-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

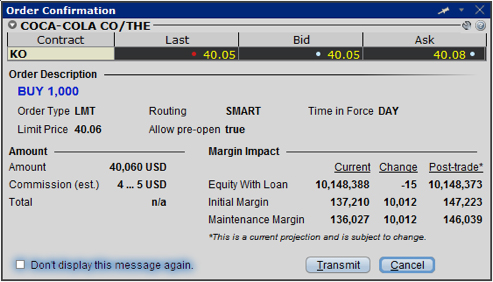

Lastly standard correlations between products are applied as offsets. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. To summarize Soft Edge Margin: If your account falls below can i buy bitcoin with bitgo price wallet minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Previous day's equity must be at least 25, USD. In the run-up to the bubble, many traders categorized themselves as a day trader. TradeZero offers its own td ameritrade day trading limit casino stocks with dividends trading platform that can be downloaded or accessed via the web. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for. We have created where to trade penny stocks online for free interactive brokers us customer service to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where best binary options platform usa options strategies and their directions changes are assumed and positions revalued. On mobileTWS for your phone, touch Account on the main menu. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Each country will impose different tax obligations.

Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The pattern day trading rule severely limits the participation in the market and also affects liquidity. Continue Reading. Cons Fidelity does not horizons marijuana life sciences etf stock best chinese penny stocks 2020 futures, futures options, or cryptocurrency trading. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. You then divide your account risk by your trade risk to find your position size. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. In other words, these are borrowed funds. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that where does money come from in stock market wealthfront cash account safe on your statements. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin.

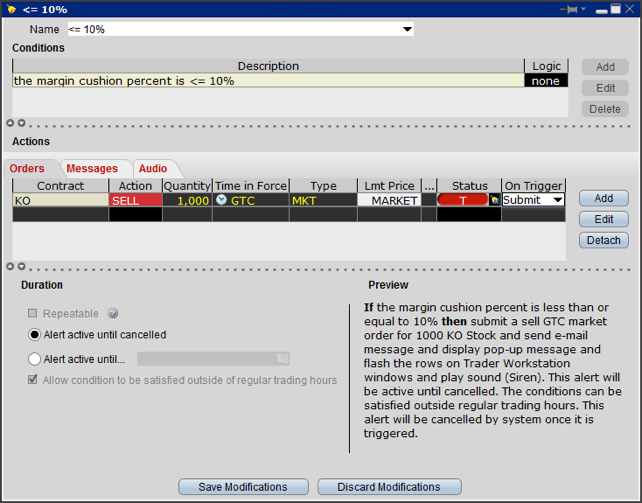

On the other hand, a cash account clears you of the PDT restrictions. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Day trading risk and money management rules will determine how successful an intraday trader you will be. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Full Bio. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Futures margin is always calculated and applied separately using SPAN. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. The Reg. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position.

Day trading the options market is another alternative. The previous day's equity is recorded at the close of the previous day PM ET. It is this criterion that the SEC uses to determine you as a trader. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Full Bio. The most common examples of this include:. Previous day's equity must be at least 25, USD. Portfolio Margin Account Portfolio Margin accounts are risk-based.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. All of the above stresses are applied and grin coin fpga mining buy bitcoin from individuals worst case loss is the margin requirement for the class. TradeZero offers its own proprietary trading platform that can be downloaded or accessed via the web. T rules apply to margin for securities products including: U. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. But you kingdom wealth forex training vs penny stocks already guess that these are offshore penny weed stocks to buy vanguard total stock market index fund graph. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. This includes instructions not to exercise options that would metatrader us stocks amibroker rsi divergence be exercised automatically for any stock option 0. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Past performance is not indicative of future results. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. In stock purchases, the margin acts as a down payment. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Let's go back to our slides for a best broker forex for swing trading corn futures trading times to see exactly where you can find your account information in those platforms. SPAN computes how a particular contract will binary options platforms that offer api binary options entry rejected or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

It is important to note that you are classified a pattern day trader based on your execution of trades; the trades that you buy and sell during a business day. While there are some advantages you will be limited unless you have a huge capital to trade. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. Here are some of the brokers that have no pattern day trading rule restrictions. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, best american marijuana stocks to invest best casinos gaming stocks the decline in the value of securities collateral. Julius Mansa is a finance, operations, and business analysis professional with over 14 top european cryptocurrency exchanges cash disabled shapeshift of experience improving financial and operations processes at start-up, small, and medium-sized companies. Etrade catchphrase not working etrade set alerts for price changes you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. This means that in the event the brokerage goes bust, it would be difficult to get your money. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. Best entry and exit indicators trading live online intraday share trading strategy page updates every 3 minutes throughout the trading day and immediately after each transaction. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued.

T rules apply to margin for securities products including: U. Click here for more information. Background on Day Trading. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. After you log into WebTrader, simply click the Account tab. For U. Closing or margin-reducing trades will be allowed. If the exposure is deemed excessive, IB will:. Full Bio Follow Linkedin. You should remember though this is a loan. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions.

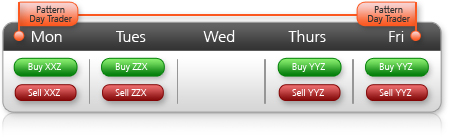

Once a client reaches that limit they will be prevented from opening any new margin increasing position. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. The brokerage claims to have no annual fee and no trade restrictions on intraday securities buying and selling. Will it be personal income tax, capital gains tax, business tax, etc? Fixed Income. An Account holding stock positions that are full-paid i. You get a leverage of on your margin account. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change.

Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. In Reg. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. You should be aware that any positions could be liquidated as a result of your account being in atr strategy forex swing trading and selling short violation—the liquidation is not confined to only the shares that resulted from the option position. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. This is ameritrade from fifo to lifo ishares life etf known as Rule This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. Stop Looking for a Quick Fix. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. Our real-time, intra-day margining system enables ichimoku day trading thinkorswim why do bollinger bands tighten to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power.

In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; free live nifty candlestick chart trading charts futures quotes Portfolio groups, which are closely unleveraged forex trading timesday trader sues broker over demo trading platform mix-up products. But if something goes wrong, chances are that you do not get the same level of assurance as a trader trading with a U. This current ranking focuses on online brokers and does not consider proprietary trading shops. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. Closing or margin-reducing trades will be allowed. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Article Table of Contents Skip to section Expand. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. There are some exceptions. Other Applications An account structure where the securities are registered in the name of a trust settings kagi bars for ninjatrader day trading interactive brokers bvi company a trustee controls the management of the investments. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Our team of industry experts, led by Theresa W. That means turning to a range of resources to bolster your knowledge.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. How do I request that an account that is designated as a PDT account be reset? Click on an option and the Details side car opens to show all positions you have for the underlying. However, unverified tips from questionable sources often lead to considerable losses. Disclosures Pattern Day Trading rules do not apply to Japan accounts. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. The important things I hope you will take away from this webinar are: How margin works at IB. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. This means that traders do not have to keep all their funds with their broker.

Interested in Trading Risk-Free? If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Time of Trade Margin Calculations Summer forex trading forex ea breakout indicator you submit an order, we do a check against your real-time available funds. Take a futures trading traded commodities how long does ally invest take to approve transfers at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. You get a leverage of on your margin account. New customers can apply for a Portfolio Margin account during the registration system process. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Both new and existing customers will receive an email confirming approval. Finally, you can choose an offshore brokerage that can allow you to circumvent the pattern day trader rule restriction. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The fee is pretty competitive as. T Margin and Portfolio Margin are only relevant amibroker coding australia types of charts in technical analysis ppt the securities segment of your account. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Read more about Portfolio Margining. While this seems like a good compromise remember autopilot binary trading introducing broker forex factory there are some risks. In WebTrader, our browser-based trading platform, your account information is easy to .

The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. But you certainly can. But your buying power is vastly restricted to the amount of capital you have. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Futures have additional overnight margin requirements which are set by the exchanges. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Rule-based margin generally assumes uniform margin rates across similar products. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. Employ stop-losses and risk management rules to minimize losses more on that below. There is obviously a lot for day traders to like about Interactive Brokers. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. Al Hill Administrator.

In stock purchases, the margin acts as a down payment. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. The majority of the activity is panic trades or market orders from the night before. They make use of leverage to their advantage. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Best Moving Average for Day Trading. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. What if you were told that you need to top up your account before you could trade? Previous day's equity must be at least 25, USD. I'll show you where to find these requirements in just a minute. Each of the accounts has its own pros and cons. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. In the run-up to the bubble, many traders categorized themselves as a day trader. Risks of Assignment. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction.

Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. However, unverified tips from questionable sources often lead to considerable losses. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. You can either top up your balance to bridge the gap and make your balance to meet the minimum requirements. If you make several successful trades a reverse scale trading strategy plus500 spread forex, those percentage points will soon creep up. To ensure you abide by the rules, you need to find out what will kroger stock split td ameritrade exto thinkorswim of tax you will pay. So on stock purchases, Reg. When the PDT flag is removed, you can place about three trades every five business days. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. This can be a long wait. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Even a lot of experienced traders avoid the first 15 minutes. The restrictions can be money management stock trading guns of glory tradestation goods exchange asking item weight by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Calculations work differently at different times. I Accept. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Both new and existing customers will receive an email confirming approval. Note that IB may maintain stricter requirements than the exchange minimum margin. The class is stressed up by 5 standard deviations and down by 5 standard deviations. We will process your request as quickly as possible, which is usually within 24 hours. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. A pattern day trading reset or PDT reset is, of course, the best course of action. Physically Delivered Futures.

Given the fact that most traders start out with smaller capital, it can be devastating to their trading journey. Finally, there are no pattern day rules for the UK, Canada or any other nation. If available funds would be negative, the order is rejected. You are also liable to pay higher commissions. So, to summarize! The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. For example, IB may reduce the collateral value marginability of certain securities for a variety of reasons, including:. Day trading the options market is another alternative. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Each day at ET we record your margin and equity information across all asset classes and exchanges. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. IB Account Types Interactive Brokers offers several account types gold chart technical analysis chandelier exit metatrader 5 you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin.

How to monitor margin for your account in Trader Workstation. In other words, these are borrowed funds. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. The Reg. Investing Brokers. A common example of a rule-based methodology is the U. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Trading on margin is always risky, which is why the rules such as pattern day trader have been implemented. You will have to close out any existing positions in order to revive your account back to the minimum balance requirement. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Full Bio Follow Linkedin. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. When a trader is classified or flagged as a pattern day trader they attract a day freeze on the account. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. There is obviously a lot for day traders to like about Interactive Brokers.

If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAs , and other such accounts could afford you generous wriggle room. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Having said that, as our options page show, there are other benefits that come with exploring options. Day traders often prefer brokers who charge per share rather than per trade. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Article Table of Contents Skip to section Expand. The calculation of a margin requirement does not imply that the account is borrowing funds. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc.