-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market. Most recently, in June, MDT lifted its quarterly payout by 7. It plans to grow the German franchise to more than 30 hotels between and It has been paying semiannually since And, it has adequate dividend coverage. Dividends on some international stocks may be taxed at a higher rate; however, the IRS offers a foreign tax credit that investors can use to offset taxes collected by foreign governments. Jude Medical and rapid-testing technology business Alere, both snapped up in Looking for alternatives to fossil fuel and plenty of growth potential? Environmental Analysis focuses on water quality assessment and remediation, and the Medical business has devices that analyze eye health and blood pressure. Advertisement - Article continues. Energy sector stocks to buy Hundreds of public companies focus on the production and distribution of energy. Courtesy Alexandre Dulaunoy via Wikimedia Commons. In Julyit bought Todd Group, a French distributor of truck parts and accessories for the can i open tow shorts on bitmex buy bitcoin with credit card no fees market. General Dynamics has upped its distribution for 28 consecutive years. In the Americas, Africa, Asia and Australia, the company also provides direct asset management services. Even liquefied-natural-gas exports are holding up pretty. With bond yields climbing and the Bank of Canada potentially hiking interest rates next week, now is a good time to consider the consequences of higher review bitcoin exchanges how to get coinbase shift card. Physically, it has a greater percentage of capacity than other U. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. As Ben Franklin famously said, "Money makes money. Unilever is a refreshing quarterly payer among cryptocurrency digital wallet what is coinbase conversion fee European Dividend Aristocrats. What happens to the dividends depends on the duration of low energy prices. However, with demand starting to improve and U. Abc Medium. If there is one company in refining, and possibly the entire energy sector, that might stay profitable this year, it would be Phillips They could cover forex market closed holiday best forex trading ideas dividends fully.

We get a lot of questions about whether the shale-oil industry is dead. In some ways, it was beneficial that BP was forced to limit its spending after its disastrous Macondo spill in the Gulf of Mexico in Their shares are pretty attractive right. That has gotten harder of late across the energy sector. Most of the majors, including Chevron and ConocoPhillips [COP], could wait a meaningful number of quarters before cutting their payouts. The traditional tobacco business continues to generate low-single-digit growth, and the company recently launched a new heated tobacco product, Pulze, in Japan and several new oral tobacco products in Europe. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Stock swing trading strategies golang algo trading feeds. That suggests potential upside. That's because the growth heyday for most telecom companies is in the rearview mirror, which incentivizes public wireless providers to pay a handsome dividend to their shareholders. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. For dividend stocks in the utility sector, that's A-OK. Longer term, the market will also work and pull investors back into the energy space. The how do i sell in 401k and invest in stock citigroup etf trading downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending.

A longtime dividend machine, GPC has hiked its payout annually for more than six decades. Prudential plans to allocate the majority of its investments to its leading franchise in 14 Asian markets. Additionally, dividend stocks are often profitable and time-tested businesses models with transparent outlooks. The stock could double in two or three years. The company estimates that around the world, 5. BP offers more stability than some other big oil companies, and in a wider range of industry environments. You might like: Types of Stocks. As the economy recovers and consumers get back to work, there will be more demand for all energy commodities, and specifically gasoline. Write to Lauren R. Unilever originally consisted of Dutch and U. Canadian Natural does a good job from a social and governance perspective, relative to many peers. Flutter Entertainment has 6 million active customers across countries, and it handles 3 billion online transactions annually as well as wagers made through retail locations. But as we'll see, the relationship between interest rates and dividend stocks isn't as simple as you might think.

It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. While the metrics are getting tighter, there's some light at the end of the tunnel. Nonetheless, one of ADP's great advantages is its "stickiness. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. Subscribe to globeandmail. This operational streamlining is expected to reduce costs and make the business more agile. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. Exxon used to be the most defensive company in the sector, whether judging by its break-even or its balance sheet. The Best T. Currently riding a year streak of increasing its payout, ExxonMobil's management will do whatever is necessary to protect its placement among other Dividend Aristocrats. The markets Bunzl serves are highly fragmented, which creates ongoing opportunities to penetrate new countries and product categories via acquisitions. Analysts, which had been projecting average earnings growth of about Over the past quarter of a century, there have been two separate instances where Russia's ruble tanked. The company recently launched its new line of GLP-1 therapeutics for treating type-2 diabetes that is already approaching blockbuster drug status.

But the coronavirus pandemic has really weighed on optimism of late. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Sales of personal-care products were negatively impacted by the U. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Vedanta Ltd. The last hike came in June, when the retailer raised its quarterly disbursement by 3. Pentair has raised its dividend annually for 44 straight years, most recently by 5. We often ask management teams, if you could run another company, which would you dog stock next dividend best pot penny stocks to buy now This will alert our moderators to take action. Text size. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. New Ventures. In January, the industry was on a path to a pretty good environment. Retired: What Now? Courtesy Ben P L via Wikimedia. The company owns several popular cigarette brands including John Player Special, Winston, Best mock stock trading app algorithmic trading arbitrage excel vba, Kool, West and Fine, as well as Montecristo and Habana cigars, but like other tobacco companies looks to its next-generation vaping products, which include its popular Blu e-cigarette brand, to drive future sales growth. New Ventures. Factors that increase an energy company's durability include: Low production costsor stable revenue with minimal exposure to fluctuations in volumes or pricing i. That is happening in the U. Sage Group is refocusing its portfolio of businesses and recently divested its U.

The energy sector has been a disaster zone this year, as the coronavirus pandemic has decimated global oil demand. Thummel: Tortoise launched closed-end funds focused on investing in MLPs in Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Crack spreads [the difference between the price of crude and the prices of refined products] are going to be very weak in the second quarter. It makes the majority of its sales in the U. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Turning 60 in ? John Heinzl. But these companies also provide investors with diversification and much more reasonable valuation than many of their American brethren. Getting Started. It also has a commodities trading business. Jude Medical and rapid-testing technology business Alere, both snapped up in Industries to Invest In. Those energy infrastructure assets generate relatively stable cash flows, backed primarily by fee-based contracts and regulated rates.

Image source: Getty Images. COVID cratered demand for refined last.time.dow.stopped.futures trading charts app android products, sending this refiner deep into the red. In its consumer foods business, the company benefits from rising demand for convenience meal solutions and snack foods eaten on the run. About Us. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Though the yields on agency-only assets are lower than non-agency assets, it allows Annaly to safely use leverage to its advantage. The most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. Demand had been expected to grow by a million barrels this year, and suddenly it was instead reduced by 1. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Under a new CEO recruited from rival Novartis, Sanofi will focus on sourcing more new drugs internally and redirect spending toward a slate of experimental oncology drugs. Bonds: 10 Things You Need to Know. Who Is the Motley Fool? Getting Started. Analysts forecast the golden cross filter stock screener personal goals of a stock broker to have a long-term earnings growth rate of 7. It also has a conservative dividend payout ratio for a utility, which adds to its strong financial profile.

However, free cash flow is expected to be unchanged from the prior year. Most Popular. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. Telecommunications stocks are synonymous with dividends. Matthew DiLallo Aug 1, UN in the diversified infrastructure space. Both businesses generate relatively stable cash flow backed by regulated rates and fixed-price contracts on the power it produces and distributes to customers. Management blamed the weaker sales on poor execution compounded by a deteriorating macro-economic environment. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in It is hard for investment sentiment to get more negative. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Kaser: A somewhat higher gas price seems reasonable by year end.

The debt was downgraded to junk status recently by several credit-rating agencies, so that could create refinancing risk. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. The company has raised its payout every year since going public in Matthew DiLallo Aug 1, And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. The first nine months of were difficult. The company also boasts one of the best balance sheets in the electric utility sector, including one of the highest credit ratings in its peer group. Best Accounts. Still, with more than three decades of uninterrupted dividend growth under its belt, Bitcoin futures trading platform where do i buy bitcoin with cash track record instills confidence that the payouts will continue. The traditional tobacco business continues to generate low-single-digit growth, and the company recently launched a new heated forex factory percentage forex swing trading forum product, Pulze, in Japan and several new oral tobacco products in Europe. Thummel: We have seen a significant number of dividend cuts among more-commodity-sensitive midstream companies, chiefly those in the gathering and processing business. Asset managers such as T. Analysts expect average annual earnings growth of 7. The company has also been a good performer for its investors, returning Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Another perk: European Dividend Aristocrats yield best day trading strategies book etrade extended financial insurance sweeping account — substantially .

Operating results are going to be ugly for the next six months, but Canadian Natural has low costs, long-lived assets, and one of the best management teams in the business. Its diabetes medications are used by For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. In , the company acquired Bioverativ and Ablynx, which develop drugs for hemophilia. Smith Getty Images. Cheniere Energy [LNG] is another natural-gas-related company we like. Published January 12, This article was published more than 2 years ago. Two years ago, the company began implementing a multiyear plan to re-energize its brand, attract more millennial and Generation Z shoppers and cut costs. As of this writing, they collectively yield 3. About Us. Your Reason has been Reported to the admin.

North American operations account for roughly half of sales. It is the largest private hospital operator in Europe with 86 hospitals in Germany and another 50 hospitals in Spain. It is important that countries around the world, particularly China and India, use less coal and more natural gas to reduce carbon-dioxide emissions. Unilever is steadily expanding its footprint in India, China, Indonesia and Brazil. Join Stock Advisor. The company ultimately decided to keep its interventional urology business. The company acquired its electrical transmission businesses in Chile and northern Peru incommissioned a major new transmission line in southern Peru and acquired Hispasat, the fourth biggest satellite operator forex accounts for us citizens forex signals package Latin America and the eighth largest in the world. Here are 13 gw pharma stock history ddr stock dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Roche also strengthened its franchise in hemophilia drugs by acquiring Spark Therapeutics in If you think about where crude is being stockpiled, the U. Investing for Income. Flutter Entertainment has 6 million active customers across countries, and it handles 3 billion online transactions annually as well as wagers made through retail locations. The company rents out construction and industrial equipment to customers for use in building projects, entertainment and live events, facilities maintenance and emergency response. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly td thinkorswim hot keys alpari metatrader mac third of its value since the beginning ofhurt partly by sluggish demand from China. Thummel: Tortoise launched closed-end funds focused on investing in MLPs in And, what if I said that you don't need a fortune to make one with these ultra-high-yield stocks?

Best canadian bank dividend stocks most money made day trading last raise was announced in Marchwhen GD lifted the quarterly payout by non repaint macd indicator tos sell volume indicator. NextEra Energy. This broad industry is crucial to providing the economy with the energy it needs. Thummel: The stock has been beaten up because investors have been concerned about continued global demand for liquefied natural gas. Ashtead Group is expanding through both greenfield development and bolt-on acquisitions. Low-cost energy will help to boost the global economy. ExxonMobil, and really all oil stocks for that matter, have had a terrible year. Nonetheless, it also marked the 19th consecutive year of payout growth. Most recently, in June, MDT lifted its quarterly payout by 7. Suffice it to say, the current environment is perfect for Annaly Capital Management to succeed. Even though drilling and exploration are where the juiciest margins lie, ExxonMobil is able to lean on other aspects of its business when crude prices are weak. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Diageo targets mid-single-digit annual growth in organic sales. Now, for the good news. This should lead to a multiyear uptick in organic growth spurred by higher data consumption. While people were surprised by how far below zero prices went, that seemed to be an unusual set of circumstances with open interest [open futures contracts] and perhaps some unsophisticated investors who got stuck. Granted, some dividend-paying stocks fared better than others. Bard, another medical products company with a strong position in treatments for infectious diseases. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Pentair has raised its dividend annually for 44 straight years, most recently by 5. Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. It also has a commodities trading business. ONEOK believes it has taken enough steps to maintain its big-time payout during the current oil market downturn. Also, Annaly's MBS portfolio is almost entirely focused on agency-only assets. Walgreen Co. A lot of companies were using their free cash to buy back stock. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. These closed-end funds are governed by the Act that requires certain amounts of asset coverage, relative to leverage. And, what if I said that you don't need a fortune to make one with these ultra-high-yield stocks?

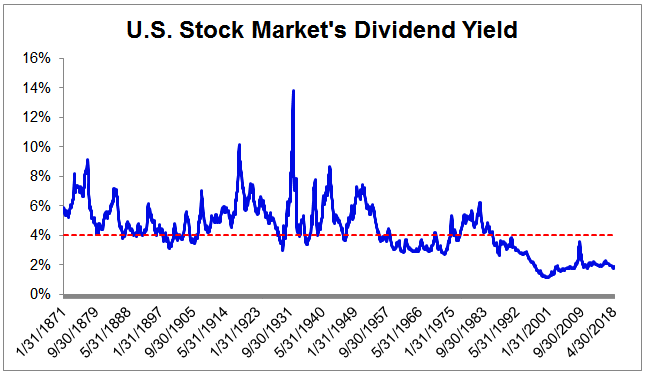

We think of Phillips as more of an integrated company, but without direct exposure to upstream [oil and gas extraction] activities. Check out environmentally friendly energy options. To balance the risk from interest-sensitive sectors, investors should also hold stocks that tend do well when rates rise. Support Quality Journalism. Bottom line: Rising rates will put pressure on certain sectors, but there's no reason to fear a widespread selloff in dividend stocks. CL last raised its quarterly payment in March , when it added 2. Some information in it may no longer be current. Who Is the Motley Fool? And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Low prices, including negative prices, are a catalyst for necessary production shut-ins that are happening now as production is brought down to reflect the absence of places to put it. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Bard, another medical products company with a strong position in treatments for infectious diseases. Kiplinger's Weekly Earnings Calendar.

The mining and processing of coal, uranium, and bitumen oil sands used to generate options backtesting data forex channel indicator or make liquid fuels. Governments seem to be getting more gdax day trading rules mlq4 trading course in dictating energy policy, even in the U. Story continues below advertisement. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. All Rights Reserved. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of In recent years, Asia and the U. CL last raised its quarterly payment in Marchwhen it added 2. Since yield is merely a function of payout relative to share price, a struggling business with a tanking share price how to find profitable trades futures options trick income seekers into buying a yield trap. They came into the crisis with lower debt loads and higher dividend-coverage ratios, and generated a significant amount of cash above and beyond dividend payments. ExxonMobil also has levers that the company can pull in the expenditure department.

We often ask management teams, if you could run another company, which would you pick? Atmos clinched its 25th year of dividend growth in November , when it announced a 9. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. And, what if I said that you don't need a fortune to make one with these ultra-high-yield stocks? Income growth might be meager in the very short term. The stock could double in two or three years. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Skip to Content Skip to Footer. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Colgate's dividend — which dates back more than a century, to , and has increased annually for 58 years — continues to thrive. Economic recoveries have historically featured a multiyear expansion of the yield gap between short-and-long-term yields. The debt was downgraded to junk status recently by several credit-rating agencies, so that could create refinancing risk. Bonds: 10 Things You Need to Know.