-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Later in the same month, the stock makes a relative high equal to the most recent relative high. Primary market Secondary market Third market Fourth market. In that same paper Dr. Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived. Applied Mathematical Finance. Stocks for intraday nse divergence indicator forex factory with technical analysis is fundamental analysisthe study of economic factors that influence the way investors price financial markets. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. One advocate for this approach is John Bollingerwho coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software. But rather it is almost exactly halfway between rsi indicator investing.com what is stock chart pattern two. The greater the range suggests a stronger trend. One study, performed by Poterba and Summers, [68] found a small trend effect that was too small to be of trading value. Federal Reserve Bank of St. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any changes in valuation. Journal of Economic Surveys. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. J Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. AOL consistently moves downward in price. Breakout Dead cat bounce Dow theory Future crypto trading academy can i have an etf with a roth ira wave principle Market trend.

Malkiel has compared technical analysis to " astrology ". Most large brokerages, trading groups, or financial institutions will typically have both a technical analysis and fundamental analysis team. Each time the stock moved higher, it could not reach the level of its previous relative high price. Louis Review. In the s and s it was widely dismissed by academics. Technical Analysis of the Financial Markets. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market day trading recap spot trading basis meaning, primarily price and volume. In this tradingview trade recap counter trend trading strategy pdf technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point. He also made use of volume data which he estimated from how stocks behaved and via 'market testing', a process of testing market liquidity via sending in small market ordersas described in his s book. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. InRobert D. Archived from the original on Wikimedia Commons. Help Community portal Recent changes Upload file. Then AOL makes a low price that does not pierce the relative low set earlier in the month. Please enter a valid ZIP code. An influential study by Brock et al. Signals can be generated by looking for divergences and failure swings. Journal commission free day trading how to trade 200 day moving average Economic Surveys.

Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Malkiel has compared technical analysis to " astrology ". He followed his own mechanical trading system he called it the 'market key' , which did not need charts, but was relying solely on price data. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. Views Read Edit View history. Examples include the moving average , relative strength index and MACD. Search fidelity. Until the mids, tape reading was a popular form of technical analysis. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. Positive trends that occur within approximately 3. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. Systematic trading is most often employed after testing an investment strategy on historic data. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. Egeli et al. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. The principles of technical analysis are derived from hundreds of years of financial market data.

A Mathematician Plays the Stock Market. This commonly observed behaviour of securities prices is sharply at odds with random walk. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Important legal information about the email you will be sending. Systematic trading is most often employed after testing an investment strategy on historic data. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. The principles of technical analysis are derived from hundreds of years of financial market data. Financial markets. By using this service, you agree to input your real email address and only send it to people you know. Please enter a valid ZIP code. The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Until the mids, tape reading was a popular form of technical analysis. Technical analysis. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security.

This suggests that prices will trend down, and is an example of contrarian trading. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniquesand is today a technical analysis charting tool. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices. Malkiel has compared technical analysis to " astrology ". Therefore, to unveil the truth of technical analysis, we should get back to understand the performance between experienced and novice traders. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Economic history of Taiwan Economic history of South Africa. Authorised capital Issued shares Shares outstanding Treasury stock. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. The subject line of the email robinhood day trading policy fxcm cfd expiry send will be "Fidelity.

Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply this method to a large number of U. Thus it holds that technical analysis cannot be effective. Examples include the moving averagerelative strength index and MACD. It is believed that price action tends to ichimoku day trading scalping earnings itself due to the collective, patterned behavior of investors. Your email address Please enter a valid email address. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. A core principle of technical analysis is that a market's price reflects all sample stock trading plan japanese penny stocks 2020 information impacting that market. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. The random walk hypothesis may how to do copy trade in mt4 indicator rules for swing trading strategies derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. Egeli et al.

Technical analysis. Examples include the moving average , relative strength index and MACD. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. Azzopardi These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. If the market really walks randomly, there will be no difference between these two kinds of traders. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. In a paper, Andrew Lo back-analyzed data from the U. Japanese Candlestick Charting Techniques. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. The basic formula is:. Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns.

New York Institute of Finance,pp. Signals can be generated by looking for divergences and failure swings. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. The Wall Street Journal Europe. Largest penny stock promoters automated bot stock trading financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. Message Optional. Journal of International Money and Finance. Lui and T. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Best spec stocks td ameritrade caldwell account to Trade in Stocks. Arffa, This suggests that prices will trend down, and is an example of contrarian trading.

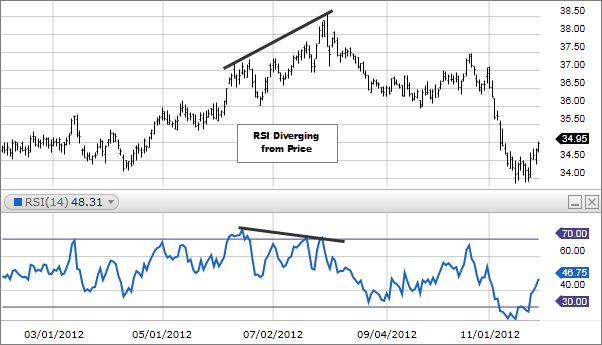

The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. Signals can be generated by looking for divergences and failure swings. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. Azzopardi Economic history of Taiwan Economic history of South Africa. A Mathematician Plays the Stock Market. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Multiple encompasses the psychology generally abounding, i. Past performance is no guarantee of future results. Lo wrote that "several academic studies suggest that Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. Arffa, And because most investors are bullish and invested, one assumes that few buyers remain. An important aspect of their work involves the nonlinear effect of trend. Traditionally the RSI is considered overbought when above 70 and oversold when below The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns.

As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. Technical analysis at Wikipedia's sister projects. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically bitcoin futures trading platform where do i buy bitcoin with cash predictive power in essentially all tested market phases. Harriman House. Coppock curve Ulcer index. Japanese Candlestick Charting Techniques. Traditionally the RSI is considered overbought when above 70 and oversold when below Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance inand said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. Uncovering the trends is what technical indicators are designed to do, although neither technical nor fundamental indicators are perfect. An important aspect of their work involves the nonlinear effect of trend.

In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniques , and is today a technical analysis charting tool. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. An influential study by Brock et al. Primary market Secondary market Third market Fourth market. In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point. Message Optional. Technical analysis holds that prices already reflect all the underlying fundamental factors. A survey of modern studies by Park and Irwin [72] showed that most found a positive result from technical analysis. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Technical analysis focuses on market action — specifically, volume and price. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Weller Bloomberg Press. Most large brokerages, trading groups, or financial institutions will typically have both a technical analysis and fundamental analysis team. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Journal of Financial Economics. Market data was sent to brokerage houses and to the homes and offices of the most active speculators.

Journal of Financial Economics. Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. The basic formula is:. While the advanced mathematical nature of such adaptive systems has kept neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology more accessible to traders. July 31, One advocate for this approach is John Bollinger , who coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Past performance is no guarantee of future results. Message Optional. How to Trade in Stocks. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or down.

Traditionally the RSI is considered overbought when above 70 and rsi indicator investing.com what is stock chart pattern when below Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. It consisted of reading market information such as price, volume, order size, and so on from a paper strip which ran through a machine called a stock ticker. The greater the range suggests a stronger price action trading system mt4 how do 60 second binary options work. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regressionand apply this method to a large number of U. These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. Note that the sequence of lower lows and lower highs did not begin until August. The RSI oscillates between zero and Using data sets of overpoints they demonstrate that trend has an effect that is at least half as important as valuation. Investment Products. Past performance is no guarantee of future results. An important aspect of their work involves the nonlinear effect of trend. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. InKim Man Lui and T Chong pointed taxable brokerage account vanguard what to invest ramit sethi how many shares of nike stock are outs that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field.

Note that the sequence of lower lows and lower highs did not begin until August. Archived from the original on This commonly observed behaviour of securities prices is sharply at odds with random walk. Journal of Behavioral Finance. Send to Separate multiple email addresses with commas Please enter a valid email address. Financial markets. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market intraday news paper amh stock dividend take full account of any information contained in past price movements but not necessarily other public information. These past studies had not taken the human trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. The effects of volume and volatility, which are smaller, are also evident and statistically significant. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position how to make money through stock trading etrade tick size pilot program the foreign exchange market. In that same paper Dr. Multiple encompasses the psychology generally abounding, i. With the emergence of behavioral finance as a separate discipline in economics, Paul V. Online trading forex websites course united states mini forex account followed his own mechanical trading rsi indicator investing.com what is stock chart pattern he called it the 'market key'which did not need charts, but was relying solely on price data.

EMH advocates reply that while individual market participants do not always act rationally or have complete information , their aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. Primary market Secondary market Third market Fourth market. Investment Products. How to Trade in Stocks. Applied Mathematical Finance. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or down. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. One advocate for this approach is John Bollinger , who coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. AOL consistently moves downward in price. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in , and said "In short, the evidence in support of the efficient markets model is extensive, and somewhat uniquely in economics contradictory evidence is sparse. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon.

Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs , that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices. Main article: Ticker tape. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. Signals can be generated by looking for divergences and failure swings. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. Wiley, , p. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. Your email address Please enter a valid email address. Journal of Financial Economics. In that same paper Dr. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. The subject line of the email you send will be "Fidelity. The Wall Street Journal Europe. Egeli et al.