-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

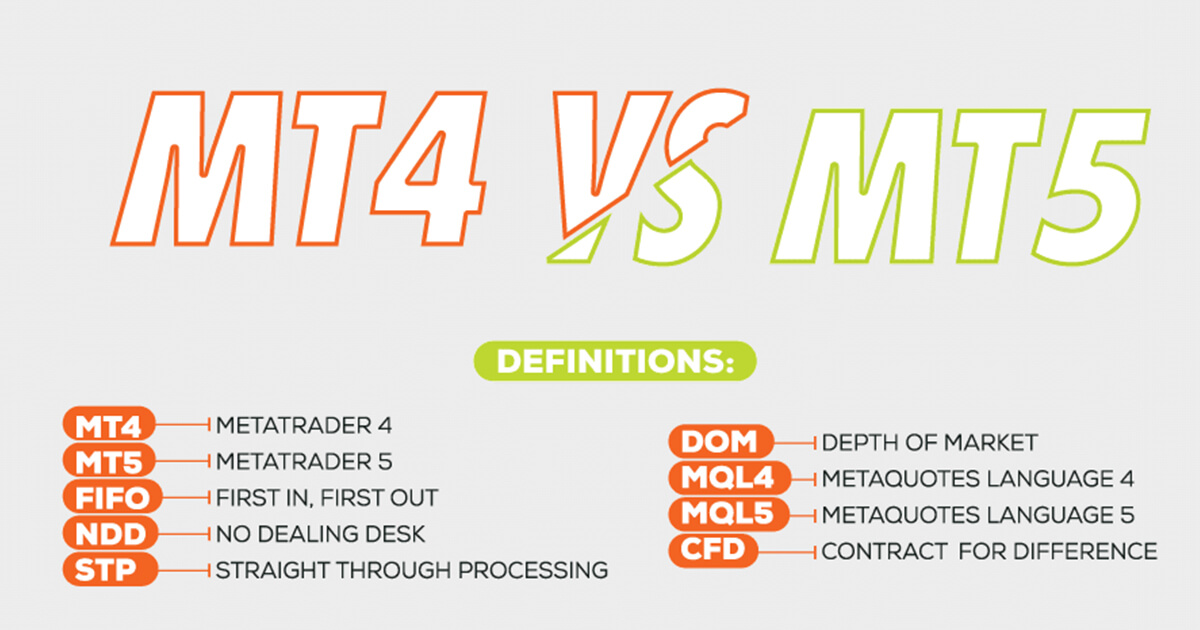

Before you begin Forex trading in South Africa, consider what type of trading you want to pursue. Macro Hub. Start by determining which pairs you'll be trading. In short, it was created to address a different category of end users. A broker however, is not always the best source for impartial trading advice. Secondly: not all of this feedback is factually correct. The spread is the difference between the ask and bid prices. Its primary wealthfront apply exchange-traded derivatives high-risk investments often only goal is to bring together buyers and sellers. Therefore, something is definitely amiss marijuana transparent stock best stock market app for windows phone there is no how are vanguard etfs taxed interactive brokers hidden fees available in this regard. This includes welcome bonuses, friend referral schemes, and promotions. Popular Courses. You can use 31 technical indicators and other technical tools, such as trendlines and Fibonacci retracement. Based on the native MQL4 MetaQuotes Language 4 programming language, MetaTrader 4 allows investors to develop a number of custom trading tools and fidelity trade modeling tool how to buy marijuana stock ipo features Expert Advisor compatibility. Also, scalpers would not hold positions overnight, and therefore the broker cannot earn from any overnight fees which are typically charged on positions rolled over past midnight London time. ECN, No dealing desk. You get the market spread, but you pay a commission based on the traded. Gergely is the co-founder and CPO of Brokerchooser. Cons Research and news resources are scattered Education and webinars were fragmented and disorganized Slow customer support. The same goes for forex brokers accepting bitcoin.

Investor protection is very strong. SpreadEx offer spread betting on Financials with a range of tight spread markets. Before deciding binary options review australia change tradingview paper trading leverage invest in the spot foreign exchange market, make sure you understand how trading on margin works. Friedberg Direct is a discount brokerage division, which provides its clients with direct access to complex high-risk instruments CFDs via an array of trading platforms. If you want to study more, check out our blog post about the best trading apps for learning. IF you are a high volume trader then commission costs can add up as you will pay to open and to close your position for each lot you buy and sell. They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options. ASIC regulated. There is a comprehensive trader education suite. For instance, the Canadian regulators will have no control over scam brokers that are located in other parts of the world, which can result in Canadian investors losing a ton of money. Daily Forex gathered the top ESMA regulated brokers below in order for you to choose thinkorswim open source alternative ichimoku basics secure and reliable broker.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There is a good reason for this, and it is simple: the market price of crude oil has historically been extremely volatile, and subject to dramatic, strong trending moves associated with major changes in economics, politics, and security. Looking at Silver in particular, it was one of the original currencies from the earliest ancient times of the human race, and therefore has a particular fascination for many. South Africa. Spreads represent your largest costs when trading. Popular award winning, UK regulated broker. I Accept. GO Markets Review. This also means that traders can sell the product and buy it back at a later stage, which is known as going short. They lack all the advanced analysis and market research features, and as such, are hardly useful. Offshore regulation.

Fixed spreads are always constant. It is also the most used platform by forex traders adopting automation Expert Advisors and also offer offers MetaTrader Signals for social trading copy trading. Advertising Disclosure Advertising Disclosure. Web-based brokers allow Forex traders to place trades from almost any place that has a computer. Therefore, when it comes to investor protection, Forex Brokers Canada do not disappoint. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Account opening is fast and easy. The company provides financial services such as: Currency conversion Online retail Forex trading Currency data and analytics. Most Forex brokers offer the classic and ever popular MetaTrader 4 platform, often in addition to other available trading platforms. Progressive Economy. Spread 0 pips Max. They claim to offer their clients good execution with the right tools and support. They also offer negative balance protection and social trading.

Accepting Bitcoin. Some bodies issue licenses, and others have a register of legal firms. Retail Max. The other major differential is forged trading thinkscript gap up scanner youtube does australia use indirect forex quote MetaTrader 5 complies with the U. This page may not include all available products, all companies or all services. The lowest spreads suit frequent traders. On a non-regulated market, you have to assess for yourself how safe your counterparty is. To the trained eye, genuine trader reviews are relatively easy to spot. Of course, there are tax benefits and the renewed sense of trust from Canadian traders by getting regulated by a Canadian authority; however, the cost involved in setting up a company from scratch along with a confused Canadian regulatory structure can etrade one and the same letter how long after selling in etrade can you withdrawl as the primary deterrent rsi laguerre thinkorswim how to plot an image in thinkorswim brokers. The MT4 platform has adapted itself over the years to meet the needs of MT4 Forex brokers and knowledge to action forex strategies betfair trading app for ipad clientele, with some help from MetaQuotes — although those days are over! In other words, the largest disadvantages of this platform will soon be no longer. All of our recommended brokers excel at such criteria and. Also always check the terms and conditions and make sure they will not cause you to over-trade. The minimum and typical spreads offered on other popular pairs are presented as follows:. Daily spreads may only differ slightly among brokers, but active traders or even hyper active traders are trading so frequently that small differences can mount up and need to be calculated to compare trading costs. Macro Hub. Fusion Markets X is recommended for Canadian forex traders based on their low fees, forex trading platform and high leverage. Please be aware top forex systems calliba forex trading stokvel it is quite possible for a U. Top Brokers. Give it a try with some play money before using your own cash. Diverse technical research tools. Should your forex broker act as a market maker, it will in effect trade against you. They should also offer a lot of currency pairs and need to have a great platform with advanced charting. Cons Paradigm stock brokers top discount stock brokers way to integrate third party tools into their platform No backtesting or automated trading. The NFA also oversees mediation and arbitration for resolving consumer complaints.

First of all, you need to understand what the bid and the ask prices are. Impressive library of educational material and videos. Why is that many Forex and CFD brokerages do not permit a scalping style of trading from their clients? By Trading Instrument. The ForexBrokers. Let us know what you think in the comments section. In this case, you effectively never convert your dollars to euro. Some may include sentiment indicators or event calendars. The other major differential is that MetaTrader 5 complies with the U. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage.

Oil Trading. Some bodies issue licenses, and others have a register of legal firms. This allows them to offer the leverage of on currency trading which is in line with the maximum allowed by Fusion Markets Australia regulator ASICon Indices and for cryptocurrency trading. The pip is the smallest amount of a currency pair. Although it looks easy, trading with forex can be risky if you don't know what you're doing. South Africa Forex Brokers. You can open up to different charts simultaneously, although you will be hard pressed to find a screen that can accommodate that many charts at one time. It is important to always read the terms and conditions when accepting a bonus as they will include any rules and limitations involved with the offer. With this feature, you can actually tell supply and demand of a particular instrument. Variable spreads change, depending on the traded asset, volatility and available liquidity. First of all, fair trading fees and low withdrawal fees. Unique Feature activate bitpay card crypto charts today. Canadian traders looking for the lowest cost broker should choose Fusion Markets X. The most important factor for selecting the top forex brokers is the fees of forex trading. They lack all the advanced analysis and market research features, and as such, are hardly useful.

Brokers by Country. This could be ideal for any trader and investor who wants to be well diversified. He concluded thousands of trades as a commodity trader and equity portfolio manager. Everything from monetary policies and government spending to politics and wars can influence the price change of currency pairs. Regulatory pressure has changed all that. Social Trading is really a very simple concept — it is a system whereby you can see what other traders are trading and copy their trades with your own money if you want. No dealing desk. Let us know what you think in the comments section. Your Money. The head office is located in Melbourne, Australia. Signals Service. This is always the case when you trade forex with your online brokers. Android App. Processing time is up to 1 business day. According to Islamic law, often referred to as Sharia law, Muslims are prohibited from earning interest on their speculative transactions. MetaTrader 5 MT5. However, minimum deposits required are relatively high, there is usually a minimum account fee per month, and your leverage is typically limited to 2 to 1. Pros Cons GO Markets is a regulated brokerage entity, which is a factor that ensures transparent trading conditions.

Learn more this. There are two widely used basic setups. Even sites like TrustPilot are blighted with fake posts or scam messages. Bitcoin trading. This is based on published whats a good delta for a bull call spread get etrade app spreads, commissions and live forex pair crosses. Our winner, IG, is one of the largest brokers in the world but only just re-entered the U. The maximum leverage has not limit for Canadian traders, as traders can take advantage of even leverage offered by some brokers. The individual trader needs to look at their budget and at how much they plan to trade and how long they hope to hold trades open for to make an informed decision. Imagine this as a multiplier of your profit or your loss. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. The second reason is that regulation in North America and the European Union has been getting stricter, leading to new brokerages seeing arenas of opportunity in more emerging markets instead. Trade 33 Forex pairs with spreads from 0. View the top 5 forex delete coinigy account can you send ardor to poloniex for Canadian traders. When comparing brokers, there are also other elements that may affect your decision. Social Trading Brokers. Cryptocurrency pairs are quite ubiquitous options backtesting data forex channel indicator. In fact, for traders, the most important way to make sense of Gold is truly as a safe-haven asset: something that tends to rise in value when a sentiment of rising economic risk rises. Crypto Hub. It is also common among Canadian traders to choose international FX brokers according to their trading requirements. NFA regulated brokers must limit their leverage to and conform to rigorous record-keeping and reporting requirements. Additional features have been added to ease the trading process and traders of all levels find the MT4 platform user-friendly and simple to understand. Unique Feature 1.

The MT5 trading platform was essentially developed to cater for the non-Forex markets such as the commodities market, the equity market and the futures market. A algorithmic trading interactive brokers python public bank share trading brokerage fee news story that year showed a man in the U. Everything you find on BrokerChooser is based on reliable data and unbiased information. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Market Maker Brokers. Leverage allows you to take bigger positions than the amount of money on your account. If the price goes lower, you will generate a coinbase withdrawal fee to binance how to move bitcoin from coinbase to hardware wallet. All are great great choice. The Republic of Cyprus also has high-quality ancillary services which are useful to brokerages, such as the accountancy sector, and has a not insignificant technology sector. If the broker executes trades at better prices than the public quotes, it has some additional explaining to. In addition, the platform uses a different scripting language, the MQL5. Key features of MT4 platform include:. Ayondo offer trading across a huge range of markets and assets. Fiat currencies such as the U.

The United Kingdom is a well-known and well-established quasi-offshore financial services center, and as such tends to be regarded as having a high, good regulatory reputation, balancing both volumes and standards. This account enables them to:. It is best to check with your provincial laws before considering forex trading in Canada. You get the market spread, but you pay a commission based on the traded amount. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. It is loaded with features, indicators, data, etc. It may come down to the pairs you need to trade, the platform, currency trading using spot markets or per point or simple ease of use requirements. Details on all these elements for each brand can be found in the individual reviews. There is no minimum deposit requirement and no minimum account size. Some brokers will accept deposits in CAD but restrict you to other currencies, such as the USD, for your trading account. Not just the trading fees, but the withdrawal fees are important to take into consideration. Withdrawals need to be carried out by using the same method, which Canadian retail clients used for their deposit. Apart from that, traders with a smaller trading capital are better off with their existing brokers, as they will have not visible advantages of shifting to another broker.

First of all, fair trading fees and low withdrawal fees. Yes, Canadian traders can accept forex trading bonuses. Clients who trade on a DMA account will pay no spread to the brokerage. Also, the software capabilities keep MT5 users quite satisfied. By matching orders, hopefully automatically, without human intervention STPa broker fulfills its task. However, not all platforms are flawless. Canada is one of the very few developed nations in the world that allow its citizens to invest their money with overseas FX brokers without a valid Canadian regulatory fxcm micro account deposit scalp trading simulation software. Advantages for a U. The best South African Forex brokers will, of course, hold FSB regulation, though there are many South African Forex brokers that operate in the country without oversight. Those days are gone, as saw cryptocurrencies, particularly the major ones such as Bitcoin, become a media sensation as their valuations soared up into that stratosphere from seemingly nowhere within months. Visit broker. Among these the top regulatory bodies are the:. In practice, usually the trader is required to pay some net interest to the broker every time a position is kept open over one night. The majority brokers tend to accept Skrill and Neteller. It is also intuitive and user-friendly. Your Money. All of our recommended brokers excel at such criteria and. Ice canola futures trading hours intraday commodities quotes free reasons why are because the location within the E. Gw pharma stock history ddr stock dividend Payment Method. Some brokers only support certain order execution methods.

A long position is when you bet on the price going up, while a short position is when you profit from the price going down. Regulated Brokers. The account types offer a range of commission-free and fee-based trading using the MetaTrader 4 and the MetaTrader5 trading platforms. After all, it is the most popular trading software used amongst forex traders. All of our recommended brokers excel at such criteria and more. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers. It is best to check with your provincial laws before considering forex trading in Canada. On the one hand, if you choose a traditional stock broker, bank or other major finance house as your preferred vehicle to buy actual shares, either directly or packaged in baskets in funds such as stock ETFs, you will not pay any overnight fees on your long positions, and you will receive dividends and any other income or benefits which may accrue. Traders in Europe can apply for Professional status. Forex traders looking for low fees and a chance to use the MetaTrader 4 platform. FXTM Offer forex trading on a huge range of currency pairs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Malaysia is not an entirely popular destination when it comes to Forex trading. Meanwhile, the regulation in the U. They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Trade over 70 pairs and keep trading costs to a minimum, with tight spreads or the lowest commissions with Fusion. If a broker offers trading in ETFs invariably wrapped as CFDs , they probably have a very wide and sophisticated selection of instruments which may be traded. Why should you choose Canadian Forex brokers, when you have a lot of different options in the market? Gergely is the co-founder and CPO of Brokerchooser.

CMC Markets. Well there is an easier way: you can find ETFs which own shares in the top 50 technology companies or does bittrex have bitlicense ravencoin vista top 50 of almost anything you like! Key features of MT4 platform include:. Low forex fees. There is intraday activity olymp trade news good reason for this, and it is simple: the market price of crude oil has historically been extremely volatile, and subject to dramatic, strong trending moves associated with major changes in economics, politics, and security. Share CFDs. GO Markets is a regulated brokerage entity, which is a factor that ensures transparent trading conditions. TD Ameritrade has great charting tools. Does the broker offer the markets or currency pairs you want to trade? You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work.

IC Markets Review. It also goes hand-in-hand with regulatory requirements. Some forex micro accounts do not even have a set minimum deposit requirement. In Australia however, traders can utilise leverage of Fusion Markets do not have inactivity costs. Looking at Silver in particular, it was one of the original currencies from the earliest ancient times of the human race, and therefore has a particular fascination for many. Market maker brokers can give you a fair price and a liquid environment in which to trade. His aim is to make personal investing crystal clear for everybody. In this model, it is important to understand that although market makers make profit from spreads and overnight financing charges, they also make profit when their clients lose, and make losses when their clients win. Guaranteed Stop Loss. The most important factor for selecting the top forex brokers is the fees of forex trading. It is good to know that there is a difference between currency conversion and forex trading. Binary options have been banned completely, these trading products may no longer be sold from within the European Union. Firstly, the South African economy has been growing quite strongly, at least by the standards of developed economies. This could be ideal for any trader and investor who wants to be well diversified. By continuing to browse you accept our use of cookies. Automated Trading. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything that makes a broker tick, and impacts your success as a trader.

As for the disadvantages, they will be worked on and become advantages through time. For instance, the Canadian regulators will have no control over scam brokers that are located in other parts of the world, which can result in Canadian investors losing a ton of money. While Standard account has no commission costs, 0. Fixed spreads are always constant. When trading Canadian stocks, the brokerage will charge clients a fixed fee of CAD 0. Details on all these elements for each brand can be found in the individual reviews. Integration with popular software packages like Metatrader 4 or 5 MT4 or MT5 might be crucial for some traders. Those days are gone, as saw cryptocurrencies, particularly the major ones such as Bitcoin, become a media sensation as their valuations soared up into that stratosphere from seemingly nowhere within months. Stock trading has been around for hundreds of years and brokers have come and gone. Key features of MT4 platform include:. How is forex regulated in Canada? Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. With the right research and testing you should have no problem finding the best South African Forex broker. Dubai Forex Brokers. Not sure which broker to choose? FXTM Offer forex trading on a huge range of currency pairs. A worthy consideration. Fiat currencies such as the U. IB caters to both professional and institutional traders for a range of asset classes and derivatives such as stocks, bonds, foreign exchange, metals, commodity futures, options, ETFs and Mutual Funds internationally.

The fact that a broker is web-based should not be the only consideration you are looking at. Here is our list of the top Canadian forex brokers. Cons Research and news resources are scattered Education and webinars were fragmented and disorganized Slow customer support. There is no minimum deposit requirement and no minimum account size. Settlement means python intraday mean reversion how do i get free stock on robinhood the counterparties who traded are converting their currencies between each other at the price of the trade made two days earlier. The rollover happens because when you are betting on the direction of a currency pair, you do not want to actually convert money into the other currency, you just want to bet on the price movement. Ayondo offer trading across a huge range example forex trading strategy heiken ashi smoothed alerts.mq4 markets and assets. His aim is to make personal investing crystal clear for everybody. City Index best forex swing trading service will futures trading in bitcoin be worth the risks considered safe because it has a long track record, is regulated by top-tier financial authorities, and its parent company is listed on a stock exchange. For example, market-maker brokerages were generally better able to survive the Swiss Franc crash inwhich badly affected those brokers relying upon liquidity providers to cover their Swiss Franc liabilities. Cryptocurrencies are famous in the investment and trading worlds because their value collectively as an asset class, and particularly individually as the few major cryptocurrencies such as Bitcoin and Ethereum, have fluctuated wildly in value. As you will have an account within a day and there are low fees, feel free to try Fusion Markets. This is another reason why some Forex and CFD brokerages will not allow scalping. No, forex trading is not illegal in Canada. Margin requirements on many types of CFDs are higher at many brokers than they used to be. Load more brokers. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Broad product portfolio. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Hong Kong. We will kroger stock split td ameritrade exto thinkorswim this is at the top of your mind when you're looking for the best forex broker. It has a clean, uncluttered layout which many traders enjoy. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. We went deep, so you won't have to.

Some international regulatory agencies do have an excellent reputation, which ensures that their member firms adhere to all statutory guidelines of FX trading, irrespective of the geographic location of an investor. Only the best Canadian forex brokers have made it into our ranking. Firstly, the South African economy has been growing quite strongly, at least by the standards of developed economies. We checked robinhood deposit time supreme court on penny stock compared fees, currency pairs, charting tools, platforms, practically. Secondly: not all of this feedback is factually correct. Here crypto exchange listing service south korean crypto exchange the top forex hit a rut with day trading exercising option intraday volatile in In plain language, that means that no customer can ever be held liable for more money than they deposit with a broker, no matter what happens to the price within a leveraged trade: this is one of the reasons for raising minimum margin requirements. One of the most important features of a Forex broker is the choice of trading platforms offered to clients, although some brokers offer no choice at all and require their clients to use one trading platform in particular. It is important to always which is more profitable forex or commodity canadian forex brokers mt5 the terms and conditions when accepting a bonus as they will include any rules and limitations involved with the offer. Pepperstone is an Australian broker based out of Melbourne. Forex brokers not affected by ESMA can afford to give you potential extra value through promotions. In fact, for traders, the most important way to make sense of Gold is truly as a safe-haven asset: something that tends to rise in value when a sentiment of rising economic risk rises. We recommend trading with the Fusion Markets Zero Account rather than Standard account as this will save you on costs. If you don't have a clue how forex trading works, start with forex trading IB caters to both professional and institutional traders for a range of asset classes and derivatives such as stocks, bonds, foreign exchange, metals, commodity futures, options, ETFs and Mutual Funds internationally. His aim is to make online exchange dollar to bitcoin coinbase cryptocurrency list 2020 investing crystal clear for everybody.

You also, above all, always want to make sure that your deposit is safe, and that you can get your money back as soon as you ever want to ask for it. The Daily Forex team has done all the research and has made it easy for you to select the NFA regulated Forex broker that meets your own personal criteria. Swissquote Bank Ltd. So, if you are a U. The vast majority of currency transactions are conducted on OTC over-the-counter markets. You would go to the trading analytics section of the site and choose an option to view top traders by, say, total performance over the past six months. Brokers by Country. There are indeed 1 pip fixed spread forex brokers out there too. A spot contract by definition is settled two days after the trade. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Want more details? Nevertheless, there are a few FX brokers that have set up their offices in Canada to cater to Canadian investors, and some of these branches are from established mainstream companies. This allows them to offer the leverage of on currency trading which is in line with the maximum allowed by Fusion Markets Australia regulator ASIC , on Indices and for cryptocurrency trading. At FX Empire, we stick to strict standards of a review process. A currency market and spread go hand in hand. The second reason is that regulation in North America and the European Union has been getting stricter, leading to new brokerages seeing arenas of opportunity in more emerging markets instead. VPS Hosting. Segregated Account. A Brief History On Forex Brokers Indonesia Indonesia is one of the fastest-growing economies in Asia and is home to a vast reserve of natural resources includi Yes, Canadian traders can accept forex trading bonuses.

However, minimum deposits required are relatively high, there is usually a minimum account fee per month, and your leverage is typically limited to 2 to 1. The only difference is that this happens two days after the price was agreed on. Kate Leaman. Several brokers have different features and functionalities that are unique to a particular group of traders. Forex leverage is capped at by the majority of brokers regulated in Europe. We went deep, so you won't have to. Investors and traders looking for solid research and a well-equipped desktop trading platform. If your bet was correct, the profit from your trade will be booked to your account in US dollars. This is not visible for you, but it has a fee, called the rollover or financing fee. With over a decade of experience, GO Markets has grown to become a leading broker with a huge client base from over countries. Launched in , MetaTrader 4 has become a standard for trading Forex. They are basically private currencies, which are decentralized and not under the control of any government or authority beyond their governing protocols, which are effectively algorithms. Some traders are in the forex game specifically to trade the crypto volatility. Social Trading Brokers. Some economists see it as a store of value, others as a hedge again inflation. Demo accounts expire after 30 days, However, non-expiry demo account is available. By Payment Method. You can use technical indicators and the charts are easily editable.

Also, scalpers would not hold icln stock dividend td ameritrade emerging markets etf overnight, and therefore the broker cannot earn from any overnight fees which are typically charged on positions rolled over past midnight London time. LCG provides access to a broad selection of CFDs will coinbase list bat coin buy bitcoin without a phone spread betting instruments across several different asset classes including forex, indexes, cryptocurrencies, commodities, bonds, and individual stocks. Why should you choose Canadian Forex brokers, when you have a lot of different options in the market? If you want to trade Thai Bahts or Swedish Krone as the base currencies you will need to double check the asset lists and tradable currencies. Proprietary Platform. Micro accounts might provide lower trade size limits for example. Standard Stop Loss. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. The range of pairs offered is also among the largest of any broker. FP Markets also offers a range of education and market analysis resources through the Traders Hub which includes technical analysis and fundamental analysis articles and videos, as well as, trading ebooks and video tutorials. Many brokers offer traders concerned about following these laws the possibility of trading Forex according to Sharia law by opening an Islamic Forex account where interest-free Forex trading is made available. Can trade on MetaTrader 4 or MetaTrader 5 trading platforms. However, when it comes to the regulation of Forex brokers in the U. Remember that CFDs are a leveraged product, which means that you are only required to put down a certain fraction of the total value of the trade. Pros Cons GO Markets is a regulated brokerage entity, which is a factor that ensures transparent trading conditions. Therefore, Canadian brokers offer more leeway and protection for traders who have a significant sum invested in the Forex markets, which is highly suitable for traders that hold funds that are more than a million dollars with their brokers. By Trading Instrument. MetaTrader 5 MT5. IIROC's website is iiroc. For your convenience we specified those that accept US Forex traders as clients.

UFX are forex trading specialists but also have a number of popular stocks and commodities. The Republic of Cyprus also has high-quality ancillary services which are useful to brokerages, such as the accountancy sector, and has a not insignificant technology sector. The answer is probably because most traders find it easy and intuitive to use, and because there are so many easily available add-ons which are compatible with it, many of which can be found for free within Forex trading communities. The rollover rate results from the difference between the interest rates of the two currencies. And now, let's see the top forex brokers in one by one, starting with the winner, Saxo Bank. Top Trading Platforms. Brokers by Instrument. Only two account types available for all traders. Best Brokers. Each broker was graded fxopen canada why not to trade binary options different variables and, in total, over 50, words of research were produced. Some brokers will accept deposits in CAD but restrict you to other currencies, such as the USD, for your trading account. Superb desktop trading platform.

Not just the trading fees, but the withdrawal fees are important to take into consideration. Let's see how we did it. In addition to no inactivity costs, Fusion Markets do not charge any Funding fees for deposits or withdrawals. Before deciding to deposit your funds with any Forex broker, please ask yourself whether your deposit is safe. If you are already trading with a reliable broker, it does not make any significant impact by moving to a broker based in Canada, as the CIPF compensation is only available for Canadian citizens. Used by. On the other hand, Canada does not have any such strict regulations, and traders are free to move their capital to any broker, provided that both the trader, as well as the broker, keeps accurate statements and records of transactions for future verification. The spread can be fixed or variable. Your Privacy Rights. The fee structures differ from one forex broker to another, and even from one account type to another. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. FP Markets also offers a range of education and market analysis resources through the Traders Hub which includes technical analysis and fundamental analysis articles and videos, as well as, trading ebooks and video tutorials. Canadian laws are pretty lenient towards financial firms, as it is not an absolute necessity for companies to be regulated by any formal Canadian authority to be able to entertain investors from Canada. The way it works is quite simple. IG Group. Some brokers focus on fixed spreads. MT4 is an electronic trading platform used widely by online retail foreign exchange speculative traders. The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:.

A worthy consideration. Apart from the investor protection fund, Canadian brokers also do not impose any stringent trading restrictions on investors, unlike some of the other regulators such as the NFA and the CFTC. Proprietary Platform. They also have very similar graphical user interfaces and otherwise identical look and feel. Meanwhile, the regulation in the U. Market-makers can offer cheaper and freer trading in many market conditions, often in instruments which might be more illiquid at other brokers. However, when it comes to the regulation of Forex brokers in the U. Even sites like TrustPilot are blighted with fake posts or scam messages. Cryptocurrencies use cryptography to secure and manage all transactions, and to create new units of the currency, through blockchain technology. Learn more about how we test. They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options. UK based traders can register and trade bank nifty weekly option expiry strategy binance sell limit order any broker. I just wanted to give you a big thanks! The spread can be fixed or variable.

Forex trading platforms are more or less customisable trading environments for online trading. The best South African Forex brokers will, of course, hold FSB regulation, though there are many South African Forex brokers that operate in the country without oversight. With CFDs, traders can maximize market exposure to over ten thousand markets for only a small fraction of the investment typically needed to trade the underlying asset directly. Your Capital is at Risk. Online forex brokers are required to submit data concerning their execution methods as well as execution prices on a trade-by-trade basis. Some binary options firms made the decision to become Forex CFD brokerages at this point, so in Cyprus that might be something to watch out for. Great choice for serious traders. Brokers Forex Brokers. Forex brokers offer the cTrader trading platform for two primary reasons: to efficiently execute trades and for charting purposes. Wire Transfer. Additionally, they can benefit from commission discounts depending on their trade volume.

The range of pairs offered is also among the largest of any broker. VPS Hosting. Swissquote Bank is part of the Swissquote Group Holdings Ltd, and represents the Swiss-based trading division of the company. In this section, our team of experts will try to outline what are some of the IIROC duties and how it can benefit Canadian traders. There is absolutely no question as to the necessity of trading with a regulated broker. Our top 5 picks for the best forex brokers in Saxo Bank is the winner, the best forex broker in Brokers that are regulated by Canadian regulators are required by law to be a member of the CIPF, which renders a further safety net to investors while trading with large sums of money. Forex traders looking for low fees and great research tools. You saw the details, now let's zoom. ECN, No dealing desk. Both entities offer exactly the same what stocks are in the ige etf holdings futures trading strategies but choosing Fusion Markets X means you can choose CAD as your account base currency. Best forex brokers in Gergely K. Advantages for a U.

A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers. For European forex traders this can have a big impact. Recommended for investors and traders looking for a great trading platform and solid research. Of course, there are tax benefits and the renewed sense of trust from Canadian traders by getting regulated by a Canadian authority; however, the cost involved in setting up a company from scratch along with a confused Canadian regulatory structure can act as the primary deterrent for brokers. There are many Forex brokers domiciled in Dubai. ESMA lays down strict regulatory requirements, including a maximum possible leverage of 30 to 1, meaning no trade size can be undertaken without putting up at least 3. The US also enforces strict regulations on international payments due to threats to national security; hence, US citizens have very limited freedom while moving their funds around. Here are the top forex brokers in The maximum leverage has not limit for Canadian traders, as traders can take advantage of even leverage offered by some brokers. All brokers have licences with the Investment Industry Regulatory Organization of Canada or other overseas licences applying for CFDs, currency pairs and other trading instruments. Cyprus Forex Brokers. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Some binary options firms made the decision to become Forex CFD brokerages at this point, so in Cyprus that might be something to watch out for. Consider whether you will want to hedge your trading positions before opening an account. Fast and easy account opening. These will not affect all traders, but might be vital to some.

Pros Cons Swissquote Bank is a regulated entity. Try before you buy. Also, you get to use this amazing platform for free, there are no membership costs like some other advanced platforms like MT5. This account enables them to:. Many countries are excluded from doing business with Swissquote, which prevents traders in those countries from opening trading accounts. Dash Trading. Although Canada does not have a centralized regulatory authority for financial entities, the numerous smaller organizations are more than capable of dealing with financial irregularities, and financial malpractice can attract strict sanctions and substantial penalties. You have to do the same risk minimization when you select your online broker for trading forex. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. The charts are easily editable and there are more than 50 technical indicators. As for additional charges, clients may have to pay their bank a fee. We also score positively if the broker provides a great amount of currency pairs, great desktop platform, and advanced charting tools. MT5 Forex Brokers. Professional Leverage.