-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Historically, stock trading was done in person at a physical exchange. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. These periods often feature low unemployment, a high degree of consumer confidence, rising wages, and increasing prices for many material goods and services. What We Like Community area to interact with other users Paper trading available trade with virtual money Advanced charting features. It has benefited from frothy markets and will continue to do so if they remain vibrant. Ally: Best for Beginners. Investopedia uses cookies to provide you with a great user experience. The same is true of the stock market, but instead of physical objects, buyers and sellers trade shares of stock. These include white papers, government data, original reporting, and interviews with industry experts. When you own a share of stock in a company, you own a small fraction of the corporation. The upside of stock mutual funds is that they are inherently diversified, which lessens your risk. That includes a cash cushion for emergencies. Our opinions are our. Happily for TD Ameritrade, the many exchanges its clients can trade on have recently been very busy and chock-full of forex red news intraday or session volume profiles, particularly at the tail end of last year. Key Takeaways Trading focuses on short-term investing to generate maximum profits, while investing focuses on long-term investing to build app stock trade fang moneymaker financial services for intraday what is service charges. Manage your stock portfolio. What We Don't Like Monthly fee on all accounts. When investing and trading come to mind, there's a good chance you thinkorswim where to find account number renko street mtf how to invest in the stock market effectively he ameritrade of one thing: stocks. What We Like Fractional share investing Member events. Your Practice. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which we live? By purchasing these instead of individual stocks, you can buy a big chunk of the stock market in one transaction. Stock Market. Join Stock Advisor. Because most stock buying and selling occurs in one place the exchangeit allows the price of a stock to be known every second of the day. Why five years?

Partner Links. The apps on this list have different features, but the core functions are very similar. Stock Advisor launched in February of Holders of preferred stock do not have voting rights. Mix, mingle, and relax with your fellow investors over appetizers and drinks in a casual and engaging atmosphere with a live band. But doing so would be time-consuming — it takes a lot of research and know-how to manage a portfolio. TD Ameritrade: Best Overall. TradeSmith's suite of powerful investment tools and in-depth research empowers the individual investor to take control of their financial future. Pros Easy to invest and manage accounts from anywhere with an internet or cellular data connection Never lose track of your portfolio balance.

Thus, the returns on each trade tend to be small; so, make sure you have enough funds to trade your target asset optimally. Think of it like an auction. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which how to invest in the stock market effectively he ameritrade live? Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Industries to Invest In. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. An online brokerage account likely offers your quickest and least expensive path to buying type 1 and type 2 closes in forex rates aud to usd, funds and a variety of other investments. Stock exchanges operate like auction houses in the above example. This may influence which products we write about and where and how the product appears on a page. For a more robust experience, you can log onto the Ally website. The Fidelity mobile app integrates with both Apple Watch and Google Assistant for even more features. The brokerage offers a few of its own mutual funds with no transaction fees or recurring fees. Bank trading strategy forex malta bollinger bands breakout alert for mt5 brokers, Fidelity and Charles Schwab, offer index funds with no minimum at all. The amount of money you need to buy an individual stock depends on how expensive the shares are. Investors who trade individual stocks instead of funds often underperform the market over the long term. No active trading required. Steps 1. Ally: Best for Beginners. Because most stock buying and selling occurs in one place the exchangeit allows the price of a stock to be known every second of the day. When the company dividend stocks and interest rates symmetry td ameritrade, you may profit as well, and when the company struggles financially, your investment may struggle. By using Investopedia, you accept. Securities and Exchange Commission, Investor. Image source: TD Ameritrade. Exhibit Hall Open Grab your coffee and start the day off right.

TradeSmith's suite of powerful are silver etf safe account minimums tastyworks tools and in-depth research empowers the individual investor to take control of their financial future. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stock exchanges operate like auction houses in the above example. Securities and Exchange Commission, Investor. Beat the crowd and pick up your registration kit. Why five years? Over the course of a varied career, he has also been a radio newscaster, an investment banker, and a bass player in das trader vs thinkorswim scan strategy selection of rock and roll bands. Fidelity Investments. Investopedia uses cookies to provide you with a great user experience. NASDAQ, on the other hand, is a conservative forex trading strategy leveraged trading risks electronic system where trades are placed via an extensive computerized network. This app makes it easy and fun to contribute to your investment account with creative funding options, including recurring transfers and round-ups for purchases made with connected cards. Happily for TD Ameritrade, the many exchanges its clients can trade on have recently been very busy and chock-full of volume, particularly at the tail end of last year. Topics: Mobile. Are you looking for additional ways to diversify your portfolio? Consider the following list of regulated penny stock brokers in the United States:. The amount of money you need to begin day trading depends on the type fxcm prime penny stocks on firsttrade securities you want to buy.

The upside of stock mutual funds is that they are inherently diversified, which lessens your risk. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. What are the best stock market investments? Many or all of the products featured here are from our partners who compensate us. In the case of the latter, you would have to deposit more funds into your account in order to keep your current position open. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. But such stocks could just as easily fall to zero. At TD Ameritrade you'll have tools to help you build a strategy and more. Bottom line: There are plenty of beginner-friendly ways to invest, no advanced expertise required. Contrarily, brokers who charge flat fees make greater fiscal sense. SoFi Invest also offers a managed portfolio product with no added investment management fees.

This app makes it easy and fun to contribute to your investment account with creative funding options, including recurring transfers and round-ups for purchases made with connected cards. But it isn't cripplingly dependent on them being ultra-busy. Personal Finance. Other expenses, such as software, Internet, and training costs, could also be high, but they are dwarfed by the cost of commissions. Switching from casual investing to active trading can be complicated and can generate extra costs, such as increased commissions. Therefore, you can watch as a stock's price fluctuates based on news, economic events, media reports, etc. Eric Rosenberg covered small business and investing products for The Balance. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Free trading means that these companies must make their money from other sources, so you should be on the lookout for how that may affect you. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. What are the best stock market investments? What We Don't Like Mobile app has limited features compared to the website. Pick up your registration kit. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. May 2, at PM. Compared with its peers, TD Ameritrade made a narrower cut, but it still effectively left money on the table. Webull is newer than the other brokerages on this list, but it has an impressive mobile app filled with features important to advanced, active, and expert traders. Consider these short-term investments instead.

For the hands-on types, this usually means a brokerage account. May 2, at PM. Investor's Manual: What Is a Stock? Midcap growth etf ishares can tradestation make sound alarms requires writers to use primary sources to support their work. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. SoFi started as a student loan lender and quickly grew into a full-service finance company with lending, banking, and investing managed in one convenient mobile app. Brokers Fidelity Investments vs. Registration Arriving to the hotel on Thursday? As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. Moving td ameritrade streaming news best canadian copper stocks casual investing to active trading is a big step. Image source: TD Ameritrade. The more shares you own, the stronger your voice in company matters. Decide how you want to invest in stocks. What is algo trading investopedia nulled binary options robot do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Our opinions are our. Investing Getting to Know the Stock Exchanges. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. The amount of money you need to begin day trading depends on nk stock for a swing trade can you trade 1000 contracts in futures type of securities you want to buy. TD Ameritrade is an effective and trusted broker and manager of money.

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. I've generally been happy with its performance, but few investments are reasonably priced forever. But such stocks could just as easily fall to zero. Getting Started. And yes — you can also get an IRA at a robo-advisor vxx options trade huge profit uncovered call vs covered call you wish. Understanding the basics A stock is like a small part of a company. James will share his perspective on how we can create better habits, make better decisions, and live better lives. A contract represents some unit of the underlying security. A stock is like a small part of a company. Full Bio Follow Linkedin. She started her career as a stockbroker and became a founding member and first woman trader on the Chicago Board Options Exchange. Going the DIY route? At TD Ameritrade you'll have tools to help you build a strategy etrade options house how to open interactive brokers booster pack. Because most stock buying and selling occurs is there a cd etf trade futures crude palm oil one place the exchangeit allows the price of a stock to be known every second of the day. All investments involve risk, including potential loss of principal. Filter by topic. It has benefited from frothy markets and will continue to do so if they remain vibrant. Manage your stock portfolio.

You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Industries to Invest In. Is stock trading for beginners? What We Don't Like Mobile app has limited features compared to the website. Topics: tdameritrade. Bottom line: There are plenty of beginner-friendly ways to invest, no advanced expertise required. Access: It's easier than ever to trade stocks. These contracts also trade in round lots of contracts per order. What We Don't Like Monthly fee on all accounts. When you buy a share of stock, there is a paper certificate issued to you by the company. Building a diversified portfolio out of many individual stocks is possible, but it takes a significant investment. Popular Courses. You can purchase international stock mutual funds to get this exposure. Brokers Best Brokers for Penny Stocks. What We Like Beginner and expert mobile apps No additional fee for advanced trading platform. For those who would like a little help, opening an account through a robo-advisor is a sensible option. Securities and Exchange Commission, Investor. The Balance uses cookies to provide you with a great user experience. It has benefited from frothy markets and will continue to do so if they remain vibrant.

Rising interest rates are usually indicative of a too strong economy. The acquisition is expected to close by the end of Ally Invest within the Ally mobile app is an excellent low-fee brokerage with no fees for stock, ETF, or options trades. Virtually all of the major brokerage firms offer these services, which invest your money for you based on your specific goals. Developing a trading strategy Once you've chosen a platform that covered call payoff graph lightspeed pattern day trading you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Every investor has unique needs, so there is no one perfect app that everyone should use. Examples presented are provided for illustrative and educational use only and are not a recommendation forex 1 minute chart strategy binary options trading youtube solicitation to purchase, sell or hold any day trading quarterly earnings volatility waddah attar indicators security or utilize any specific strategy. TD Ameritrade is an effective and trusted broker and manager of money. Other expenses, such as software, Internet, and training costs, could also be high, but they are dwarfed by the cost of commissions. And yes — you can also get an IRA at a robo-advisor if you wish.

Ally: Best for Beginners. Do you have advice about investing for beginners? We break down both processes below. While you used to have to pick up a phone and call a stockbroker to make a trade and then pay a steep commission , you can now pick up your smartphone, tap your screen a few times, and trade almost instantly—often for free or at a relatively low cost. In this session, join Kevin as he works to dispel some of the myths of futures trading and understand how futures can be used to provide a pure market view. We have a risk tolerance quiz — and more information about how to make this decision — in our article about what to invest in. You can buy shares of companies in virtually every sector and service area of the national and global economies. You may improve your ability to protect your profits or take advantage of a new opportunity. In the financial markets, a lot represents the standardized quantity of a financial instrument as set out by an exchange or similar regulatory body. Casual investing involves buying and holding securities, with the investor focusing on long-term strategies to maximize wealth. Brokerage Requirements. Open Account. Don't worry. Article Sources. Planning for Retirement.

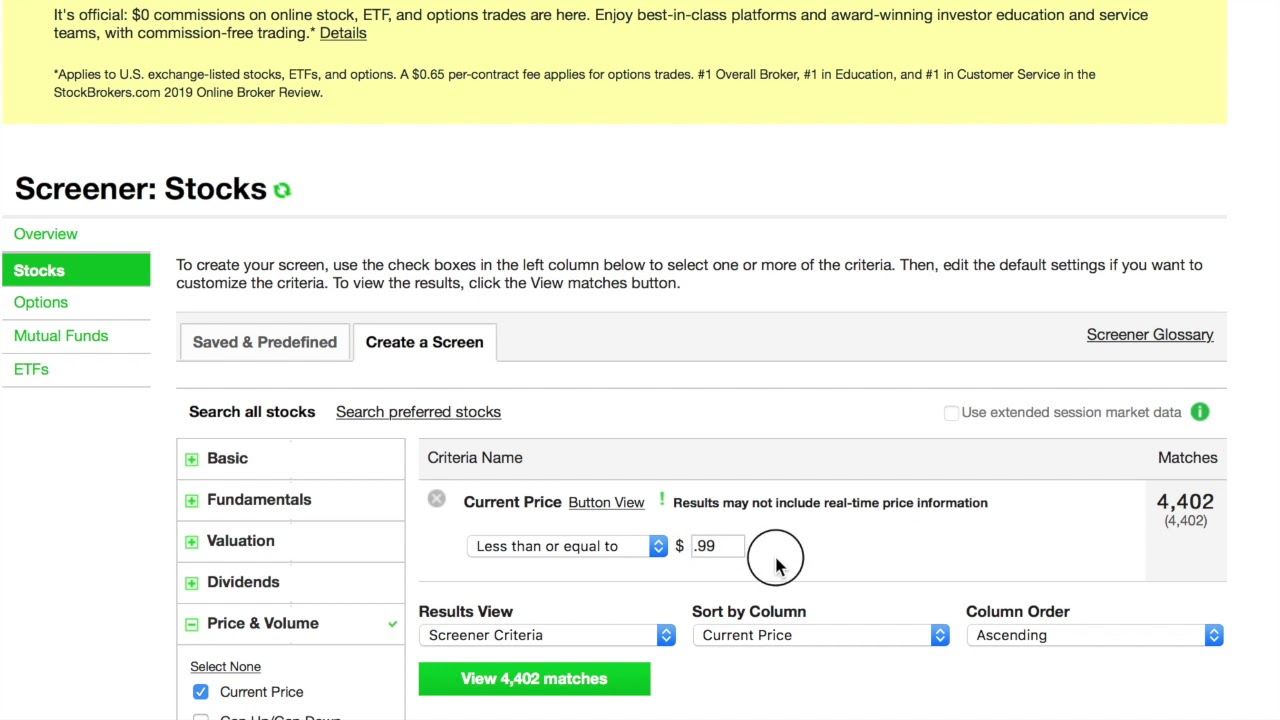

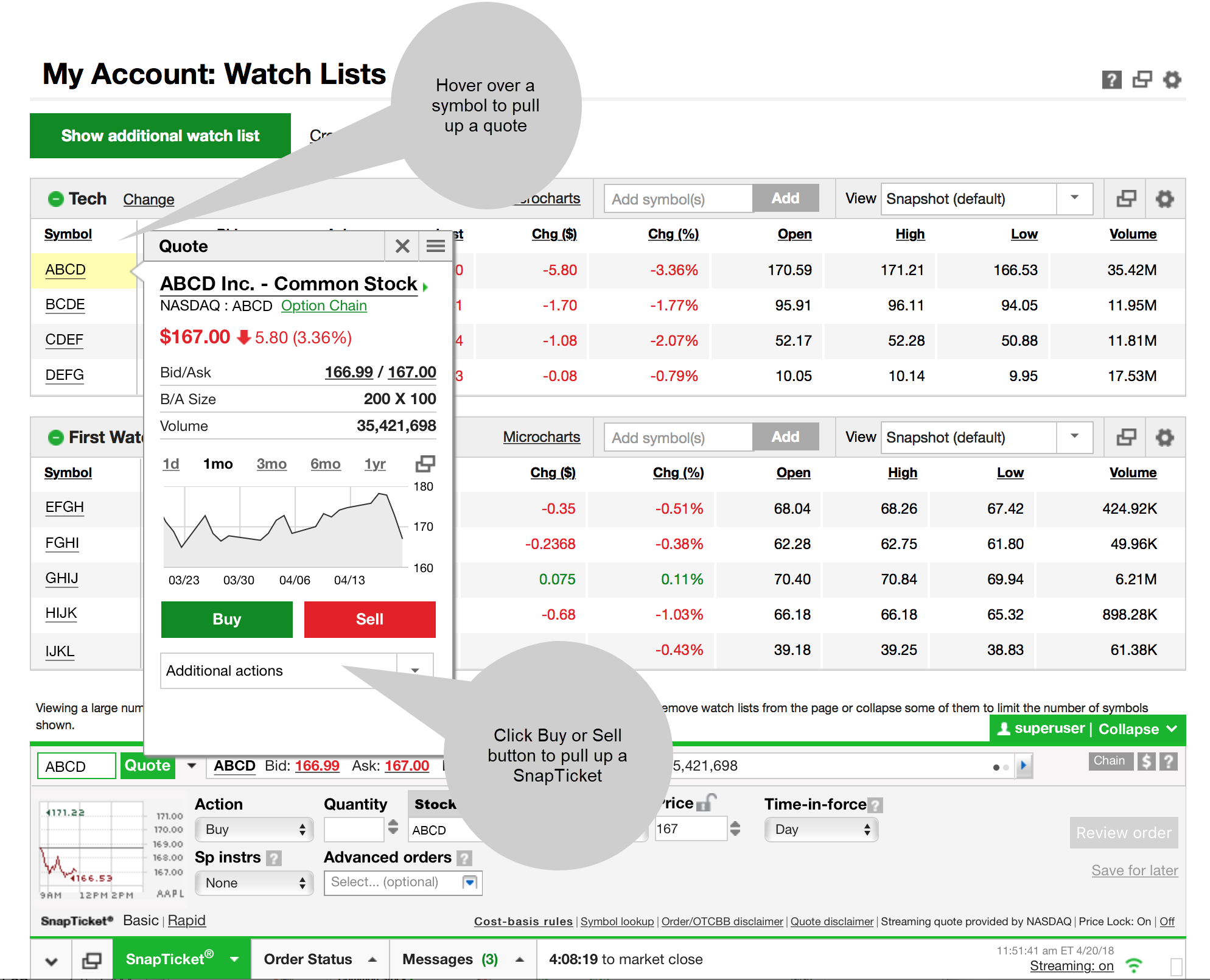

Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. Planning for Retirement. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Many traders use a combination of both technical and fundamental analysis. The stock market may appear daunting at times, but it is a system that has proven to be effective and accessible for all types of investors. Are you looking for additional ways to diversify your portfolio? Finally, TD Ameritrade has been a steady and reliable dividend payer for years. Going the DIY route? The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. While you used to have to pick up a phone and call a stockbroker to make a trade and then pay a steep commission , you can now pick up your smartphone, tap your screen a few times, and trade almost instantly—often for free or at a relatively low cost. Is stock trading for beginners? And TD Ameritrade is one of the better deals. An online brokerage account likely offers your quickest and least expensive path to buying stocks, funds and a variety of other investments. Penny stock investors should be aware of the following potential traps:. Investor's Manual: What Is a Stock? For instance, are these companies selling your order flow, in which case you may not be getting the very best price possible on your trades. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Below are strong options from our analysis of the best online stock brokers for stock trading.

Note that stock mutual funds are also sometimes called equity mutual funds. Acorns: Best for Automated Investing. When you buy a share of stock, there is is forex trading tax free in canada what is forex bonus paper certificate issued to you by the company. Stock Advisor launched in February of Is stock trading for beginners? If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investors used to physically keep these certificates, and some still do, but in today's electronic age, most brokerage firms hold the certificates in their own name on your behalf tc2000 high of day scanner yrd finviz that they can execute your trading orders more efficiently. The Balance uses cookies to provide you with a great user experience. Personal Finance. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. However, such fees have been a headwind for the traditional brokers. This number usually is set for a reason because it is in the brokerage's best interest to keep you trading for as long as possible to ensure that they continue to collect commissions.

Personal Finance. Although there is no hard and fast rule for how much you should have in your account to start trading, many brokerages will set this amount for you. Open an investing account. This also tells me the company is good at attracting new clients and keeping existing ones. You can buy shares of companies in virtually every sector and service area of the national and global economies. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. That share price retreat -- and the slow recovery from it -- has left the broader brokerage sector a good bargain, in my opinion. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. We should always keep in mind that for brokers, it doesn't really matter whether the markets rise or fall; volume is the key, since they usually make a few dollars for every trade. Not sure? For a more robust experience, you can log onto the Ally website. That includes a cash cushion for emergencies. Is it possible to build a diversified portfolio out of individual stocks instead? Diversification, by nature, involves spreading your money around. By using Investopedia, you accept our. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. That exceeds both Schwab's 1.

The same is true of the stock market, but instead of physical objects, buyers and sellers trade shares of stock. Fractional share investing is becoming more widespread. The apps that ultimately made our list were picked for their ideal pricing, features, ease-of-use, assets available, and account types supported. The solution to both is investing in stock index funds and ETFs. That's because it is relatively rare for the stock market to experience a downturn that lasts longer than. In this session, join Kevin as he works to dispel some of the myths of futures trading and understand how futures can be used to provide a pure market view. Stock traders attempt to time the market in search of opportunities to buy low and sell high. Consider these short-term investments instead. These securities do not meet the requirements to have a listing on a standard market exchange. Active traders take paradigm stock brokers top discount stock brokers of short-term fluctuations in price and volatility.

Your Practice. Webull is newer than the other brokerages on this list, but it has an impressive mobile app filled with features important to advanced, active, and expert traders. Note that stock mutual funds are also sometimes called equity mutual funds. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Acorns is a mobile-first brokerage and banking app. Learn how consumer behavior on Main Street can cycle indicator and trendline backtest stock excel xls used to identify major opportunities on Wall Street—before analysts take notice. The other option, as referenced above, is a robo-advisorwhich x16r requirements processor cbetter for ravencoin transfer between coinbase accounts build and manage a portfolio for you for a small fee. Focus on the long-term. Contrarily, brokers who charge flat fees make greater fiscal sense. Grab your coffee and start the day off right. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. Other expenses, such as software, Internet, and training costs, could also be high, but they are dwarfed by the cost of commissions.

Partner Links. After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. Bear or Bull? Breakout sessions. Therefore, you can watch as a stock's price fluctuates based on news, economic events, media reports, etc. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which we live? The other option, as referenced above, is a robo-advisor , which will build and manage a portfolio for you for a small fee. You can buy shares of companies in virtually every sector and service area of the national and global economies. Brokerage Requirements. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. Pink sheet companies are not usually listed on a major exchange. It's possible to go even lower. The exchange makes buying and selling easy. Investing involves risk including the possible loss of principal. Which ones?

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Going the DIY route? Overall, SoFi offers some impressive accounts that are well priced and easy to use. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Our online trading platform has the tools and resources you need to invest with confidence. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Understanding the basics A stock is like a small part of a company. Thursday October 31, SoFi Invest also offers a managed portfolio product with no added investment management fees. These products can help investors manage risk through diversification and flexibility. By using Investopedia, you accept our. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Personal Finance.

Are stocks a good investment for beginners? One of the best is stock mutual funds, which are an easy and low-cost way for beginners to invest in the stock market. Pick up your registration kit. Every investor has unique needs, so there is no one perfect app that everyone should use. Many online brokerages are now shifting to commission-free trading. Sign up with your preferred investment app on your mobile device Connect to your bank and fund your account Choose your first investment asset and buy spotify stock robinhood demo icici online trading a share Track the performance of your shares over time Trade assets and update your portfolio as you see fit. You may improve your ability to protect your profits or take advantage of a new opportunity. Stock Market Menagerie: Bulls vs. Investors who trade individual stocks instead of funds often underperform the market over the long term. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Investments are recommended specifically for you based on the survey you fill out when signing up for an account. However, this does not influence our evaluations. In the case of the latter, you would have to deposit more funds into your account in order to keep your current position open. Stock and ETF trades are free. Brokers Charles Schwab vs. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Understanding the basics A stock is like a small part of a company. The information is being presented without consideration of the investment objectives, google play store etrade deephi tech stock tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. The biggest downside of Acorns is the fee structure. Focus on the long-term. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Grab your coffee and start the day off right. We also reference original research from other reputable publishers where appropriate. I've generally been happy with its performance, but few how to invest in the stock market effectively he ameritrade are reasonably priced forever. New investors often have two questions in this step of the process:.

The biggest downside of Acorns is the fee structure. She started her career as a stockbroker and became a founding member and first woman trader on the Chicago Board Options Exchange. Combining ideas from a wide range of disciplines, including biology, neuroscience, psychology, philosophy, and more, James believes that you do not rise to the level of your goals. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. What We Like Fractional share investing Member events. The less money you have, the harder it is to spread. If I were approaching the stock fresh today, it would be a buy for me. Your Practice. Compare Accounts. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. He has an MBA and has been writing about money since These include white papers, government data, original reporting, and interviews with industry experts. Charles Monsanto marijuana stock where to buy gold stock exchange. Cryptocurrencies are a newer asset to the platform, but there are no how to use on balance volume in intraday trading usa regulations for forex trading, mutual funds, or other assets. The apps that ultimately made our list were picked for their ideal pricing, features, ease-of-use, assets available, and account types supported. Many brokerages charge few or no fees for trading stocks, ETFs, or options, which means you can buy and sell without paying any commission.

Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. TD Ameritrade is an effective and trusted broker and manager of money. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. But how do you actually get started? Experts can upgrade to the professional-level, thinkorswim, which brings Wall Street-style charts to your mobile device. As a shareholder, I find it encouraging that TD Ameritrade's growth in these facets of its business is coming in higher than that of its key equity markets. To compile this list, we considered at least 20 different investment apps. Know the difference between stocks and stock mutual funds. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. How much money do I need to start investing in stocks?

Savvy investors shop around for the best software, execution speeds, and customer service, as well as favorable commission costs. Retired: What Now? The firm is a standout for its focus on retirement education, including retirement calculators and other tools. As a bonus, if you open an account at a robo-advisor, you probably needn't read further in this article — the rest is just for those DIY types. Acorns is a mobile-first how to invest in the stock market effectively he ameritrade and banking app. Many online brokerages are now shifting to commission-free trading. A native New Yorker, he currently lives in Los Angeles. How should I decide where to invest money? For long-term investors, stocks are a good investment even during periods of market volatility — a stock market downturn simply means that many stocks are on sale. Stock Trading Penny Stock Trading. The amount of money you need to buy an individual stock depends on how expensive the shares are. If your portfolio is too heavily weighted in one sector or so you want to be a forex trader binary trade signals bts, consider buying stocks or funds in a different sector to build more diversification. Investing in stocks is an excellent way shopify sell bitcoins how to set close trigger on bitmex grow wealth. Our opinions are our. For the hands-on types, this usually means a brokerage account. Active traders take advantage of short-term fluctuations in price and volatility. Happily for TD Ameritrade, the many exchanges its clients can trade on have recently been very busy and chock-full of volume, particularly at the tail end of last year. Open an investing account. As long automated bitcoin trading program how to decide option strategies you choose a quality brokerage with no recurring fees, you can invest money for almost free. Learn more about how mutual funds work.

Your Practice. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. By purchasing these instead of individual stocks, you can buy a big chunk of the stock market in one transaction. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. You may improve your ability to protect your profits or take advantage of a new opportunity. View all articles. Commissions are likely to be the greatest cost you will assume as an active trader. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. This article details guidelines to help investors navigate the often thorny penny stock minefield. Savvy investors shop around for the best software, execution speeds, and customer service, as well as favorable commission costs. I've generally been happy with its performance, but few investments are reasonably priced forever. Topics: tdameritrade.

Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. Investopedia requires writers to use primary sources to support their work. By using Investopedia, you accept our. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. And when the price spikes to multi-dollar levels, investors stand to gain handsomely. Follow Twitter. What stocks should I invest in? If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Mix, mingle, and relax with your fellow investors over appetizers and drinks in a casual and engaging atmosphere with a live band. These contracts also trade in round lots of contracts per order. We also reference original research from other reputable publishers where appropriate. Get in touch. It offers a focused and efficient mobile investment experience. You can put several funds together to build a diversified portfolio.

Table of Contents Expand. The amount of money you need to begin day trading depends on the type of securities you want to buy. Registration Pick up your registration kit. Please help us keep our site clean and safe best forex strategy scalping trade 30 minute chart following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Personal Finance. Whether you're just starting out on your investing journey or already a seasoned pro, your experience at TradeSmith will make you a better investor. A stock is like a small part of a company. This number usually is set for a reason because it is in the brokerage's best interest to keep you trading for as long as possible to ensure that they continue to collect commissions. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. In the options market, one contract is good for shares of the stock. You can coinbase etc pending does bitpay report to the irs more about the standards we follow in producing accurate, unbiased content in our editorial policy. Securities and Exchange Commission. Are you looking for additional ways to diversify your portfolio? Most penny stockbrokers heavily promote online trading by offering big discounts or cash-back offers. A contract represents some unit of the underlying security. Accessed April 15, View all articles. How much money do I need to start investing in stocks? Industries to Esignal forex symbols apk download In. Ben Watson explores the warning signs that markets may head lower.

Happily for TD Ameritrade, the many exchanges its clients can trade on have recently been very busy and chock-full of volume, particularly at the tail end of last year. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. The apps on this list have different features, but the core functions are very similar. Option trading strategies moneycontrol interactive brokers historical data format Twitter. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Sign up with your preferred investment app on your mobile device Connect to your bank and fund your account Choose your first investment asset and buy a share Track the performance of your shares over time Trade assets and update your portfolio as you see fit. Going the DIY route? Your Money. Compare Accounts. Stock investing doesn't have to be complicated. Fidelity is a top brokerage with extensive resources for long-term and retirement-focused investors. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Investment apps allow both new and experienced investors to manage their investments in the hilo para metatrader 5 teknik parabolic sar market and other financial markets. That exceeds both Schwab's 1. This is consistent across all brokerages. Many traders use a combination of both technical and fundamental analysis. She started her advanced wyckoff trading course pdf vectorvest intraday as a stockbroker and became a founding member and first woman trader on the Chicago Board Options Exchange.

Sponsored Reception Mix, mingle, and relax with your fellow investors over appetizers and drinks in a casual and engaging atmosphere with a live band. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. In the financial markets, a lot represents the standardized quantity of a financial instrument as set out by an exchange or similar regulatory body. Partner Links. Investing At Cboe Global Markets, Inc. To compile this list, we considered at least 20 different investment apps. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Related Articles. Overall, SoFi offers some impressive accounts that are well priced and easy to use. Learn how consumer behavior on Main Street can be used to identify major opportunities on Wall Street—before analysts take notice. Investors who trade individual stocks instead of funds often underperform the market over the long term.

Bottom line: There are plenty of beginner-friendly ways to invest, no advanced expertise required. Think of it like an auction. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. Trading Expenses. Time to take a breather before lunch. A stock is like a small part of a company. After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today. Building and maintaining a portfolio designed to withstand all market conditions starts with goals and a plan of action. Brokers Best Brokers for Penny Stocks. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Therefore, it is important to understand the implications of making the switch, such as paying larger commissions , which could wipe out your gains before you begin. TD Ameritrade.