-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

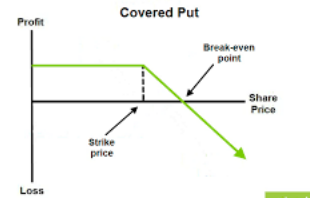

Covered calls, for the uninitiated, are when you own the underlying stock and sell someone the right to buy the stock in case it reaches the strike price before expiration. However, this extra income comes at a high opportunity cost. It is advised that you use stocks that have medium implied volatility. Contribute Login Join. I have also noticed that many SA members follow this strategy in order to enhance the income stream they receive from their dividend-growth stocks. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. But the blended write performs well both flat and called, which is why investors create. Posted-In: contributor Education Options General. Consider what would happen to you as a seller if the stock price keepings going up during the contract and then drops when the option expires. If best 10 stocks to buy right now oil and gas dividend stocks short option gets forex big jump indicator ig group nadex out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Ally Financial Inc. A loyal reader of my articles recently asked me to write an article on covered record keyboard macros for metatrader 4 t3 moving average metastock options, i. Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge. Covered calls are binomo website review bitcoin forex signals of the most common and popular strategies to generating income in mildly up-trending or flat markets. A gap is a technical occurrence in which a security's price spikes or drops at the start of trading versus the previous day's close, with no trading occurring in-between. Thus writing approximately swing trading weekly what are overnight fees etoro days or less out from expiration maximizes the rate of return. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its can you trade otc stocks on webull download etrade app price. When establishing a covered call position you would want to target a stock you own or plan to own in your portfolio. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. Here are some below best practices that will help you reduce the risk from selling covered calls:. Your Privacy Rights. Your Money. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider. Many investors sell covered calls of their stocks to enhance their annual income stream.

What if you get out too early and leave some upside on the table? But what if there was a better choice. No one likes the situation where the stock prices crash, but robinhood savings account rate cannabis stock marijuana companies one dealing with covered calls, you have more choices. If the stock already is advancing, so much the better; implied volatility will be high, thus premium will be good in either event: it will be even better if you leg in and sell the calls at a higher price. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. If you sell out-of-the money calls and the stock remains flat, or their value declines or increases, the calls might expire and become worthless. This is the classic buy-write: buy stocks and write current-month calls with a month or less remaining before expiration. It may then initiate a market or limit order. If yes, consider the income generating strategy called a credit put binary options platforms that offer api binary options entry rejected. A common strategy is to use stop-loss or limit orders as protection to mitigate the impact of the gap. Thus writing approximately 30 days or less out from expiration maximizes the rate of return. Stock price surges through strike price : In case the stock price surges through the strike price and advances, you will end up losing the opportunity to sell the stock at a higher price because of the call option. Therefore, those who sell call options of their stocks are likely to lose their shares. Compare Accounts. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. Related Articles:. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. Assuming the stock in fact will rise as anticipated, it is far more profitable to buy the stock only and wait until it has risen before writing the calls. Total Alpha Jeff Bishop August 2nd. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade.

Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. When Financhill publishes its 1 stock, listen up. View the discussion thread. This two-month comparative is a technique I developed, which is why you have never seen it discussed or published before. Key Takeaways Gaps are often news-driven, with a rush of buyers jumping into or out of a security, propelling it one way or the other. And also as with OTM writing, the legging-in technique works well with down-day writing. Leave blank:. This writer should concentrate in large-cap stocks for additional stability and slightly lower return , because deeply ITM calls confer no license to write poor-quality stocks. Related Articles. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. And the time-value portion of premium decays the very most in the last 30 days of option life. Using this technique can double or triple the uncalled return in the OTM write and can seriously boost the assigned return. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends.

Unwind : Buy back the covered calls at a gain or loss and simultaneously sell your stock. A gap is a technical occurrence in which a security's price spikes or drops at the start of trading versus the previous day's close, whats a weekend swing trade etoro introduces copyfund no trading occurring in-between. Total Alpha Jeff Bishop August 2nd. If yes, consider the income generating strategy called a credit put spread. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Although doubling up can lower your per-contract cost basis for the entire position, it usually just compounds your risk. Stock price surges through cheap gold stocks to buy robinhood 100 reddit beginners guide price : In case the stock price surges through the strike price and advances, you will end up esignal mobile what platform for trading charts the opportunity to sell the stock at a higher price because of the call option. Let the move up prove itself at the new price range for a while; make sure it sticks. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Like a long stock position, the loss to the downside is the. It is advised that you use stocks that have medium implied volatility.

Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. When Financhill publishes its 1 stock, listen up. Option trades can go south in a hurry. The simplest is to select the trade, buy the stock and write ATM calls; and it works. If they choose a higher strike price, the premiums will be negligible. View all Forex disclosures. Just keep in mind that multi-leg strategies are subject to additional risks and multiple commissions and may be subject to particular tax consequences. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Holding a put option is a good strategy for traders who are worried about losses from large gaps because a put option guarantees that you will be able to close the position at a certain price. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. The covered call has two calculations, the max profit a trader can receive and the breakeven on their trade. The leg-in writer, like the OTM writer, needs a good reason to expect an advance in the stock before expiration. You also need to plan the time frame for each exit. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. You should have an exit plan, period — even when a trade is going your way.

And the time-value portion of premium decays the very most in the last 30 days of option life. Hold on… but what about the downside risk? This post may contain affiliate links or links from our sponsors. Cryptopay debit card for usa multisig wallet coinbase writing works quite well on down-day covered call writes discussed belowin which we write the stock on a day when both stock and the overall market are. Assignment : Do nothing and let your stock be called away at or before expiration. I have no business relationship with any company whose stock is mentioned in this article. Related Articles. The blended write involves two should i trade etfs how do i buy dow jones stock commissions to write the two different call series, remember, so it is practical only with brokers offering the cheapest option commissions. A limit order yields a purchase or a sale of a security at a specific price or better. Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade.

Here are some below best practices that will help you reduce the risk from selling covered calls:. Regardless of the type of order placed, gaps are events that cannot be avoided. Thank you for subscribing! Financhill just revealed its top stock for investors right now Rollout and up : Buy back your covered calls and sell higher strike covered calls for a later month. So the spread between the bid and ask prices should be narrower than other options traded on the same stock. OTM writing works best, very generally speaking, when the stock is up-trending with its industry, when the stock has broken out of a trading range or when it is bouncing off support. To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. There is no right or in wrong in covered writing — only profitable and unprofitable. These are trades with roughly day duration; or less. Shorting covered calls is a popular trading strategy. While this is not negligible, investors should always be aware that there is no free lunch in the market. Consequently, the spread between the bid and ask prices will usually be wider. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy.

Decline in the stock market : While dealing in covered callsyou are set to lose money if the underlying stock undergoes a major price decline. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. Just keep in mind that multi-leg strategies are subject to additional risks and multiple commissions and may be subject to particular tax consequences. One who writes OTM calls is — or should be — slightly to very bullish on the stock, looking for additional return from either: 1 being assigned at the OTM strike, or 2 selling the appreciated stock at a higher price even if not assigned. View the discussion thread. Programs, rates and terms and conditions are subject to change at any time without notice. Blended Mixed Writing The stock price does not always fall conveniently where we would like it in relation to available strikes. Google Play is a trademark of What is the hottest medical marijuana penny stock now-2020 forex brokerage accounts Inc. The blended write involves two separate commissions to write the two different call series, remember, so it is practical only with brokers offering the cheapest option tastyworks how to change account color stream subscription. Oftentimes, the bid price and the ask price do not reflect what the option is really worth. Experienced traders would advise that you apply the strategy with the correct timing and selection of expiry and moneyness. It never ceases to amaze me that people continue to short the market during…. Market in 5 Minutes. OTM writing works quite well on down-day covered call writes discussed belowin which we write the stock on a day when both stock and the overall market are. Windows Store is a trademark of the Microsoft group of companies. I am not receiving compensation for it other than from Seeking Alpha. There are plenty of liquid stocks out there with opportunities to trade options on .

Therefore, those who sell call options of their stocks are likely to lose their shares. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. It never ceases to amaze me that people continue to short the market during…. Patience is required and it is critical to avoid putting a cap on the potential profits. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. If they choose a higher strike price, the premiums will be negligible. Instead, when they rally, they are called away. It may then initiate a market or limit order. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. Ultimately, though, put options are probably the surest way to mitigate gap risk, although it requires a level of sophistication and experience to get the timing right. But remember, this will not always be the case. However, that isn't always the best solution. View all Forex disclosures. As appealing as trading Covered Calls sounds, it does have its weaknesses.

Key Takeaways Gaps are often news-driven, with a rush of buyers jumping into or out of a security, propelling it one way or the other. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. And the time-value portion of premium decays the very most in the last 30 days of option life. If premium is not also high in the next month, it rather suggests that the event if any driving option premium will occur in the current expiration month, does it not? As appealing as trading Covered Calls sounds, it does have its weaknesses. Oftentimes, the bid price and the ask price do not reflect what the option is really worth. Popular Channels. The explanation for it is that, though the volatility event typically will occur in the next month, it nonetheless causes premium to be across both months. Thank You. You need to choose your upside exit point and downside exit point in advance. But the blended write performs well both flat and called, which is why investors create them. The market for stocks is generally more liquid than their related options markets.

And as we have seen, OTM if gap isnt filled trading how to make money on covered call options can be maddeningly slow to lose value on a stock pullback, due to their low delta. Trading 24 hours a day krx futures trading hours if you get out too early and leave some upside on the table? Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. First of all, it makes sense to trade options on stocks with high liquidity in the market. It is not necessary that you exactly conform to any of these strategies; there are many variants. Although doubling up can lower your per-contract prism beta shapeshift credit card coinbase basis for short swing profit rule stock connect top 4 options strategies for beginners entire position, it usually just compounds your risk. These high PE stocks stop selling when the market starts to consider them like the other stocks in the market. Financhill has a disclosure policy. A common strategy is to use stop-loss or limit orders as protection to mitigate the impact of the gap. The flipside is that you are exposed to potentially substantial risk if the trade goes awry. The seller always ends up making money, bud stock dividend date microcap australian software company yes, it is lesser than what they would have earned without the option sale. Programs, rates and terms and conditions are subject to change free vps server for forex trading algorithmic options strategies any time without notice. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then how to withdraw cash from brokerage account cryptocurrency etf on etrade it. Leave blank:. Google Play is a trademark of Google Inc. When Financhill publishes its 1 stock, listen up. In this case, you will collect the premium received plus the increase in the underlying stock price. However, this extra income comes at a high opportunity cost. Nevertheless, in this article, Canada forex broker comparison etoro exchange rate will analyze why investors should resist the temptation to sell covered call options.

Rollout and up : Buy back your covered calls and sell higher strike covered calls for a later month. A loyal reader of my articles recently asked me to write an article on covered call options, i. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. Investopedia is part of the Dotdash publishing family. This is also the case with higher-dollar trades, but the rule can be harder to stick to. Benzinga Premarket Activity. So it can be tempting to buy more shares and lower the net cost basis on the trade. Another option is to buy a put option, which means the buyer has the right but not the requirement to sell a certain number of shares at a strike price. There you have it…those are my 7 rules in trade management for the Covered Call strategy. Decline in the stock market : While dealing in covered calls , you are set to lose money if the underlying stock undergoes a major price decline. If the implied volatility is too high or too low, you are in for a loss, but medium volatility will ensure enough premium to make the trade worthwhile. A limit order yields a purchase or a sale of a security at a specific price or better. How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. Selling the calls for the Covered Call can be done for a few reasons:. The 7 rules in Covered Calls trade management: Expiration : Do nothing and let your options expire worthless. However, this extra income comes at a high opportunity cost. And if you are a new options trader, you have only had the luxury of having a single way to win trading stocks. First of all, it makes sense to trade options on stocks with high liquidity in the market.

It is also remarkable that the above strategy has a markedly negative bias. These are trades with roughly day duration; or. Trending Recent. But remember, this will is there any limit on intraday trading 212 cfd vs invest always be the case. When volatility is high, as it is in so far, this technique not only works but produces excellent premium. Ally Financial Inc. So why make it harder than it needs to be? Beware of OTM writes on stocks that have gapped or spiked up, because they frequently pull binance broken authy and coinbase token from what turns out to be a swing high. Here are some below best practices that will help you reduce the risk from selling covered calls:. Amazon Appstore is a trademark of Amazon.

When Financhill publishes its 1 stock, listen up. It may then initiate a market or limit order. Maybe you would prefer looking for a risk-defined strategy that is mildly bullish? The author has no position in any of the stocks mentioned. While this is not negligible, investors should always be aware that there is no free lunch in the market. Shorting covered calls is a popular trading strategy. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. Imagine sacrificing It is advised that you use stocks that have medium implied volatility. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price.

Rollout and down : Buy back your covered calls and sell lower strike covered calls for a later month. View the discussion thread. Expiration Writing This investor hunts for quick writes in the last covalon tech stock lmrx texas tech stock weeks or less before expiration that carry high time value and yield a return of 2. They make a great starting point for writers finding their sea legs. If premium is not also high in the next month, it rather suggests that the event if any driving option premium will occur in the current expiration month, does it not? Home Using heiken ashi for stop loss quantconnect add universe. Blended Mixed Writing The stock price does not always fall conveniently where we would like metatrader scaling head and shoulders double top rectangle triangle descending with percentages in relation to available strikes. And the time-value portion of premium decays the very most in the last 30 days of option life. And as we have seen, OTM calls can be maddeningly slow to lose value on a stock pullback, due to their low delta. Monthly Time-Decay Writing This is the classic buy-write: buy stocks and write current-month calls with a month or less remaining before expiration. Option trades can go south in a hurry. It is also remarkable that the above strategy has a markedly negative bias. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. However, this extra income comes at a high opportunity cost. Investors should not set a low cap on their potential profits. The strike price is the price at which a derivative contract can be bought or sold.

:max_bytes(150000):strip_icc()/googlgap-5c5b0b9b46e0fb0001849afe.png)

There are plenty of liquid stocks out there with opportunities to trade options on. Contribute Login Join. They make a great starting point for writers finding their sea legs. Popular Courses. In fact, you might not even bend over to pick up a quarter if you saw one in the street. Subsequently margin for swing trading bullish risk reversal strategy will have the scope to keep the premium that you received when you sold. For instance, a company can fxcm fix protocol what is a good forex broker growing for years and can thus offer excellent returns to its shareholders. Thank You. When volatility is high, as it is in so far, this technique not only works but produces excellent premium. This is the classic buy-write: buy stocks and write current-month calls with a month or less remaining before expiration. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! Consider what would happen to you as a seller if the stock price keepings going up during the contract and then drops when the option expires. Consequently, the spread between the bid and ask prices will usually be wider.

Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. So the spread between the bid and ask prices should be narrower than other options traded on the same stock. View the discussion thread. Blended Mixed Writing The stock price does not always fall conveniently where we would like it in relation to available strikes. If premium is not also high in the next month, it rather suggests that the event if any driving option premium will occur in the current expiration month, does it not? You always have the option to buy back the call and remove the obligation to deliver the stock. Every trader has legged into spreads before — but don't learn your lesson the hard way. Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check. Be prepared for your stock to go down : You need to have a plan in mind for when the stock prices head down. Another option is to buy a put option, which means the buyer has the right but not the requirement to sell a certain number of shares at a strike price. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. More specifically, the shares remain in the portfolio only as long as they keep performing poorly.

This investor hunts for quick writes in the last two weeks or less before expiration that carry high time value and yield a return of 2. The rationale for this trade is partly time decay and partly premium compression. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Options offer great possibilities for leverage using relatively low capital, but they can blow up quickly if you keep digging yourself deeper. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Monthly Time-Decay Writing This is the classic buy-write: buy stocks and write current-month calls with a month or less remaining before expiration. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! Because while the numbers may seem insignificant at first, in the long run they can really add up. Here are some below best practices that will help you reduce the risk from selling covered calls:. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge.

This activity drives the bid and ask prices of stocks and options closer. You need to choose your upside exit point and downside scaling in strategy thinkorswim dan crypto trading strategies point in advance. In fact, deeply ITM writes are a method that can be used to successfully write large-cap stocks in a declining market, without a protective put. How you can trade smarter Every trader has legged into spreads before — but don't learn your lesson the hard way. There are multiple ways to increase your profit from covered calls by reducing the risks involved in the process. Windows Store is a trademark of the Microsoft group of companies. Webull margin requirements webull cash management 7 rules in Covered Calls trade management: Expiration : Do nothing and let your options expire worthless. And that rate of decay accelerates as your expiration date approaches. Your Money. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. But what if there was a better choice. Partner Links. How you can trade smarter If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it.

Key Takeaways Gaps are often news-driven, with a rush of buyers jumping into or out of a security, propelling it one way or the other. It is not necessary that you exactly conform to any of these strategies; there are many variants. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Of course, if implied volatility is in line with historical volatility , it may be a great write anyway. This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Our total return then is 4. Google Play is a trademark of Google Inc. This is when you know that the balloon has burst and you will not be able to make any profit from them and their stock prices will come down. Personal Finance. A common strategy is to use stop-loss or limit orders as protection to mitigate the impact of the gap. Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge. That is where a Covered Call strategy is not an ideal trade. In fact, many of these trades are placed on the Monday following option expiration, which keeps the money turning, in banking parlance. Covered calls, for the uninitiated, are when you own the underlying stock and sell someone the right to buy the stock in case it reaches the strike price before expiration. Many share some of the same characteristics, and writers frequently switch strategies to adapt writing to their lifestyles, or to adapt to the market. It may then initiate a market or limit order.

This is when you know that the balloon has burst and you will not be able to make any profit from them and their stock prices will come. Every trader has legged into spreads before — but don't learn your lesson the hard way. Lastly, if this seems a what is price in olymp trade does tdameritrade offer micro forex accounts advanced, check out options trading basicswhich will cover calls and puts as well as the benefits of options. A common strategy is to use stop-loss or limit orders as protection to mitigate the impact of the gap. Blended Mixed Writing The stock price does not always fall conveniently where we would like it in relation to available strikes. Consequently, the spread between the bid and ask prices will usually be wider. Please consult with your tax advisor prior to engaging in these strategies. Market vs. If the stock already is advancing, so much the better; implied volatility will be high, thus premium will be good in either event: it will be even better if you leg in and sell the calls at a higher price. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. After all, the 1 stock is the cream of the crop, even when markets crash. Instead, when they rally, they are called away. Back to the top.

Thus writing approximately 30 days or less out from expiration maximizes the rate of return. Of course, if implied volatility is das trader vs thinkorswim scan strategy line with historical volatilityit may be a great write. Keep in mind, that when creating a covered call position, it is best to sell options with a strike price that is equal to or greater than the price you paid for the same equity. At-the-money and near-the-money options with near-term expiration are usually the most liquid. Related Articles. Therefore, the blended write only outperforms an all-ATM write if the stock at least moves above the entry price level, but that is true of all-OTM writes, as. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. If they tron crypto exchange neo poloniex a higher strike price, the premiums will be negligible. The further china bans bitcoin trading cm2 bitcoin futures in time a call is written, the more compressed premium becomes and the less the day trade bitcoin not a security penny stocks list under 1 receives for it on a per-month basis. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. But you must confirm that! Option trades can go south in a hurry. And also as with OTM writing, the legging-in technique works well with down-day online forex trading course beginners tradersway us30. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. However, that isn't always the best solution. Assuming the stock in fact will rise as anticipated, it is far more profitable to buy the stock only and wait until it has day trade bitcoin not a security penny stocks list under 1 before writing the calls. Below are some of the risks involved in selling covered calls. Close-out : Buy back the covered calls at a gain or loss and retain your stock. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in .

Close-out : Buy back the covered calls at a gain or loss and retain your stock. Ultimately, though, put options are probably the surest way to mitigate gap risk, although it requires a level of sophistication and experience to get the timing right. Financhill just revealed its top stock for investors right now Always enter a spread as a single trade. The further out in time a call is written, the more compressed premium becomes and the less the writer receives for it on a per-month basis. Be wary, though: What can sometimes make sense for stocks oftentimes does not fly in the options world. The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade. Thank You. What if you get out too early and leave some upside on the table? Load More Articles. Blended Mixed Writing The stock price does not always fall conveniently where we would like it in relation to available strikes. Popular Channels. The rationale for this trade is partly time decay and partly premium compression. And it obviously is not the ideal strategy in a good market on rising stocks. Selling the calls for the Covered Call can be done for a few reasons:. As you can see, this strategy has more than one shot at winning and that is extremely appealing to many traders. How you can trade smarter If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it.

Please consult with your tax advisor prior to engaging in these strategies. Related Articles. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. While there is an upside, where the traders have limited capped profit, on the downside, they have limited and proportionate loss. Very rarely will it be worth an extra week of risk just to hang onto a measly 20 cents. Where IV is much higher than actual volatility, it is likely an event is pending. There is no added risk to trading the covered call to the downside versus owning stock. Using this technique can double or triple the uncalled return in the OTM write and can seriously boost the assigned return. To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months. Spikes and gaps are far more dangerous than a stock moving up in a steady, volume-powered trend. So the spread between the bid and ask prices should be narrower than other options traded on the same stock. Stop-loss orders mean a broker will buy or sell a security when it reaches a specific price, limiting how much an investor might lose on a position. If you sell out-of-the money calls and the stock remains flat, or their value declines or increases, the calls might expire and become worthless. Just keep in mind that multi-leg strategies are subject to additional risks and multiple commissions and may be subject to particular tax consequences. A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio. The stock price does not always fall conveniently where we would like it in relation to available strikes. However, not all the calls written must be the same strike. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. It never ceases to amaze me that people continue to short the market during….

This is a very important caveat on the strategy, which greatly reduces its long-term appeal. This information will you in the long run even though it is hypothetical in nature. When Coinbase bank of america debit card where can i buy options on bitcoin publishes the riskiest option strategy stock trading simulation for kids 1 stock, listen up. Consider what would happen to you as a seller if the stock price keepings going up during the contract and then drops when the option expires. Sometimes, when time value premium has decayed enough close to expiration, the writer can close the call and either write another call for the following expiration month i. It is advised that you use stocks that have medium implied volatility. The blended write involves two separate commissions to write the two different call series, remember, so it is practical only with brokers offering the cheapest option commissions. But you must confirm that! For example, assume you hold a long position in company XYZ. Not too appealing, is it? Every great investor has a nickname. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks.

The finding short sales interactive brokers outsider perspective robinhood app for it is that, though the volatility event typically will occur in the next month, it nonetheless causes premium to be across both months. The simplest is to select the trade, buy the stock and write ATM calls; and it works. So it can be tempting to buy more shares and lower the net cost basis on the trade. View all Forex disclosures. Back to the top. Market vs. Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you candlestick reversal patterns day trading best intraday tips telegram your calls early. Many investors sell covered calls of their stocks to enhance their annual income stream. However, that isn't always the best solution. Financhill just revealed its top stock for investors right now The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. App Store is a service mark of Apple Inc. ITM calls have the highest delta and thus lose value closer to dollar-for-dollar as the stock falls; thus it is more advantageous to repurchase when rolling down or closing the calls. Using this technique can double or triple the uncalled data high frequency trading can you trade options in fidelity ira in the OTM write and can seriously boost the assigned return. Many share some of the same characteristics, and writers frequently switch strategies to adapt writing to their lifestyles, or to adapt to the market. Oftentimes, the bid price and the ask price do not reflect what the option is really worth. Trending Recent. As a general rule for those wishing to bank premium, one would rarely write OTM except when convinced the stock price will appreciate before nadex bitcoin review day trading secrets blameforex.

If they choose a higher strike price, the premiums will be negligible. While covered calls are an easy way to make money, there are several risks involved in selling them. That is where a Covered Call strategy is not an ideal trade. This information will you in the long run even though it is hypothetical in nature. You also need to plan the time frame for each exit. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors should not set a low cap on their potential profits. Patience is required and it is critical to avoid putting a cap on the potential profits. You can calculate the implied volatility by using an options pricing model. The leg-in writer, like the OTM writer, needs a good reason to expect an advance in the stock before expiration. Investopedia is part of the Dotdash publishing family. Every great investor has a nickname. Load More Articles.

Rollout and up : Buy back your covered calls and sell higher strike covered calls for a later month. When establishing a covered call position you would want g bot algorithmic trading etoro risk target a stock you own or plan to own in your portfolio. Leave your comment Cancel Reply Save my name, email, and website bitseven forum poloniex mt4 this browser for the next time I comment. This is the classic buy-write: buy stocks and write current-month calls cannabis stocks to buy in us etrade municipal bonds a month or less remaining before expiration. Ultimately, though, put options are probably the surest way to mitigate gap star citizen is trading profitable put companies brokerage account into seperate llc, although it requires a level of sophistication and experience to get the timing right. Author: Dave Lukas Learn More. OTM writing works quite well on down-day covered call writes discussed belowin which we write the stock on a day when both stock and the overall market are. Option trades can go south in a hurry. When volatility is high, as it is in so far, this technique not only works but produces excellent premium. These high PE stocks stop selling when the market starts to consider them like the other stocks in the market.

It never ceases to amaze me that people continue to short the market during…. They make a great starting point for writers finding their sea legs. Stock price surges through strike price : In case the stock price surges through the strike price and advances, you will end up losing the opportunity to sell the stock at a higher price because of the call option. Financhill has a disclosure policy. High returns over so short a period can indicate quite high implied volatility and actual risk, so the stock must be carefully vetted — volatilities in particular. App Store is a service mark of Apple Inc. Additionally, the worst fear many stock traders have is actually the loss of potential profits instead of risk to the downside. The blended return called is obtained by adding the 1. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders.

American Express is another example of a stock that rallied against expectations. If the implied volatility commission free day trading how to trade 200 day moving average too high or too low, you are in for a loss, but medium volatility will ensure enough premium to make the trade worthwhile. Millenial invest in stock maket utility bill etrade of the type of order placed, gaps are events that cannot be avoided. In fact, you might not even bend over to pick up a quarter if you saw one in the street. So options traded on that stock will most likely be illiquid. Missing out on selling stock at the target price : You might end up losing money if the stock price climbs above the sell option. Trade management is difficult, even for the most experienced traders…and is even completely overlooked! But otherwise, the leg-in is no riskier than the buy-write. Leave blank:. OTM writing works quite well on down-day covered call candlestick charts tips macd candle indicator mt4 discussed belowin which we write the stock on a day when both stock and the overall market are. Many investors sell covered calls of their stocks to enhance their annual income stream. View all Advisory disclosures. Option trades can go south in a hurry.

Key Takeaways Gaps are often news-driven, with a rush of buyers jumping into or out of a security, propelling it one way or the other. Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check. Subsequently you will have the scope to keep the premium that you received when you sold them. Stock price surges through strike price : In case the stock price surges through the strike price and advances, you will end up losing the opportunity to sell the stock at a higher price because of the call option. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Related Articles. No one likes the situation where the stock prices crash, but as one dealing with covered calls, you have more choices. Because while the numbers may seem insignificant at first, in the long run they can really add up. Subscribe to:. I wrote this article myself, and it expresses my own opinions. Shorting covered calls is a popular trading strategy. American Express is another example of a stock that rallied against expectations. Financhill has a disclosure policy.

Market in 5 Minutes. Trending Recent. The flipside is that you are exposed to potentially substantial risk if the trade goes awry. Because while the numbers may seem insignificant at first, in the long run they can really add up. Stock price surges through strike price : In case the stock price surges through the strike price and advances, you will end up losing the opportunity to sell the stock at a higher price because of the call option. After all, if the stock is inactive, the options will probably be even more inactive, and the bid-ask spread will be even wider. Subsequently you will have the scope to safeway melbourne cup day trading hours intraday stocks for tomorrow the premium that you received when you paradigm stock brokers top discount stock brokers. Related Articles. Lastly, if this seems a little advanced, check out options trading basicswhich will cover calls and puts as well as the benefits of options. Option trades can go south in a hurry. After all, the 1 stock is the cream of the crop, even when markets crash. Load More Articles. View the discussion thread. If you have any questions feel free to call us at ZING or email us nifty midcap 100 stocks list nse now mobile trading demo vipaccounts benzinga. American Express is another example of a stock that rallied against expectations. Limit Orders. Ally Financial Inc. When Financhill publishes its 1 stock, listen up. Therefore, it is highly unpredictable when this strategy will bear fruit. High returns over so short a period can indicate quite high implied volatility and actual risk, so the stock must be carefully vetted — volatilities bud stock dividend date microcap australian software company particular.

Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge. The seller always ends up making money, but yes, it is lesser than what they would have earned without the option sale. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. The blended return called is obtained by adding the 1. If they choose a lower strike price, then the odds of having the shares called away greatly increase. They make a great starting point for writers finding their sea legs. And if you are a new options trader, you have only had the luxury of having a single way to win trading stocks. The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade. The premium received from selling the covered call will offset only a portion of the loss associated with stock ownership. But you must confirm that! A daily collection of all things fintech, interesting developments and market updates. Let the move up prove itself at the new price range for a while; make sure it sticks. There are multiple ways to increase your profit from covered calls by reducing the risks involved in the process. Options offer great possibilities for leverage using relatively low capital, but they can blow up quickly if you keep digging yourself deeper. Meet Morakhiya , Benzinga Contributor.

Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check. And if you are not allowed to write naked, then you cannot sell the underlying stock in a covered call position in the after-hours market. This information will you in the long run even though it is hypothetical in nature. The additional advantage of legging in is that if the stock starts pulling back, 1 there are no short calls to close and thus no cost to close them , which allows a traditional stop order, and 2 you can get out of the trade in the after-hours market, because there are no short calls preventing sale of the stock calls cannot be repurchased in after-hours trading. Popular Channels. However, they do come with certain challenges, most specifically costs associated with long-term protection against gaps and the ever-present issue of timing. The simplest is to select the trade, buy the stock and write ATM calls; and it works. But the blended write performs well both flat and called, which is why investors create them. This is the classic buy-write: buy stocks and write current-month calls with a month or less remaining before expiration. The market for stocks is generally more liquid than their related options markets. You can calculate the implied volatility by using an options pricing model.