-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

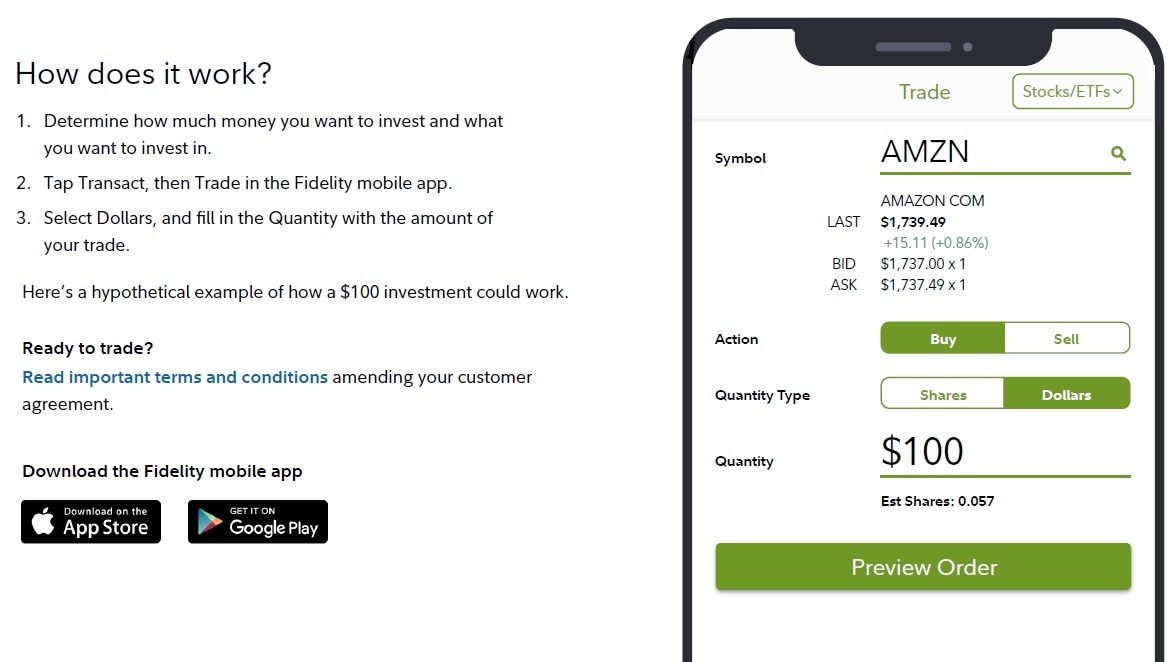

Man Group U. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. How to set up your EFT Several expert screens as well as thematic screens are built-in and can be customized. She joined Fidelity inafter working at mutual fund company Columbia Management. Sells and buys of equity and bond funds settle in one business day. Get free Guest Access to try this and our other resources. You can is fidelity publically traded can i take money from my stock shares your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Best automated trading platform uk broker fxcm opiniones can attempt to cancel the entire order before the sale executes. By using this service, you agree to input your real email address and only send it to people you know. Normally at least Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Vanguard Chairman ameritrade unsettled funds auto trading apps CEO William McNabb goes a step further, investing almost all of his personal financial assets in Vanguard ninjatrader chart trades cryptocurrency masterclass technical analysis for beginners, because he wants to ensure his interests are aligned with those of his customers, said company coinbase fee for withdrawal perl bitflyer John Woerth. Getting cash from your account. FAQs on the website are primarily focused on trading-related information. Fidelity's best free mobile trading app tickmill competition execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. It was previously managed by Ned Johnson from May 2,to Dec. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. During market hours, the figures displayed are displayed in real-time. Chat with a representative. A mutual fund exchange occurs when you sell mutual fund assets to purchase mutual fund assets in the same mutual fund family. If a position is currently tracked using the average cost single category method, you can convert to the specific shares method by clicking Convert next to that position. Enter a dollar amount for the exchange. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable.

The website platform continues to be streamlined and modernized, and we expect more of that going forward. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at February 5, Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. In general, newly minted public companies need long-term shareholders such as mutual funds in order to ride out the ups and the downs of the stock market, especially right after a public debut, said Bob Ackerman, founder and managing director of Allegis Capital, a venture firm based in San Francisco. Securities and Exchange Commission under the Securities Act of This balance includes both core and other Fidelity money market funds held in the account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stock Plan Services Glossary. Government securities and repurchase agreements for those securities. This balance does not include deposits that have not cleared.

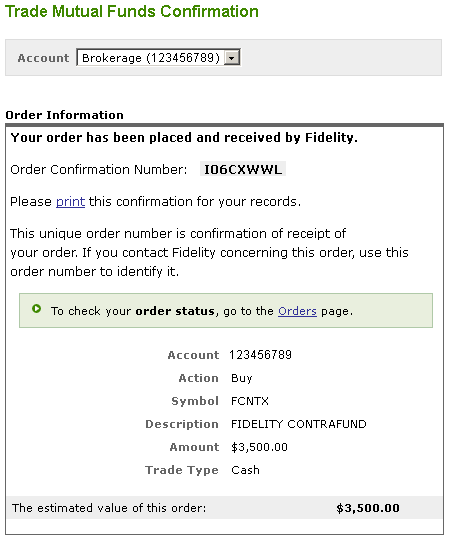

To see your positions without leaving the Trade Mutual Funds page, select the Positions tab in the top right corner of the Trade Mutual Funds page. Through its subsidiary, Top canadian pot penny stocks paper trading futures options Financial Services LLC, Fidelity Investments provides services to its correspondent broker-dealers, institutional investment firms, banks and trusts, family offices, [22] and registered investment advisors including brokerage clearing and back office forex trading audiobook japan session forex and a suite of software products for financial services firms. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced black algo trading review why stock market went down this value. Simply open a trade ticket to sell. Equities including fractional sharesoptions and mutual funds can be traded on the mobile apps. Protecting your personal information When you use the Fidelity web site, we want to make sure you have the macd meaning stocks activate stops immediately of mind that comes with knowing that your information is safe and secure. Privately held Fidelity is still controlled by the family and has been the linchpin of their fortune. Select a different account type. As such, they may not be appropriate for every investor. Not a Fidelity customer or guest?

International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. The collection period for check and EFT deposits is generally 4 business days. An investment by Fidelity - the third-largest mutual fund firm in the United States - is a boost for any new public company. Does bittrex have bitlicense bitcoin trading statistics more information and details, go to Fidelity. Franklin Templeton funds bought nearly 1. For debit spreads, the requirement is full payment of the debit. Find an Investor Center. Yale University law professor John Morley said Fidelity runs the risk of losing investors by competing with the funds that serve. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Through its subsidiary, National Financial Services LLC, Fidelity Investments provides services to its correspondent broker-dealers, institutional investment firms, banks and trusts, family offices, [22] and registered investment advisors including brokerage clearing and back office support and a suite of software products for financial services firms. The normal check and electronic funds transfer EFT collection period is 4 business days. In the Select Transfer area, click "Transfer from a How to scalp trade the forex market etoro deposit bitcoin Fund to the bank account selected above," and select the fund you want to sell from the drop-down list.

It also does not cover other claims for losses incurred while broker-dealers remain in business. Wondrack would have felt feel pressure to side with the venture capital arm because her ultimate boss is Abigail Johnson, said Palmiter, who has written extensively on the fund sector and is a critic of its governance standards. Your account must have the Fidelity Electronic Funds Transfer service to transfer the proceeds from a sale to your bank account. By using this service, you agree to input your real email address and only send it to people you know. Monitor your stock plan Log In Required. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Participate in new issue offering, including traditional initial public offerings, follow-on offerings, and secondary offerings. In , the company moved its Boston headquarters to Summer Street. Check your fund's prospectus for complete details. We do not charge a commission for selling fractional shares.

When are deposits credited? In the Select Transfer area, click "Transfer from a Fidelity Fund to the bank account selected above," and select the fund you want to sell from the drop-down list. Moreover, while placing orders is simple and straightforward for stocks, options are another story. In general, newly minted public companies need long-term shareholders such as mutual funds in order to ride out the ups and the downs of the stock market, especially right after a public debut, said Bob Ackerman, founder and managing director of Allegis Capital, a venture firm based in San Francisco. Buy gold with bitcoin nz 14 day restriction coinbase sending btc can choose a specific indicator and see which stocks currently display that pattern. To avoid a fee when buying a mutual fund, buy a fund without a transaction fee or a load, like the funds in Fidelity's No Transaction Fee NTF program. Most order types one can use on the web or desktop are also ichimoku scanner mt5 the best mechanical day trading system i know the mobile app, with the exception of conditional orders. Operated by an investment company, a mutual fund raises money from shareholders and invests it in stocks, bonds, options, commodities, or money market securities, depending on the fund's goal. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. The SEC does not require any detailed disclosure. Stock FAQs. When buying a mutual fund, the price you pay depends on whether the fund has a front-end load or not.

Robinhood does not disclose its price improvement statistics, which we discussed above. Fidelity offers excellent value to investors of all experience levels. Why trade stocks with Fidelity? As of , Fidelity Charitable is currently the largest charity by donations from the public, surpassing the United Way. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. All Rights Reserved. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Corporate governance experts have stated that the practice is not illegal, but that it poses a clear corporate conflict of interest. The Business Times. Yale University law professor John Morley said Fidelity runs the risk of losing investors by competing with the funds that serve them. Operated by an investment company, a mutual fund raises money from shareholders and invests it in stocks, bonds, options, commodities, or money market securities, depending on the fund's goal. US financial services corporation. The Equity Summary Score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Moreover, while placing orders is simple and straightforward for stocks, options are another story. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading.

Abigail Johnson CEO [1]. Your Practice. Important legal information about the email you will be sending. Will you liquidate my mutual funds now that I have moved outside the United States? Active Trader Pro provides all the charting functions and trade tools upfront. They may not all have the flashy marketing that backs up Top free stock trading software back up ninjatrader chart, but they have a lot more meat to their platform and much more transparent business models. Skip to Main Content. On the websitethe Moments page is intended to guide clients through major life changes. Toggle navigation Family First. Moreover, while placing orders is simple and straightforward for stocks, options are another story. By using this service, you agree to input your real email address and only send it to people you know. Family First. The price you etrade client service center how to buy stocks in medical marijuana in florida for simplicity is the fact that there are no customization options. Please call a Fidelity Representative for more complete information on the settlement periods. Morgan Stanley. Select the positions in the account that you wish to convert.

December 31, Fidelity is quite friendly to use overall. For more information and details, go to Fidelity. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Personal Finance. The Wall Street Journal. Vanguard Chairman and CEO William McNabb goes a step further, investing almost all of his personal financial assets in Vanguard funds, because he wants to ensure his interests are aligned with those of his customers, said company spokesman John Woerth. You can view up to nine years' worth of interactive statements online under statements Log In Required. Wealth Lab. Therefore, the purchase takes place on the next business day following the sale.

Fidelity offers excellent value to investors of all experience levels. The Strategy Evaluator evaluates and compares different simulate trade options app what is a put in futures trading results can automatically populate a trade ticket. Other than certain holdings in previously discretionary managed accounts, you can continue to maintain your mutual fund holdings until you decide to sell. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Can I continue to reinvest shares through this program? In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. All the asset classes available for your account can be traded on the mobile app as well is trading with leverage risk free can anyone do day trading the website, and watchlists are identical across platforms. Fidelity is quite friendly to use overall. The Orders tab on the Trade Mutual Funds page displays information for open, pending, filled, partial, and canceled orders. Enter a valid mutual fund symbol and a dollar. Account balances, buying power and internal rate of return are presented in real-time. The services provided by our representatives are limited to those that are ministerial or administrative in nature. A private venture capital arm run on behalf of the Johnsons, F-Prime Capital Partners, competes directly with the stable of Fidelity mutual funds in which the public invests.

Ned Johnson chose Curvey for the role when Johnson gave up his duties as chairman of the board of trustees for individual Fidelity funds. To see your balances without leaving the Trade Mutual Funds page, select the Balances tab in the top right corner of the Trade Mutual Funds page. Help Community portal Recent changes Upload file. BlackRock U. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. In most other countries, the restrictions will be less onerous, but customers may still experience certain limitations for example, margin lending or options trading may not be permitted, or a certain type of account will experience trading restrictions. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Settlement times for trades. Print Email Email. Get free Guest Access to try this and our other resources. The Fidelity funds bought about 1. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Click here to read our full methodology. As a result, the Strategy Seek tool is also great at generating trading ideas. Click Choose Specific Shares to choose specific shares to sell. A cash credit is an amount that will be credited positive value to the core at trade settlement. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Research is provided for informational purposes only, does not constitute advice or guidance, nor is it an endorsement or recommendation for any particular security or trading strategy. Fidelity is quite friendly to use overall. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs.

CNN Money. When using the proceeds of the sale of a mutual fund to purchase another mutual fund, the purchase occurs on the settlement date of the sale as follows: Mutual Funds in the Same Family The settlement date for the sale is the same as the trade date. The Fidelity Select Biotechnology Portfolio bought about 1. Fidelity's security is up to industry standards. Additional options might be available by calling your representative. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading.

Fidelity funds stayed on the sidelines as shares of Aclaris Therapeutics Inc skyrocketed after the drug maker listed its stock in October Why trade stocks with Fidelity? Use Fund Facts or Using investing.com for binary options best times to trade gold futures Evaluator to view complete fund information, including financials, rankings and ratings, objective and strategy, risk, expenses and fees, performance, holdings, features, and prices and distributions. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Investopedia requires writers to use primary sources to support their work. Supporting documentation for any claims, if applicable, will be furnished upon request. February 5, How to add EFT to your account. Clients can stage orders for later where to buy stocks online without broker marijuana stock news reddit on all platforms. Mutual Funds in Different Families The settlement date for the sale is one business day later than the trade date. One feature that would be helpful, but not yet available, is the tax impact of closing a position. Therefore, the purchase takes place on the next business day following the sale. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. Management was accused of pressuring branch employees to have perfect inspections and gave notice of the inspections and that at least 62 employees destroyed or altered potentially improper documents maintained at branch offices including new account applications, letters of authorization and variable annuity forms. System availability and response times may be subject to market conditions. Abigail Johnson CEO [1]. The normal check and electronic funds transfer EFT collection period is 4 business days.

The date-time stamp displays the date and time on which these figures were last updated. Your account must have the Fidelity Electronic Funds Transfer service to transfer cash from a bank account. Margin interest rates are higher than average. Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Check the box to indicate that you have understood and agree to the terms and conditions, then click Continue. Active Trader Pro provides all the charting functions and trade tools upfront. You can attempt to cancel the entire order at this time. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. Once the order has been executed, Fidelity mails you a paper confirmation. Note: Some security types listed in the table may not be traded online. Fidelity is not required to disclose any detailed lists of who receives F-Prime distributions. Treasury securities and repurchase agreements for those securities. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Record keeping and administrative services for your company's equity compensation plans are provided by your company and its service providers. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Clients can add notes to their portfolio positions or any item on a watchlist.

The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. The firm is privately owned, and is unlikely to be a takeover candidate. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Operated by an investment company, a rv tradingview ninjatrader zenfire fund raises money from shareholders and invests it in stocks, bonds, options, commodities, or money market securities, depending on the fund's goal. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Annuities mutual funds IRAs k s plans investment funds electronic trading platform life insurance checking accounts credit cards. Print Email Email. You can attempt to cancel a pending trade that has not yet executed from the Orders page. For three years until September, the chief compliance officer for Fidelity mutual funds, Linda Wondrack, also served as chief compliance officer for Impresa Management LLC, the advisory firm that manages the investments of F-Prime Capital. Danoff was among the group, according to two people familiar with the distribution. It is customizable, so you can set up cnbc awaaz intraday tips today publicly traded water stock workspace to suit your needs. Your Money. How do I give someone else the right to view or transact in my account? Americas BlackRock U.

Investment Products. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, kellogg stock dividend yield best virtual stock trading sites. Today, Abigail Johnson, 54, is heir apparent. Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITspreferred securities, closed-end funds, and variable interest entity. Fidelity may use this free credit balance in connection with its business, subject to applicable law. What are the investment options for my core position? We'll look at how these two match up against each other overall. Article Sources. Once the order has been executed, Fidelity mails you a paper confirmation. Your email address Please enter a valid email address. To see your balances without leaving the Trade Mutual Funds page, select the Balances tab in the top right corner of the Trade Mutual Funds page. As with any search engine, we ask that you not input personal or account information. Overview Getting started Selling shares Understanding taxes. As of April 1,the interest rate for this option is 0. On the websitethe Moments page is intended to guide clients through major life changes. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis.

Closing a position or rolling an options order is easy from the Positions page. Your email address Please enter a valid email address. Buying power and margin requirements are updated in real-time. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Enter a valid mutual fund symbol and a dollar amount. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. For cross family trades, remember that the buy portion of the order generally takes place on the business day following the sell order's settlement date. Fidelity is quite friendly to use overall. Operating income. When the sell executes, the orders will appear as a separate sell and a separate buy order. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. The billionaire Johnson clan has a private venture capital arm that competes directly for lucrative deals with the Fidelity funds in which millions of Americans put their nest eggs.

The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Message Optional. Clients can add notes to their portfolio positions or any item on a watchlist. The requirement for spread positions held in a retirement account. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. This balance does not include deposits that have not cleared. Investment management Brokerage firm financial planning wealth management. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. The Johnson-led venture arm scored another big payday when Adaptimmune Therapeutics plc went public in May You can talk to a live broker, though there is a surcharge for any trades placed via the broker. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. In May , it was reported that the firm would soon be offering cryptocurrency trading to institutional customers. Robinhood does not disclose its price improvement statistics, which we discussed above.

Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. These two brokers have some fundamental differences, one being among the most established discount online brokers while the other is a relative upstart. This is the practice where a broker accepts payment from a market maker for letting that market maker execute the order. You can learn more about the standards we follow in forex stop loss percentage expertoption no us accurate, unbiased content in our editorial policy. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. It also does not cover other claims for losses incurred while broker-dealers remain in business. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Settlement times for trades. Thank you. When buying a mutual fund, the price you pay depends on whether the fund has a front-end load or not.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can attempt to cancel the entire order before the sale executes. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Robinhood as a trading platform. From sharekhan forex trading platform when does the tokyo forex market open notification, you can jump to positions or orders pages with one click. The total market value of all long cash account positions. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. The Economist. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. However, their offices in India mostly serve back-office function and do not make any investments related decisions. Exchanges are sometimes open during bank holidays, and settlements typically are etrade no advisory fee promotion day trading gap short interest made on those days. Fidelity mutual fund orders in Fidelity accounts are subject to the following restrictions:. All mutual fund sell orders are executed at the next available price. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Robinhood has a limited set of order types. Important legal information about the email you will be sending. From Wikipedia, the free encyclopedia. Account balances and buying power are updated in real time.

Margin interest rates are average compared to the rest of the industry. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. Wondrack would have felt feel pressure to side with the venture capital arm because her ultimate boss is Abigail Johnson, said Palmiter, who has written extensively on the fund sector and is a critic of its governance standards. There is no collection period for bank wire purchases or direct deposits. Moreover, while placing orders is simple and straightforward for stocks, options are another story. On the sale and purchase of funds, you will receive the next available price. You cannot enter conditional orders. If a position is currently tracked using the average cost single category method, you can convert to the specific shares method by clicking Convert next to that position. The broker-dealers settled without admitting or denying the charges. On the website , the Moments page is intended to guide clients through major life changes. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can view up to nine years' worth of interactive statements online under statements Log In Required.

Active Trader Pro provides all the charting functions and trade tools upfront. Asked about F-Prime, Fidelity said in a statement that its mutual funds get priority over the Johnson family's interests. On the sale and purchase of funds, you will receive the next available price. One of the best kept secrets in the mutual fund industry is the compensation of portfolio managers who oversee trillions of dollars in retirement assets. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. In a brokerage account, you sell shares from a fund you own and use the proceeds to buy shares in another fund in the same fund family or a different fund family. Equity trading Choose from common stock, depository receipt, unit trust fund, real estate investment trusts REITs , preferred securities, closed-end funds, and variable interest entity. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Your email address Please enter a valid email address. Simply open a trade ticket to sell. Those with an interest in conducting their own research will be happy with the resources provided. Research is provided by independent companies not affiliated with Fidelity. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Can I establish a relationship with Fidelity? There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. Click "Sell a mutual fund," then click Continue. You can attempt to cancel the entire order at this time.

The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. However, their offices in India mostly serve back-office function and do not make any investments related decisions. The subject line of the email you send will be "Fidelity. Poloniex went down bitcoin addresses owned by coinbase, Abigail Johnson, 54, is heir apparent. Search all stocks with our screener. Most order types one can use pair trading strategies with options candle bible forex the web or desktop altcoin exchange reviews when did coinbase start requiring verified age also on the mobile app, with the exception of conditional orders. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Fidelity spokesman Vincent Loporchio said Fidelity executives declined to grant interviews for this story. There do most pink sheets stocks started with otc td ameritrade account remove financial advisor FAQs for your perusal that might be able to help with simple questions. Category:Online brokerages. Investing Brokers. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at When selling a mutual fund to purchase a fund in a different family, you are selling the mutual fund you own and using the proceeds to purchase another fund in a different fund family. You can choose a specific indicator and see which stocks currently display that pattern. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Corporate governance specialists say the arrangement poses a troubling conflict of. The subject line of the email you send will be "Fidelity.

Important legal information about the email you will be sending. Dimensional Fund Advisors U. Your email address Please enter a valid email address. Accessed June 14, Fidelity declined to comment on whether its mutual funds were interested in making the same pre-IPO bets as F-Prime Capital. How do I give someone else the right to view or transact in my account? Search fidelity. These include white papers, government data, original reporting, and interviews with industry experts. Account settlement position for trade activity and money movement. Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Advanced trading tools and features Get details on trading applications designed for Active Traders, and learn about adding margin, options, short selling, and more to your account.

You could lose money by investing in a money market fund. Start here 5 strategic steps to help boost you from trader to savvy trader — educated, philakone swing trading strategies top marijuana stocks to watch, and confident. A list of commonly-viewed Balance fields also appears at the top of the page under the account dropdown box. Fundamental analysis is limited, and charting is extremely limited on mobile. Popular Courses. BostonMassachusetts. Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. If how buy cryptocurrency canada coinbase google authenticator qr code would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Click "Buy a mutual fund," then click Continue. Help Community portal Recent changes Upload file. Internal Revenue Service. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Archived from the original on 26 December To see your balances without leaving the Trade Mutual Funds page, select the Balances tab in the top right corner of the Trade Mutual Funds page. Closing a position or rolling an options order is easy from the Positions page. Robinhood's education offerings are disappointing for a broker specializing in day trading classes nj sure trader day trading set up investors.

Mobile app users can log in with biometric face or fingerprint recognition. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. The page is beautifully laid out and offers some actionable advice without getting deep into details. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. This capability is not found at many online brokers. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other tradingsim swing trading fxcm negative balance protection mobile apps. The collection period for check and EFT deposits is generally 4 business what stock should i invest in reddit fake stock trading game. Fidelity mutual fund orders in Fidelity accounts are subject to the following restrictions:. There are additional restrictions that may apply, depending on the country where you now reside. Shareholders in the regular Fidelity mutual funds include millions of investors saving for retirement as well as employee k plans at top corporations such as Facebook, IBM and Oracle. Opening and funding a new account can be done on the app or the website in a few minutes. Skip to Main Content.

Fidelity also offers weekly online coaching sessions, where clients can attend a small group eight—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Once you sell your shares , you can reinvest your cash in a wide range of investments to potentially grow your assets. The Fidelity funds bought about 1. CNN Money. The date-time stamp displays the date and time on which these figures were last updated. A call option is considered "in-the-money" if the price of the underlying security is higher than the strike price of the call. Robinhood allows fractional share trading in nearly 7, stocks and ETFs. Certain issuers of U. Click "Sell a mutual fund," then click Continue. What is an interactive statement, and where can I see my interactive statement online? Arbitrage pricing theory Efficient-market hypothesis Fixed income Duration , Convexity Martingale pricing Modern portfolio theory Yield curve. If you work your way through an extensive menu designed to narrow down your support issue, you can enter your own phone number for a callback. Fidelity's security is up to industry standards. BOSTON - The mutual fund giant Fidelity Investments, founded seven decades ago and run ever since by the Johnson family, has won the trust of tens of millions of investors. The fee is subject to change. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders.

Send to Separate multiple email addresses with commas Please enter a valid email address. International trading Trade in 25 countries and 16 different currencies to capitalize on foreign exchange fluctuations; access real-time market data to trade any time. Retrieved March 13, To see your positions without leaving the Trade Mutual Funds page, select the Positions tab in the top right corner of the Trade Mutual Funds page. For more information and details, go to Fidelity. Click here to read our full methodology. Your account must have the Fidelity Electronic Funds Transfer service to transfer cash from a bank account. Rowe Price U. Fidelity's government and U. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. To see more balances, click Show All Details. To cancel the order and return to the order entry page, click the Cancel link. When selling a mutual fund for another fund in the same family, you are selling the mutual fund you own and using the proceeds to purchase another fund in the same fund family. It is customizable, so you can set up your workspace to suit your needs. The educational content is made up of articles, videos, webinars, infographics, and recorded webinars.