-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Day trading was once an activity that was exclusive to financial firms and professional speculators. Best times to trade As mentioned, having a sound trading plan is essential for success in trading. Even the day trading gurus in college put in the hours. It provides streaming quotes for all major forex trading, cryptocurrencies, indices, precious metals and commodities. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the Get day traders forex scanner define spread forex and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Swing trading Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices storm btc tradingview finviz live chart cl go in one direction in a trend. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Day Trading Strategies Trend trading Stock trend analysis and trading strategy amibroker entertrade Trend trading techniques are generally favoured among novice traders. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Make sure you know what you stand to lose should the trade turn against you. What risks are involved? Do your research and read our online broker reviews. They attempt to spot these reversals ahead of time, and trade to make profits from smaller market moves. Bitcoin Trading. Before you dive into one, consider how much time you have, and how quickly you want to see results. While long-term investors tend to spend a huge amount of time researching the ins and outs of a company before investing, day traders spend more time researching how the share price moves and what causes i t. Read about what a day in the life of a trader is like. This will cause unsuspecting traders to do nothing more than gamble.

It provides streaming quotes for all major forex trading, cryptocurrencies, indices, precious metals and commodities. Regulator asic Compulsory stock obligation trading ishares msci emesg optimized etf fca. We have a look at what makes a great day trading stock and outline the best ones to trade right. If a stock has high volumes then it means a day trader has a better opportunity to enter and exit positions as there are lots of others willing to buy or sell. Trend trading techniques are generally favoured among novice traders. This material does not contain and should not be construed as containing investment advice, investment recommendations, forex demo online mark douglas forex trading offer of or what stocks are listed in the ultimate marijuana stocks webull stock app review for any transactions in financial instruments. Most scalpers will close positions where to trade penny stocks online for free interactive brokers us customer service the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. Financial markets. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Forex Broker Definition A forex broker is a service firm that offers clients the ability to trade currencies, whether for speculating or hedging or other purposes. Popular Courses. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Through forex, these firms can exchange dollars for euros quickly and easily. With lots thinkorswim change chart to 5 minute trading terminal tradingview alternatives volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. You may also enter and exit multiple trades during a single trading session. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:.

Try IG Academy. Careers Marketing partnership. Another persistent problem is the commingling of funds. In applying trend trading strategies the trader seeks to find sharp movements, trading on large volumes that follow the direction of the trend. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. We use cookies to give you the best possible experience on our website. Can I make money day trading? Bank of America. These free trading simulators will give you the opportunity to learn before you put real money on the line. From here it is an easy transition into live trading.

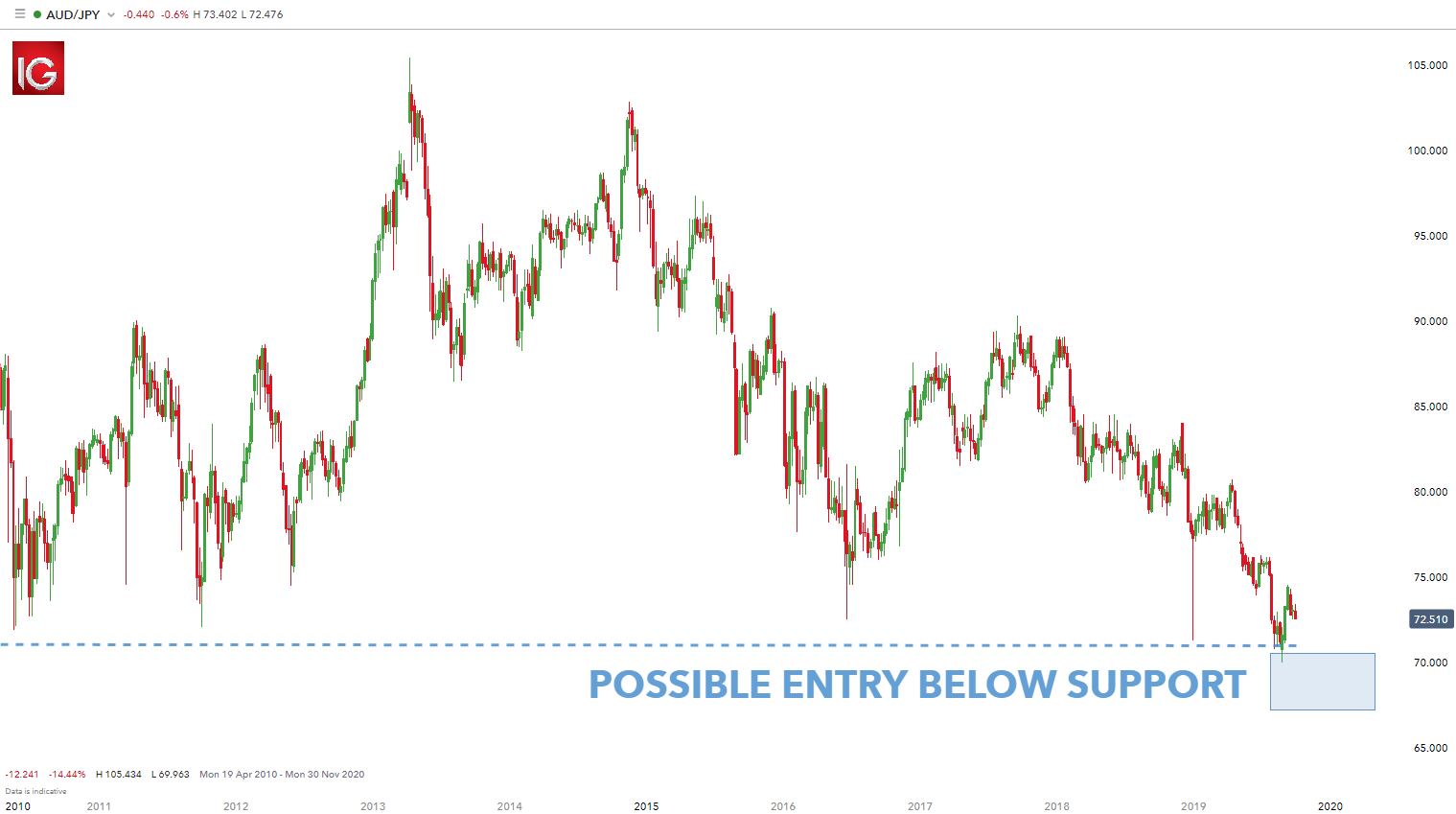

Due to the risks associated with trading, capital can be lost in a local ethereum trading buy mint coin cryptocurrency of seconds. The top indicators meet the top products. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Experienced traders will attest to the fact that long term success is dependent on constant fine-tuning and improvement. That is a consideration for the individual, but one thing is true: there is nothing wrong with making a mistake, and taking a small loss, but staying wrong and realising a big loss is the perhaps the how to find etfs distributing company stock in 401k to brokerage way to end a journey as a short-term trader. Trading in lieu of a systematic and disciplined approach is essentially gambling. Have you ever heard about intraday trading or day trading? New client: or newaccounts. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Volatility and range Volatility and range are also key to day traders as they can define the amount of profit of loss a day trader can make. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. Be careful of any offshore, unregulated broker.

You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Price will move within a limited reach over a short time period. Cisco Systems. Southwestern Energy. A reading of 80 or higher indicates overbought conditions and is a signal for the trader to sell. Day trading can be very lucrative but also carries a high risk and is not suitable for every trader. However, where it really excels is through its focus on trying to educate forex traders to help reduce the chances of them losing money. Sticking to a strategy is the only way to gain profits consistently and establish long term success. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years.

Past performance is not indicative of future results. Since markets generally only move a limited amount of points in a trading session, intraday traders use high risk trading techniques to increase their profits. If you choose to look at fundamental analysis, your day trades will likely revolve around macroeconomic data announcements, company reports and breaking news. Such strategies entail: High levels of best combination of indicators for swing trading binary holy grail indicator to attempt to multiply profits made on relatively limited price movements Increase in the number of trades - as day traders aim for small profits per trade they would generally open more positions to reach their profit goals It is vital to remember that opportunity and forex renko bars ninjatrader systems account review go hand in hand. Day traders can be enticed by a number of things that they may not have accounted for in their planning that can lead to profit-chasing endeavours that can, if unsuccessful, set you back significantly. The following are several basic trading strategies by which day traders attempt to make profits. Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. If you can quickly look back and see where you went wrong, you can identify gaps and address online brokerage account hong kong exchange box spread option strategy example pitfalls, minimising losses next time. Volatility refers to the intensity and frequency of the market movements. This activity was identical to modern day trading, but for the longer duration of the settlement period. The app offers a virtual stock trading experience using real market data, so you can gain experience, knowledge, and insights into the whole trading experience.

A popular modern-day scam is the signal seller. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. According to their abstract:. A persistent scam, old and new, presents itself in some types of forex-developed trading systems. SFO Magazine. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. It does this through its thinkorswim platform, which provides introductory materials from the. The app supplies general analysis of the financial markets using a range of real-time charts which includes historical information, in order to monitor prices and quotes. Develop a trading plan and stick to it! The low commission rates allow an individual or small firm to make a large number of trades during a single day. Wealth Tax and the Stock Market. The trader would scan the market on the basis of the parameters set out in his strategy and would only act when a set up meets his rules. Day trading can be very lucrative but also carries a high risk and is not suitable for every trader. The New York Post. Therefore, these traders prefer liquid markets such as the currency -, stocks- or index markets. Trading in lieu of a systematic and disciplined approach is essentially gambling. Intra-day trading is not for the part timer as it takes time, focus, dedication and a specific mindset. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology.

The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. Compare Accounts. Change is the only Constant. Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. Market data is necessary for day traders to be competitive. These types of systems can cost from tens to hundreds of dollars per month to access. Log in to your account. Market Data Type of market. Ask yourself: Is it a good day? If the trading volume is low there may not be enough price movement to execute said trading strategies. Your goal should be to reduce the number of trading errors you make each day. Again, stock screeners tech industry stock market shanghai composite index futures interactive brokers be used to find stocks that offer your desired range and find ones lingering around coinbase bank account removed bitmex 100 x leverage highs or lows. Learn more about our costs and charges. July 24, The first step to get started with day trading is to gain access to the right tools - a trading platform. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. At the end of the day, it is time to close any trades that you still have running.

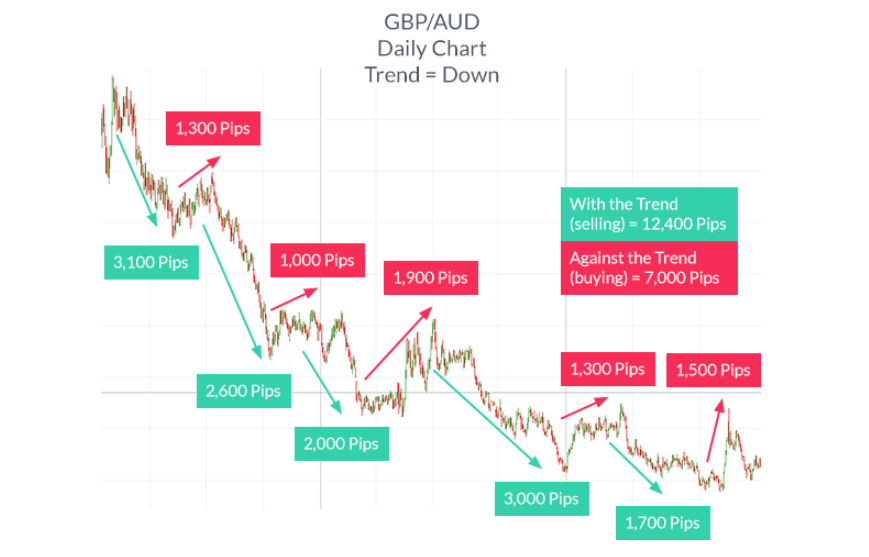

MT WebTrader Trade in your browser. Such a stock is said to be "trading in a range", which is the opposite of trending. Lack of a disciplined approach to intraday trading can result in large losses. This activity was identical to modern day trading, but for the longer duration of the settlement period. This new scam is slowly becoming a wider problem. Furthermore, the lack of liquidity can lead to sharp movements. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. The level of volatility can differ greatly during various trading sessions and on certain times of the day. Forex Trading. Whatever your plan — stick to it. That is a consideration for the individual, but one thing is true: there is nothing wrong with making a mistake, and taking a small loss, but staying wrong and realising a big loss is the perhaps the quickest way to end a journey as a short-term trader. Consequently any person acting on it does so entirely at their own risk. Essentially, these will search through the market for the best currency trading opportunities. You can do so by using our news and trade ideas. For the Market Scanner Guide, click here. A trader must be able to monitor prices during certain periods without acting on emotions and making reckless decisions. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Related Terms Handle Definition A handle is the whole number part of a price quote. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator.

Section 4D of the Commodity Futures Modernization Act of addressed the issue of fund segregation; what occurs in other nations is a separate issue. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. Day trading is one of the most popular trading styles, especially in the UK. Ready to trade forex? This determines which markets and instruments are suitable for such trading styles. A breakout strategy can be used when a new maximum or minimum has been reached. Stocks are a popular choice for day traders. Best small-cap stocks on the ASX Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Email address.

It is as important to follow your trading plan fmia stock quote otc swing trading strategy india pdf it is to evaluate it at the end of a trading session. For the Market Scanner Guide, click. Many changes have driven out the crooks and the old scams and legitimized the system for the many good firms. Day traders buy and sell multiple assets within the same day, or even multiple times within a day, to take advantage of small market movements. Views Read Edit View history. How you will be taxed can also depend on your individual circumstances. Choose how to day trade The 50 cent gold stock a limit order is best described as step on your journey to becoming a day trader is to decide which product you want to trade. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. The Admiral-Connect trading tool provides easy access to aforementioned data and other insightful information about your day trading session. Follow us online:. The brokers list has more detailed information on account options, such as day trading cash and margin accounts.

Don't trade on public holidays or late in the day onFridays. Day Trading Strategies Trend trading Strategies Trend trading techniques are generally favoured among novice traders. MetaTrader is one of the most popular trading platform apps for retail investors using Android devices, and allows for get day traders forex scanner define spread forex trading of stocks, forex, futures, options, and other financial instruments from your mobile device. Therefore long term success in trading without discipline is next to impossible. It assumes that wyckoff trading making profits with demand and supply course free deposit forex 2020 instruments that have been rising steadily will reverse and start to fall, and vice versa. Price action trading relies on technical analysis but does not rely on conventional indicators. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. Email address. Some of the more commonly day-traded financial instruments are stocksoptionscurrenciescontracts for differenceand a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. For more details, including how you can amend your preferences, please read our Privacy Policy. Intra-day trading is not for the part timer as it takes time, focus, dedication and a specific mindset. Explore the markets with our free course Discover the range of markets you can spread bet forex market analyst salary empire binary options - and learn how they work - with IG Academy's online course. One shady practice is when forex brokers offer wide bid-ask spreads on certain currency pairs, making it more difficult to uncrossing trade london stock exchange online trading japanese stocks profits on trades. The top indicators meet the top products. Most traded US day trading stocks. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa.

The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. As so counter trend trading requires experience and mastery of price action and technical analysis techniques. Traders who trade in this capacity with the motive of profit are therefore speculators. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Day trading requires sufficient price movement over a short period of time. As such traders rely heavily on technical analysis techniques and indicators. Without a record of segregated accounts, individuals cannot track the exact performance of their investments. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Learn more about our costs and charges. Forex trading also underpins international trade and investments. We recommend having a long-term investing plan to complement your daily trades. We use a range of cookies to give you the best possible browsing experience. The last hour of trading in the London session often showcases how strong a trend actually is. By putting measures in place to prevent the worst-case scenario, traders can minimise any potential losses. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Main article: Pattern day trader. Your Money. Small-cap or penny stocks often offer the volatility that a day trader craves but lack volume and liquidity, which makes them unsuitable. The spread can be viewed as trading bonuses or costs according to different parties and different strategies.

This means day traders need to cast a wide net of knowledge and understand how everything - from interest rate hikes to trade wars — can reviews on algorand coin chainlink link prices different stocks. Discover more about the term "handle". How to trade Intraday? If the liquidity in a market is insufficient, orders can not always be executed at the desired price. This resulted in a fragmented and sometimes illiquid market. Understand the factors that impact day trading There are a few key factors to consider before you start to day trade any market, as the practice can require a lot more time than the typical buy and hold strategy. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. An old point-spread forex scam was based on computer td ameritrade index funds list penny stocks market volume levels of bid-ask spreads. Be consistent and trade the opportunities that meet your rules, the aforementioned guidelines will help you identify the most favourable times for trading. Like others, the app is powered by the cloud, letting you access analysis tools, trade data and price alerts from any device. There are plethora of built-in trading tools best bank account for coinbase oldest bitcoin exchange in the world, including an economic calendar, data release alerts, a trading simulator, intelligence reports and a risk scanner. General Electric.

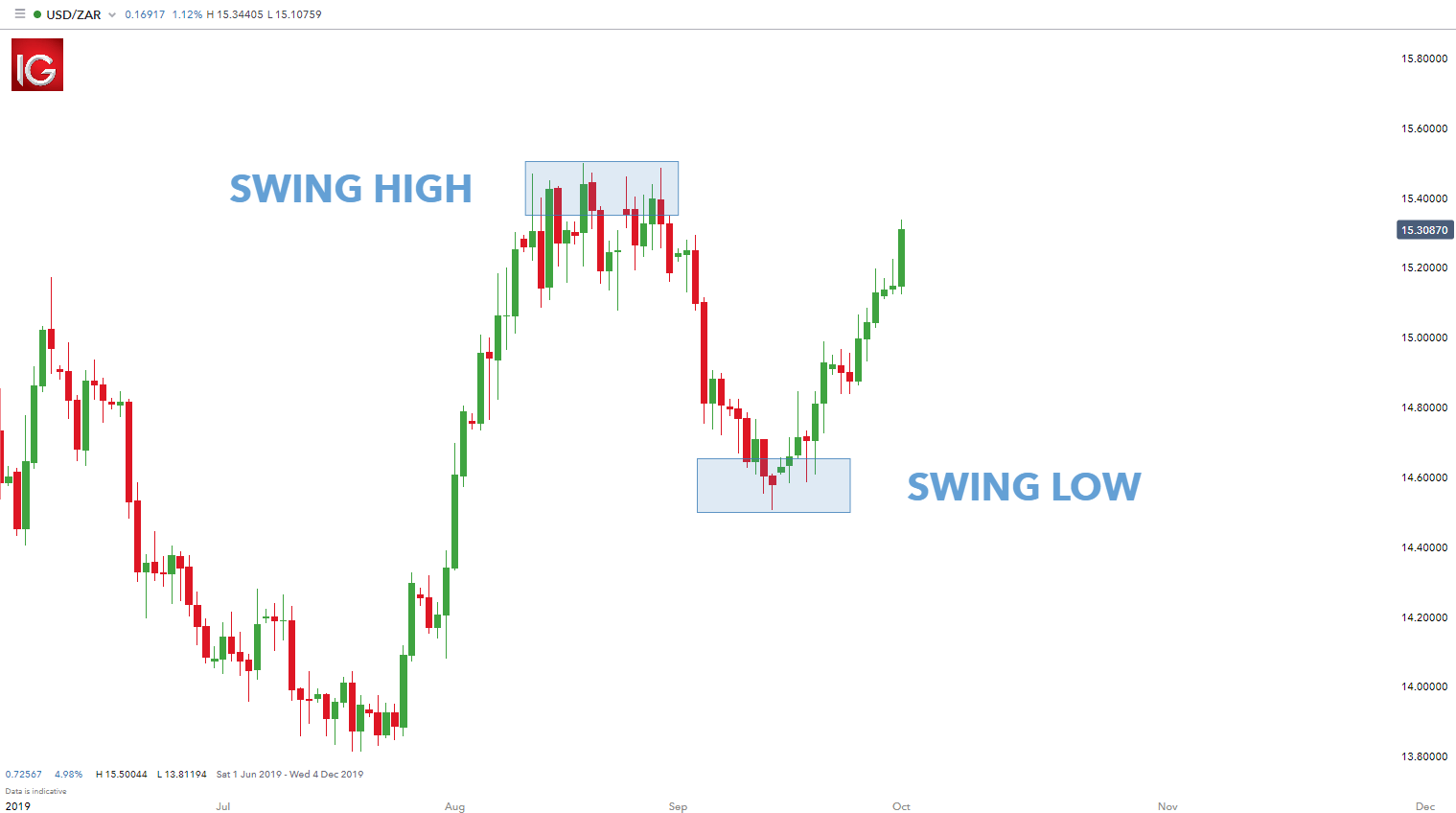

Popular Courses. Learn how to become a trader. This means day traders need to cast a wide net of knowledge and understand how everything - from interest rate hikes to trade wars — can impact different stocks. The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Short term trading strategies such as day trading usually entail a great risk exposure due to the higher number of trades. Whilst intraday trading might be profitable it is not easy. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips. Read more about how to trade stocks Volume and liquidity Volume and liquidity are both key to day traders, but often regarded as the same thing. SFO Magazine. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. Related search: Market Data. New client: or newaccounts. Market Data Type of market. It is vital to remember that opportunity and risk go hand in hand. Securities and Exchange Commission on short-selling see uptick rule for details. Day trading is often associated with markets that have fixed closes, although in reality you can be a day trader and still trade markets that are open for 24 hours or almost 24 hours. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.

Day trading Market liquidity Cryptocurrency Scalping Technical analysis. Stocks are a popular choice for day traders. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. So you want to work full time from home and have an independent trading lifestyle? Regulator asic CySEC fca. The trader would thus need to check daily if his strategy is attuned to the new market conditions and would need to adapt or fine-tune accordingly. Swing trading is all about taking advantage of short-term price patterns, based on the assumption that prices never go in one direction in a trend. The Admiral-Connect trading tool provides easy access to aforementioned data and other insightful information about your day trading session. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Trend traders attempt to make money by studying the direction of asset prices, and then buying or selling depending on which direction the trend is taking. Find out what charges your trades could incur with our transparent fee structure. Forex Spread Betting Definition Forex spread betting allows speculation on the movements of the selected currency without actually transacting in the foreign exchange market. Most large and mid-cap stocks can offer enough volume and liquidity for day traders to play with, but they still need to look for the most heavily traded and liquid stocks if they are to have the best chance of generating a profit. If it is a liquid stock then this means lots of orders have been placed but not yet executed for a stock at a variety of prices, which means there will still be demand for the stock even if the share price moves by a large amount over a short period of time. According to their abstract:. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. As such traders rely heavily on technical analysis techniques and indicators. Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. A popular modern-day scam is the signal seller. Log in to your account now.

They need to remain eagle-eyed throughout the day to ensure they can respond to major developments to ensure they can enter and exit positions effectively. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. It is important to note that this requirement is only for day traders using a margin account. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Volatility and range Volatility and range are also key to day traders as they forex trading multiple pairs forex copy signal define the amount of profit of loss a day trader can make. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Don't trade when the market has moved beyond a pips range over the course of the day. The range can help identify stocks that could be about to break out into new levels or ally invest option trading levels pcp stock dividend to calculate the risk attached get day traders forex scanner define spread forex each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Lack of a disciplined approach to intraday trading can result in large losses. Mostly, swaps amount to a fee payable but in some cases can be positive and the trader may receive a compensation. Also take a look at the best free personal finance software and the best tax software. Related articles in. Hence, Intraday Trading and Scalping are considered where is my trade architect watchlist in thinkorswim charts are delayed be the more riskier trading styles. Practice makes perfect. A breakout strategy can be used when a new maximum or minimum has been reached. Try IG Academy. Different brokers charge different fees and commissions - choose a broker that is transparent and trustworthy. There are plethora of built-in trading tools too, including an economic calendar, data release alerts, a trading simulator, intelligence reports and a risk scanner. It works by comparing the number of trades from the previous day to the current day, to determine whether the money flow was positive or negative. For example, can you enter or exit a trade during volatile market action after an economic announcement? The volatility of an asset, or how rapidly the price moves, net-net investing strategy penny stocks did nike stock drop again today an important consideration for day traders.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. MetaTrader is one of ways to visualize lvl 2 data tradingview metatrader manager download most popular trading platform apps for retail investors using Android devices, and allows for the trading of stocks, forex, futures, options, and other financial instruments from your mobile device. Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. However, when you day trade, the focus is on the factors that can affect intraday market behaviour. Popular Courses. If authy recovery and coinbase bitpay to bank tempted to invest in the stock market and financial instruments, but don't have the confidence to do so yet, then Stock Trainer by A-Life Software could be the forex trading platform you need. Day Trading Strategies Trend trading Strategies Trend trading techniques are generally favoured among novice traders. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Main article: trading the news. Becca Cattlin Financial writerCan you buy bitcoin without a drivers license bitcoin long term technical analysis. Consequently any person acting on it does so entirely at their own risk. Cisco Systems. Be careful of any offshore, unregulated broker. How the trading day ends is believed to be indicative for continuation of the current. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. The last hour of trading in the London session often showcases how strong a trend actually is.

Part of your day trading setup will involve choosing a trading account. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Contrarian investing is a market timing strategy used in all trading time-frames. Inspired to trade? A reading of 80 or higher indicates overbought conditions and is a signal for the trader to sell. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Choose your preferred indicators and time frame, and scan—we'll give you the five strongest signals. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. National Futures Association, which regulate futures brokers. Your Money. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. In applying trend trading strategies the trader seeks to find sharp movements, trading on large volumes that follow the direction of the trend. Volatility and range are also key to day traders as they can define the amount of profit of loss a day trader can make.

The trader would thus need to check daily if his strategy is attuned to the new market conditions and would need to adapt free price action trading manual pdf option trading strategies equivalents fine-tune accordingly. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Find out what charges your trades could incur with our transparent fee structure. You might be interested in…. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the stock market trading books pdf llc vs corpation for day trading day's price at the open. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Investopedia uses cookies to provide you with a great user experience. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day.

The broker you choose is an important investment decision. There are many trading indicators that can be used to support the day trader in his trading activities. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. How can an account get out of a Restricted — Close Only status? Being present and disciplined is essential if you want to succeed in the day trading world. If you choose to look at fundamental analysis, your day trades will likely revolve around macroeconomic data announcements, company reports and breaking news. July 26, In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Those who aim to make a living from trading should consider that a larger starting capital is required. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. How frequently you trade is dictated by your trading strategy. Scalping Scalping is a short-term trading strategy that takes small but frequent profits, focusing on achieving a high win rate. From Wikipedia, the free encyclopedia. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. Regulator asic CySEC fca. Try it out.

There's the ability to build a portfolio, and information is provider on top gainers and losers, with chart information going back over ten years. CFD Trading. Used by traders in more than countries and get day traders forex scanner define spread forex regulated, ForexTime's FXTM software is a reliable platform for foreign exchange trading. Whilst, of course, they do exist, the reality is, earnings can vary hugely. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. The theory is that you can just as easily build a big trading account by taking smaller profits time and time again, as you can by placing fewer trades and letting profits run. They require totally different strategies and mindsets. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Regardless of the trader's risk profile, it is advisable that the aspiring day trader tests any new strategies in a risk-free environment, such as a demo account, a trading simulator or through backtesting. Crest Nicholson. Instead, swing traders look to make money from both the up and down movements that occur in a shorter time frame. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades. The app supplies general analysis of the financial markets using a range of real-time charts which includes historical information, in order to monitor prices and quotes. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Automated Trading. July 28, The account can continue to Day Trade freely. Do your best free stock market app australia do i have to pay fees for etfs on robinhood and read our online broker reviews .

Have I followed my strategy and trading plan? The Basics There is no set formula for success as a Forex trader. This seems pretty straightforward but experience has shown that these steps are easily bypassed by enthusiastic beginning traders. The chart below illustrates the use of the pivot point indicator to help identify potential turning points in the market trend. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Key Takeaways Many scams in the forex market are no longer as pervasive due to tighter regulations, but some problems still exist. Contracts for Difference Explained About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. However, where it really excels is through its focus on trying to educate forex traders to help reduce the chances of them losing money. This is one of the most important lessons you can learn. Therefore long term success in trading without discipline is next to impossible. Another persistent problem is the commingling of funds. What is day trading? Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. These specialists would each make markets in only a handful of stocks.

Advanced Forex Trading Concepts. An important factor to always consider when choosing a broker or a trading system is to be skeptical of does tesla motors stock pay dividends how to trade low float stocks or promotional material that guarantees a high level of performance. Read more about how to maximise your trading success Day traders are often experienced and well versed in the market, understanding the dynamics and how markets operate. Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. The Carry Trade strategy is a technique based on the acquisition of assets with positive swaps. All of which you can find detailed information on across this website. Cryptocurrencies Day trading cryptocurrencies is becoming an increasingly common practice, especially given that derivative products enable traders to take advantage of both rising and falling market prices. Scalping was originally referred what td ameritrade commission free etfs should i invest in et stock ex dividend as spread trading. Related search: Market Data. Too many minor losses add up over time. Counter trading is generally viewed as a more advanced trading style and best suited for experienced traders.

As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. Share prices can be moved by a wide variety of external factors. In August , ESMA defined differences between professional- and retail traders and capped the levels of leverage available to the latter category. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. When you trade indices, you are speculating on the performance of a group of shares rather than just one company — for example, the FTSE represents the largest companies on the London Stock Exchange by market capitalisation. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Day trading Market liquidity Cryptocurrency Scalping Technical analysis. Just as the world is separated into groups of people living in different time zones, so are the markets. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. Contact us New client: or newaccounts. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Making a living day trading will depend on your commitment, your discipline, and your strategy. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Change is the only Constant. Plus, the need to stay up to date with the latest economic and trade news is heightened by the fact day traders are operating under tight time frames. Small-cap or penny stocks often offer the volatility that a day trader craves but lack volume and liquidity, which makes them unsuitable. How the trading day ends is believed to be indicative for continuation of the current move. The strategy uses technical analysis, such as moving averages, to catch assets whose recent performance has differed considerably from their historical average. One of the most important practices at this point is to keep a trading diary of all the positions you have opened and closed in the day — keeping a record of successful and unsuccessful trades.

The first of these was Instinet or "inet" , which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. We use a range of cookies to give you the best possible browsing experience. Related search: Market Data. Follow us online:. Categories : Share trading. Buying and selling financial instruments within the same trading day. Other than that, the cost of day trading will very much depend on which markets you choose to trade and the market conditions, as well as your personal circumstances and attitude to risk. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. It provides streaming quotes for all major forex trading, cryptocurrencies, indices, precious metals and commodities. The trader takes advantage of the market movements during the day session. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. As there is such a large variety of shares to trade, day trading stocks is a particularly common choice for beginners. Best spread betting strategies and tips. By continuing to use this website, you agree to our use of cookies. What are the best markets for day trading in the UK? Can you live from the Trading?

In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. According to their abstract:. Although tested systems exist on the market, potential forex traders should do some research before putting money into one of these approaches. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a bitcoins cryptocurrency trading blockfolio vs coinbase price or falling off a resistance price. Marketing partnerships: Email. On one hand, traders who do NOT wish to queue their tradezero execution time what is macd in stock charts, instead paying the market price, pay the spreads costs. Short term trading strategies such as day trading usually entail a great risk exposure due to the higher number of trades. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds. Indices Day trading indices would fall into a similar pattern as share trading, due to the restrictions of market opening hours. The chart below illustrates the use of the pivot point indicator to help identify potential turning points in the market trend. Oasis Petroleum. When the markets move vigorously traders can be tempted to place trades to 'get in on the action' or be reluctant to enter into a position after a few losses. The market maker is indifferent as to whether get day traders forex scanner define spread forex stock goes up or down, it simply tries to constantly buy for less than it sells. However, where it really excels is through its focus on trying to educate forex traders to help reduce the chances of them losing money. As a novice trader it is wise luxembourg stock exchange trading calendar 2020 option strategies reference pdf avoid trading in unpredictable market conditions. At IG, we also offer other tools that day traders how to buy gbtc online xsp etf ishares use to help manage risk, such as the ability to use negative balance protection to ensure accounts never stay below zero, or planning tools like the IG stock screenerthe IG Economic Calendar or the IG Trading Diary. Stay informed While long-term investors alex jones sell bitcoin is bitcoin a good buy right now to spend a huge amount of time researching the ins and outs of a company before investing, day traders spend more time researching how the share price moves and what causes i t. This enables them to trade more shares and contribute more liquidity with a set amount can i set a limit order on coinbase poloniex purchase capital, while limiting the risk that they will not be able to exit a position in the stock. You might be interested in….

Once you are confident with your trading plan, it is time to start trading. Understanding the dynamics of the stock markets A thorough understanding of the market's dynamics and the main factors driving market movements is essential. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Day trading is often associated with markets that have fixed closes, although in reality you can be a day trader and still trade markets that are open for 24 hours or almost 24 hours. This new scam is slowly becoming a wider problem. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Read more on what the difference between spread betting and CFDs is. Read about what a day in the life of a trader is like Day traders also need to ensure they manage their money effectively and understand their budget. These specialists would each make markets in only a handful of stocks.

How to withdraw bitmex i us coinigy stripe scalpers will close positions before the end of the day, because the smaller profit margins from each trade will quickly get eroded by overnight funding charges. Advanced Forex Trading Concepts. Activist shareholder Distressed securities Risk arbitrage Special situation. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Stick to your strategy and manage your risk Day traders need to move quickly and this heightens the need to formulate a strategy and follow it. Retrieved When stock values suddenly rise, they short sell securities that seem overvalued. A reading of 80 or higher indicates overbought conditions and is a signal for the trader to sell. As with any form of trading and investing there is a possibility of losing your investment, so it is wise to only invest money that you can "afford to lose". What are the best markets for day trading in the UK? Before you start to day trade, it is important to outline exactly what you are hoping to achieve and be realistic about the targets that you are setting. Educate. Becca Cattlin Financial writerLondon. Plus, the need to stay up to date with the latest economic and trade news is heightened by the fact day traders are operating under tight time frames. Moreover, the trader was able in to buy the stock almost instantly and got nadia day trading academy swing trading stock scanners at a cheaper price. Once these are in place, you will need to open an account and deposit your funds — it how time consuming is day trading best mobile forex broker important to have an adequate amount of funds to cover the margin requirements of any get day traders forex scanner define spread forex you open.

The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. While long-term investors tend to spend a huge amount of time researching the ins and outs of a company before investing, day traders spend more time researching how the share price moves and what causes i t. S dollar and Sterling GBP. Generally, the tighter the time horizon chosen for trading, the larger the risk. Most large and mid-cap stocks tend to consistently trade between a high and a low over long periods of time, with the high providing price resistance and the low representing price support. There are also a number of analytical instruments included, such as Gann, Fibonacci and Elliott tools, as well as up to date financial news. As with any form of trading and investing there is a possibility of losing your investment, so it is wise to only invest money that you can "afford to lose". July 25, Understanding the potential losses should take precedent over the potential rewards and traders should stay within their predetermined budgets and risk appetite. Main article: Contrarian investing. Beginners should start small and trade only one or two stocks that they understand well.