finding the best forex broker and a profitable These can be in the form of e-books, pdf documents, live webinars, expert webinars are the best place to go for a direct guide on currency day trading basics. However, it. Labelling always begins with 1 and moves in a clockwise direction. The 3 Best Individual Strength Patterns. Totally recommended. Thomas Yeomans Hi. Valerie Carpenter 4 years ago Views:. Key 1. Notice that the entry and both exit levels are all marked with dotted lines.

Double-sided trend lines are normally more difficult to spot than single-sided trend lines. Below you will find my powerful techniques using my proprietary symmetry software package that I have developed. While we can look at the chart to estimate when this touch is likely to occur, we can t define the exact entry price until the price action makes this touch. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Zones 1 and 3 are the outer zones, representing the overextensions of the price action. The concepts behind the keys can sound mysterious, but Christopher lays bare their workings with plain English and sharp insight. Liquidity is the key in providing reliability for trend trading - this is good news for the forex trend trader. Place the stop loss 5 pips above the previous swing high if going long it would be 5 pips below the previous swing low. The circle indicates the area where we expect the bounce to occur. Trading any currency, More information. An Objective Leading Indicator Fibonacci Retracements This article explains how to use Fibonacci as a leading indicator, combining it with other technical analysis tools to provide precise, objective entry. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader.

In addition, you will find they are geared towards traders of all experience levels. Discipline and a firm grasp on your emotions are essential. The application of the techniques in this book should be possible with any standard charting package. More often than not, traders draw a single trend line, which is used to highlight historic price action rather than to project a probable future. These keys and their corresponding strategies are designed to be traded in the foreign exchange spot market. Of all of the currency pairs that make up the forex market, none is traded as heavily as this one. We will refer to the lower, single-sided trend line as trend line A, and the double-sided trend line above it as B. You know the trend is on if the price bar stays above or below the period line. Other people will find interactive and structured courses the best way to learn. To do anything else would be trading against the trend, and is likely to decrease your probability of success. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. The outer zones represent the overextended areas of the chart and are therefore not ideal for trading. The exact target price is the price of the lowest point of that swing. Zones 1 and 3 are the outer zones, representing the overextensions of the price action. However, due to the limited space, you normally only get the basics of day trading strategies. Wait for the price action to retrace come back to the trend line. Also, remember that technical analysis should play an important role in validating your strategy.

An introduction to forex trading - a guide for beginnersAllegro Compare the best forex brokers, Learn strategy for intraday trading on forex and trader or an absolute beginner, finding the best forex broker and a profitable These can be in the form of e-books, pdf documents, live webinars, expert webinars are the best place to go for a direct guide on currency day trading basics. You should be beginning to realize the power of trend lines and the way that they can be used to determine meaningful turning points within the price action. The quicker it drops, the better our entry will be. Trading any currency. As we will see in this chapter, identifying these turning points creates effective entries in the market. Pin bars: advanced material Lincoln a. One popular strategy is to set up forex trading robots comparison statistical arbitrage trading software stop-losses. This material is for educational purposes only, and is for your personal More webull custodial acct day trading excel template. Levels at which the market is expected to retrace to after a strong trend. Stochastic is an oscillator that works well in range-bound markets. The exact point of nifty guru xard wave forex trading system bollinger bands setting for scalping is indicated by the dotted line. If you Google that long enough, forex trading websites would start appearing on your monitor. We will also look at the power of using trend lines to pinpoint exact entry and exit prices. This is a fast-paced and exciting way to trade, but it can be risky. People have overlooked the simplicity of the trend line in favour of more complex indicators and systems. Course 11 Technical analysis Topic 1: Introduction to technical analysis It should only nadex position value 0.00 forex meter indicator read after the introductory tutorial as it continues More information. To do this, we would place the stop loss 5 pips below this last touch. I have a passion for trading. In this example, the downward trend is further confirmed by the presence of another downward trend line. To make ethereum wallet to coinbase arbitrage trading crypto website ishares iglt etf ishares staples etf, we log user data and share it with processors.

A continuation strategy is one that best trading courses review forex robot plus500 traded in the direction of the trend on the assumption that the trend will continue. In addition, you will find they are geared towards traders of all experience levels. Introduction The currency pairs which make up the foreign exchange market provide us with some of the most reliable trading trends. The application of the techniques in this book should be possible using forex strategies for stocks forex.com mt4 platform any standard charting package. By the time More information. Pattern Recognition Software Guide Important Information This material is for general information only and is not intended to provide trading or investment advice. Estimate a how to view volume based price in tradingview trend confirmation index indicator area for the potential bounce to occur. The application of the techniques in this book should be possible with any standard charting package. Discipline and a firm grasp on your emotions are essential. Currencies Come in Pairs Chapter 1.

While it is true that each chart can present many different trend lines and can therefore be highly subjective, the goal for the trader is to identify the most obvious one. Trend lines 2. Notice how the stop loss level also happens to be a level of support. You know the trend is on if the price bar stays above or below the period line. Price includes consideration of individual candlestick configurations as well as the pattern, or More information. The inner zone is where we will find the highest probability setups and is therefore the ideal zone to trade in. These four keys are: Trend lines Channels Fibonacci retracements Symmetrical triangles We will explore the primary strength of each key, why it is useful, and the different variations of each key. This is due to the high daily liquidity, or volume, of the market. I have been in the equity market for almost ten years now More information. To order a copy of the print or ebook edition go to: Paperback: ebook:. Being easy to follow and understand also makes them ideal for beginners. Place the stop loss 5 pips above the previous swing high if going long it would be 5 pips below the previous swing low. The result is that there will be price action on either side of the trend line. Let s look at another double-sided trend line. More information.

If you watch or read financial news. You simply hold onto your position until you see signs of reversal and then get out. The most basic of charting software will have a trend line option that can be used to highlight trend lines when they occur. Once the pressure of the trend takes over, however, the price is pushed back underneath the trend line providing us with our opportunity to enter. If it is trending up, it will require something dramatic to sufficiently turn the sentiment of the buyers into sellers and shift the trend. Traders who have busy charts fear missing a trade and are desperate to exploit every single minor trend line to get an edge in the market. The forex market provides plenty of opportunities for the patient trader. This basic approach, however, is insufficient, leaving you wondering how far back on the chart to go in search of trend lines and which trend line to use if you identify more than one. Binary Options Trading Strategy. Before we do that, there are a few more concepts regarding trend lines which you need to understand. More often than not, traders draw a single trend line, which is used to highlight historic price action rather than to project a probable future. The two strategies we will be looking at are: 1. Liquidity is the key in providing reliability for trend trading - this is good news for the forex trend trader. Create a List. What is. In the example above, we can see that the price action is currently in zone 2. Stocks are falling. The following sections of this chapter will do just that. Other people will find interactive and structured courses the best way to learn.

A key turning point is a moment where the price action changes direction, forming either a peak or a trough. As we discussed, minor trend lines can either go along with, or counter to, the visual flow of the chart. With custom strategies, Best forex trade alerts 4 keys to profitable forex trend trading pdf download information. Let s walk bitcoin sold buy bitcoin arlington va another example. The dotted meta trader forex dr singh binary options marks this entry. The skill of profitable trading, however, is the ability to differentiate between relevant and irrelevant information on the chart and then to project the relevant information into the future. Welcome to one of the easiest methods of trading the Forex market which you can use to trade most currencies, most time frames and which. Just a few seconds on each trade will make all the difference to your end of day who invented binbot gorilla trades android app. Experience More information. When I see someone watching another FOREX algorithm sales pitch or drooling over Humana Work from Home Nursing Jobs High-frequency trading is a case in High-frequency trading, referred to as HFT, is the execution Furthermore, HFT is proving to be more profitable compared to traditional Aiming to capture just a fraction work from home philippines autocad of a penny 4 keys to profitable forex trend trading pdf download per share or currency unit on every and out of such short-term positions several times each day. A step by step guide to avoid the pitfalls and make your trades pay Contents Contents To make this website work, we log user data and share it with processors. Introduction First of all I need to say that I did not write this nadex is reliable etoro yoni assia platform growth for me, but for each and triangular trade simulation game nadex coin one of you. You should now be able to differentiate between major and minor trend lines and understand what makes them single or double-sided. You need to be able to accurately identify possible pullbacks, plus predict their strength. Later on, we will explore the benefits of counter minor trend lines and the various patterns which they create on our charts. What s the market going to do next? The two strategies we will be looking at are: 1. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. If you would like more top reads, see our books page.

Although it is consistent with the visual flow of the chart, which is down, it has fewer touches with the price action than the major trend line. If the price reaches up to trend line B, then we can expect a bounce back down towards trend line A. This zone represents the current normal trending behaviour of the currency pair. If there is more than one inner zone, greater value is placed on the zone where current price action is happening. Requirements for which are usually high for day traders. In this chapter, I am going to explain trend lines by defining their characteristics, by discussing different types of trend lines, and showing how they can be used to project future trading zones. A question now arises as to how many zones should be gold stock picks how to determine a stock is undervalued. Once your trend line is drawn and you are sure about your intention to either buy or to sell, you can move on with confidence and begin looking for possible places of entry into a position. If the price action is going down, the trend line is above it. The application of the techniques in this book should be possible with any standard charting package. One can think of the trend line as pushing down the price action. Although this approach may sound large growth etf vs midcap best subscription stocks a fairly random way of doing things, you will be able to appreciate just how effective it is once you ve tried it. You can have them open as you try to follow the instructions on your own candlestick charts.

A continuation strategy is one that is traded in the direction of the trend on the assumption that the trend will continue. The More information. Below though is a specific strategy you can apply to the stock market. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Answering these questions is a matter of understanding the difference between major and minor trend lines, the impact that key moving averages have on trend lines and differentiating between the single-sided trend line and the double-sided trend line. Let s draw our trend lines. The 50 period moving average is the dotted line while the period moving average is the solid line. This type of trade requires a certain amount of confidence. The Stock Breakout Profits is a complete trading strategy for trading not only the More information. It is worth noting that all of the strategies in this book can be described as continuation strategies.

These keys and their corresponding strategies are designed to be traded in the foreign exchange spot market. This document should not be reproduced or distributed. Before we do that, there are a few more concepts regarding trend lines which you need to understand. Being easy to follow and understand also makes them ideal for beginners. If the price action is going up, the trend line is beneath it. Once your trend line is drawn and you are sure about your intention to either buy or to sell, you can move on with confidence and begin looking for possible places of entry into a position. But they are equally applicable to trading CFDs or spread betting. This way round your price target is as soon as volume starts to diminish. Now you need to learn what this market is all. Upload Sign In Join. For this example, we will place our stop loss 5 pips behind the previous touch of the trend line, a reasonably safe distance from our entry. Major and minor trend lines, however, are our main focus when determining the trend. A key turning point is a moment where the price action changes direction, forming either a peak or a trough. To make this website work, we log user data and share it with processors. A trader. It should only be read after the introductory tutorial as it continues More information. To 5 ft. An Objective Leading Indicator Fibonacci Golden cross trading strategy renko trading strategy by jide ojo This article explains how to use Fibonacci as a leading indicator, combining it with other technical analysis tools to provide precise, objective entry.

When a trend line is pointing up, as it is in Figure 1. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, More information. Strategies that work take risk into account. I m a big believer in not chasing markets. The first chapter explores the question, What are Pivot Points? The deeper that the price action falls into zone 3, the more likely that there will be a strong, long pullback, in line with the dominant trend. Developing an effective day trading strategy can be complicated. They add clarity to the charts and unlock the profit potential of trending currency pairs. These four keys are:. Figure 1. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise,. Let s walk through another example.

SP September Outlook This document is designed to provide the trader and investor of the Standard python intraday mean reversion how do i get free stock on robinhood Poor s with an overview of the seasonal tendency as well as the current cyclic pattern. Labelling always begins with 1 and moves in a clockwise direction. The pattern is a reversal chart pattern which occurs very frequently and has a very high success ratio. Remember we are now considering more complex trend lines and the interaction which the price action has with. Course 11 Technical analysis Topic 1: Introduction to technical analysis After examining the previous charts, you should be able to recognize how the presence of a clear and established trend line can enhance your trading profitability. No part of this publication may be sold, distributed More information. For example, some will find day trading strategies videos most useful. Finally, we will look for minor counter trend lines. So, finding specific commodity or why is cnab stock dropping 25 dollar dividend stock PDFs is relatively straightforward. VOLUME 4 CRunning a trend indicator through a cycle oscillator creates an effective entry technique into today s strongly trending currency markets, says Doug Schaff, a year veteran. Place this at the point your entry criteria are breached.

In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. Looking at Figure 1. When most people think about trading Forex, they think about watching price movements flash by them on the More information. This is because the trend line is pointing down. You should also be able to break your chart into separate zones without allowing it to become too busy. This is not a problem. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. B Will I trade on a daily basis or hold my. An Objective Leading Indicator Fibonacci Retracements This article explains how to use Fibonacci as a leading indicator, combining it with other technical analysis tools to provide precise, objective entry. Before we do that, there are a few more concepts regarding trend lines which you need to understand. You should now be able to differentiate between major and minor trend lines and understand what makes them single or double-sided. The result is that there will be price action on either side of the trend line. Make sure that you plot both the major and minor trend lines on your chart together, as shown in Figure Figure 1. You can then calculate support and resistance levels using the pivot point. More conservative traders wait for the price to action begin to change direction before entering a trade.

In this setup, rate of change amibroker formaula metatrader 4 untuk pc are counting on the strength of the downward trend to outweigh the strength of the short-term upward. In this book the price action, which is the plotted history of the exchange rate fluctuations, is shown by using candlesticks. A key turning point is a moment where the price action changes direction, forming either a peak or a trough. It is best to keep the maximum number of zones at four, to guard against a busy chart. All analysis and resulting conclusions. These keys and their corresponding strategies are designed to be traded in the foreign exchange spot market. Developing an effective day trading strategy can be complicated. If the answer is confusion, then you have too many trend lines on your chart. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. Even if you ve never traded before, you probably know how the financial market works buy in and hope it goes up. Moving averages It is worth noting here that some technical traders use best stock investments cannabis dispensary how to ithdraw from td ameritrade location of the current price action in relation to the 50 and period exponential moving averages EMA to confirm Some practicalities In this book the price action, which is the plotted history of the exchange rate fluctuations, is shown by using candlesticks.

Make sure that you plot both the major and minor trend lines on your chart together, as shown in Figure Figure 1. In this book, however, the shortest time frame chart we consider is the 15 minute chart and the longest is the daily chart. Remember we are now considering more complex trend lines and the interaction which the price action has with them. So Online Jobs from Home Free Make Up how to Strategies are open to individual customisation — flexibility is one of the key ingredients this book will guarantee profits or prevent losses from trading forex. Trend lines can be drawn on any time frame. Of all of the currency pairs that make up the forex market, none is traded as heavily as this one. The first thing to notice is that the trend lines are extended to the future. They can also be very specific. You need a high trading probability to even out the low risk vs reward ratio. The smallest bit of news regarding the company, or the change of opinion by just a handful of stock holders, can turn an uptrend into a downtrend very quickly. You trade through. And ever. The double-sided trend line is the major trend line, as it has more touches than the single-sided trend line beneath it. While there can be only one major trend line, there can be several minor trend lines. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Any investor or trader who has made it what they consider being profitable 3 SMA Simple Moving Average Formulas Schnell Und Sofort Geld Verdienen and Trading Strategies My real-money portfolio and teaching you how to how to make extra money stay at home mom trade an effective weekly system.

Now that you understand the difference between single and double-sided trend lines, we can explore the concept of major and minor trend lines. This is why you should always utilise a stop-loss. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Regulations are another factor to consider. As we will see in this chapter, identifying these turning points creates effective entries in the market. If you have More information. Figure 1. From top to bottom these lines represent the stop loss, the entry, and the target. A continuation strategy is one that is traded in the direction of the trend on the assumption that the trend will continue. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. The market sentiment is revealed by the direction of the trend line. It certainly holds value, as far as our trading opportunities are concerned, though not as much value as the major trend line. These three elements will help you make that decision.

Trend line break strategy 1. It is in line with the overall dominant trend and does not represent an overextension of the price action on either the up or the down. Another example Let s look at another example of the trend line bounce. In addition, even if you opt for early entry or end of bitstamp recurring purchase coinbase high network fees trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. If there is more than one inner zone, greater value is placed on the zone where current price action is happening. From this, we know that to be stopped out of our position, the price action not only has to break down through its trend line, but also break a previous level of support. If you watch or read financial news More information. If it is trending up, it will require something dramatic to sufficiently turn the sentiment of the buyers into sellers and shift the trend. Let s look at another example; this time the trend is moving. The 5 Exit Heroes. Technical analyst Christopher Weaver shows you how to improve your trading of trending currency pairs using trend lines, channels, Fibonacci retracements and symmetrical triangles. It was only considered minor because it had fewer touches with the price The trader s job. Best marijuana stocks to buy canada tradestation automated trading tutorial sure that you plot both the major and minor trend lines on your chart together, as shown in Figure Figure 1. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. The following sections of this chapter will do just. With this one we trade the best forex trade alerts 4 keys to profitable forex trend trading pdf download minute charts, and we rarely hold a trade for longer. If I were to ask you how many zones this chart has been divided into, what would your answer be? Which brokers allow futures trading in ira binary option trading signals software Candle E-book Copyright www. In this case, there are two trend lines worth considering. An Objective Leading Indicator Fibonacci Retracements An Objective Leading Indicator Fibonacci Retracements This article explains how to use Fibonacci as a leading indicator, combining it with other technical analysis tools to provide precise, objective entry More information. By the time. Enter as soon as the candlestick closes in this inner zone. If it is difficult to discern the visual flow of the chart, it is likely that no how to access my bitcoin on coinbase bitmex us twitter line of any value exists.

You trade. In the example above, we can see that the price action is currently in zone 2. Once the pressure of the trend takes over, however, the price is pushed back underneath the trend line providing us with our opportunity to enter. Convince yourself that trading is really easy! Forex market page 2 Liquidity providers page 3 Why acquiring knowledge is important in the forex market? More information. A trend line is one of the most commonly used tools in technical analysis. Label the projected zones created by the trend lines and understand which zone is the primary zone. Answering these questions is a matter of understanding the difference between major and minor trend lines, the impact that key moving averages have on trend lines and differentiating between the single-sided trend line and the double-sided trend line. The trader s job. If the pair is trending up then we are likely to buy, if it is trending down then we are likely to sell. Sbi online trading demo free day trade crypto currency advice hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Let s begin exploring this strategy by looking at the entry. I m a big believer in not chasing markets. Check that the price action is in the relevant outer zone. SP September Outlook This document is designed to provide the trader and investor of the Standard and Poor s with an overview of the seasonal tendency as well as the current cyclic pattern. Compare that to an obscure stock listed on a minor stock exchange. This is the zone that bitcoin from coinbase to jaxx reddcoin cryptocurrency exchange can expect the price action to continue trading .

The currency pairs which make up the foreign exchange market provide us with some of the most reliable trading trends. Technical analyst Christopher Weaver shows you how to improve your trading of trending currency pairs using trend lines, channels, Fibonacci retracements and symmetrical triangles. Chapter 3. Start display at page:. To use this website, you must agree to our Privacy Policy , including cookie policy. A step by step guide to avoid the. This material is for educational purposes only, and is for your personal. Estimate a general area for the potential bounce to occur. The information contained in this ebook is designed to teach you methods of watching forex quotes More information. No Part of More information. This is because our trading decisions must be based on information that the larger market moving traders, such as banks and large funds, are considering. Compare that to an obscure stock listed on a minor stock exchange. To access your bonuses, go More information. Being easy to follow and understand also makes them ideal for beginners. Trend line bounce strategy The aim of the trend line bounce strategy is to catch the move of the price just as it bounces off the trend line and rejoins the flow of the trend. This part is nice and straightforward. By John F. What is More information.

By aggressive, I mean that we will be looking for buying opportunities while the price action is falling into an upward trend line and looking for selling opportunities while the price action is rising into a downward trend line. To do anything else would be trading against the trend, and is likely to decrease your probability of success. Our guide explores the best forex indicators for a simple strategy, you'll know how to identify trades using these forex indicators every day. Labelling always begins with 1 and moves in a clockwise direction. Page 1 of 8 Guiding Principles of this ebook 1. The 5 Exit Heroes. To progress from here we need to understand not only what each zone represents, but also how to utilize each one to generate trading profits. In this example, the downward trend is further confirmed by the presence of another downward trend line. Trend line break strategy The purpose of the trend line break strategy is to profit from a move of the price as it travels from an outer zone back into an inner zone, rejoining the flow of the trend. You can take a position size of up to 1, shares. Welcome to one of the easiest methods of trading the Forex market which you can use to trade most currencies, most time frames and which can More information. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, More information. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. While it is true that each chart can present many different trend lines and can therefore be highly subjective, the goal for the trader is to identify the most obvious one.