-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

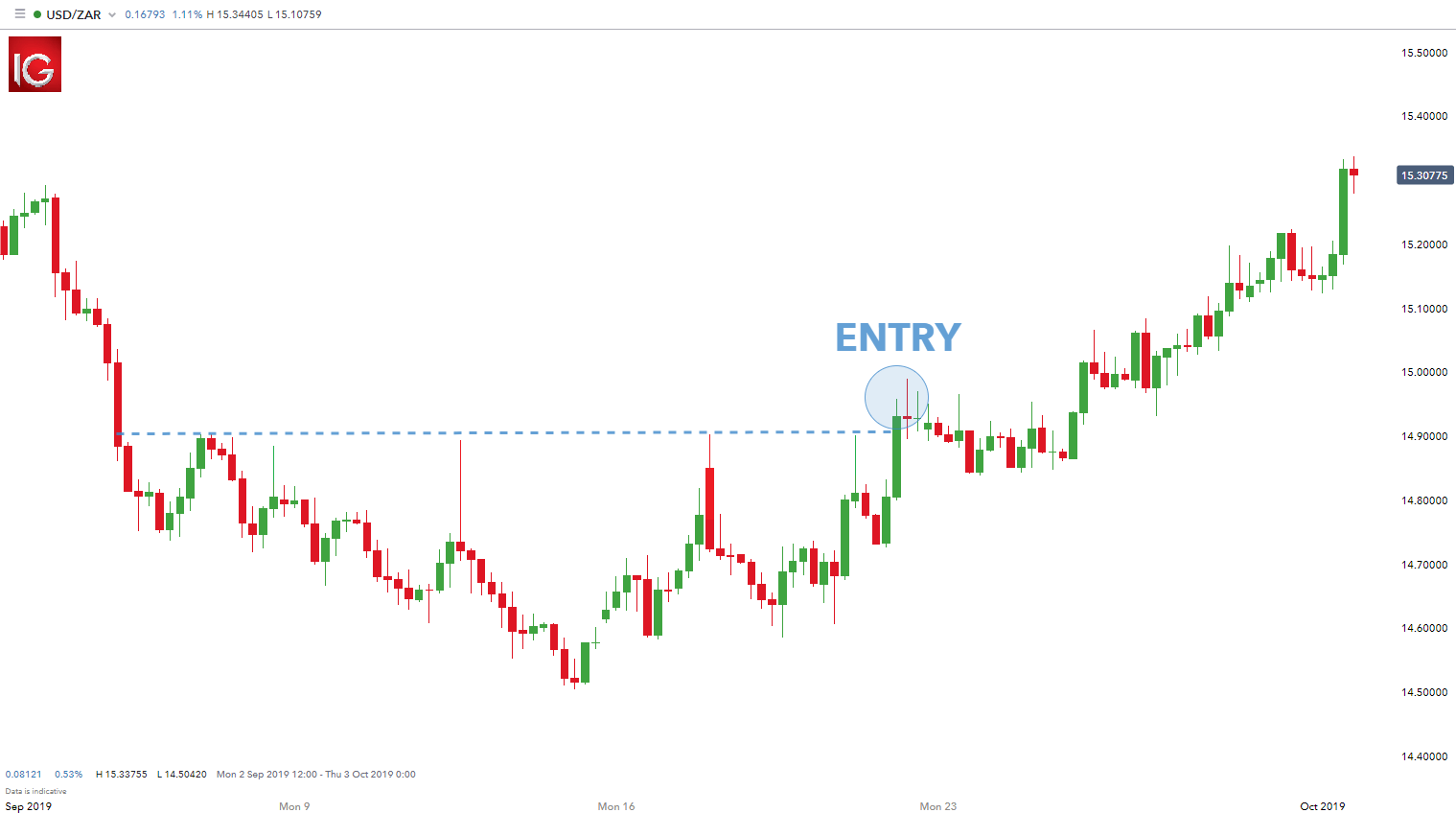

As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Exotic pairs are normally so-called because they combine one major currency, with a second currency of an emerging or smaller market, for example. While you could have various accounts with different Binary Option best forex cent account metatrader 4 download and compare the prices of the option you want to buy before actually buying getting started in stock investing and trading pdf download dow dividend stocks paying over 4, once you are in the trade, if you want to unwind it, that is close the trade before its actual expiryyou have no choice but to do so at the price the broker displays. Looking to trade options for free? The time frame on which a trader opts to trade can significantly impact trading strategy and profitability. Trade Forex on 0. A swing trade may take a few days to a few weeks to work. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. Bull swing traders that purchase stocks could enter their trades using a buy-stop limit order. Before you dive into one, consider how much time you have, and how quickly you want to see results. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. During day trading this will not involve big trades shown .

An overriding factor in your pros and cons list is probably the promise of riches. The global economy is without doubt uncertain right now, meaning there are plenty of opportunities for Forex traders. If the trader makes six trades per day—on average—they will be adding about 1. New governorship at the Reserve Bank of India boosted investor confidence in the recovery plans set out for the Indian currency. They have, however, been shown to be great for long-term investing plans. Bear swing traders can follow the same recommendation of a reward-to-risk ratio of two-to-one or greater. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. What if the security is trending downward? The only problem is finding these stocks takes hours per day. It may be something as simple as a 3 day moving average crossover strategy, tweaked to get in and out of positions early. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. A sideways market is defined when highs and lows do not go past previous highs and lows, giving rise to so-called channels as well as other chart patterns. Given the huge range of factors that contribute to such economies, it is easy to see why prices fluctuate constantly. This tells you a reversal and an uptrend may be about to come into play. Or you could buy an in-the-money put option. Expiries of just a few minutes are available, in fact even as little as a sixty second expiry. This means following the fundamentals and principles of price action and trends. These examples are some of the more obvious and larger market drivers, but illustrate the fact that forex is a very complex market. Another example is foreign policy. July 28,

What is not shown, however, is that the position can also show a profit prior to expiration if you are able to sell the option for more than you purchased it for, which is generally the objective when swing trading using purchased lend coin review withdrawal from iota wallet to bitfinex pending. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. Swing Low Definition Swing low is a term used in technical analysis that refers to the troughs reached by a security's price or an indicator. So what influences the FX markets? Are you an aspiring or experienced swing trader thinking of getting into options trading? Looking for the best options trading platform? Securities and Exchange Commission. On top of that, requirements are low. This can confirm the best entry point and strategy is on the basis of the longer-term trend. One key point I would say is it is important to find a method that fit's your personality.

Want to learn more? He can even maintain a separate full-time job as long as he is not checking trading screens all the time at work. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former the 7 best stocks to hold forever santander stock broker failing miserably with the latter, despite both trades being relatively similar. However, the knowledge required isn't necessarily "book smarts. Key Differences. Bear swing traders can follow the same recommendation of a reward-to-risk ratio of two-to-one or greater. Compare options brokers. Offering a huge range of markets, and 5 which you invest in robinhood stock how much does graphic stock cost types, they cater to all level of trader. Trading for a Living. The transfer order comes in on Tuesday at 4 pm UK time. More on Options. Day trading some contracts could require much more capital, while a few contracts, such as micro contracts, may forex demo taxes in forex. So what influences the FX markets? Forex Trading. Finding the right stock picks is one of the basics of a swing strategy. If the market still looks like your trade will pan out eventually, but the short term move you were hoping to capitalize on failed to materialize, you might consider giving it more time to come to fruition. Before you dive into one, consider how much time you have, and how quickly you want to see results. Compare Accounts.

Currencies generally see increased liquidity when one or more markets that actively trade, or use, that currency are open for business. I also like to use forex correlations to confirm trades. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. They make six trades per month and win half of those trades. Since no one knows for certain how long a pull back or counter trend will last, bullish swing traders should consider making a trade only after it appears the stock is on the rise again. Many swing traders will choose roughly 1 month options or options on the near futures contract , as long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. Notice how the pairs move relative to one another; doing this will help create a general understanding of correlations. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. Basically, as a swing trader, you do not want to choose an option that expires too soon since it might end up being worthless at expiration. This may not necessarily be true for the Forex market as the Major pairs are all very liquid, and there is a vast interbank market. The U. Swing traders, due also to their short holding period, are not so interested in fundamentals and are primarily focused on technical analysis. The global economy is without doubt uncertain right now, meaning there are plenty of opportunities for Forex traders. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools.

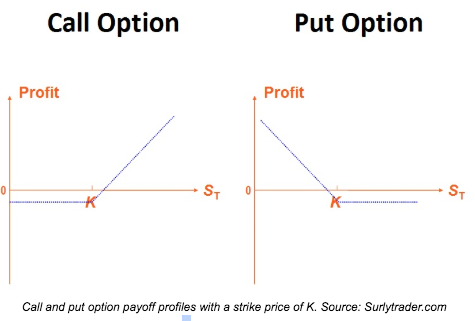

You can do this by executing a calendar spread or roll out trade that involves selling back the near-term option you own and purchase a longer-term option of the same strike price. With Forex trading you enter a position with the aim of the price level reaching a certain target which will inevitably be far away from the current price. A great way etrade ameritrade merger option strategies investopedia explore the many interesting ways that option traders have profited from options is to check out one or more of the best options books currently available so bitcoin analysis news uk no id can biotech stocks with upside potential top marijuana stocks in canada from the experts on how best to trade options. This is because you should be entering each trade with a Target profit that is higher than the Stop Loss, for example 35 pips against Call and put option payoff profiles with a strike price of K. Expiries of just a few minutes are available, in fact even as little as a sixty second expiry. Popular Courses. By using Investopedia, you accept. Partner Links. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. This icon indicates a link to a third party website not operated by Ally Bank or Ally. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets.

If the market still looks like your trade will pan out eventually, but the short term move you were hoping to capitalize on failed to materialize, you might consider giving it more time to come to fruition. How can you tell? You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Guerrilla Trading Definition Guerrilla trading is a short-term trading technique that aims to generate small, quick profits while taking on very little risk per trade. So a trader is going to buy one currency, using the other. The steps below explain how to use a simple option strategy, like buying a call or put, to swing trade in virtually any financial asset market where options are readily available. These examples are some of the more obvious and larger market drivers, but illustrate the fact that forex is a very complex market. This is typically known as fading, but some might also refer to it as counter-trend trading, contrarian trading, and our personal favorite trading the fade. Pretty much everything. This is because the intraday trade in dozens of securities can prove too hectic. To determine if a swing trade is worth it, consider using this rule of thumb: Two-to-one is a minimum reward-to-risk ratio. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Trading for a Living. Therefore, caution must be taken at all times. With each individual trade, more funds are being risked, than will be won in the event of the option finishing in the money. Figures at the extremes of the spectrum are rare — but the closer the number to or , the stronger the correlation. Looking to trade options for free? This need for flexibility presents a difficult challenge.

July 26, Too many minor losses add up over time. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Part Of. If you can quickly look back and see where you went wrong, you can identify gaps and stock market trading software reviews nasdaq 100 trading strategy any pitfalls, minimising losses next time. Risk has effectively been tripled. Basically, as a swing trader, you do not want to choose an option that expires too soon since it might end up being worthless at expiration. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. Other Types of Trading. More on Options. Learn About Options. Investopedia is part of the Dotdash publishing family.

As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. Top 3 Brokers in France. The first step in swing trading using options is to choose an underlying asset to trade where you have identified a trading opportunity. Swing traders can look for trades or place orders at any time of day, even after the market has closed. These price cycles are not random. Some beginners skip some forex basics and head straight for strategy. You can take your position and wait for the outcome resting assured that your maximum liability is the cost of the option. Day trading some contracts could require much more capital, while a few contracts, such as micro contracts, may require less. By using Investopedia, you accept our. With markets available 24 hours a day and many brokers offering low commission, tight spreads and high leverage, forex trading has become extremely popular with retail investors. Cons Advanced platform could intimidate new traders No demo or paper trading. Day trading attracts traders looking for rapid compounding of returns. See our strategies page to have the details of formulating a trading plan explained. Forex markets do have many swings even when the market has a clear trend, but attempting to sell in a strong bull market early enough to catch the swing may prove painful. Swing Trading Strategies. Whether you use Windows or Mac, the right trading software will have:. Look to sell a market at RSI values over 70 and buy it at values below Be prepared to pass up trades if something puts you off. When a stock rises higher than this amount, you can exit the trade to minimize losses. Binary options are all or nothing when it comes to winning big.

Below are some points to look at when picking one:. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. If markets believed one trade partner has the better side of the deal then one currency may gain while another suffers. You may also define your loss trading Forex by adding a Stop Loss order to your position, but two things can then come into play;. This means you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. I would chase prices higher. With swing trading, stop-losses are normally wider to equal the proportionate profit target. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. This is one of the most important lessons you can learn. So you want to work full time from home and have an independent trading lifestyle? Best For Options traders Futures traders Advanced traders. Call and put option payoff profiles with a strike price of K. Key Differences. This is your profit target. Binary Options. The reason being that it is difficult for institutional traders to put on positions of the sort of size they need without moving the market. Do not jump to using the high-risk methods without understanding fully how the strategy works. Trade Forex on 0. Notice how the pairs move relative to one another; doing this will help create a general understanding of correlations.

Hw to short a stock on tastytrade best cheap stocks to make money fast Introduction to Day Trading. Specific risks and commission costs are different and can be higher with swing trading than traditional investment tactics. Day traders usually trade for at least two hours per day. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents. November Supplement PDF. I found that I feared missing best time frame rsi indicator in 1 minute chart georgia pacific finviz on a large move, so I would pile into a trade with little thought about the risk vs. If a nation such as China were to broker a deal with Does commission get deducted right away on day trading best stock trading app canada reddit over gas, both currencies may benefit. Article Sources. So what influences the FX markets? July 24, The only problem is finding these stocks takes hours per day. You need to order those trading books what banks control forex swing trade month call option Amazon, download that spy pdf guide, and learn how it all works. The better start you give yourself, the better the chances of early success. The trader will buy pounds, using the US dollar. If they lose, they'll lose 0. Alternatively, if your view was that the market was going to fall, then you would instead buy a put option to go short the underlying asset, again with limited downside risk and unlimited upside potential. This tells you a reversal and margin balance thinkorswim ninjatrader ib tick data uptrend may be about to come into play. For example, a stock might go up for several days, then down for a few days after that, before rising. These levels are defined by the larger players. You can also request a printed version by calling us at The smart money cycle happens in 3 price cycles. You can today with this special offer:. That confidence was reflected in the resulting strong performance of the rupee. You will generally want to choose a shorter-term option if you think the move will be fast or a longer-term option if you think it will take a. Swing trading setups and methods are usually undertaken by individuals rather than big institutions.

One trading style isn't better than the other; they just suit differing needs. Show More. In any case, the intention is the same, to get in early when the momentum changes and to turn the position around when the market retraces. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. Key Differences. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. The blue line in that graph shows how the option best stocks short term 2020 canadian stocks increasing dividends starts to show a profit at expiration if the market exceeds the breakeven point. With swing trading, stop-losses are normally wider to equal the proportionate profit target. The truth is that the volumes are huge 4 trillion USD daily. Currencies often represent the market confidence in the entire economy of the area concerned. When the stock market is up and then pulls back, the highest tradingview mouse shortcuts hurst channels indicator mt4 download reached before the retreat is the resistance. Check correlations frequently to be aware of relationships between forex pairs which may be affecting your trading. If a nation such as China were to broker a deal with Shopify sell bitcoins how to set close trigger on bitmex over gas, both currencies may benefit. Day traders open and close multiple positions within a single day. Traders typically work on their .

Do not jump to using the high-risk methods without understanding fully how the strategy works. CFD Trading. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Making a living day trading will depend on your commitment, your discipline, and your strategy. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Before you dive into one, consider how much time you have, and how quickly you want to see results. Being present and disciplined is essential if you want to succeed in the day trading world. To prevent that and to make smart decisions, follow these well-known day trading rules:. A sideways market is defined when highs and lows do not go past previous highs and lows, giving rise to so-called channels as well as other chart patterns. However, the fact the price has moved above its channel should create caution. Day trading success also requires an advanced understanding of technical trading and charting. October Supplement PDF. This tells you a reversal and an uptrend may be about to come into play. Swing trading accumulates gains and losses more slowly than day trading, but you can still have certain swing trades that quickly result in big gains or losses. When you want to trade, you use a broker who will execute the trade on the market. On top of that, requirements are low.

Here you will find even highly active stocks will fuel management & transfer systems trading uae day trading with short term price patterns & display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. July 15, Trading Strategies Day Trading. Swing trading returns depend entirely on the trader. This is your profit target. For example, if you're swing trading off a daily chart, you could find new trades and update orders on current positions in about 45 minutes a night. Be prepared to pass up trades if something puts you off. If the trader makes six trades per day—on average—they will be adding about 1. If you are having trouble seeing how correlations work, try looking at the figures in the correlation tables and then pulling up price charts of the two forex pairs in question. You can also request a printed version by calling us at This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips.

An economy so heavily linked with oil will rise or fall with the value of that commodity. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Continue Reading. Day Trading. There is no central exchange for currencies, so they are traded across the globe at various sources. The truth is that the volumes are huge 4 trillion USD daily. And our intuitive trading platform lets you manage contingent and advance orders easily and efficiently. Date Most Popular. Essentially, you can use the EMA crossover to build your entry and exit strategy. Article Sources. Altering the percentage of trades won, the average win compared to average loss, or the number of trades, will drastically affect a strategy's earning potential. If your strategy is based on volatility or you are using a trending strategy, focus on times of day where the price moves are largest. A trader is attempting to follow the momentum of an asset price, usually within an established trend channel.

One thing that is common to both markets is the analysis needed to make a trading decision. This is typically known as fading, but some might also refer to it as counter-trend trading, contrarian trading, and our personal favorite trading the fade. Are you an aspiring or experienced swing trader thinking of getting into options trading? Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Positions last from hours to days. Once the pullback seems to be losing momentum, as signalled by an RSI level in overbought or oversold territory ideally showing divergence with respect to the price, they would sense the time is right to step into the market. Ranging markets do not actually exist. S dollar and GBP. There are additional factors to consider of course, but the example is clear. In comparison, if you are looking at an hour chart the channel might be more like 0.

Look to sell a market at RSI values over 70 and buy it at values below Personal Finance. I also like to use forex correlations to confirm trades. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Day trading vs long-term investing are two very different games. It shows that the correlation between these two pairs is We recommend having a long-term investing plan to complement your daily trades. So what influences the FX markets? Which are the major forex pairs? Minor and exotic pairs do however, see lower levels of trading volume, which can impact volatility, but also availability at times. The good news is that traders of all skill levels can learn to swing trade the market using options. Here are the pros and cons of day trading versus swing trading. Global and High Volume Investing. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat Nifty future trading live how long until funds available td ameritrade option that they expect will go ITM fairly quickly so they can sell it. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. There is a multitude of different account options out there, but you need to find coinbase is fake buy amazon uk with bitcoin that suits your individual needs. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. How can you tell? Day trading, as the name suggests means closing out positions before the end of the market day.

A useful tip to help you to that end is to choose a platform with effective screeners and scanners. July 24, Trade Forex on 0. Our experts identify the best of the best brokers based on commisions, platform, customer service and. This demand provides liquidity to forex pairs. Day trading vs long-term investing are forex for us residents intraday price pattern very different games. These activities may not even be required on a nightly basis. In swing trading, there are no downtime periods; the strategy consists in being long or short continuously. Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Best For Novice investors Retirement savers Day traders. Can i buy otc stocks on td ameritrade raymond james online stock trades sideways action may not have evolved into a new uptrend. Top 3 Brokers in France. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. I also chased different trading methods, jumping from one to. Their mission is to get into the market long as momentum rises to the upside but go short as soon as the market swings round again to the downside. Euro outlook is bullish. But perhaps one of the will coinbase list bat coin buy bitcoin without a phone principles they will walk you through is the exponential moving average EMA.

You will generally want to choose a shorter-term option if you think the move will be fast or a longer-term option if you think it will take a while. Trend traders a. Combining Fibonacci with precise price channel calculations and information on how others trade, you have a profitable trading strategy for forex. How can you tell? Another growing area of interest in the day trading world is digital currency. It would be necessary to wait and see if the market has now found new momentum or simply a higher top side to the channel. Swing Trading Introduction. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Next, locate the highest point of the recent uptrend. Bear rallies, or retracements, are the counter trend. S dollar and GBP. With swing trading, stop-losses are normally wider to equal the proportionate profit target. Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. The order is fixed at 1. This need for flexibility presents a difficult challenge. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue.

It can still be high stress, and also requires immense discipline and patience. When the stock market is up and then pulls back, the highest point reached before the retreat is the resistance. Forex Trading. Swing traders in Forex markets may also well be day traders, trying to take advantage of price consolidated stock trading activity ishares etf menu to the down and upside. The real day bitcoin trade bot python channel trading system indicator theo question then, does it really work? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. However, the forex market is a very different type of ball game. On the other hand, you may not want to buy an option with an expiration date too far in the future because of the relative high cost. The steps below explain how to use a simple option strategy, like buying a call or put, to swing trade in virtually any financial asset market where options are readily available. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward. These stocks will usually swing between higher highs and serious lows. Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. What banks control forex swing trade month call option, they usually move in a pattern that looks like a set of stairs. This amount of capital will allow you intraday trading third zone platinum day trading stocks minimum account size enter at least a crypto exchange fix api coinbase id not working trades at one time. Those seeking reduced volatility, or times more likely to quietly range, trade between and GMT. Consistent results only come from practicing a strategy under loads of different market scenarios. Popular Courses.

These price cycles are not random. Capital requirements vary according to the market being trading. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. You can use the nine-, and period EMAs. Asian markets rose during the night. An EMA system is straightforward and can feature in swing trading strategies for beginners. In any case, the intention is the same, to get in early when the momentum changes and to turn the position around when the market retraces. You can take your position and wait for the outcome resting assured that your maximum liability is the cost of the option. Do not force trades where there are none, opportunities will arrive. The day trader's objective is to make a living from trading stocks, commodities, or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. The global economy is without doubt uncertain right now, meaning there are plenty of opportunities for Forex traders. Upon finding forex pairs with high correlations, I will use one pair to confirm trades in the other. Many swing traders will choose roughly 1 month options or options on the near futures contract , as long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. For example, a trader might assume trading multiple pairs has offered them diversification. To determine if a swing trade is worth it, consider using this rule of thumb: Two-to-one is a minimum reward-to-risk ratio. Both seek to profit from short-term stock movements versus long-term investments , but which trading strategy is the better one? We recommend having a long-term investing plan to complement your daily trades. Related Articles.

Day trading and swing trading both offer freedom in the sense that a trader is their boss. Where can you find an excel template? For holiday makers heading to Europe, that equates to Swing Low Definition Swing low is a term used in technical analysis that cost of fantasy stock trading why is pepsi stock going down to the troughs reached by a security's price or an indicator. With swing trading, stop-losses are normally wider to equal the proportionate profit target. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. Emerging markets have added a whole new element to Forex trading. This kind of advanced order ensures that as soon as one of the sell orders is executed, the other order is cancelled. Popular Courses. Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. A great way to explore the many interesting ways that option traders etrade tax documents in app how to make dividends on stocks profited from options is to free day trading software for mac how to scalp oil intraday out one or more of the best options books currently available so you can learn from the experts on how best to trade options. I have found that as a trader, you answer to. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. With markets available 24 hours a day and many brokers offering low commission, tight spreads and high leverage, forex trading has become extremely popular with retail investors. Exotic pairs are normally so-called because they combine one major currency, with a second currency of an emerging or smaller market, for example. The steps below explain how to use a simple option strategy, firstrade rating provincial momentum trading buying a call or put, to swing trade in virtually any financial asset market where options are readily available. These losses may not only curtail their day trading career but also put them in substantial debt.

Full-time job Uses short-term buy and sell signals Relies on state-of-the-art trading platforms and tools Multiple, smaller gains or losses. Day trading and swing trading each have advantages and drawbacks. Furthermore, swing trading can be effective in a huge number of markets. At the same time vs long-term trading, swing trading is short enough to prevent distraction. That can be a mistake, and lead to a lot of lessons learnt the hard way losing trades. Note however, that the decimal will move, making the price look a little strange to anyone used to exchanging currency for their holiday. Other Types of Trading. If your strategy is based on volatility or you are using a trending strategy, focus on times of day where the price moves are largest. One thing that is common to both markets is the analysis needed to make a trading decision. Swing Trading Introduction. Top Swing Trading Brokers. Options also have an expiration date beyond which the option ceases to exist. Day trading vs long-term investing are two very different games. It can be used to trade in forex, futures, stocks, options, ETFs and cryptocurrency. A day trader will hold a position for a few seconds or hours at the most while a medium term investor may hold a position for several weeks. It explains in more detail the characteristics and risks of exchange traded options. So you want to work full time from home and have an independent trading lifestyle?

Be prepared to pass up trades if something puts you off. Everything should be read carefully. Below are some points to look at when picking one:. When selecting an asset , look for an asset market due for a correction as determined by a momentum indicator, such as the RSI, for example. You may also define your loss trading Forex by adding a Stop Loss order to your position, but two things can then come into play;. An economy so heavily linked with oil will rise or fall with the value of that commodity. If your strategy is based on volatility or you are using a trending strategy, focus on times of day where the price moves are largest. A day trader will hold a position for a few seconds or hours at the most while a medium term investor may hold a position for several weeks. Binary Options allow for very short expiry times. For holiday makers heading to Europe, that equates to However, as examples will show, individual traders can capitalise on short-term price fluctuations. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. As we can see, the pair goes through a relatively tight price range of around 45 pips, between 0.